The California State Teachers’ Retirement System (CalSTRS) administers pension and other benefits for about 800,000 current and former educators of school and community college districts. In order to fund defined monthly benefits to eligible retired teachers, CalSTRS uses (1) returns generated from its $174 billion investment portfolio and (2) contributions made pursuant to state law by teachers, districts, and the state.

Under current law, the state must make two separate annual payments to CalSTRS from the General Fund:

- A payment of about 2 percent of prior–year teacher payroll for CalSTRS’ Defined Benefit (DB) Program, which funds the basic pension benefits of retired teachers.

- A payment of 2.5 percent of prior–year payroll for the Supplemental Benefit Maintenance Account (SBMA), which is also known as the “purchasing power account.” The SBMA funds prevent erosion of the purchasing power of retirees’ benefits by the effects of inflation.

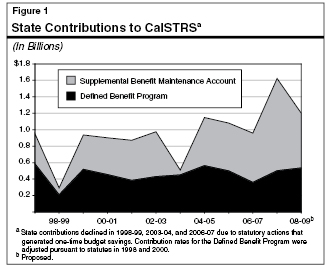

Figure 1 shows that the state’s contributions to CalSTRS in recent years have been volatile due to several prior legislative actions that have produced one–time budget savings. The 2008–09 Governor’s Budget proposes $1.1 billion to cover the two regular annual payments to the DB Program and SBMA, about the same amount as those two regular payments during 2007–08. In addition, the budget reflects increased expenditures in 2007–08 and 2008–09 due to a court order described below which reverses legislative action in 2003–04. In total, the administration estimates that state contributions to CalSTRS will total $1.6 billion in 2007–08 and proposes $1.2 billion in contributions in 2008–09.

The most recent California State Teachers’ Retirement System actuarial valuation reported that the system’s unfunded liability declined for a second consecutive year to $19.6 billion in 2006. Measured as a percentage of the system’s total liabilities, this unfunded liability is about average among comparable pension systems.

System Is 87 Percent Funded, With $19.6 Billion Unfunded Liability. The system’s actuaries reported that, as of June 30, 2006, CalSTRS’ unfunded actuarial obligation for its DB Program was $19.6 billion, and the actuarially determined value of DB Program assets on hand was $150 billion (the bulk of the system’s assets). This means that the program is 87 percent funded. According to a recent report by the Pew Center for the States, the average state pension system in the U.S. is 85 percent funded.

Proposal to Address Liabilities Would Require Legislative Approval. In 2006, the Teachers’ Retirement Board (TRB), the governing body of CalSTRS, formulated a general proposal to address the unfunded liability but has yet to formally submit it to the Legislature. Among other provisions, the proposal would give TRB the authority to increase required contributions by teachers, districts, and the state. The Legislature must approve any such change in TRB’s authority.

The administration complied with part of a recent court order and paid in 2007–08 $500 million withheld from the California State Teachers’ Retirement System (CalSTRS) purchasing power account in 2003–04. To comply with another part of the order—to pay over $200 million in interest—the administration proposes to pay the costs over a three–year period beginning in 2008–09. Unless CalSTRS and other parties in the case agree to this payment plan, we recommend that the Legislature reject it because it probably would be legally unworkable. If CalSTRS and the other parties do not agree to the plan, we recommend that the Legislature comply with the court order and appropriate funds to pay the entire interest obligation, as well as other court–ordered costs, in the 2008–09 Budget Act or earlier.

Administration Lost Its Appeals on CalSTRS SBMA Lawsuit. In our Analysis of the 2007–08 Budget Bill (see page F–67), we described the lawsuit related to the state’s withholding $500 million from CalSTRS’ purchasing power account on a one–time basis in 2003–04. In 2007, an appellate court ruled against the administration, and the California Supreme Court declined to hear further appeals. To comply with the court order, the state made a $500 million principal payment to CalSTRS in September 2007. In addition to the principal payment, the courts have ordered the state to pay (1) interest in specified amounts “until the date that the $500 million is deposited into the SBMA” and (2) costs of the other parties in the case. The administration estimates that the interest costs total about $210 million. The other parties’ legal costs may total around $11,000.

Budget Proposal Would Pay Interest Costs Over Three–Year Period. The $500 million principal payment was paid to CalSTRS under the terms of the continuous appropriation for the SBMA. In contrast, the payment of interest requires an appropriation by the Legislature. The administration proposes that the Legislature approve a plan to pay the court–ordered interest over three years beginning with a payment of $80 million in 2008–09. Specifically, the administration proposes that the payments for interest and court costs be appropriated in the annual claims bill.

Ability to Delay Interest Payments Is Uncertain. The court order does not mention the possibility of paying interest over a multiyear period. In addition, we are not aware of precedent in similar cases to pay interest costs over a multiyear period without agreement from the other litigating parties. (In this case, the other parties are CalSTRS and a group representing retired teachers.) If these other parties were to agree to such a payment plan, they probably would insist on even larger payments from the state over time to compensate for the investment returns that CalSTRS would likely forego as a result of giving up the ability to begin investing the entire interest payment immediately. In short, without the other parties agreeing to the administration’s payment plan, the viability of such a measure in the courts is very uncertain. With such an agreement, state costs would likely increase even more in future years.

Recommend Paying Interest in One Lump Sum. Barring an agreement from the other parties to pay the required interest over several years at no additional state cost, we recommend that the Legislature comply with the court order and appropriate funds to pay the entire interest obligation (as well as any court–ordered costs) in the 2008–09 budget or earlier. This would increase General Fund costs over the two–year period of 2007–08 and 2008–09 by over $130 million, compared to the administration’s budget plan. This approach, however, limits the potential for any future liabilities from this case.

We recommend that the Legislature reject the administration’s proposed trailer bill language to (1) guarantee retirees’ purchasing power benefits through the California State Teachers’ Retirement System (CalSTRS) and (2) reduce General Fund costs by $80 million in 2008–09. There are major risks in assuming that the proposed change will generate budget savings, and we are concerned about the idea of the state guaranteeing another benefit through CalSTRS, which serves employees of local districts.

Budget Proposes Changing State Payments and Guaranteeing the Benefit. As the administration proposed one year ago, the Governor’s budget again proposes changing the annual SBMA appropriation from 2.5 percent of prior–year teacher payroll to 2.2 percent. The administration proposes amending the law to guarantee CalSTRS members that they will receive the current SBMA benefit: 80 percent of the purchasing power of the retiree’s original monthly benefit, as measured by annual inflation increases. Currently, this benefit is not guaranteed and instead must be paid to retirees by CalSTRS only to the extent funds are available in the account. This year’s administration proposal, unlike last year’s, also proposes that the annual SBMA payments be made in two equal payments on November 1 and April 1 of each year. Currently, the state makes one SBMA payment each year on July 1.

This Year’s Proposal Is Less Likely to Be Workable Than Last Year’s. Longstanding California case law in the area of public employees’ retirement benefits requires that a government’s changes in pension benefits resulting in disadvantages to employees be accompanied by “comparable new advantages” for those same employees. In the Analysis of the 2007–08 Budget Bill (see page F–68), we discussed some of the legal risks of the administration’s earlier SBMA proposal. The Legislature did not approve the administration’s proposal, and a payment equal to 2.5 percent of prior–year teacher payroll was paid to CalSTRS’ SBMA account in early July under its continuous appropriation (while the Legislature was still deliberating on the 2007–08 Budget Act.) This year’s administration proposal carries greater legal risks. The new advantages to CalSTRS members under the proposal (a guarantee of the current SBMA benefits for the first time) are clear, though not quantifiable in their value. At the same time, the disadvantages to employees (reduction in the state’s annual payments and the delay in those payments past July 1, which would diminish CalSTRS’ ability to earn investment returns) are substantial and able to be estimated. The addition of the proposal to delay the state’s payments, therefore, reduces the chance that the plan would be legally workable. (Statutory changes related to SBMA probably would need to be enacted into law prior to July 1 in order to reduce 2008–09 General Fund costs.)

Proposed Language Could Add State Costs. On January 31, 2008, the administration submitted trailer bill language to implement its proposals. These provisions would give TRB the authority to set the state’s contribution rates for SBMA beginning in 2009–10. Based on prior actions of the TRB and statements by CalSTRS’ consulting actuaries, this raises the strong possibility that state contribution rates would rise back to 2.5 percent of prior–year payroll or even higher after the budget year. As a result, the state could end up paying more each year under the administration’s proposal. We will provide additional analysis of these provisions during budget subcommittee hearings.

Legislature Should Pursue Broader Reforms. An actuarial valuation obtained by the administration indicates that the current–law contributions to SBMA may, over time, lead to the account accumulating a significant fund balance. In contrast to the Governor’s proposal, we believe that any excess moneys should be used to first shore up the financial condition of the DB Program as part of a comprehensive reform of CalSTRS. We recommend reforms that (1) place clear responsibility on local districts to fund their own teacher retirement benefits in the future and (2) give districts and their teachers and administrators greater flexibility to determine the level of retirement benefits they wish to fund. The administration’s proposal, by contrast, means the state would be guaranteeing yet another benefit for local districts’ employees. This proposal moves CalSTRS in the wrong direction.

Recommend Rejecting Administration’s Proposal to Change SBMA Benefits. Given both the legal risks and our policy concerns, we recommend that the Legislature reject the administration’s proposed changes to SBMA benefits. This would increase General Fund costs by $80 million in 2008–09.

The Public Employee Post–Employment Benefits Commission recommends that all public pension plans have periodic performance audits performed by independent auditors. Current law requires the California State Teachers’ Retirement System (CalSTRS) to have an independent audit annually, but restricts the ability of the Bureau of State Audits or Department of Finance to review CalSTRS’ books and operations. This restriction lacks clarity and could be construed to limit the Legislature’s authority to request performance audits of certain CalSTRS programs. Accordingly, we recommend that the Legislature enact a law that repeals or clarifies this restriction.

PEBC Report Contains 34 Recommendations for the State and Local Governments. The Public Employee Post–Employment Benefits Commission (PEBC) report lists 34 recommendations for California state and local policy makers—grouped into eight general categories. The report contains several recommendations to promote independent analyses of pension system operations and transparency for policy makers, system members, and the general public.

Commission Recommends More Independent Audits of Pension Systems. The PEBC recommends that “all public pension plans should have periodic performance audits performed by an independent auditor.” Pension systems, including CalSTRS, already are required to hire an outside, independent accounting firm each year to audit their financial records to ensure compliance with generally accepted accounting rules. However, current law, the commissioners conclude, “does not provide for regular performance audits of public retirement systems,” which “could look at any aspect of the workings of a retirement system (administrative, investment, or benefit delivery), compare policies to practice, and provide valuable insight into how operations might be improved.” We concur with this recommendation.

Current Law Restricts Ability of Legislature to Request Such Audits. Section 22217 of the Education Code requires CalSTRS to have its financial records audited annually by an independent accountant. The law, however, states that “the audits shall not be duplicated by the Department of Finance (DOF) or the State Auditor.” In state government, DOF and the Bureau of State Audits (BSA) are the principal entities that the Legislature may direct to conduct performance audits of government programs. This code section is unclear if these restrictions also apply to DOF and BSA concerning performance audits.

Recommend Repealing or Clarifying Restriction. Accordingly, we recommend repealing or clarifying the law so that DOF and BSA may conduct performance audits on the programs of CalSTRS. This would allow the Legislature, including the Joint Legislative Audit Committee, to request performance audits of CalSTRS without any restrictions, similar to the way that lawmakers may request audits of other state programs.

Return to General Government Table of Contents, 2008-09 Budget AnalysisReturn to Full Table of Contents, 2008-09 Budget Analysis