Retirement system boards, such as the California Public Employees’ Retirement System (CalPERS) Board of Administration, have the authority to undertake actuarial reviews of their pension systems and to administer funds for the benefit of system members. Employees and retirees of the state and many local governments are members of CalPERS. Assets and liabilities related to each public employer are accounted for separately. Control Section 3.60 specifies the state’s contribution rates for state employees in CalPERS.

In order to fund defined monthly benefits for retired public employees, CalPERS uses (1) returns generated from its investment portfolio—which was valued at $246 billion as of January 10, 2008—and (2) contributions made by public employees and employers. The system reported that actuarial accrued liabilities of its Public Employees’ Retirement Fund (PERF) were 87 percent funded as of June 30, 2006. This means the PERF had a $29.1 billion unfunded actuarial accrued liability (UAAL) at that time. Of this amount, $15.4 billion represents the portion of the UAAL attributable to the state. Local governments and school districts are responsible for the other liabilities.

State law and labor agreements define retirement benefits that state employees earn as part of their compensation, as well as employees’ contributions to cover part of the costs of those benefits. The state also makes employer contributions to CalPERS. These contributions cover the estimated cost of pension benefits earned by employees in each pay period (normal cost), as well as costs to eliminate (over time) any unfunded liabilities for employees’ and retirees’ prior service. In defined benefit programs, such as those of CalPERS, unfunded liabilities emerge when actuarial assumptions related to annual investment returns, employee pay levels, and demographic factors are not met. Since these trends cannot be predicted with precision, CalPERS’ contribution rates change from year to year—sometimes increasing and sometimes decreasing.

Other items in the budget outside of the control section also relate to CalPERS, including Item 1900 (which budgets certain CalPERS operational funds) and Item 9650 (which appropriates the majority of funds required to meet health and dental benefit obligations to state government and California State University retirees).

The Governor’s budget assumes that 2008–09 pension contribution rates remain the same as in 2007–08. The 2008–09 contribution rates will be based on investment returns and demographic trends in the California Public Employees’ Retirement System (CalPERS) through June 30, 2007. These trends currently are under review by CalPERS actuaries as part of the annual actuarial report process, which typically concludes in May. We withhold recommendation on the 2008–09 CalPERS’ contribution rates pending their final determination through this process.

Healthy Investment Returns Have Helped Reduce Pension Rates Recently. In 2005–06, the investment return of CalPERS’ assets totaled about 12 percent, compared to the system’s normal projected investment return of under 8 percent annually. This favorable investment return contributed to the slight declines in the state’s contribution rates for most pension classes during 2007–08, as shown in Figure 1. The state’s 2008–09 pension contribution rates will be based in part on CalPERS’ investment performance during 2006–07, when its assets earned a return of over 19 percent. This outstanding performance was led by a (1) 30 percent return on international stocks, (2) 23 percent return on alternative investments such as private equity and venture capital, (3) 21 percent return on U.S. stocks, and (4) 20 percent return on real estate holdings.

|

|

|

Figure 1

State Retirement Contribution Rates |

|

1995‑96 Through 2008‑09 (As Percent of

Payroll) |

|

Fiscal Year |

Misc.

Tier 1 |

Misc.

Tier 2 |

Industrial |

Safety |

Peace Officer/

Firefighter |

Highway Patrol |

|

1995‑96 |

12.4% |

8.3% |

9.0% |

14.2% |

14.4% |

14.8% |

|

1996‑97 |

13.1 |

9.3 |

9.3 |

14.7 |

15.4 |

15.9 |

|

1997‑98 |

12.7 |

9.8 |

9.0 |

13.8 |

15.3 |

15.5 |

|

1998‑99 |

8.5 |

6.4 |

4.6 |

9.4 |

9.6 |

13.5 |

|

1999‑00 |

1.5 |

— |

— |

7.5 |

— |

17.3 |

|

2000‑01 |

— |

— |

— |

6.8 |

2.7 |

13.7 |

|

2001‑02 |

4.2 |

— |

0.4 |

12.9 |

9.6 |

16.9 |

|

2002‑03 |

7.4 |

2.8 |

2.9 |

17.1 |

13.9 |

23.1 |

|

2003‑04 |

14.8 |

10.3 |

11.1 |

21.9 |

20.3 |

32.7 |

|

2004‑05 |

17.0 |

13.2 |

16.4 |

20.8 |

23.8 |

33.4 |

|

2005‑06 |

15.9 |

15.9 |

17.1 |

19.0 |

23.6 |

26.4 |

|

2006‑07 |

17.0 |

16.8 |

17.9 |

19.3 |

24.5 |

31.5 |

|

2007‑08 |

16.6 |

16.6 |

17.3 |

18.8 |

25.6 |

32.2 |

|

2008‑09a |

16.6 |

16.6 |

17.3 |

18.8 |

25.6 |

32.2 |

|

|

|

a Budgeted. |

|

|

Other Demographic Factors May Affect Contribution Rates. The CalPERS’ actuaries report that after many public employees’ pension benefits were enhanced in 2000, assumptions about the numbers of retirements over the next few years were decreased after an initially anticipated rise in retirement activity failed to materialize. Recently, however, CalPERS’ actuaries have noted increases in state employee retirements not assumed in the system’s current actuarial models. In 2004–05, for example, retirements were 50 percent higher than anticipated by these models, and in 2005–06, while retirements declined, they were still 26 percent greater than actuarial assumptions. One possible cause of the changes is the enactment of laws allowing CalPERS members to purchase up to five years of additional retirement service credit (commonly known as “airtime”). The system has reported that it is conducting an “experience study” to examine these and other demographic changes in more detail. Based on the study, the system may modify its actuarial assumptions about future retirement

activity or increase the purchase costs of airtime. These pension system demographic issues temper what would otherwise be our expectation of declines in the state’s pension contribution rates.

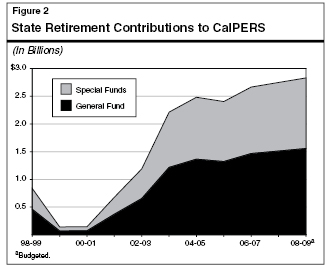

Total Contributions Should Rise, Due to Larger Payroll. While the Governor’s budget assumes that required state contribution rates to CalPERS remain steady, it also assumes that the state’s total contributions increase due to payroll growth. Figure 2 shows recent trends in the state’s total contributions from the General Fund and special funds, including the amount assumed in the Governor’s budget. This budget assumes that state contributions grow from $2.7 billion in 2007–08 to $2.8 billion in 2008–09, up 3 percent. Over one–half of this amount (an estimated $1.6 billion) would be paid from the General Fund.

Withhold Recommendation. We withhold recommendation on the control section pending CalPERS’ final determination of required 2008–09 contribution rates, which typically occurs in May. The administration should be able to submit any necessary revisions to the control section and in budgeted pension contribution funds with the May Revision or soon thereafter.

In 2007, the California Public Employees’ Retirement System (CalPERS) changed its method for communicating the funding status of its pension funds to policy makers and the public. The new method suggests that CalPERS’ major pension funds have eliminated nearly all of their unfunded liabilities, despite the fact that CalPERS’ own method for setting employer pension contribution rates continues to identify large unfunded liabilities. We believe that this inconsistency may confuse policy makers and the public concerning the financial condition of CalPERS’ pension funds.

CalPERS’ Policies for Setting Employer Pension Contribution Rates. Almost all public pension systems disclose their unfunded liabilities using a smoothed, actuarially determined value of assets. These figures, in turn, are used to determine employer contribution rates. In 2005, the CalPERS Board of Administration adopted a policy to smooth its pension funds’ asset gains and losses over 15 years when setting employer contribution rates—a change from the prior policy (still used by many other pension funds) to smooth changes of asset values over three years. This policy was implemented to prevent the volatility in employers’ annual contribution rates that occurred in the late 1990s and early 2000s due largely to swings in the stock market.

CalPERS Has Started Using the Market Value of Assets in Discussing Unfunded Liabilities. The CalPERS’ large unfunded pension liabilities—recently exceeding $20 billion for the PERF—have been a major issue for the public and policy makers in recent years. In 2007, CalPERS changed how its officials and key public documents disclosed its unfunded pension liabilities. Instead of describing its liabilities based on the smoothed value of assets used to set employer rates, CalPERS began publicly disclosing this financial indicator based on a calculation that uses the market value of its assets. (In technical documents CalPERS also discloses unfunded liabilities based on the earlier method of calculation.) Due to CalPERS’ strong investment gains in recent years, this change allowed the system suddenly to start discussing how its major pension funds were fully funded or approaching “full funding” during 2007.

Under the Method Used to Set Employer Rates, CalPERS Still Has Significant Unfunded Liabilities. The CalPERS’ new method of discussing its unfunded liabilities is inconsistent with its method for setting employer rates. We believe this may lead to confusion among policy makers and the public about the financial condition of CalPERS’ pension funds. With the smoothed value of assets used by the system to set employer rates, PERF had a $29 billion unfunded liability as of June 30, 2006 (meaning its liabilities were 87 percent funded). With the market value of assets now used by the system in discussing its unfunded liabilities, PERF had a $17 billion unfunded liability on the same date (suggesting its liabilities were 93 percent funded). This is because the market value of PERF assets was $12 billion greater on that date than its smoothed value of assets. Given the system’s strong investment performance in 2006–07 and the resulting growth in the market value of its assets, the disparity between these two measures probably expanded in subsequent months through the end of 2007. Accordingly, CalPERS has claimed its system is now approaching full funding.

CalPERS Should Be Consistent in Discussing Unfunded Liabilities. In our Analysis of the 2006–07 Budget Bill (see page F–121), we discussed the merits of CalPERS’ policy to reduce volatility in public employers’ contribution rates. The system’s new method for discussing unfunded liabilities means that this key pension system indicator now will be subject to the same type of volatility CalPERS sought to avoid in contribution rates. In the short term, the new method may allow CalPERS to report the elimination or near–elimination of its unfunded liabilities. This is a concern because it may lead some policy makers and employee groups to conclude incorrectly that the state could lower pension contribution rates or increase pension

benefits. We believe that the system should disclose its unfunded liabilities in a manner consistent with its contribution rate methodology—using the smoothed value of assets. This would be consistent with the accepted method of reporting liabilities in public financial statements. It would also make CalPERS’ disclosures more consistent with those used by nearly all other public pension systems.

The Public Employee Post–Employment Benefits Commission recommends that all public pension plans have periodic performance audits performed by independent auditors. Current law requires the California Public Employees’ Retirement System (CalPERS) to have an independent audit annually, but restricts the ability of the Bureau of State Audits or Department of Finance to review CalPERS’ books and operations. This restriction lacks clarity and could be construed to limit the Legislature’s authority to request performance audits of certain CalPERS programs. Accordingly, we recommend that the Legislature enact a law that repeals or clarifies this restriction.

PEBC Report Contains 34 Recommendations for the State and Local Governments. The Public Employee Post–Employment Benefit Commission’s (PEBC’s) over–300–page report lists 34 recommendations for California state and local policy makers—grouped into eight general categories. The report also includes results from new surveys of the financial condition of the state’s public retirement systems, as summarized in the nearby text box. The report contains several recommendations to promote independent analyses of pension system operations and transparency for policy makers, system members, and the general public.

Commission Was Directed to Identify State and Local Liabilities. The Public Employee Post–Employment Benefits Commission (PEBC) was asked to estimate the total amount of unfunded pension liabilities for the state and local governments and make recommendations for how policy makers should address these liabilities. The PEBC found that the total amount of unfunded public pension liabilities in California was $63.5 billion. With unfunded actuarial accrued liabilities of nearly $50 billion between them, the two largest public pension funds—the California Public Employees’ Retirement System and the California State Teachers’ Retirement System—account for the majority of the liabilities, which are attributable to the state, California State University, and local government employers enrolled in the two systems. The PEBC report stated that the aggregate funded ratio for all public pension systems in the state was 89 percent. The commission relied on conventional pension statistics in compiling this data.

In General, Sound Recommendations for Policy Makers. We are still reviewing the commission’s thorough report. In general, we concur with the spirit of its recommendations—to enhance the financial status, transparency, and governance of the state’s public retirement systems. We believe that adoption of some of the commission’s key suggestions by state and local leaders will help policy makers in the difficult task of considering what retirement benefits are best suited for each public entity’s workforce.

Commission Recommends More Independent Audits of Pension Systems. The PEBC recommends that “all public pension plans should have periodic performance audits performed by an independent auditor.” Pension systems, including CalPERS, already are required to hire an outside, independent accounting firm each year to audit their financial records to ensure compliance with generally accepted accounting rules. However, current law, the commissioners conclude, “does not provide for regular performance audits of public retirement systems,” which “could look at any aspect of the workings of a retirement system (administrative, investment, or benefit delivery), compare policies to practice, and provide valuable insight into how operations might be improved.” We concur with this recommendation.

Current Law Restricts Ability of Legislature to Request Such Audits. Section 20228 of the Government Code requires CalPERS to have its financial records audited annually by an independent accountant. The law, however, states that “the audits shall not be duplicated by the Department of Finance (DOF) or the State Auditor.” In state government, DOF and the Bureau of State Audits (BSA) are the principal entities that the Legislature may direct to conduct performance audits of government programs. This code section is unclear if these restrictions also apply to DOF and BSA concerning performance audits.

Recommend Repealing or Clarifying Restriction. Accordingly, we recommend repealing or clarifying the law so that DOF and BSA may conduct performance audits on the programs of CalPERS. This would allow the Legislature, including the Joint Legislative Audit Committee, to request performance audits of CalPERS without any restrictions, similar to the way that lawmakers may request audits of other state programs.

Return to General Government Table of Contents, 2008-09 Budget AnalysisReturn to Full Table of Contents, 2008-09 Budget Analysis