Ballot Pages

A.G. File No. 2015-115

January 25, 2016

Pursuant to Elections Code Section 9005, we have reviewed a proposed constitutional initiative concerning taxes (A.G. File No. 15-0115, Amendment No. 1). The proposal extends temporary personal income tax (income tax) rate increases on high-income taxpayers that were approved as part of Proposition 30 in 2012.

Background

California’s State Budget. California state taxes—primarily income taxes—are spent mainly from the state government’s General Fund, the state’s main operating account. The General Fund will spend about $115 billion during the current 2015-16 state fiscal year. The General Fund pays for part of California’s K-12 and higher education programs, health and human services programs, state prisons, statewide retirement systems for public employees, debt service on state infrastructure bonds, and other programs.

Proposition 30. Proposition 30 temporarily raised state taxes.

- Sales Taxes. Proposition 30 increased the state sales tax rate by one-quarter cent from 2013 through 2016. In the current fiscal year, this increase is expected to raise $1.5 billion of revenue.

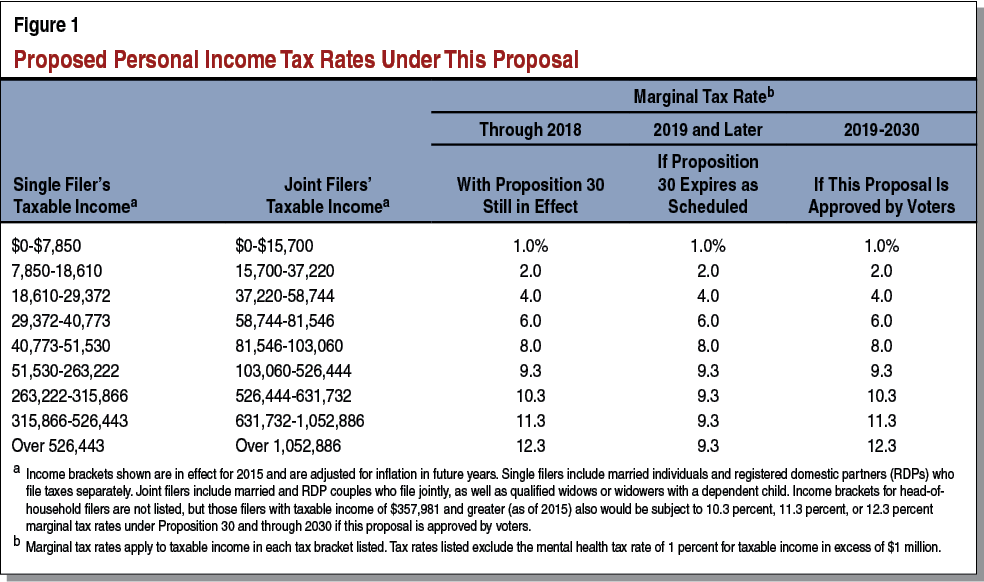

- Income Taxes. Proposition 30 also increased marginal income tax rates paid by roughly the 1 percent of tax filers in the state with the highest incomes. Depending on their taxable income levels, these filers pay an extra 1 percent, 2 percent, or 3 percent tax on part of their incomes. These increases are in effect from 2012 through 2018. In the current fiscal year, the Proposition 30 income tax increases are expected to raise between $6 billion and $8 billion of revenue.

Proposition 98. The largest category of state General Fund spending is for school districts and community colleges. Proposition 98, approved by voters in 1988 and modified in 1990, establishes a minimum funding level for schools and community colleges. This funding level tends to grow over time based on growth in the state’s economy, state tax revenue, and student attendance, among other factors. In the current fiscal year, the state will spend around $50 billion on Proposition 98 programs (over 40 percent of all General Fund revenues). In addition to this state funding, schools and community colleges will receive around $19 billion from local property taxes.

Medi-Cal Program. In California, the federal Medicaid program is known as Medi-Cal. The Medi-Cal program uses state and federal funds to provide health care services to most low-income persons. Medi-Cal is the largest state-administered health program in terms of spending and people served. In the current fiscal year, the state will spend around $18 billion from the General Fund on Medi-Cal.

Proposition 2. In November 2014, California voters approved Proposition 2. Proposition 2 creates a new set of rules to determine the amount of money the state has to deposit to a rainy day fund (the Budget Stabilization Account), particularly when the economy and stock market are doing well. This fund is intended to reduce the need for budget cuts, tax increases, and other measures in the future when the economy or stock market weakens. Proposition 2 requires that money be deposited into the rainy day fund until the total reaches a maximum of 10 percent of General Fund tax revenues—which now equals about $12 billion. Proposition 2 also requires the state to pay down certain state debts faster.

Proposition 2 allows the state to reduce the rainy day fund deposit only if the Governor calls a “budget emergency.” The Legislature would have to agree to reduce the deposit. The Governor could call a budget emergency only if:

- A natural disaster occurs, such as a flood or an earthquake.

- There is not enough money available to keep General Fund spending at the highest level of the past three years (adjusted for changes in the state population and the cost of living).

State Spending Limit. In addition to Propositions 2, 30, and 98, the State Constitution includes other rules affecting the state budget, such as the state spending limit that has been in place since passage of Proposition 4 in 1979.

Department of Finance (DOF). Led by the Director of Finance, DOF is the executive branch entity that supervises the state government’s financial policies.

Proposal

Extends Proposition 30 Income Tax Increases Through 2030. Under this measure, the Proposition 30 income tax rate increases on high-income Californians would not expire at the end of 2018, as scheduled under current law. As summarized in Figure 1, this measure would extend those income tax rate increases through 2030. Spending from the revenues raised by this measure would be subject to the state’s spending limit. (Under this measure, Proposition 30’s sales tax rate increase would not be extended.)

Provides Some New Monies for Medi-Cal. For fiscal years 2018-19 through 2030-31, the measure requires DOF to determine how much revenue raised by this measure would be available for the Medi-Cal program. Specifically, DOF would (1) estimate the amount of revenues raised by this measure and (2) subtract from that estimate higher required school and community college spending and certain other government costs, such as the cost of more people being served by state government programs. The lesser of (1) 50 percent of the resulting amount or (2) $2 billion would be allocated to the Medi-Cal program. During a Proposition 2 budget emergency, the measure allows this allocation to be reduced in proportion to the reduction in overall General Fund spending.

Fiscal Effects

Increased State Tax Revenues. Currently, the Proposition 30 income tax rate increases are scheduled to expire at the end of 2018. This measure would increase state income tax revenues by billions of dollars per year above current expectations for the years 2019 through 2030. (This would result in increased tax revenues for fiscal years 2018-19 through 2030-31.) The precise amount of this revenue in any given year would depend heavily on trends in the stock market and the economy. For example, if the stock market and economy were weak in 2019 (the first year of the proposed tax increase extension), this measure might generate around $5 billion of increased revenue. Conversely, if the stock market and economy were strong at that time, the measure might raise around $11 billion. Near the midpoint of this range—around $7.5 billion—is one reasonable expectation of the additional revenue that this measure would generate in 2019. Thereafter, through 2030, that amount would rise or fall each year depending on trends in the stock market and the economy.

Increased School and Community College Funding. Under current law, the expiration of Proposition 30 is expected to slow the growth of state tax revenues, thereby slowing the growth of the Proposition 98 minimum funding level. Under this measure, the amount of Proposition 98 funds provided to schools and community colleges each year probably would increase by a few billion dollars, compared to what these entities would receive if all of Proposition 30’s tax increases expired. The amount of increased school spending over the 2019-2030 period could vary significantly, depending on such factors as the Proposition 98 variables and the state of the economy during the period.

Increased Budget Reserves and Debt Payments. Under current law, the expiration of Proposition 30 will result in less revenue available for budget reserves and debt payments compared to when Proposition 30 was in effect. This measure would increase the amount of money used for budget reserves and debt payments, particularly when the economy and stock market are doing well. Because the measure would increase the amount of money used for budget reserves, it would be more likely that the total amount of reserves would reach the 10 percent maximum established by Proposition 2. If this occurred, the measure could result in more funding being used to build and maintain infrastructure.

Increased Medi-Cal Funding. The amount of increased Medi-Cal spending could vary significantly each year, ranging from $0 to $2 billion. The measure delegates to DOF the authority to make this estimate by implementing this measure’s provisions.

Remaining Funding Generally Available for Any Purpose. After satisfying requirements that the state tax revenues raised by this measure be allocated for (1) school and community college funding, (2) budget reserves and debt payments, and (3) the Medi-Cal program, the state could use any remaining funds for any budget purpose. The use of that funding would depend on decisions by future legislatures and governors.

Other Fiscal Effects. The likelihood that the state exceeds its Proposition 4 spending limit in the future is difficult to predict. If, however, this were to occur between 2019 and 2030, part of this measure’s revenues would go to one-time taxpayer rebates and one-time school and community college spending instead of being available for other state purposes.

Fiscal Summary. This measure would have the following major fiscal effects:

- Increased state revenues annually from 2019 through 2030—likely in the $5 billion to $11 billion range initially—with amounts varying based on stock market and economic trends.

- Increased revenues would be allocated under constitutional formulas to schools and community colleges, budget reserves and debt payments, and health programs, with remaining funds available for these or other state purposes.