April 2018 State Tax Collections

May 18, 2018

April Is a Major Revenue Month. April is the most important revenue month for the state, as taxpayers file returns for their personal income tax (PIT) liabilities. Specifically, taxpayers in April make estimated payments on their 2018 tax liabilities as well as final and extension payments on their 2017 tax liabilities. April also is a heightened month for refunds. This activity is in addition to withholding from paychecks, which is fairly consistent throughout the year.

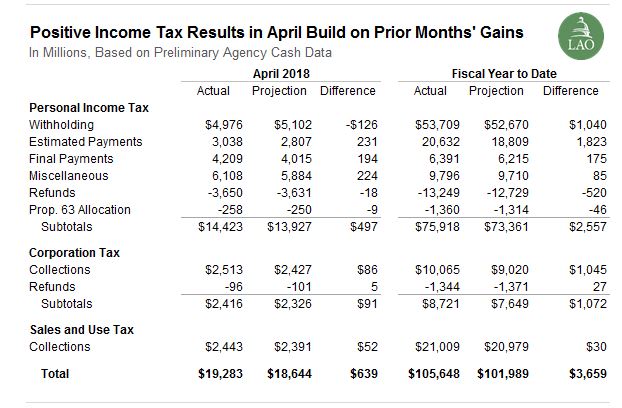

Income Taxes are $3.7 Billion Ahead of Projections Through 10 Months of 2017-18. As shown in the table below, April collections from the PIT were $497 million over the administration’s projections and the year-to-date PIT collections are $2.6 billion above estimates. Combined with the corporation tax, collections from the state’s two income taxes are $3.7 billion above administration projections through the first 10 months of the fiscal year.

Making Sense of the December 2017 Surge in PIT Payments…Recent changes in federal tax law created an incentive for taxpayers to shift estimated payments relating to their 2017 tax liabilities from January and/or April 2018 into December 2017. December 2017 saw a large surge of estimated payments—$7.7 billion compared with $4.6 billion in December 2016, for a 66 percent year-over-year gain. In considering the impacts of federal tax changes on PIT revenues, a key question is to what extent that surge accelerated payments that the state would have otherwise received in January 2018 or April 2018. Tax payments appear to have been shifted somewhat from January 2018 to December 2017, as estimated payments in January were 3 percent below the year prior. That weakness, however, did not appear to carry into April 2018, as final and extension payments were 9 percent above the year prior. Over the December 2017 through April 2018 period, payments relating to 2017 tax liabilities were almost 21 percent above payments over the same period of 2016-2017. This suggests that the December 2017 surge was not just a matter of timing. Rather, ongoing growth in tax payments appears to be healthy.

April 2018 Estimated Payments Were 13 Percent Over the April 2017 Level. Because the changes in federal tax law lowered tax rates starting in 2018, the law also created an incentive for taxpayers to delay income from 2017 to 2018. If that were the case, we would expect delayed income to be reflected in estimated payments starting in April 2018. Estimated payments in April 2018 totaled $3 billion, a 13 percent increase over April 2017 estimated payments. Given current stock market levels, we expect to see strong growth in estimated payments. Accordingly, it does not appear that taxpayers made decisions to defer large amounts of income into 2018. That said, it is possible that taxpayers are making estimated payments on some other basis. We will need data on estimated payments in June, September, and December/January, as well as final and extension payments in April 2019, before reaching any conclusions concerning the extent to which taxpayers deferred 2017 income into 2018.

<<Updated May 18, 2018>>