State Retiree Health Liabilities Growing. Yesterday, the State Controller's Office announced that the state's unfunded liabilities for retiree health and dental benefits (also known as retiree health benefits, or OPEB [other post-employment benefits]) had grown to $71.8 billion under the current "pay-as-you-go" state system for funding most such benefits. Retiree health benefits are, by far, the largest category of state debt payments not being fully addressed at this time. As we have pointed out various times in recent years, it is very costly to make retiree health payments on a pay-as-you-go basis. Paying more now to "prefund" these benefits—that is, setting aside funds and investing them, as governments do with pensions—will save future taxpayers large amounts of money over the long term. Importantly, prefunding retiree health benefits would move the state toward paying for these benefits as costs accrue: during the working lives of public employees, as they earn the benefits. Paying for costs as they accrue is a basic tenet of sound public finance.

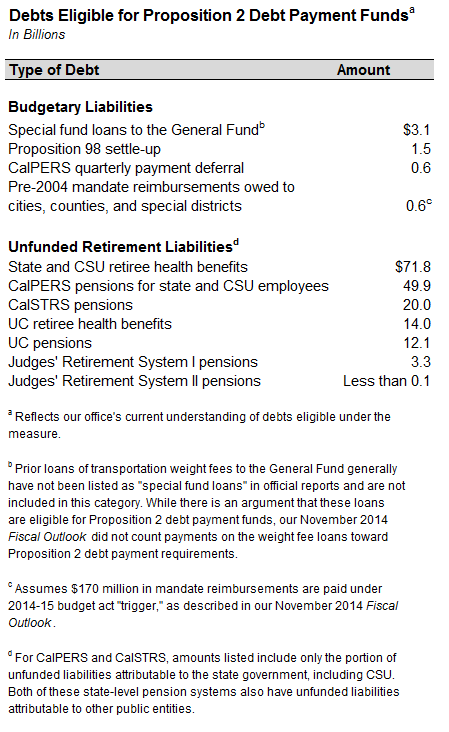

Taxes Set Aside by Proposition 2 May Be Key Funding Source for Retiree Health Liabilities. For the next 15 years, Proposition 2—approved by voters last month—sets aside a portion of California's General Fund taxes each year for legislative appropriation toward one or more debt payments specified in the measure. (We call these tax set asides "Proposition 2 debt payments" below.) The figure below lists the major categories of liabilities eligible to be paid from the Proposition 2 debt payments.

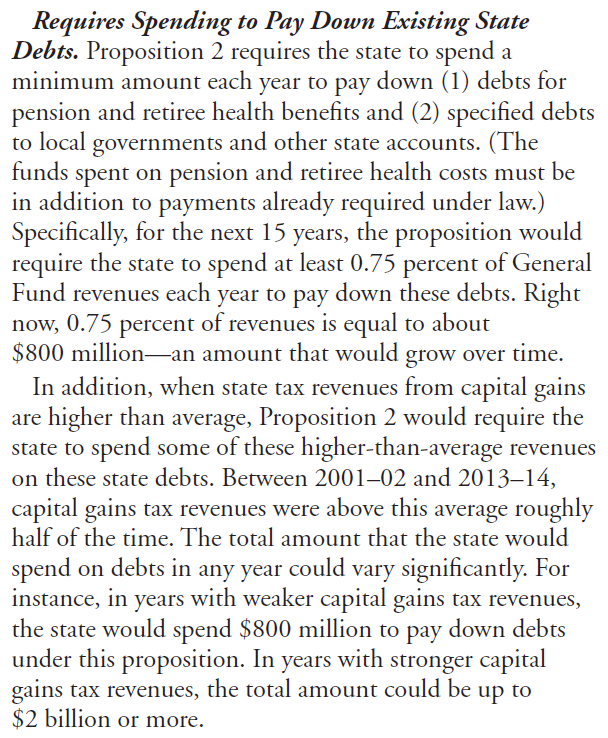

Proposition 2 Debt Payments Mandatory for 15 Years. Proposition 2 requires the state to set aside General Fund tax revenue in reserves and for debt payments. While the reserve payments can be suspended or reduced in certain circumstances (such as when revenue growth is particularly slow), the Proposition 2 debt payments are mandatory for the next 15 years through 2030. In our analysis of Proposition 2 in the November 2014 Voter Information Guide, we described the required debt payments under Proposition 2 as follows:

How Much in Tax Revenue Available to Address Retiree Health or Other Debts? In our November 2014 Fiscal Outlook, we estimated that 0.75 percent of General Fund tax revenues—the "base amount" of annual required supplemental debt payments under Proposition 2—would equal a somewhat higher amount in 2015-16 ($850 million) than we indicated in the Voter Information Guide. In addition, because we estimate that capital gains taxes will exceed 8 percent of General Fund taxes in 2015-16, an additional $1.12 billion would also be required to be spent on state debts in 2015-16 under the Proposition 2 formula. In total, we projected that $1.97 billion of General Fund taxes would be required to be used for supplemental payments in 2015-16 on one or more of the eligible state debts described in Proposition 2. (As discussed in the Fiscal Outlook, this calculation makes certain assumptions about how to implement the Proposition 2 formulas. Other assumptions could result in lower amounts for Proposition 2 debt payments.)

Proposition 2 Debt Payments Could Cover Substantial Share of Retiree Health Liabilities. In his press release yesterday, the Controller noted that beginning to set aside money for retiree health liabilities can quickly result in billions of dollars of reductions to the state's retiree health liabilities. This is because under governmental accounting rules, a higher "discount rate" (essentially, an investment earnings rate) can be assumed once the state starts setting aside money to invest and pay off the liabilities. As the Controller noted, as of 2014-15, if the state had set aside an additional $1.8 billion, it would be enough—along with future annual contributions—to "reduce future costs to the state and its employees of paying for retiree healthcare benefits." Over the next few decades, assuming similar annual payments every year in the future, the unfunded liability gradually could be eliminated. In 2015-16, the amount Proposition 2 sets aside for debt payments could potentially cover all of the $1.8 billion amount the Controller cites.

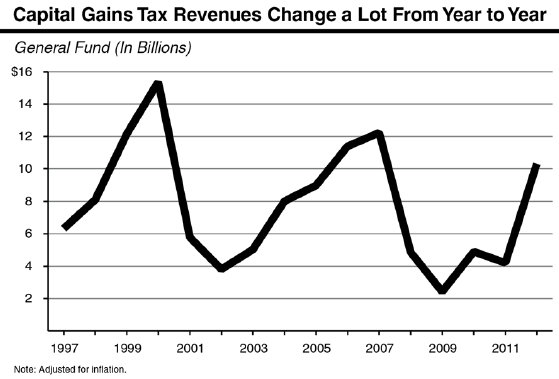

It is important to note, however, that Proposition 2 will not provide this much money every year, since the amount of the measure's required debt payments will fluctuate with the state's capital gains taxes, which, in turn, are driven up and down by trends in stock prices every year. The volatility in capital gains taxes, illustrated below, means that Proposition 2 debt payments will fluctuate up and down over the next 15 years.

What Should the State Do? Proposition 2 attempts to manage the state's revenue volatility by requiring the accumulation of budget reserves in strong economic times, and it also attempts to improve the state's future fiscal health by accelerating payment of certain debts, including, if the Legislature chooses, the state's large unfunded retiree health liabilities. The state has a number of important debts to address in both the short term (such as some portion of the state's remaining special fund loans and other budgetary liabilities) and the long term (pensions and retiree health debt). Accordingly, the state may not wish to devote every dollar of the Proposition 2 debt payments to retiree health liabilities.

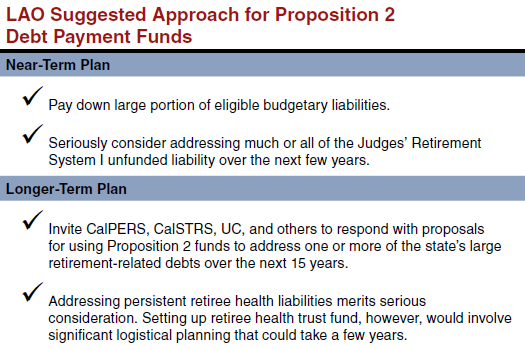

In our November Fiscal Outlook, we suggested that the Legislature adopt the following approach in the coming months as its develops a plan for the Proposition 2 required debt payments:

In the Fiscal Outlook, we noted that using Proposition 2 debt payments to fund retiree health liabilities merits serious consideration. We said that the state’s "current pay-as-you-go retiree health funding system is much more costly than if the state funded those benefits as they were earned." "Accordingly," we added, "reducing and eventually addressing unfunded retiree health liabilities of public entities could save taxpayers billions of dollars over the long term."

Issues to Address Before Committing Tax Dollars to Retiree Health Liabilities. If the state chose to use Proposition 2 debt payment funds to pay down retiree health liabilities, it would have a number of significant issues to consider, including:

- whether to increase fees of state special funds that do not currently have the budgetary flexibility to fund their share of retiree health costs,

- how to manage federal funding for the share of state employee costs funded by the U.S. government,

- whether state employees should pay more to fund retiree health benefits,

- how a state retiree health trust would be administered (including how future contribution amounts to the trust would be determined), and

- how legislation should clarify the effect that these contributions have on state contractual commitments concerning both future retiree health funding and benefits.

In our Fiscal Outlook, we suggested that the Legislature invite the administration, CalPERS, CalSTRS, UC, and other stakeholders to respond with proposals describing how Proposition 2 debt payment funds could help address retiree health and other liabilities. During this process, the Legislature could consider the various technical, logistical, financial, and legal issues related to retiree health benefit funding.