March 18, 2010

Since July 2009, the Beverage Container Recycling Program has faced severe cuts, necessitated by a projected $157 million fund deficit for 2009–10 in its primary funding source—the Beverage Container Recycling Fund (BCRF). In February 2010, the Legislature enacted a number of measures in the special session to begin addressing the funding challenges in this program.

We find that the changes adopted in the special session—while going a long way to address the BCRF’s projected deficit—may not make the BCRF fully solvent in the budget year. This means that the Legislature may need to act to either further reduce expenditures and/or increase revenues into the fund.

In this report, we review the Governor’s budget and policy proposals to address the deficit, recap the enacted special session changes to the program in both the current year and the budget year, and offer our recommendations for additional budget–year actions. In summary, we recommend that the Legislature:

- Adopt certain of the Governor’s policy proposals affecting program expenditures.

- Act in general to protect the level of payments to recyclers (the core of the program).

- Wait until the May Revision update of the BCRF fund condition before making additional budget–related changes to the program.

- Consider long–term changes to the program in the legislative policy process.

We also discuss issues for the Legislature to consider as it evaluates long–term policy changes to the program.

Administration of the Beverage Container Recycling Program. The Division of Recycling (DOR) of the Department of Resource Recovery and Recycling (DRRR) administers the Beverage Container Recycling Program, commonly referred to as the bottle bill program. (The DOR was formerly part of the Department of Conservation [DOC]). This program was created more than 20–years ago by Chapter 1290, Statutes of 1986 (AB 2020, Margolin). The program encourages the voluntary recycling of most beverage containers by guaranteeing a minimum payment (termed a California Redemption Value [CRV]) for each container returned to certified recyclers. Beverage containers are subject to the CRV based on both the content of the container (the beverage type, such as water or sports drinks) and the container material (such as glass or plastic). Figure 1 below shows the types of beverages and containers currently in the program.

Figure 1

Beverage Container Recycling Program Coverage

|

Container Type |

Beverage Type |

Container Size |

Covered in Program |

Glass |

Soda |

24 oz or less—5 cent CRV |

|

Plastic (all resin types) |

Water |

24 oz to 64 oz—10 cent CRV |

|

Aluminum |

Sports drinks |

|

|

Bi–metal |

Fruit juice |

|

|

|

Beer |

|

| |

|

|

|

Not Covered in Program |

Aseptic |

Wine |

64 oz or more |

|

Foil pouches |

Distilled spirits |

|

|

Styrofoam |

Milk |

|

|

|

Vegetable juices |

|

|

|

Soy drinks |

|

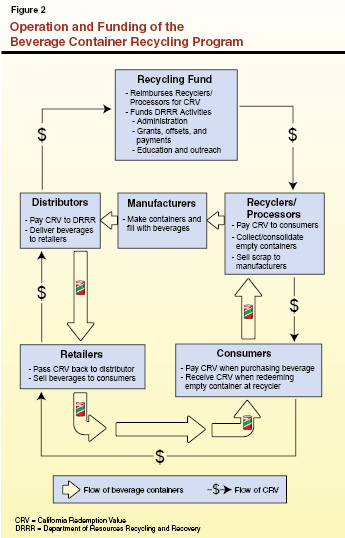

Flow of Funding. Funding for the program flows through the BCRF, which DOR administers. As shown in Figure 2, the program involves the flow of beverage containers and payments between several sets of parties, and generally operates as follows:

- Distributors and Retailers. For each beverage container subject to the CRV that they sell to retailers, distributors make redemption payments that are deposited into the BCRF. The cost to distributors of the redemption payments is typically passed on to retailers.

- Retailers and Consumers. Beverage retailers sell beverages directly to consumers, collecting the CRV from consumers for each applicable beverage container sold.

- Consumers and Recyclers. Consumers redeem empty recyclable beverage containers with recyclers, from whom they recoup the cost of the CRV they paid at the time of purchase. In this way, from the consumer’s perspective, the CRV can be viewed as a “deposit.”

- Recyclers/Processors and Manufacturers. Recyclers sell the recyclable materials to processors in exchange for the scrap value of the material and for the CRV. Processors, who are reimbursed from the BCRF for these CRV pass–throughs, then collect, sort, clean, and consolidate the recyclable materials and sell them to container manufacturers or other end users who make new bottles, cans, and other products from these materials. Manufacturers also make an additional payment to recyclers (not shown on Figure 2) to partially support the cost of recycling glass and plastic.

Unredeemed Deposits Used to Support the Program. As the redemption rate is not 100 percent, there are funds available in the BCRF from the unclaimed CRV. These unredeemed deposits stay in BCRF and have been used to support a number of recycling–related programs, including:

- Subsidizing Glass and Plastic Recycling. From the standpoint of a recycler, it would cost more to handle glass and plastic containers for recycling than the materials are worth when sold for scrap to a processer. In order to promote the recycling of these materials, the program subsidizes the majority of the cost of recycling these materials with unredeemed funds from the BCRF (beverage manufacturers contribute a small proportion of the costs). These subsidies paid to the recyclers are called “processing payments.”

- Subsidizing Supermarket Collection Sites. To encourage convenient recycling locations, supermarket collection centers (called Convenience Zone Recyclers) are paid an additional “handling fee” or subsidy per container recycled. This payment covers the additional cost of operating recycling collection sites at supermarket locations.

- Supporting Other Recycling–Related Grant Programs. Unredeemed CRV funds are also used to support other recycling programs, such as grants for the development of markets for recycled materials, grants to local curbside operators, and grants to local conservation corps for recycling–related activities.

Several factors, working in combination, have resulted in what at one point was estimated by the administration as a $157 million deficit in the BCRF.

Loans From the BCRF. Several years ago, the BCRF had accrued significant fund balances in excess of the annual costs of the recycling program. This occurred during a period in which the program was running well below its target recycling rate of 80 percent. Consumers, in effect, were paying much more in CRV deposits into the BCRF than they were subsequently redeeming through the recycling of beverage containers. These once–large balances in the BCRF were used to help the state address its ongoing fiscal problems as well as to assist in the implementation of state programs to reduce greenhouse gas emissions.

Since 2002–03, a total of $519 million has been loaned from BCRF—$452 million to the General Fund and $67 million to the Air Pollution Control Fund (a fund administered by the California Air Resources Board). Figure 3 shows all of the loans made from the fund. The Legislature subsequently extended the repayment dates of some of these loans.

Figure 3

Loans From the Beverage Container Recycling Fund

(Dollars in Millions)

Special Fund Making Loan |

Date of Loan |

Loan Amount |

Original Repayment Date |

Amended Repayment Date |

Terms of Loan |

Loans to General Fund |

|

|

|

|

BCRF |

2002–03 |

$188 |

6/30/2009 |

6/30/2013 |

Original authorized loan amount was for $218 million, but the BCRF could only accommodate a loan of $188 million. |

BCRF |

2003–04 |

98 |

6/30/2009 |

6/30/2013 |

|

BCRF |

2009–10 |

99 |

6/30/2013 |

— |

|

PET Processing Fee Accounta |

2003–04 |

27 |

6/30/2009 |

6/30/2012 |

Original authorized loan amount was for $45 million, but the account could only accommodate a loan of $27 million. |

Glass Processing Fee Accountb |

2003–04 |

39 |

6/30/2009 |

6/30/2012 |

|

Subtotal |

|

($452) |

|

|

|

Loans to Air Pollution Control Fund |

|

|

|

BCRF |

2008–09 |

$32 |

6/30/2013 |

|

One–third of the loan is to be repaid on or before June 30, 2011. |

BCRF |

2009–10 |

35 |

6/30/2014 |

|

One–third of the loan is to be repaid on or before June 30, 2012. |

Subtotal |

|

($67) |

|

|

|

Total Loans |

|

$519 |

|

|

|

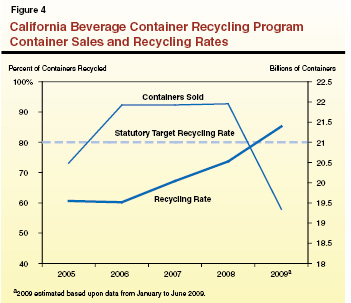

Declining Sales and Increasing Recycling Rates. As shown in Figure 4, recycling rates have increased in recent years and are now at more than 80 percent (the target recycling rate defined in statute). This increase in the redemption of CRV payments translates into increased expenditures from the BCRF. During 2009, container sales also sharply declined, thus simultaneously reducing revenues into the fund.

Legislature Rejected Governor’s May 2009 Proposal. The Governor presented a proposal at the time of the 2009 May Revision to restructure the program and begin to address the fiscal problems described above. Under the proposal, (1) beverage manufacturers would have been required to pay around $100 million in additional payments into the BCRF to support recyclers, (2) handling fees paid to Convenience Zone Recyclers would have been capped at $40 million to reduce BCRF expenditures, and (3) an existing statute that provides ongoing appropriations (outside of the annual budget act) for various recycling programs would have been repealed and replaced with an annually appropriated grant program allowing for more control over expenditures from the fund. The Legislature rejected this proposal, preferring a different legislative solution outlined below.

Bill Passed to Address Deficit, but It Was Vetoed. The Legislature passed legislation (SB 402, Wolk) in September 2009 to make the BCRF solvent in 2009–10 through a number of changes. These included:

- Broadening the recycling program to include aseptic containers (plastic coated paper containers used for drinks such as orange juice) as well as other types of beverages not currently in the program (such as vegetable and soy drinks).

- Changing the deadlines for beverage distributors to remit CRV payments, which would accelerate the collection of revenues into the fund by one month.

- Making more containers subject to a 10–cent redemption value rather than a 5–cent redemption value.

The Governor vetoed SB 402 in October 2009 over a series of specific concerns about expansion of the types of containers made subject to the CRV. He also objected to the measure on the grounds that it did not bar future loans from the BCRF to the General Fund, nor require the repayment of past loans from the General Fund.

Addressing the Deficit in Absence of Program Reform. The veto of SB 402 meant that the department was obligated by statute to maintain the fund’s solvency. Specifically, under current law, if there are not sufficient funds available in the fund to make all of the required payments, the department is required to reduce all payments in equal proportions—what is commonly referred to as “proportionate reductions”—in order to keep the fund in balance. The only payment from the fund that is not subject to the proportionate reductions is the return of CRV to consumers. That is, consumers will always have their deposits returned in full even if expenditures from the fund for other recycling programs must be reduced.

As a result of the veto, the department implemented the proportionate reductions in 2009–10 that had the following major impacts:

- Overall payments to recyclers were reduced by about 15 percent.

- No per–container handling payments were paid to Convenience Zone Recyclers.

- Beverage manufacturers’ contribution to the processing payments was increased by around $50 million.

- Funding for most grant and market development programs was reduced to zero.

The Governor’s 2010–11 budget contains proposals to restore funding for the program and to implement long–term reforms to restore solvency to the BCRF. The Governor requested that these items be considered by the Legislature as part of the recently concluded special session that was called in January. We will discuss the proposals as they affect the program in three time periods: (1) the current year, (2) the budget year through 2013–14, and (3) 2014–15 and beyond.

Current–Year Proposal Would Have Restored Six Months of Program Funding. The Governor’s proposal contained two current–year changes intended to generate an additional $155 million that would have fully funded programs for January 2010 through June 2010. The additional revenues to the BCRF would have come from:

- General Fund Loan Repayment. The administration’s budget proposes a $55 million payment from the General Fund in the current year as partial repayment of the 2002–03 Budget Act loan. The administration has existing authority granted in the original budget act authorizing the loan to repay the loan.

- Acceleration of CRV Payments. Under current law, distributors have up to 90 days following the sale of a container to a California retailer to remit the CRV for the container to the department. The Governor proposed to reduce the time the distributor has to remit the payment to 60 days. The department estimates that this acceleration would generate an additional $100 million in revenue for 2009–10.

The Legislature accepted part of the proposal pertaining to the special session and modified other provisions. We discuss the legislative response later in this analysis.

Budget–Year Changes Would Make Structural Adjustments to the Program. The Governor’s proposal for the budget year would make further changes to repay loans in order to replenish the BCRF and to reduce expenditures for recycling programs funded from that source. Specifically, the proposals are:

- Loan Repayments. Under the proposal, $98 million in outstanding loans to the General Fund and $21 million to the Air Pollution Control Fund would be repaid to BCRF. The proposal would to make the General Fund repayments in way that would reduce the payments that beverage manufacturers must make to recyclers. We discuss this proposal in more detail in the box below.

- Elimination of Most Automatic Appropriations. The proposal would generally eliminate authority in statute for the automatic appropriation of about $110 million for programs outside of the budget act. Instead, DRRR would be responsible for administering a grant program appropriated through the budget act at a level determined each year by the Legislature. The budget requests $29 million in the budget year for the first year of this new grant program. However, the Governor also proposes to prioritize payments to recyclers from the BCRF (both processing payments and handling fees) by allowing automatic appropriations for these purposes each year to continue.

- Reduction in the Number of Convenience Zones. The administration’s plan would change the current requirement that there be a recycling center within one–half mile of each supermarket with annual sales of $2 million to require a center within this distance of each supermarket with annual sales of $6 million. The department estimates that this would reduce the number of convenience zone recyclers from around 1,300 to approximately 700. The proposal would also eliminate an existing requirement that such recycling centers be located on the supermarket site.

- Reduction in the Department’s Administration Budget. The administration proposes a reduction of $300,000 to the department’s budget for the administration of the beverage container recycling program.

|

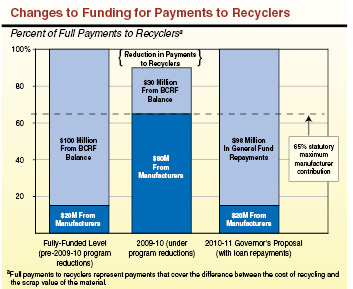

The Governor proposes that the planned loan repayments from the General Fund be used to reduce beverage manufacturers’ contributions towards funding payments to recyclers, beginning in the budget year. These proposals have some significant fiscal and policy implications for the beverage container recycling program.

Why Manufacturers Were to Subsidize Glass and Plastic Recycling. As we noted earlier, from the standpoint of a recycler, it would cost more to handle glass and plastic containers for recycling than the materials are worth when sold for scrap to a processer. For this reason, a core component of the original beverage container recycling program is payments made by manufacturers to subsidize recyclers for the costs of recycling these materials. In theory, these payments to recyclers (1) encourage beverage manufacturers to switch to types of materials that have a lower cost of recycling and (2) increase the market for recycled products (thereby increasing the scrap value of the material).

In Practice, Manufacturers Pay Small Amount of Processing Payments. Manufacturers’ contributions are now statutorily capped at 65 percent of the cost of the processing payments (originally manufacturers paid all of the processing payments). Over time, the percentage of the funding for processing payments contributed by manufacturers has been reduced to the point where it now ranges from roughly 15 percent to 19 percent. The remainder of the payments has been supported with unredeemed California Redemption Value (CRV) funds. This contribution is referred to as the “processing fee offset.”

Current–Year Impact of Fund Deficit Is That Recyclers Are Losing Money. In the current fiscal year, beverage manufacturers are paying at their statutory cap of 65 percent of payments to recyclers. However, many recyclers are not receiving enough in subsidies from the unredeemed CRV funds, the processing fee offset, to make a profit on the recycling of glass and plastic. That is because the processing fee offsets were subject to the proportionate reductions that resulted from the deficits recently experienced in the program.

|

|

For the budget year, the Governor proposes that the $98 million of loan repayments from the General Fund be used to reduce manufacturers’ funding contribution back to the 15 percent to 19 percent range while also restoring full payment of the glass and plastic subsidies to recyclers. The Governor also proposes to change state law to specify that all General Fund loan repayments for the next four years would be used to support such beverage manufacturer subsidies. The figure shows how payments to recyclers would be funded under three scenarios: (1) with full funding available for the entire beverage container recycling programs (as was the case prior to 2009–10), (2) under the current program reductions that resulted from the deficit in the BRCF, and (3) under the Governor’s proposal.

|

These proposals—with the exception of the loan repayments—would require the adoption of statutory changes to the program.

Changes Beyond the Budget Year. The administration proposes to repay all of the loans made from the BCRF in installments from 2011–12 through 2013–14. After that, the administration proposes to fund payments to recyclers with a new non–refundable, per–container fee that would be paid by consumers. This per–container fee would be separately identified for the consumer at the point of sale. The fee paid by the consumer would vary according to the type of container, and would reflect the cost of recycling that particular material. This would differ from the current structure of CRV payments, which are generally the same (5 cents or 10 cents) regardless of the type of container. In addition, beverage manufacturers would no longer be liable for payments to recyclers.

Except for repayment of some of the loans, these proposals would also require the adoption of statutory changes.

Actions Affect Both Current and Budget Years. The Legislature passed—and the Governor signed—Chapter 5, Statutes of 2010 (ABX8 7, Evans) during the special session to address current and budget–year shortfalls in the BCRF. Chapter 5 did not include most of the long–term structural changes to the program proposed by the administration. These discussions were deferred to the legislative policy process. Specifically, Chapter 5 contains provisions that:

- Accelerate the Collection of CRV Revenues. The Legislature accepted the Governor’s proposal to accelerate one month of CRV revenue into the fund. One legislative change specifies that this provision will expire July 2012 unless extended by the Legislature.

- Suspend Some Program Expenditures. The Legislature suspended expenditures that would otherwise be required for market development grants, grants to non–profits, and funding for public education for the current and budget years. The total savings to the BCRF from these suspensions is $19 million in the current year and $38 million in the budget year.

- Cap Fund Expenditures to Subsidize Recycling. The Legislature capped the amount that the fund would otherwise contribute to the subsidies paid to recyclers for glass and plastic. The cap was set at the 2008 calendar year amount of $83 million. In effect, this means that the recyclers will receive payments equal to the cost of recycling, with beverage manufacturers contributing any additional funds required above the contribution from BCRF. The estimated savings to the BCRF in the current year from this change is $9 million.

- Refocus Programs for Glass and Plastic. Chapter 5 focuses so–called quality incentive payments—those made to recyclers for high–quality materials such as those that are clean and appropriately sorted—on glass materials, thus excluding plastic. This change reduces quality incentive payments from BCRF by $5 million annually. On the other hand, grants to foster the development of the market were focused on plastic materials (thus excluding glass) and were increased by $5 million per year.

- Restrict Future Borrowing From the Fund. Chapter 5 states the Legislature’s intent that BCRF monies should not be used, loaned, or transferred for any purpose in the future other than for the support of the beverage container recycling program.

Fiscal Impact of Special Session Changes. The changes enacted under Chapter 5 reduced the need for the repayment of General Fund loans from $55 million, as proposed by the Governor, to $27 million. The program reductions combined with the $27 million of loan repayments will be sufficient to make six months of modified program payments and leave the fund with a reserve of around $40 million (as required under statute).

Figure 5 shows the projected impact of the special session changes on the fund balance in the current fiscal year. The changes are expected to result in the fund having a reserve of around $40 million at the end of the current fiscal year.

Figure 5

Beverage Container Recycling Fund—

Summary of Impacts of Special Session Solutions

2009–10 (In Millions)

|

2009–10 |

Resources Available for Programs |

|

Opening balance |

$167 |

Revenuesa |

1,170 |

California Redemption Value payments to consumers |

–1,010 |

Loans made from fund |

–134 |

General Fund repaymentb |

27 |

Totals |

$220 |

Program Expenditures |

|

Processing fee offsets |

$55 |

Handling fees |

27 |

Department administration |

51 |

Curbside program |

8 |

Local conservation corps |

11 |

Payments to cities and counties |

6 |

Non–profit competitive grants |

— |

Quality incentive payments |

8 |

Market development grants |

— |

Recycler incentive program |

6 |

Plastics market development |

3 |

Public education and information |

3 |

Community beverage container grants |

— |

Totals |

$177 |

Ending Fund Balance |

$43c |

Await May Revision Update Before Making Key Fiscal Decisions. As we noted, the special session changes should be sufficient to provide a positive balance in the fund at the end of the current fiscal year. However, that does not now appear to be the case with respect to the end of the budget year. For example, under the department’s January budget projections of beverage sales and redemption expenditures, and assuming $98 million in loan repayments, an additional $40 million of revenue and/or expenditure solutions would be necessary to have the statutorily required fund balance at that time.

However, the department has acknowledged significant shortcomings in its forecast methodology for both sales and redemption rates. Thus, these fiscal projections are subject to significant uncertainty. For example, Figure 6 illustrates the impact of three different assumptions of redemption rates on the fund balance. The January budget assumed a 90 percent recycling rate, but the figure shows the impact of an 85 percent (the rate for the first six months of 2009) and 80 percent recycling rate. As it indicates, the BCRF would end 2010–11 with a much healthier balance if the actual consumer recycling rate turned out to be lower than assumed in the Governor’s January budget proposal. These alternative scenarios could mean that the Legislature might not need to take additional actions or might have more leeway to adopt alternative approaches to ensuring the solvency of the BCRF.

Figure 6

Beverage Container Recycling Fund—Fiscal Impacts of Special

Session Solutions Under Different Recycling Rates

2010–11 (In Millions)

|

2010–11 |

Recycling Rate |

90 Percent |

85 Percent |

80 Percent |

Resources Available |

|

|

|

Opening fund balance |

$43 |

$43 |

$43 |

Loans made from fund |

— |

— |

— |

Revenues |

1,069 |

1,069 |

1,069 |

California Redemption Value payments to consumers |

–970 |

–910 |

–860 |

General Fund repaymenta |

98 |

98 |

98 |

Repayments from other fundsb |

21 |

21 |

21 |

Totals |

$261 |

$321 |

$371 |

Program Expenditures |

|

|

|

Processing fee offsets |

$83 |

$83 |

$83 |

Handling fees |

48 |

48 |

48 |

Department administration |

51 |

51 |

51 |

Other program expenses |

75 |

75 |

75 |

Totals |

$257 |

$257 |

$257 |

Fund Balance |

$4 |

$64 |

$114 |

We note that the revenue and expenditure estimates used in the Governor’s budget are based on the information available to the administration as of September 2009. We also note that the program is currently the subject of an audit by the Bureau of State Audits that is expected to be completed before the end of the current fiscal year. The audit results could inform the Legislature’s decisions in this area.

Given the uncertainty about the BCRF fund condition for the budget year, and the forthcoming audit, we recommend that the Legislature await the receipt the most up–to–date fund projections from the department at May Revision before making the key fiscal decisions that may be needed to ensure the solvency of the fund in the budget year.

Minimize Impact on General Fund. When the Legislature takes budgetary action with regard to BCRF, as we propose occur after the May Revision, we recommend that it take into account the state’s significant General Fund deficit. In particular, we recommend that it adopt additional expenditure reductions or find other ways to increase revenues to the BCRF in order to minimize the need for the Governor’s proposal for $98 million in loan repayments from the General Fund to the BCRF in the budget year. We discuss some options for increasing revenue into the fund in the box below.

|

There are two primary ways to increase revenues into the Beverage Container Recycling Fund—expand the types of containers covered by the program or cover beverages currently excluded. Not all disposable beverages are currently covered by the program. As increasing revenue (customer deposits) into the fund would also lead to additional expenditures (redemption payments), the extent to which the program experiences a net increase, if at all, in funding will depend upon the recycling rate of the particular type of container.

Consider the Impacts of Program Expansion. In considering expansion of the program, we recommend that the Legislature also weigh the rationale for, and the program impacts of, including another type of container or beverage in the program. There are specific considerations for different beverages and containers not currently covered under the program:

- Wine and Distilled Spirits. The department understands that recyclers may already be redeeming glass and plastic containers containing these beverages (and hence paying customers’ deposits). Also, expanding the program to cover these beverage types is not likely to require any additional recycling infrastructure. We note that there already is an established market for glass and plastic recycled materials. Given these factors, we think that the Legislature should consider expanding the program to cover wine and distilled spirits. If enacted, there would need to be lead time for wine and spirit manufacturers, who may be located outside of the state, to adjust labeling of their products before California Redemption Value payments could be collected.

- Vegetable, Soy, and Milk Drinks. While these beverages are in containers covered by the program, these beverage types nonetheless are now exempt from it. Again, recyclers may already be paying for the return of these containers. However, the administration has expressed concern with including these types of beverages in the program, as it would add costs to products that may be a part of a family’s core nutrition.

- New Container Types. Types of disposable beverage containers not currently covered in the program include aseptic containers and foil pouches. Technology to recycle these products is currently limited and it is unclear whether there is a market for the recycled materials.

|

Consider Some Components of the Governor’s Proposal Now. Even with the uncertainty surrounding the fund projections, we think that there are several components of the Governor’s proposal that warrant consideration now:

- Changes to Convenience Zone Requirements. We recommend the Legislature accept the proposal to change Convenience Zone recycling center requirements. This will save the fund approximately $8million per year in per–container handling fees. However, we recommend that the department be directed to develop regulations to ensure that rural communities are not left without a recycling center as a result of these changes.

- Prioritization of Payments to Recyclers. We recommend that the Legislature adopt the Governor’s proposed statutory change to prioritize payments to recyclers (processing payments and handling fees). In addition to continuing to provide ongoing appropriation authority for these payments as proposed by the Governor, we recommend the Legislature also adopt language that specifies that they would not be subject to the proportionate reductions that apply whenever the fund faces a deficit. This change will provide needed fiscal certainty for recyclers, who find it difficult to plan their business operations under the current structure of the program.

- Reductions to Department’s Administration Budget. We recommend that the Legislature reduce the department’s administration budget by $300,000 as requested by the Governor’s budget.

- Recommend Against Earmarks for Manufacturers. If General Fund repayments of loans from BCRF are made in the budget year and beyond, we recommend against dedicating them solely to reduce the payments beverage manufacturers would otherwise be obligated to make to recyclers. In enacting the statute calling for proportionate reductions, the Legislature intended that all program participants be treated equally in a situation where adequate funds were not available. Offering preferential treatment for the beverage manufacturers runs counter, in our view, to this original legislative intent.

Twelve local conservation corps established in various locations across the state provide job training and academic instruction for at–risk youth. Each local corps operates a beverage container recycling program that receives the same payments from the BCRF that are provided to other recycling operations. In addition, the corps are allocated a share of a supplemental funding allocation earmarked for litter cleanup and recycling activities. Funding for local conservation corps has been included in the beverage container recycling program since its inception in 1986. These supplemental monies, which amounted to $19 million in 2008–09, are all appropriated by statute on an ongoing basis and thus are not subject to approval in the annual budget act. Most of the local corps are supported by a mix of state, local, federal, and private non–profit funding sources which varies from one organization to another and from year to year.

Recent reductions that have occurred in the funding available to the corps due to the deficit in the BCRF raise some significant budget issues:

Ongoing Appropriation From the Fund at Risk. As noted above, the supplemental allocation to the corps, before any reduction due to the fund deficit, would have been $19 million. Under the proportionate funding cuts relating to the deficit in the fund, however, the local conservation corps would have received less than $1 million in base program funding. In addition, the recycling programs operated by the corps have received the same 15 percent reduction in processing payments.

Given the severe impact of the BCRF deficit on funding for the local corps, the Legislature looked to alternative funding sources for the corps in the 2009–10 Budget Act. Specifically, the Legislature included $16.5 million of additional funding for the local corps through (1) an $8.25 million loan from the Alternative and Renewable Fuel and Vehicle Technology Fund, and (2) an $8.25 million loan from the General Fund. The Governor vetoed the loan from the General Fund, leaving a total of $8.25 million in additional funding for the local corps. The result of the actions taken in the special session is that the local corps will receive an additional $8.5 million in the current year from the BCRF, bringing their total funding to $17 million (close to full funding).

Alternative Funding Sources Should Be Considered. As long as local corps operate recycling programs, they are eligible to receive processing payments to support those operations, as is the case for any recycler. We are not proposing to change the local corps’ eligibility to receive these regular recycling payments. These payments would continue to be appropriated on an ongoing basis. We recommend payments to all recyclers, including those to the corps, be made a funding priority in line with the Governor’s proposal.

However, as has been the case in the current year, the BRCF has become an unstable source of funds for the supplemental payment in support of the local corps. We recognize that the local corps would benefit from having a long–term, stable source of funding through which they could leverage additional state and federal funds. Given that the educational and vocational training mission of the local conservation corps goes well beyond the operation of recycling programs, we recommend that the Legislature consider alternative funding sources to support the work of the local corps in addition to any funding received from BCRF. Other funding sources could include funding available for other education, vocational training, and green jobs training and development. Specifically, one alternative source of funding could be federal Workforce Investment Act funding available for the Legislature to appropriate on an annual basis. Another possibility is receiving funding for California Partnership Academies administered by the state Department of Education. However, these fund sources may be variable in nature and may be subject to a competitive grant process.

Annually Appropriate Supplemental Support for the Local Corps. To the extent that the Legislature wants to provide supplemental funding for the local corps, we recommend that such funding be appropriated in the annual budget act (rather than through the current continuous appropriation). In creating an annual appropriation for the local corps, the Legislature will have the opportunity to direct funding, as available from the BCRF and from other budgetary funding sources, in support of the local corps’ mission.

Based upon our analysis of the long–term changes to the program proposed by the Governor, we find that the proposal to establish a non–refundable consumer fee for beverage containers has merit in concept. Imposition of such a fee means that consumers would (1) pay more to purchase beverage containers that are expensive to recycle, or (2) shift their purchases to containers that are less expensive to recycle. Such incentives are lacking under the current program structure. However, such fundamental structural changes to the program, in our view, are more appropriately considered in the legislative policy process rather than in the state budget process. This approach would allow the Legislature to take a broader perspective on how the program should be changed for the long term.

Consider How All of the State’s Recycling Efforts Fit Together. As part of the implementation of Chapter 21, Statutes of 2009 (SB 63, Strickland), all of the state’s recycling functions are now located in a single department (DRRR) within the Natural Resources Agency. As part of the ongoing work to merge the functions previously housed in the California Integrated Waste Management Board and DOC, the administration is reviewing where program efficiencies might be gained. One such possibility is the creation of a single market development program for all recycled materials as opposed to the current approach under which the state operates multiple programs for different types of materials and products. In assessing the future of the beverage container recycling program, the Legislature should consider how all of these types of programs fit together and whether, as a single combined program, the state’s waste diversion, recycling, and litter reduction goals can be met more efficiently and effectively.

Consider All Models for Running a Redemption Program. Eleven other states and many other countries have bottle bill programs. Other jurisdictions operate programs involving greater use of in–store redemption, administration of the program by beverage manufacturers instead of the government, and higher reuse requirements for specified recyclable materials. A further policy review may show that some of these models may not be applicable to California, but we recommend that a thorough review of all possible models be conducted before the Legislature selects a long–term approach for the program.

Consider Different Performance Measures for the Program. Currently, the target for the program is an 80 percent recycling rate. The Legislature may wish to consider whether a target recycling rate is the most appropriate performance measure for the program going forward, particularly in light of the consistently high recycling rates in recent years. Other performance–type measures could include a target reuse rate—that is the rate at which materials are reused and for what purpose. The Legislature may also want to consider the program in conjunction with the state’s other environmental policy goals, such as those related to greenhouse gas reduction, and consider what program design best meets the combination of these goals.

Return to LAO 2010-11 Budget: Resources Table of Contents

Return to LAO 2010-11 Budget: Full Table of Contents