December 2, 2009

Pursuant to Elections Code Section 9005, we have reviewed

the proposed initiative (File No. 09‑0065, Amdt. #2-NS). This measure would

increase excise taxes on cigarettes and use these revenues to fund various

health research and tobacco-related programs.

Background

Tobacco Taxes

Existing Tax Rate. Current state law

imposes excise taxes on cigarettes and other tobacco products. The state's

cigarette tax is currently 87 cents per pack (with an equivalent tax on other

types of tobacco products) and is levied on cigarette distributors who supply

cigarettes to retail stores. The proceeds are used for both General Fund and

certain special fund purposes.

The total 87 cents per pack tax is made up of the

following components:

-

Fifty cents per pack pursuant to the California

Children and Families First Act of 1998. This measure, enacted by the voters

that year as Proposition 10, supports early childhood development programs.

-

Twenty-five cents per pack pursuant to the Tobacco Tax

and Health Protection Act. This initiative, enacted by the voters as

Proposition 99 in 1988, increased the cigarette tax by 25 cents per pack,

and provided that the tax on other tobacco products be raised commensurately

with this and any future tax on cigarettes. These revenues are allocated to

tobacco education and prevention efforts, tobacco-related disease research

programs, and health care services for low-income uninsured persons, as well

as for environmental protection and recreational resources.

-

Ten cents per pack for the state General Fund.

-

Two cents per pack enacted through a separate measure

approved by the Legislature and Governor in 1993 to create the Breast Cancer

Fund, which supports research efforts related to breast cancer and of breast

cancer screening programs for uninsured women.

Sales of cigarettes and other tobacco products also are

subject to the sales and use tax, which is imposed on their price including

excise taxes.

Existing Backfill Provisions. Part of the

Proposition 10 revenues are used to "backfill" or offset any revenue losses

experienced by Proposition 99's health-related education and research programs

and the Breast Cancer Fund due to decreased consumption of tobacco products

resulting from Proposition 10's tax increase. (Revenue reductions to

Proposition 99 health care and resources programs were not backfilled under the

provisions of Proposition 10.) The revenue reductions occur because an increase

in the price of cigarettes generally reduces cigarette consumption and results

in more sales for which taxes are not collected, such as smuggled products and

out-of-state sales.

Proposal

New State Tobacco Tax Revenues

The average retail price of a pack of cigarettes

currently is roughly $5 in California, including all taxes. This measure

increases the existing excise tax on cigarettes by $1 per pack effective 90 days

after its passage. Existing state law requires the Board of Equalization (BOE)

to increase taxes on other tobacco products—such as loose tobacco and snuff—in

an amount equivalent to any increase in the tax on cigarettes. Thus, this

measure would also result in a comparable increase in the excise tax on other

tobacco products. The measure does not specify how revenues from increased

excise taxes on other tobacco products would be used. Under current law, those

revenues would be deposited in the Cigarette and Tobacco Products Surtax Fund

and used to support Proposition 99 programs.

How Additional Tobacco Revenues Would Be Spent

Receipts from the tobacco tax increases would be

deposited in a new special fund created by the measure called the California

Cancer Research and Life Sciences Innovation Trust Fund. The monies would be

distributed among five funds as follows:

-

Hope 2010 Research Fund. Sixty percent of

the funds would be used to provide grants and loans to support research on

prevention, diagnosis, treatment, and potential cures for tobacco-related

diseases such as cancer and heart disease.

-

Hope 2010 Facilities Fund. Fifteen

percent would be used to provide grants and loans to build and lease

facilities and provide capital equipment for research on tobacco-related

diseases.

-

Hope 2010 Smoking Cessation Fund. Twenty

percent would be used for tobacco prevention and cessation programs

administered by the California Department of Public Health (DPH) and the

California Department of Education.

-

Hope 2010 Law Enforcement Fund. Three

percent would be allocated to state agencies to support law enforcement

efforts to reduce smuggling, tobacco tax evasion, illegal sales of tobacco

to minors, and to otherwise improve enforcement of existing law.

-

Hope 2010 Committee Account. Two percent

would be deposited into an account that would be used to pay the costs of

tax collection and expenses of administering the measure.

Committee Established to Administer Trust Fund

The trust fund would be overseen by a nine-member Cancer

Research Citizen's Oversight Committee established by the measure. The committee

would be composed of four members appointed by the Governor, three of whom are

directors of designated cancer centers; two members appointed by DPH; and three

chancellors from certain University of California campuses where biomedical

scientific research is conducted.

Authority Granted to the Committee. The

measure gives the committee the authority to develop a long-term financial plan

including an annual budget and to establish a process for soliciting, reviewing,

and awarding grants and loans for researchers and facilities. The committee

would have the authority to appoint a chief executive officer and other

employees. The committee also would have the authority to make final decisions

on awards of loans and grants and to establish policies regarding intellectual

property rights arising from research funded by this measure.

Tax Collection and Administrative Costs.

The committee would be authorized by this measure to reimburse the BOE from the

Hope 2010 Committee Account for the cost of collecting the new tax levy. This

account would also be used to pay for any expenses of administering the act,

such as hiring employees.

Accountability Measures. The measure would

require the committee to issue an annual report to the public that included

information on its administrative expenses, the number and amount of grants and

loans provided, and a summary of research findings. The committee would also be

required to commission an independent financial audit that would be provided

each year to the State Controller, who would then review the audit and publicly

report on the review. The State Controller would also provide the committee with

reports that set forth the allowable costs for general administration of the

trust fund.

The measure includes conflict-of-interest provisions that

govern the conduct of committee members, and includes specific criminal

penalties for anyone convicted for the misuse of trust fund monies.

Other Expenditure Rules

Committee Administers Trust Fund. Under

this measure, the committee would be authorized to administer the trust fund.

The funds allocated under this measure would not be subject to appropriation by

the Legislature through the annual state Budget Act, and thus, amounts would not

be subject to change by actions of the Legislature and Governor.

Transfers Permitted From Facilities Fund.

In the event the committee determined that there was a surplus in the Hope 2010

Facilities Fund, the measure authorizes the Committee to transfer those monies

to the Hope 2010 Research Fund, the Hope 2010 Smoking Cessation Fund, or the

Hope 2010 Law Enforcement Fund.

New Backfill Provisions. The measure

requires the transfer of monies from the trust fund to backfill any losses that

occur to the Cigarette and Tobacco Products Surtax Fund (Proposition 99), the

Breast Cancer Fund, and the General Fund, that directly result from imposition

of the additional tax. One existing program—the California Children and Families

First Fund (Proposition 10)—would not be provided such a backfill.

Fiscal Effects

This measure is likely to have a number of fiscal effects

on state and local governments.

Impacts on State and Local Revenues

Revenues Will Be Affected by Consumer Response.

Our revenue estimates assume that the distributors of tobacco products, who

actually remit the excise tax, largely pass along the excise tax increase of $1

per pack to consumers. In other words, we assume that the prices of tobacco

products would be raised to include the excise tax increase. This would result

in various consumer responses. The price increase is likely to result in

consumers reducing the quantity of taxable tobacco products they purchase.

Consumers could also change the way they acquire tobacco products so that fewer

transactions are taxed, such as through Internet purchases or purchases of

out-of-state products.

The magnitude of these consumer responses is uncertain

given the size of the proposed tax increase. There is substantial evidence

regarding the response of consumers to small and moderate tax increases on

tobacco products in terms of reduced tobacco consumption. However, the increase

in taxes proposed in this measure is greater than experienced previously in the

state. A reasonable projection of consumer response is incorporated into our

revenue estimates, but these estimates are still subject to uncertainty given a

variety of factors, including the large tax change involved.

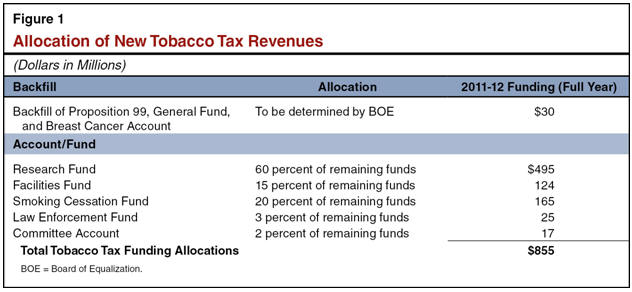

New Excise Tax Revenues. Estimated revenues

from current excise taxes on cigarettes and other tobacco products are about

$850 million a year. We estimate that the increase in excise taxes required by

this measure would raise about $450 million in 2010-11 (partial-year effect from

January 1, 2010 through June 30, 2010) and about $850 million in 2011-12 (the

first full-year impact). Our estimate of the allocation of new excise tax

revenues is shown in Figure 1 below. The excise tax increase would raise

somewhat less revenue each year thereafter, due to the well-established trend of

declining per capita cigarette consumption in the state. The higher tax also

would reduce revenues from the existing excise tax, as discussed further below.

Effects on Existing Tobacco Excise Tax Revenues. The

decline in consumption of tobacco products caused by this measure would

similarly reduce revenues from the existing tobacco taxes. The measure ensures

that revenues for the existing tobacco taxes (except Proposition 10) do not

decline due to lower cigarette consumption caused by the new excise tax. We

estimate that this allocation of backfill funding would initially amount to

about $30 million annually. We estimate that the initial annual revenue loss to

the California Children and Families First Fund (Proposition 10), which is not

protected by a backfill provision, would be about $45 million annually.

In addition to its allocation of backfill funding,

Proposition 99 programs would receive additional revenues because of the

existing provision in state law under which any cigarette tax increase triggers

an automatic increase in the taxes collected on other tobacco products. We

estimate that this factor would result in a revenue gain for Proposition 99

programs of about $45 million annually.

Effects on Excise Tax Collection. As

discussed above, the measure would deposit 3 percent of total revenues

into a Law Enforcement Fund to support law enforcement efforts. These funds

would be used to support increased enforcement efforts to reduce tax evasion,

counterfeiting, smuggling, and the unlicensed sales of cigarette tobacco

products; increased enforcement of existing laws; and efforts to reduce sales of

tobacco products to minors. These activities would probably have a minor impact

on the amount of revenues collected through the excise tax.

Effect on State Sales Tax Revenues. Sales

taxes are levied on the final price of cigarettes and other tobacco products,

including all excise taxes. The higher price of cigarettes resulting from the

new excise tax, therefore, would increase state General Fund revenues. We

estimate that the state's General Fund sales tax revenues would increase by

about $22 million annually.

Effects on Local Revenues. Local

governments would likely experience an annual increase in sales tax revenues of

approximately $10 million.

Impact on State and Local Government Costs

The state and local governments incur costs for providing

(1) health care for low-income persons and (2) health insurance coverage for

state and local government employees. Consequently, changes in state law that

affect the health of the general populace—and low-income persons and public

employees in particular—would affect publicly funded health care costs.

The use of tobacco products has been linked to various

adverse health effects by federal health authorities and numerous scientific

studies. This measure is likely to result in a decrease in the consumption of

tobacco products because of its provisions increasing the cost of these products

and curbing tobacco use. To the extent that these changes affect publicly funded

health care programs, they are likely to reduce state and local government

health care spending on tobacco-related diseases.

However, this measure may have other fiscal effects that

may partially or fully offset these cost savings. For example, the state and

local governments may incur future costs for the provision of health care and

social services that may otherwise not have occurred, such as long-term care for

individuals who avoid tobacco-related diseases and live longer. Thus, the net

fiscal impact of this measure on state and local government costs is unknown.

Summary

The measure would have the following major impacts:

-

Increase in new cigarette tax revenues of about

$850 million annually by 2011‑12, declining slightly annually thereafter,

for various health research and tobacco-related programs.

-

Increase of about $45 million annually to existing

health, natural resources, and research programs funded by existing tobacco

taxes, but a decrease of about $45 million annually in tobacco taxes for

early childhood programs.

-

Increase in state and local sales taxes of about

$32 million annually.

Return to Propositions

Return to Legislative Analyst's Office Home Page