2009-10 Budget Analysis Series: Transportation

Transportation Relies Heavily on Dedicated Revenue Sources

Traditional State Fund Sources. State transportation programs have traditionally been funded on a pay–as–you go basis from taxes and user fees. Two special funds—the State Highway Account (SHA) and the PTA—have provided the majority of ongoing state funding for highways and local transit programs. The SHA is funded mainly by an 18 cent per gallon tax on gasoline and diesel fuel (referred to as the gas tax) and truck weight fees. Revenues to the PTA come from a portion of the state sales tax on diesel fuel and gasoline. Since 2003, state gasoline sales tax revenues that previously were used for General Fund programs are used under Proposition 42 for highway improvements, transit and rail, and local streets and roads.

Other transportation–related programs, including traffic enforcement programs administered by DMV and CHP, also rely on dedicated revenue sources for their support. Specifically, both departments are funded mainly from fees imposed on drivers and vehicles.

Bonds. Since 2006, the state has increasingly used bond funds for various transportation programs. In 2006, voters passed Proposition 1B to provide about $20 billion in bond funding over multiple years for a variety of transportation improvement purposes. In November 2008, Proposition 1A was passed to provide $9.95 billion to develop a high–speed rail system and to improve other passenger rail systems in the state.

Expenditure Proposal and Trends

Budget Proposal. The Governor’s budget proposes $16.5 billion in expenditures for transportation programs in 2009–10. This amount includes about $13 billion in state and bond funds, and $3.6 billion in federal funds. The total amount proposed is a net decrease of $3 billion, or about 16 percent, below the estimated current–year expenditure level. The drop is mainly due to the Governor’s proposal to significantly increase current–year expenditures on transportation capital improvements, in order to stimulate the economy. Specifically, as part of his economic stimulus package, the Governor is proposing to increase by about $1.7 billion the current–year funding from Proposition 1B bonds for state highways, transit capital improvements and local streets and road improvements.

For 2009–10, key proposals in the budget would:

- Transfer $1.7 billion in Proposition 42 gasoline sales tax to transportation. The amount reflects the revenue projected to result from the higher state sales tax rate proposed by the Governor.

- Provide $3.5 billion in bond money for various Proposition 1B programs.

- Use $769 million in GARVEE bonds backed by future federal funds to pay for three highway rehabilitation projects.

- Use $125 million in Proposition 1A (2008) bonds to develop a high–speed rail system.

- Provide no operating assistance to transit operators.

- Increase CHP traffic officers by 240 positions.

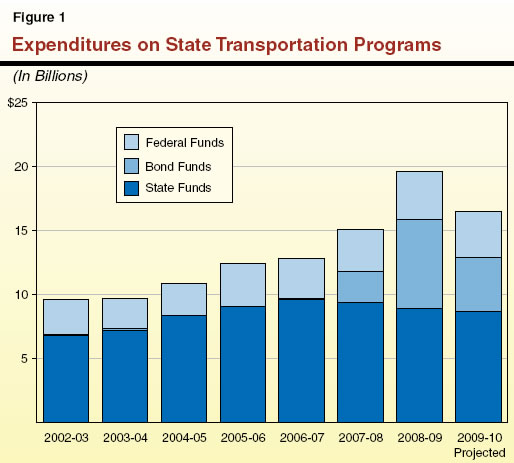

Overall Growth Trends. Figure 1 shows expenditures for state transportation programs from state, bond, and federal funds from 2002–03 through 2009–10. The figure shows that total state transportation expenditures were relatively stagnant up until 2004–05, but have grown steadily since. The increase is mainly due to the availability of bond funding.

As Figure 1 shows, bond expenditures increased beginning 2007–08. In fact, bond expenditures are estimated to increase to about $7 billion in the current year, accounting for 36 percent of all expenditures on state transportation programs. Figure 1 also shows that while bond expenditures have increased, expenditures from non–bond state funds have decreased, and will make up a smaller proportion of expenditures on state transportation programs. Specifically, non–bond funding will account for about 53 percent of all state transportation expenditures in 2009–10 compared to 71 percent in 2002–03. A main reason for the decrease in the past couple of years is the redirection of transportation funds to help the General Fund, as discussed later in this section.

Spending by Major Programs

Figure 2 shows spending for the major transportation programs and departments from all fund sources, including state, federal, and bond funds, as well as reimbursements.

Figure 2

Transportation Budget Summary—Selected Funding Sources |

(Dollars in Millions) |

|

Actual

2007‑08 |

Estimated 2008‑09 |

Proposed 2009‑10 |

Change From 2008‑09 |

|

Amount |

Percent |

Department of Transportation |

|

|

|

|

|

General Fund |

$1,416.3 |

$1,351.0 |

$1,751.7 |

$400.7 |

29.7% |

Other state funds |

3,948.4 |

3,010.1 |

2,590.7 |

-419.4 |

-13.9 |

Federal funds |

3,265.4 |

3,662.0 |

3,578.5 |

-83.5 |

-2.3 |

Bond funds |

1,003.3 |

4,773.1 |

3,746.5 |

-1,026.6 |

-21.5 |

Other |

1,704.6 |

1,467.7 |

1,288.4 |

-179.3 |

-12.2 |

Totals |

$11,338.0 |

$14,263.9 |

$12,955.8 |

-$1,308.1 |

-9.2% |

California Highway Patrol |

|

|

|

|

|

Motor Vehicle Account |

$1,652.8 |

$1,743.8 |

$1,802.9 |

$59.1 |

3.4% |

State Highway Account |

57.7 |

61.6 |

60.4 |

-1.2 |

-1.9 |

Other |

110.8 |

140.5 |

140.6 |

0.1 |

0.1 |

Totals |

$1,821.3 |

$1,945.9 |

$2,003.9 |

$58.0 |

3.0% |

Department of Motor Vehicles |

|

|

|

|

|

Motor Vehicle Account |

$480.6 |

$619.3 |

$887.2 |

$267.9 |

43.3% |

Vehicle License Fee Account |

358.5 |

267.7 |

— |

-267.7 |

-100.0 |

State Highway Account |

49.7 |

51.5 |

52.5 |

1.0 |

1.9 |

Other |

20.2 |

21.8 |

23.3 |

1.5 |

6.9 |

Totals |

$909.0 |

$960.3 |

$963.0 |

$2.7 |

0.3% |

State Transit Assistance |

|

|

|

|

|

Public Transportation Account |

$306.4 |

$153.2 |

— |

-$153.2 |

-100.0% |

Bond funds |

530.3 |

1,219.7 |

350.0 |

-869.7 |

-71.3 |

Totals |

$836.7 |

$1,372.9 |

$350.0 |

-$1,022.9 |

-74.5% |

High-Speed Rail Authority |

|

|

|

|

|

Public Transportation Account |

$1.7 |

$5.6 |

— |

-$5.6 |

-100.0% |

Bond funds |

15.6 |

37.3 |

$125.2 |

87.9 |

235.7 |

Other |

3.6 |

3.5 |

— |

-3.5 |

-100.0 |

Totals |

$20.9 |

$46.4 |

$125.2 |

$78.8 |

169.8% |

Caltrans. The Governor’s budget proposes total expenditures of $13 billion in 2009–10 for Caltrans—about $1.3 billion, or 9 percent, less than estimated current–year expenditures. As Figure 2 shows, Caltrans expenditures from the General Fund are projected to increase—by $400 million (or about 30 percent)—while expenditures from all other funds are projected to decrease. The higher General Fund expenditures reflect the projected increase in Proposition 42 gasoline sales tax transfers to transportation, resulting from the increase in the state sales tax rate proposed by the Governor. The decrease in bond–funded expenditures in the budget year (mainly from Proposition 1B) reflects the Governor’s proposal to increase current–year bond spending as an economic stimulus, as noted earlier.

CHP and DMV. Spending for CHP is proposed at about $2 billion, which is 3 percent higher than the current–year estimated level. About 90 percent of all CHP expenditures would come from MVA, which generates its revenues primarily from driver license and vehicle registration fees. The increase includes first–year support for an additional 240 traffic officers.

For DMV, the budget proposes expenditures of $963 million—essentially the same as the current–year level. Traditionally, support for DMV comes from MVA and vehicle license fee revenues. Vehicle license fees are an in–lieu property tax, which DMV collects for local governments. In past years, these revenues typically paid for a significant portion of the department’s support (from 35 percent to 40 percent). For 2009–10, the budget proposes no vehicle license fee revenues for DMV support in order to free up funds for local public safety programs. Instead, the budget proposes to support DMV almost entirely with MVA funds. To generate sufficient funding in the MVA to cover the funding shift, the budget proposes to increase vehicle registration fees by $12 per vehicle. In addition, the budget proposes to increase driver license and identification card fees by $3 each in order to fund the production of a new license/card with enhanced security features.

Transit Assistance. The state provides funding assistance to transit systems for both operations and capital improvements. Current law allocates a portion of the annual PTA revenues to transit operators under the STA program, mainly for operations. In recent years, program funding has been limited and PTA funds were used instead for home–to–school transportation and regional center transportation, which previously had been paid from the General Fund. For instance, the current–year budget, as passed in September 2008, kept STA at the 2007–08 level of $306 million. However, due to deepening state fiscal problems, the Governor’s budget now proposes to eliminate STA funding for the remainder of the current year, thereby reducing the current–year funding level to $153 million. For 2009–10, the budget proposes no STA funding.

Proposition 1B provides $3.6 billion in bond funds for transit capital improvements. As part of his economic stimulus package, the Governor is proposing to increase the current–year appropriation from Proposition 1B bonds by $800 million (from $350 million to $1.15 billion). For 2009–10, the budget proposes $350 million for transit capital improvements.

High–Speed Rail Authority. In November 2008, voters passed Proposition 1A, which authorizes $9 billion in general obligation bonds for the development and construction of a high–speed rail system. (Proposition 1A also authorizes another $950 million for capital improvements of other passenger rail systems in the state.) Under law, up to 10 percent of the bond funds may be used for noncapital costs, including planning, design, and engineering of the system. For 2009–10, the budget proposes $125 million in Proposition 1A funds to continue a number of contracts to plan and develop the system and to fund the authority’s administrative expenses.

Recent Use of Transportation Funds to Help General Fund

Due to the state’s difficult fiscal condition in the past several years, funding that has traditionally been dedicated to transportation has been loaned to the General Fund or redirected to pay for programs that previously were funded from the General Fund.

Loans and Repayments. Since 2001–02, various amounts of transportation funds have been loaned to the General Fund. Figure 3 shows the amount of loans outstanding, and the amount of repayments due to transportation. As Figure 3 shows, three substantial loans require repayment.

Figure 3

Transportation Loans and Repaymentsa |

(In Millions) |

|

To General Fundb From: |

Year |

TCRFc |

Proposition 42 |

SHA |

Other |

Total Amount Borrowed |

$1,383 |

$2,079 |

$200 |

$31 |

Balance through 2008‑09 |

749d |

587 |

200 |

31 |

2009‑10 |

-100d |

-83 |

— |

— |

2010‑11 |

-100 |

-83 |

-200 |

-31 |

Beyond 2010‑11 |

-549 |

-421 |

— |

— |

|

a Amounts do not include interest. |

b Positive numbers are amounts payable to the General Fund, negative numbers are amounts payable from the General Fund. |

c Funds shown from the General Fund as payment to the TCRF come from tribal gambling revenues. |

d As part of his 2009‑10 budget, the Governor proposes to delay the payment of tribal gambling revenues in 2008‑09 and 2009‑10. |

SHA = State Highway Account; TCRF = Traffic Congestion Relief Fund. |

First, $1.4 billion was loaned from the Traffic Congestion Relief Fund (TCRF) to the General Fund in 2001–02 and 2002–03. (The TCRF provides funding for 141 transportation projects statewide.) About $1.2 billion of the loan was to be repaid from bonds backed by tribal gambling revenues. However, because these bonds have not been issued, repayment has been made in annual installments with tribal gambling revenues of about $101 million a year. The Governor’s budget proposes to defer both the current– and budget–year repayments, and retain a combined $202 million for General Fund uses.

Second, over $2 billion in Proposition 42 funds was loaned in 2003–04 and 2004–05 combined. As of the end of the current year, $587 million is still outstanding. Under the Constitution, the General Fund is required to repay the loan with interest by June 30, 2016, at a specified minimum rate each year. In accordance with the requirement, the Governor’s budget proposes a General Fund repayment of $83 million in 2009–10.

Third, to help the General Fund in the current year, $231 million was loaned to the General Fund from SHA and other transportation accounts. The 2008–09 Budget Act requires this amount to be repaid with interest by June 30, 2011.

Redirections and Broadened Use of Transportation Funds. In addition to the loans of transportation funds discussed above, the use of certain transportation revenues has been broadened to include purposes that had previously been paid from the General Fund to help address the state’s fiscal problems. In particular, in 2007–08 and 2008–09, a portion of so–called “spillover” gasoline sales tax revenue was used to reimburse the General Fund for transportation–related expenses, such as bond debt service. Additionally, PTA revenues were used to fund home–to–school transportation as well as regional center transportation. In the current year, these uses total about $1.4 billion. For 2009–10, the budget proposes a total of $541 million for these uses, including $403 million for home–to–school transportation and $138 million for regional center transportation.

Return to Transportation Table of Contents, 2009-10 Budget Analysis SeriesReturn to Full Table of Contents, 2009-10 Budget Analysis Series