In our March 2015 report, California’s High Housing Costs: Causes and Consequences, we highlighted the rapid rise in California’s housing costs in recent decades. In this post, we discuss one of the likely consequences of these rising costs: intergenerational differences in homeownership and housing costs.

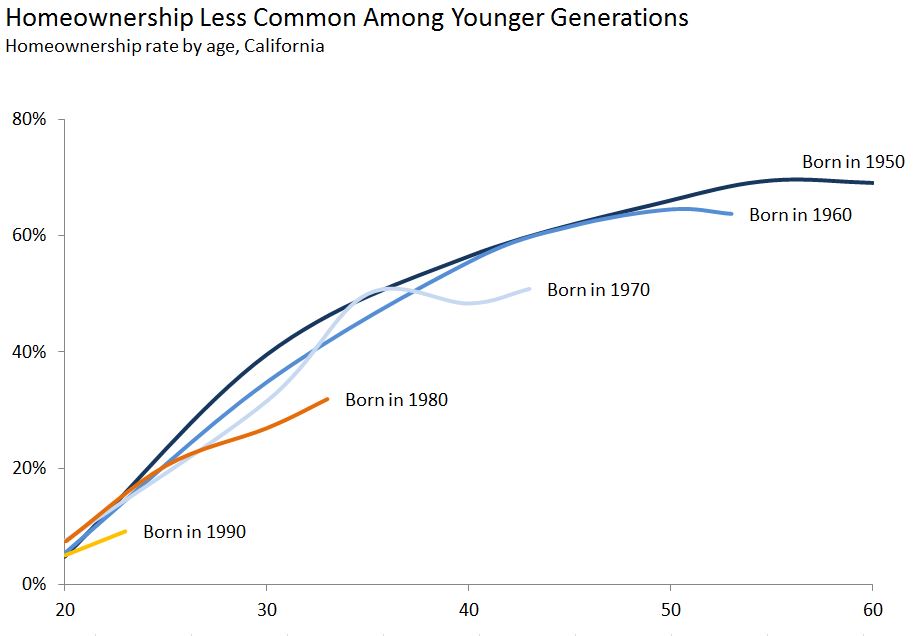

Homeownership Less Common Among Younger Generations. In general, as illustrated above, California’s current generations of 20 and 30 year olds are less likely to own a home than earlier generations in their 20s and 30s.

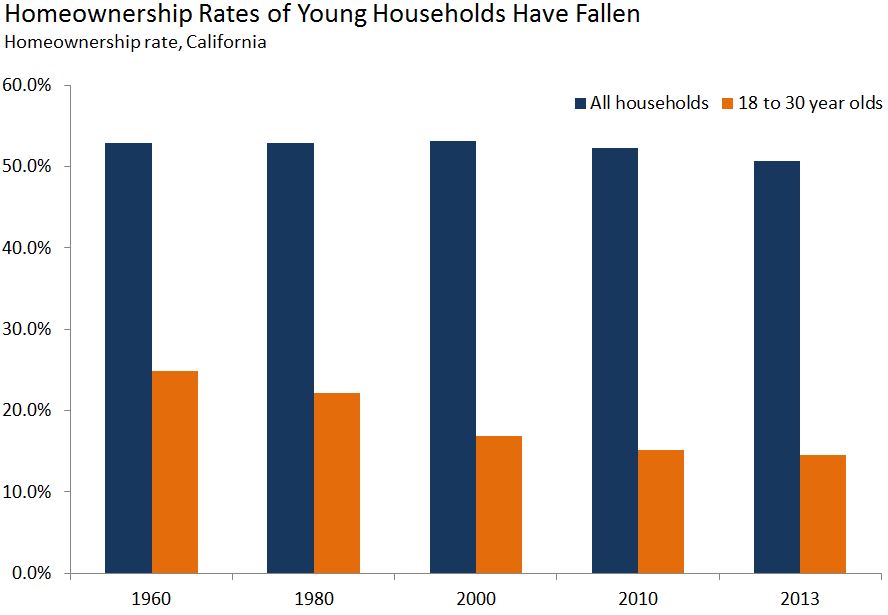

Homeownership Rates in Decline. People generally are more likely to own a home as they get older. This increase in homeownership with age, however, appears to be less significant for those born in 1980 and 1990. For example, 40 percent of those born in 1960 owned a home at age 30, while only 27 percent of those born in 1980 did, as illustrated above. Along the same lines, as shown below, homeownership rates for Californians age 18 to 30 have fallen significantly since 1960—dropping from 25 percent to 15 percent. Over the same period, homeownership rates for all Californians were relatively flat.

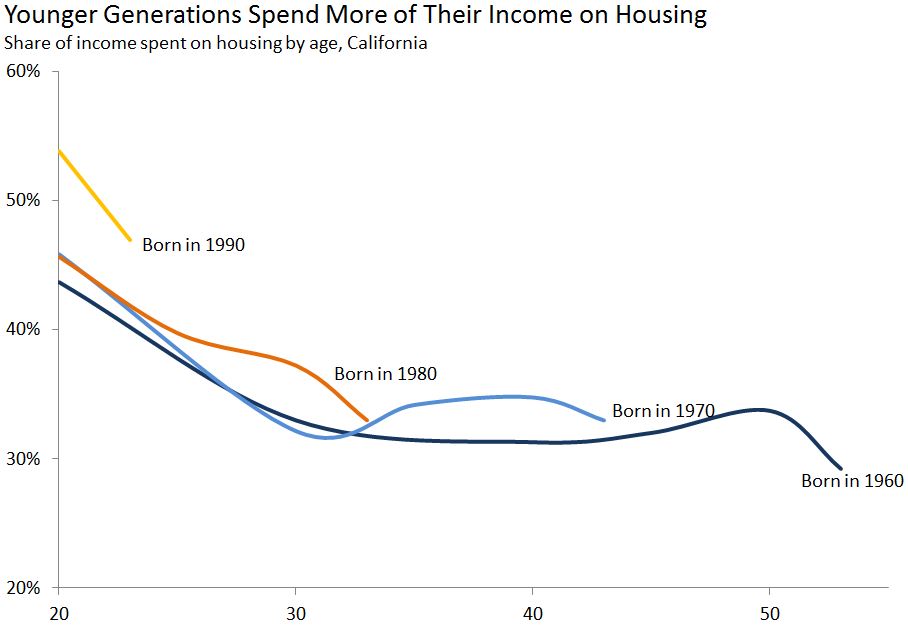

Housing Costs on the Rise. Paralleling the increase in homeownership with age, people generally spend a smaller share of their income on housing as they get older. This pattern appears to be true for California’s in the 20s and 30s, as well as for earlier generations. Nonetheless, because California’s younger generations have tended to start their adult lives facing higher housing costs, they typically spend more of their income on housing than did earlier generations. For example, as shown below, a household headed by a 30 year old born in 1960 spent, on average, 33 percent of its income on housing, compared to 37 percent for a household headed by a 30 year old born in 1980.

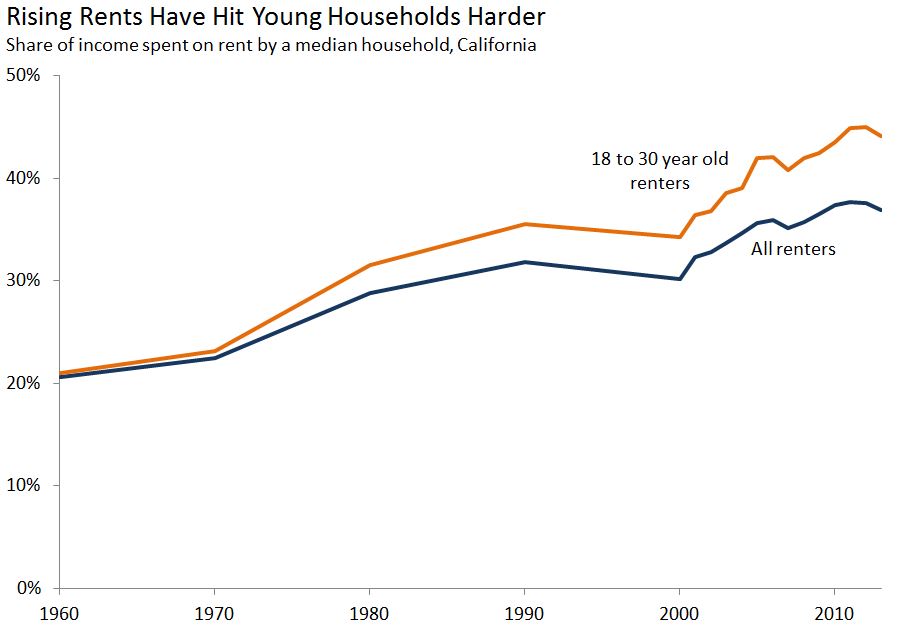

Rising rents have affected younger households especially, as shown below.

Many Factors in Play. While falling homeownership rates and rising housing costs for younger Californians have coincided with the rapid growth in the state’s housing costs in recent decades, other factors likely contributed to these trends. Differences in earnings potential, personal debt, and preferences about housing all likely play a role in explaining these trends.

The data above uses American Community Survey data, plus decennial U.S. Census data for years prior to 2005.