2009-10 Budget Analysis Series: Health

California’s major health programs provide health coverage and additional support services for various groups of eligible persons—primarily poor families and children as well as seniors and persons with disabilities. Medi–Cal is by far the largest state health program both in terms of funding and persons served. In addition, the state supports health care insurance for children, various public health programs, substance abuse treatment programs, and community services and state–operated facilities for the mentally ill and developmentally disabled.

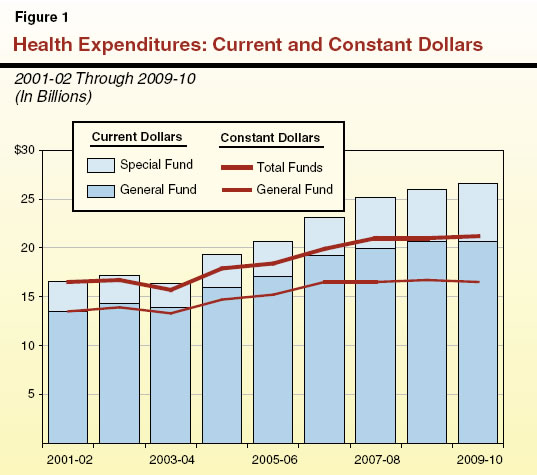

Expenditure Proposal and Trends

Budget Year. The budget proposes General Fund expenditures of $20.7 billion for health programs in the budget year, which is about 22 percent of total proposed General Fund expenditures. The budget proposes an increase of $14 million General Fund or 0.1 percent above adjusted spending for 2008–09, holding General Fund spending virtually flat compared to the current–year spending level. The budget also proposes to increase special funds spending for health programs by about $589 million, or 11 percent, to about $5.9 billion, due mainly to an administration proposal to shift support for drug and alcohol treatment programs to a new special fund.

Adjusting for Inflation. Figure 1 displays the spending for these programs adjusted for inflation (constant dollars) using the California Consumer Price Index. On this basis, General Fund expenditures are estimated to increase by almost 22 percent from 2001–02 through 2009–10. Combined General Fund and special funds expenditures from 2001–02 through 2009–10 are estimated to increase by 28 percent during this same period, an average annual increase of 3.1 percent.

Spending by Department

Figure 2 shows General Fund expenditures by department/agency for the prior year, current year, and budget year. It also shows the percentage change between the administration’s revised proposal for the current year and the budget year.

Figure 2

Governor’s January 10 Budget Plan—General Fund Spending |

(Dollars in Millions) |

|

|

|

|

Current Year to

Budget Year |

Department/Agency |

2007‑08 |

2008‑09a |

2009‑10b |

Difference |

Percent |

Department of Health Care Services |

$14,357.1 |

$14,731.2 |

$15,175.5 |

$444.3 |

3.0% |

Department of Developmental Services |

2,548.1 |

2,788.3 |

2,777.9 |

-10.4 |

-0.4 |

Department of Mental Health |

1,930.9 |

2,118.7 |

1,972.9 |

-145.8 |

-6.9 |

Managed Risk Medical Insurance Board |

389.4 |

399.9 |

406.4 |

6.5 |

1.6 |

Department of Public Health |

361.7 |

349.9 |

351.9 |

2.0 |

0.6 |

Department of Alcohol and Drug Programs |

285.1 |

299.0 |

— |

-299.0 |

-100.0 |

Emergency Medical Services Authority |

13.3 |

11.5 |

12.0 |

0.5 |

4.3 |

Secretary for Health and Human Services |

4.6 |

4.3 |

3.9 |

-0.4 |

-9.3 |

Office of Statewide Health Planning Development |

5.0 |

0.4 |

0.1 |

-0.3 |

-75.0 |

California Medical Assistance Commission |

1.3 |

1.3 |

1.3 |

— |

— |

State Council on Development Disabilities |

— |

— |

— |

— |

— |

General obligation bonds |

8.9 |

15.6 |

32.5 |

16.9 |

108.3 |

Totals |

$19,905.4 |

$20,720.1 |

$20,734.4 |

$14.3 |

0.1% |

|

a Revised. |

b Proposed. |

Major Health Programs

The state administers six major programs that represent almost 96 percent of the total health spending proposed by the administration. Figure 3 summarizes the actual and estimated General Fund expenditures for these programs from 2001–02 through 2008–09. As can be seen in Figure 3, between 2001–02 and 2008–09 General Fund spending has grown for all of the major health programs. The combined average annual growth rate for the programs shown in Figure 3 is 6.9 percent. In some cases, funding shifts between programs may make it appear as if a program is growing faster than is really the case.

Figure 3

Major Health Programs |

(In Millions) |

General Fund Spendinga |

2001‑02 |

2002‑03 |

2003‑04 |

2004‑05 |

2005‑06 |

2006‑07 |

2007‑08 |

Estimated 2008‑09 |

Medi-Cal |

$9,740.9 |

$10,554.1 |

$9,879.2 |

$11,592.6 |

$12,362.9 |

$13,406.0b |

$14,036.0 |

$14,413.7 |

Regional Centers |

1,342.1 |

1,510.6 |

1,582.1 |

1,718.7 |

1,831.3 |

2,106.8 |

2,120.9 |

2,366.4 |

Developmental Centers |

344.9 |

344.7 |

354.8 |

385.1 |

386.5 |

397.6 |

398.8 |

387.8 |

Community Mental Health Services |

383.0 |

324.9 |

306.1 |

303.9 |

313.6 |

775.2b |

766.1 |

849.2 |

Mental Hospitals/Long-Term Care Services |

488.7 |

507.0 |

573.6 |

660.9 |

802.2 |

959.2 |

1,099.4 |

1,202.5 |

Healthy Families Program |

2.1 |

24.1 |

276.4 |

288.4 |

316.7 |

347.7 |

387.0 |

397.5 |

Totals |

$12,301.7 |

$13,265.4 |

$12,972.2 |

$14,949.6 |

$16,013.2 |

$17,992.5 |

$18,808.2 |

$19,617.1 |

|

a Excludes headquarters. |

b Reflects technical funding shift in budget display from Medi-Cal to Community Mental Health Services. |

Description of Major Health Programs

Medi–Cal (DHCS). In California, the federal Medicaid program is administered by DHCS as the California Medical Assistance Program (Medi–Cal). The Medi–Cal Program provides health care services to qualified low–income persons, primarily consisting of families with children and the aged or disabled. Federal law establishes some minimum requirements for state Medicaid programs regarding the types of services offered and who is eligible to receive them. Required services include hospital inpatient and outpatient care, skilled nursing care, and doctor visits. In addition, California offers an array of services considered optional under federal law, such as coverage of prescription drugs and adult dental care. California also has expanded eligibility beyond the levels required under federal law. Figure 4 provides basic expenditure and caseload information on the program.

Figure 4

Medi-Cal General Fund Budget Summary

Department of Health Care Servicesa |

(Dollars in Millions) |

|

Expenditures |

|

Change From 2008‑09 |

|

Actual 2007‑08 |

Estimated 2008‑09 |

Proposed 2009‑10 |

|

Amount |

Percent |

Local Assistance |

|

|

|

|

|

|

Benefits (medical services) |

$13,167 |

$13,524 |

$13,976 |

|

$452 |

3.3% |

County Administration (eligibility processing) |

781 |

782 |

806 |

|

24 |

3.1 |

Fiscal Intermediary (claims processing) |

92 |

108 |

102 |

|

-6 |

-5.3 |

Totals, Local Assistance |

$14,040 |

$14,414 |

$14,884 |

|

$470 |

3.3% |

Support (State Operations) |

$128 |

$125 |

$127 |

|

$2 |

1.6% |

Caseload (Thousands) |

6,650 |

6,798 |

6,673 |

|

-125 |

-1.8 |

|

a Excludes General Fund Medi-Cal budgeted in other departments. |

Community Services Program (Department of Developmental Services [DDS]). This program provides community–based services to developmentally disabled persons through 21 nonprofit corporations known as regional centers (RCs) that are located throughout the state. The RCs are responsible for eligibility determinations and consumer assessment, the development of an individual program plan for each consumer, and case management. They generally pay for services only if an individual does not have private insurance or they cannot refer an individual to so–called “generic” services that are provided at the local level by counties, cities, school districts, and other agencies. The RCs also purchase services such as transportation, health care, day programs, and residential care provided by community care facilities. The department contracts with RCs to provide services to more than 230,000 clients each year.

Developmental Centers (DC) Program (DDS). The department operates five DCs, and two smaller leased facilities, which provide 24–hour care and supervision to approximately 2,400 clients. All of the facilities provide residential and day programs as well as health care and assistance with daily activities, training, education, and employment. About 6,900 permanent and temporary staff serve the current population of about 2,400 clients at all seven facilities. We note that Agnews DC is slated for closure in the current year and, at the time this analysis was prepared, only 64 clients remained there.

Community Services (DMH). Community mental health services include a variety of programs administered by DMH, generally through state–county partnerships. Based on total expenditures, the four biggest programs are services funded by the Mental Health Services Act (MHSA); Early and Periodic Screening, Diagnosis, and Treatment (EPSDT); Mental Health Managed Care (MHMC); and AB 3632 Special Education Pupils. Generally, the services provided by theses programs are intended to help improve the health and functionality of individuals with mental illness while also minimizing their potential for disability, homelessness, criminal activity, and hospitalization. Specifically:

- The MHSA, passed by voters in 2004, imposes a 1 percent income tax on personal incomes in excess of $1 million to support the expansion of community mental health services. Most MHSA services are provided by the counties, although some MHSA activities are coordinated by DMH at the statewide level.

- The MHMC program provides specialty mental health services to Medi–Cal eligible adults through county Mental Health Plans which are “carved out” of regular Medi–Cal services.

- The EPSDT, a federally mandated program, requires states to provide a broad range of screening, diagnosis, and medically necessary treatment services to Medi–Cal beneficiaries under age 21 even if these services are optional under the state’s Medicaid plan.

- Chapter 1747, Statutes of 1984 (AB 3632, W. Brown), and related statutes established the Special Education Pupils Program, also known as the “AB 3632” program, and shifted the responsibility for providing special education related mental health services from local education agencies to counties.

State Hospitals/Long–Term Care Services (DMH). The DMH administers the Long–Term Care Services Program, which includes the state’s five mental hospitals, the Forensic Conditional Release Program, and the Sex Offender Commitment Program. The state’s mental hospitals provide inpatient treatment services for judicially and civilly committed clients, mentally disabled county clients, and transfers from the California Department of Corrections and Rehabilitation (CDCR). In addition, the Long–Term Care Services Program manages state prison psychiatric treatment services at the California Medical Facility at Vacaville and at Salinas Valley State Prison.

Forensic patients are generally committed by the courts to state hospitals under one of four categories: “incompetent to stand trial” (ISTs), “mentally disordered offender” (MDOs), “not guilty by reason of insanity” (NGIs), and “sexually violent predator” (SVPs). Some inmates and wards of CDCR receive care in the Vacaville and Salinas Valley facilities, while additional offenders in the custody of CDCR are transferred to the state hospitals for mental health treatment. Also, counties contract with the state to purchase beds at state hospitals for adults and children committed for mental health treatment under the provisions of the Lanterman–Petris–Short (LPS) Act.

Healthy Families Program (HFP), (Managed Risk Medical Insurance Board [MRMIB]). The HFP was created in 1997, with funding provided under the federal SCHIP. Under SCHIP, California receives roughly two federal dollars for each state dollar used to provide health care coverage to children through HFP. Currently, over 900,000 children receive comprehensive health care—including dental, vision, and basic mental health benefits—through HFP.

The program allows low–income families to purchase subsidized health insurance for uninsured children. Specifically, children (ages 1 to19) in families making up to 250 percent of the FPL and infants (up to age 1) in families making up to 300 percent of the FPL are eligible for coverage through HFP. Eligible families pay monthly premiums based on their income, which range from $4 to $17 per child, up to a family maximum of $51 per family.

Caseload Trends and Cost Drivers For the Major Programs

As noted before, General Fund spending for major health programs grew at an average annual rate of 6.9 percent between 2001–02 and 2008–09. Much of the increase in General Fund expenditures has been driven by increases in caseload, costs, and utilization of services in Medi–Cal. In addition, increased expenditures for prescription drugs, hospitalization, and long–term care for the aged and disabled have been significant health cost drivers. Growth in caseload, and increased utilization and costs for services for persons with developmental disabilities has also contributed significantly to the increase in General Fund spending for health services. Similarly, the costs of operating state mental hospitals have more than doubled between 2001–02 and 2008–09 due in part to the opening of a new state hospital at Coalinga and enhanced staffing ratios that were implemented to address issues raised by the U.S. Department of Justice (U.S. DOJ) under the Civil Rights of Institutionalized Persons Act (CRIPA).

Major Budget Changes

Some Major Budget Proposals Are Continued. The budget plan reintroduces the major cost–reduction proposals that the administration put forward in the special sessions of the Legislature called in November and December 2008. These proposals include the following:

- Eliminate Medi–Cal Optional Benefits. Eliminate certain Medi–Cal optional benefits including dental, optometry, and psychology to achieve General Fund savings of $19.7 million in the current year and $129.4 million in the budget year.

- Implement Month–to–Month Eligibility for Undocumented Immigrants. Shift undocumented immigrants from annual to month–to–month Medi–Cal eligibility for General Fund savings of $4.8 million in the current year and $71.2 million in the budget year.

- Reduce Eligibility for the 1931(b) Program. Reduce income eligibility and modify eligibility for two–parent families for the Medi–Cal 1931(b) program for General Fund savings of $2.6 million in the current year and $88.6 million in the budget year.

- Shift Safety Net Care Pool Funding. Reduce reimbursement rates for public hospitals by $54.2 million in federal funds and instead use these federal funds to pay for certain health programs currently supported from the General Fund.

- Impose Share of Cost for Aged, Blind, and Disabled Individuals. Impose a share–of–cost requirement on certain aged, blind, and disabled Medi–Cal recipients for General Fund savings of $14.3 million in the current year and $185.8 million in the budget year.

- Limit Benefits for Certain Immigrants. Limit benefits to newly qualified immigrants and immigrants who permanently reside in the United States under the color of law to the same level as currently provided for undocumented immigrants, for General Fund savings of $9.4 million in the current year and $139.9 million in the budget year.

- Impose 3 Percent Reduction on RC Programs. Implement a 3 percent discount of payments made to RC service providers and RC operations, for General Fund savings of $24.6 million in the current year and $60.2 million in the budget year.

Budget Contains Major New Proposals. In addition to the above major cost–reduction proposals, the Governor’s January budget proposal includes the following additional major cost–reduction proposals:

- Fund MHMC With Proposition 63 Monies. The budget plan proposes to use almost $227 million of Proposition 63 monies to pay for MHMC in lieu of General Fund. Under Proposition 63, revenues are to be used to create new community mental health programs and to expand some existing programs. Due to Proposition 63’s non–supplantation requirements, voter approval would be required in order to implement this proposal.

- Establish Savings Target for RCs. The budget plan establishes a budget–year savings target of $334 million General Fund for RCs. According to the administration, DDS will work with the Legislature and stakeholders in the coming months to achieve $334 million in savings while ensuring RC program and service integrity are maintained. At the time this analysis was prepared, no specifics were available on how the savings would be achieved.

- Increase Alcohol Excise Tax to Fund Alcohol and Drug Programs. The budget plan proposes to raise the excise tax on each type of alcohol by a “nickel–a–drink” to generate an estimated $585 million annually in new revenues. These new revenues would be deposited in a new special fund called the Drug and Alcohol Prevention and Treatment Fund (DAPTF). Of the $585 million in new revenues, $312 million would support alcohol and drug programs in the Department of Alcohol and Drug Programs (DADP), $54 million would support such programs in the Department of Social Services (DSS), and $220 million would support such programs in CDCR. All of these programs are currently paid for from the General Fund.

- Delay Payment to Medi–Cal Providers. The budget plan proposes to delay payments to Medi–Cal providers at the end of the current year for a one–time General Fund savings of $85.5 million. The state generally makes weekly payments to Medi–Cal fee–for–service (FFS) providers to reimburse them for the claims they have submitted. The providers would receive a payment in the budget year that was due to them in the current year. This proposal is in addition to previously authorized delays.

- Suspend Cost–of–Living Adjustment (COLA) for County Administration. The budget plan proposes to suspend the statutory COLA for county administration in the Medi–Cal Program, for General Fund savings of $24.7 million in the budget year.

Overall Impact of Budget Plan on Health Programs. As described above, the budget proposes a negligible year–over–year General Fund spending increase for health programs in 2009–10. The administration’s plan holds General Fund spending virtually flat using two basic approaches:

- First, the budget plan proposes reductions to control expenditures that are generally caused by caseload, cost, and utilization growth. For example, the administration proposes to reduce: (1) caseload by tightening eligibility requirements for the 1931(b) program, (2) costs by imposing a 3 percent discount of payments made to RC operations and certain services, and (3) utilization by limiting the benefits received by certain immigrants.

- Second, the administration proposes alternative funding sources for certain programs. For example, the administration proposes to fund DADP with new revenues from an increase in the alcohol excise tax, which would be routed into a new special fund for drug programs. Another example of this approach is the administration’s proposal to fund the MHMC program with Proposition 63 funds instead of General Fund.

The overall budget–year impact of the spending plan on health programs would be to appreciably reduce services for Medi–Cal beneficiaries, RC clients, and some other programs. However, there would likely be little or no reduction in services for other health programs, such as HFP administered by MRMIB and the Drug Medi–Cal Program administered by DADP.

Return to Health Table of Contents, 2009-10 Budget Analysis SeriesReturn to Full Table of Contents, 2009-10 Budget Analysis Series