All Articles

December Income Taxes Far Above June Budget Act Projections

January 8, 2015

Minor Revisions Included: January 8, 2015.

The first "wave" of December 2014 state revenue collection information—preliminary personal and corporate income tax collections—is now available. (Prelimimary sales tax collection information, the next wave of December revenue data, will follow in the coming days.)

Key Points: December Income Tax Collections

- December is Major Income Tax Month. In December, high-income personal income tax (PIT) payers began to make their final required 2014 "estimated payments," largely on capital gains and business income. These 2014 estimated payments continue to arrive through mid-January, meaning that collections over the next few weeks could either continue or negate the December payment trends. In addition, December is a major month for PIT withholding (including the start of "bonus season" for some high-income taxpayers) and corporation tax (CT) collections.

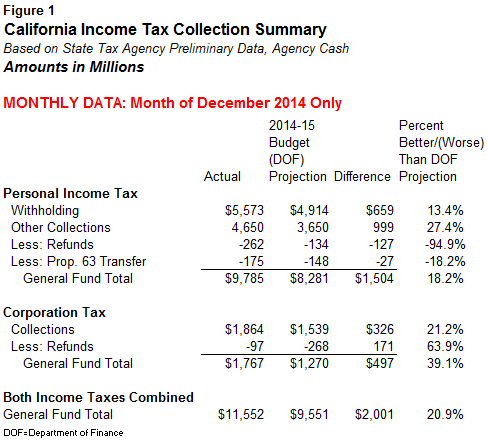

- December Preliminary Totals Far Above June 2014 Budget Act Projections. December 2014 PIT collections appear to have been $1.5 billion above the administration's projections (which were incorporated in the 2014-15 state budget act last June). Net CT collections were about $500 million above those administration projections, due to both higher-than-projected payments and lower-than-projected refunds.

- Combined, Income Taxes $3.6 Billion Above Budget Projections for 2014-15 To Date. As of the end of December 2014, the halfway point of the 2014-15 fiscal year, preliminary tax agency data indicates that combined PIT and CT revenues are $3.6 billion above the administration's budget act projections for the fiscal year to date.

- For comparison, note that our November 2014 Fiscal Outlook estimates anticipated that combined PIT and CT revenues would run $2.5 billion over the budget act projections over the course of the entire fiscal year, partially offset by weakness in sales tax and certain other revenues. As discussed above, the combined PIT and CT revenues are already running $3.6 billion ahead of the budget projections at the halfway point of the fiscal year. We noted in the Fiscal Outlook the possibility that 2014-15 revenues would be billions of dollars above our projections, and the December totals increase this possibility. As we noted in November, virtually all of any such increased revenues in 2014-15, above budget act projections, likely would go to schools and community colleges under the Proposition 98 minimum funding guarantee.

- New Administration Revenue Projections Expected on Friday. The Governor will introduce his proposed 2015-16 state budget plan on Friday. At that time, as usual, it is expected that updated administration revenue estimates will include new monthly projections, including ones that "true up" prior months' revenue totals to amounts actually received. Accordingly, revenue data after the Governor's budget introduction may not be directly comparable to figures discussed in this note.

Revenue Tracking: By The Numbers

Below are figures showing preliminary income tax collection information as of December 2014.

Methodology

- Agency Cash Is Preferred Method to Track State Budgetary Revenue Totals. In general, the data we provide concerning monthly revenue collections is based on preliminary agency cash reports—the most timely data received from the state's tax agencies concerning their collections. Agency cash reports are used to track revenue collections compared to state budget projections. Due to timing differences, agency cash reports are not directly comparable to "Controller's cash" reports.

- Accruals Generally Not Reflected In These Reports. A fiscal year's state budget revenues also are affected by revenue accruals, which generally can not be reflected in monthly agency cash reports.

- Education Protection Account. Unless otherwise indicated, General Fund revenue collections include those for the Education Protection Account established by Proposition 30 (2012).

- Preliminary Amounts Can Change. Preliminary agency cash reports can and do change based on subsequent data reconciliations and updates.