Written July, 2005

This measure makes major changes to California’s Constitution relating to the state budget. As shown in Figure 1, the measure creates an additional state spending limit, grants the Governor substantial new power to unilaterally reduce state spending, and revises key provisions in the California Constitution relating to school and community college funding.

|

|

|

Figure 1 Proposition 76: Main Provisions |

|

|

|

ü An Additional State Spending Limit |

|

· Places a second limit on state expenditures, which would be based on an average of revenue growth in the three prior years. |

|

ü Expanded Powers for Governor |

|

· Grants the Governor substantial new authority to unilaterally reduce state spending during certain fiscal situations. |

|

ü School Funding Changes |

|

· Changes several key provisions in the State Constitution relating to the minimum funding guarantee for K-12 schools and community colleges. |

|

ü Other Changes |

|

· Makes a number of other changes relating to transportation funding; loans between state funds; and payments to schools, local governments, and special funds. |

|

|

The combined effects of these provisions on state spending are shown in Figure 2. The main impact is a likely reduction in spending over time relative to current law. In addition, the measure could result in a smoother pattern of state spending and a different mix of state expenditures.

|

|

|

Figure 2 Proposition 76: Key Fiscal Effects |

|

|

|

ü Effects on Spending |

|

· The additional spending limit and new powers granted to the Governor would likely reduce state spending over time relative to current law. These reductions also could shift costs to local governments (primarily counties). |

|

·

The new limit could also “smooth out” state spending

over time, |

|

·

The new spending-reduction authority given to the

Governor and other provisions of the measure could result in a

different mix of state |

|

ü Effects on Schools |

|

· The provisions changing school funding formulas would make school funding more subject to annual decisions of state policymakers and less affected by a constitutional funding guarantee. |

|

·

Budget reductions resulting from the spending limit or

Governor’s |

|

|

Each of the measure’s key provisions is discussed in more detail below.

California will spend about $113 billion to provide public services through its state budget this year. About four-fifths of this total—around $90 billion—will come from the state’s General Fund for such major programs as elementary and secondary (K-12) education, higher education, health and social services, and criminal justice. The money to support General Fund spending is raised largely from the state’s three major taxes—personal income tax, sales and use tax and corporation tax.

The remaining one-fifth of total state spending is from hundreds of special funds—that is, funds in which specific revenues (such as excise taxes on gasoline or cigarettes) are dedicated to specific purposes (such as transportation or health care).

State and local government finances are closely related to one another in California. For example, most state spending for K-12 education, health, and social services is allocated to programs that are administered by local agencies. In some cases, program costs are shared between the state and local governments.

California has faced large annual shortfalls in its General Fund state budget since 2001‑02. These shortfalls developed following the stock market plunge and the economic downturn that took place in 2001, which caused state revenues to fall sharply below the level needed to fund all of the state’s spending commitments. Although revenues are growing again and the state has made progress toward resolving its budget problems, policymakers will need to take additional actions to address a likely state budget shortfall in 2006‑07.

Since 1979, California has imposed annual spending limits on the state and its thousands of individual local governments. The annual limit for each jurisdiction is based on its spending in 1978‑79 (the base year), adjusted each year for growth in population and the economy. State government spending is currently about $11 billion below its spending limit, meaning that the present limit is not currently constraining spending. The large gap between the limit and actual expenditures opened up in 2001‑02 following the steep revenue downturn in that year.

This measure adds a second limit on the annual growth in state expenditures. Beginning in 2006‑07, combined expenditures from the state’s General Fund and special funds would be limited to the prior-year level of expenditures, adjusted by the average of the growth rates in combined General Fund and special fund revenues over the prior three years.

In years in which actual spending falls below the limit, the spending limit for the subsequent year would be based on the reduced level of actual expenditures. Spending could temporarily exceed the limit in the event of a natural disaster (for example, fire, floods, or earthquakes) or an attack by an enemy of the United States.

What Happens If Revenues Exceed the Limit? If revenues exceed the limit, the excess amount would be divided proportionally among the General Fund and each of the state’s special funds. The exact way in which this allocation would occur is not specified in the measure. The portion of the excess revenues that is allocated to special funds would be held in reserve for expenditure in a subsequent year. In the case of the General Fund, its share of the excess revenues would be allocated as follows:

25 percent—the state’s reserve fund.

50 percent—allocated through annual budget acts to repay any of the following: (1) the Proposition 98 maintenance factor outstanding (see below) at a rate of no more than one-fifteenth of the amount per year; (2) state-issued deficit-financing bonds; and (3) loans made from the Transportation Investment Fund in 2003‑04 through 2006‑07, with annual amounts not to exceed one-fifteenth of the amount outstanding as of June 30, 2007.

25 percent—for road, highway, and school construction projects.

Funds allocated for the above purposes would not be counted as expenditures for purposes of calculating the following year’s spending limit.

Based on budget actions taken in 2005 and the recent strong revenue growth trend, the new spending limit is unlikely to constrain state expenditures in 2006‑07—its first year of implementation. This is because the limit would likely exceed projected revenues and expenditures under current law.

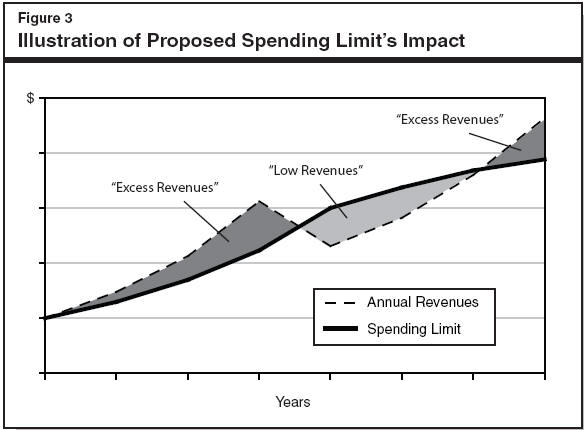

Over the longer term, however, we believe that the spending limit could have significant impacts on annual state spending. This is because of the way in which the new spending limit would interact with changes in the economy and state revenues over time. California’s revenues are highly sensitive to economic changes. That is, they tend to grow fast during the upside of business cycles when the economy is expanding, and slow—or fall—when the economy is on the downside of business cycles. As a result, the new spending limit—which is based on a rolling average of past revenue growth—would grow more slowly than actual revenues when the economy is accelerating, and grow faster than actual revenues when the economy is in recession. This is illustrated in Figure 3, which shows the relationship between annual revenues and the proposed spending limit during periods of strong and weak revenues.

The net impact of this measure on expenditures over time would depend on whether the state were able to “set aside” enough reserve funds during revenue expansions to maintain spending during periods of revenue softness.

If it were able to set aside sufficient funds, the main impact of the spending limit would be to smooth out spending over time—restraining spending during economic expansions and permitting additional spending (supported from its reserves) during revenue downturns. In terms of Figure 3, this means that enough reserves would need to be set aside during the “excess revenues” period to maintain spending at the limit during the “low revenues” period.

However, if the state were not able to accumulate large reserves, the limit would likely result in less spending over time. This is because the state would not have enough reserves available to cushion the decline in revenues during bad times. When this occurred, the reduced level of actual spending during periods of low revenues would then become the new, lower, “starting point” from which the next year’s spending limit is calculated. This could cause the spending limit to ratchet down over time.

Effects on Ability to Raise Taxes. The impact of the limit on the state’s ability to raise taxes to fund spending would depend on the specific situation:

The state would be able to raise taxes or fees and immediately use the proceeds during periods of revenue weakness, when total receipts would likely be below the spending limit.

The state would not, however, be able to raise revenues and immediately use the proceeds if spending was already at the limit. It would, however, eventually be able to use new tax proceeds as the impact of the tax increase worked its way into the new spending limit’s adjustment factors over several years.

The latter situation would be relevant if the state were considering tax or fee increases either (1) to support new or expanded services or (2) when the state was attempting to eliminate an ongoing budget shortfall.

Over time, we believe the operation of this limit would likely reduce state expenditures relative to current law.

Basic Provisions. The State Constitution requires that the Governor propose a budget by January 10 for the next fiscal year (which begins each July 1), and that the Legislature pass a budget by June 15. The Governor may then either sign or veto the resulting budget bill. The Governor may also reduce spending in most areas of the budget before signing the measure. However, this line item veto authority cannot be applied to programs where expenditures are governed by separate laws. The vetoes can also be overridden by a two-thirds vote of each house of the Legislature. Once the budget is signed, the Governor may not unilaterally reduce program funding.

Balanced Budget Requirements. Proposition 58 (approved by the voters in March 2004) requires that budgets passed by the Legislature and ultimately signed into law be balanced. This means that expenditures cannot exceed available revenues.

Late Budgets. When a fiscal year begins without a state budget, most expenses do not have authorization to continue. However, a number of court decisions and legal interpretations of the Constitution have identified certain types of payments that may continue to be made when a state budget has not been enacted. Thus, when there is not a state budget, payments continue for: a portion of state employees' pay; principal and interest payments on bonds; and various other expenditures (such as general purpose funds for K-12 schools) specifically authorized by state law or federal requirements.

Midyear Adjustments. Under Proposition 58, after a budget is signed into law but falls out of balance, the Governor may declare a fiscal emergency and call the Legislature into special session to consider proposals to deal with the fiscal imbalance. If the Legislature fails to pass and send to the Governor legislation to address the budget problem within 45 days after being called into special session, it is prohibited from acting on other bills or adjourning in joint recess.

This measure makes changes relating to late budgets and grants expanded powers to the Governor.

Late Budgets. If a budget is not enacted prior to the beginning of a new fiscal year, this measure requires that the spending levels authorized in the prior-year’s budget act remain in effect until a new budget is enacted. Thus, funding would continue for all state programs that had received budget act appropriations in the prior year.

Fiscal Emergency. The measure grants the Governor new powers to (1) declare a fiscal emergency based on his or her administration’s fiscal estimates, and (2) unilaterally reduce spending when an agreement cannot be reached on how to address the emergency.

Specifically, the measure permits the Governor to issue a proclamation of a fiscal emergency when his or her administration finds either of the following two conditions:

General Fund revenues have fallen by at least 1.5 percent below the administration’s estimates.

The balance of the state’s reserve fund will decline by more than one-half between the beginning and the end of the fiscal year.

Once the emergency is declared by the Governor, the Legislature would be called into special session and then have 45 days (30 days in the case of a late budget) to enact legislation which addresses the shortfall. If such legislation is not enacted, the measure grants the Governor new powers to reduce state spending (with the exception of the items discussed below)—at his or her discretion—to eliminate the shortfall. The Legislature could not override these reductions.

Application of Reductions. The reductions may apply to all General Fund spending except for (1) expenditures necessary to comply with federal laws and regulations, (2) appropriations where the reduction would violate contracts to which the state is already a party, and (3) payment of principal and interest that is due on outstanding debt. Any General Fund spending related to contracts, collective bargaining agreements, or entitlements for which payment obligations arise after the effective date of this measure would be subject to these reductions.

Impact on Entitlement Spending. A significant portion of state General Fund spending is for entitlements. These are programs where individuals who meet specific eligibility criteria—involving, for example, age, income levels, or certain disabilities—have a right to receive the service. Major entitlements include, for example, various health and social services programs for low-income individuals. Most of these programs are administered by local agencies.

This measure gives the Governor the authority to reduce the amount of money available to fund an entitlement program. However, it does not give the Governor authority to modify specific laws that govern, for example, who is eligible to receive the service, the amount of a grant, or the scope of services provided under the program. Absent changes to these underlying laws by the Legislature, it would appear that the entitlement programs would continue to be administered in accordance with the laws that were in effect at the time of the Governor’s reductions. When the funding remaining after the reductions was exhausted, the state would no longer have the obligation to fund the entitlement for the remainder of the fiscal year.

This measure would grant new authority to the Governor to make reductions in almost all state spending. The fiscal effect of this change in individual years would depend on budget-related priorities of Governors and Legislatures. Over time, however, this grant of authority to the Governor to reduce spending would likely result in less state spending relative to current law. It could also result in a different mix of expenditures. That is, some programs’ share of total spending would rise and others would fall relative to current law.

Effect on Local Governments. California counties administer most state health and social services entitlement programs. Also, counties fund other health and social services programs for low-income people who do not qualify for such state services. If the Governor reduced state funding for entitlement programs, some costs to pay for certain programs could shift to counties and there could be increased demand for locally funded health care and social services programs. The Governor also could reduce other state funding provided to local governments.

Proposition 98 is a measure passed by the voters in 1988 which established in the State Constitution a “minimum funding guarantee” for K-12 schools and community colleges (K-14 education). The intent of Proposition 98 is for K-14 funding to grow with student attendance and the state economy. California currently devotes about $50 billion in Proposition 98 funds to K-14 education annually. Of this total, about $37 billion is from the state’s General Fund, and the other $13 billion is from local property tax revenues. Each year, the minimum guarantee is calculated based on a set of funding formulas. Under the main funding formula (referred to as “Test 2”), the guarantee increases each year roughly in line with school attendance and the state’s economy. Figure 4 summarizes how Proposition 98 works and how this measure would change it.

|

|

|

Figure 4 How the Measure Would Change School Spending Guarantee for K-12 and Community Colleges |

|

How Current Guarantee Works |

|

ü Proposition 98 Minimum Guarantee. Is based on the operation of three formulas (“tests”). The operative test depends on how the economy and General Fund revenues grow from year to year. |

|

Test 1—Share of General Fund. Provides 39 percent of General Fund revenues. This test has not been operative since 1988‑89. |

|

Test 2—Growth in Per Capita Personal Income. Increases prior-year funding by growth in attendance and per-capita personal income. This test is generally operative in years with normal-to-strong General Fund revenue growth. |

|

Test 3—Growth in General Fund Revenues. Increases prior-year funding by growth in attendance and per-capita General Fund revenues. Generally, this test is operative when General Fund revenues fall or grow slowly. |

|

ü Suspension of Proposition 98. This can occur through the enactment of legislation passed with a two-thirds vote of each house of the Legislature, and funding can be set at any level. |

|

ü Long-Term Target Funding Level. This would be the K-14 education funding level if it were always funded according to the provisions of Test 2. Whenever Proposition 98 funding falls below that year’s Test 2 level, either because of suspension of the guarantee or the operation of Test 3, the Test 2 level is “tracked” and serves as a target level to which K-14 education funding will be restored when revenues improve. |

|

ü

Maintenance Factor. This is created

whenever actual funding falls below the Test 2 level. The

maintenance factor is equal to the difference between actual funding

and the long-term target amount. Currently, the |

|

ü Restoration of Maintenance Factor. This occurs when school funding rises back up toward the long-term target funding level. Restoration can occur either through a formula that requires higher K-14 education funding in years with strong General Fund revenue growth, or through legislative appropriations above the minimum guarantee. |

|

What This Measure Does |

|

ü Eliminates Future Operation of Test 3. In low-revenue years, the Proposition 98 minimum guarantee would no longer automatically fall below the Test 2 level. |

|

ü Eliminates Future Creation of Maintenance Factor. If in any given year K-14 education was funded at a level less than that required by Test 2 (through suspension or Governor’s reductions), there would no longer be a future obligation to restore that funding shortfall to the long-term target. These reductions would permanently “ratchet down” the Proposition 98 minimum guarantee. |

|

ü Converts Outstanding Maintenance Factor to One-Time Obligation. The measure converts the outstanding maintenance factor (estimated to be $3.8 billion) to a one-time obligation. Payments to fulfill this obligation would be made over the next 15 years. These payments would not raise the future Proposition 98 minimum guarantee (in contrast to existing law). |

|

ü Counts Future Appropriations Above the Minimum Guarantee as One-Time Payments. Spending above the minimum guarantee would not raise the base from which future guarantees are calculated. |

|

|

Proposition 98 also has an alternative—and less generous—funding formula (called “Test 3”) that generally takes effect when the state is experiencing slow growth or declines in its revenues. Funding for schools also can be reduced directly through a two-thirds vote of the Legislature. This is referred to as “suspension” of the guarantee. When Test 3 or suspension occurs, the state generally provides less in K-14 funding. The state is required to keep track of this funding gap, which is referred to as the “maintenance factor.” Under current law, the state would end the 2005‑06 fiscal year with a $3.8 billion maintenance factor created in prior years.

As state revenues improve, Proposition 98 requires the state to spend more on schools to catch up with its long-term target funding level by making maintenance factor payments. When this occurs, the maintenance factor is said to be “restored.” These restorations become part of the base for the next year’s Proposition 98 calculation.

The formulas allowing for less generous K-14 funding during weak revenue periods (Test 3) and more generous funding during subsequent strong revenue periods (maintenance factor restoration) were added by Proposition 111, which was approved by the voters in 1990. These modifications to the original version of Proposition 98 were made to allow the guarantee to automatically slow down during “bad” economic times and rise again during “good” economic times.

Test 3 and Maintenance Factor Eliminated. This measure eliminates Test 3 and maintenance factor, undoing the changes made by Proposition 111. Thus, the Constitution would no longer allow for automatic reductions in the minimum funding guarantee in difficult times nor would it automatically restore funding in good times. The Legislature would retain the authority to suspend Proposition 98; however, the nature of suspension would change. Since the maintenance factor would no longer exist, a suspension would result in a permanent downward adjustment to the minimum guarantee. Similarly, if the Governor unilaterally reduced Proposition 98 funding during a fiscal emergency, these reductions would also permanently lower the minimum guarantee.

Outstanding Maintenance Factor Converted to One-Time Obligation. The measure also converts the outstanding maintenance factor (estimated to be $3.8 billion) to a one-time obligation. Payments to fulfill this obligation would be made over the next 15 years. These payments would not raise the future Proposition 98 minimum guarantee (in contrast to existing law).

Future Spending Above the Minimum Guarantee Would Not Permanently Raise the Guarantee. Under current law, if the Governor and Legislature spend more money on K-14 education than is required by the minimum guarantee in a given year, the higher spending level generally becomes the “base” from which the next year’s minimum funding guarantee is calculated. In this regard, a higher-than-required appropriation in one year typically raises the K-14 education minimum funding levels in subsequent years. Under this measure, future spending above the guarantee would be counted as one-time funding and would no longer raise future Proposition 98 minimum guarantee amounts.

Outstanding Settle-Up Obligations Would Be Paid Within 15 Years. The estimate of the minimum Proposition 98 funding guarantee for a particular fiscal year will usually change after the budget’s enactment. If these changes result in a higher guarantee calculation, the difference between the guarantee and the actual level of appropriations becomes an additional K-14 education expense. This is referred to as “settle up.” Existing settle-up obligations for past fiscal years currently total over $1 billion. Under current statutes, these will be paid at roughly $150 million per year beginning in 2006‑07. This measure would require that these settle-up obligations be fully paid within 15 years.

Given the uncertainty about future economic growth and budgetary circumstances, it is not possible to predict how the measure’s changes would affect actual state spending for K-14 education and other programs. In general, the elimination of Test 3 and future maintenance factors means that year-to-year changes in the minimum guarantee would be less volatile than in the past—absent a suspension or a reduction by the Governor.

Decreases Minimum Guarantee Over Long Term. Over time, however, the net impact of the Proposition 98 changes and related changes in the measure would be to lower the minimum guarantee for K-14 education, as discussed below:

Since K-14 education accounts for almost 45 percent of the state’s General Fund budget, it is likely that policymakers would need to consider reductions in this area whenever the budget fell significantly out of balance. Whenever such spending was reduced—either through suspension or through Governor’s reductions—the state would no longer be required to restore that reduction in the minimum funding guarantee in subsequent years.

The provision making future appropriations over the minimum guarantee one-time in nature would also hold down the minimum guarantee relative to current law. For example, if this provision applied to 2005‑06, it would convert an estimated $740 million in appropriations above the guarantee in the 2005‑06 budget to one-time spending. This would lower the minimum guarantee for 2006‑07 by a similar amount compared to current law.

By converting the $3.8 billion outstanding maintenance factor to a one-time obligation, the measure eliminates the requirement for $3.8 billion to be restored into the annual base funding over time.

Combined, these changes would result in a lower minimum guarantee over time compared to current law.

Unknown Impact on K-14 Spending. A lower guarantee, however, does not mean that actual spending for schools would necessarily be lower. Policymakers would still be free to spend more than required by the minimum guarantee in any given year. Since spending above the guarantee for K-14 education would no longer permanently ratchet up the guarantee, future Legislatures and Governors might be more likely to spend above the minimum guarantee in a given year. Overall, the measure’s Proposition 98-related changes would result in the annual budgets for K-14 education being more subject to annual funding decisions by state policymakers and less affected by the minimum guarantee.

Interactions with Other Provisions of the Measure. While the Proposition 98-related changes, by themselves, would not necessarily reduce K-14 education spending, other provisions of the measure might have that effect. To the extent, for example, that the measure constrains overall spending, budget reductions resulting from the spending limit or Governor’s new authority could apply to schools.

Current Law. In 2002, the voters approved Proposition 42. This measure requires that sales taxes on motor vehicle fuel be transferred from the General Fund to a special fund for transportation. This special fund, called the Transportation Investment Fund (TIF), supports capital improvements and repairs of highways, roads and public transit.

Proposition 42 includes a provision allowing for its suspension when the Governor finds (and the Legislature concurs) that the transfer will have a significant negative fiscal effect on General Fund programs. To help address the state’s major budget shortfalls, the Governor and Legislature partially suspended the Proposition 42 transfer in 2003‑04 ($868 million) and fully suspended the transfer in 2004‑05 ($1.2 billion). Legislation passed with the 2003‑04 and 2004‑05 budgets designated the suspensions as “loans” from the TIF, to be repaid by the General Fund in 2007‑08 and 2008‑09.

Proposal. This measure prohibits the suspension of Proposition 42 transfers after 2006‑07. The total amount of transfers that were suspended through June 30, 2007, would be paid within 15 years, at an annual rate of no less than one-fifteenth of the cumulative amount owed. The measure also permits the Legislature to authorize the issuance of bonds by the state or local agencies that are secured by the anticipated repayments of suspended Proposition 42 transfers.

Fiscal Effect. The inability to suspend Proposition 42 would result in a more stable funding stream for transportation.

Current Law. In addition to the Proposition 42 loans discussed above, the Governor and Legislature have borrowed available balances from other special funds in the past to cover General Fund shortfalls. The amount of these loans outstanding at the conclusion of 2005‑06 is expected to be roughly $1 billion. Some of the loans have specified repayment dates. In other cases, budget language requires that the loans be repaid when the funds are needed to carry out the operations of the particular special fund.

Proposal. Under this measure, such loans would be prohibited beginning in 2006‑07 (except for short-term cash-flow borrowing purposes). Outstanding loans from special funds as of July 1, 2006, would be repaid within 15 years.

Fiscal Effect. Taken together, these provisions would result in more stable funding for some special fund programs.

The State Constitution requires the state to pay local governments for new or expanded programs which it imposes on local governments. In past years, the Governor and Legislature have deferred payments for mandate claims filed by school and community college districts and noneducation local governments (counties, cities, and special districts). Current law requires the state to pay within fifteen years any unpaid noneducation mandate claims incurred before 2004‑05. There is no specific time frame for payment of unpaid education claims. This measure (1) shortens to five years the period in which the state must pay overdue noneducation mandate claims and (2) sets a 15-year deadline on payment of overdue education mandate claims. The measure also states that Proposition 98 funds allocated to schools “shall first be expended . . . to pay the costs for state mandates incurred during that year.” This would change the state’s current practice of providing specific funding to reimburse each school and community college district for its state-mandated activities.

Fiscal Effect. These provisions would have the effect of increasing state costs over the next five years with a comparable reduction over the subsequent ten years.