Analysis of the 2008-09 Budget Bill: Perspectives and Issues

A declining economic outlook, sagging revenues, and rising costs have created bleak prospects for the state’s budget. Over the current and budget years, the Governor identified a gap of $14.5 billion between revenues and expenditures and proposes more than $17 billion in solutions to bring the state’s budget back into balance. These budget–balancing actions include the issuance of additional deficit–financing bonds, higher revenue accruals, and budget reductions across most state programs.

LAO Bottom Line. Primarily due to the continued deterioration of the state’s revenue outlook, we project that the state’s budget shortfall (prior to any corrective actions) has increased to about $16 billion. Consequently, the reserve at the end of 2008–09 under the Governor’s budget policies would be $1.1 billion—$1.6 billion less than forecasted by the administration. Despite achieving a positive reserve, we conclude that the administration’s budget–balancing approach is fundamentally flawed. Its across–the–board reductions reflect little effort to prioritize and determine which state programs provide essential services or are most critical to California’s future. In the absence of a credible plan that prioritizes state spending and revenues, we offer an alternative approach for the Legislature’s consideration. By making more targeted reductions and adding ongoing revenue solutions, we believe this approach offers the Legislature a better foundation to begin crafting a 2008–09 budget that focuses on essential services.

The budget’s economic forecast for the remainder of 2007–08 and 2008–09 is for modest growth and inflation. Both the national and California economies are expected to experience slower growth in 2008 than in 2007, especially in the earlier parts of 2008. In 2009, growth is expected to be somewhat better. Continuing problems in the housing market and high energy prices are predicted as the main forces holding down growth. On an annual average basis, the budget forecasts that the U.S. gross domestic product will slow slightly from 2.1 percent in 2007 to 1.9 percent in 2008, before partially rebounding to 2.9 percent in 2009. In California, personal income is expected to fall to 4.8 percent in 2008 and then rise a bit to 5.2 percent in 2009.

Very modest revenue growth occurred in 2006–07 and is forecast for the remainder of 2007–08 and 2008–09. The Governor’s budget forecasts that underlying revenues for 2006–07 through 2008–09 are down by a combined $9.3 billion from what was assumed at the passage of the 2007–08 Budget Act. After accounting for one–time factors, the underlying growth rate assumed for 2007–08 is 1.6 percent, rising to about 3.5 percent in 2008–09. Including the revenue–related changes described below, General Fund revenues are forecasted to total $102.9 billion in 2008–09, up 0.6 percent from the current year.

Revenue–Related Changes. Although the budget does not include any significant tax changes, the administration proposes several proposals that would have a significant effect on General Fund revenues. Specifically, the 2007–08 revenue forecast assumes the sale of $3.3 billion of additional deficit–financing bonds. The budget also adds $2 billion to its 2008–09 revenue total by accruing dollars that are currently reflected as 2009–10 revenues. The administration proposes some increased tax enforcement and collection activities at the state’s tax agencies, as well as a change in the use tax for vessels, vehicles, and aircraft. In addition, the administration assumes that tribal gambling compact payments to the General Fund will increase dramatically due to the recent passage of Propositions 94, 95, 96, and 97. In total, compact payments to the General Fund are forecasted to total $154 million in 2007–08 and $430 million in 2008–09.

The budget proposes total state spending in 2008–09 of $128.8 billion (excluding expenditures of federal funds and bond funds). General Fund spending is projected to total $101 billion, a decrease of 2.3 percent due to various budget reductions. Special fund spending would decline by 3.7 percent to $27.8 billion.

Figure 1 shows the General Fund’s condition from 2006–07 through 2008–09 under the budget’s assumptions and proposals. The current fiscal year is estimated to have begun with a reserve of $3.5 billion. With proposed expenditures of $2.6 billion more than revenues, the Governor’s budget projects ending 2007–08 with a reserve of less than $1 billion. For the budget year, various budget–balancing proposals would allow the state to grow the reserve to $2.8 billion.

|

|

|

Figure 1

Governor’s Budget General Fund Condition |

|

(Dollars in Millions) |

|

|

|

|

Proposed for 2008‑09 |

|

|

Actual 2006‑07 |

Proposed 2007‑08 |

Amount |

Percent

Change |

|

Prior-year fund balance |

$9,898 |

$4,372 |

$1,757 |

|

|

Revenues and transfersa |

95,887 |

100,758 |

102,904 |

2.1% |

|

Total resources available |

$105,785 |

$105,130 |

$104,661 |

|

|

Expenditures |

$101,413 |

$103,373 |

$100,998 |

-2.3% |

|

Ending fund balance |

$4,372 |

$1,757 |

$3,663 |

|

|

Encumbrances |

$885 |

$885 |

$885 |

|

|

Reserve |

$3,487 |

$872 |

$2,778 |

|

|

Budget

Stabilization Account (BSA) |

472 |

— |

— |

|

|

Reserve for Economic Uncertainties |

3,015 |

872 |

2,778 |

|

|

|

|

a Display of

revenues related to the BSA is different than that of the

administration. The 2006‑07 amount includes $472 million and the

2007‑08 amount includes $1.023 billion in General Fund revenues

received in those years and transferred to the BSA. The

administration instead shows the entire $1.494 billion as

2007-08 revenues, when the funds were transferred back to the

General Fund. |

|

|

The Governor’s budget plan calls on the Legislature to take actions affecting both the current and budget years. Figure 2 summarizes the major components of the Governor’s $17 billion in proposed solutions, which we describe below.

|

|

|

Figure 2

How the Governor’s Budget Closes the 2008‑09

Shortfall |

|

(In Millions) |

|

|

Reserve as of

June 30, 2009 |

|

Administration’s Definition of Shortfall |

-$14,479 |

|

Budget Solutions |

|

|

Reduce Proposition 98 spending: |

|

|

2007‑08 reduction |

$400 |

|

Suspend 2008‑09 minimum guarantee |

4,825a |

|

Issue additional deficit-financing bonds |

3,313 |

|

Accrue 2009‑10 revenues to 2008‑09 |

2,001 |

|

Suspend transfer to Budget Stabilization

Account |

1,509 |

|

Reduce Medi-Cal local assistance spending |

1,126 |

|

UC/CSU reductions (unallocated) |

569 |

|

CalWORKs reforms |

463 |

|

Early release of prisoners and summary

parole |

372 |

|

Suspend SSI/SSP cost-of-living adjustments |

323 |

|

Other solutions |

2,356 |

|

Governor’s Budget

Estimate of 2008‑09 Reserve |

$2,778 |

|

|

|

a The

administration proposes a $4 billion suspension. Due to the way

it built its baseline budget, it shows savings of a somewhat

higher amount. |

|

|

Special Session. On January 10, 2008, the Governor declared a fiscal emergency under the State Constitution and called a special session of the Legislature to address the state’s budget problems. The Governor’s budget proposes $817 million in current–year savings proposals. In many cases, these proposals would yield greater savings in 2008–09 once fully implemented. Among the major current–year proposals are:

- A reduction of $400 million in Proposition 98 K–14 education spending.

- A 10 percent reduction in Medi–Cal provider rates and a shift of $165 million in provider payments from June to July.

- California Work Opportunity and Responsibility to Kids (CalWORKs) reforms, including increased sanctions for not complying with program requirements.

- The suspension of a scheduled June 2008 Supplemental Security Income/State Supplementary Program (SSI/SSP) cost–of–living adjustment (COLA).

- The release of certain nonviolent and nonserious offenders from prison up to 20 months early and no longer actively supervising such offenders on parole.

Due to the continued decline in the state’s revenue outlook, the administration has also proposed a number of actions to help the state meet its cash demands, in addition to its budgetary demands. The administration proposes $4.7 billion in cash solutions—primarily from delaying payments to school districts, counties, and cities by several months. At the time this analysis was prepared, the Legislature was deliberating on the administration’s current–year budget and cash proposals.

Budget–Year Savings Proposals. Relative to a current–law baseline budget, the administration proposes more than $10 billion in spending–related reductions in 2008–09. While some areas of the budget were exempt, most programs are targeted for reductions by the administration. In a number of areas, these reductions are achieved through significant policy and/or funding changes to the way in which programs operate. In other cases, however, the proposed reductions are across–the–board—evenly distributed across all of a department’s programs. The Governor’s major budget–year reduction proposals include:

- Continued savings from current–year proposals such as Medi–Cal provider rate reductions, CalWORKs reforms, the SSI/SSP COLA suspension, and the corrections’ early release and summary parole changes.

- Suspension of the Proposition 98 minimum guarantee for K–14 education by $4 billion. Revenue limits and categorical programs are generally cut by about 10 percent.

- Unallocated reductions to the budgets of the judiciary, University of California (UC), California State University (CSU), the Legislature, and constitutional officers.

- Elimination of specified Medi–Cal optional benefits for adults.

- Reduced county allocations for child welfare services and foster care grants.

- Reduced In–Home Supportive Services hours for domestic services such as meal preparation, cleaning, and errands.

- Suspension of the 2008–09 transfer to the Budget Stabilization Account—eliminating a $1.5 billion supplementary debt payment towards outstanding deficit–financing bonds.

New Spending Proposals. Despite the budget reductions, the administration makes several new spending proposals—primarily using sources other than the General Fund. For instance, the administration proposes to finance the costs of a $1.6 billion computer project to modernize the state’s budgeting and accounting systems—known as the Financial Information System for California (FI$Cal). The Governor’s budget also proposes to expand the state’s wildland firefighting capacity through a new surcharge on property insurance policies. Regarding infrastructure, the Governor proposes placing $48 billion in general obligation bonds before the state’s voters by 2010. One of the key General Fund augmentation proposals is about $260 million annually to provide a 5 percent pay raise (retroactive to July 1, 2007) to correctional officers as part of the imposition of a contract offer.

In this section, we examine the implications of the 2008–09 Governor’s Budget proposal for the near– and longer–term General Fund condition, using our own revenue forecast and our own estimates of the impacts of the Governor’s proposals on revenues and expenditures. Our estimates do not reflect any of the programmatic recommendations that we make in our companion publication, Analysis of the 2008–09 Budget Bill. The causes of our differences from the budget projections are limited to (1) assumptions about the economic and revenue outlook under the Governor’s policies and (2) estimating differences in the level of expenditures that would be needed to fund the Governor’s budget plan.

As indicated in Figure 3, we estimate that if the Governor’s budget proposals were fully adopted, the state would end 2008–09 with a reserve of $1.1 billion—$1.6 billion less than the administration’s forecast of its own budget. This difference largely reflects our lower estimate of revenues, as well as a slightly higher net estimate of expenditures from 2006–07 through 2008–09. In comparison to the Governor’s identified budget problem of $14.5 billion, therefore, we now project the state would face roughly a $16 billion shortfall, absent corrective actions.

|

|

|

Figure 3

Governor’s Budget General Fund Condition

Using LAO Estimates |

|

(Dollars in Millions) |

|

|

|

|

Proposed for 2008‑09 |

|

|

Actual 2006‑07 |

Proposed 2007‑08 |

Amount |

Percent

Change |

|

Prior-year fund balance |

$9,898 |

$4,557 |

$779 |

|

|

Revenues and transfersa |

95,887 |

99,823 |

102,361 |

2.5% |

|

Total resources available |

$105,785 |

$104,380 |

$103,140 |

|

|

Expenditures |

$101,228 |

$103,601 |

$101,119 |

-2.4% |

|

Ending fund balance |

$4,557 |

$779 |

$2,021 |

|

|

Encumbrances |

$885 |

$885 |

$885 |

|

|

Reserve |

$3,672 |

-$106 |

$1,136 |

|

|

Budget

Stabilization Account (BSA) |

472 |

— |

— |

|

|

Reserve for Economic Uncertainties |

3,200 |

-106 |

1,136 |

|

|

|

|

a Display of

revenues related to the BSA is different than that of the

administration. The 2006-07 amount includes $472 million and the

2007-08 amount includes $1.023 billion in General Fund revenues

received in those years and transferred to the BSA. The

administration instead shows the entire $1.494 billion as

2007-08 revenues, when the funds were transferred back to the

General Fund. |

|

|

Lower Revenues. We forecast that General Fund revenues in 2007–08 and 2008–09 will fall below the budget forecast by a combined total of $1.5 billion. Economic conditions at both the national and state levels have deteriorated since the budget’s estimates were put together. These conditions have already begun to further weaken the state‘s General Fund revenues compared to the Governor’s budget forecast. For instance, corporate tax (CT) receipts in December, and personal income tax (PIT) and sales and use tax (SUT) receipts for the month of January were both soft. In the two years combined, our forecast of the state’s three biggest tax revenues—PIT, CT, and SUT—are down $1.4 billion from the administration’s forecast. In addition, the Governor’s budget makes overly aggressive assumptions about the growth in Indian casinos’ customer bases and slot machines. Even with the passage of Propositions 94, 95, 96, and 97, we conclude the administration’s estimate of tribal payments to the General Fund is overstated by $173 million over 2007–08 and 2008–09 combined. Other revenue sources offset a portion of this effect.

Our forecast also adjusts the timing of the receipt of two significant one–time payments to the state—$500 million from the sale of EdFund and $193 million in rebated penalties from the federal government as a result of implementing a child support automation system. In both cases, the administration scores the revenues in 2007–08, while we believe 2008–09 is a more realistic time line. While these adjustments do not affect the state’s projected reserve at the end of the budget year, they do shift $693 million in expected revenues from 2007–08 to 2008–09.

Higher Costs. We estimate that General Fund expenditures under the Governor’s budget proposals would exceed the administration’s estimate by a net amount of $164 million over the prior, current, and budget years combined. This is the result of a number of factors, which tend to offset each other. The two largest factors are:

- Higher Property Taxes. Under the financing of K–14 education, increases in local school district property taxes generally offset state General Fund Proposition 98 costs on a dollar–for–dollar basis. Due to more recent data on property taxes received by schools in 2006–07, our estimate of the base amount of property taxes available is higher than the amount assumed in the Governor’s budget. This is partially counteracted by lower assumed growth rates in 2007–08 and 2008–09. By 2008–09, our property tax estimate is roughly the same as the administration’s. In total, our forecast includes about $300 million in higher local school property tax revenues in 2006–07 and 2007–08 combined than the administration.

- Public Transportation Account (PTA) Lawsuit. The PTA derives its revenues from diesel sales tax and a portion of the gasoline sales tax, including an amount known as the “spillover.” As a solution, the 2007–08 budget used $1.3 billion of the PTA’s funds to help the General Fund. In January, a superior court judge ruled that a portion of that solution was illegal. Specifically, the court found that the state could not use $409 million from the PTA to reimburse the General Fund for prior–year transportation bond debt service. At the time this analysis was prepared, the administration had not formally proposed a solution to address this issue. Our expenditure totals for the administration’s plan, therefore, are $409 million higher than the Governor’s budget.

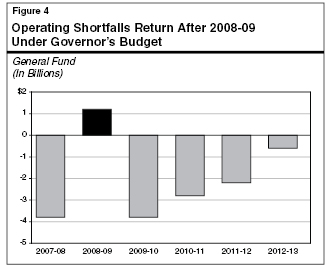

In addition to forecasting the General Fund’s condition through 2008–09, we have projected the state’s revenues and expenditures through 2012–13 under the Governor’s policies. When the 2007–08 Budget Act was adopted, it was widely acknowledged that the state would face multibillion dollar budget shortfalls in future years. The continued deterioration of the state’s revenue outlook increases the long–term gap between revenues and spending even further than these prior estimates. In response, virtually all of the administration’s $9 billion in spending reductions are intended to be ongoing. If adopted, therefore, the budget plan would reduce ongoing spending and bring total expenditures closer into line with annual revenues. Some elements of the Governor’s plan, however, work against this progress. In particular, the issuance of additional deficit–financing bonds and their slower pay off pushes extra debt–service costs into the future. Taken all together, as shown in Figure 4, we project that the state would face about a $4 billion operating shortfall in 2009–10. The shortfalls would shrink to between $2 billion and $3 billion in the two following years. In 2012–13, the shortfall would remain but total less than $1 billion, as the budget would begin to reflect the benefit of the final pay off of the deficit–financing bonds in that year.

The administration’s approach to have virtually all programs share in the pain of balancing the budget has some surface appeal of “fairness.” Yet, it fails to differentiate between the importance of various state programs. All state programs are not equally valuable. The administration’s budget reductions reflect little effort to prioritize and determine which state programs provide essential services or are most critical to California’s future. As a result, we conclude that the administration’s approach is fundamentally flawed. In many cases, there is no rationale or justification for the reductions (other than saving money). The risk with the administration’s approach is that—by attempting to preserve most funding for most programs—many programs end up operating in a less than optimal manner and provide lower–quality services to the public.

The administration’s budget plan affects most areas of the spending side of the budget. On the revenue side, the administration makes some modest adjustments to increase ongoing revenues. For example, the administration proposes to reinstate the 12 month use tax requirement on vehicles, vessels, and aircraft, as well as to augment staff at the state’s tax agencies to improve tax collections. The administration also looks to create an insurance surcharge to partially defray General Fund wildfire costs and anticipates student fees will be raised by the governing boards to defray a portion of the proposed reductions to UC and CSU. In the context of the amount of corrective actions that are proposed, however, these ongoing revenue–related changes are minimal. By focusing almost exclusively on the spending side, the administration’s plan unnecessarily limits the range of budget solution options.

With the state’s declining revenues, the Proposition 98 minimum guarantee—accounting for about 40 percent of the state’s General Fund budget—is now well below the level estimated in the 2007–08 Budget Act. The Proposition 98 minimum guarantee grows each year based on the amount of spending in the previous year. Consequently, the decisions that the Governor’s budget makes on Proposition 98 in the current year fundamentally determine the direction of the administration’s entire budget plan. As we discuss in detail in the “Education” chapter in our

2008–09 Analysis, the administration’s current–year proposal misses a critical opportunity to achieve additional budgetary flexibility. The Governor’s budget proposes $400 million in current–year Proposition 98 savings. Yet, that would leave the state about $1 billion above the minimum guarantee and lock the state into a higher minimum guarantee in 2008–09 and beyond. This higher guarantee, in turn, increases pressure in 2008–09 to either suspend the guarantee or find significantly greater budget solutions in other areas.

Facing a huge 2008–09 budget problem, the Governor’s budget failed to put forward a plan that prioritizes state spending and makes difficult choices. We recommend the Legislature reject the administration’s across–the–board approach. In the absence of a meaningful starting point for budget deliberations from the administration, we have developed an alternative approach. In contrast to the Governor’s budget, we have put forth a strategic alternative that is both more balanced and targeted in addressing the state’s budget shortfall. It is more balanced in that it focuses not just on program reductions, but also adds revenues in several different ways without making any broad–based tax increases. It takes a targeted approach to expenditures by attempting to determine which programs are most important and preserve their funding, if not at the current level, at least at a level that does not significantly adversely impact program accomplishments. In addition, we sought to eliminate duplicative, inefficient or ineffective programs and restructure other programs in order to achieve budgetary savings and improve service delivery.

The LAO Alternative Budget is laid out in “Part V” of this publication. Its

key components are summarized in Figure 5.

|

|

Figure 5

Key Elements of the

LAO Alternative Budget |

|

|

|

♦

A Balanced Budget Through 2012‑13 |

|

·

Provides reserve of $1.3 billion at the end of

2008‑09, about $150 million more than our forecast of the

Governor’s budget reserve. |

|

·

Keeps budget balanced—though precariously—through

our five-year forecast period. Small operating shortfalls in

some years are covered by carry-in reserves. |

|

♦

Targeted Program Reductions |

|

·

In contrast to an across-the-board approach, makes

targeted program reductions. To the extent possible, maintains

core services at their

current spending levels. |

|

·

Eliminates or modifies ineffective or nonessential

programs. |

|

·

Considers availability of other fund sources in

order to maintain service levels. |

|

♦

Rethink Which Programs Are Operated or Funded

by the State |

|

·

Shifts programs to the local level when it makes

programmatic sense. |

|

·

Reduces or eliminates program funding for programs

that are primarily local government responsibilities. |

|

♦

A Better Proposition 98 Approach |

|

·

Reduces current-year funding to the minimum

guarantee to maximize budget-year flexibility but not impact

school operations in 2007‑08. |

|

·

Suspends the guarantee by $800 million, compared

to a $4 billion

suspension by the Governor. The suspension is only required

because of added revenues as part of our overall solution. |

|

♦

Add Revenues in a Reasonable Manner |

|

·

Selects tax credits or exemptions for reduction or

elimination because they are not achieving their stated purposes

or are of lower priority. |

|

·

Makes no broad-based tax rate increases. |

|

·

Does not

include the administration’s problematic $2 billion revenue

accrual. |

|

♦

No Additional Borrowing or Debt |

|

·

Does not add any new borrowing or debt to the

state’s credit card.

However, we do restructure some repayments of existing debt. |

|

|

2008–09 Reserve. The LAO alternative budget would finish the 2008–09 year with a $1.3 billion reserve, about $150 million more than our forecast of the Governor’s budget reserve. Although budget–year spending would be $2.5 billion higher than the Governor’s budget, the higher reserve is achieved primarily through two means:

- More Current–Year Savings. Lowering Proposition 98 spending to the minimum guarantee in 2007–08 and rejecting the administration’s proposed 5 percent raise for correctional officers creates greater flexibility to preserve key spending programs in the budget year. (Although the Legislature was deliberating on special session actions at the time this analysis was prepared, most of our proposed current–year savings in Proposition 98 will remain viable until the end of 2007–08.)

- Additional Revenues. We identify $2.7 billion in additional revenues that can be raised by modifying or eliminating tax credits and exemptions that are not achieving their stated purposes or are of lower priority. A portion of these increased revenues are offset by not adopting the administration’s problematic proposal to accrue $2 billion in future revenues to 2008–09.

Balanced Through 2012–13. Unlike the Governor’s budget, our alternative maintains a balanced budget through the end of our forecast period in 2012–13. While our plan would have small operating shortfalls in some future years, the budget remains balanced—although precariously so—using reserves carried forward from earlier years. Our alternative achieves this improved long–term outlook by slowing the rate of program growth, implementing some changes now that will yield future dividends, and providing increased revenues on an ongoing basis.

We do not expect the Legislature to adopt the LAO alternative as an entire package. The alternative, of necessity, reflects judgments as to how state government could maintain essential services while achieving budgetary savings. We are sure that there are components of our alternative with which many Members of the Legislature will not agree. The Legislature’s assessment of its own priorities should form the framework of the adopted 2008–09 budget. In working towards a final budget, the Legislature will have to make many tough decisions. Our hope is that the LAO alternative budget offers the Legislature a better foundation to begin crafting the budget and helps demonstrate how the state can be more strategic in bringing its revenues and expenditures into balance.

Return to Perspectives and Issues Table of Contents, 2008-09 Budget AnalysisReturn to Full Table of Contents, 2008-09 Budget Analysis