January 27, 2012

Pursuant to Elections Code Section 9005, we have reviewed the

proposed statutory initiative

(A.G. File No. 11‑0088, Amendment #1S) that would increase personal

income tax rates and dedicate revenues for K-12 education, early care

and education programs, and debt service on education facilities.

Background

State’s Fiscal Situation. California’s

General Fund, the state’s core account that supports a variety of

programs (such as public schools, higher education, health, social

services, and prisons) has experienced chronic shortfalls in recent

years. During this period, policymakers have taken actions to reduce

expenditures for a variety of public programs and temporarily raised

certain taxes between 2009 and 2011. State General Fund shortfalls of

several billion dollars per year are expected to continue over at least

the next few years under current tax and expenditure policies.

Personal Income Tax. The state’s personal

income tax (PIT) imposes rates ranging from 1 percent to 9.3 percent on

the portions of a taxpayer’s income in several income brackets, with the

9.3 percent rate applying to income in excess of $48,029 for single

filers and $96,058 for joint filers. The PIT revenue, which is deposited

into the General Fund, totaled $49.5 billion in 2010‑11. An additional

1 percent tax applies to income over $1 million, with associated

revenues dedicated to mental health services.

Proposition 98 Funding. In 1988, voters

approved Proposition 98. Including later amendments, Proposition 98

establishes a guaranteed minimum annual funding level—commonly called

the minimum guarantee—for K-14 education (consisting of schools and

community colleges). The minimum guarantee is funded through a

combination of state General Fund revenues and local property tax

revenues. In 2011‑12, schools and community colleges received

$48.7 billion in Proposition 98 funding. Of that amount, $43 billion was

allocated to K-12 local education agencies (LEAs)—school districts, county offices

of education, and charter schools. The calculation of the minimum

guarantee depends on a number of factors, including the year-to-year

changes in General Fund revenues, student attendance, and California per

capita personal income. With a two-thirds vote in any given year, the

Legislature can suspend the Proposition 98 guarantee for one year and

provide any level of K-14 funding it chooses.

Early Care and Education (ECE). In 2011‑12,

state and federal funds provided roughly $2.5 billion to offer a variety

of child care and preschool programs for approximately 530,000, or about

15 percent, of California children ages five and younger. Standards and

characteristics—including staff qualifications, curriculum, and

adult-to-child ratios—vary across individual programs. In general,

participation in these publically subsidized programs is reserved for

families that display “need.” Eligibility criteria include low family

income, participation in the California Work Opportunities and

Responsibility to Kids program or other work or training activities,

and/or children with special needs. Because of funding limitations,

waiting lists for subsidized programs are common in most counties. As of

June 2010, about 125,000 eligible children under the age of five were

waiting for a slot in one of the state’s subsidized programs. Limited

data are available on children’s participation in non-subsidized

programs.

Proposal

This measure increases rates on the vast majority of Californian

personal income taxpayers and uses the funds for schools, ECE programs,

and debt service payments for education facilities. We discuss these

proposals in further detail below.

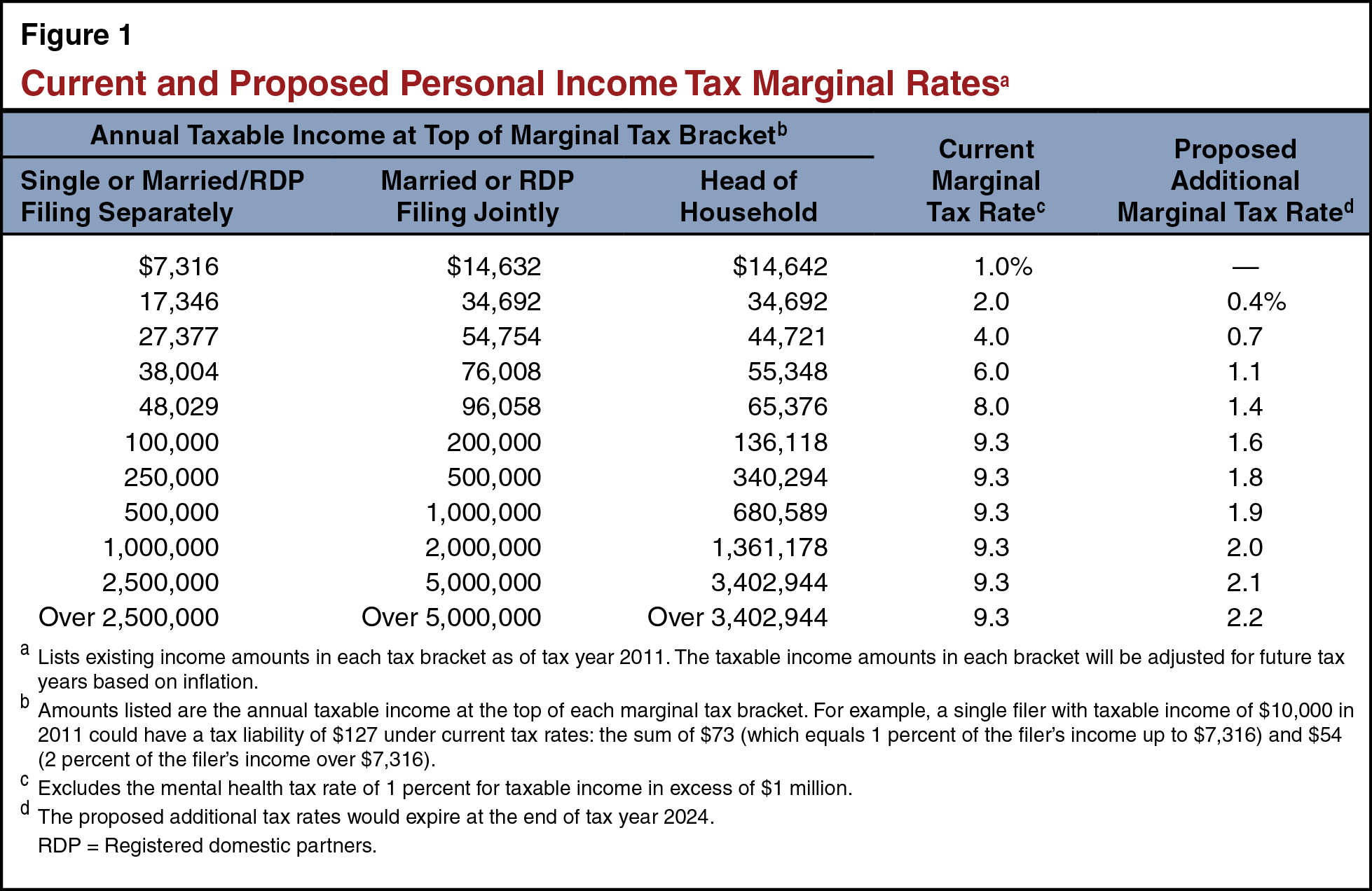

Increases PIT Rates Through 2024. As shown

in Figure 1 (see next page), this measure increases PIT rates on all but

the lowest income bracket, effective beginning in 2013 and ending in

2024. The additional marginal tax rates would be higher as taxable

income increases. For income of PIT filers currently in the highest

current tax bracket (9.3 percent marginal tax rate, excluding the mental

health tax), additional marginal tax rates would rise as income

increases. For example, as shown in Figure 1, an additional 1.8 percent

marginal tax rate would be imposed on income of joint filers between

$200,000 and $500,000 per year and an additional 2.2 percent marginal

tax rate would be imposed on income of joint filers over $5 million per

year. The income levels in the tax brackets shown in Figure 1 would be

indexed for inflation. The current mental health tax would continue to

be imposed.

Allocates Funds for Schools and ECE Programs.

The revenues raised by the measure would be deposited into a

newly created California Education Trust Fund (CETF). In 2013‑14 and

2014‑15, all revenues deposited into the CETF would be allocated for

schools and ECE programs (85 percent for schools, 15 percent for ECE).

Beginning in 2015‑16, total CETF allocations to schools and ECE programs

could not increase at a rate greater than the average growth in

California personal income per capita in the previous five years. The

measure also prohibits CETF monies from being used to replace state,

local, or federal funding that was in place prior to November 1, 2012.

All revenue collected by the measure and allocations made to schools are

excluded from the calculation of the Proposition 98 minimum guarantee.

Excess Funds Used for Education Debt Service Payments. The measure requires any CETF monies collected in excess

of the growth rate limit described above be used by the state to pay

debt service costs for general obligation bonds issued for the

construction or rehabilitation of pre-kindergarten, K-12, or university

school facilities. These funds would offset the state’s General Fund

costs and would provide state General Fund savings.

Provides Three Grants to Schools. The

measure requires 85 percent of CETF allocations be made to schools.

These allocations are split into three different grants: educational

program grants (70 percent of K-12 allocations); low-income per-pupil

grants (18 percent); and training, technology, and teaching materials

grants (12 percent). Educational program grants are distributed on a

per-pupil basis depending on the grade of each student, with students in

higher grades receiving more funding than students in the lower grades.

Low-income per-pupil grants are allocated based on the number of

low-income students (defined as the number of students eligible for free

meals) enrolled in each school. These two grants can be spent on a broad

range of activities, including instruction, school support staff (such

as counselors and librarians), and parent engagement. Training,

technology, and teaching materials grants are provided on a per-pupil

basis and can be used for professional development activities, new

technology, or teaching materials. The governing board of the LEA has

sole authority over how to spend CETF funds.

Includes Several School-Site Spending Restrictions.

Up to 2 percent of a school district’s allocation can be used

to cover the district’s audit, budget, public meeting, and reporting

requirements. The remaining funds allocated must be spent at the

specific school where the associated student enrollment funding is

generated. In the case of low-income per-pupil grants, for example, if

100 percent of low-income students in a school district are located in

one particular school, all associated grant funds must be spent at that

specific school. The measure also prohibits CETF funds from being used

to provide salary or benefit increases for personnel, unless the

increases are provided to other like employees that are funded with

non-CETF monies.

Creates New School Reporting Requirements.

The measure includes several reporting requirements for LEAs. Most

notably, the measure requires all LEAs to create and publish an online

budget for every school within the LEA’s jurisdiction. The state

Superintendent of Public Instruction must provide a uniform format for

budgets to be reported and must make all budgets statewide available for

the public. The LEA governing boards also must seek input from the

public on how to spend CETF funds and explain how CETF expenditures will

improve educational outcomes and how those improved outcomes will be

measured. In addition, LEAs must provide a report on how CETF funds were

spent at each school within the LEA’s jurisdiction within 60 days after

the close of the school year.

Expands ECE Programs. The measure dedicates

15 percent of CETF allocations to the state’s ECE system for children

ages five and younger. Of this amount, the first $300 million would be

used to restore recent state budget reductions to existing child care

programs. The majority of remaining funds would be used to expand the

number of children from low-income families served in publicly funded

child care and preschool programs. The measure also uses new revenues to

establish a quality rating scale by which to assess the effectiveness of

ECE programs; allocates supplemental funding to those programs achieving

higher ratings on that scale; and establishes a new state database to

collect and maintain information on ECE programs and participants.

Cannot Be Amended by the Legislature. If

adopted by voters, this measure could only be amended by a future ballot

measure approved by majority vote in a statewide election. The

Legislature would be prohibited from making any modifications to the

measure.

Fiscal Effect

Additional State Revenues. If approved, the

measure’s tax provisions would take effect January 1, 2013. In 2013‑14

(reflecting a full-year fiscal effect), estimates of the additional

state revenues that would be generated from the proposed PIT rate

increases currently range from about $10 billion (based on the current

Legislative Analyst’s Office revenue forecast) to about $11 billion

(based on the current Department of Finance revenue forecast). (In

2012‑13, the partial-year effect would be additional revenues of about

half this amount.) The total revenue generated would tend to grow over

time, but be somewhat volatile due primarily to the volatility of income

for upper-income filers. Most of the income reported by upper-income

filers is related in some way to their capital investments, rather than

wages and salary-type income, and can change significantly from one year

to the next.

Uses of Funds. In the first full year of

implementation, the measure would allocate $8.5 billion to $9 billion

for schools and $1.5 billion to $1.7 billion for ECE programs. Given

these revenues are excluded from the Proposition 98 calculations, the

minimum guarantee would be unaffected by this measure. Accordingly,

funding distributed to these educational entities under this measure

would be in addition to their annual Proposition 98 funding.

In Many Years, Some Debt Service Relief.

The measure is likely to provide General Fund relief on education bond

debt service costs in many of the 12 years that the measure is

operative. This is for two reasons. Because PIT revenues would increase

as population growth increases, they likely would grow at a faster rate

than per capita personal income. In addition, because PIT

revenues are more sensitive to swings in the capital gains of

upper-income earners, they tend to be considerably more volatile than

the five-year average growth in per capita personal income, often

exceeding that growth rate. When PIT revenues outpace the five-year

rolling average of per capita personal income, the measure would provide

General Fund savings. The exact amount of General Fund savings would

depend in the difference in the associated PIT and per capita personal

income growth rates, but state savings easily could be several hundred

million dollars per year.

Interaction With Rest of State Budget. The

vast majority of revenues raised by this measure would directly benefit

schools and ECE programs, with no corresponding state General Fund

savings. Given the state’s fiscal situation, the state’s General Fund

budget still would need to be balanced in future years with actions such

as further reductions in spending on other state programs or other

increased taxes.

Summary of Fiscal Effect

- Increased state personal income tax revenues beginning in 2013

and ending in 2024. Estimates of the revenue increases vary from

$10 billion to $11 billion per year initially, tending to increase

over time. The revenues would be dedicated to K-12 education

(85 percent of the funds) and early care and education programs

(15 percent) and would supplement existing funding for these

programs.

- In years with stronger growth in state personal income tax

revenues, some of the revenues raised by this measure—several

hundred million dollars per year—would be used to pay education debt

service costs, resulting in state savings.

Return to Propositions

Return to Legislative Analyst's Office Home Page