November 2008

California Spending Plan 2008–09

The Budget Act and Related Legislation

Contents

Chapter 1

Key Features of the 2008–09 Budget

The state’s already difficult budget situation was made worse this year by a significant drop in revenues due to a sluggish economy. The enacted budget, combined with special session actions in February 2008, contains about $24 billion in solutions and projects a General Fund reserve of $1.7 billion. As described in more detail below, this large gap primarily was closed through numerous one–time revenue solutions and the lack of inflationary adjustments for many state spending programs. Unfortunately, the nation’s worsening economic troubles have already threatened the budget plan’s viability.

Budget Overview

Total State Spending

The state spending plan for 2008–09 includes total budget expenditures of $131.6 billion. This includes $103.4 billion from the General Fund and $28.2 billion from special funds. As Figure 1 shows, total state spending declines slightly by $511 million from 2007–08 (0.4 percent). Bond fund spending is expected to increase by 1.3 percent, as the state continues to allocate funds from the $43 billion bond package approved at the November 2006 election.

Figure 1

2008-09 Budget Package

Total State Expenditures |

(Dollars in Millions) |

Fund Type |

Actual

2006-07 |

Estimated 2007-08 |

Enacted

2008-09 |

Change From 2007-08 |

Amount |

Percent |

General Fund |

$101,413 |

$103,333 |

$103,401 |

$68 |

0.1% |

Special funds |

22,554 |

28,767 |

28,188 |

-578 |

-2.0 |

Budget Totals |

$123,967 |

$132,100 |

$131,589 |

-$511 |

-0.4% |

Selected bond funds |

6,001 |

12,736 |

12,900 |

164 |

1.3 |

Totals |

$129,968 |

$144,836 |

$144,489 |

-$347 |

-0.2% |

The General Fund Condition

Figure 2 summarizes the estimated General Fund condition for 2007–08 and 2008–09 under the budget plan.

Figure 2

2008‑09 Budget

General Fund Condition |

(Dollars in Millions) |

|

|

2008‑09 |

|

2007‑08 |

Amount |

Percent Change |

Prior-year fund balance |

$4,777 |

$3,999 |

|

Revenues and transfersa |

102,555 |

101,991 |

-0.5% |

Total resources available |

$107,332 |

$105,990 |

|

Expenditures |

$103,333 |

$103,401 |

0.1% |

Ending fund balance |

$3,999 |

$2,589 |

|

Encumbrances |

885 |

885 |

|

Reserve |

$3,113 |

$1,703 |

|

Budget Stabilization Account (BSA) |

— |

— |

|

Special Fund for Economic Uncertainties |

$3,113 |

$1,703 |

|

|

a Display of revenues related to the BSA is different than the administration’s. The 2006-07 revenue amount (reflected in the prior-year fund balance) includes $472 million and the 2007-08 revenue amount includes $1.023 billion in General Fund revenues received in those years and transferred to the BSA. The administration instead shows the entire $1.494 billion as 2007-08 revenues, when the funds were transferred back to the General Fund. |

2007–08. The figure shows that 2007–08 began the year with a fund balance of $4.8 billion. Three major budgetary solutions adopted this year push 2007–08 revenues $5 billion higher than they otherwise would be:

- The issuance of an additional $3.3 billion in deficit–financing bonds (also known as economy recovery bonds, or ERBs). These bonds are paid back from the “triple flip” financing mechanism and transfers from the Budget Stabilization Account (BSA).

- The adoption of new penalties on corporations for underpayment of taxes. Most of the new penalties ($1.4 billion) will be accrued to 2007–08.

- As a result of a change in state accounting practices, the accrual of $0.4 billion in revenues to 2007–08.

Despite these revenue changes, the state spent almost $800 million more during 2007–08 than it received.

2008–09. The budget plan projects revenues of $102 billion in 2008–09, a decrease of 0.5 percent from 2007–08. The plan authorizes expenditures of $103.4 billion, an increase of 0.1 percent. Under the plan, the state has a projected reserve of $1.7 billion and will spend $1.4 billion more than it is projected to receive.

Programmatic Features of the 2008–09 Budget

Figure 3 outlines the major pieces of the state’s $24 billion in solutions adopted in response to its major budget shortfall.

Figure 3

2008‑09 Budget Plan Includes $24 Billion in Solutions |

Special Session and Budget Act (2007-08 and 2008-09, In Millions) |

|

|

Revenue-Related |

|

Sale of additional deficit-financing bonds |

$3,313 |

Accelerated estimated payments |

2,305 |

Revenue accrual |

1,856 |

Corporation penalties |

1,510 |

Net operating loss suspension and carryback |

1,190 |

Tax credit limitations |

690 |

Special fund loans |

648 |

Move limited liability companies payment forward |

360 |

Tax gap enforcement enhancements |

205 |

Special fund transfers |

152 |

Red Hawk Casino compact revenues |

38 |

Use tax on vehicles and vessels |

16 |

Other |

308 |

Subtotal, Revenue-Related |

($12,591) |

Spending-Related |

|

Proposition 98 |

|

Reduce 2007‑08 spending |

$507 |

Provide only 0.68 percent COLA |

2,845 |

Higher property tax estimate |

600 |

Redevelopment funds shift offset |

350 |

Defer settle-up payment |

150 |

Capture redevelopment pass-throughs |

98 |

Suspend Budget Stabilization Account transfer |

1,509 |

Redirect transportation funds to the General Funda |

819 |

Provide no funding for pay raise for correctional officers |

521 |

Reduce UC/CSU (unallocated) |

373 |

Assume savings from July executive order on personnel |

340 |

Reduction of Medi-Cal provider rates |

291 |

Suspend SSI/SSP COLAs |

288 |

Adopt regional center cost containment measures |

241 |

Veto of senior tax relief funding |

191 |

Delay of Medi-Cal checkwrite |

165 |

Suspend CalWORKs COLA |

162 |

Delay of new judges |

93 |

Use of court reserve funds |

92 |

Defer mandates repayment |

75 |

Shift payment schedule for mandate claims |

75 |

CalSTRS supplemental benefit account package |

66 |

Cash management package |

60 |

Reduce county funding for Medi-Cal administration |

53 |

Unallocated reductions |

50 |

All others |

1,366 |

Subtotal, Spending-Related |

($11,380) |

Total Solutions |

$23,971 |

|

a Amount above current law. |

Revenue–Related Solutions. The key revenue solutions include:

- Borrowing. As noted above, the state sold an additional $3.3 billion in ERBs during the spring of 2008. This sale exhausts the state’s $15 billion in authority provided by the voters through Proposition 57 in 2004. In addition, the budget plan borrows $648 million from various state special funds. These funds are generally not expected to be paid back to special funds until 2010–11 or later. This special fund borrowing is in addition to the $750 million in outstanding special fund loans from prior years. As shown in Figure 4, the state began the year with more than $18 billion in outstanding budgetary borrowing—requiring more than $2 billion in repayments during the budget year.

- Timing Changes on Tax Payments. The budget package accelerates the timing of two types of tax payments—estimated payments and limited liability company fee payments. Combined, these changes are expected to increase 2008–09 revenues by $2.7 billion.

- Revenue Accrual. The budget package changes the state’s accounting practices to accrue about $1.9 billion earlier than otherwise would be the case. This is a “paper change” and does not alter the amounts or timing of any tax payments.

- Corporation Penalties. The budget anticipates $1.5 billion in increased revenues resulting from new penalties on corporations for underpayment of taxes.

- Net Operating Loss (NOL) Provisions. The budget suspends the use of NOL deductions for two years for larger companies while providing more benefits to businesses in future years.

- Tax Credit Limitations. The budget plan restricts for larger companies the use of specified business–related tax credits in 2008 and 2009, resulting in an estimated increase of $690 million in 2008–09.

Figure 4

Budgetary Borrowing and the 2008‑09 Budget |

(In Millions) |

|

Estimated

Outstanding

Borrowinga |

2008‑09

Budgeted

Payment |

Resources |

|

|

Paterno lawsuit financing |

$278 |

$62 |

Transportation |

|

|

Proposition 42 loan |

$662 |

$83 |

Tribal gambling bond-related loan |

871 |

100 |

Education |

|

|

Settle-up |

$1,101b |

— |

Quality Education Investment Act |

2,514 |

$450 |

Mandates |

|

|

Noneducation |

$970 |

— |

Special Funds |

|

|

Various loans |

$1,397 |

$32 |

Economic Recovery Bonds |

$10,465 |

|

Triple Flip |

|

$1,440 |

Budget Stabilization Account |

|

— |

Surplus property sales |

|

30 |

Totals |

$18,258 |

$2,197 |

|

a At time of budget enactment. |

b Reflects settle-up obligation for 2002-03 and 2003-04. |

Spending–Related Solutions. The key spending–related solutions include:

- Proposition 98. The budget provides a 0.68 percent cost–of–living adjustment (COLA) to K–14 programs—substantially below the 5.66 percent level that otherwise would be required under state law.

- BSA Transfer. The Governor issued an executive order to suspend the annual transfer to the BSA. Consequently, a $1.5 billion supplemental debt–service payment for outstanding ERBs will not be made this year.

- Transportation. The budget uses $1.7 billion in transportation funds to reduce General Fund expenditures. This is about $800 million more than would have been used to benefit the General Fund under the 2007–08 budget agreement.

- State Employee Pay. Most state employees (other than highway patrol officers and engineers) are not budgeted for COLAs this year. The Legislature rejected funding (over a two–year period) for a correctional officer pay increase proposed as part of the administration’s compensation offer.

- Social Services COLAs. The budget plan suspends scheduled state–supported COLAs for both Supplemental Security Income/State Supplementary Payment (SSI/SSP) and California Work Opportunity and Responsibility to Kids (CalWORKs) recipients.

- Other Reductions. In other areas, the budget includes many of the budget–balancing reductions (BBRs)—generally 10 percent of program funding—originally proposed as part of the Governor’s January budget.

Ballot–Related Measures. The Legislature passed a series of measures to be placed before the state’s voters pertaining to the state lottery and budget practices. It is expected that a special election will be called for the first part of 2009 to vote on these propositions. The lottery proposition would provide the Lottery Commission with increased flexibility to set prize payouts. In addition, the state would be authorized to borrow billions of dollars in future lottery profits to benefit the General Fund in the near term. The budget reform package would increase payments to the BSA, further restrict when funds can be taken out of the BSA, and provide the Governor with enhanced authority to make spending reductions during the fiscal year.

General Fund Spending by Program Area. Figure 5 shows General Fund spending by major program for 2006–07 through 2008–09. These amounts do not include other sources of funding, such as state special, local, or federal funds. For instance, K–12 education excludes funding provided by local property taxes. In addition, year–to–year changes in spending are significantly affected by a variety of one–time factors. For example, resources spending as budgeted is expected to drop in the budget year, due to extraordinary firefighting costs in 2007–08. (However, the actual firefighting costs in 2008–09 are uncertain and could be considerably higher than budgeted.) Spending in the “other” category will drop by more than $2 billion. About one–half of this drop is due to the state not making a supplemental debt–service payment on outstanding ERBs through the BSA in 2008–09. Much of the redirection of transportation dollars to benefit the General Fund is also reflected in this category as a negative expenditure. Finally, General Fund spending on social services is growing at 8.1 percent, due primarily to funding shifts and federal requirements in the CalWORKs program.

Figure 5

2008-09 Budget Package

General Fund Spending by Major Program Area |

(Dollars in Millions) |

|

Actual 2006-07 |

Estimated 2007-08 |

Enacted 2008-09 |

Change From 2007-08 |

Amount |

Percent |

K-12 Education |

$39,255 |

$39,485 |

$40,018 |

$534 |

1.4% |

Higher Education |

11,190 |

11,780 |

12,070 |

290 |

2.5 |

Health |

19,235 |

20,095 |

20,705 |

610 |

3.0 |

Social Services |

9,777 |

9,631 |

10,415 |

784 |

8.1 |

Criminal Justice |

11,856 |

13,186 |

13,221 |

34 |

0.3 |

Transportation |

2,980 |

1,416 |

1,432 |

16 |

1.1 |

Resources and

Environmental Protection |

2,054 |

2,060 |

1,912 |

-148 |

-7.2 |

All other |

5,066 |

5,679 |

3,627 |

-2,053 |

-36.1 |

Totals |

$101,413 |

$103,333 |

$103,401 |

$68 |

0.1% |

General Fund Spending Over Time

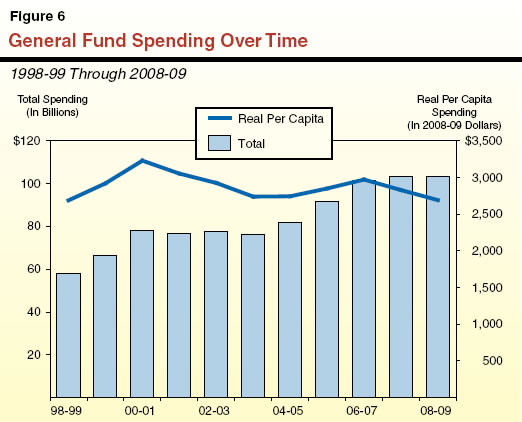

Figure 6 shows General Fund expenditures from 1998–99 through 2008–09 both in current dollars and as adjusted for population and inflation (that is, in real per capita terms). The figure illustrates that after growing rapidly in the late 1990s, real per capita spending fell significantly throughout the first part of the 2000s before rebounding through 2006–07. For 2008–09, real per capita spending is projected to be at the same level as it was in 1998–99.

Out–Year Impacts of the 2008–09 Budget

As described above, many of the budget solutions are of a one–time nature. Based on the 2008–09 budget plan’s policies, therefore, the state would once again face multibillion dollar operating shortfalls in the coming years. A key piece of the budget plan is the lottery proposal to ask voters to authorize the borrowing of billions of dollars in future lottery profits. Currently, the plan envisions borrowing $5 billion in each of the next two fiscal years to help balance the budget. The magnitude of additional solutions that will be necessary to balance upcoming budgets will largely depend on the health of the state’s economy and tax revenues. We will be updating our fiscal projections for 2008–09 and future years in November 2008, when we release our annual California’s Fiscal Outlook.

Evolution of the Budget

In this section, we highlight the major developments in the evolution of the 2008–09 budget, beginning with the Governor’s original January budget proposal and ending in September 2008, when the budget was signed into law.

Governor’s January Proposal

At the time of the 2007–08 budget’s passage, it was expected that the state’s persistent gap between revenues and expenditures would reemerge for 2008–09 in an amount of at least $5 billion. By the time the Governor proposed his 2008–09 budget in January, however, that projected shortfall had grown to $14.5 billion due to continued softness in the state’s economy, delays in several 2007–08 budget solutions, and rising costs in some programs. As a result of the bleak budget outlook, the Governor declared a fiscal emergency under the State Constitution and called the Legislature into special session.

Major Proposals. The Governor’s January budget proposed $17 billion in 2007–08 and 2008–09 solutions, with a projected reserve of $2.8 billion. Figure 7 summarizes the administration’s major proposals from January. The largest components were:

- Raising $3.3 billion from issuing additional ERBs.

- Changing the state’s accrual practices to count $2 billion in 2009–10 revenues in 2008–09.

- Suspending the $1.5 billion 2008–09 BSA transfer.

- Suspending the Proposition 98 minimum guarantee for 2008–09.

- Reducing most programs’ spending by 10 percent in an across–the–board manner. These reductions were known as BBRs.

Figure 7

January Budget—$17 Billion in Proposed Solutions |

(In Millions) |

|

|

Reduce Proposition 98 spending |

|

2007-08 reduction |

$400 |

Suspend 2008-09 minimum guarantee |

4,825 |

Issue additional deficit-financing bonds |

3,313 |

Accrue 2009-10 revenues to 2008-09 |

2,001 |

Suspend transfer to Budget Stabilization Account |

1,509 |

Reduce Medi-Cal spending |

1,126 |

UC/CSU reductions (unallocated) |

569 |

CalWORKs reforms |

463 |

Early release of prisoners and summary parole |

372 |

Suspend SSI/SSP COLAs |

323 |

Other solutions |

2,356 |

Total Solutions |

$17,257 |

The administration also expressed concern about the state’s ability to meet its cash demands. The administration proposed special session legislation to delay the timing of a series of state payments. Specifically, the administration proposed to shift $4.7 billion from July and August 2008 to later months to increase the state’s cash–on–hand prior to the state’s issuance of revenue anticipation notes (the state’s typical external cash flow borrowing within a fiscal year).

Budget Reform. The Governor also proposed putting a constitutional amendment before the state’s voters related to the state’s budgeting practices. The measure would have limited the amount of revenues that the General Fund could receive in any year to the average revenue growth rate from the past decade. Any excess revenues were to be put into a new state reserve and could not be accessed unless a year’s revenues were below the ten–year average. In addition, the Governor proposed a system of automatic across–the–board reductions if the state’s budget situation declined after a budget’s passage.

Special Session

In February, the Legislature adopted a package of more than $7 billion in solutions which brought the 2007–08 budget back into balance and began the process of balancing the 2008–09 budget. Figure 8 lists the solutions that were adopted. (Some solutions later were amended by actions taken with the passage of the 2008–09 Budget Act.) More than $6 billion of the adopted solutions were one–time in nature and, therefore, did not address the state’s ongoing shortfall between revenues and expenditures. The Legislature also adopted the administration’s proposed cash management solutions with some modifications, including making the shifts effective for 2008–09 only (rather than ongoing as originally proposed).

Figure 8

Special Session Actions |

2007‑08 and 2008‑09 Savings

(In Millions) |

|

|

Sale of additional deficit-financing bonds |

$3,313 |

Suspension of Budget Stabilization Account transfer |

1,509 |

Reduction of Medi-Cal provider rates |

508 |

Reduction in current-year Proposition 98 spending |

507 |

Public Transportation Account reimbursement to the General Funda |

409 |

Regional center cost containment measures |

229 |

Higher tideland oil revenue estimate |

218 |

Delay of Medi-Cal checkwrite |

165 |

Delay of SSI/SSP cost-of-living adjustment (COLA) |

91 |

Delay of new judges |

76 |

Shift payment schedule for mandate claims |

75 |

Delay of CalWORKs COLA |

42 |

Elimination of CalWORKs performance incentives |

40 |

Recognition of CDCR program delays |

40 |

Shift of parks maintenance to bond funds |

30 |

Other |

201 |

Total |

$7,452 |

|

a The administration excludes this issue from both its problem and solution definition. |

May Revision

Worsening Budget Outlook. Between January and May, the administration’s view of the budget outlook worsened by $8 billion, as a result of:

- A further deterioration of the economic and revenue outlook for 2008–09 ($6 billion).

- Rising state expenditures in a number of state programs ($1.7 billion).

In addition, in January, the administration assumed that many of its proposals would be adopted by March 1, 2008. For proposals which had not been adopted by the Legislature, the administration revised its savings estimates in May down by $0.5 billion, assuming implementation by July 1, 2008. The May Revision also reversed several key January proposals. In May, the administration proposed $1.1 billion in higher Proposition 98 spending and $196 million in higher university spending compared to January. In addition, the administration dropped its proposals for the early release of state prisoners and the closure of 48 state parks. These developments also added to the budget problem, but were offset in part by some program savings.

New Solutions. As a result of these changes, the administration proposed more than $8 billion in new solutions, which are summarized in Figure 9. By far the largest proposal was the sale of $5 billion in lottery bonds which were to be paid back from future lottery profits. The administration proposed placing the lottery proposal on the November 2008 ballot. If the ballot measure failed, a one cent sales tax increase would have gone into effect. With these proposals, the May Revision had a projected reserve of $2 billion.

Figure 9

May Revision—$8 Billion in New Solutions Proposed |

(In Millions) |

|

|

Sell lottery bonds |

$5,122 |

Expand use of transportation funds to benefit General Fund |

828 |

Special fund loans |

564 |

Reduce funding for correctional officers pay offer |

421 |

CalWORKs grant reductions and policy changes |

370 |

Accelerate limited liability company fee payment |

360 |

Reduce IHSS state participation to minimum wage |

187 |

Eliminate Cash Assistance Program for Immigrants |

111 |

Do not pass through federal SSI cost-of-living adjustment |

109 |

Reduce health services for newly qualified immigrants |

87 |

Defer mandates repayment |

75 |

Other (net) |

221 |

Total |

$8,455 |

Conference Committee

Following the May Revision, the Senate and Assembly took actions on the administration’s revised proposals, and the budget was sent to the Conference Committee to reconcile the differences between the houses. The adopted Conference Committee version of the budget on July 8 had a projected reserve of $1.4 billion and substantially differed from the May Revision. Specifically, it:

- Included a $10 billion tax revenue package, including imposing 10 percent and 11 percent income tax brackets, raising the corporation tax rate, implementing a tax amnesty program, suspending NOL provisions for companies, suspending personal income tax indexing for inflation, and eliminating the dependent credit for high–income taxpayers.

- Proposed spending totaling more than $3 billion higher than the May Revision, including $2.2 billion more for Proposition 98 K–14 education (providing a 2.12 percent COLA).

- Rejected most of the administration’s proposed reductions in health and social services.

- Provided $600 million in alternative savings in criminal justice, through a package of inmate and parole population reductions and local public safety subvention reductions.

- Did not include revenue accrual, lottery, or budget reform proposals.

August Revision/Compromise

After the close of the Conference Committee, the Governor and the Legislature continued budget negotiations through July and August. On July 31, the Governor issued an executive order aimed at reducing state spending by paying state workers only minimum wage during the budget impasse (currently being challenged in court by the State Controller) and restricting the use of retired annuitant, temporary, and permanent intermittent employees. On August 20, the Governor released an “August Compromise” document which proposed a budget package that started with the Conference Committee version of the budget and made some key modifications. The August Compromise:

- Replaced most of the tax revenue provisions included in the Conference version of the budget. It instead included a one cent increase in the sales tax rate for three years, followed by a permanent one–quarter cent reduction. It also included a smaller tax amnesty program, modified the NOL suspension, and included a revenue accrual proposal similar to the January budget.

- Provided no COLA for Proposition 98 programs.

- Included a smaller package of prison population reductions.

- Proposed a lottery securitization proposal that would not yield a General Fund benefit until 2009–10.

- Proposed a budget reform package that focused on increasing transfers into the BSA, limiting transfers out of the BSA, and increasing executive authority to make midyear reductions.

The August Compromise had a reserve of $1.1 billion.

Final Budget

On the night of September 15, the Senate and Assembly passed a budget and sent it to the Governor. Key components were rejection of tax rate increases, replaced by a number of one–time revenue increases, and the final budget also included: (1) increased Proposition 98 spending to allow a COLA of 0.68 percent, (2) increased redevelopment pass–through payments to benefit the state by offsetting General Fund support, (3) redirection of transportation funds to benefit the General Fund, and (4) no prison or parolee population changes.

The Governor threatened to veto this budget plan. After further negotiations, the Legislature made two key modifications to its budget. First it replaced PIT withholding changes with increased penalties on corporations for underpayment of taxes owed. Second it modified the budget reform proposal to make it more difficult to transfer funds out of the BSA.

After making $510 million in General Fund vetoes, the Governor signed this budget package on September 23. The Governor vetoed $191 million in funding for low–income seniors’ tax relief programs, suspending their operation for the budget year. The Governor also vetoed $22 million from the California Department of Corrections and Rehabilitation budget and directed the department to establish a new parole program designed to divert certain parole violators from prison to community sanctions. In addition, the administration stated that it expects $340 million in savings from its July executive order. The stated reserve of the enacted budget was $1.7 billion. Additional details on the enacted budget package are provided throughout this publication.

Budget–Related Legislation

In addition to the 2008–09 Budget Act, the budget package includes a number of related measures enacted to implement and carry out the budget agreement. (A criminal justice bill was not passed by the Legislature as part of the budget.) The Legislature also passed a package of legislation in February 2008 during the budget special session to help bring the 2007–08 budget back into balance. Figure 10 lists these bills.

Figure 10

2008-09 Budget and Budget-Related Legislation |

Bill Number |

Chapter |

Author |

Subject |

Special Session |

|

ABX3 3 |

1 |

Budget Committee |

2007-08 budget amendments |

ABX3 4 |

2 |

Budget Committee |

Education |

ABX3 5 |

3 |

Budget Committee |

Health |

ABX3 6 |

4 |

Budget Committee |

Human services |

ABX3 7 |

5 |

Budget Committee |

Transportation |

ABX3 8 |

6 |

Budget Committee |

General government |

Budget Package |

|

|

AB 1781 |

268 |

Budget Committee |

Budget bill (conference report) |

AB 88 |

269 |

Budget Committee |

Budget bill revisions |

AB 10 |

753 |

Budget Committee |

Overtime pay |

AB 158 |

754 |

Torrico |

Indian Gaming Special Distribution Fund |

AB 186 |

755 |

Maze |

Central Valley Rural Crime Prevention Program |

AB 268 |

756 |

Budget Committee |

Transportation |

AB 519 |

757 |

Budget Committee |

Education |

AB 1183 |

758 |

Budget Committee |

Health |

AB 1279 |

759 |

Budget Committee |

Human services |

AB 1338 |

760 |

Budget Committee |

Resources |

AB 1389 |

751 |

Budget Committee |

General government |

AB 1452 |

763 |

Budget Committee |

Revenues |

AB 1526 |

Vetoed |

Budget Committee |

Proposition 49/after school programs |

AB 1654 |

Pending |

Budget Committee |

Lottery changes |

AB 1741 |

Pending |

Budget Committee |

Lottery securitization |

AB 1805 |

Vetoed |

Budget Committee |

Emotionally disturbed children |

AB 2026 |

761 |

Villines |

State property |

AB 2246 |

762 |

Villines |

Charter schools |

AB 2784 |

Vetoed |

La Malfa |

Hospital reimbursements |

ABX3 36 |

Vetoed |

Laird |

Tax withholding |

SBX1 28 |

1 |

Committee on Budget and Fiscal Review |

Tax accelerations and penalties |

SCA 12 |

143 |

Perata |

Lottery constitutional change |

SCA 13 |

144 |

Ashburn |

Budget reform |

SCA 30 |

167 |

Ashburn |

Budget reform amendments |

Chapter 2

Tax–Related Provisions

The 2008–09 budget package included a significant number of tax–related changes, although no broad–based tax increases were enacted. These changes contributed $8 billion to the 2008–09 Budget Act. The longer–term impact of these provisions, however, is much smaller. In fact, after 2009–10, the net impacts of these changes are expected to reduce state General Fund revenues below what they would have otherwise been.

Figure 1 summarizes the major tax–related changes adopted in the 2008–09 Budget Act. As the figure shows, these revisions result in a combined $8 billion in additional revenues in 2007–08 ($1.9 billion) and 2008–09 ($6.1 billion). In 2009–10, the additional resources generated by these changes falls sharply, bringing in an estimated $1.6 billion. Then, starting in 2010–11, the net impact of these changes is negative, growing from –$117 million to –$427 million in 2011–12 (and greater amounts thereafter).

Figure 1

Estimated Effects of the Major Tax-Related Provisions

In the 2008‑09 Budget Package |

(In Millions) |

|

2007‑08 |

2008‑09 |

2009‑10 |

2010‑11 |

2011‑12 |

Tax Expenditures |

|

|

|

|

|

Suspends net operating loss provisions for two years |

|

$1,190 |

$660 |

-$295 |

-$535 |

Limits business-related

credits to one-half of tax liability |

|

690 |

295 |

-355 |

-430 |

Subtotals, tax expenditures |

|

($1,880) |

($955) |

(-$650) |

(-$965) |

Revenue Accelerations |

|

|

|

|

|

Accelerates estimated

payments |

|

$1,350 |

$255 |

$180 |

$195 |

Eliminates “safe harbor” for

estimated payments |

|

955 |

120 |

55 |

55 |

Accelerates payments of

limited liability corporations |

|

360 |

50 |

50 |

50 |

Subtotals, revenue

accelerations |

|

($2,665) |

($425) |

($285) |

($300) |

Other |

|

|

|

|

|

Increases penalties for

underpaying corporation taxes |

$1,435 |

$75 |

$45 |

$30 |

$110 |

Accrual accounting change |

416 |

1,440 |

133 |

218 |

128 |

Subtotals, other |

($1,851) |

($1,515) |

($178) |

($248) |

($238) |

Totals |

$1,851 |

$6,060 |

$1,558 |

-$117 |

-$427 |

These revenue effects result from a number of major statutory provisions, which we have grouped into three categories: tax expenditure changes, revenue accelerations, and other changes. We discuss these provisions in more detail below.

Tax Expenditure Programs

As Figure 1 displays, $1.9 billion in revenues are projected for 2008–09 from reducing or suspending existing tax expenditure programs. Tax expenditure programs are special tax provisions—such as exemptions, deductions, and credits—that attempt to encourage certain types of behavior or target relief to specific groups of people or businesses. The 2008–09 budget package includes changes to two significant tax expenditures: net operating loss (NOL) provisions and business–related credits.

Suspends NOL Deductions. The budget agreement eliminates the NOL deduction for firms with taxable business income over $500,000. This change, which applies to tax years 2008 and 2009, is estimated to raise $1.2 billion in 2008–09. Under current law, firms that report a taxable loss in one year can apply the loss as a deduction in a future year in which they turn a profit.

The budget package also expands the NOL deduction in two ways. First, it extends the period for which an NOL can be carried forward to 20 years from the current 10 years. Second, the legislation allows firms to “carry back” NOLs for up to two years to retroactively reduce their tax bills from previous years. For example, a firm that turns a profit and initially owes taxes in 2013 but records an NOL in 2014 will be able to file an amended return for 2013 and apply all or part of the 2014 NOL to reduce its 2013 tax bill. The carryback provisions are phased in beginning in 2011.

Limits Business–Related Tax Credits to 50 Percent of Liability. The budget package contains a provision that precludes firms with business income over $500,000 from using certain tax credits to reduce their taxes by more than 50 percent. This restriction, which applies to tax years 2008 and 2009, is expected to raise $690 million in 2008–09. Under current law, firms can use tax credits to eliminate as much of their tax liability in any given year as possible. The two largest business tax credits are for research and development expenses and subsidies provided to businesses operating in special “enterprise zones.”

Similar to the expansion of the NOL deduction, the budget package also expands the value of tax credits in future years. Starting in 2009–10, a firm that is part of a unitary group will be allowed to share its unused credits with other firms in the same unitary group. (Generally speaking, unitary groups allow corporations to be taxed similarly no matter whether they are structured as a single entity with divisions or separate, but closely related, corporations.) Currently, credits must be applied against income earned by the same company. This provision is expected to increase the cost of these business credits by more than $300 million annually beginning in 2010–11.

Revenue Accelerations

The 2008–09 budget package also includes three provisions that accelerate the collection of existing personal and corporate taxes. These changes generate an estimated $2.7 billion in 2008–09. Because these measures do not alter the underlying amount of taxes paid by Californians (only their timing), these changes have a much smaller ongoing effect after 2008–09.

Accelerates Estimated Payments. The 2008–09 budget package requires taxpayers to pay a larger proportion of estimated tax payments in the first one–half of the calendar year. Most taxpayers have taxes withheld from their paychecks each pay period. Taxpayers also are required to make estimated payments each quarter when taxes are not withheld (typically, for income such as dividends, capital gains, or self–employed income). The general rule calls for taxpayers to pay 25 percent of their estimated annual liability that is not subject to withholding each quarter (April, June, September, and December). Under the budget agreement, however, starting in 2009, payments in April and June will increase to 30 percent of the annual liability. The September and December payments would fall to 20 percent. By shifting the timing of estimated payments, this provision is estimated to generate an additional $1.4 billion in 2008–09.

Eliminates the “Safe Harbor” Provision for Estimated Payments. A second change in the budget package results in an increase in the amount of estimated payments high–income individuals are required to make. Under current law, taxpayers face penalties if estimated payments fall below 90 percent of the current year’s liability. One exception to this rule—called the safe harbor rule—waives these penalties if the taxpayer’s estimated payments equal at least 100 percent of the previous year’s liability. The budget package deletes this safe harbor provision beginning in 2009 for taxpayers with incomes over $500,000 ($1 million for married couples filing joint returns). The budget assumes an additional $1 billion in revenues in 2008–09 due to this timing change.

Accelerates Payments From Limited Liability Companies (LLCs). The third revenue acceleration in the budget package requires LLCs to pay a fee to the state earlier than previously. Current law directs LLCs to pay an income–based fee to the state each year by April 15 (for most companies)—four months after the end of the tax year. The new provision requires most companies to make this payment 11 months earlier—by June 15th, or roughly halfway through the current tax year. This ongoing timing change is estimated to bring in $360 million in 2008–09 and about $50 million annually thereafter.

Other Tax Provisions

Alters Accrual Accounting Rules. The budget package redefines the way estimated tax payments are treated in the state accounting rules. Generally, the state operates under an “accrual” accounting system, which requires the state to recognize revenues and expenditures during the fiscal year in which they are realized. To implement this principle, prior law directed state agencies to recognize revenues in a fiscal year if the funds were collected within two months after the close of the fiscal year and if the underlying transaction took place in that fiscal year. The budget agreement deletes the two–month limit. Under the new rule, for example, a tax payment due in January 2010 can be “booked” in fiscal year 2008–09 if the underlying transaction that generated the taxable income took place in fiscal year 2008–09. The budget assumes this change will increase revenues in 2007–08 by $416 million and in 2008–09 by $1.4 billion.

Increases Penalty for Underpaying Corporate Income Taxes. The budget package establishes new penalties for significantly underpaying corporate income taxes. Currently, a corporation may be penalized when it fails to pay its full tax liability as required by law. Beginning in 2009, the state will impose a 20 percent penalty for all cases in which underpayment exceeds $1 million. A firm can avoid the new penalty for tax years 2003 through 2007 if it files an amended return by May 31, 2009. The 2008–09 budget assumes this provision will result in an additional $1.4 billion in revenues based on the assumption that many firms will take advantage of the penalty amnesty. Because most payments are expected to result from prior–year tax liabilities, the revenues are assigned to the prior fiscal year—2007–08.

Other Major Provisions

Tribal Gambling

Tribal Payments to General Fund Projected to Increase. The Legislature has ratified compacts in recent years that allow several tribes to expand their casino operations. Most of these compacts have increased tribes’ required payments to the General Fund. The budget package relies on an administration estimate that tribal payments to the General Fund will increase from $143 million in 2007–08 to about $485 million in 2008–09. This figure for 2008–09 includes $38 million from the new Red Hawk Casino in El Dorado County, which is owned by the Shingle Springs Band of Miwok Indians. Chapter 334, Statutes of 2008 (AB 3072, Price), ratifies an amended compact that expands the number of slot machines the tribe is allowed to operate. This amended compact with the Shingle Springs tribe now awaits approval by the U.S. Department of the Interior.

Grants to Non–Casino Tribes Continue to Be Funded From Distribution Fund. Several of the recent compacts ratified by the Legislature eliminated some tribes’ payments to the Indian Gaming Special Distribution Fund (SDF). (The SDF is an account that funds casino regulatory activities, the state’s problem gambling programs, grants to local governments affected by casino development, and budget shortfalls in another account—the Indian Gaming Revenue Sharing Trust Fund [RSTF]. The RSTF provides $1.1 million in annual grants to dozens of tribes that have no casino or only a small casino.) The Governor’s January budget proposal assumed that the General Fund—rather than the SDF—would cover the approximately $40 million of costs to cover the RSTF’s expected budget shortfall in 2008–09. The May Revision, however, proposed instead that funds from the SDF be appropriated to cover the costs of the RSTF’s budget shortfall—thereby saving $40 million of General Fund resources. The Legislature adopted the May Revision proposal with minor modifications.

Casino Mitigation Grants to Local Governments Will Resume. In 2007, the Governor vetoed a $30 million appropriation from the SDF for grants to local governments affected by casino development. The Governor cited a Bureau of State Audits (BSA) report that was critical of several aspects of the existing grant distribution methodology. In response, the Legislature enacted Chapter 754, Statutes of 2008 (AB 158, Torrico), which includes provisions to address several of the BSA’s findings. Chapter 754 also appropriates $30 million from the SDF for local government grants in 2008–09 and extends the statutory sunset date on the methodology for distributing the grants from January 1, 2009, to January 1, 2010.

Enhanced Tax Gap Enforcement

The Board of Equalization (BOE) and the Franchise Tax Board (FTB) are among the few state departments for which the budget authorizes major expansions of funding. Each of the two departments will add about 250 new positions over the next two years for enhanced efforts to reduce the difference between owed and remitted taxes—known as the “tax gap.” The budget act assumes $205 million of additional General Fund revenues in 2008–09 as a result of these tax gap enforcement efforts at a cost of $28 million. Both costs and revenues are expected to increase in subsequent years.

Under the spending plan, BOE is directed to use the additional resources to improve its filing of tax liens in bankruptcy liquidations, improve use tax collections from California service businesses, and augment sales and use tax audit and collections programs activities. Enhanced tax gap enforcement activities at FTB include increased fraud detection and prevention activities, pursuit of additional audit and collections workloads, review of inactive collections accounts where new asset information is available, mandatory electronic payment of personal income tax payments above a specified dollar threshold, and increased analysis of federal audit findings for unpaid state liability.

Chapter 3

Expenditure Highlights

Proposition 98

Proposition 98 funding constitutes about three–fourths of funding for education (which includes child care, preschool, K–12 schools, and community colleges). In this section, we review major Proposition 98 decisions for 2007–08 and 2008–09 and then identify outstanding Proposition 98 funding obligations. In the following sections, we discuss the K–12 and child care budgets in more detail, and in the “Higher Education” section, we discuss the community college budget in more detail.

Major Funding and Spending Decisions

Below, we recap Proposition 98 spending adjustments made during the special session, explain the effect of revenue changes on the Proposition 98 funding requirement for 2007–08 and 2008–09, and highlight the major Proposition 98 spending decisions for 2008–09.

Recap of Special Session—2007–08 Proposition 98 Spending Adjusted Downward by Approximately $500 Million. The 2007–08 Budget Act provided $57.1 billion in ongoing Proposition 98 funding for K–14 education. This funding level was intended to meet the Proposition 98 funding requirement, as estimated at the time the 2007–08 budget was enacted. Subsequently, state General Fund revenues came in lower than anticipated—resulting in a drop of roughly $1.5 billion in the Proposition 98 funding requirement. In response, the state adjusted Proposition 98 funding downward by $507 million during the Third Extraordinary Session. Specifically, Chapter 2, Statutes of 2008 (ABX3 4, Committee on Budget), adjusted 2007–08 spending downward by unappropriating a total of $211 million from various categorical programs that had been determined to be overbudgeted and reducing ongoing monies for Targeted Instructional Improvement Grants (TIIG) by $295 million. (Chapter 2 also appropriated $295 million in one–time monies for TIIG, thereby backfilling the loss of ongoing monies and preventing a reduction in the program.)

Final Revenue Package Affects Proposition 98 Minimum Guarantee for 2007–08. As of February 2008, the adjustments made during the Third Extraordinary Session left Proposition 98 spending for 2007–08 more than $1 billion above the Proposition 98 funding requirement. However, the final budget package includes components that increase the revenue attributed to 2007–08, thereby raising the Proposition 98 funding requirement such that it roughly matches the special session spending level ($56.6 billion). Specifically, the final budget package scores $1.9 billion in additional revenue to 2007–08 ($0.4 billion related to tax accrual and $1.4 billion related to increased penalties on corporation tax underpayments). These higher revenue assumptions raise the Proposition 98 minimum guarantee for 2007–08 by about $950 million (assuming no other changes).

Revenue Package Also Affects Proposition 98 Minimum Guarantee for 2008–09. In addition to the new revenues attributed to 2007–08, the final budget package also assumes new General Fund revenues for 2008–09. As discussed earlier in this report, the budget includes about $6.1 billion in new tax revenues for 2008–09. Because the Proposition 98 calculation accounts for growth in General Fund revenues, the additional tax revenues increase the Proposition 98 funding requirement by roughly $3 billion (assuming no other changes). The Proposition 98 funding provided in the 2008–09 Budget Act is based on these higher revenue assumptions. (Although it has no effect in 2008–09, the final budget package includes a lottery component that would affect Proposition 98 in 2009–10. See the Other Major Provisions section of this report for a description.)

Proposition 98 Funding Increases by About $1.5 Billion Year to Year. Figure 1 compares Proposition 98 funding in 2007–08 and 2008–09. As shown in the figure, ongoing Proposition 98 funding increases by $1.5 billion (2.7 percent). The bulk of this increase ($1.1 billion) is covered with higher local property tax revenues, with less than $400 million of the increase covered with General Fund monies. (Approximately $350 million of the growth in local property tax revenues is due to a one–time increase in the revenue that redevelopment agencies must pass through to schools, as discussed in the “General Government” section of this report.)

Figure 1

Ongoing Proposition 98 Funding |

(Dollars in Millions) |

|

2007‑08

Budget Act Revised |

|

2008‑09

Budget Act |

|

Change from Revised |

Amount |

Percent |

K-12 Education |

|

|

|

|

|

|

|

General Fund |

$37,203 |

$37,294 |

|

$37,535 |

|

$241 |

0.6% |

Local property tax revenue |

13,594 |

13,042 |

|

14,085 |

|

1,043 |

8.0 |

Subtotals |

($50,797) |

($50,336) |

|

($51,620) |

|

($1,284) |

(2.6%) |

California Community Colleges |

|

|

|

|

|

|

|

General Fund |

$4,157 |

$4,137 |

|

$4,302 |

|

$164 |

4.0% |

Local property tax revenue |

2,052 |

1,982 |

|

2,058 |

|

76 |

3.8 |

Subtotals |

($6,209) |

($6,119) |

|

($6,359) |

|

($240) |

(3.9%) |

Other Agencies |

$119 |

$121 |

|

$106 |

|

-$15 |

-12.2% |

Totals, Proposition 98 |

$57,125 |

$56,576 |

|

$58,086 |

|

$1,510 |

2.7% |

General Fund |

$41,479 |

$41,552 |

|

$41,943 |

|

$391 |

0.9% |

Local property tax revenue |

15,646 |

15,024 |

|

16,143 |

|

1,119 |

7.4 |

Most New Proposition 98 Spending Goes to Backfill Ongoing Programs. Not reflected in the figure, however, are several significant spending decisions that affected Proposition 98–funded programs in 2007–08. These include roughly $1 billion in one–time funds supporting ongoing K–14 programs in 2007–08 and about $200 million in one–time reductions made during the Third Extraordinary Session. Because most of the $1.5 billion in new 2008–09 Proposition 98 spending is used to backfill these 2007–08 “holes,” the actual amount of Proposition 98 resources available to support new activities in 2008–09 is only about $300 million, or 0.5 percent. This is discussed in more detail below, as well as in the subsequent “K–12 Education” and “Community College” sections of this report.

Increase Designated for Small Cost–of–Living Adjustment (COLA), Growth Adjustments. After backfilling for programs funded with one–time funds in the prior year, the budget package designates most of the new funding in 2008–09 for a small COLA. As shown in Figure 2, general purpose funding for school districts, county offices of education (COEs), and community colleges would receive a 0.68 percent COLA. This is notably less than the statutory K–12 COLA rate of 5.66 percent. The budget does not include any COLA for K–12 or community college categorical programs. (As discussed below, the final budget package includes a “deficit factor” for the foregone COLA for school districts and COE revenue limits, although not for K–14 categorical programs or community college apportionments.) Also shown in Figure 2, the final budget package makes various growth–related adjustments, including funding anticipated growth in both California Work Opportunity and Responsibility to Kids (CalWORKs) and non–CalWORKs child care ($22 million) and community college enrollment ($114 million). These costs are offset by estimated savings of $128 million from an expected decline in K–12 attendance.

Figure 2

Major Ongoing Proposition 98 Spending Increases |

2008‑09

(Dollars in Millions) |

|

Percent |

Amount |

Cost-of-Living Adjustments (COLAs): |

|

|

School district revenue limits |

0.68% |

$240 |

County office of education revenue limits |

0.68 |

4 |

Community college apportionments |

0.68 |

40 |

Total—COLAs |

|

$284 |

Growth Adjustments: |

|

|

Child care—CalWORKsa |

1.15% |

$11 |

Child care—non-CalWORKs |

0.69 |

11 |

K-12 education |

-0.52 |

-128 |

Community colleges |

1.98 |

114 |

Total—Growth Adjustments |

|

$7 |

|

a Reflects caseload adjustments for Stages 2 and 3. |

Outstanding Proposition 98 Funding Issues

The state currently faces a number of other Proposition 98–related funding obligations. Several of these obligations, highlighted in Figure 3, can be funded from within annual Proposition 98 appropriations. These include “deferrals,” unpaid mandate claims, and the revenue limit deficit factor. The 2008–09 budget package substantially increases these obligations. Two additional commitments—one related to a K–14 program established in 2006–07 and the other to “settling–up” unmet prior–year Proposition 98 obligations—require additional General Fund resources outside of the annual Proposition 98 appropriation. The budget package funds the new program but does not provide any settle–up funding.

Figure 3

Outstanding Proposition 98 Obligationsa |

(In Millions) |

|

2005‑06 |

2006‑07 |

2007‑08 |

2008‑09 |

K-14 deferrals |

$1,303 |

$1,303 |

$1,303 |

$1,303 |

K-12 mandatesb |

1,229 |

424 |

583 |

746 |

California Community Colleges mandates |

100 |

90 |

115 |

300 |

K-12 revenue limit deficit factor |

300 |

— |

— |

1,785 |

Totals |

$2,932 |

$1,817 |

$2,001 |

$4,134 |

|

a Reflects cumulative obligations at year end. |

b Based on a 2004 court ruling and the cost of pending claims relating to the state's high school science graduation requirement, we estimate the state could owe an additional $160 million for fiscal years 2003-04 through 2008-09. Moreover, if the Commission on State Mandates approves the proposed Reasonable Reimbursement Methodology for teacher salary costs extending back to 1995, then the amount owed would be significantly larger. |

Outstanding Obligations Grow to More Than $4 Billion. Figure 3 displays outstanding Proposition 98–funded obligations through the end of 2008–09. The figure shows these commitments were reduced by more than $1 billion in 2006–07, with the substantial repayment of K–12 mandate claims and full restoration of K–12 revenue limits. In contrast, the 2008–09 budget package substantially increases outstanding obligations—making no progress toward paying down outstanding deferral and mandate obligations, providing no funding for new K–12 mandate costs, and little funding ($4 million) for community college mandate costs. It also creates a sizeable new K–12 revenue limit obligation. As a result of these factors, outstanding obligations will grow to more than $4 billion in 2008–09. The specific obligations are discussed in more detail below.

Deferrals. From 2001–02 through 2003–04, the state achieved substantial budget solution by delaying certain Proposition 98 spending. Specifically, the state decided to defer significant education costs ($1.3 billion) to the subsequent fiscal year. Rather than a budget reduction, these deferrals resulted in districts receiving some state funds a few weeks later than normal (commonly called the “June deferral”). The state has not yet shifted this payment back to its regular schedule.

Mandates. Since 2001–02, the state has delayed reimbursing schools and community colleges for mandate claims. In essence, the state has required schools and colleges to undertake certain activities but has not paid them for the costs they have incurred. We estimate the annual costs of funding existing mandated activities is around $190 million (roughly $160 million for K–12 education and $30 million for community colleges). While the state made a large payment for outstanding mandate claims in 2006–07—eliminating debts from several prior years—it has been providing virtually no funding for ongoing mandate costs. As a result, the balance of outstanding mandate claims continues to grow.

Revenue Limits. To achieve budget solution in 2003–04, the state made reductions to K–12 revenues limits. Rather than making these reductions permanent, the Legislature decided to create an obligation to add the foregone amount—referred to as the deficit factor—to the revenue limit base in future years. As shown in the figure, this obligation was fully met in 2006–07, thereby raising revenue limits to the level they would have been absent the earlier reduction. However, as discussed earlier, the 2008–09 budget package provides only a partial COLA for K–12 school district and COE revenue limits—0.68 percent rather than the statutory rate of 5.66 percent. Consistent with previous practice, the budget package establishes a new deficit factor for the foregone COLA, creating a statutory commitment to use Proposition 98 funds at some point in the future to raise revenue limits to the level they would have been absent the 2008–09 reduction. As shown in the figure, the foregone revenue limit COLA totals almost $1.8 billion in 2008–09—$1.75 billion for school districts (resulting in a deficit factor of 4.71 percent) and $30 million for COEs (resulting in a deficit factor of 4.40 percent).

Substantial Increase for Quality Education Investment Act (QEIA). In addition to the $58.1 billion in Proposition 98 funding discussed above, the final budget package includes $450 million in General Fund monies to support the second year of the QEIA program. Of this amount, $402 million is provided to K–12 schools and $48 million is provided to California Community Colleges (CCC). This represents a substantial increase from the 2007–08 funding levels ($268 million was provided to K–12 schools and $32 million to CCC). As set forth in Chapter 751, Statutes of 2006 (SB 1133, Torlakson), the state has scheduled $450 million annual payments until a total of $2.8 billion has been provided (estimated to occur in 2013–14).

No “Settle–Up” Payment Provided. In 2002–03 and 2003–04, the Proposition 98 constitutional funding requirement ended up being higher than the amount of Proposition 98 funding appropriated. As a result, the state incurred a settle–up obligation totaling $1.1 billion across the two years. In Chapter 216, Statutes of 2004 (SB 1108, Committee on Budget and Fiscal Review), the state decided to pay off this obligation in $150 million annual installments until the entire $1.1 billion had been paid. Of the annual $150 million payments, $125 million is designated for K–12 education and $25 million is designated for CCC. The final budget package notwithstands the Chapter 216 requirement and does not provide the scheduled 2008–09 payment.

K–12 Education

In this section we summarize the 2008–09 budget package for K–12 education and describe the Governor’s K–12 vetoes.

K–12 Funding From All Sources Remains Relatively Flat Year to Year. Figure 4 displays all significant funding sources for K–12 education in 2007–08 and 2008–09. The figure shows that funding from all sources remains relatively flat year to year, with total funding in 2008–09 ($71.9 billion) increasing only $281 million, or 0.4 percent, compared to 2007–08.

Figure 4

K-12 Education Fundinga |

(Dollars in Millions) |

|

2007‑08

Revised |

2008‑09

Budget Act |

Change From 2007‑08 |

|

Amount |

Percent |

K-12 Proposition 98 |

|

|

|

|

State General Fund |

$37,294 |

$37,535 |

$241 |

0.6% |

Local property tax revenue |

13,042 |

14,085 |

1,043 |

8.0 |

Subtotals |

($50,336) |

($51,620) |

($1,284) |

(2.6%) |

Other Funds |

|

|

|

|

State General Fund |

|

|

|

|

Teacher retirement |

$1,535b |

$1,044 |

-$491 |

-32.0% |

Bond payments |

2,056 |

2,371 |

315 |

15.3 |

Other programsc |

1,616 |

1,031 |

-585 |

-36.2 |

State lottery funds |

936 |

936 |

— |

— |

Federal funds |

6,691 |

6,805 |

114 |

1.7 |

Other fundsd |

8,438 |

8,082 |

-356 |

-4.2 |

Subtotals |

($21,273) |

($20,269) |

(-$1,004) |

(-4.7%) |

Totals |

$71,609 |

$71,889 |

$281 |

0.4% |

|

a Includes funding for child care and development programs as well as adult education. |

b Total for 2007‑08 includes one-time California State Teachers’ Retirement System payment required by court order. |

c Includes spending for Quality Education Investment Act. |

d Includes special funds, local debt service, and other local revenues. |

Large Amount of One–Time Funds Backfilled With Ongoing Funds. Also shown in the figure, ongoing K–12 Proposition 98 spending in 2008–09 increases to $51.6 billion, which is about $1.3 billion more than the spending level for 2007–08. However, this increase is offset by a $1 billion year–to–year decrease in spending from all other fund sources. This decrease is mostly explained by the large amount of one–time funding included in the 2007–08 budget (reflected in the “other programs” and “other funds” categories). The TTIGs, Deferred Maintenance, High–Priority School Grants, Home–to–School Transportation, and Charter School Facility Block Grants were all at least partially supported with one–time monies in 2007–08. In the 2008–09 budget package, these one–time funds are backfilled with ongoing Proposition 98 dollars. (This represents the first time charter school facilities have been funded with ongoing rather than one–time funds.) As a result, funding from various sources has changed across the two years, but K–12 schools will receive about the same amount of total programmatic funding, with the slight increase in 2008–09 going to support the small COLA for revenue limits ($244 million).

Other Notable Changes. As shown in Figure 4, the amount of funding provided for teacher retirement declines considerably. This is due to a court decision affecting funding in 2007–08. (Please see the “General Government” section of this report for more detail.) General Fund costs associated with school facility bonds also have been on the rise in recent years, largely resulting from the passage of Proposition 47 (2002) and Proposition 55 (2004), with some additional costs beginning to arise from the recent passage of Proposition 1D (2006). Federal funding increases less than 2 percent from 2007–08, with a notable amount of the increase due to additional funding for low–performing schools. (As discussed in the nearby box, the final budget package includes a newly crafted plan for using available federal funding to support low–performing schools.)

State Crafts New Plan to Support Low–Performing Schools

The budget recognizes $191 million in federal funding available for schools and districts in Program Improvement (PI) under the federal No Child Left Behind (NCLB) Act. Under NCLB, schools and districts that fail to meet federal performance targets for two consecutive years enter PI. After two additional consecutive years of not meeting federal performance targets, PI schools and districts enter corrective action and are subject to federal sanctions. The new budget plan for 2008–09 integrates available federal funding to support PI districts facing corrective action.

New Program Funds Districts Facing Corrective Action. In this initial year of the program, a district facing corrective action may apply for a one–year, nonrenewable grant to assist in its improvement efforts. Districts must use the funds in accordance with NCLB requirements. Pursuant to the technical assistance requirements under NCLB, the State Board of Education (SBE) may require a district to use improvement funds to contract with a technical assistance provider. If required to use such a provider, funding must first be used to cover the associated cost.

Funding Linked With Severity of Performance Problems. Under the new plan, eligible districts are to be placed in one of three funding categories based on the severity of their performance problems, as determined by SBE. Funding is then allocated based on the number of PI schools in the district, with school rates ranging from $50,000 to $150,000 depending on the funding category. For 2008–09, 149 districts with roughly 1,400 PI schools are expected to receive funding. A total of $111 million is expected to be expended in 2008–09, leaving $80 million to carry over to the subsequent year. |

Per Pupil Funding Increases Less Than 1 Percent. As shown in Figure 5, total per pupil funding increases by $111, or just less than 1 percent, from 2007–08 to 2008–09. Based on the 2008–09 Budget Act, ongoing Proposition 98 per pupil spending is $8,726—an increase of $262, or 3.1 percent, over the prior year. However, including all the one–time monies supporting ongoing, traditionally Proposition 98–funded programs in 2007–08, the year–to–year increase in per pupil Proposition 98 funding is $112, or 1.3 percent.

Figure 5

K-12 Education Funding Per Pupil |

(Dollars in Millions) |

|

2007‑08

Revised |

2008‑09

Budget Act |

Changes From 2007‑08 |

|

Amount |

Percent |

K-12 Proposition 98 |

|

|

|

|

State General Fund |

$6,271 |

$6,345 |

$74 |

1.2% |

Local property tax revenue |

2,193 |

2,381 |

188 |

8.6 |

Subtotals |

($8,464) |

($8,726) |

($262) |

(3.1%) |

Other Funds |

|

|

|

|

State General Fund |

$876 |

$752 |

-$124 |

-14.2% |

State lottery funds |

157 |

158 |

1 |

0.01 |

Federal funds |

1,125 |

1,150 |

25 |

2.2 |

Other funds |

1,419 |

1,366 |

-53 |

-3.7 |

Subtotals |

($3,577) |

($3,426) |

(-$151) |

(-4.2%) |

Totals |

$12,042 |

$12,152 |

$111 |

0.9% |

Average Daily Attendance |

5,946,802 |

5,915,673 |

-31,130 |

-0.5% |

|

One–Time Funds Used for Emergency Facilities. In addition to ongoing Proposition 98 spending, the budget package includes slightly more than $100 million in one–time K–12 spending. Specifically, it provides $101 million for emergency facility needs at low–performing schools. This meets the annual requirement for Chapter 899, Statutes of 2004 (SB 6, Alpert), which implements the Williams v. California settlement. Chapter 899 requires the state to provide a total of $800 million for this program over a number of years. Since 2005, the state has provided $393 million (including the new 2008–09 funds). To date, $246 million has been allocated to schools.

Budget Uses Other Funds to Avert Reductions to Existing Programs. The budget package also includes the use of federal and special funds to help offset reductions in General Fund spending. The adopted budget restores a proposed $9.2 million unallocated reduction to the State Special Schools (SSS) using $8.9 million in federal special education funds and $300,000 from the state Public Transportation Account (PTA). (The budget uses an additional $3.8 million in PTA monies to help the SSS cover increases in its base transportation costs.) The budget also uses an additional $5.4 million in federal Title II monies to fund University of California (UC) Subject Matter Projects ($5 million), teacher misassignment monitoring ($308,000), and administrator training ($100,000). In all three cases, the federal funds are used to avert reductions proposed by the Governor.

K–12 Vetoes

The Governor vetoed $8.7 million from various fund sources for the following K–12 expenditures.

State Monitoring of Low–Performing Schools ($6 Million). The Governor eliminated $6 million (ongoing Proposition 98 funding) to support state sanctions for low–performing schools that previously participated in the Immediate Intervention for Underperforming Schools Program (II/USP). Schools that participated in II/USP face state monitoring and sanctions for failing to meet performance criteria needed to exit the program successfully. Although II/USP ended in 2004–05, approximately 50 schools have yet to meet performance criteria to exit state monitoring. As a result, they continue to receive funding to implement state–imposed sanctions. The veto is consistent with prior legislative action to eliminate federal funding for the phased–out program.

Other Reductions ($2.7 Million). The Governor also vetoed four other expenditures totaling $2.7 million:

- Advancement Via Individual Determination ($904,000). The Governor reduced funding for this program by $904,000 (non–Proposition 98 funding). In his veto statement, the Governor stated the reduction was made to achieve state savings, not due to any programmatic issues.

- Child Nutrition ($862,000). The Governor reduced state funding for child nutrition programs by $862,000 (non–Proposition 98 funding). This reduction also was made to achieve state savings rather than as a result of programmatic concerns.

- Migrant Education ($600,000). The Governor reduced expenditure authority by $600,000 (federal funding) as a result of rejecting a proposed enhancement to an existing evaluation of the federal Migrant Education Program. As a result of the veto, the federal funding likely will roll forward to next year.

- Reviews of Districts With Emergency Loans ($295,000). The Governor deleted $295,000 (one–time Proposition 98 funds) for conducting reviews of the three school districts that currently receive emergency loans from the state, stating that the districts should be responsible for funding these reviews.

Child Care and Development

In this section, we summarize the 2008–09 budget package for child care and development (CCD) programs and describe the Governor’s CCD vetoes.

Budget Contains More Than $3 Billion for CCD Programs. The final budget package includes just over $3.2 billion for CCD programs in 2008–09. Of that total, $2.6 billion (approximately $2.1 billion in state spending and more than $500 million in federal support) is for CCD programs administered by the California Department of Education. Consistent with previous years, a notable portion of the ongoing CCD program is supported in 2008–09 with one–time funding ($338 million in one–time state funds and $7 million in one–time federal funds).

CCD Funding Increases More Than 5 Percent Year to Year. As shown in Figure 6, total funding has been increased by more than 5 percent. The majority of the year–to–year change is due to CalWORKs caseload adjustments. By comparison, funding for non–CalWORKs programs is flat year to year when comparing the budget act funding levels for 2007–08 and 2008–09. (The reduction in non–CalWORKs funding shown for the 2007–08 revised budget reflects various one–time adjustments.) For non–CalWORKs direct child care programs, the budget provides no COLA and a growth adjustment of only $11 million (0.7 percent). The final package includes no major programmatic changes.

Figure 6

Child Care and Development Budget Summary |

All Funds

(Dollars in Millions) |

Programa |

2007-08 |

|

2008-09

Budget Act |

|

Change From Revised |

Budget Act Revised |

|

Amount |

Percent |

CalWORKsb Child Care |

|

|

|

|

|

|

|

Stage 1 c,d |

$511 |

$536 |

|

$617 |

|

$81 |

15.1% |

Stage 2 d,e |

489 |

548 |

|

532 |

|

-16 |

-2.9 |

Stage 3 |

405 |

405 |

|

432 |

|

27 |

6.7 |

Subtotals |

($1,405) |

($1,489) |

|

($1,581) |

|

($92) |

(6.2%) |

Non-CalWORKs Child Care |

|

|

|

|

|

|

|

General child care |

$805 |

$759 |

|

$805 |

|

$46 |

6.1% |

Other child care programs |

336 |

329 |

|

336 |

|

7 |

2.1% |

Subtotals |

($1,141) |

($1,088) |

|

($1,141) |

|

($53) |

(4.9%) |

State Preschool |

$442 |

$422 |

|

$442 |

|

$20 |

4.7% |

Support Services |

106 |

106 |

|

106 |

|

— |

— |

Growth |

— |

— |

|

11 |

|

— |

— |

Totals—All Programs |

$2,988 |

$2,999 |

|

$3,281 |

|

$165 |

5.5% |

|

a Except where noted otherwise, all programs are administered by the California Department of Education. |

b California Work Opportunity and Responsibility to Kids. |

c Administered by California Department of Social Services. |

d Does not include reserve funding in 2007-08. No reserve was created in 2008-09—base funding was increased instead, as shown here. |

e Includes funding for centers run by California Community Colleges. |

Addressing Child Care Carryover Issues—Exploring Changes to Contract Policies. For each of the past five fiscal years, at least $200 million of the CCD appropriation has gone unspent and has been “carried over” to fund future years of service. The result of such chronic carryover is that less children are served than intended and more children remain on the waiting list for subsidized CCD services. Approximately 22,000 more children could be served each year if all appropriated funds were spent. To address this issue, the 2008–09 budget makes changes intended to facilitate voluntary contract changes between providers—allowing providers to relinquish funding they will not use to other providers who are serving additional children and can use the funds. Although these contractual changes are unlikely to fully address the CCD carryover, they represent a positive step in that direction.

CCD Vetoes

The Governor deleted a $16.4 million legislative augmentation (one–time Proposition 98 funds) for Stage 2 CalWORKs childcare programs, citing lower caseload estimates. The Governor also vetoed a bill that would have enacted changes to the After School Education and Safety (ASES) program. Assembly Bill 1526 (Committee on Budget), which was part of the budget package enacted by the Legislature, would have removed the requirement that a minimum amount of state funding be provided annually for the ASES program. The Governor vetoed the bill. If it had been signed and subsequently approved by voters, ASES funding would have become subject to the annual budget process, beginning in 2009–10.

Higher Education

The budget provides a total of $11.4 billion in General Fund support for higher education in 2008–09 (see Figure 7). This reflects an increase of $149 million, or 1.3 percent, above the amount provided in 2007–08. As shown in the figure, this net increase is almost entirely due to a $164 million augmentation for CCC. The General Fund budgets of the other higher education agencies and segments remain nearly flat on a year–to–year basis.

Figure 7

Higher Education Receives Slight General Fund Decrease |

(Dollars in Millions) |

|

|

|

Change |

|

2007‑08 |

2008‑09 |

Amount |

Percent |

California Community Colleges |

$4,168.3 |

$4,332.2 |

$163.9 |

3.9% |

University of California |

3,259.3 |

3,250.3 |

-8.9 |

-0.3 |

California State College |

2,970.7 |

2,970.7 |

— |

— |

Student Aid Commission |

842.9 |

837.5 |

-5.4 |

-0.6 |

Hastings College of the Law |

10.6 |

10.6 |

— |

— |

California Postsecondary Education Commission |

2.2 |

2.0 |

-0.2 |

-9.2 |

Totals |

$11,254.0 |

$11,403.4 |

$149.4 |

1.3% |

UC and CSU

General Fund Support. As shown in Figure 7, the enacted budget provides the UC with $3.3 billion in General Fund support, and the California State University (CSU) with $3 billion in General Fund support.

The budget includes language (proposed by the Governor) which characterizes UC and CSU’s budgets as including unallocated reductions of $201 million and $172 million, respectively. These amounts represent the difference between what the budget provides and what the segments had expected to receive under the “compact” they signed with the Governor in 2004. The budget also reflects allocated reductions (from the level expected under the compact) to executive administrative costs of $32.3 million at UC and $43.2 million at CSU.