January 6, 2010

Pursuant to Elections

Code Section 9005, we have reviewed the proposed constitutional initiative

relating to state and local approval requirements for taxes, fees, and penalties

(A.G. File No. 09‑0092).

Background

Taxes

State Taxes.

The State Constitution

requires a two-thirds vote of each house of the Legislature for measures that

result in increases in revenues from imposing new state taxes or changing

existing state taxes. This has been interpreted to allow measures that do not

result in a net increase in state taxes to be adopted by majority vote. For

example, a measure that results in higher taxes for some taxpayers but an equal

(or larger) reduction in taxes levied on other taxpayers would not result in an

aggregate increase in taxes. Under current practice, this type of measure could

be passed by a majority vote.

Local Taxes. Local governments may impose or increase taxes (other than ad

valorem property taxes) subject to the approval of their local voters. If the

local government proposes to use the tax proceeds for general purposes (a

"general tax"), the tax requires approval by a majority of local voters. If the

tax proceeds are earmarked for a specific purpose (a "special tax"), the voter

approval threshold is two-thirds. In some cases, local governments place

nonbinding "companion measures" on the same ballot with proposed general tax

increases. These advisory measures express voter intent regarding the

expenditure of funds raised by general taxes. The Constitution currently does

not specify the vote requirement for the Legislature to pass a law that has the

effect of increasing local tax revenues.

Fees, Assessments, Fines, and Other Charges

Current law generally gives state and local

governments significant discretion in establishing fees, assessments, fines,

penalties, and other charges. Governments may impose these charges for many

reasons, including to offset their costs to provide specific services and

benefits ("user fees"), regulate a particular activity ("regulatory fees"),

penalize certain behaviors ("penalties"), and finance property or business

improvements ("assessments").

In some cases—such as many user fees, admission fees, and

assessments—the charge is closely linked to the cost of providing a particular

service to an individual

beneficiary. In other cases—particularly regulatory fees (including

environmental mitigation)—the charge may be based on the costs of government

oversight of a group or industry, or on the social costs associated with

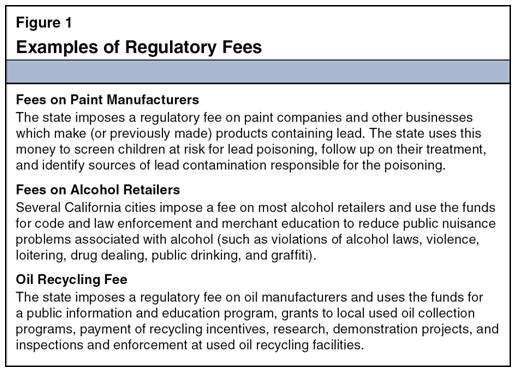

particular activities. Figure 1 provides some examples of state and local fees

imposed for broad regulatory purposes.

Imposing Fees, Assessments, and Charges. The

state generally may impose fees, assessments, and charges by a majority vote of

the Legislature, provided these charges do not exceed government's related

costs. (State charges in excess of costs are considered "taxes" and are subject

to the Constitution's approval requirements for taxes.)

With three exceptions, local governments generally have similar authority to

impose fees, assessments, and charges. Specifically, state law requires local

governments to obtain the approval of business owners before imposing

assessments to finance improvements in business districts. In addition, the

Constitution requires local governments to receive approval from property owners

or voters before imposing (1) property owner assessments or (2) fees as an

incident of property ownership ("property-related fees"), other than fees for

water, sewer, and refuse collection services.

State and Local Requirements Regarding Fines and

Penalties. State and local governments have significant discretion to

set fines and penalties for violations of state laws and local ordinances and to

discourage certain behavior. The Constitution generally does not restrict how

state and local governments spend the funds raised from fines and penalties.

State and local governments may impose most fines and penalties with a majority

vote of the governing body.

Proposal

This measure amends the Constitution to expand the

definitions of a "tax" and subject all state tax increases to voter approval.

Voter Approval of State Taxes. The measure

specifies that any change in a state statute that results in any taxpayer

paying a higher tax requires (1) a two-thirds vote of the Legislature and (2)

majority approval by the statewide electorate. (This would include statutes that

reallocate tax burdens without yielding a net increase in revenues and those

affecting only local taxes.) The measure provides a waiver of the voter-approval

requirement in cases of emergency, as long as the tax expires by the next

statewide election in the year after the emergency.

Definition of Taxes. The measure broadens

the definitions of a state tax and a local special tax to include a wide range

of charges that governments currently may impose by a majority vote of its

governing entity. Specifically, the measure provides that all state and local

charges are taxes, except:

-

User charges, based on a government's reasonable costs,

for specific services or benefits that government provides directly and

exclusively to the fee payer.

-

Regulatory charges limited to a government's reasonable

administrative costs for issuing licenses and permits and undertaking

investigations, inspections, audits, enforcement, and adjudication.

-

Charges for the use of or entrance to state or local

government property.

-

Fines and penalties imposed by government "as a result

of a violation of a law."

-

Local

charges imposed as a condition of property development, property owner

assessments, and property-related fees.

Effective Date for State Provisions. This

measure specifies that any state tax enacted after January 1, 2010 that is

inconsistent with this initiative's provisions would become inoperative 12

months after the effective date of this initiative unless the tax is reenacted

into law in compliance with this initiative's requirements.

Burden of Proof. In any legal challenge,

the measure specifies that government bears the burden of proving that a charge

is not a tax and that the amount raised is consistent with the measure's

provisions.

Fiscal Effects

By expanding the scope of what is considered a tax and

subjecting all state tax increases to voter approval, the measure would make it

more difficult for state and local governments to enact a wide range of measures

that generate revenues.

State Government

The measure makes two significant changes to state

finance. First, the measure redefines a large number of state charges as taxes.

The extent of this change is not clear, but it would appear to include many

regulatory fees that address health and environmental concerns, such as the fees

summarized in Figure 1. Second, the measure requires state statutes that

increase state or local taxes to be approved by a two-thirds vote of the

Legislature and a majority of the state's voters.

The overall revenue impact of this measure would depend

on future actions of the Legislature and voters. Given that state tax and fee

measures frequently total hundreds of millions or billions of dollars, the

measure could result in major decreases in future state revenues and spending

compared to what they otherwise would be.

Local Government

Under the measure, a large number of local charges,

including local regulatory fees and business assessments, would be considered

special taxes. Instead of being approved by a majority of local governing boards

(and, in the case of business assessments, business owners), these charges would

be subject to the approval by two-thirds of local residents.

The overall revenue impact of this measure would depend

on future actions of the local governing bodies and voters.

Given the amount of revenues derived from

these local charges, the higher approval threshold in this measure could result

in major decreases in future local revenues and spending compared to what they

otherwise would be.

Summary

The measure would have the following impacts on state and

local governments:

-

Potentially major decrease in state and local revenues

and spending, depending upon future actions of the Legislature, local

governing bodies, and voters.

Return to Propositions

Return to Legislative Analyst's Office Home Page