All Articles

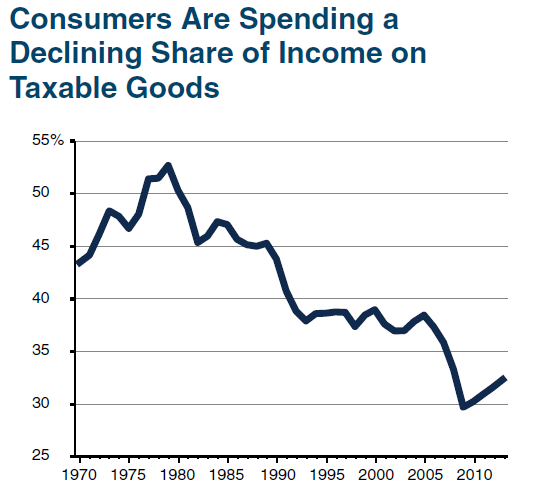

- Californians Spending More of Their Income on Services. Since 1970, the state's sales and use tax (sales tax or SUT) base, "taxable sales," has grown 6.3 percent per year, while personal income (the total income earned by individuals and businesses in California) has grown 7 percent per year. Californians are spending more of their income on housing, health care, and other services not subject to the sales tax.

- As we described in our August 2013 report, Why Have Sales Taxes Grown Slower Than the Economy?, this shift in consumer spending has occurred primarily because prices for services have grown four times as much as prices for goods since 1980, thereby leading consumers to spend more of their income on services.

- Average Sales Tax Rate Has Increased. Total state and local SUT revenue has grown 7.4 percent per year since 1970. Revenue growth has outpaced taxable sales growth because the average sales tax rate across the state has increased from 5 percent to 8.4 percent.

- In our August 2013 report, we noted that "had consumer spending not shifted toward services, the sales tax would generate the same amount of revenue as it does today at a significantly lower rate—5.2 percent instead of the current rate, 8.4 percent."