March 2018 State Tax Collections

April 9, 2018

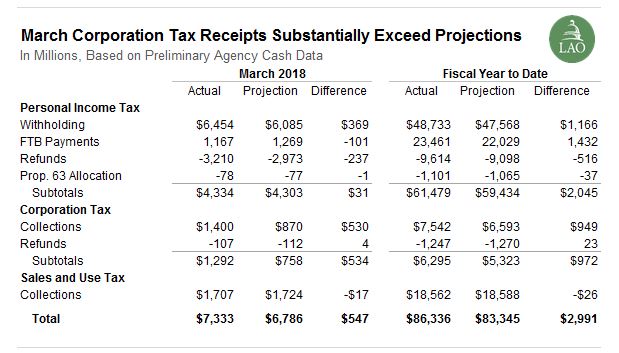

Overall, March is a minor revenue month for the state’s three main taxes. As shown in the figure below, collections from these taxes exceeded the administration’s January 2018 projections by $547 million (8 percent). Personal income tax withholding outperformed the administration’s expectations by $369 million (6 percent). That positive result, however, was mostly offset by FTB payments and refunds falling short of projections. In addition, corporation tax (CT) collections greatly exceeded projections, which we describe below. Through the first nine months of the fiscal year, receipts from the three main taxes are running about $3 billion (about 4 percent) above budget projections.

CT revenues were $534 million (or 70 percent) above the administration’s monthly projection. March has historically been a major CT revenue month. Changes in state and federal law two years ago shifted a key filing deadline for corporations from March to April, as well as a key filing deadline for pass-through businesses from April to March. The administration accounted for the changes affecting corporation payments in their monthly estimates, but did not account for the changes affecting pass-through business entities (which resulted in a significant increase in miscellaneous payments in March). Consequently, CT revenues will likely fall below the administration’s projection in April. Overall, CT revenue generally has been running above the administration’s projections during the current fiscal year and we expect this trend to continue due to the strength in corporation profits relative to the administration’s assumptions. Through March 2018, CT revenues are running about $1 billion above projections.

April is key revenue month for the state. In the coming days we be updating our revenue tracker each week day. Stay tuned.