2009-10 Budget Analysis Series: Higher Education

The Governor’s budget proposal includes $11.5 billion in General Fund support for higher education in 2009–10. This is $561 million, or 5.1 percent, more than the Governor’s proposed funding level for 2008–09. The higher education budget includes funding for UC, CSU, CCC, Hastings College of the Law, CSAC, and CPEC. Funded activities include instruction, research, and related functions, as well as other activities, such as providing medical care at UC hospitals and managing three major U.S. Department of Energy laboratories.

Putting the Higher Education Budget In Context

Even though higher education would receive increased General Fund support under the budget proposal, it would receive less than the “workload” levels that the administration assumes would normally be required in the budget year. The administration projects that higher education would thus contribute about $1.5 billion toward closing the estimated $41.6 billion budget shortfall by the end of 2009–10.

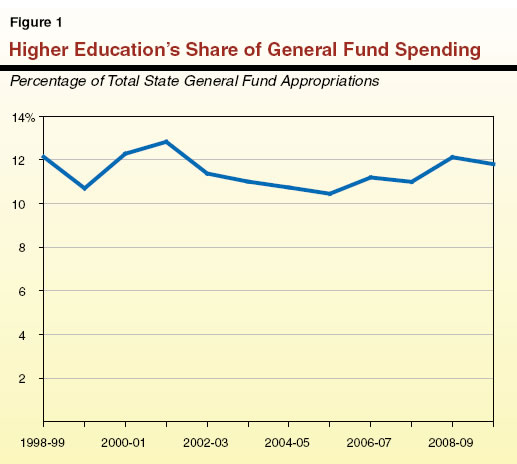

Higher Education’s Share of State Funding Same as a Decade Ago. Under the Governor’s proposal, higher education would receive about 11.8 percent of total state General Fund spending. As shown in Figure 1, higher education’s share of state spending has varied about one percentage point above or below this level over the past decade. Under the Governor’s proposal, higher education’s share would remain at about the same level as a decade ago.

Proposed Current–Year Reductions. The Governor’s proposed budget solutions include General Fund reductions to the three higher education segments in the current year. These include unallocated base reductions of $65.5 million and $66.3 million to UC and CSU, respectively. For CCC, the Governor proposes a current–year reduction of about $270 million, although most of this amount ($230 million) is simply a deferral of funding from 2008–09 to 2009–10, and thus would have no programmatic impact.

All Except CSAC Would Receive More General Fund Support in 2009–10. Under the Governor’s proposal, all higher education agencies except CSAC would receive increased General Fund support in 2009–10. In contrast, CSAC would receive about $170 million less than its revised current–year funding. This net General Fund reduction reflects a proposed $87.5 million cut to financial aid programs, as well as workload adjustments and nonprogrammatic funding swaps.

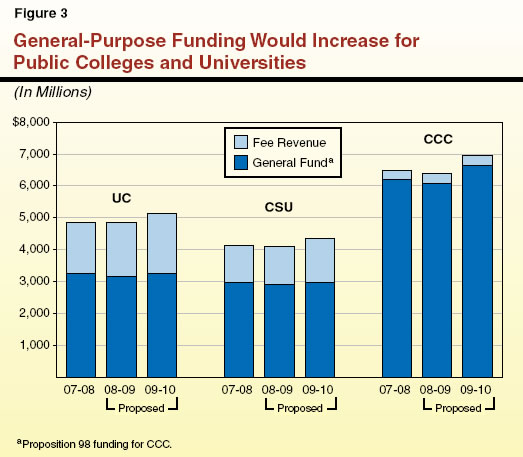

Modest Programmatic Increases for the Universities and Colleges. As opposed to CSAC (and most other state agencies), the higher education segments would realize modest year–to–year increases in their programmatic funding. For example, as shown in Figure 2, UC and CSU would receive substantial new revenue from fee increases in 2009–10. When fees and General Fund support are combined, UC and CSU would receive year–to–year increases of well over 5 percent. Even allowing that some new revenue would backfill other reductions (such as lottery income), the universities would experience net increases in general purpose funding. For CCC, the main sources of general–purpose support include General Fund, local property taxes, and student fees. These funds would increase by almost 9 percent year–to–year under the Governor’s proposal, although only about one–third of this increase would be available for programmatic needs (with the remaining increase primarily due to the proposed deferral and lottery changes).

Figure 2

Governor's 2009‑10 Higher Education Budget Proposal |

(Selected General Purpose Funds in Millions) |

|

2007‑08 |

2008‑09

Proposeda |

2009‑10

Proposed |

Change From 2008‑09 |

Amount |

Percent |

University of California |

|

|

|

|

|

General Fund |

$3,257.4 |

$3,135.0 |

$3,240.2 |

$105.2 |

3.4% |

Fee revenue |

1,593.1 |

1,734.7 |

1,903.1 |

168.4 |

9.7 |

Totals |

$4,850.6 |

$4,869.6 |

$5,143.3 |

$273.6 |

5.6% |

California State University |

|

|

|

|

|

General Fund |

$2,970.6 |

$2,871.8 |

$2,962.2 |

$90.5 |

3.1% |

Fee revenue |

1,176.3 |

1,251.3 |

1,382.9 |

131.6 |

10.5 |

Totals |

$4,146.9 |

$4,123.1 |

$4,345.1 |

$222.0 |

5.4% |

California Community Colleges |

|

|

|

|

|

General Fundb |

$4,170.0 |

$4,062.0 |

$4,597.0 |

$534.6 |

13.2% |

Local property taxes |

1,970.7 |

2,053.5 |

2,063.6 |

10.1 |

0.5 |

Fee revenue |

281.4 |

299.4 |

308.4 |

9.0 |

3.0 |

Totals |

$6,422.4 |

$6,415.4 |

$6,969.1 |

$553.8 |

8.6% |

All Other Agenciesc |

|

|

|

|

|

General Fund |

$879.4 |

$912.9 |

$743.1 |

-$169.7 |

-18.6% |

Fee revenue |

26.2 |

32.2 |

36.4 |

4.2 |

13.0 |

Student Loan Operating Fund |

94.9 |

130.0 |

106.1 |

-24.0 |

-18.4 |

Totals |

$1,000.5 |

$1,075.2 |

$885.6 |

-$189.5 |

-17.6% |

Grand Totals |

$16,420.4 |

$16,483.3 |

$17,343.2 |

$859.9 |

5.2% |

General Fund |

$11,277.7 |

$10,982.0 |

$11,542.6 |

$560.6 |

5.1% |

Fee revenue |

3,077.0 |

3,317.7 |

3,630.9 |

313.2 |

9.4 |

Local property tax |

1,970.7 |

2,053.5 |

2,063.6 |

10.1 |

0.5 |

Student Loan Operating Fund |

94.9 |

130.0 |

106.1 |

-24.0 |

-18.4 |

|

a Reflects General Fund reductions the Governor ordered as part of his 2008‑09 veto package and proposed midyear reductions. |

b Most, but not all, of this amount applies toward Proposition 98 appropriations. |

c California Student Aid Commission, Hasting College of the Law, and California Postsecondary Education Commission. |

Because the Governor’s proposals would affect the current and budget years, a fuller view of the combined effect can be achieved by comparing them to the prior year (2007–08). As Figure 3 shows, all three segments would receive more general–purpose funding in 2009–10 than they received in 2007–08.

Major Funding Proposals

Figure 4 summarizes the Governor’s major funding proposals for higher education. It shows that virtually all General Fund reductions for UC, CSU, and CCC are confined to the current year, while CSAC would receive significant General Fund reductions in the budget year. The figure also shows that a number of the General Fund adjustments in higher education would not have any programmatic effect. For example, all three segments would receive General Fund augmentations to replace revenue they would lose under the planned securitization of the state lottery.

Figure 4

Proposed Major Higher Education Funding Changesa |

|

University of California |

2008‑09: Net $82.3 million General Fund reduction |

-$65.5 million—Unallocated base reduction |

-$16.8 million—Nonprogrammatic, technical adjustments |

2009‑10: Net $105 million General Fund augmentation, plus $166 million in new fee revenue |

+$33.1 million—Restore one-time 2008‑09 veto reduction |

+$2.5 million—Nursing and medical program enrollment growth |

-$5 million—Phase out UC Merced start-up costs |

+$74.6 million—Nonprogrammatic, technical adjustments |

+$166.1 million—Revenues generated by 9.3 percent student fee increase |

California State University |

2008‑09: Net $67.6 million General Fund reduction |

-$66.3 million—Unallocated base reduction |

-$1.3 million—Nonprogrammatic, technical adjustments |

2009‑10: Net $90.5 million General Fund augmentation, plus $130 million in new fee revenue |

+$31.3 million—Restore one-time 2008‑09 veto reduction |

+3.6 million—Growth in nursing enrollment |

+$55.6 million—Nonprogrammatic, technical adjustments |

+$130 million—Revenues generated by 10 percent student fee increase |

California Community Colleges |

2008‑09: Net $269.8 million General Fund reduction |

-$39.8 million—Eliminate 0.68 percent cost-of-living adjustment |

-$230 million—Deferral of state spending to 2009‑10 |

2009‑10: Net $534.7 million General Fund augmentation |

+$185.4 million—3 percent enrollment growth |

-$4 million—Suspend state mandates |

+$353.3 million—Nonprogrammatic, technical adjustments (including effect of deferral of 2008-09 costs and replacement of lottery funds) |

California Student Aid Commission |

2008‑09: $92.6 million General Fund augmentation |

+$62.6 million—Growth in financial aid costs |

2009‑10: Net $169.5 million General Fund reduction |

+$87.5 million—Growth in financial aid costs |

-$87.5 million—Reduce and restrict Cal Grant benefits |

-$169.5 million—Nonprogrammatic, technical adjustments (swaps between General Fund and federal special funds) |

|

a General Fund, unless otherwise noted. |

Proposed Enrollment Total Is Below Current Level

As we describe in more detail in the “Enrollment and Access” section of this report, UC and CSU’s enrollment has grown in 2008–09, even though the budget provides no explicit augmentation for growth. The Governor’s budget for 2009–10 would once again provide no new funding explicitly for growth at the universities, and establishes enrollment floors that are substantially lower than estimated current–year enrollment. Accordingly, both universities have expressed their intent to reduce freshman enrollment in 2009–10.

Unlike the universities, CCC would receive an augmentation specifically for enrollment growth in 2009–10, raising its funded enrollment to about 1,236,000 full–time equivalent (FTE) students. However, preliminary estimates suggest that CCC has already achieved this level of enrollment in the current year. Thus, the target envisioned in the Governor’s budget for 2009–10 would be about the same as estimated enrollment in the current year. Figure 5 shows the segments’ actual, estimated, and budgeted enrollment levels for the prior, current, and budget years, respectively.

Figure 5

Higher Education Enrollment |

Full-Time Equivalent Students |

|

Actual

2007‑08a |

Estimated

2008‑09b |

Budgeted

2009‑10c |

Change |

|

Amount |

Percent |

University of California |

|

|

|

|

|

Undergraduate |

166,206 |

170,942 |

160,824 |

-10,118 |

-5.9% |

Graduate |

24,556 |

25,482 |

25,400 |

-82 |

-0.3% |

Health Sciences |

13,144 |

13,392 |

12,445 |

-947 |

-7.1% |

Subtotals |

(203,906) |

(209,816) |

(198,669) |

(-11,147) |

(-5.3%) |

California State University (CSU) |

|

|

|

|

|

Undergraduate |

304,729 |

306,253 |

295,583 |

-10,670 |

-3.5% |

Graduate/post baccalaureate |

49,185 |

49,431 |

47,650 |

-1,781 |

-3.6% |

Subtotals |

(353,915) |

(355,684) |

(343,233) |

(-12,451) |

(-3.5%) |

California Community Colleges (CCC) |

1,182,771 |

1,236,127 |

1,236,446 |

319 |

— |

Hastings College of the Law |

1,262 |

1,250 |

1,250 |

— |

— |

Totals |

1,741,853 |

1,802,877 |

1,779,598 |

-23,279 |

-1.3% |

|

a Reported by segments. |

b Latest available estimates of total current-year enrollment. Figures for CSU and CCC are Legislative Analyst’s Office estimates. |

c Governor's 2009‑10 budget proposal. Numbers for CSU reflect correction to Governor’s budget display. |

Student Fee Increases

Figure 6 shows student fee levels proposed by the Governor. The UC and CSU would increase fees by 9.3 percent and 10 percent, respectively. The CCC’s fee level would remain unchanged at $20 per unit. At the same time the Governor proposes fee increases at the universities, he proposes significant reductions to long–standing financial aid programs that normally would shield financially needy students from such fee increases. For example, the competitive Cal Grant program would be eliminated, while remaining Cal Grant programs would become more restrictive and would no longer fully cover UC and CSU fees.

Figure 6

Annual Education Fees for Full-Time Resident Students |

2007‑08 Through 2009‑10 |

|

2007‑08 |

2008‑09 |

2009‑10a |

Change |

Amount |

Percent |

University of California |

|

|

|

|

|

Undergraduate |

$6,636 |

$7,126 |

$7,788 |

$662 |

9.3% |

Graduate |

7,440 |

7,986 |

8,736 |

750 |

9.4 |

Hastings College of the Law |

$21,303 |

$26,003 |

$29,383 |

$3,380 |

13.0% |

California State University |

|

|

|

|

|

Undergraduate |

$2,772 |

$3,048 |

$3,354 |

$306 |

10.0% |

Teacher Credential |

3,216 |

3,540 |

3,894 |

354 |

10.0 |

Graduate |

3,414 |

3,756 |

4,134 |

378 |

10.1 |

Doctoral |

7,380 |

7,926 |

7,926 |

— |

— |

California Community Colleges |

$600 |

$600 |

$600 |

— |

— |

|

a Proposed. |

Return to Higher Education Table of Contents, 2009-10 Budget Analysis SeriesReturn to Full Table of Contents, 2009-10 Budget Analysis Series