March 25, 2010

Pursuant to Elections Code Section 9005, we have reviewed

the proposed initiative entitled the "McCauley Pension Recovery Act" (A.G. File

No. 10‑0014).

Background

The base of the

state's personal income tax consists of (1) all income earned by California

residents except for income attributable to activities in other states and

(2) income earned by residents of other states attributable to activities in

California. The state conforms to the federal treatment of pension income: the

portion attributable to employer contributions is taxable but the fraction

attributable to the taxpayer's own contributions is exempt.

Proposal

The measure establishes new taxes on pension income

beginning in 2012. Specifically, the measure creates:

-

A personal income tax surcharge on resident taxpayers

who receive more than $40,000 of "pension taxable income."

-

An excise tax on nonresidents or people who move out of

the state whose vested pension benefits from a California employer exceed

$40,000 per year.

Surcharge on Resident Pension Income

The proposal creates a new surcharge on pension taxable

income in excess of $40,000. Unlike the current definition of "taxable pension

income," pension taxable income includes all pension income whether attributable

to employer or taxpayer contributions, plus employer-paid health insurance

premiums. Pension income derived from employer contributions would also still be

taxable as it is under current law.

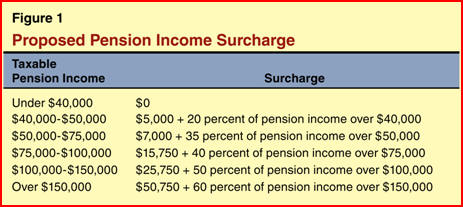

The surcharge would increase as the amount of pension

income increases, so that pension income above $150,000 would face a tax

surcharge of 60 percent. For example, a couple receiving pension income of

$160,000 with no other income and only the standard deduction would pay $9,637

in regular taxes (at the 9.3 percent top rate) and a surcharge of $56,750.

Taxpayers who were 75 or older on the date of enactment would receive a

nonrefundable annual credit of $10,500 against the surcharge. Figure 1 displays

the proposed surcharge schedule.

Excise Tax on Pensions of Nonresidents and Former Residents

The proposal imposes a one-time 50 percent excise tax on

the fair market value of "excess" vested pension benefits from California

employers that are received by nonresident taxpayers and by people who reside in

California on the date of enactment but later move out of the state. Excess

benefits are defined as the amount above $40,000 per year that the taxpayer's

vested pension benefits would provide on average over the individual's remaining

life expectancy as determined by the state Franchise Tax Board (FTB). The

taxpayer would be permitted to pay the excise tax as a lump sum or over time.

Taxpayers who were 75 or older on the date of enactment would receive a credit

of $250,000 against the excise tax.

Fiscal Effects

The initiative could result in $6 billion to $8 billion

in additional General Fund revenues each year beginning in 2012 assuming no

behavioral changes, but it would also likely induce behavioral changes that

would be significant and very hard to quantify. Consequently, we conclude the

measure could increase state revenues by several billion dollars annually. We

discuss the impact of the proposed income tax surcharge and the excise tax

separately below.

Income Tax Surcharge

The FTB estimates that the income tax surcharge would

generate roughly $5 billion per year. This assumes that the new tax does not

result in behavioral changes on the part of taxpayers or employers. Employers

would have a strong incentive to shift the mix of compensation toward wages and

salaries and away from pension benefits. Similarly, the measure would encourage

workers to retire or leave the state as soon as the estimated value of their

vested benefits (including employer-paid health insurance) approached $40,000

per year. As no state has ever imposed a tax on pensions at a rate even close to

the rate proposed in this measure, no data are available to estimate the

behavior changes that would result from such a policy.

Excise Tax on Nonresidents and Movers

The FTB estimates that the excise tax would generate

annual revenue in the range of $1 billion to $3 billion, again assuming no

behavioral changes designed to reduce tax liability. This estimate should be

interpreted with caution, as data on the life expectancy of people with vested

pensions who leave the state were not available. Also, taxpayers would have an

incentive to leave the state before the date of enactment to avoid being counted

as a resident of the state on that date.

Potential Legal Problems of the Excise Tax.

The measure raises legal issues that may result in the excise tax being

invalidated under federal law. According to FTB, states are prohibited from

imposing an income tax on the retirement income (from an in-state employer) of a

nonresident. While the proposed excise tax is not technically a tax on current

income, the outcome is similar especially since this measure allows the excise

tax to be paid over time. As a result, the excise tax may not survive a legal

challenge.

If a court were to

strike down the excise tax, taxpayers subject to the surcharge would have an

incentive to leave and would avoid any additional payments. Large-scale

outmigration of retirees (who are no longer tied to the state by their jobs)

could result, which would in turn induce job losses in health care and other

sectors that support retirees. It is conceivable that revenue losses from such a

reduction in the state's economic base could outweigh gains from the surcharge,

causing a reduction in overall revenue.

Summary of Fiscal Effect

The measure would have the following major fiscal effect:

Return to Propositions

Return to Legislative Analyst's Office Home Page