The Secretary for Business, Transportation and Housing oversees 13 departments detailed in Figure 1 that develop and maintain the state’s transportation infrastructure, promote traffic safety, promote housing availability in the state, and regulate state–licensed financial entities as well as managed health care.

|

|

|

Figure 1

Departments Under Business,

Transportation and Housing Agency |

|

Business and Regulatory Departments |

|

Alcoholic Beverages Control Board |

|

Department of Financial Institutions |

|

Department of Corporations |

|

Department of Real Estate |

|

Office of Real Estate Appraisers |

|

Managed Health Care |

|

Office of Patient Advocate |

|

Transportation Departments |

|

Department of Transportation |

|

California Highway Patrol |

|

Department of Motor Vehicles |

|

Office of Traffic Safety |

|

Housing Departments |

|

Department of Housing and Community

Development |

|

California Housing Finance Agency |

|

|

In addition, the secretary’s office also manages a number of economic development programs, such as the Infrastructure and Economic Development Bank (I–Bank), the Film Commission, the Small Business Loan Guarantee Program, and the Travel and Tourism Commission.

The budget provides 65.5 positions and $23 million (including $7 million from the General Fund) for the secretary’s operations in 2008–09. This represents a net increase of 6.6 positions and about $1 million (from special funds) over the estimated current–year expenditures, mainly to increase staff support for the I–Bank.

The Infrastructure State Revolving Fund (ISRF) program is one of two programs administered by I–Bank. The ISRF program provides loans for local infrastructure improvements. Currently, the program is supported by about eight staff.

Program Objectives. The purpose of the ISRF program is to provide financial assistance to local governmental entities for infrastructure projects such as roads, water systems, sewer systems, and other public facilities. More specifically, statute intends the program to fund projects that promote efficient land use and resource conservation while also providing economic development opportunities. Local governmental entities eligible for funding from the program include cities, counties, assessment districts, and redevelopment agencies.

The program provides loans to sponsors of eligible infrastructure projects at interest rate costs that are lower than financing that can otherwise be obtained from the private market. Specifically, loans are made at two–thirds of the market interest rate for an A–rated tax–exempt bond. This reduced interest rate lowers the cost of borrowing to local governments and can enable infrastructure investment to occur sooner or at greater levels than may otherwise happen.

Initial Funding Came From General Fund. In 1998–99 and 1999–00 the I–Bank received a total of about $200 million from the General Fund to start up the ISRF program. Of this amount, $180 million was for financial assistance and program administration, and $20 million was set aside for infrastructure projects for the Imperial Irrigation District.

Revenue Bonds Used to Leverage Initial Appropriation. The I–Bank loaned out the initial $180 million in the first few years of the program. These loans will typically be repaid over a 30–year period. In order to continue to make loans, the I–Bank issued revenue bonds in 2004 and 2005 to obtain additional funds up–front instead of waiting to collect enough funds from loan repayments before making more loans. In turn, the bonds will be paid from the repayments of outstanding loans. As a result, the amount of bonds the I–Bank can issue for the program is limited by, among other things, the stream of loan repayments available for debt service. The I–Bank indicated that it is currently undertaking a review of its leveraging model to determine the maximum loan level that can be supported by the ISRF program. According to I–Bank staff, a preliminary review suggests that the initial $180 million can be leveraged between one to three times. This means that the program can provide a maximum amount of loans between $360 million and $540 million.

Program Has Provided $337 Million in Loans So Far. With funding from the initial appropriations, revenue bond proceeds, and various interest earnings and fee revenues the I–Bank has issued a total of $337 million in loans to date, providing funding for 81 projects throughout the state. Funded projects cover a broad range of infrastructure including upgrading water systems, improving roads, and constructing complete packages of infrastructure (including water, sewer, roads and utilities) for new development and redevelopment projects, among others.

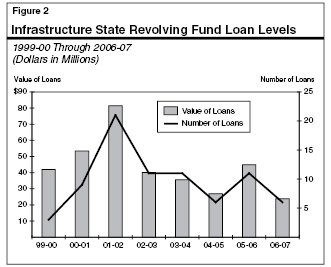

New Loan Activity Likely to Remain at Lower Levels. Figure 2 shows the loans made annually from 1999–00 through 2006–07. As shown in the figure, the amount of loans dropped after 2001–02 when the initial $180 million was loaned out. This slowdown reflects, at least in part, the limitation on the amount of revenue bonds the I–Bank can issue based on the repayment of outstanding loans. So far, the I–Bank has issued two series of bonds, at $50 million each, for a total of about $100 million.

Program staff indicate that about $20 million is still available for new loans from the last bond issuance and that the I–Bank will likely issue a third series of revenue bonds sometime in 2008–09 to provide an additional $50 million for loans. Based on the average length of time it has taken the I–Bank to loan out bond funds, we estimate that it would take two years or longer to loan out the entire $70 million. Given the average loan amount of between $3 million and $5 million, this would allow the I–Bank to make about eight to ten loans a year for the next two years—on par with the level of new loan activities in recent years.

We recommend the enactment of legislation to provide further direction to the Infrastructure and Economic Development Bank on achieving the objectives of the Infrastructure State Revolving Fund program. This should include a provision to require projects to demonstrate economic development and land use benefits to be eligible for the program.

As mentioned previously, the purpose of the ISRF program is to provide infrastructure financing for projects that (1) provide for economic development, and (2) promote improved land use. While the ISRF program has helped local governments to make infrastructure improvements, our review shows that the program is not meeting statutory objectives and could better target limited state funds.

Economic Development and Improved Land Use Merit Increased Focus. To evaluate and rank potential projects for their eligibility for funding, the I–Bank uses 13 criteria and a project scoring system with a maximum 200 possible points as shown in Figure 3. A project must score at least 80 points to be eligible for an ISRF loan.

|

|

|

Figure 3

Infrastructure State Revolving Fund Program

Project Scoring Criteria |

|

|

Maximum Points |

|

Economic Development Impact |

50 |

|

Job creation/retention |

30 |

|

Economic base employers |

10 |

|

Community economic development plan |

10 |

|

Community Economic Need |

55 |

|

Unemployment rate |

20 |

|

Median family income |

15 |

|

Change in labor force |

10 |

|

Poverty rate |

10 |

|

Land Use, Environmental Protection, and

Housing |

40 |

|

Land use |

20 |

|

Environmental protection |

10 |

|

Housing element |

10 |

|

Others |

55 |

|

Quality of life/community amenities |

30 |

|

Leverage |

15 |

|

Project readiness |

10 |

|

Total Possible Points |

200 |

|

|

Our review shows that the current scoring system does not effectively target funds to projects to provide economic development and promote better land use. Specifically, our review of approved ISRF loans indicates (1) the majority of projects that received loans have little or no economic development impact, and (2) projects do not need to have much impact on improving land use to receive loan funds.

- Many Projects Approved Despite Scoring Zero on Economic Development. As shown in Figure 3, the scoring criteria uses three measures of a project’s economic development impact. Together, these measures account for one–quarter of the maximum possible score for a project. “Job creation/retention” measures a project’s contribution to the development and retention of permanent jobs. “Economic base employers” assesses whether a project will benefit employers that bring revenues into the community from sales outside the region. Lastly, “community economic development plan” measures the cooperativeness of project sponsors with local economic and job development programs. Our review of all 81 projects that received ISRF financing, however, shows that two–thirds of them scored zero points on all three measures.

- Land Use Objectives Receive Little Weight in Project Selection. Statute requires the I–Bank to consider the State Environmental Goals and Policy Report (SEGPR) in the development of project selection criteria for the ISRF program. The SEGPR sets forth statewide land use and environmental goals and suggests policies to achieve those goals. As Figure 3 shows, the weight of the land use criterion is worth a maximum of 20 points, or 10 percent of the total score. This weight does not appear to be large enough to ensure that projects that receive funding from the program will have any significant land use impact. It would be possible for a project to receive an ISRF loan even if it fails to achieve land use objectives. For instance, a project could score zero in the land use category and still receive an overall score high enough to qualify for a loan.

The ISRF program provides a service to local governments by assisting them in making infrastructure improvements at a lower cost than if financing is obtained from the private market. We think that the program can be made to better promote the state’s economic development and land use objectives by targeting limited funds to those projects that demonstrate the desired benefits in their applications. Specifically, we recommend enactment of legislation to require that all ISRF–funded projects demonstrate at least a minimum level of economic development and land use benefits. For instance, projects could be required to achieve a portion, such as one–half, of their overall score from the economic development and land use criteria. Another approach would be to screen potential projects for economic development and land use benefits to ensure that only projects meeting the stated goals of the program are allowed to compete for funding.

The budget requests four positions to augment staff for the Infrastructure State Revolving Fund program. Our review shows that two of these positions are not justified on a workload basis. Accordingly, we recommend rejecting two positions for a reduction of $219,000. (Reduce Item 0520–001–0649 by $219,000.)

The budget requests seven new positions for the I–Bank in 2008–09, including four positions to handle ISRF program workload. The four positions include two loan officers, an accounting position, and an office assistant. Our review of the program’s workload shows that two of the requested positions are not justified on a workload basis.

- New Loan Activity Has Declined While Staffing Remained the Same. As discussed earlier, the program’s new loan workload has not increased in recent years. In fact, as shown in Figure 2, the number and value of new loans issued by the ISRF program has declined since 2001–02. For instance, the I–Bank issued six loans worth $24 million in 2006–07 and thus far in 2007–08 it has approved four new loans worth $13.7 million. This level of activity is substantially lower when compared to 21 loans (worth $81 million) in 2001–02. However, the number of staff assigned to the program has remained at about the same level as it was in 2001–02.

- New Loan Activity Not Expected to Increase in 2008–09. As mentioned previously, the volume of new loans that the program will be able to make in 2008–09 is likely to remain at the lower levels seen in recent years. This expected level of new loan activity does not provide justification for an increase in staffing.

- Workload Associated With Existing Loans Has Increased. The workload to service and manage the portfolio of outstanding loans is handled in part by by accounting staff. For every approved loan, certain loan information must be entered into an accounting system, and repayments must be collected. Some of this accounting workload has increased, and appears to justify the addition of one accounting position. Other workload is performed by loan officers and is related mostly to the disbursement of funds. Disbursement workload does not appear to have increased and is relatively stable from year to year. This is because as new loans are approved and require disbursements, workload on older loans drops off as funds for them are fully disbursed. Additional disbursement workload will only increase by the extent to which new loans are made. In view of this stable workload, the request for an additional loan officer is not justified.

Accordingly, we recommend that the request for two loan officer positions be rejected, for a reduction of $219,000.

The Infrastructure and Economic Development Bank (I–Bank) is required to provide an annual report to the Legislature on its activities. The report, however, does not provide sufficient information to evaluate the performance of specific programs. We recommend that the I–Bank be directed to provide additional information necessary to facilitate legislative oversight.

Legislative Oversight Hampered by Limited Information. The I–Bank is required by statute to submit an annual report to the Legislature by November 1 of each year. The report currently provides a consolidated financial snapshot of the I–Bank as a whole, and provides some information on loan applications to the ISRF program. The report however does not provide financial information specific to the programs administered by the bank. Therefore, it is not possible to separately identify activities in the ISRF program; account for program and loan activities, workload levels, and program costs; or assess the program’s performance in terms of the types and amounts of financial assistance applied for and subsequently granted. For instance, the level of funding provided for the ISRF program for loans and support cannot be determined from the annual report. Discussions with I–Bank staff have yielded some estimates of how much funding this program has received since its inception, but the use of these funds cannot be accounted for completely.

Additional ISRF Information Needed. To provide better information to facilitate legislative oversight of the I–Bank’s activities, we recommend amending current law to expand the I–Bank’s reporting requirement to include the following additional information in its annual report.

- The amount and source of main categories of revenues (such as interest earnings, fees collected, and bond proceeds) by program, specifically providing separate information for the ISRF program.

- The amount and type of major categories of expenditures (such as loans provided, debt service payments, and program support costs) by program, specifically providing separate information for the ISRF program.

- For the ISRF program, a summary of the number of preliminary applications that did not receive funding and the reason the sponsor or project did not qualify.

Return to General Government Table of Contents, 2008-09 Budget AnalysisReturn to Full Table of Contents, 2008-09 Budget Analysis