Ballot Pages

A.G. File No. 2015-081

November 30, 2015

Pursuant to Elections Code Section 9005, we have reviewed the proposed constitutional and statutory initiative (A.G. File No. 15-0081, Amendment #1) that would increase the state’s cigarette excise tax from 87 cents to $2.87 per pack and apply the tobacco products excise tax to electronic cigarettes.

Background

Tobacco Products and Electronic Cigarettes

Tobacco products are derived from tobacco plants, contain nicotine, and are intended for human consumption, such as cigarettes and smokeless tobacco. Electronic cigarettes are battery-operated products that are generally designed to deliver nicotine, flavor, and other chemicals. These devices turn chemicals, including nicotine, into an aerosol that is inhaled by the user. Some types of electronic cigarettes are sold together with those chemicals, while others are sold separately. (There are also some electronic cigarettes that produce aerosols that do not contain nicotine.)

Tobacco and Electronic Cigarette Taxes

Tobacco products are subject to state and federal excise taxes, and state and local sales and use taxes. In contrast, electronic cigarettes are currently not subject to state and federal excise taxes but are subject to state and local sales and use taxes.

Existing State Excise Taxes on Tobacco Products. Current state law imposes excise taxes on the distribution of cigarettes and other tobacco products, such as cigars and chewing tobacco. Tobacco excise taxes are paid by distributors who supply cigarettes and other tobacco products to retail stores. These taxes are typically passed on to consumers as higher prices on cigarettes and other tobacco products.

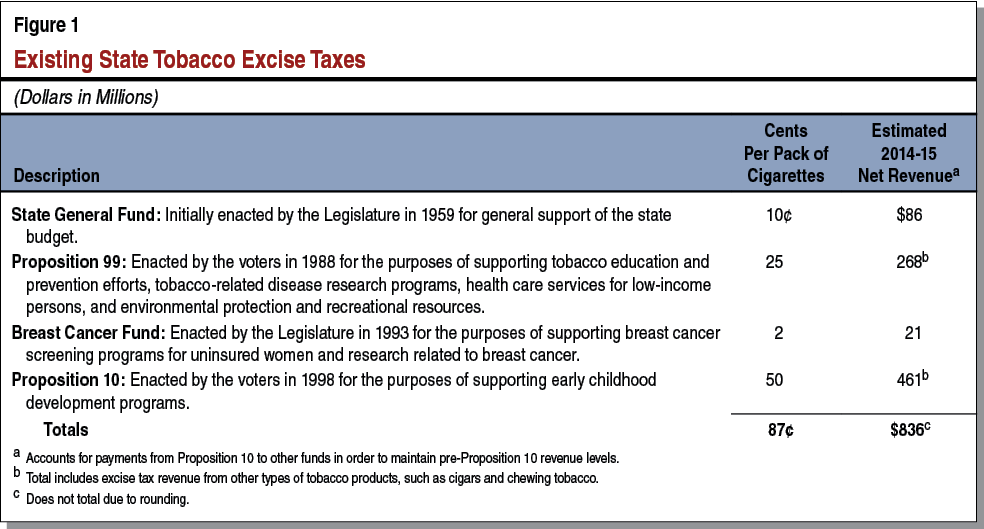

The state’s cigarette excise tax is currently 87 cents per pack. Figure 1 describes the different components of the per-pack tax. As the figure shows, two voter-approved measures—Proposition 99 in 1988 and Proposition 10 in 1998—are responsible for generating the vast majority of tobacco excise tax revenues. As the figure indicates, total state revenues from existing excise taxes on cigarettes and other tobacco products were just under $840 million in 2014-15.

Revenues from existing excise taxes on other tobacco products support Proposition 10 and Proposition 99 purposes. Under current law, any increase in cigarette taxes automatically triggers an equivalent increase in excise taxes on other tobacco products, with the latter revenues going to support Proposition 99 purposes.

Existing Federal Excise Tax on Tobacco Products. The federal government imposes an excise tax on cigarettes and other tobacco products. In 2009, this tax was increased by 62 cents per pack (to a total of $1.01 per pack) to help fund the Children’s Health Insurance Program, which provides subsidized health insurance coverage to children in low-income families.

Existing State and Local Sales and Use Taxes on Tobacco Products and Electronic Cigarettes. Sales of cigarettes, other tobacco products, and electronic cigarettes are subject to state and local sales and use taxes. These taxes are imposed on the retail price of a product, which includes excise taxes that have generally been passed along from distributors. The average retail price of a pack of cigarettes in California currently is close to $6. Roughly $400 million in annual revenue from sales and use taxes on cigarettes and other tobacco products go to the state and local governments.

State and Local Health Programs

Department of Health Care Services (DHCS). The DHCS administers the Medicaid program, known as the California Medical Assistance Program (Medi-Cal) in California. Medi-Cal is a joint federal-state program that provides health care services to qualified low-income persons. Currently, Medi-Cal provides health care services to over 12 million people, with a General Fund budget estimated at $18 billion for 2015-16. Federal law establishes some minimum requirements for state Medicaid programs regarding the types of services offered and who is eligible to receive them. Required services include hospital inpatient and outpatient care, skilled nursing care, and doctor visits. In addition, California offers an array of services considered optional under federal law, such as coverage of prescription drugs and durable medical equipment. While Medi-Cal is by far the largest healthcare program that DHCS administers in terms of both funding level and persons served, the department also administers a few other programs that provide health care services.

Department of Public Health (DPH). The DPH administers and oversees a wide variety of programs with the goal of optimizing the health and well-being of Californians. The department’s programs address a broad range of health issues, including tobacco-related diseases, maternal and child health, cancer and other chronic diseases, communicable disease control, and inspection of health facilities. Many public health programs and services are delivered at the local level, while the state provides funding, oversight, and overall strategic leadership for improving population health. The state also centrally administers certain public health programs, such as licensing and certification of health facilities.

State Spending Limit

The State Constitution contains various rules affecting the state budget, such as the state spending limit that has been in place since passage of Proposition 4 in 1979. The Constitution requires the state to issue taxpayer rebates if the state exceeds the spending limit.

Proposal

This measure increases excise taxes on the distribution of cigarettes and other tobacco products. It also applies, for the first time, the tobacco products excise tax (as amended by the measure) to certain types of electronic cigarettes. The additional revenues would be used to increase funding for existing healthcare programs and services, tobacco-related prevention and cessation programs, law enforcement programs, medical research on tobacco-related diseases, and for other specified purposes. The major provisions of the measure are described below.

New State Tobacco Taxes

This measure increases—effective April 1, 2017—the existing state excise tax on cigarettes by $2 per pack. The total state excise tax, therefore, would be $2.87 per pack. This measure also creates a one-time “floor tax” on cigarettes that are stored by businesses at the time the new excise tax is levied. Floor taxes are typically used to prevent businesses from avoiding taxes by stockpiling products before a tax goes into effect.

As described above, any increase in cigarette taxes automatically triggers an equivalent increase in excise taxes on other tobacco products. As a result, the $2 per pack cigarette tax increase would lead to an equivalent increase in the tax rate on other tobacco products, which is currently equivalent to a $1.37 per pack tax on cigarettes. The new tax rate on other tobacco products would be equivalent to a $3.37 per pack tax on cigarettes.

Tax on Electronic Cigarettes

This measure also applies the tobacco products excise tax to electronic cigarettes that contain nicotine or are sold with liquid containing nicotine (hereafter referred to as “e-cigarettes”). As with other tobacco products, the tax rate would be equivalent to $3.37 per pack of cigarettes. The equivalent of 87 cents per pack would support Proposition 99 purposes, the equivalent of 50 cents per pack would support Proposition 10 purposes and the equivalent of $2 per pack would support the purposes of this measure.

How Revenues From New Tobacco and E-Cigarette Taxes Would Be Spent

Revenues from the cigarette, other tobacco product, and e-cigarette excise taxes that are increased by this measure would be deposited directly into a new special fund, called the California Healthcare, Research and Prevention Tobacco Tax Act of 2016 Fund (hereafter referred to as the fund). Revenues deposited in the fund would only be used for purposes set forth in the measure and would not be subject to appropriation by the Legislature. Here we describe how the revenues would be spent in the order required by the measure. (Revenues from expanding the taxpaying base of existing taxes to include e-cigarettes would support Proposition 99 and Proposition 10 purposes as described in Figure 1.)

Backfill of Existing Tobacco Tax Programs. This measure requires the transfer of some revenues raised by the new taxes to “backfill,” or offset, any revenue losses that occur to funds supported by existing state cigarette and tobacco taxes as a direct result of the imposition of the new taxes. These revenue losses would occur mainly because an increase in the price of cigarettes and other tobacco products generally reduces consumption and leads some consumers to acquire untaxed products instead of taxed ones. This, in turn, would reduce the amount of revenues collected through the existing state excise taxes described above. The amount of backfill payments needed to offset any loss of funding in these areas would be determined by the Board of Equalization (BOE).

Backfill of State and Local Sales and Use Tax Revenue Losses. Similarly, the measure requires backfill payments to the state and affected local governments in respect of any revenue losses of state and local sales and use taxes resulting directly from the new taxes on cigarettes and tobacco products.

BOE Would Receive Up to 5 Percent of Remaining Funds for Administrative Costs. The BOE would receive not more than 5 percent of the funds remaining after backfill of existing tobacco programs to cover administrative expenses resulting from the new tax. (The BOE would also receive additional funds for enforcement of the new tax as explained below.)

Specified State Entities Would Receive Predetermined Amounts. After backfilling for specified revenue losses due to the imposition of the new taxes and providing funds to BOE for administrative costs, the University of California (UC), California Department of Justice (DOJ), Office of the Attorney General (OAG), BOE, and DPH would annually receive predetermined amounts of funding as follows:

- UC Would Receive $40 Million for Physician Training. Forty million dollars would be used to provide funding to UC for the purpose of increasing the number of primary care and emergency physicians trained in California. The UC provides instruction to about 8,000 graduate medical students at six of its campuses. In addition, the university operates five teaching hospitals that support clinical teaching programs.

- DPH Would Receive $30 Million for Dental Program. Thirty million dollars would be provided to the DPH State Dental Program for the purpose of educating about, preventing, and treating dental disease. The funds shall be used for activities including, but not limited to, education, disease prevention, disease treatment, surveillance, and case management.

- DOJ and OAG Would Receive $30 Million for Local Law Enforcement. Thirty million dollars would be provided to the DOJ and the OAG to, in turn, distribute to local law enforcement agencies. The funds would be used to support and hire law enforcement officers for programs including, but not limited to, enforcement of state and local laws related to the illegal sales and marketing of tobacco to minors, increasing investigative activities, and compliance checks to reduce illegal sales of tobacco products to minors and youth tobacco use.

- OAG Would Receive $6 Million to Enforce Tobacco Laws. Six million dollars would be provided to the OAG for activities including, but not limited to, enforcing laws that regulate the distribution and sale of cigarettes and other tobacco products.

- DPH Would Receive $6 Million for Tobacco Enforcement Programs. Six million dollars would be provided to DPH to support programs, including, but not limited to, providing grants and contracts to local law enforcement agencies to provide training and funding for the enforcement of state and local laws related to the illegal sales of tobacco to minors, increasing investigative activities and compliance checks, and other activities to reduce the illegal sales of tobacco to minors.

- BOE Would Receive $6 Million for Enforcement. Six million dollars would be provided to the BOE for enforcement of laws that regulate the distribution and retail sale of cigarettes and other tobacco products. The BOE administers a variety of tax programs, including sales and use taxes, property taxes, and special taxes, such as those on cigarettes and other tobacco products.

Predetermined Amounts Would Be Adjusted to Reflect Revenues. If the BOE determines that there has been a reduction in revenues resulting from a reduction in the consumption of cigarette and tobacco products due to the measure, the predetermined amounts of funding described above would be adjusted proportionately. The BOE would make such determinations annually beginning two years after the measure went into effect.

Remaining Funds Go to State Health Programs. After backfilling for specified revenue losses, paying BOE administrative costs, and distributing predetermined amounts of funding to specified state entities, the following state agencies would receive the remaining funds for health programs:

- Medi-Cal in DHCS. Eighty-two percent of the remaining funds would be allocated to DHCS to provide funding to increase the level of payment for health care, services, and treatment provided to Medi-Cal beneficiaries. Examples of health care, services, and treatment would include physician visits, hospital care, and prescription drugs. While this measure requires DHCS to use revenues from this measure to supplement, not supplant, existing state funding for Medi-Cal, it is unclear how this requirement would be interpreted and enforced.

- California Tobacco Control Program (CTCP) in DPH. About 11 percent of the remaining funds would fund tobacco prevention and control programs administered by CTCP. The DPH administers the CTCP with the aim of reducing illness and death from tobacco-related diseases. The CTCP, with a budget estimated at $38 million in 2014-15, funds programs aimed at countering pro-tobacco messages, reducing secondhand smoke exposure, reducing access to tobacco products, and increasing smoking cessation services.

- California Department of Education (CDE). About 2 percent of the remaining funds would be provided to CDE for school programs to prevent and reduce the use of tobacco products by young people. The department administers various education programs, and allocates funding to various types of local education agencies, including county offices of education, school districts, and charter schools. The CDE’s budget for tobacco education and prevention programs is estimated at $16 million for 2014-15, with the funding for these programs coming from Proposition 99.

- Tobacco-Related Disease Research Program Administered by UC. Five percent of the remaining funds would be allocated to the Tobacco-Related Disease Research Program administered by UC for medical research into prevention, early detection, treatments, and potential cures of all types of cancer, cardiovascular and lung disease, and other tobacco-related diseases. Currently funded with Proposition 99 tobacco tax revenues, this research program supports research on the prevention and treatment of tobacco-related diseases in California by awarding grant funding to researchers at California public, private, and nonprofit entities, such as universities, hospitals, laboratories, local health departments, and managed care organizations.

Administrative Costs Limited to 5 Percent. The measure would limit the amount of revenues raised by the measure that could be used to pay for administrative costs. Entities receiving funds would be allowed to use not more than 5 percent of the funds for administrative costs.

Other Major Provisions

California State Auditor. The California State Auditor would conduct audits of agencies receiving funds from the new taxes at least every other year. The Auditor would receive up to $400,000 annually to cover costs incurred from conducting these audits. The Auditor provides independent and nonpartisan assessments of the California government’s financial and operational activities in compliance with generally accepted government accounting standards.

Revenues From Measure Would Be Exempt From State Spending Limit. The measure would amend the State Constitution to exempt the measure's revenues and spending from the state's constitutional spending limit. (This constitutional exemption is similar to ones already in place for prior, voter-approved increases in tobacco taxes.)

Fiscal Effects

This measure would have a number of fiscal effects on state and local governments. The major impacts are discussed below.

Impacts on State and Local Revenues

Revenues Would Be Affected by Consumer Response. Our revenue estimates assume that the proposed excise tax increases would be passed along to consumers. In other words, we assume that the retail prices of cigarettes, other tobacco products, and e-cigarettes would be raised to include the excise tax increase. We expect consumers to respond to this price increase in two ways: by reducing their consumption of cigarettes, other tobacco products, and e-cigarettes and by changing the way they acquire cigarettes, other tobacco products, and e-cigarettes so that fewer transactions are taxed. For example, consumers could avoid paying the new tax on e-cigarettes by purchasing untaxed e-cigarettes from Internet vendors.

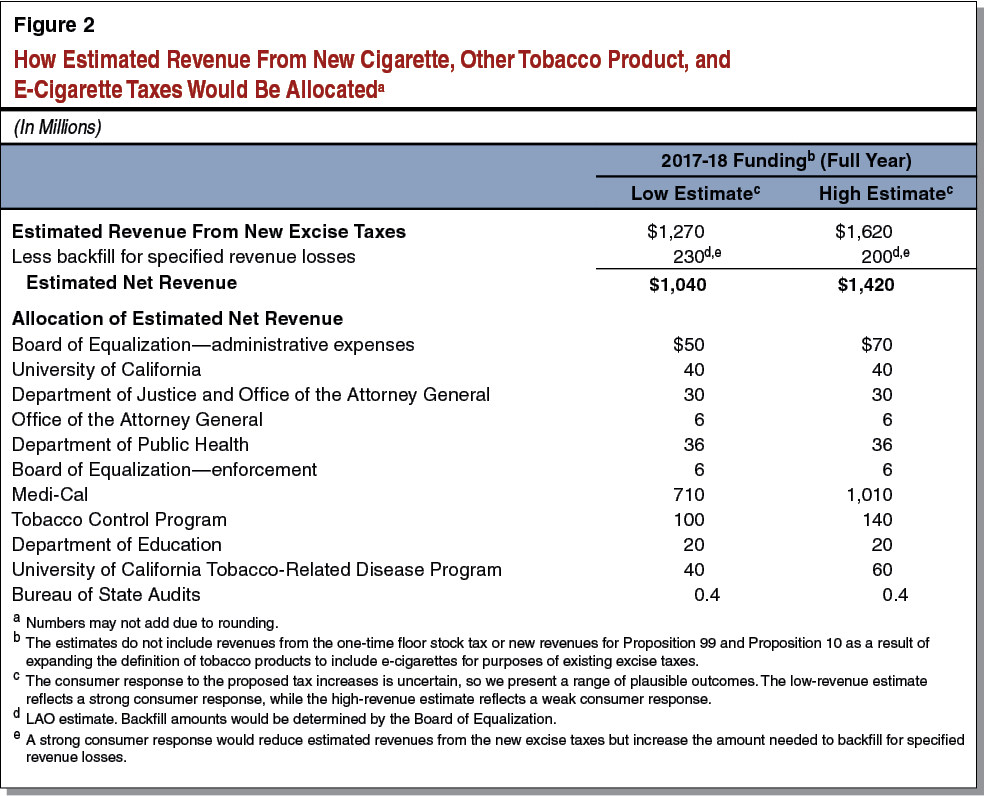

Revenues From New Excise Taxes. We estimate that the new excise taxes on cigarettes and other tobacco products (including e-cigarettes) required by this measure would raise an estimated $1.3 billion to $1.6 billion in annual revenue. The range reflects the uncertainty of the magnitude of the consumer response to the proposed tax increase discussed above. Our estimate of the allocation of new excise tax revenues in 2017-18 (the first full-year impact) is shown in Figure 2. After backfilling losses in existing tax revenue (described in more detail below), the new cigarette excise tax would generate an estimated $1 billion to $1.4 billion in net revenue in 2017-18 for the purposes described in the measure. (These estimates do not include additional revenue from the provision of the measure that expands the taxpaying base of existing excise taxes to include e-cigarettes, which we discuss below. They also do not include revenue from the one-time floor stock tax.) The excise tax increases would generate somewhat lower amounts of revenue in subsequent years, based on our projections of continued declines in cigarette consumption.

Effects on Revenues From Existing Excise Taxes. The classification of certain e-cigarettes as a tobacco product would expand the set of products subject to the existing excise tax on other tobacco products. As a result, it would generate additional revenue for the Proposition 99 and Proposition 10 purposes described earlier in Figure 1. In 2017-18, excise taxes on e-cigarettes could generate revenue ranging from tens of millions of dollars to over $100 million for Proposition 99 purposes and an amount in the low-to-mid tens of millions of dollars for Proposition 10 purposes.

The decline in consumption of cigarettes and other tobacco products caused by this measure would reduce revenues from the existing excise taxes that go to support Proposition 99 and Proposition 10 purposes, the General Fund, and the Breast Cancer Fund. The measure provides for the backfill of these losses from revenues raised by the new excise taxes. We estimate that the amount of backfill funding needed to comply with this requirement would range from $200 million to $230 million in 2017-18.

Effect on State and Local Sales and Use Tax Revenues. Sales and use taxes are levied on a variety of products, including the retail price of cigarettes, other tobacco products, and e-cigarettes. The retail price usually includes the cost of all excise taxes. The excise tax increases under the measure would raise the retail price of taxable cigarettes, tobacco products, and e-cigarettes, and consumers would respond by buying fewer of those goods. As a result, the effect of the measure’s tax increases on sales and use tax revenue from the sale of cigarettes, tobacco products, and e-cigarettes could be positive or negative, depending on the magnitude of the consumer response. For cigarettes and tobacco products, the measure provides for the backfill of sales and use tax revenue losses from revenues raised by the new excise taxes. We estimate this provision is not likely to be used.

Effects on Excise Tax Collection. As discussed above, the measure would allocate $48 million to the DOJ, OAG, DPH, and BOE to support state law enforcement efforts. These funds would be used to support increased enforcement efforts to reduce tax evasion, counterfeiting, smuggling, and the unlicensed sales of cigarettes and other tobacco products. The funds would also be used to support efforts to reduce sales of tobacco products to minors. These activities could bring in more excise tax revenue, but the magnitude of this effect is uncertain.

Impact on State and Local Government Health Care Costs

The state and local governments in California incur costs for providing (1) health care for low-income and uninsured persons and (2) health insurance coverage for state and local government employees and retirees. Consequently, changes in state law such as those made by this measure that affect the health of the general population—and low-income and uninsured persons and public employees in particular—would affect publicly funded health care costs.

For example, as discussed above, this measure would result in a decrease in the consumption of tobacco products as a result of the expected price increase of tobacco products. Further, this measure provides funding for tobacco prevention and cessation programs, and to the extent these programs are effective, this would further decrease consumption of tobacco products. The use of tobacco products has been linked to various adverse health effects by the federal health authorities and numerous scientific studies. Thus, this measure would reduce state and local government health care spending on tobacco-related diseases over the long term. This measure would have other fiscal effects that offset these cost savings. For example, health care and social services that otherwise would not have occurred as a result of individuals who avoid tobacco-related diseases living longer. Further, the impact of a tax on e-cigarettes on health and the associated costs over the long term is unknown, because e-cigarettes are relatively new devices and the health impacts of e-cigarettes are still being studied. Thus, the net long-term fiscal impact of this measure on state and local government costs is unknown.

Potential Other Effects on State General Fund Resulting From Increases in Health Care Provider Reimbursement. As noted above, a portion of the funds from this measure are to be used to increase the level of payment for health care providers that provide services to individuals enrolled in Medi-Cal. Currently, certain types of Medi-Cal providers, such as managed care plans, typically receive rate increases that account for such things as medical inflation and changes in the amount and types of health care services provided to enrollees. These rate increases are partially funded with state General Fund monies. In addition, absent the measure, there may be some pressure for the state to increase payment to other types of Medi-Cal providers to ensure beneficiaries have adequate access to health care services. To the extent funds generated by the measure are used to increase provider payments that would otherwise have been covered by the General Fund, the measure would reduce state General Fund costs. On the other hand, higher provider payments created by the measure could establish an expectation that similar payment levels will be maintained in future years. The funds generated from this measure are expected to decline over time as cigarette consumption decreases and fewer cigarettes are purchased. To the extent the measure would create pressure to maintain the level of provider payments initially achieved by this measure, it could create pressure to use state General Fund monies to backfill the expected decline in funds available from this measure. The net fiscal effect of these two potential impacts of the measure cannot be estimated.

Summary of Fiscal Effects

This measure would have the following major fiscal effects:

- Net increase in excise tax revenues in the range of $1.1 billion to $1.6 billion annually by 2017-18, with revenues decreasing slightly in subsequent years. The majority of funds would be used for payments to health care providers. The remaining funds would be used for a variety of specified purposes, including tobacco-related prevention and cessation programs, law enforcement programs, medical research on tobacco-related diseases, and early childhood development programs.