Since 2014, California has exempted certain sales of manufacturing or research and development (R&D) equipment from part of the sales and use tax. In a 2015 blog post, we provided some background on this exemption and noted that the resulting revenue reductions were much smaller than the administration had projected originally.

Annual Report on Use of Exemption. State law requires the State Board of Equalization (BOE)—the agency that administers the tax exemption—to submit an annual report to the Legislature on use of the exemption. On March 1, 2017, BOE reported that taxpayers claimed an estimated $165 million in 2016—a 6% increase from 2015.

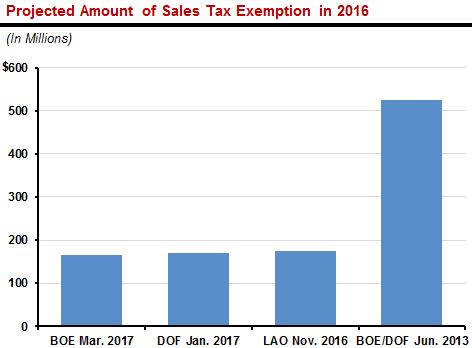

Current Estimates Similar to Recent Projections… As shown in the figure below, BOE’s current estimate is quite similar to other recent projections. In particular, it is just $5 million below the Department of Finance’s projection in January and $10 million below our office’s projection in November. These projections had already incorporated some data from 2016.

…But Still Far Lower Than Original Projections. The current estimates for 2016 are about one-third as large as the administration projected three years ago, when the Legislature passed the law that created the exemption.

Report Includes Options For Expanding Exemption. When the total amount of the exemption falls below the administration’s estimates, state law requires BOE’s report to include options for increasing the amount of the exemption “so as to meet estimated amounts.” Accordingly, BOE’s report includes three options for the Legislature to consider:

-

Giving businesses more options for demonstrating that the equipment they purchase is eligible for the exemption.

-

Increasing the cap on the amount of eligible equipment that a single business can claim. The cap is currently $200 million per year. At current tax rates, a business that buys $200 million of eligible equipment would be eligible for a sales tax exemption of about $8 million.

-

Expanding the set of businesses that are eligible to claim the exemption.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.