Ballot Pages

Propositions on the November 8, 2016 Ballot

November 8, 2016Proposition 53

Revenue Bonds. Statewide Voter Approval. Initiative Constitutional Amendment.

Yes/No Statement

A YES vote on this measure means: State revenue bonds totaling more than $2 billion for a project that is funded, owned, or managed by the state would require statewide voter approval.

A NO vote on this measure means: State revenue bonds could continue to be used without voter approval.

Summary of Legislative Analyst’s Estimate of Net State and Local Government Fiscal Impact

-

Fiscal impact on state and local governments is unknown and would depend on which projects are affected by the measure, whether they are approved by voters, and whether any alternative projects or activities implemented by government agencies have higher or lower costs than the original project proposal.

Ballot Label

Fiscal Impact: State and local fiscal effects are unknown and would depend on which projects are affected by the measure and what actions government agencies and voters take in response to the measure’s voting requirement.

Background

State Pays for Infrastructure Projects Using Cash and Borrowing. The state builds various types of infrastructure projects like bridges, dams, prisons, and office buildings. In some cases, the state pays for projects on a pay-as-you-go basis using tax revenues received each year. In other cases, the state borrows money to pay for projects, especially for larger projects.

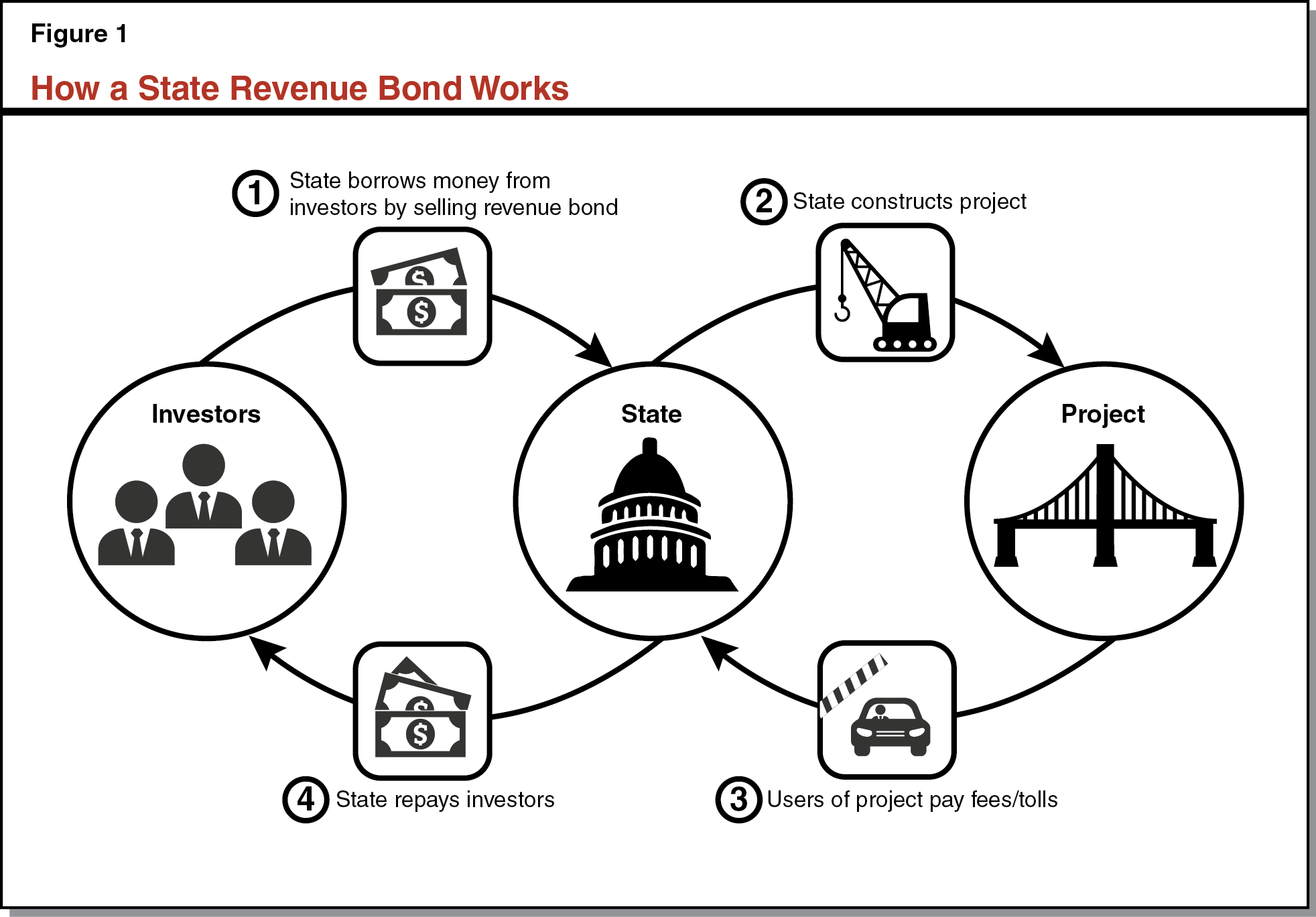

State Borrows Money Using Bonds. The main way the state borrows money is by selling bonds to investors. Over time, the state pays back these investors with interest. The state sells two main types of bonds: general obligation bonds and revenue bonds. The state repays general obligation bonds using the state General Fund, which is funded primarily by income and sales taxes. In contrast, the state usually repays revenue bonds using revenue from fees or other charges paid by the users of the project (such as from bridge tolls). Figure 1 shows how a state revenue bond generally works. (For more information on the state’s use of bonds, see the “Overview of State Bond Debt” later in this voter guide.)

Voter Approval Not Required for State Revenue Bonds. Under the California Constitution, state general obligation bonds need voter approval before the state can use them to pay for a project. State revenue bonds do not need voter approval under existing state law.

Proposal

Requires Voter Approval of Certain State Revenue Bonds. The measure requires statewide voter approval of revenue bonds that meet all of the following conditions:

-

State Sells the Revenue Bonds. Revenue bonds are sold by the state, as well as certain associations that the state creates or in which the state is a member. The statewide voting requirement does not apply to bonds sold by cities, counties, schools, community colleges, and special districts.

-

Bonds Sold for State Project. The revenue bonds are sold for a project that is funded, owned, operated, or managed by the state. The measure also contains provisions to prevent a single project from being separated into multiple projects to avoid voter approval.

-

Bonds for the Project Exceed $2 Billion. The revenue bonds sold for a project total more than $2 billion. Under the measure, this amount would be adjusted every year for inflation.

Fiscal Effects

The measure’s fiscal effects on state and local governments are unknown. It is unlikely there would be very many projects large enough to be affected by the measure’s requirement for voter approval. However, for those projects that are affected, the fiscal effects would depend on what actions the state, local governments, and voters take in response to this measure’s voting requirement.

Measure Likely to Cover Relatively Few Projects

Few Projects Cost Over $2 Billion. Relatively few state projects are likely to be large enough to meet the measure’s $2 billion requirement for voter approval. Two state projects that are over $2 billion and might use revenue bonds are (1) the California “WaterFix” project, which would build two tunnels to move water through the Sacramento-San Joaquin River Delta; and (2) the California High-Speed Rail project. It is possible other large projects could be affected in the future, such as new bridges, dams, or highway toll roads.

Uncertain Which Projects Would Be Affected. While it is unlikely that very many projects would be large enough to be affected by the measure, there is some uncertainty regarding which projects would be affected. This is because the measure does not define a “project.” As a result, the courts and the state would have to make decisions about what they consider to be a single project. For example, in some cases a project could be narrowly defined as a single building (like a hospital). In other cases, a project could be more broadly defined as including multiple buildings in a larger complex (like a medical center). A broader definition could result in more projects meeting the $2 billion requirement, thus requiring voter approval.

How Government Agencies and Voters Respond Would Affect Costs

Government and Voters Could Take Different Actions. When a proposed project meets this measure’s requirements for voter approval, governments and voters could respond in different ways. These responses, in turn, would determine the fiscal effects, if any, of this measure:

-

On the one hand, if the state held an election and voters approved the project, the state could proceed with the project as planned using revenue bonds. As a result, there would be little fiscal effect from this measure.

-

On the other hand, if voters rejected the project or the state chose not to hold an election as required by this measure, the state would not be able to use revenue bonds for the project. Without access to revenue bonds, the state and/or local governments might take other actions to meet the concerns the project was intended to address. They might (1) replace the large project with other smaller projects, (2) perform other activities that would reduce the need for the project, or (3) find other ways to pay for the project instead of using revenue bonds. These actions could result in either higher or lower net costs depending on the specific alternatives that governments pursued and how they compared to the original project proposal.

Some Actions Could Result in Higher Costs. Some types of government and voter response to this measure could result in higher costs for the state and local governments. For example, it could be more expensive in some cases for state and local governments to complete several smaller projects than it would have been for the state to build the original large project. This could happen if the large project was a more efficient way to meet the concerns that the project addressed.

The state also could fund a project in a different way than revenue bonds that might be more expensive. For example, the state could partner with a private company that would sell bonds to fund the project. The state would then have to pay back the private company. This could result in higher costs for the state because the private company would need to make a profit on the project. Also, the private company would probably pay higher interest rates than the state. The private company would likely pass these higher borrowing costs on to the state.

Some Actions Could Result in Lower Costs. Other types of responses could result in lower state and local costs. For example, state and local governments might find ways to make better use of existing infrastructure. For instance, local water agencies might implement water conservation measures, which could reduce the need to build new dams or other projects to provide more water. If existing infrastructure could meet the state’s needs adequately with these types of actions, there would be savings from not having to spend the money to build a new project.

The state also could fund a project in a way that might be cheaper than using revenue bonds. For example, the state could borrow money using general obligation bonds. While state general obligation bonds require voter approval, there would be some savings because they have lower interest rates than revenue bonds.