Cap-and-Trade Revenue: Likely Much Higher Than Governor's Budget Assumes

February 26, 2015

In this post, we summarize information about state cap-and-trade auction revenues provided in our February report The 2015-16 Budget: Resources and Environmental Protection. We also discuss the February 18, 2015 auction, the results of which were not available at the time of our February analysis.

Results From Past Auctions. The Air Resources Board (ARB) conducted nine quarterly cap-and-trade auctions between November 2012 and November 2014. In recent auctions, most or all of the allowances offered for sale were purchased at prices at, or slightly above, the minimum price established by the state. A portion of the total revenue collected at auctions goes to electric utilities and, in the case of joint auctions, Quebec. (For more information on joint auctions and the linkage between cap-and-trade programs in California and Quebec, please see ARB’s website.) These nine auctions generated a total of $969 million in state revenue.

Beginning January 1, 2015, transportation fuel suppliers are required to obtain allowances for the GHG emissions associated with the combustion of the fuels they provide. In connection with this change, the number of state-auctioned allowances will increase significantly and, as a result, future auctions are expected to raise greater amounts of state revenue than in the past.

Future Revenue Is Subject to Substantial Uncertainty. The amount of future auction revenue will depend on two basic factors: the number of state allowances purchased and the selling price of the allowances. Both of these factors are uncertain because they can be affected by many factors that are difficult to predict, including overall economic activity, covered entities’ costs of emission reduction alternatives, market expectations about future allowance prices, industry expectations about future statutory or regulatory changes, and the degree to which other state policies reduce greenhouse gas emissions.

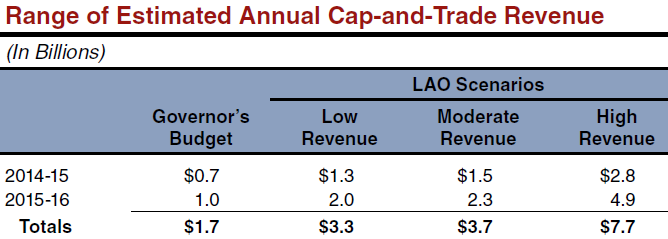

Governor’s Budget Assumes $1.7 Billion In Revenue. The Governor’s 2015-16 budget assumes the receipt of $650 million in state revenue from cap-and-trade auctions in 2014-15 and $1 billion in 2015-16.

Revenue Will Likely Be Significantly Higher Than the Budget Assumes. To illustrate the range of potential revenues in 2014-15 and 2015-16, the table below provides revenue estimates under three different LAO-generated scenarios, as well as the level of revenue assumed in the Governor’s budget. Each LAO scenario uses a different set of assumptions about the proportion of state allowances sold and the average price of allowances sold.

Based on our analysis of different factors (such as prior auctions and studies that projected future allowance prices), we consider the moderate-revenue scenario the most likely of the three scenarios presented. This scenario results in revenues totaling $3.7 billion in the current and budget years—assuming that nearly all allowances offered at state auctions are sold at the minimum price established by the state (between $12 and $13 in 2014-15 and 2015-16). The low-revenue scenario assumes a smaller portion—but still a majority—of allowances are purchased at the minimum price. The high-revenue scenario assumes all allowances are purchased at an average price of $25—roughly double the minimum price. The low- and high-revenue scenarios are plausible, but less likely. Under all three scenarios, state auction revenue will likely be significantly higher than what is assumed in the budget.

February Auction Results Appear to Be Consistent With LAO Moderate-Revenue Scenario. The ARB conducted another auction on February 18, 2015. A summary of the results from the auction was made public on February 25, 2015—several days after our analysis was published. All of the allowances offered for sale were purchased at prices near the minimum price. The results are generally consistent with our moderate-revenue projection, which assumes almost all of the allowances would be purchased at the minimum price. The ARB is expected to publish the precise amount of state revenue generated from the February auction in the middle of March.

The results from the February auction provide useful information about the current market prices for allowances. However, it is important to reiterate that many different factors could influence future market prices, and the results of future auctions continue to be subject to substantial uncertainty.