Ballot Pages

A.G. File No. 2015-005

March 6, 2015

Pursuant to Elections Code Section 9005, we have reviewed the proposed initiative (A.G. File No. 15-0005) that would allow the state to sell $9 billion in general obligation bonds for school and community college facilities.

Background

California Has 8.3 Million Students Enrolled in Public K-14 Education. The public kindergarten through grade 12 (K-12) education system consists of about 950 school districts, 10,000 schools (including 1,100 charter schools), and 58 county offices of education (COEs). About 6.2 million students are enrolled in K-12, with school districts serving 5.7 million students, charter schools serving 500,000 students, and COEs serving 41,000 students (primarily at alternative schools, such as juvenile court schools). The California Community Colleges (CCC) consists of 112 campuses operated by 72 locally governed districts throughout the state. The CCC system owns about 5,500 buildings on 24,000 acres of land. About 2.1 million students are enrolled in the CCC system.

K-12 School Facilities

School Facilities Program (SFP) Primarily Funds New Construction and Modernization Projects. The SFP funds multiple types of projects, as described below. In addition to these project types, the SFP also funds projects addressing seismic deficiencies or energy efficiency. In most cases, the State Allocation Board provides funds on a first-come, first-served basis.

- New Construction. New construction grants provide funding to buy land and construct new buildings. School districts and COEs establish eligibility by showing they lack adequate space in existing facilities to house projected enrollment growth. School districts and COEs are required to match state dollars. School districts and COEs that cannot meet the match requirement may apply for financial hardship funding from the state to offset their local share of costs.

- Modernization. Modernization grants are provided to school districts and COEs that have buildings more than 25 years old. The state pays 60 percent and school districts and COEs pay 40 percent of the cost. Districts and COEs that cannot meet the match requirement may apply for financial hardship funding.

- Career Technical Education (CTE) Facilities. The state also provides grants to fund new construction and modernization of facilities used for high school CTE programs. The grants are allocated on a per square foot basis, with a maximum of $3 million for each new construction project and $1.5 million for each modernization project. Grant recipients are required to match state dollars for both types of projects. Financial hardship funding is not available for CTE projects. Grant recipients that are unable to contribute the local match may apply for a loan that must be repaid over a maximum 15-year period.

- Charter School Facilities. The SFP also provides competitive grants to help charter schools construct or modernize facilities. The state and charter schools share costs equally. Charter schools that are unable to contribute the local match may borrow the matching funds from the state and repay the state over a maximum 30-year period.

Four Main Funding Sources for School Facilities. The first two sources listed below—state and local general obligation bonds—provide most of the funding for school facilities statewide.

- State General Obligation Bonds. Since the creation of SFP in 1998, voters have approved a total of $35 billion in state general obligation bonds for K-12 school facilities. The state still has about $200 million in K-12 bond authority, primarily consisting of funds designated for seismic projects ($140 million) and charter school facilities ($32 million). The state exhausted bond authority for new construction and modernization programs in 2012.

- Local General Obligation Bonds. At the local level, school districts can issue local general obligation bonds to meet their matching requirement for SFP or address other local facility priorities. Local bonds require the approval of either 55 percent or two-thirds of the voters in the district (depending on the rules under which the bond is issued). Most bond measures adhere to the rules allowing for a 55 percent vote threshold. The bonds are repaid using local property tax revenue. Since 1998, school districts have received voter approval to issue at least $75.2 billion in local facility bonds. (Because the state did not collect data for two years, the total likely is slightly higher.) As of November 2013, an estimated $30.5 billion remained in local bond authority for K-12 school districts.

- Developer Fees. State law allows school districts to impose developer fees to finance school construction. These fees are levied on new residential, commercial, and industrial developments. Developer fees vary significantly by community depending on the amount of local development. In fast-growing areas, they can make notable contributions to K-12 school construction. School districts have collected an estimated $9.4 billion in developer fees since 1998.

- School Facilities Improvement Districts (SFIDs). A school district also may form an SFID to sell bonds for school construction projects. An SFID generally does not encompass the entire school district. The bonds, which require the approval of 55 percent of voters in the SFID, are paid off by property owners located within that SFID.

Community College Facilities

State Authorizes CCC Facilities as Part of Annual Budget Act. The state traditionally uses criteria similar to the SFP to allocate funding to CCC facilities but uses a different approval process. Community college districts submit requests for specific facility projects to the CCC Chancellor’s Office. The Chancellor’s Office, in turn, selects projects to submit to the state. The Chancellor’s Office gives priority to projects according to certain criteria, including the availability of local matching funds, projected enrollment growth, and the age of facilities. The Governor and the Legislature then approve specific projects in the annual budget act.

Two Main Sources of CCC Facilities Funding. As with K-12 facilities, CCC facilities primarily are financed by state and local general obligation bonds. Since 1998, voters have approved $4 billion in state general obligation bonds for facility projects at community colleges. Currently, no more state bond authority exists to commit to additional projects. Like K-12 school districts, community college districts are authorized to sell local general obligation bonds to finance facility projects with the approval of 55 percent or two-thirds of voters in the district. Since 1998, community college districts have received local voter approval to issue more than $29.2 billion in local facility bonds. As of November 2013, an estimated $7 billion remained in local bond authority for community college districts.

Proposal

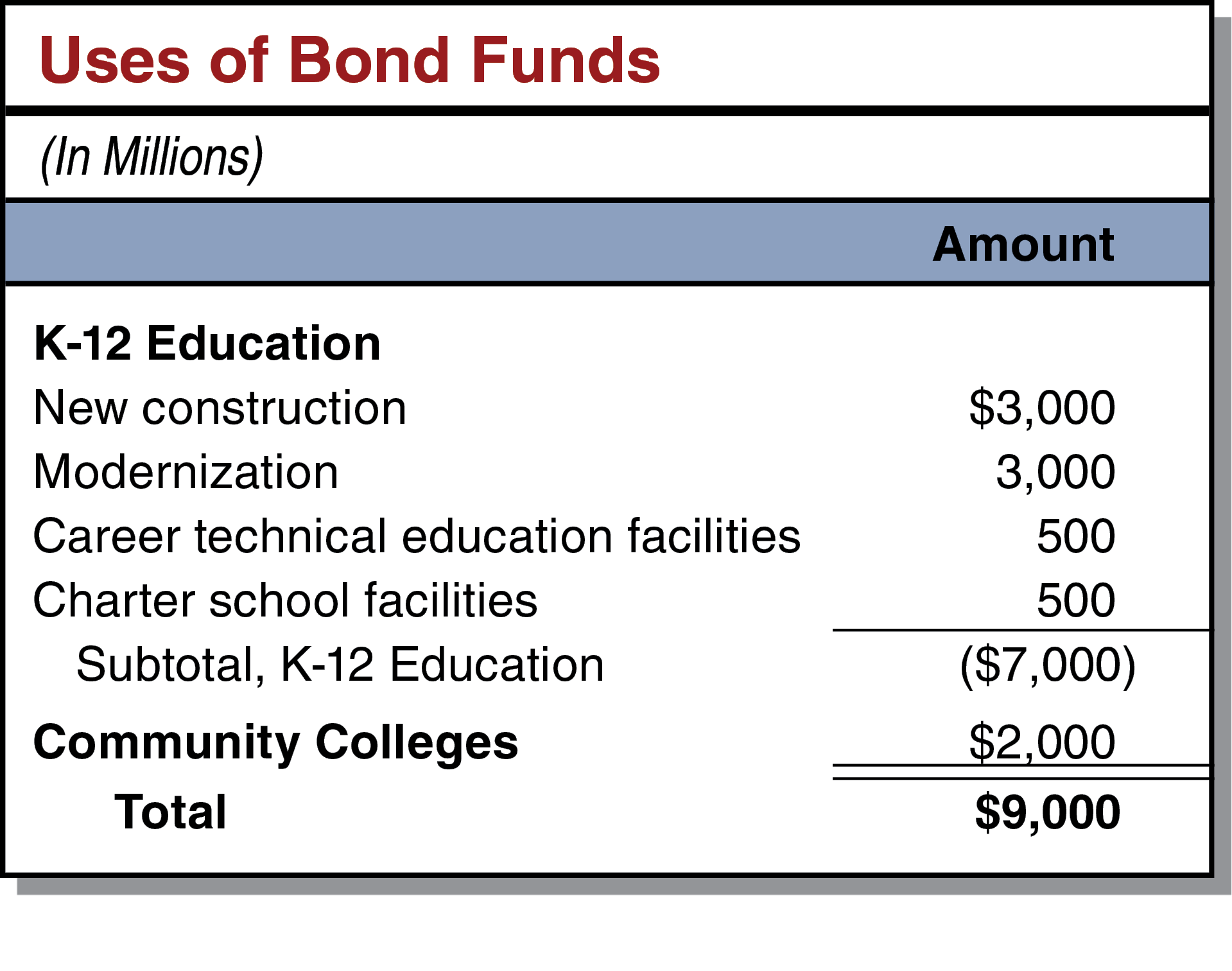

This measure allows the state to sell $9 billion of general obligation bonds—$7 billion for

K-12 school facilities and $2 billion for community college facilities.

K-12 School Facilities. As shown in the figure, the $7 billion for K-12 school facilities is designated for four types of projects: new construction, modernization, CTE facilities, and charter school facilities. The underlying requirements and funding formulas for these project types would be based on the existing SFP.

Community College Facilities. The measure includes $2 billion for community colleges to construct new buildings and related infrastructure, modernize existing buildings, and purchase equipment. The Governor and Legislature would approve the specific projects to be funded by the bond monies in the annual budget act over the next several years.

Fiscal Effects

Measure Would Increase State Debt Service Costs. The cost to the state of issuing these bonds would depend on the timing of the bond sales, the interest rates in effect at the time they are sold, and the time period over which they are repaid. The state would likely issue these bonds over a period of about five years and make principal and interest payments from the state's General Fund over a period of about 35 years. If the bonds were sold at an average interest rate of 5 percent, the cost would be $17.6 billion to pay off both principal ($9 billion) and interest ($8.6 billion). Under these assumptions, the average payment would be about $500 million per year. Annual debt service payments would ramp up in the initial few years, peak at $585 million per year, and ramp down in the final few years. (These estimates are not adjusted for inflation.)

Summary of Fiscal Effect

This measure would have the following fiscal effect:

- State General Fund costs of $17.6 billion to pay off principal ($9 billion) and interest ($8.6 billion) on bonds over a period of 35 years. Annual payments would average $500 million. Annual payments would be relatively low in the initial and final few years and somewhat higher in the intervening years.