Legislative Analyst's OfficeAnalysis of the 2001-02 Budget Bill |

In California, the federal Medicaid Program is administered by the state as the California Medical Assistance Program (Medi-Cal). This program provides health care services to welfare recipients and other qualified low-income persons (primarily families with children and the aged, blind, or disabled). Expenditures for medical benefits are shared about equally by the General Fund and by federal funds. The Medi-Cal budget also includes additional federal funds for (1) disproportionate share hospital (DSH) payments, which provide additional funds to hospitals that serve a disproportionate number of Medi-Cal or other low-income patients, and (2) matching funds for state and local funds in other related programs.

At the state level, the Department of Health Services (DHS) administers the Medi-Cal Program. Other state agencies, including the California Medical Assistance Commission (CMAC), the Department of Social Services, the Department of Mental Health, the Department of Developmental Services (DDS), the California Department of Aging, and the Department of Alcohol and Drug Programs receive Medi-Cal funding from DHS for eligible services that they provide to Medi-Cal beneficiaries. At the local level, county welfare departments determine the eligibility of applicants for Medi-Cal and are reimbursed by DHS for the cost of those activities. The federal Health Care Financing Administration (HCFA) oversees the program to ensure compliance with federal law.

Proposed Spending. The budget for DHS proposes Medi-Cal expenditures totaling $25.4 billion from all funds for state operations and local assistance in 2001-02. The General Fund portion of this spending ($9.4 billion) decreases by $129.6 million, or 1.4 percent, compared with estimated General Fund spending in the current year. However, this is not an accurate reflection of expenditure growth in this program. About $170 million of General Fund expenditures were replaced with Tobacco Settlement funds for specified Medi-Cal expansions and about $601 million in the Medi-Cal General Fund was shifted to the DDS budget in a purely technical change. If these amounts were added back to the Medi-Cal budget, the Medi-Cal General Fund would total $10.1 billion, an increase of $641.4 million or 6.7 percent. The remaining expenditures for the program are mostly federal funds ($14.4 billion).

The spending total for the Medi-Cal budget includes an estimated $2 billion (federal funds and local matching funds) for payments to DSH hospitals, and about $3.1 billion budgeted elsewhere for programs operated by other departments, counties, and the University of California.

Federal law requires the Medi-Cal Program to provide a core of basic services, including hospital inpatient and outpatient care, skilled nursing care, doctor visits, laboratory tests and x-rays, family planning, and regular examinations for children under the age of 21. California also has chosen to offer 32 optional services, such as outpatient drugs and adult dental care, for which the federal government provides matching funds. Certain Medi-Cal services—such as hospitalization in many circumstances—require prior authorization from DHS as medically necessary in order to qualify for payment.

Currently, more than half (61 percent) of the Medi-Cal caseload consists of participants in the state's two major welfare programs, which include Medi-Cal coverage in their package of benefits. These programs are (1) the California Work Opportunity and Responsibility to Kids (CalWORKs) program, which provides assistance to families with children and replaces the former Aid to Families with Dependent Children program, and (2) the Supplemental Security Income/State Supplementary Program (SSI/SSP), which assists elderly, blind, or disabled persons. Counties administer the CalWORKs program through county welfare offices which determine eligibility for CalWORKs benefits and Medi-Cal coverage concurrently. Counties also determine Medi-Cal eligibility for persons who are not eligible for (or do not wish) welfare benefits. The federal Social Security Administration determines eligibility for SSI/SSP, and the state automatically adds SSI/SSP beneficiaries to the Medi-Cal rolls.

Generally, persons who have been determined eligible for Medi-Cal benefits (Medi-Cal "eligibles") receive a Medi-Cal card, which they use to obtain services from providers who agree to accept Medi-Cal patients. Medi-Cal provides health care through two basic types of arrangements—fee-for-service and managed care.

Fee-for-Service. This is the traditional arrangement for health care in which providers are paid for each examination, procedure, or other service that they furnish. Beneficiaries generally may obtain services from any provider who has agreed to accept Medi-Cal payments. The Medi-Cal Program employs a variety of "utilization control" techniques (such as requiring prior authorization for some services) designed to avoid costs for medically unnecessary or duplicative services.

Managed Care. Prepaid health plans generally provide managed care. The plans receive monthly "capitation" payments from the Medi-Cal Program for each enrollee in return for providing all of the covered care needed by those enrollees. These plans are similar to health plans offered by many public and private employers. Currently, slightly less than half (2.6 million of the total of 5.2 million Medi-Cal eligibles) are enrolled in managed care organizations. Beneficiaries in managed care choose a plan and then must use providers in that plan for most services. Since payments to the plan do not vary with the amount of service provided, there is much less need for utilization control by the state. Instead, plans must be monitored to ensure that they provide adequate care to enrollees.

Almost all Medi-Cal eligibles fall into two broad groups of people. They either are aged, blind, or disabled or they are in families with children. More than half of Medi-Cal eligibles are welfare recipients. Figure 1 shows for each of the major Medi-Cal eligibility categories, the maximum income limit (not including earned and unearned income disregards or exemptions) in order to be eligible for health benefits and the estimated caseload and total benefit costs for 2000-01. The figure also indicates for each category, whether an asset limit applies and whether eligible persons with incomes over the limit can participate on a "spend down" basis. If spend down is allowed, then Medi-Cal will pay the portion of any qualifying medical expenses that exceed the person's "share of cost," which is the amount by which that person's income exceeds the applicable Medi-Cal income limit.

|

Figure 1 |

|||||

|

Major Medi-Cal Eligibility Categories |

|||||

|

2000-01 |

|||||

|

Maximum Monthly Income |

Asset Limit |

Spend Down b Allowed? |

Enrollees (Thousands) |

AnnualBenefit Costs (Millions) c |

|

|

Aged, Blind, or Disabled Persons |

|||||

|

$1,265 |

U |

— |

1,182 |

$8,281 |

|

934d |

U |

U |

140 |

905 |

|

Special limits |

U |

U |

69 |

2,807 |

|

Families, Children, and Pregnant Women |

|||||

|

Families |

|||||

|

$969e |

U |

— |

1,768 |

$2,571 |

|

1,421 |

U |

— |

1,394 |

2,037 |

|

1,141 |

U |

U |

—g |

—g |

|

Children and Pregnant Women |

|||||

|

Children |

|||||

|

$2,842 |

— |

— |

49 |

—h |

|

1,890 |

— |

— |

103 |

$87 |

|

1,421 |

— |

— |

83 |

67 |

|

1,141 |

U |

U |

149 |

325 |

|

Pregnant women |

|||||

|

$2,842 |

— |

— |

123 |

$554 |

|

1,141 |

U |

U |

6 |

82 |

|

Emergency-Only |

|||||

|

Undocumented immigrants who qualify in any eligibility group are limited to emergency services (including labor and delivery and long-term care). |

143i |

$433 |

|||

a Amounts are for countable income or grant only for a four-person family and do not include income disregards. |

|||||

b Indicates whether persons with higher incomes may receive benefits on a share-of-cost basis. |

|||||

c Combined state and federal costs. |

|||||

d Effective January 1, 2001, this category is expanded and would include couples with an income limit equivalent to $1,247. |

|||||

e Income limit to apply for CalWORKs. After becoming eligible, the income limit increases to $1,760 (family of four) with the maximum earned income disregard. |

|||||

f Includes Transitional Medi-Cal, which extends coverage for families who leave CalWORKS or 1931(b)-only for up to 12 months. |

|||||

g Enrollment and costs included in amounts for Section 1931(b) family coverage. |

|||||

h Costs included in amount for 200 percent of poverty pregnant women group. |

|||||

i About 244,400 additional undocumented immigrants are included in other categories at a cost of $1.1 billion. |

|||||

Aged, Blind, or Disabled Persons. About 1.4 million low-income persons who are (1) at least 65 years old or (2) disabled or blind persons of any age receive Medi-Cal coverage—about 27 percent of the total Medi-Cal caseload. Overall, the disabled make up more than half (61 percent) of this portion of the Medi-Cal caseload. Most of the aged, blind, or disabled persons on Medi-Cal (85 percent) are recipients of SSI/SSP benefits and receive Medi-Cal coverage automatically.

The other aged, blind, or disabled eligibles are in the "medically needy" category. They also have low incomes, but do not qualify for, or choose not to participate in SSI/SSP. For example, aged low-income noncitizens generally may not apply for SSI/SSP (although they may continue on SSI/SSP if they already were in the program as of August 22, 1996). As another example, about 19 percent of the medically needy persons in this category have incomes above the Medi-Cal limit and participate on a share-of-cost basis. Beginning January 1, 2001, as a result of no-cost Medi-Cal expansion, fewer persons will participate on a share-of-cost basis.

The number of Medi-Cal eligibles in long-term care is small—only 68,500 people, or 1.3 percent of the total caseload. Because long-term care is very expensive, benefit costs for this group total $2.8 billion, or 16 percent of total Medi-Cal benefit costs.

Almost 60 percent of the aged or disabled Medi-Cal eligibles also have health coverage under the federal Medicare Program. Medi-Cal generally pays the Medicare premiums, deductibles, and any co-payments for these "dual beneficiaries," and Medi-Cal pays for services not covered by Medicare, such as drugs and long-term care. Medi-Cal also provides some limited assistance to a small number of Medicare eligibles who have incomes somewhat higher than the medically needy standard.

Families with Children. Medi-Cal provides coverage to families with children in three eligibility categories. The first two categories were created by Section 1931(b) of the Social Security Act, which required states to grant Medicaid eligibility to anyone who would have been eligible for cash-assistance under the welfare requirements in place on July 16, 1996. One of these categories consists of CalWORKs welfare recipients who automatically receive Medi-Cal. The second category—referred to as the 1931(b)-only group—consists of families who are eligible for CalWORKs, but who choose only to receive Medi-Cal services. The income limit for families in this second category is 100 percent of the federal poverty level (FPL). However, once enrolled in Section 1931(b) coverage, families may work and remain on Medi-Cal at higher income levels (up to about 155 percent of the FPL indefinitely, or a higher amount for up to two years).

A third eligibility category referred to as the medically needy, consists of families who do not qualify for CalWORKs, but nevertheless have relatively low incomes. These families have incomes up to 80 percent of the FPL, have less than $3,300 in assets, and meet additional requirements. Families whose incomes are above the medically needy limits, but who meet all of the other medically needy qualifications, may receive Medi-Cal benefits on a share-of-cost basis.

About 34 percent of all Medi-Cal eligibles are CalWORKs welfare recipients. Although CalWORKs recipients constitute the largest single group of Medi-Cal eligibles by far, they account for only 14 percent of total Medi-Cal benefit costs. This is because almost all CalWORKs recipients are children or able-bodied working-age adults, who generally are relatively healthy. Similarly, 1931(b)-only and medically needy families who are Medi-Cal eligible account for 27 percent of all Medi-Cal eligibles and only 11 percent of total benefit costs.

Women and Children. Medi-Cal includes a number of additional eligibility categories for pregnant women and for children. Medi-Cal covers all health care services for poor pregnant women in the medically indigent category, which has the same income and asset limits and spend-down provisions as apply to medically needy families. However, pregnancy-related care is covered with no share of cost and no limit on assets for women with family incomes up to 200 percent of the FPL (an annual income of $34,100 for a family of four).

The medically indigent category also covers children and young adults under age 21. Several special categories provide coverage without a share of cost or an asset limit to children in families with higher incomes—200 percent of the FPL for infants, 133 percent of the FPL for children ages 1 through 5, and 100 percent of the FPL for children ages 6 through 18. Pregnant women and the FPL-group children also may use a simplified mail-in application to apply for Medi-Cal or Healthy Families Program coverage (for children above the Medi-Cal income limits). Medi-Cal also provides family planning services for women or men with income up to 200 percent of FPL who do not qualify for regular Medi-Cal.

Emergency-Only Medi-Cal. Noncitizens who are undocumented immigrants, or are otherwise not qualified immigrants under federal law, may apply for Medi-Cal coverage in any of the regular categories. However, benefits are restricted to emergency care (including labor and delivery). Medi-Cal also provides prenatal care and long-term care to undocumented immigrants. These services, as well as nonemergency services for recent legal immigrants, do not qualify for federal funds and are supported entirely by the General Fund.

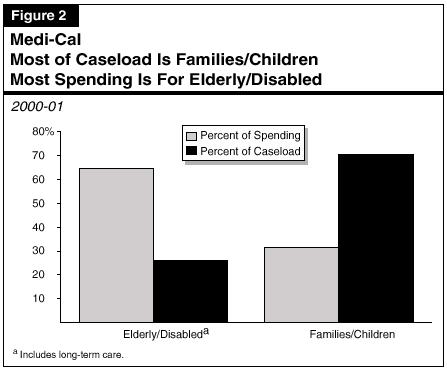

The average cost per eligible for the aged and disabled Medi-Cal caseload (including long-term care) is much higher than the average cost per eligible for families and children on Medi-Cal. As a result, almost two-thirds of Medi-Cal spending is for the elderly and disabled, although they account for only about one-fourth of the total Medi-Cal caseload, as shown in Figure 2.

Figure 3 presents a summary of Medi-Cal General Fund expenditures in the DHS budget for the past, current, and budget years.

|

Figure 3 |

|||||

|

Medi-Cal General Fund Budget Summary a |

|||||

|

1999-00 Through 2001-02 |

|||||

|

|

Change From 2000-01 |

||||

|

Actual |

Estimated |

Proposed |

Amount |

Percent |

|

Support |

$70.4 |

$80.4 |

$86.3 |

$5.9 |

7.3% |

|

Local Assistance |

|||||

|

Benefits |

$7,593.0 |

$8,953.7 |

$8,782.8 |

-$170.9b |

-1.9%b |

|

County administration (eligibility) |

410.7 |

433.3 |

469.7 |

36.4 |

8.4 |

|

Fiscal intermediaries |

61.2 |

70.5 |

72.5 |

2.0 |

2.9 |

|

Hospital construction debt service |

45.9 |

55.0 |

51.4 |

-3.6 |

-6.5 |

|

Subtotals, |

($8,110.8) |

($9,512.6) |

($9,376.5) |

(-$136.1) |

(-1.4%) |

|

Totals |

$8,181.2 |

$9,593.0 |

$9,462.8 |

$-130.2b |

-1.4%b |

Caseload (thousands of beneficiaries) |

5,106 |

5,210 |

5,850 |

640 |

12.3% |

a Excludes General Fund Medi-Cal spending budgeted in other departments. |

|||||

b The replacement of Medi-Cal General Funds with $170 million of Tobacco Settlement funds and shifting $601 million to the Department of Developmental Services' budget causes the budget to decrease. If this had not been done, the total budget would have increased by $641 million or 6.7 percent. |

|||||

The budget e1stimates that for the current year the General Fund share of Medi-Cal local assistance costs will increase by $1.4 billion (17 percent), compared with 1999-00. The bulk of this increase is for benefit costs, which will total an estimated $9 billion in 2000-01. Other local assistance costs will also increase in the current year compared with 1999-00. For example, county administration costs will go up about $23 million (5.5 percent) and costs related to claims processing by the fiscal intermediary will increase by $9.4 million or about 15 percent. The General Fund cost for hospital construction debt service will increase by $9.1 million (20 percent) during 2000-01.

Most of the $1.4 billion increase in benefit costs results from increases in the cost and utilization of health care goods and services (including provider rate increases)—about $871 million. In addition, the settlement of a ten-year-old lawsuit over Medi-Cal hospital reimbursement rates will increase expenditures by $175 million. Caseload growth adds about $82 million of General Fund cost. A change in the way the state pays for Medicare claims accounts for $54 million, changes in the state-federal cost-sharing ratio increases state costs by $52 million, and other factors account for the remainder of the cost increase (about $127 million).

2000-01 Provider Rate Increases. About $596 million of the General Fund spending increase for benefits in the current year is for provider rate increases. Various rate increases for physicians, dentists, in-home nursing, and other medical provider services will total $230 million, most of which is to increase physician services rates by about 17 percent, including a 40 percent increase for physician services provided in emergency rooms. Increases for long-term care facilities such as nursing homes and intermediate-care facilities total $204 million including a 5 percent wage pass-through. Rate increases approved by DHS or CMAC for Medi-Cal managed care plans account for $103 million of the increase. In addition, hospitals have negotiated rate increases with CMAC resulting in a $60 million increase for inpatient costs.

Pharmacy and Certain Other Costs Growing Rapidly. The budget estimates that the General Fund cost of payments to pharmacy providers (for drugs and various types of medical supplies) will result in a net increase of $138 million in the current year. In addition, General Fund costs for adult day health services will increase by an estimated $39 million, compared with 1999-00. Both of these categories include some groups of providers that DHS has targeted for fraud prevention efforts.

Settlement of Hospital Payment Suit Results in Payout. Pending federal approval, the state has settled the Orthopaedic Hospital v. Belshe' litigation and other related lawsuits over the amount Medi-Cal pays for hospital outpatient services. As part of the settlement, Medi-Cal will pay hospitals a lump sum of $350 million ($175 million General Fund) in the current year. We discuss this litigation further later in this analysis.

Caseload Increase Reflects Eligibility Expansions and Simplification. The budget estimates that caseload in the current year will increase by more than 100,000 eligibles or 2 percent. The increase is primarily related to two factors. The first factor is the continued expansion of Section 1931(b) eligibility to cover both the children and parents in families with income at or below 100 percent of the FPL. While the expansion has increased total Medi-Cal caseload by approximately 75,000, the phase-in of new eligibles has been slower than originally estimated. Further caseload increases resulting from this change are expected to continue in 2001-02.

The second factor increasing caseload is two statutes enacted this year simplifying the eligibility process. Legislation provided 12-month continuing eligibility for Medi-Cal children and eliminated the quarterly status reporting requirements for families eligible for Medi-Cal. These changes are projected to increase the monthly average caseload by about 26,000 in the current year, with significant additional caseload increases anticipated in the budget year.

The 2000-01 Budget Act anticipated some of the ongoing Medi-Cal cost increase and provided funding for legislatively approved rate increases and caseload increases caused by the expansion of Section 1931(b) family eligibility and simplified eligibility processes. However, the Governor's budget proposes a net increase in Medi-Cal spending of $204 million above the budget act. This is primarily because of the settlement of the hospital rate lawsuit. The major components of the additional spending are discussed below.

Settlement of Hospital Litigation—$175 Million. Most of the current-year deficiency results from the settlement reached in lawsuits pertaining to Medi-Cal payment rates for hospital outpatient services. Hospitals have been in litigation with the state over reimbursement rates since 1990 in the case known as Orthopaedic Hospital v. Belshe'. The DHS had set rates based on what it deemed necessary to encourage enough hospitals to participate in the Medi-Cal Program. However, the courts interpreted federal law to require reimbursement based upon a determination of "reasonable costs." The DHS expects to pay a lump sum payment of $175 million from the General Fund in the current year. In 2001-02 it will increase hospital outpatient rates by approximately 30 percent and then for each of the following three years by 3.3 percent annually.

Inpatient Costs and Managed Care Rate Increases—$95.6 Million. The budget act underestimated the rate increases that hospitals would negotiate with CMAC by $60 million. Also, managed care costs increase by $36 million because additional funding is provided to ensure the same level of provider rate increases in managed care as were provided in fee-for-service.

Los Angeles County Outpatient Services—$30 Million. Under the terms of the extension of its Medicaid Demonstration Project, Los Angeles County outpatient sites and their private partner contract clinics will receive Federally Qualified Health Center (FQHC)-like cost based reimbursement for outpatient services provided to Medi-Cal patients. These rates will be paid pending their application and approval of FQHC status. State General Fund costs are expected to be $30 million in both the current year and 2001-02.

Continuous Eligibility For Children—$5.6 Million. Effective January 1, 2001 legislation provides 12 month continuing eligibility for all Medi-Cal eligible children. This was not reflected in the 2000-01 budget plan because the legislation was enacted at the end of the legislative session.

Medicare HMO Premiums—$5 Million. Effective January 1, 2001 Medi-Cal will pay the monthly premiums for Medi-Cal eligibles enrolled in Medicare health maintenance organizations (HMOs). By paying these premiums the Medi-Cal Program expects to avoid General Fund costs of up to $14 million in the current year and $28 million in 2001-02 that otherwise would have occurred if persons affected by the new premiums dropped their Medicare HMO coverage and Medi-Cal had to pay their drug costs.

The Governor's budget estimates that total General Fund spending for Medi-Cal local assistance will be $9.4 billion in 2001-02, a decrease of $136 million, or 1.4 percent from the estimated spending in the current year. This amount does not reflect true expenditure growth in the Medi-Cal Program. This is because the decrease results from the replacement of approximately $170 million of General Fund expenditures for specified Medi-Cal expansions with new Tobacco Settlement funds, as well as the shift of $601 million in Medi-Cal General Fund monies to the DDS budget in a purely technical change. Barring these changes, Medi-Cal General Fund spending for local assistance would total $10.1 billion, an increase of $638 million or 6.8 percent. The budget estimates that the Medi-Cal caseload will increase by 640,000 (about 12 percent) in 2001-02 to a total of almost 5.9 million average monthly eligibles—roughly 17 percent of the state's population.

Most of the added spending in 2001-02 is for benefit costs. Because of the switch to tobacco settlement funding and the DDS funding shift, it appears that major benefits spending decreased by $199 million when it has actually increased by $606 million. Figure 4 (see next page) shows the major components of the change in benefit costs, which we discuss below.

Increased Costs and Utilization of Services—$258.8 Million Cost. Based on the budget's projections, General Fund costs for Medi-Cal benefits appear to decrease by 1.9 percent in 2001-02. However, disregarding funding shifts, benefits spending actually increases by 6.7 percent, largely due to higher prescription drug costs, caseload expansions, and hospital rate increases. The department attributes most of the increase to spending on drugs. This includes price and utilization increases of $272 million for existing drugs and for new drugs added to the Medi-Cal formulary and rebates of about $69 million obtained through the drug-rebate program.

Medi-Cal "buy-in" payments for Medicare premiums also are increasing. Medi-Cal pays Medicare premiums for Medi-Cal enrollees who also are eligible for Medicare (dual eligibles) in order to obtain 100 percent federal funding for those services covered by Medicare. The budget estimates that the General Fund cost of these buy-in payments will increase by $51 million in 2001-02. The budget also projects a $5 million increase in the monthly premium that the Medi-Cal Program pays to HMOs that have enrolled beneficiaries eligible for both the Medi-Cal and Medicare programs (dual eligibles).

|

Figure 4 |

|

|

Medi-Cal Benefits |

|

|

2001-02 |

|

|

Price and Utilization of Services |

$258.8 |

|

Increased pharmacy costs |

271.7 |

|

Increased cost for Medicare premiums |

50.7 |

|

Payment of a monthly premium to HMOs that enroll beneficiaries eligible for both Medi-Cal and Medicare |

5.0 |

|

Savings from drug rebate program |

-68.6 |

|

Caseload |

$258.8 |

|

Full-year impact of providing 12-month continuing eligibility to children |

129.1 |

|

Elimination of the quarterly status report |

68.4 |

|

Continued expansion of 1931(b) eligibility to 100 percent of poverty |

37.8a |

|

Expanded eligibility for aged, blind, and disabled |

23.5a |

|

Pass-Through Funding for Other Departments |

-$601.0 |

|

Shift Medi-Cal costs for DDS Regional Center consumers |

-346.0 |

|

Shift Medi-Cal costs for developmental center consumers |

-255.0 |

|

Changes in Financing, Payments, and Recoveries |

-$115.3 |

|

Reduce Orthopaedic Hospital settlement payment amount |

-110.8 |

|

Other |

-4.5 |

|

Total |

-$198.7 |

a Approximately $170 million of expenditures for specified caseload expansions are being shifted to a new Tobacco Settlement Fund. |

|

Caseload Increases—$258.8 Million Cost. The largest caseload-related cost increases are due to the full-year effect of simplification of the complex Medi-Cal eligibility process that took effect January 2001. The budget includes $129.1 million from the General Fund to provide continuous eligibility to children 19 years of age and younger if federal financial participation is available. This is expected to result in a caseload increase of about 390,000 eligibles in 2001-02. Eliminating quarterly status reporting requirements for parents and providing continuous Medi-Cal eligibility for persons leaving the CalWORKs program are expected to enable 218,000 adults to retain coverage at a cost of $68.4 million from the General Fund.

The phase-in of the program to expand 1931(b) eligibility to cover both children and parents in families with income at or below 100 percent of the FPL has been slower than anticipated. As a result, the $37.8 million General Fund cost of this change has been shifted to 2001-02 to cover the anticipated cost of nearly 161,000 additional enrollees. These costs will be funded by the new Tobacco Settlement Fund under the Governor's spending plan.

Legislation enacted in 2000 expanded Medi-Cal benefits for aged, blind, and disabled persons. Effective January 2001, Medi-Cal benefits are being provided without a share of cost to all aged, blind, and disabled persons with current income equivalent to 133 percent of the FPL and below. The $23.5 million increase in the budget year is due to the full-year cost of this change. In 2001-02, this caseload expansion of about 37,000 would also be funded by the new Tobacco Settlement Fund.

Pass-Through Funding for Other Departments/Programs—$601 Million Decrease. Previously, Medi-Cal costs for services provided by DDS to Medi-Cal beneficiaries were budgeted in the DHS General Fund item and transferred to DDS as a reimbursement. According to the Governor's Budget Summary, these costs will be budgeted directly in the DDS budget beginning in 2001-02 to eliminate any unnecessary fund transfers between the two state agencies. The Governor's budget proposes that $346 million for the General Fund portion of Medi-Cal costs for regional center consumers and $255 million of Medi-Cal General Fund costs for the developmental centers be budgeted directly in the DDS budget.

Changes in Financing, Payments, and Recoveries—$115 Million Decrease. The bulk of the spending decrease in this category involves the one-time payment in the current fiscal year of $175 million for the settlement reached in the Orthopaedic Hospital v. Belshe' litigation and other related lawsuits pertaining to Medi-Cal payments for hospital outpatient services. According to the terms of the settlement, following the lump-sum $175 million payment in 2000-01, DHS expects to increase hospital outpatient rates by approximately 30 percent in 2001-02, at a cost of $64.2 million General Fund. Because funding for the one-time payment will not be carried over into the 20001-02 budget for Medi-Cal there is effectively a cost reduction of $110.8 million from the General Fund in the budget year.

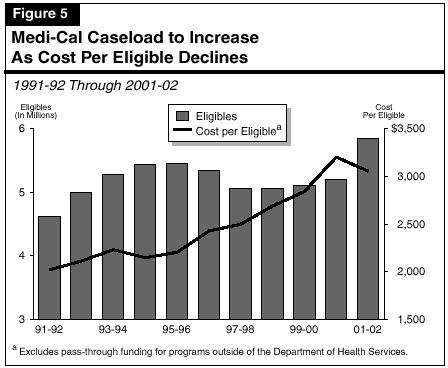

Figure 5 illustrates how Medi-Cal caseload and per-eligible costs have changed since 1991-92, along with projections of these for 2000-01 and 2001-02 based on the budget estimates.

The budget projects that in the current year the number of eligibles and the cost of benefits per eligible will grow. In the budget year, however, caseloads are projected to continue to grow while the cost per eligible will decline.

Caseload. The number of persons enrolled in Medi-Cal grew rapidly in the early 1990s—caseload growth in 1992-93 was almost 8 percent over the prior year. Between 1991-92 and 1995-96, the Medi-Cal average monthly caseload grew from 4.6 million eligibles to 5.5 million. The rapid growth resulted from the ongoing effects of Medicaid eligibility expansions enacted in the late 1980s and from increased welfare caseloads associated with the severe recession that California experienced at that time.

In the mid-1990s, the Medi-Cal caseload leveled off, and then dropped by almost 300,000 eligibles (5.4 percent) in 1997-98. Again, the change in the Medi-Cal caseload roughly paralleled changes in the CalWORKs welfare caseload. That caseload began a sharp drop at that time in response to the turnaround in the state's economy and greater emphasis on moving families from welfare to work in the wake of enactment of state and federal welfare reform legislation. Another factor contributing to declining welfare and Medi-Cal caseloads probably was reluctance among immigrant Californians to make use of public benefits because of concerns about whether such use might adversely affect their ability to naturalize or to sponsor the immigration of family members in the future.

From 1997-98 through 1999-00, the Medi-Cal caseload was relatively flat while the CalWORKs caseload continued to decline. The Medi-Cal caseload has not declined primarily because of the backlog of eligibility determinations for former CalWORKs recipients that resulted from the delay in implementation of Section 1931(b) Medi-Cal eligibility by DHS and the counties. In the current year and 2001-02, the budget estimates that the Medi-Cal caseload will grow once more, primarily due to a variety of eligibility expansions and simplified eligibility processes.

Cost Per Eligible. While the caseload has gone up and down, the cost trend has been almost steadily upward until 2001-02. The average annual growth rate of the estimated cost of benefits per eligible (excluding pass-through funding to other departments and local governments) is 4 percent, which is twice the rate of general inflation during this period, as measured by the Gross Domestic Product deflator.

The temporary dip in the cost per eligible that occurred in 1994-95 and 1995-96 was partly the result of a change in the caseload mix, rather than an underlying drop in health care costs. This is because the rapid increase in the number of families on welfare (whose health care costs are relatively low) temporarily reduced the proportion of aged and disabled persons (relatively high-cost groups) in the Medi-Cal caseload, and this change in the mix tended to reduce the average cost per eligible. As the CalWORKs welfare caseload subsequently fell, the elderly and disabled share of the Medi-Cal caseload returned to its earlier level of about 26 percent, and the cost per eligible resumed its growth in 1996-97. In 1999-00, the estimated cost per eligible increased by 5.7 percent.

Based on the Governor's budget, these costs would increase by almost 13 percent in the current year, but would depart from the pattern of the prior five years by decreasing 4.6 percent in the budget year. The projected slowing of the growth rate in 2001-02 appears to be the result of an increase in the number of healthy beneficiaries rather than a decrease in health care costs. The simplification of the eligibility process means that the Medi-Cal Program probably will retain a greater number of children and families on its caseload who do not regularly need health care services. In the past, these individuals might not have submitted quarterly status reports because they did not need health care services at that time and, as a result, they were dropped from Medi-Cal coverage. These individuals would probably reenroll later when they needed health care services. With continuous eligibility, these individuals are much less likely to leave the program. Therefore, the Medi-Cal caseload increase will include a larger segment of the population that is healthy, resulting in fewer additional program costs compared to other beneficiaries, such as the aged, blind, and disabled.

We find that the budget's overall estimate for the Medi-Cal caseload is reasonable, but that the projected increase in the caseload of Medi-Cal nonwelfare families may be overestimated. Accordingly, we will monitor caseload trends and recommend appropriate adjustments at the time of the May Revision.

Figure 6 shows the budget's forecast for the Medi-Cal caseload in the current year and 2001-02. The majority of the projected Medi-Cal caseload growth consists of families and children. The budget estimates that the caseload for this group will increase by 2.8 percent in the current year and about 16 percent in the budget year. Nonwelfare families account for most of the projected increase in Medi-Cal eligible families and children. The budget estimates that the caseload of Medi-Cal eligible nonwelfare families will increase by about 52 percent in the current year, then increase again by 49 percent in the budget year.

The projected caseload increase is primarily the result of growth in the 1931(b) program, elimination of the quarterly status reporting requirements for adults, and the implementation of new continuous eligibility rules for children.

Nonwelfare Family Growth May Be Overestimated. Our analysis indicates that the projected increase in Medi-Cal eligible nonwelfare families for the budget year may be overestimated. This is because in the current year, the caseload increase expected to result from the expansion of the nonwelfare 1931(b) program to 100 percent of FPL (effective March 2000) has been about half of what was anticipated. This is attributed to the complexity of making 1931(b) eligibility determinations. Additionally, the overall Medi-Cal caseload for the current year appears to be slightly below the estimate upon which the Governor's budget plan for 2001-02 is based. If this caseload trend continued, state Medi-Cal costs could be tens of millions of dollars below the level of spending assumed in the 2001-02 Governor's Budget.

|

Figure 6 |

|||||||

|

Medi-Cal Caseload |

|||||||

|

1999-00 through 2001-02 |

|||||||

|

|

Change from |

|

Change From |

||||

| 1999-00 | 2000-01 |

Amount |

Percent |

2001-02 |

Amount |

Percent |

|

|

Families/Children |

3,573 |

3,675 |

102 |

2.8% |

4,271 |

596 |

16.2% |

|

CalWORKsa |

2,033 |

1,768 |

-265 |

-13.0 |

1,652 |

-116 |

-6.6 |

|

Nonwelfare familiesb |

919 |

1,394 |

475 |

51.7 |

2,071 |

677 |

48.6 |

|

Pregnant women |

176 |

178 |

2 |

1.3 |

203 |

25 |

14.1 |

|

Children |

446 |

335 |

-111 |

-24.8 |

345 |

10 |

3.0 |

|

Aged/Disabled |

1,311 |

1,357 |

45 |

3.5% |

1,402 |

46 |

3.4% |

|

Aged |

489 |

508 |

18 |

3.7 |

525 |

18 |

3.5 |

|

Disabled |

823 |

849 |

27 |

3.3 |

877 |

28 |

3.3 |

|

Totals |

4,885 |

5,032 |

147 |

3.0% |

5,674 |

642 |

12.8% |

a California Work Opportunity and Responsibility to Kids program. |

|||||||

b Includes former CalWORKs recipients temporarily continued in the "Edwards" category. |

|||||||

Uncertainties in Estimate. However, it is highly uncertain at this time whether this trend will be sustained. There are a number of factors that could result in higher caseloads as well as factors that could produce lower caseloads. On the upside, a number of significant expansions in Medi-Cal coverage and change in eligibility rules only began to take effect on January 1, 2001. It may be several months before they are fully implemented and their true effects on the Medi-Cal caseload are known.

There is downside potential for the caseload estimates as well. For example, the lag in eligibility determinations (discussed above) may carry over into the budget year and some counties may continue to encounter delays and difficulties in the Section 1931(b) eligibility process. In this event, the number of adults enrolling in the 1931(b) program would be less than anticipated. Moreover, the projected number of additional persons who would remain enrolled in Medi-Cal because they no longer have to submit a quarterly status report could also be less than estimated in the budget.

Overall Projections Appear Reasonable. Our review found that other caseload estimates appear reasonable. The overall children's monthly caseload component of the nonwelfare families category is expected to increase by about 17,000 in the current year, and nearly 370,000 in the budget year. This growth is consistent with the new rules providing these children with continuous eligibility. Caseloads for the aged and disabled are expected to grow by about 45,000 in both the current year and in the budget year. This budget forecast also appears reasonable, given the recent expansions of eligibility for this group and recent caseload trends. In summary, while we believe that some caseload savings in the budget year are possible, we do not recommend a specific budget adjustment at this time. That is because it is not yet clear whether the delays associated with 1931(b) determinations will continue. Accordingly, we will continue to monitor the Medi-Cal caseload trends and recommend appropriate adjustments at the time of the May Revision.

Potential Risks to Accuracy of Caseload Projections and Cost Estimates. The accuracy of the department's caseload projections and cost estimates are dependent upon a number of other more general factors not discussed above. Among the factors that could cause the Medi-Cal program's caseload and cost to vary from the projections are:

Significant changes in any of these areas could easily result in a caseload growth higher or lower that the one contained in DHS's Medi-Cal estimate.

For 2001-02, the Medi-Cal Program will spend an estimated $1 billion ($500 million General Fund) for physician services in the traditional "fee-for-service" portion of the program in which providers are paid for each examination, procedure, or other service that they furnish. In addition, a significant portion of the estimated $4.2 billion ($2 billion General Fund) in premiums that Medi-Cal provides to health plans for beneficiaries in managed care indirectly pays for physician services.

About half of the persons eligible for Medi-Cal are enrolled in managed care organizations while the remainder receive services under the fee-for-service portion of the program. Although we believe a review is warranted of the managed care plan rate system, this analysis focuses primarily upon the mechanism for establishing physician rates for fee-for-service Medi-Cal services.

Our analysis indicates that the rates paid to physicians for services provided under the Medi-Cal Program are relatively low compared to the rates paid by the federal Medicare program and other health care purchasers. Despite state and federal requirements, the Department of Health Services has not conducted annual rate reviews or made periodic adjustments to Medi-Cal rates to ensure reasonable access to health care services. Rate adjustments have generally been adopted in the budget process on an ad hoc basis, usually in response to complaints about limited access to specific services and to provider requests for rate increases. Thus, there is not a rational underlying basis for the state's complex system of setting Medi-Cal rates. In comparison, Medicare uses a comprehensive, annually updated, rate-setting system that is available for use by other government programs and the public generally. Our key findings, which we discuss below, are summarized in Figure 7 .

|

Figure 7 |

|

Current Physician Rate-Setting System |

|

Key Findings |

|

|

|

|

|

|

Studies Show Medi-Cal Rates Are Low. Studies show that the rates that Medi-Cal pays for physician services are relatively low compared to rates paid by other major purchasers of health care. For example, a May 1999 study conducted by Pricewaterhouse Coopers LLP for the Medi-Cal Policy Institute found that Medi-Cal physician rates for some common procedures were substantially less than those paid by the federal Medicare program, which provides health care benefits for the elderly and some disabled persons, or by private health plans. Medi-Cal rates for certain medical services were often less than half the rates paid by other health care purchasers.

A national study of physician rates in state Medicaid programs by The Urban Institute found that these states, on average, paid physicians at rates equal to about 64 percent of Medicare rates. However, the study found that California's Medi-Cal rates were comparatively lower, amounting to an average of 47 percent of the Medicare rates in 1998.

Budget Problems Held Down Rates. These low rates resulted in part from the state's budget problems during the recession of the early 1990s. Most Medi-Cal physician rates were frozen and some rates were actually reduced to hold down state costs. As the state economy and state budget situation improved, rates were increased in the 1998-99 and 1999-00 state budgets for specific services, such as primary care and emergency room services. But no general increase affecting Medi-Cal physician rates across the board had been implemented since 1985-86 until the enactment of the 2000-01 Budget Act.

As shown in Figure 8, the 2000-01 budget provided about $133 million from the General Fund (plus matching federal funds) for (1) targeted rate increases and (2) a general physician rate increase (identified as "other physician services" in Figure 8). The recent rate increases, however, do not put into place any ongoing process for evaluating physician rates or for periodically adjusting them when appropriate.

Requirements for Regular Rate Reviews Have Not Been Met. State law establishes the following two general criteria for Medi-Cal physician rates: (1) rates must be sufficient to provide Medi-Cal recipients with reasonable access to medical care services and especially to primary and maternity care services; and (2) rates must apply statewide, except that higher rates may be paid if necessary to provide access to care in specific areas. The state provision for reasonable access to care is consistent with the requirement of federal Medicaid law that rates be sufficient to enlist enough providers so that care and services are available to Medicaid participants to at least the same extent that they are available to the general population in the geographic area. State law also requires the Department of Health Services (DHS) to annually review and periodically revise Medi-Cal physician and dental rates "to ensure the reasonable access of Medi-Cal beneficiaries to physician and dental services."

|

Figure 8 |

||

|

Physician Rate Increases for Medi-Cal and |

||

|

2000-01 |

||

|

Amount |

Percent Increase |

|

|

Child Health and Disability Prevention

Program— |

$19.2 |

20.0% |

|

California Children's Services |

9.2 |

20.0 |

|

Emergency-room and on-call physicians |

10.5 |

40.0 |

|

Neonatal intensive care |

5.4 |

30.0 |

|

Comprehensive perinatal services |

2.6 |

11.0 |

|

Other physician services |

84.9 |

15.6 |

|

Total |

$132.9 |

|

Despite these statutory provisions, DHS has not performed the required annual rate reviews or proposed revisions to physician rates for many years. The rate increase included in the 2000-01 budget was not based upon any objective analysis of the adequacy of physician rates.

The Legislature approved a bill in 1999 (AB 461, Hertzberg) to require DHS to conduct a rate review by April 1, 2000, including a comparison of Medi-Cal physician rates with those of Medicaid programs in five comparable states. The Governor vetoed this legislation, stating that DHS lacked the administrative resources to conduct such a rate review.

Studies Show Relationship Between Rates and Health Care. A recent national analysis of Medicaid physician rates by The Urban Institute concluded that "physician fee levels affect both access and outcomes for Medicaid patients." One study cited by The Urban Institute report found that higher rates were "associated with a small, but significant, decline in the infant mortality rate." Another study found that children enrolled in Medicaid programs that paid relatively higher physician fees were more likely to obtain care at a doctor's office.

The findings of this national study are consistent with a recent survey of Medi-Cal beneficiaries. Specifically, in a recent survey of Medi-Cal beneficiaries, the Medi-Cal Policy Institute reported that 80 percent of program participants believe that they are receiving high-quality medical services. However, 56 percent reported difficulty finding doctors who would provide them treatment, and 78 percent said it is very important that more doctors participate in the program.

No Rational Basis for Rate System. There are three basic steps in the methodology for calculating most Medi-Cal physician rates. First, physician procedures are classified according to a coding structure. Second, each procedure is assigned a relative unit value. Third, the payment amount is determined by multiplying the relative unit value by a dollar conversion factor. (We explain this process in more detail in our February 2001 report entitled, A More Rational Approach to Setting Medi-Cal Physician Rates.)

The structure of Medi-Cal rates is complex with thousands of possible combinations of procedure codes, relative unit values, conversion factors, and other rate modifications. Nevertheless, DHS has no regular process in place for the periodic evaluation of the adequacy of physician rates or for periodically adjusting them. Physician rates are no longer tied to a 1969 relative unit value system developed by the California Medical Association. Thus, the rate adjustments approved in recent years in the budget process have generally been adopted on an ad hoc basis, usually in response to complaints about limited access to specific services and to provider requests for rate increases.

The rate increases included in the 2000-01 budget, for example, were based upon general legislative concerns about the adequacy of rates and overall budget priorities; they were not based on any specific objective measures of the adequacy of those rates in ensuring patient access to care or quality of care. While DHS has used additional funding received through the budget to adjust Medi-Cal physician rates to reduce some of the disparities with Medicare, large differences still exist for some medical procedures.

The lack of a rational system for physician rate setting has significant potential ramifications for the provision of health care for Medi-Cal beneficiaries and the administration of the program: (1) the state will not ensure reasonable access to quality health care services; (2) physician services will be used less efficiently, with overpayments for some medical procedures and underpayments for others, providing an incentive for the overuse of some services and the under use of others; (3) some medical providers may not be fairly compensated for certain medical procedures; and (4) the Medi-Cal rate system will remain complex and difficult to administer for DHS and participating physicians.

Medicare Is a Useful Benchmark. Our analysis indicates that Medicare provides the state with a useful benchmark for rate setting, for several reasons. Similar to the Medi-Cal Program, Medicare uses a three-step rate-setting process involving a coding structure, relative unit values, and a dollar conversion factor. The key differences in Medicare which we believe make it a useful benchmark are that (1) the relative values and conversion factor the Medicare rate system assigns to medical procedures are updated regularly, and (2) Medicare rates fairly accurately reflect the current costs of providing physician services. Medicare has the most comprehensive, annually updated, rate system in the nation, and it is publicly available for use by anyone, including other public agencies such as the Medi-Cal Program. Many purchasers of health care, including both private health plans and about 19 state Medicaid programs, use the relative value-based rate system developed by Medicare when adjusting physician rates.

Using Medicare rates as the basis for Medi-Cal rate setting would allow DHS to avoid the expensive and unnecessary process of developing its own separate physician rate structure. This approach also should not be difficult for health care providers to accept, given that four out of five California physicians participate in Medicare.

Medi-Cal Rates Now 60 Percent of Medicare. The 2000-01 budget included about $85 million from the General Fund (plus an equivalent amount of federal matching funds) for a general increase in physician rates averaging 15.6 percent. Because the intent of the budget action was to reduce disparities with Medicare, larger rate increases were provided for some procedures than for others. State payments to managed care health plans will also be increased proportionally to allow those plans to provide higher compensation for physicians.

Based upon data provided by DHS, we estimate that the overall level of Medi-Cal physician payments has increased to roughly 60 percent of the Medicare rates allowed for nonhospital settings as a result of the recent physician rate increases. We estimate that Medi-Cal physician payments averaged about 50 percent of the Medicare rates before the recent rate increases were implemented.

We recommend that the Legislature establish a more rational process for establishing Medi-Cal rates and for periodically reviewing and adjusting those rates. In the short term, if the Legislature wishes to continue to narrow the significant gap between Medi-Cal physician rates and the rates paid under other health programs, Medicare rates should be used as a benchmark. In order to provide a long-term solution, the Legislature should direct the Department of Health Services to perform a comprehensive analysis of access to physician services and the quality of care provided to Medi-Cal beneficiaries, and offer proposals commencing in 2002-03 for periodic future adjustments to physician rates based upon that analysis. Figure 9 summarizes our recommendations.

Interim Approach—Base Medi-Cal Rates Upon the Medicare Program. Due to the lack of objective data at this time about health care access or quality of care for Medi-Cal beneficiaries, we have no basis for recommending any further change now in Medi-Cal physician rates. However, as we have noted in this analysis, Medi-Cal rates in many cases are well below the rates paid by other health care purchasers, including Medicare.

Accordingly, we recommend that any rate adjustments the Legislature does choose to provide in the interim for the Medi-Cal Program in the state budget process be made in a way that further narrows the program's differences with Medicare rates. We also propose that DHS report each year to the Legislature regarding how Medi-Cal and Medicare rates compare, and the cost of keeping Medi-Cal rates in alignment with Medicare and other major purchasers of health care.

We further recommend that any specific rate increases generally be limited to 80 percent of the Medicare level. This is due to the way Medicare and Medi-Cal provide coverage to persons eligible for both programs. The Medi-Cal Program pays the Medicare premiums and deductibles and any required copayments for medical services on behalf of these persons. Participating physicians generally agree to accept the Medicare rates for services to Medicare beneficiaries. However, the Medicare payment is only 80 percent of the Medicare rate—with copayments by beneficiaries making up the remaining 20 percent of the payment due to the physician.

Federal law allows state Medicaid programs to limit the amount they pay for Medicare copayments on behalf of dual eligibles, and California has chosen to exercise this option under state law. If the Medicare payment is greater than the Medi-Cal rate, then Medi-Cal pays nothing, and the provider receives only the Medicare payment. If the Medi-Cal rate is greater than the Medicare payment, then Medi-Cal pays the difference between the higher Medi-Cal rate and the lower Medicare payment.

|

Figure 9 |

|

LAO Recommendations for |

|

Establish a More Rational Process |

|

|

|

For most procedures and services, the Medi-Cal rate is less than the Medicare payment amount. As a result, the state avoids substantial medical costs.

We estimate that if Medi-Cal rates were generally increased to the maximum recommended level of 80 percent of Medicare rates, the annual General Fund cost would be roughly $237 million. If the interim 80 percent limit we propose were exceeded so that Medi-Cal and Medicare physician rates were equal, we estimate that annual General Fund costs would increase much more—about $540 million—for the reasons we have discussed above.

Long Term—Base Rates on Comprehensive Review. We recommend the enactment of legislation directing DHS to perform a comprehensive analysis of the access to physician services and quality of care provided to Medi-Cal beneficiaries. The DHS would recommend periodic adjustments to physician rates based upon the results of that analysis. The Legislature would then determine whether to appropriate funding for such rate adjustments.

This analysis would involve regular measurement and evaluation of both patient access to health care and the quality of that care. While the department now contracts for such reviews for Medi-Cal managed care plans, it does not comprehensively or regularly do so for fee-for-service Medi-Cal services.

The long-term fiscal impact of the proposed new rate-setting mechanism is uncertain and would largely depend upon the extent to which the Legislature appropriated funding for any periodic rate increases recommended by DHS.

We believe that our proposal to establish a rational process for setting Medi-Cal rates, and for periodically reviewing and adjusting those rates, offers some significant potential benefits. For example, it would ensure that the Medi-Cal Program remains in compliance with state and federal statutory requirements for the payment of rates sufficient to ensure the participation of medical providers and regular review and adjustment of physician rates. Our approach is likely in the long term to foster reasonable access to health care for Medi-Cal beneficiaries and a better quality of care. This is because our proposal would ensure that rates are reviewed and adjusted with these factors in mind. Physician services are likely to be used more efficiently under our proposal since rates would be more in line with current costs, thus avoiding overuse of some medical procedures and under use of others. Medi-Cal rates would keep pace with changes in medical practices and technology.

Our proposal would also simplify administration of the Medi-Cal Program by doing away with an extremely complex rate structure. For example, the 20 different dollar conversion factors used to determine payments for physician services would be consolidated into one such factor, and many special modifications of rates would no longer have to be calculated.

We recommend approval of $30 million from the General Fund requested for the extension of a Medicaid demonstration project providing state and federal funds to enable Los Angeles County to reduce its inpatient, and expand its outpatient, health care system.

In order to strengthen the Legislature's oversight of this project, we recommend the adoption of supplemental report language requiring that the state Department of Health Services report on the county's progress toward restructuring the local health system and its assessment of county plans to address significant health program budget shortfalls projected to begin in 2003-04.

We further recommend that the 2001-02 budget request for funding to monitor the demonstration project be reduced by $6.8 million (about $3.4 million General Fund and $3.4 million federal funds), because the monitoring contract is unlikely to be awarded until 2002-03. In addition, the Legislature may wish to consider using available federal funds instead of the General Fund to pay for workforce training related to the demonstration project, thereby saving about $27 million from the General Fund over a five-year period. (Reduce Item 4260-101-0001 by $3.4 million and Item 4260-101-0890 by $3.4 million.)

Background. At the start of the 1995-96 fiscal year, Los Angeles County faced a $655 million budget deficit in health services operations and the potential collapse of its medical "safety net" programs. State, federal, and county officials collaborated to develop a five-year plan to address the crisis by financially stabilizing the county health system, and, over time, moving it away from expensive hospital services toward community-based primary care and preventive services. In April 1996, HCFA approved the plan as a Medicaid demonstration project that was to end during 1999-00.

Since that time, Los Angeles County has made some progress toward achieving the project's goals, including increasing ambulatory (community based) sites throughout the county from 45 to 156 and decreasing emergency room visits by 27 percent. However, the fundamental restructuring goals of reducing inpatient care and expanding outpatient care were not achieved by the end of the project's term. Access to community-based care was to have been increased by 900,000 additional visits, but it was increased by 600,000 visits, and other goals for reducing operating costs were not achieved. As a result, the county requested an extension of the program to provide it additional time and funding to institute reforms and restructure its health system.

On June 27, 2000, HCFA approved a five-year extension to the demonstration project (for 2000-01 through 2004-05). The extension provides $900 million in federal funds that would be phased out over the five-year extension of the project. The total amount of supplemental funding available to Los Angeles County as a result of the demonstration project is $1.5 billion, including federal ($900 million), state ($150 million), and county ($400 million) funds.

Provisions of the Project Extension. The project's extension is contingent upon the state and county meeting a number of specific requirements that include:

Commitment of State and County Funds. Unlike the initial waiver, which did not require a significant state General Fund contribution, the extension agreement requires the state to provide $30 million annually from the General Fund for five years beginning in the current fiscal year. This funding is in addition to the normal reimbursements the state provides the county through programs such as Medi-Cal. The funding would be used to provide cost-based reimbursement for services provided at eligible county-affiliated clinics.

In addition to these state funds, the county has committed $300 million of tobacco litigation settlement funds and an additional $100 million of the county General Fund during the extension period for demonstration-related services.

State Investment Has Risks. The terms and conditions under which HCFA approved an extension to the demonstration project outline specific goals that Los County must achieve. Given that many of these goals were not fully achieved in the first five years of the project, there is uncertainty about whether they will be met in the next five years. The extension requirement that the state contribute $150 million during this five-year period gives it a vested interest in the county's success in meeting these goals and establishing a more cost-effective and efficient health care system.

However, the county's own fiscal estimates show that, even with the state and federal financial help provided for the demonstration project, the county DHS will face a budget shortfall beginning in the third year (2003-04) of the extension. The shortfall is projected to continue through the end of the project and beyond. The shortfall is projected to amount to $333 million in 2003-04 and grow to $534 by 2005-06, the year after the extension expires. The threat of continued deficits in 2005-06 and subsequent years, and the projected decline in federal funds, leaves the state at risk of being called upon to provide hundreds of millions of dollars annually for Los Angeles County health services beyond the extension period.

The county has not yet determined how it will address these shortfalls. Currently, it is considering options, including consolidations and reductions of health operations, to eliminate shortfalls during the five-year demonstration project period. To plan for the shortfall expected after the five-year period, beginning in 2005-06, the county DHS will submit a report to the county Board of Supervisors in December 2002 that provides options for changes in facilities and services in line with requirements to balance the budget.

Monitoring Funding Apparently Not Yet Needed. In addition to the $30 million General Fund augmentation in both 2000-01 and 2001-02, the Governor's budget requests $7.7 million ($3.8 million from the General Fund) and nine positions to fulfill the monitoring and auditing responsibilities mandated in the terms and conditions of the waiver extension. Of this amount, $6.8 million (about $3.4 million from the General Fund and an equal amount of federal funds) would be used to hire a contractor that would conduct the overall program monitoring activities.

The timetable for hiring the contractor involves recruiting, hiring, and training staff to develop a request for proposal; soliciting and reviewing bids; interviewing applicants; and hiring the contractor. The DHS' own timetable provides for the interviewing and hiring of the contractor to occur at the earliest between May 1, 2002 and June 30, 2002. Yet, we are advised that the contractor hiring process has already fallen behind schedule. Given this situation, we believe it is very unlikely that the monitoring contract will be awarded during 2001-02.

Workforce Investment Act Funding. One of the major components of the project is the development of a Workforce Development Program (WDP) to meet the needs of workers involved in health care delivery system restructuring areas. The WDP is a jointly developed program through the County of Los Angeles DHS and Service Employees International Union designed to:

Under the terms of the extension agreement, the WDP is to be supported by the state and county at a 2-to-1 ratio, with a combined contribution of $40 million during the extension period (fiscal year 2000-01 through 2004-05). The state's share of this funding is estimated to be about $27 million over five years.

The Governor's budget would provide the state's share from the General Fund. Our analysis indicates, however, that the workforce retraining activities required under the Medicaid demonstration project appear to be eligible for funding under the federal Workforce Investment Act (WIA). The 2001-02 Governor's Budget appropriates about $800 million in federal funds received by the state under WIA. Of this amount, there are funds which are targeted to adults—including those facing dislocation from their current jobs—to assist them with their retraining and other needs. Up to 15 percent of the allocation is reserved for statewide activities, with the balance of funding allocated to counties. The Governor's proposed budget identifies few specific statewide projects and proposes to leave most allocation decisions to the California Workforce Investment Board.

Notably, the state-federal-county agreement to extend the Los Angeles County demonstration project specifically permits the use of non-Medicaid federal funds for the required retraining activity. Substitution of WIA funds for this purpose would result in General Fund savings of $27 million over the life of the five-year demonstration project.

Analyst's Recommendation. We recommend that the budget's request for $30 million General Fund annually for the Los Angeles County demonstration project be approved. Under the terms of the project extension, the contribution of state funds enables the county to obtain a significant amount of federal funds—$900 million over five years. Without this funding, the county cannot restructure its health operations and stabilize its costs and would risk a large-scale disruption of its health system. Further, if the demonstration project were halted as a result of a state decision to withhold its financial contribution, the county's reliance on expensive inpatient care would continue and the planned shift to outpatient setting would probably suffer a setback. In addition, the demonstration project does have some mechanisms in place to help assure that the county meets the project's goals, such as a monitoring plan and the state's ability to impose financial sanctions upon the county if the monitoring plan's requirements are not met.

However, there are significant risks for the state associated with the commitment of state General Fund support. This requires that the administration and the Legislature provide strong oversight of the demonstration project over its five-year life.

Accordingly, we recommend the adoption of the following supplemental report language:

It is the intent of the Legislature that the State Department of Health Services (DHS) prepare a detailed written assessment of the progress of Los Angeles County toward meeting the goals outlined in the terms and conditions of the Medicaid Demonstration Project extension approved by the Health Care Financing Administration and report the assessment to the Chair of the Joint Legislative Budget Committee and the chair of the fiscal committee of both houses of the Legislature by December 1, 2001, and by December 1 of each subsequent year through 2005. It is also the intent of the Legislature that, by January 1, 2003, DHS prepare a detailed written assessment for the Joint Legislative Budget Committee and the fiscal committee of both houses of the Legislature of Los Angeles County's plans to address the significant budget deficits projected for its health systems, both during the term of the demonstration project and thereafter.

We also recommend deletion of the funding for the monitoring contractor that, based on our review, will not be needed in the budget year. We further recommend that the Legislature consider using available federal funds, at a state savings over five years of about $27 million, for workforce training related to the demonstration project.

We recommend the enactment of legislation directing the department to revise the Medi-Cal estimate in order to make it a more useful tool for the Legislature. In addition, we recommend the department report at budget hearings regarding the additional resources it would need to complete the redesign of the estimate.

Estimate an Inadequate Tool. The annual Medi-Cal estimate is the basic tool the administration, Legislature, and other parties use to monitor Medi-Cal and evaluate proposed changes in this $25.4 billion ($9.4 billion General Fund) program. Yet, the estimate's approach and format have changed little over the last 20 years, resulting in a tool that is inadequate for the task. In the Analysis of the 1999-00 Budget Bill, we found that the estimate's approach was outdated and failed to provide important information, such as data on caseloads and rates for the managed care plans, and provides almost no information explaining why proposed changes should occur. We proposed several ways to make the estimate a more useful tool for budgeting, monitoring, and evaluating the Medi-Cal Program.

The 1999-00 Budget Act provided DHS funding for consultants and three limited-term staff through 2000-01 to assess the Medi-Cal estimate and determine the best approach for replacing the existing information system and identifying specific functional requirements. A feasibility study report (FSR) has been completed and is currently under review by the Department of Information Technology. Following approval of the FSR, DHS intends to revise the estimating process to implement improved technology. Because the redesign process is under way, with development and implementation expected over the next two years, we believe this is an opportune time for the Legislature to direct the department to take additional steps to improve the estimate.

Analyst's Recommendation. We believe that the recommendations we offered for such improvements in our 1999-00 Analysis are still relevant and would assist the Legislature in determining the appropriate budget for the Medi-Cal Program. Accordingly, we recommend the enactment of legislation directing DHS to restructure the estimate to:

We recognize that revising the estimate as we propose may require additional DHS resources. Thus, we further recommend that the department report at the time of budget hearings regarding any funding and staffing required to carry out these changes.

We recommend that the Department of Finance and the Department of Health Services report at budget hearings regarding (1) their plans for Medi-Cal managed care and hospital inpatient rate increases for 2001-02 and (2) the potential amount of additional funding needed in 2001-02 to provide for any such rate increases. An estimate of the cost of providing anticipated rate increases for nursing homes is expected at the time of the May Revision.

Managed Care and Inpatient Rate Increases in the Current Year. A portion of the 2000-01 Medi-Cal deficiency is for rate increases the CMAC negotiated and DHS granted to Medi-Cal managed care plans and hospitals. The 2000-01 Budget Act included about $67 million from the General Fund for rate increases for Medi-Cal managed care plans operating in the 12 counties under the "two plan" model. However, about one-third of the total cost of the rate increases for the current year—an additional $36 million—was not budgeted and is contributing to the Medi-Cal deficiency in the current year.

In addition to not fully funding the cost of managed care rate increases in the current year, the 2000-01 Budget Act did not include any appropriations for the rate increases that hospitals negotiate with CMAC. The CMAC negotiated such rate increases in the current fiscal year and the related increase in inpatient costs is contributing $60 million to the current-year deficiency.

Potential Budget-Year Costs. The budget request for 2001-02 does not include any additional funding for Medi-Cal managed care or inpatient rate increases. Managed care rate increases are typically granted every year and it is likely that further inpatient hospital rate increases will also be granted. Excluding these costs results in under budgeting of the Medi-Cal Program. Furthermore, as discussed in the issues above, and in the 2000-01 Analysis, we believe the deficiency process is not an appropriate funding mechanism for these rate increases. In addition, the 2001-02 budget proposal does not include any funding for anticipated increases in Medi-Cal expenditures due to rate increases for nursing homes. The DHS ordinarily provides an estimate of the cost of these rate increases at the time of the May Revision. The combined impact of managed care, inpatient, and nursing home rate increases could exceed $100 million in the budget year.

Analyst's Recommendation. For these reasons, we recommend that DHS and DOF report at budget hearings on (1) their plans for considering Medi-Cal managed care and hospital inpatient rate increases in 2001-02 and (2) the potential amount needed to provide for these rate increases. An estimate of the cost of providing anticipated rate increases for nursing homes is expected at the time of the May Revision.

We recommend that the Department of Health Services report at budget hearings regarding (1) the impact of the settlement of the Orthopaedic Hospital v. Belshe' litigation on provider rates and (2) the potential amount of funding needed if provider rates increase in the budget year as a result of the settlement.

Potential Provider Rate Increases in the Budget Year. The recent settlement of the Orthopaedic Hospital v. Belshe' litigation and other related lawsuits pertaining to Medi-Cal payments for hospital outpatient services (discussed earlier) could result in provider rate increases. Work is currently under way to negotiate the final details of the settlement, which must then be approved by HCFA. Until this is complete, the impact of the settlement on provider rates and the Medi-Cal budget is unknown.

Analyst's Recommendation. We recommend that DHS report at budget hearings on the impact of settlement of these lawsuits on provider rates and the 2001-02 Medi-Cal budget.

The proposed Medi-Cal budget assumes that savings resulting from antifraud activities would be about the same as in the current year. However, a significant recent expansion of staff for antifraud activities should result in increased savings during the budget year, potentially amounting to millions of dollars. Accordingly, we recommend that the Department of Health Services (DHS) provide at budget hearings an updated estimate of expected fraud savings for 2001-02. The DHS report should also include the estimated savings for each type of antifraud activity. We recommend approval of the Governor's request to permanently establish 16 positions for the Medi-Cal Fraud Prevention Bureau.