Featured Items

Related LAO Publications

Other Information Sources

Infrastructure Funding

On this page:

- How does the state pay for infrastructure?

- What are bonds?

- What is the process for spending bond funds?

- What general obligation bonds have voters passed in recent years?

- How much of the state’s bonds have been sold and are still outstanding?

- How much of the state’s approved bonds haven’t been sold yet?

- How much does the state spend to repay its bonds?

How does the state pay for infrastructure?

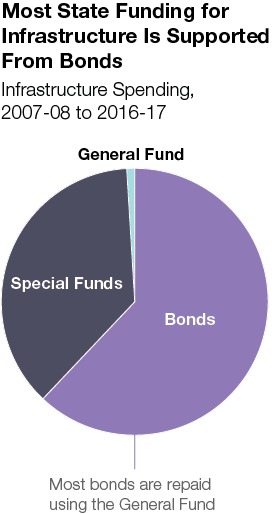

Over the past decade, we estimate that over 60 percent of the state’s infrastructure spending was borrowed using bonds. Most of these bonds are repaid from the state’s General Fund, which is its main operating account. The remaining roughly 40 percent of the state’s infrastructure spending was paid up-front, almost all from special fund revenues, such as taxes on gas.

For more information, see our publication A Ten-Year Perspective: California Infrastructure Spending (PDF).

What are bonds?

Bonds are a way that governments and companies borrow money. The state sells bonds to investors to receive “up-front” funding for projects and then repays the investors, with interest, over a period of time. The two main types of bonds used by the state are general obligation bonds and revenue bonds. The state repays general obligation bonds using the state General Fund. The state repays revenue bonds typically using revenue from the fees or other charges paid by the users of the project (such as from bridge tolls). In some cases, certain revenue bonds are paid using the state General Fund. For example, lease revenue bonds are a special kind of revenue bond that the state repays with the rent payments made by the department that occupies the facility. For more information on bonds, see our publication Overview of State Bond Debt (PDF).

What is the process for spending bond funds?

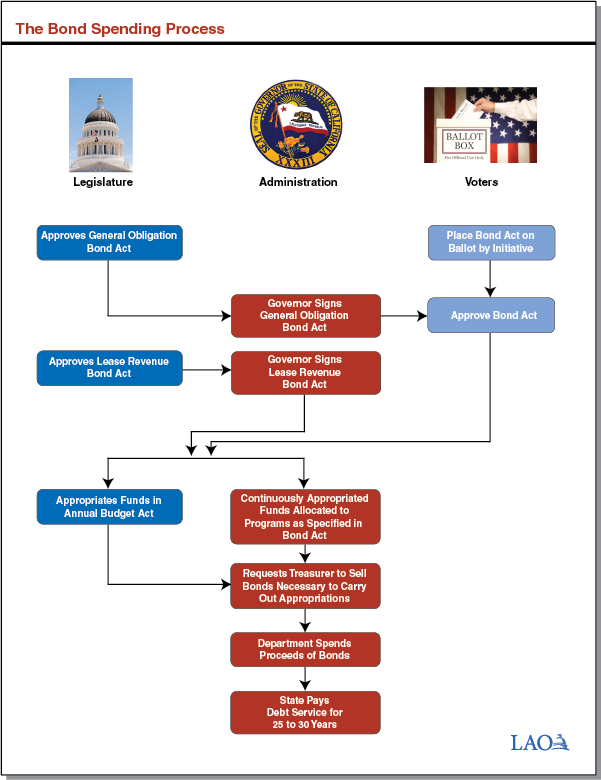

Approval of Bonds. Under the California Constitution, state general obligation bonds need voter approval before the state can use them to pay for a project. General obligation bonds can be placed on the ballot by either the Legislature or by the voters through the initiative process. State revenue bonds, including lease revenue bonds, do not need voter approval under existing state law.

Appropriation of Bond Funds. After bonds are authorized, most bond programs still require future legislative action to appropriate funding before state departments can begin spending or distributing the funds. Spending for a limited number of bond programs is continuously appropriated, meaning that a legislative appropriation is not required before bond funds can be spent.

Completion of Projects and Bond Repayment. After bond funds are appropriated, the state is responsible for carrying out the projects itself or distributing the funds to local governments to complete the projects. It is also responsible for selling the bonds, which are repaid by the state over time.

What general obligation bonds have voters passed in recent years?

Since 2000, voters have approved about $126 billion in general obligation bonds that are supported by the state’s General Fund. The large majority of these bonds are for education, transportation, and resources and environmental protection.

General Fund‑Supported Infrastructure General

Obligation Bonds Approved By Voters Since 2000

(In Millions)

|

Proposition Number |

Date |

Total Amount |

|

Education |

||

|

47 |

Nov‑02 |

$13,050 |

|

55 |

Mar‑04 |

12,300 |

|

1D |

Nov‑06 |

10,416 |

|

51 |

Nov‑16 |

9,000 |

|

Subtotal |

($44,766) |

|

|

Transportation |

||

|

1B |

Nov‑06 |

$19,925 |

|

1A |

Nov‑08 |

9,950 |

|

Subtotal |

($29,875) |

|

|

Resources and Environmental Protection |

||

|

12 |

Mar‑00 |

$2,100 |

|

13 |

Mar‑00 |

1,884a |

|

40 |

Mar‑02 |

2,597a |

|

50 |

Nov‑02 |

3,345a |

|

1E |

Nov‑06 |

3,990a |

|

84 |

Nov‑06 |

5,266a |

|

1 |

Nov‑14 |

7,465a |

|

68 |

Jun‑18 |

4,100 |

|

Subtotal |

($30,747) |

|

|

Other |

||

|

14 (Libraries) |

Mar‑00 |

$350 |

|

16 (Veterans Housing) |

Mar‑00 |

50 |

|

41 (Voting) |

Mar‑02 |

200 |

|

46 (Housing) |

Nov‑02 |

2,100 |

|

61 (Hospitals) |

Nov‑04 |

750 |

|

71 (Stem Cell) |

Nov‑04 |

3,000 |

|

1C (Housing) |

Nov‑06 |

2,850 |

|

3 (Hospitals) |

Nov‑08 |

980 |

|

41 (Veterans Housing) |

Jun‑14 |

600 |

|

1 (Housing) |

Nov‑18 |

3,000b |

|

4 (Hospitals) |

Nov‑18 |

1,500 |

|

14 (Stem Cell) |

Nov‑20 |

5,500 |

|

Subtotal |

($20,880) |

|

|

Total |

$126,268 |

|

|

aReflects amount authorized by voters as adjusted by Proposition 1 (2014) and Proposition 68 (2018). bMeasure also included $1 billion for a veterans’ home loan program, which is expected to be repaid by veterans participating in the program rather than the General Fund. |

||

How much of the state’s bonds have been sold and are still outstanding?

As of October 2021, the state has about $78 billion of General Fund-supported bonds outstanding—that is, bonds that it has sold and on which it is making principal and interest payments. Of this amount, $70 billion are general obligation bonds and $8 billion are lease revenue bonds.

How much of the state’s approved bonds haven’t been sold yet?

As of October 2021, the state has about $38 billion in General Fund-supported bonds that have been authorized by voters or the Legislature, but have not yet been sold. Of this amount, about $30 billion are general obligation bonds and about $8 billion are lease revenue bonds. About one-third of these authorized but unissued bonds are for natural resources-related projects. Most of these bonds are expected to be sold in the coming years as projects need funding.

Authorized but Unissued General Fund‑Supported Bonds

As of October 2021 (In Millions)

|

Purpose |

General Obligation Bonds |

Lease Revenue Bonds |

Totals |

|

Resources and Environmental Protection |

$11,268 |

$633 |

$11,902 |

|

Education (K‑12 and Higher Education) |

9,467 |

— |

9,467 |

|

Transportation |

6,062 |

139 |

6,201 |

|

Criminal Justice |

2 |

3,148 |

3,150 |

|

Other |

3,571 |

4,091 |

7,662 |

|

Total |

$30,370 |

$8,011 |

$38,382 |

For updated information on authorized but unissued bonds, please visit the California State Treasurer’s Office’s Public Finance Division website.

How much does the state spend to repay its bonds?

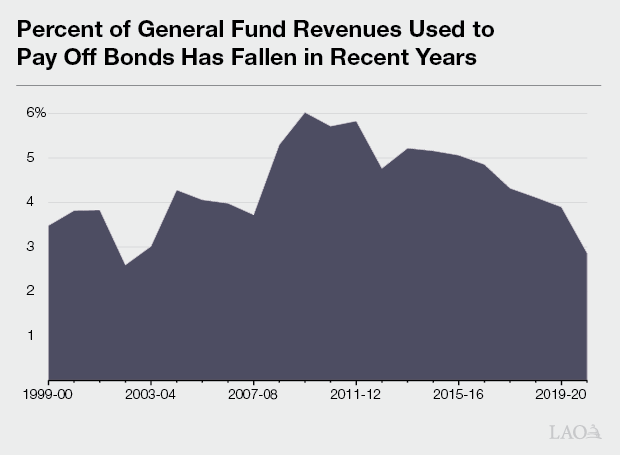

In 2020-21, the General Fund’s infrastructure bond repayments are expected to total close to $5.5 billion. One indicator of the state’s debt situation is its debt-service ratio (DSR). This ratio indicates the portion of the state’s annual General Fund revenues that must be set aside for debt-service payments on infrastructure bonds. The state’s DSR has fallen in recent years and is now under 3 percent of annual General Fund revenues.

For more information, see Overview of State Bond Debt.