Summary

Over the last four years, the judicial branch has experienced various one–time and ongoing budget reductions as the state has faced large budget shortfalls. The Governor's 2012–13 budget reflects the cumulative ongoing reductions totaling $653 million facing the judicial branch, including the continuation of the $350 million reduction enacted in 2011–12. Judicial branch entities previously addressed these reductions by implementing various operational changes, such as furlough days and closing courtrooms. In addition, the branch offset a large portion of these cuts through the routine use of one–time transfers from branch special funds in order to minimize the impacts upon trial court operations. In the current year, these one–time transfers offset $302 million of the cumulative reduction.

The Governor's 2012–13 budget continues the ongoing reduction to the branch, provides the Judicial Council with full authority to implement the reduction among branch entities, and proposes increasing civil fees to generate $50 million in new revenues to help the branch address their reduction. To the extent the Legislature approves the Governor's proposal, ongoing solutions should be identified and implemented in 2012–13, particularly since recent transfers and loans from branch special funds have greatly reduced the fund balances available as a potential budget solution. Specifically, we recommend the Legislature reject the Governor's proposed budget bill language authorizing the Judicial Council to allocate the reductions, adopt specific actions to achieve ongoing savings in the judicial branch, and require that the judicial branch submit a report on potential operational efficiencies.

Overview of the Judicial Branch Budget

The judicial branch budget can be split into two major categories: (1) local trial courts and (2) statewide courts (Courts of Appeal and Supreme Court) and the agencies of the branch (such as the Judicial Council, Judicial Branch Facility Program, and the Habeas Corpus Resource Center). Each of these entities is briefly described below.

- Trial Courts. Trial courts (also known as superior courts) have jurisdiction of all criminal and civil cases in the state. The 58 trial courts (one per county) are located in more than 400 facilities throughout the state and handle the bulk of the judicial branch workload. In 2010–11, more than ten million cases were filed in California trial courts. The trial courts receive the large majority of the funding provided to the judicial branch each year.

- Courts of Appeal. The Courts of Appeal review transcripts of cases first heard by trial courts to determine whether trial court judges applied the law appropriately during proceedings. The Courts of Appeal have original jurisdiction in select case types (such as habeas corpus or certiorari proceedings). The Courts of Appeals are organized in six appellate districts and received more than 24,000 cases in 2010–11.

- Supreme Court. The Supreme Court, the highest court in the California judicial system, typically reviews decisions of the Courts of Appeal. Like the Courts of Appeal, the Supreme Court also has original jurisdiction in certain types of cases, most notably in state–mandated automatic appeals of death penalty verdicts. The Supreme Court received more than 9,000 cases in 2010–11.

- Judicial Council. The Judicial Council is the governing body of the state court system and is responsible for setting statewide policies related to court administration, practices, and funding priorities and allocations. The council is chaired by the Chief Justice of the Supreme Court and consists of 21 voting members as well as advisory members. The Administrative Office of the Courts (AOC) is the agency that staffs the Judicial Council and is responsible for coordinating the budget process for the judicial branch and providing a range of administrative services to other judicial branch entities. These services include judicial and staff education, facility support, financial services, human resources, information technology support, legal services, legislative support, research and planning, security assistance, and court interpreter services.

- Judicial Branch Facility Program. The Judicial Branch Facility Program, staffed by the AOC's Office of Court Construction and Management, has responsibility for all branch infrastructure projects, including for trial courts and state–level entities. Specific duties include the acquisition and management of court real estate, facility maintenance and modification, and construction.

- Habeas Corpus Resource Center. The Habeas Corpus Resource Center provides defendants in state and federal death penalty habeas corpus proceedings with legal representation and offers training and resources to the private attorneys who take these cases.

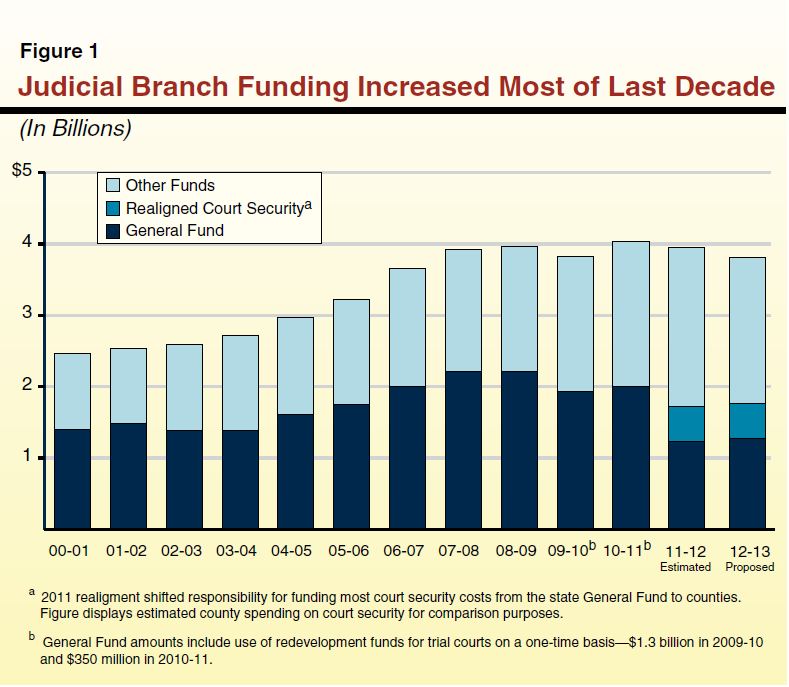

Judicial Branch Funding. As shown in Figure 1, funding for the judicial branch increased steadily throughout most of the past decade—reaching a peak in 2010–11 of roughly $4 billion. Total funding of the judicial branch (excluding funding for court security, which was realigned to counties in 2011–12) is estimated to be around $3.5 billion in 2011–12 and is proposed to be around $3.3 billion in 2012–13. When court security funding is included, total spending on courts is proposed to be $3.8 billion in the budget year, roughly the same amount the branch has received over the past several years.

As indicated in the figure, General Fund support of the judicial branch has been reduced significantly since 2008–09, when the state provided $2.2 billion from the General Fund to the courts. For 2012–13, the Governor's budget proposes $1.3 billion in General Fund support for the judicial branch. Consequently, the General Fund share of the entire judicial branch budget would decline from roughly 56 percent in 2008–09 to 38 percent in 2012–13. As we discuss in more detail below, much of these General Fund reductions have been offset from other funding sources, such as transfers from branch special funds and additional revenue from court–related fee increases.

In addition to the state General Fund, other funding sources for the trial courts include civil filing fees, criminal penalties and fines, county maintenance of effort payments to support trial court operations, and federal grants. These monies are deposited in various special funds maintained by the branch to support general trial court operations and specialized responsibilities, including court construction and maintenance.

The Legislature appropriates resources from the General Fund and special funds for each judicial branch entity during the annual state budget process. The Judicial Council retains the statutory authority to determine how to allocate the total appropriation for the trial courts among the 58 trial courts. In addition to the funding sources described above, individual trial courts annually collect about $200 million in revenue directly, such as from local fees and investment income.

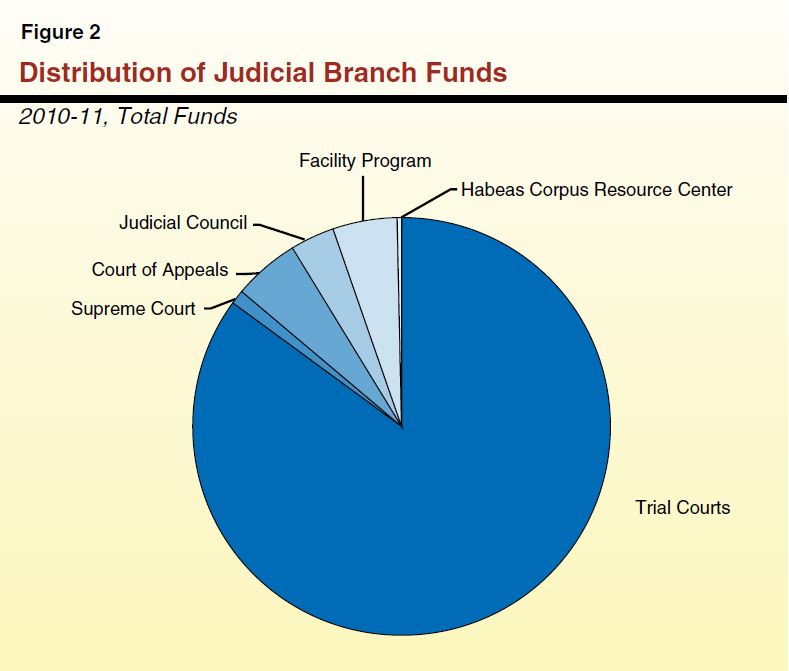

Distribution of Funds Amongst Judicial Branch Entities. As shown in Figure 2, about 85 percent of total judicial branch funding went to trial courts in 2010–11, with the remainder allocated to various other judicial branch entities (such as the Courts of Appeal). Over the past ten years, the distribution of funds across the judicial branch entities has remained relatively consistent. However, there has been an increase in the proportion of funding provided to the Judicial Branch Facility Program, from roughly 0.5 percent in 2005–06 to about 5 percent in 2010–11. This change reflects (1) the transfer of court facilities from the counties to the state under trial court realignment legislation in 2002 and (2) the undertaking of numerous court construction projects in recent years. (Prior to the transfer of court facilities to the state, counties paid for the maintenance and construction of court facilities.) Over the same time period, the trial court share of the total judicial branch budget decreased from roughly 90 percent in 2005–06 to 85 percent in 2010–11.

Trial Court Reserves. Chapter 850, Statutes of 1997 (AB 233, Escutia and Pringle), known as the Lockyer–Isenberg Trial Court Funding Act of 1997, allowed the Judicial Council to authorize individual trial courts to keep and carry over any unspent funds from one fiscal year to the next. Currently, all trial courts in the state are permitted to maintain such reserves. These reserves consist of funding designated by the courts as either restricted or unrestricted. Restricted reserves include (1) funds set aside to fulfill contractual obligations or statutory requirements, (2) funds usable only for specific purposes, and (3) funds the Judicial Council requires each trial court to maintain for use in a fiscal emergency. In contrast, unrestricted reserves do not have a required use and are used at the discretion of the individual trial court. By the end of 2010–11, trial courts had accumulated a total reserve balance of about $560 million, which was about equally divided between restricted and unrestricted funds.

Reductions to the Judicial Branch Budget

Total Reductions. As previously mentioned, the judicial branch has received a series of one–time and ongoing General Fund reductions since 2008–09. By 2011–12, the branch had received ongoing General Fund reductions totaling $653 million, including a $350 million reduction adopted as part of the 2011–12 budget. Of the $653 million total, $47 million in reductions were allocated to the state–level courts and branch entities.

Reductions to Trial Courts. About $606 million (or 93 percent) of the total $653 million General Fund reductions to the judicial branch were allocated to the trial courts, including $320 million of the 2011–12 enacted reduction. However, as shown in Figure 3, the Legislature and the Judicial Council used various one–time and ongoing solutions to address much of the reductions to the trial courts. For example, in 2011–12, the Legislature approved the transfer of $302 million from branch special funds to offset about half of the ongoing General Fund reduction. Of this amount, $213 million came from two special funds, the State Court Facilities Construction Fund (SCFCF) and the Immediate and Critical Needs Account (ICNA). (An additional $750 million was also transferred or loaned from SCFCF and ICNA directly to the General Fund.) The remaining $89 million was redirected from other special funds, such as the Judicial Administration Efficiency and Modernization Fund. (Please see the box

below for a detailed description of each of these three special funds.)

Figure 3

Half of Ongoing Reductions to Trial Courts Addressed by One–Time Transfers

(In Millions)

|

|

2008–09

|

2009–10

|

2010–11

|

2011–12

|

|

General Fund Reduction

|

|

|

|

|

|

One–time reduction

|

–$92.2

|

–$100.0

|

–$30.0

|

—

|

|

Ongoing reductions (cumulative)

|

—

|

–260.8

|

–285.8

|

–$605.8

|

|

Total Reductions

|

–$92.2

|

–$360.8

|

–$315.8

|

–$605.8

|

|

Solutions to Address Reductions

|

|

|

|

|

|

One–Time Fund Transfers

|

|

|

|

|

|

Construction funds

|

—

|

$25.0

|

$98.4

|

$213.0

|

|

Other special funds

|

—

|

110.0

|

61.6

|

89.4

|

|

Subtotals

|

—

|

($135.0)

|

($160.0)

|

($302.4)

|

|

Revenues From Increased Fines/Fees

|

|

|

|

|

Adopted in 2009–10

|

—

|

$18.0

|

$14.9

|

$6.5

|

|

Adopted in 2010–11

|

—

|

—

|

51.4

|

64.1

|

|

Subtotals

|

—

|

($18.0)

|

($66.3)

|

($70.6)

|

|

Statewide Programmatic Changes

|

—

|

$17.7

|

$13.7

|

$18.7

|

|

Individual Trial Court Changesa

|

$92.2

|

190.1

|

75.8

|

214.1

|

|

Total Solutions

|

$92.2

|

$360.8

|

$315.8

|

$605.8

|

In addition, the courts increased fines and fees to generate new revenues ($70 million) and implemented a number of statewide programmatic changes to achieve savings ($19 million) in 2011–12. As we discuss in more detail below, the remaining reduction in 2011–12 ($214 million) was accommodated with various actions taken by individual trial courts, such as staff furlough days and the use of their reserves.

Most One–Time Fund Transfers Came From Three Court Special Funds

Most of the one–time fund transfers or redirections partially offsetting reductions to the trial courts came from three branch special funds: the State Court Facilities Construction Fund (SCFCF), the Immediate and Critical Needs Account (ICNA), and the Judicial Administration Efficiency and Modernization Fund (Modernization). Legislation creating the SCFCF and ICNA provided both with dedicated funding streams for court facility construction projects. Brief descriptions of all three funds are listed below.

- SCFCF. Chapter 1082, Statutes of 2002 (SB 1732, Escutia), also known as the Trial Court Facilities Act of 2002, created the SCFCF. This legislation increased criminal fines and civil filing fees to finance $1.5 billion in lease–revenue bonds to support 14 court facility construction projects. The fund receives roughly $130 million annually from fine and fee revenue.

- ICNA. Chapter 311, Statutes of 2008 (SB 1407, Perata) created ICNA. The legislation increased various criminal and civil fines and fees to finance up to $5 billion in lease–revenue bonds or other financing tools that are being used to support 39 court facility construction projects. The account receives roughly $320 million annually from fine and fee revenue.

- Modernization. Chapter 850, Statutes of 1997 (AB 233, Escutia and Pringle), created the Modernization Fund to promote projects designed to increase access, efficiency, and effectiveness of the trial courts. Such projects include judicial education programs and technological improvements. The fund receives monies through a transfer from the General Fund appropriation provided to the judicial branch. The Governor's budget includes $38.7 million from the Modernization Fund for 2012–13.

|

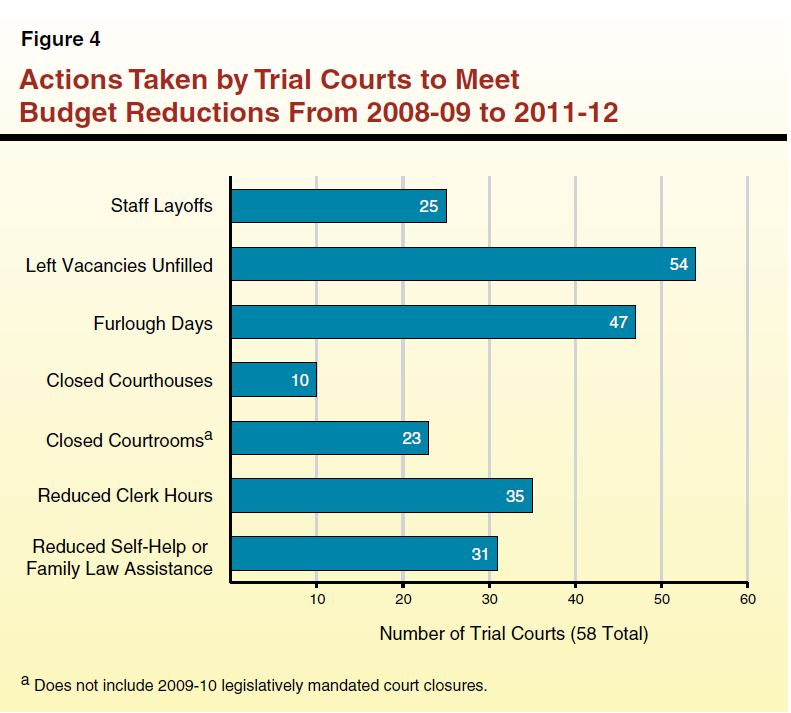

Implementing the Reductions. Judicial branch entities took various actions to accommodate their budget reductions. For example, entities instituted furlough days, left staff vacancies unfilled to reduce employee compensation costs, and reduced operating expenses by delaying or suspending travel and purchases. Additionally, many trial courts closed courtrooms or courthouses, reduced clerk office hours, and reduced self–help and family law services. Figure 4 summarizes the actions taken specifically by the trial courts from 2008–09 to 2011–12.

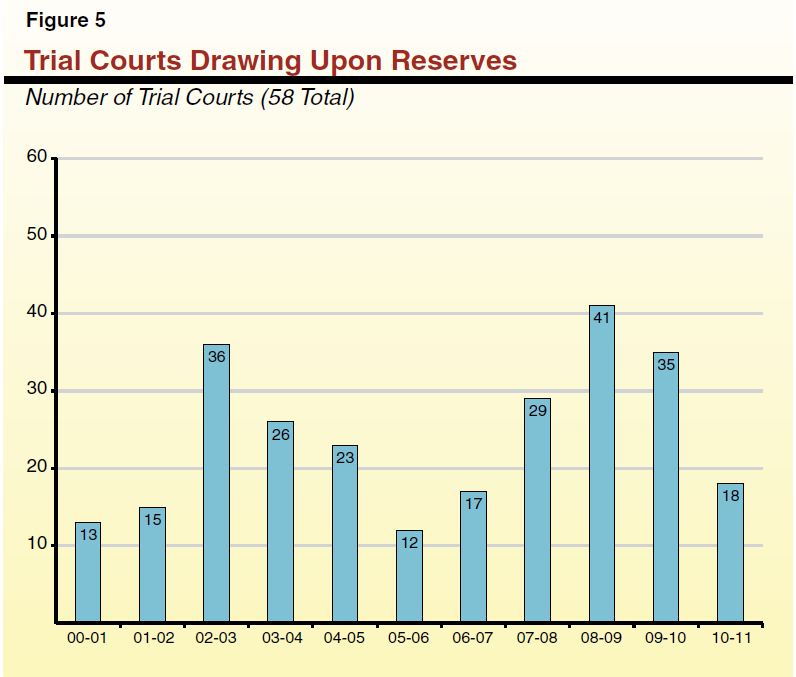

In adopting the budget for each of the past few years, the Legislature assumed that individual trial courts would also use their reserve balances to help address their ongoing budget reductions. Thus, it is no surprise that many trial courts began relying on their reserves with the onset of budgetary reductions in 2008–09. As shown in Figure 5, 41 of the 58 trial courts (or 70 percent) relied on reserves in 2008–09, and 35 courts (or 60 percent) did so in 2009–10. The figure also shows that at least 12 of the 58 trial courts (or 20 percent) have used their reserves to meet their total expenditures every year since 2000–01. While some courts have drawn down their reserves over the past few years, others have actually added to their reserve balance. On net, trial court reserves have declined from $595 million at the end of 2007–08 to $562 million at the end of 2010–11. The amount of these fund balances that were unrestricted declined from $399 million to $270 million over this period.

The Governor's 2012–13 budget proposes about $3.1 billion for the judicial branch from all fund sources (excluding local revenues), including roughly $1.3 billion from the General Fund. The major proposals in the Governor's budget are summarized below.

Continued $350 Million Reduction, But Not Allocated. The Governor proposes the continuation of the $350 million General Fund reduction to the judicial branch enacted in 2011–12. The Governor does not allocate the reduction among the judicial branch entities or programs. Rather, the Governor proposes provisional language providing the Judicial Council with the authority to allocate the reduction within the branch. This authority would also permit the Judicial Council to redirect funding from branch special funds to offset the cut.

As previously indicated, about $302 million of the current–year reduction to the judicial branch was offset by one–time solutions (such as the transfer of monies from two different special funds intended for court construction). Thus, the continuation of the $350 million unallocated reduction in 2012–13, as reflected in the Governor's budget, means that the judicial branch would need to implement at least $302 million in solutions on an ongoing basis beginning in the budget year.

Unspecified Civil Fee Increases. To help the courts address the continued reduction, the Governor's budget reflects $50 million in new revenue from increased civil fees that would be proposed by the Judicial Council after consultation with branch stakeholders. These fee increases would be included in trailer bill language for legislative consideration. The new revenues would support trial court operations and partially offset the above unallocated reduction.

Most One–Time Fund Transfers Came From Three Court Special Funds

Most of the one–time fund transfers or redirections partially offsetting reductions to the trial courts came from three branch special funds: the State Court Facilities Construction Fund (SCFCF), the Immediate and Critical Needs Account (ICNA), and the Judicial Administration Efficiency and Modernization Fund (Modernization). Legislation creating the SCFCF and ICNA provided both with dedicated funding streams for court facility construction projects. Brief descriptions of all three funds are listed below.

- SCFCF. Chapter 1082, Statutes of 2002 (SB 1732, Escutia), also known as the Trial Court Facilities Act of 2002, created the SCFCF. This legislation increased criminal fines and civil filing fees to finance $1.5 billion in lease–revenue bonds to support 14 court facility construction projects. The fund receives roughly $130 million annually from fine and fee revenue.

- ICNA. Chapter 311, Statutes of 2008 (SB 1407, Perata) created ICNA. The legislation increased various criminal and civil fines and fees to finance up to $5 billion in lease–revenue bonds or other financing tools that are being used to support 39 court facility construction projects. The account receives roughly $320 million annually from fine and fee revenue.

- Modernization. Chapter 850, Statutes of 1997 (AB 233, Escutia and Pringle) created the Modernization Fund to promote projects designed to increase access, efficiency, and effectiveness of the trial courts. Such projects include judicial education programs and technological improvements. The fund receives monies through a transfer from the General Fund appropriation provided to the judicial branch. The Governor's budget includes $38.7 million from the Modernization Fund for 2012–13.

Trigger Reduction. The Governor proposes an additional ongoing unallocated reduction of $125 million to the judicial branch budget, effective January 1, 2013, if voters reject his tax initiative this November.

As discussed above, recent reliance on one–time solutions to address judicial branch cuts results in $302 million of the current–year reductions still requiring ongoing solutions. Implementing these ongoing reductions in the budget year, as proposed by the Governor, may be difficult because the branch has fewer one–time options available to help address the reduction, largely because of the significant amount of special fund balances used this year. To the extent that the Legislature approves the continuation of the ongoing reduction, we offer a series of recommendations and options below to help meet this reduction. Specifically, we recommend the Legislature (1) reject the Governor's proposed budget bill language to authorize the Judicial Council to allocate the reductions, (2) adopt specific actions to achieve ongoing savings in the judicial branch, and (3) require that the judicial branch submit a report on potential operational efficiencies. We discuss each of these in more detail below.

Reject Governor's Proposed Budget Bill Language

We recommend that the Legislature reject the Governor's proposal for provisional language providing the Judicial Council with the authority to determine how to allocate or offset the ongoing reduction among the various branch entities. Given the magnitude of the proposed budget reductions and the limited availability of special fund balances to offset the ongoing reductions, decisions about how the cuts are allocated would likely have significant impacts on public access to the courts, as well as court operations and projects. Therefore, we recommend the Legislature establish its own funding priorities for the judicial branch rather than leaving such discretion entirely to the Judicial Council. While the Legislature should carefully consider the advice of the judicial branch and stakeholders, we believe that the Legislature should ultimately decide on the reductions adopted.

Adopt Specific Ongoing Solutions to Address Reduction

We have identified specific actions for the Legislature to consider in addressing proposed reductions of $302 million. Given the ongoing nature of the reduction, our recommendations focus on operational changes that are intended to achieve savings in the budget year and beyond. In part, this is because the availability of special fund balances (such as from the SCFCF and ICNA) that could be transferred to support court operations without significantly impacting planned projects is much more limited. For example, the transfers and loans from judicial branch special funds in 2011–12 lowered the balance in those funds, thereby reducing the amounts that would be available for additional transfers in 2012–13. The administration's projection of the combined fund balance of SCFCF and ICNA at the end of 2011–12 is $67 million, an amount much lower than what was transferred this year. Consequently, accommodating the above reduction will be challenging and likely impact court operations and statewide projects.

In developing our recommendations, we sought to identify proposals that could minimize (but by no means eliminate) the impacts on access to the courts. Figure 6 summarizes our recommendations, which we discuss in more detail below. As indicated in the figure, our recommendations would not address the full $302 million of ongoing reductions proposed in the budget year. Specifically, our recommendations would achieve $173 million in savings in 2012–13 and $259 million annually upon full implementation. As a result, we also provide later in this report a series of options that the Legislature could choose from to achieve the remainder of the savings.

Figure 6

LAO Recommendations for Managing the Ongoing Reductions to the Judicial Branch

(In Millions)

|

Recommendation

|

2012–13

|

Upon Full

Implementation

|

|

Approve Governor's proposed increase in civil fees

|

$50

|

$50

|

|

Implement electronic court reporting

|

13

|

100

|

|

Charge for court reporting in civil cases

|

23

|

23

|

|

Reduce court funding based on workload analysis

|

25

|

40

|

|

Transfer remaining CCMS funds to trial courts

|

62

|

46

|

|

Totals

|

$173

|

$259

|

Approve Governor's Proposed Increase in Civil Fees. We find that the Governor's proposal to increase civil fees to generate $50 million in additional revenues for the trial courts merits consideration given the total amount of ongoing solutions still required. We would note, however, that the Legislature has increased criminal and civil fines and fees several times in recent years to fund court facility construction projects and to offset reductions to trial court operations. The most recent increase occurred in 2010–11 with the enactment of increased civil fees, typically collected with the filing of a case, and select criminal fines. The nearly annual increase in fines and fees in recent years has raised concerns that additional increases may suffer from "diminishing returns." To the extent this were to occur, it could be a signal that fewer people are able to or choose to access the civil court process because of the increased costs.

Interestingly, revenues actually generated from the most recent increases generally match the amount originally projected by the courts (after adjusting for partial–year implementation). This suggests that the courts did not suffer from a problem of diminishing returns in the most recent fee increases. As shown in Figure 7, roughly $44 million was actually received in 2010–11, slightly surpassing the $43 million originally projected. We would also note that the majority of civil fees increased since 2008 have increased by 25 percent or less. For these reasons, we find that it is possible that the proposed increase in civil fees would not have a significant impact on court users.

Figure 7

New Revenues From 2010–11 Fee Increases Generally Match Projections

(Revenues in Thousands of Dollars)

|

Fee or Penalty

|

Fee Increase

|

EffectiveDate

|

Projected

Revenuesa

|

Revenues

(Actual)

|

|

Summary Judgment Fee

|

$300

|

10/19/2010

|

$4,392

|

$4,446

|

|

Telephonic Hearing Fee

|

20

|

10/19/2010

|

4,250

|

4,135

|

|

First Paper Filing Fee

|

20 or 40

|

10/19/2010

|

28,404

|

27,715

|

|

Pro Hac Vice Fee

|

250

|

10/19/2010

|

567

|

367

|

|

Parking Citation Penalty

|

3

|

12/18/2010

|

5,688

|

7,531

|

|

Total New Revenues

|

|

|

$43,300

|

$44,194

|

Furthermore, with limited trial court reserves and one–time transferable funds, increased fees can provide a source of ongoing revenue to help courts gradually implement their allocated reductions without significantly reducing court accessibility or public services. In addition, it will take time for trial courts to fully implement changes to court practices designed to increase efficiencies and generate ongoing savings. Thus, we recommend approval of the proposed increase in civil fees as an ongoing budget solution that can be implemented quickly. However, at the time of this analysis, the Judicial Council has not provided detailed information regarding the specific court fees that would be increased—as well as the actual amount of the increases—under the Governor's proposal. The Legislature will want to carefully review such details to ensure that the fee increases will have a minimal impact on court users and determine whether there are other more appropriate fees that could be increased.

Adopt Previous LAO Recommendations. In a prior brief,

The 2011–12 Budget: Making Targeted Reductions to the Judicial Branch (January 2011), we identified a number of specific actions trial courts could take to increase court efficiencies and generate ongoing savings. In total, these recommendations would generate roughly $60 million in savings in 2012–13 and roughly $165 million in ongoing savings once fully implemented. We continue to recommend the following:

- Implement Electronic Court Reporting. Under current law, trial courts use certified shorthand reporters to create and transcribe the official record of many court proceedings. However, many other state and federal courts currently use electronic methods of recording proceedings. A multiyear pilot study carried out in California between 1991 and 1994 found that electronic court reporting could achieve substantial savings. Accordingly, we recommend the Legislature direct the trial courts to phase in electronic court reporting. We estimate that the state could save about $13 million in 2012–13 and in excess of $100 million on an annual basis upon full implementation.

- Ensure Courts Charge for Court Reporting Services in Civil Cases. The parties in a civil case are currently required to pay for reporting services only for proceedings lasting more than an hour. However, information provided by AOC indicates a roughly $50 million difference between court reporting costs for civil cases and the amount of fee revenue collected to offset these costs. This shortfall likely includes costs related to proceedings of less than one hour, fee waivers courts are authorized to provide to indigent litigants, and some failure to collect these fees in certain courts. To generate revenue to help courts meet their ongoing reductions, we recommend the Legislature amend existing state law to require trial courts to charge court reporting fees to offset costs related to court reporting services, including proceedings lasting less than an hour (though still allowing fee waivers for indigent litigants). This new source of revenue along with more efficient collection of the fee by trial courts would generate ongoing savings of $23 million in 2012–13.

- Reduce Trial Court Funding Based on Workload Analysis. In 2005, AOC and the National Center for State Courts completed an in–depth study on the level of funding a given trial court would need based on a specified workload, as measured by the number of cases filed. This study is commonly referred to as the "resource allocation study." Based on data compiled through 2010–11, 10 of the 58 trial courts in the state received more funding—totaling roughly $40 million—than predicted by the workload study. In other words, AOC's resource allocation study suggests that these particular courts are better resourced for their caseloads than their counterparts. Consequently, these courts should be able to process their existing caseloads with less funding while still providing similar levels of service as other courts. Based on these findings, we recommend that the Legislature direct the Judicial Council to more closely align the level of funding for the above courts to their actual workload need. Given the magnitude of the cuts to the courts, we believe prioritizing cuts to those courts that have more funding than their counterparts is a reasonable approach. If implemented over a four–year period, our recommendation would achieve General Fund savings of $25 million in the first year of implementation and $40 million upon full implementation.

(Please see our

January 2011 budget brief for more detailed information regarding the above recommendations.)

Transfer Remaining California Case Management System (CCMS) Funds to Trial Courts. The judicial branch has worked since 2002 to develop a statewide court case management technology project called CCMS. This system was designed to standardize court filings, increase electronic access to court records, reduce the amount of work associated with paper–driven filings, and allow electronic interaction with criminal justice entities. Product development concluded in November 2011. However, in March 2012, the Judicial Council voted to terminate the product before deploying it to individual courts, in part because of the high projected costs of full deployment statewide. Based on AOC estimated costs, the decision to terminate CCMS will reduce spending on this project by $46 million in 2012–13. In addition, the Judicial Council will receive a one–time $16 million cash payment from the CCMS product vendor as compensation for numerous product quality issues which resulted in a ten–month project delay. We recommend that the Legislature direct AOC to transfer all of these funds (totaling $62 million in 2012–13) directly to trial court operations to offset the unallocated reduction.

Options to Further Address Ongoing Reduction. The increase in civil fees and implementation of our other recommendations would generate about $173 million in solutions for the budget year. Although this amount would grow to an estimated $259 million upon full implementation over the next five years, our recommendations would not fully address the $302 million in proposed cuts. In order to address the remaining portion of the reduction, we present below a series of options, some with significant trade–offs (such as limiting access to the courts), that the Legislature could choose from to ensure that the judicial branch meets whatever savings target the Legislature adopts.

- Implement a Furlough for Court Employees for One Year. The Legislature could mandate a statewide furlough for court employees for one year. This would be in addition to the furlough days already implemented in many courts. As discussed previously, 47 of the 58 trial courts have implemented furlough days at some point in the last few years, with the number of actual furlough days varying across courts. We note, however, that a mandatory furlough could significantly impact public access to court services. For example, a one–day–per–month furlough could generate roughly $65 million in savings in the budget year.

- Delay Or Cancel Certain Court Construction Projects. As discussed previously, two judicial branch special funds—SCFCF and ICNA—receive roughly $450 million in criminal fine and civil filing fee revenues annually for court facility construction projects. A portion of these funds are also used for maintenance of court facilities. Most ICNA construction projects are currently in either the site acquisition or design phase, whereas most SCFCF projects are already under construction. The Legislature could delay all projects not currently under construction (mainly ICNA projects) for one year and transfer a couple hundred million dollars of the $320 million in annual revenues received by ICNA to offset reductions to the trial courts. (At the time of this analysis, we had not received updated court construction figures from the branch to provide a precise estimate.) Alternatively, the Legislature could consider canceling certain courthouse construction projects and achieve significant savings on an ongoing basis. The AOC conducted an evaluation of court facility needs throughout the state in the early 2000s and used a methodology approved by the Judicial Council in 2006 to prioritize potential construction or facility modification projects. The ICNA currently funds 39 construction projects identified by this methodology as meeting either an immediate or critical (less immediate) facility need. The Legislature could direct the courts to continue the immediate need projects, but cancel the 12 critical need projects (whose budgets total roughly $1.6 billion). This would allow roughly $100 million to be transferred annually to trial court operations.

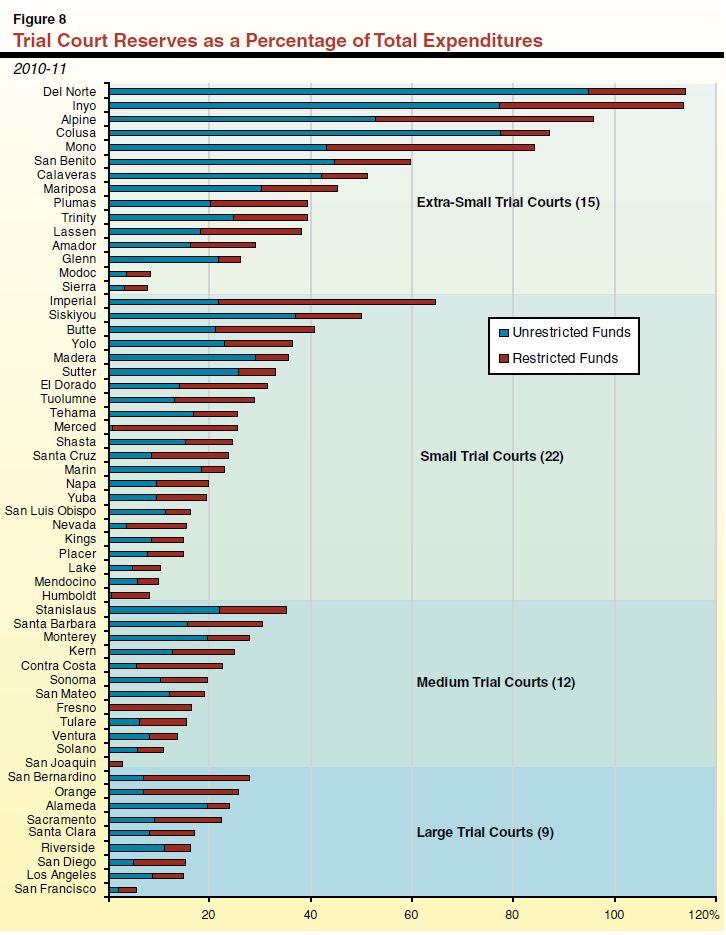

- Require Individual Courts to Make Additional Reductions. As discussed earlier in the brief, $214 million of the cumulative General Fund reduction to the judicial branch was passed on to the individual trial courts in the current year. In most cases, courts made various operational changes to accommodate the reductions (such as by implementing staff furlough days and reducing service hours). The Legislature could require that the individual trial courts be required to absorb additional reductions by expanding upon these actions. However, these actions taken in prior years have frequently resulted in a backlog of cases, delays in processing court paperwork, and longer wait times for those seeking court services. In addition, as discussed above, many trial courts also drew upon their local reserves to help offset recent budget cuts and avoid taking the operational actions described above. At the end of 2010–11, trial courts possessed combined reserves of $562 million, but only around half was unrestricted and available for use by the trial courts to address their budget reductions. With additional budget reductions in the current year, we expect the final balance of these unrestricted reserves to be even lower, leaving less available for use in 2012–13. Furthermore, the actual level of reserve balances, particularly unrestricted funds, currently varies across trial courts. As shown in Figure 8, some courts possess enough funds in their reserves to cover a large share of their annual expenditures and would probably be able to draw on these reserves—rather than make additional operational changes—to absorb additional budget reductions. Other courts lack a significant amount of unrestricted funds and might have difficulty absorbing further budgetary reductions.

Require Judicial Branch to Submit Report on Potential Operational Efficiencies

Court operations and procedures are governed by numerous state laws which are usually enacted as formal rules of court established by the Judicial Council. These rules of court are designed to ensure standard practices across all courts. For example, the rules regulate the format of case filings, identify acceptable ways to document court proceedings, and provide guidelines for proceedings for all case types. The Judicial Council, in consultation with trial court administrators and other judicial stakeholders, is best positioned to evaluate current practices to identify those processes that may be outdated, inefficient, and require statutory change. The courts have expressed that they believe opportunities exist to generate savings through changes in current law, rules of court, and operations. The judicial branch reports having already begun to identify such opportunities. Thus, we recommend that the Legislature require the judicial branch to submit a report on potential operational efficiencies as well as their estimated savings, including those requiring statutory amendments, at budget hearings for legislative consideration and potential action. We will review any cost–savings proposals put forward for legislative consideration and will assess their impact on court users and the extent to which they create ongoing savings. The Legislature may find that these other proposals could have a lesser impact on court users than our recommendations and, thus, are worthwhile alternatives.