February 24, 2014

Pursuant to Elections Code Section 9005, we have reviewed the

proposed statutory initiative

(A.G. File No. 14‑0005) that would increase the state’s cigarette excise

tax from 87 cents to $1.87 per pack.

Background

Tobacco Taxes

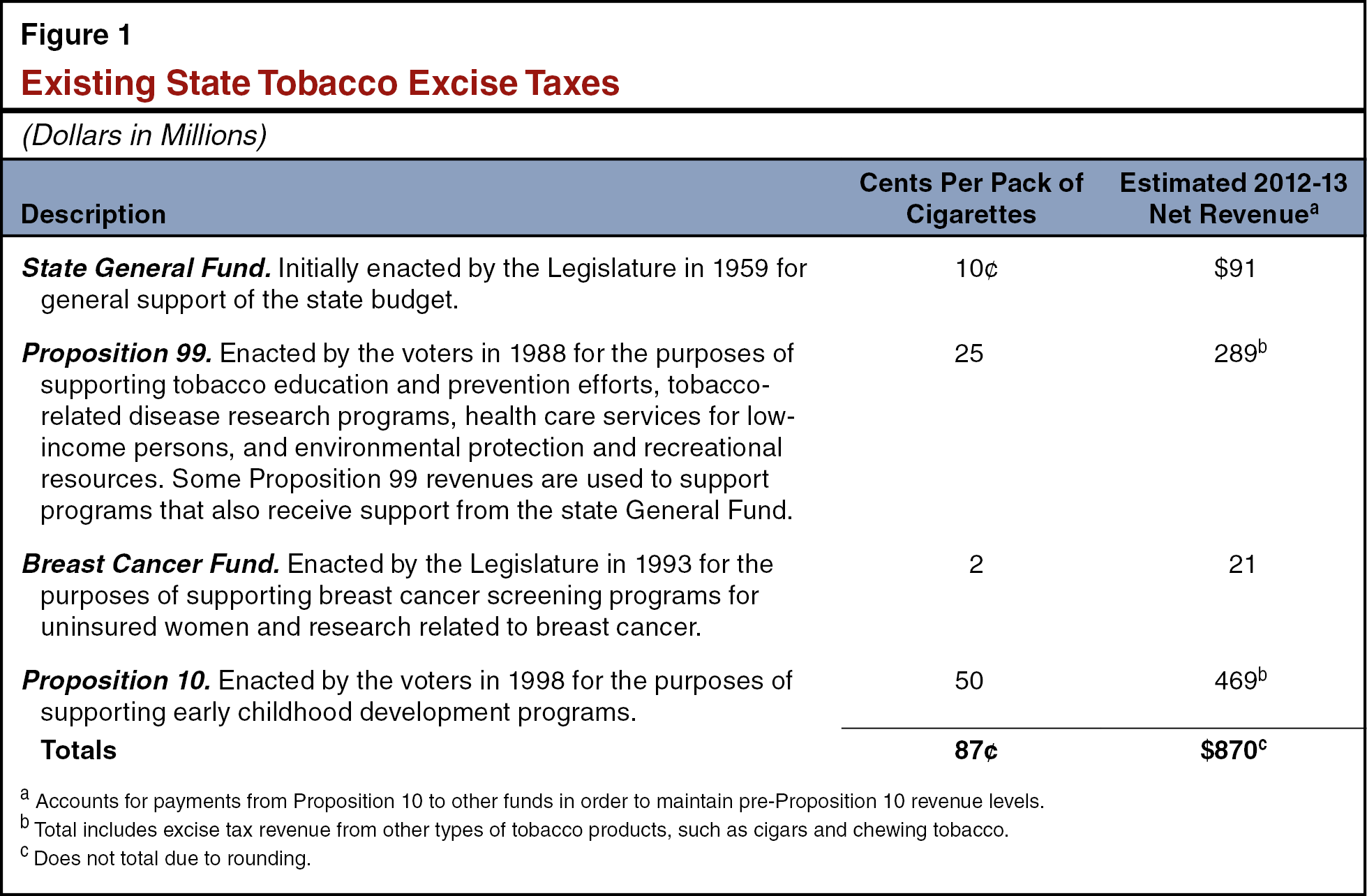

Existing State Excise Taxes. Current state

law imposes excise taxes on the distribution of cigarettes and other

tobacco products, such as cigars and chewing tobacco. Tobacco excise

taxes are paid by distributors who supply cigarettes and other tobacco

products to retail stores. These taxes are typically passed on to

consumers as higher prices on cigarettes and other tobacco products.

The state’s cigarette excise tax is currently 87 cents per pack.

Figure 1 describes the different components of the per-pack tax. As the

figure shows, two voter-approved measures—Proposition 99 in 1988 and

Proposition 10 in 1998—are responsible for generating the vast majority

of tobacco excise tax revenues. As Figure 1 indicates, total state

revenues from existing excise taxes on cigarettes and other tobacco

products were roughly $870 million in 2012‑13.

Revenues from existing excise taxes on other tobacco products support

Proposition 10 and 99 purposes. Under current law, any increase in

cigarette taxes automatically triggers an equivalent increase in excise

taxes on other tobacco products, with the revenues going to support

Proposition 99 purposes.

Existing Federal Excise Tax. The federal

government also imposes an excise tax on cigarettes and other tobacco

products. In 2009, this tax was increased by 62 cents per pack (to a

total of $1.01 per pack) to help fund the Children’s Health Insurance

Program, which provides subsidized health insurance coverage to children

in low-income families.

Existing State and Local Sales and Use Taxes.

Sales of cigarettes and other tobacco products are also subject

to state and local sales and use taxes. These taxes are imposed on the

retail price of a product, which includes excise taxes that have

generally been passed along from distributors. The average retail price

of a pack of cigarettes in California currently is close to $6. More

than $400 million in annual revenue from sales and use taxes on

cigarettes and other tobacco products go to the state and local

governments.

Funding for Brain and Central Nervous System Disorder

Research

National Institute of Neurological Disorders and Stroke

(NINDS). The federal National Institutes of Health’s (NIH)

NINDS aims to reduce the burden of neurologic disease by funding and

conducting research on the nervous system. The overall budget for NINDS

is approximately $1.6 billion annually, of which about 90 percent is

allocated to research. In federal fiscal year (FFY) 2013, NINDS awarded

almost $285 million to organizations in California.

National Institute of Aging (NIA). The

NIH’s NIA leads a broad scientific effort to understand the nature of

aging. The Division of Neuroscience within NIA supports research and

training to further the understanding of how the central nervous system

and behavior are affected by aging. The overall budget for NIA is

approximately $1.1 billion annually, of which about 40 percent is

allocated to NIA’s Division of Neuroscience. In FFY 2013, NIA awarded

over $170 million to institutes in California to support research

related to aging, including brain and central nervous system research.

Proposal

This measure increases excise taxes on the distribution of

cigarettes. The additional revenues would be used to fund research of

brain and central nervous system disorders, and for other specified

purposes. The major provisions of the measure are described below.

New State Tobacco Tax Revenues

This measure increases—effective on the date the Secretary of State

certifies the election results—the existing state excise tax on

cigarettes by $1 per pack. The total state excise tax, therefore, would

be $1.87 per pack. This measure also creates a one-time tax on

cigarettes that are stored by wholesalers and dealers on April 1, 2015.

How New Cigarette Tax Revenues Would Be Spent

Revenues from the cigarette excise tax increase would be deposited in

a new special fund, called the California Brain Research Trust Fund

(hereafter referred to as the fund). These revenues would be dedicated

to the support of research on brain and central nervous system diseases

and disorders. Revenues deposited in the fund would only be used for

purposes set forth in the measure and would not be subject to

appropriation by the Legislature. After compensating existing tobacco

tax program funds for any losses due to the imposition of the new tax

(as described in the next section), the remaining money would be

distributed as follows:

- Research Subfund. Eighty percent of

the funds would be used to award grants and loans to support

research in California into brain mapping, and brain and central

nervous system diseases and disorders. Not more than 15 percent of

the funds could be used for grants and loans for facilities and

equipment. The funds would be awarded through a peer review process

that would be modeled on the NIH’s grant-making process.

- Tobacco and Substance Prevention and Cessation

Subfund. Fifteen percent of the funds would be used to

carry out brain research in California on the causes, early

detection, treatment, prevention, and cessation of the use of

cigarettes, other tobacco products, and other addictive substances

and behaviors.

- Unallocated Subfund. Three percent of

the funds would be used to carry out any of the purposes of this

measure except for general administrative functions.

- Administrative Subfund. Two percent of

the funds would be used for the general administrative functions of

the committee which oversees the fund (described below).

Backfill of Existing Tobacco Tax Programs.

This measure requires the transfer of some revenues raised by the new

tax to “backfill,” or offset, any revenue losses that occur to existing

state cigarette and tobacco taxes as a direct result of the imposition

of the new tax. These revenue losses would occur mainly because an

increase in the price of cigarettes and other tobacco products generally

reduces consumption and results in more sales for which California taxes

are not collected. This, in turn, would reduce the amount of revenues

collected through the existing state excise taxes described above. The

amount of backfill payments needed to offset any loss of funding in

these areas would be determined by the Board of Equalization (BOE).

Committee Established to Administer Fund

The trust fund would be overseen by a newly created California Brain

Research Citizen’s Oversight Committee (hereafter referred to as the

committee). The committee would be composed of eleven members, including

four members appointed by the Governor, the president of the University

of California, and the chancellors of the University of California at

San Francisco, Berkeley, Davis, San Diego, Los Angeles, and Irvine.

Authority Granted to the Committee. The

measure would authorize the committee to act as the trustee of the fund

and oversee the operations of the fund. The measure would give the

committee the authority to:

- Appoint a chief executive officer who would have the authority

to hire employees as necessary for the administration of the fund.

- Establish a process for soliciting, reviewing, and awarding

grants and loans for research and facilities, and for revoking or

rescinding grants and loans that do not conform to approved research

standards.

- Establish and appoint additional committees and advisory bodies

as necessary to carry out the committee’s duties.

- Develop annual and long-term strategic research and financial

plans and periodically review the income and expenditures of the

fund.

- Establish policies regarding intellectual property rights

arising from research funded by this measure consistent with those

implemented by the University of California.

- Establish rules and guidelines for the operation of the fund and

its employees.

Committee Accountability. The measure

includes conflict-of-interest provisions that govern the conduct of the

committee members. The measure would require the committee to issue an

annual report to the public that includes information on its

administrative expenses, the number and amount of grants provided, and a

summary of research accomplishments. The committee would be required to

have an independent financial audit each year which would be reviewed by

the State Controller. The measure would also establish the Citizen’s

Financial Accountability Oversight Committee which would be chaired by

the State Controller to review the annual financial audit and provide

recommendations on the committee’s financial practices and performance.

Other Major Provisions

Committee Would Establish Standards to Ensure Grantees

Purchase Goods and Services From California Suppliers. The

committee would be required to establish standards to ensure that

grantees purchase goods and services from California suppliers, to the

extent reasonably possible, in a good faith effort to achieve a goal of

more than 50 percent of such purchases from California suppliers.

Fiscal Effects

This measure would have a number of fiscal effects on state and local

governments. The major impacts are discussed below.

Impacts on State and Local Revenues

Revenues Would Be Affected by Consumer Response.

Our revenue estimates assume that the proposed excise tax

increase would be passed along to consumers. In other words, we assume

that the retail prices of cigarettes and other tobacco products would be

raised to include the excise tax increase. We expect consumers to

respond to this price increase in two ways: by reducing their

consumption of cigarettes and other tobacco products and by changing the

way they acquire cigarettes and other tobacco products so that fewer

transactions are taxed. For example, consumers could substitute toward

electronic cigarettes, which are not subject to the excise tax on

cigarettes and other tobacco products. In addition, consumers could

avoid paying cigarette taxes by purchasing untaxed cigarettes from

Internet vendors. Although state and federal laws generally prohibit

this form of tax avoidance, the effectiveness of these policies is

uncertain. As a result, the magnitude of the consumer response to the

proposed tax increase is difficult to estimate precisely.

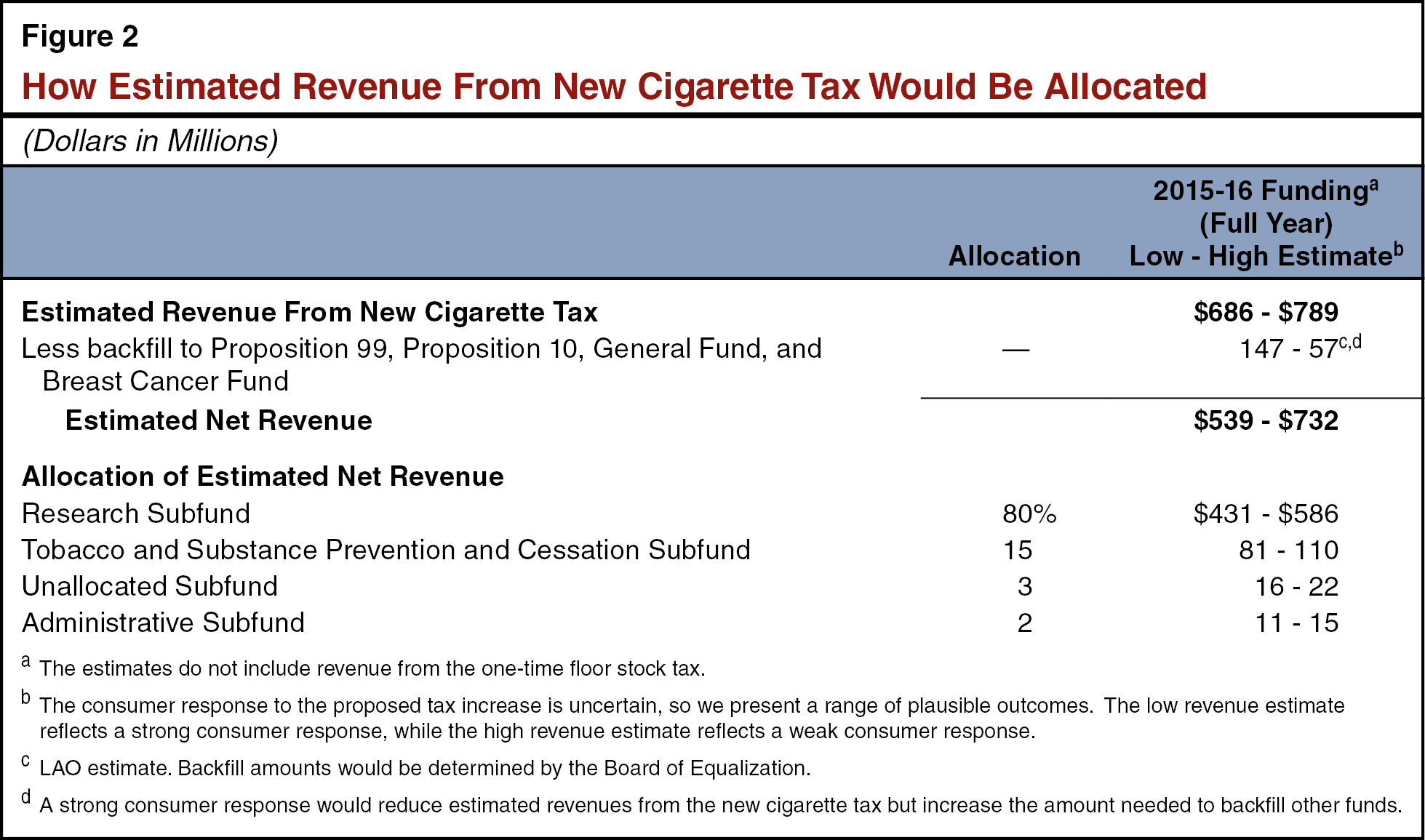

New Cigarette Excise Tax Revenues. We

estimate that the increase in cigarette excise taxes required by this

measure would raise an estimated $700 million to $800 million in

revenue. The range reflects the uncertainty of the magnitude of the

consumer response to the proposed tax increase discussed above. Our

estimate of the allocation of new cigarette excise tax revenues in

2015‑16 (the first full-year impact) is shown in Figure 2. After

backfilling losses in existing tobacco excise tax revenue (described in

more detail below), the new cigarette excise tax would generate an

estimated $500 million to $750 million in net revenue in 2015‑16 for the

purposes described in the measure. (These estimates do not include

revenue from the one-time tax on cigarettes stored by wholesalers and

dealers.) The cigarette excise tax increase would generate somewhat

lower amounts of revenue each year thereafter, based on our projections

of continued declines in cigarette consumption.

Effects on Existing Tobacco Excise Tax Revenues.

The decline in consumption of cigarettes and other tobacco

products caused by this measure would reduce revenues from the existing

excise taxes that go to support Propositions 99 and 10 purposes, the

General Fund, and the Breast Cancer Fund. The measure provides for the

backfill of these losses from revenues raised by the new excise tax. We

estimate that the amount of backfill funding needed to comply with this

requirement would be at least $50 million but not more than $150 million

annually, as shown in Figure 2.

As noted earlier, this measure would have an additional fiscal effect

on excise taxes that go to support Proposition 99 purposes. Under

current law, any cigarette tax increase triggers an automatic

corresponding increase in the taxes on other tobacco products, with the

additional revenues going to support Proposition 99 purposes. We

estimate that the higher tax on other tobacco products would result in a

full-year Proposition 99 revenue gain of roughly $50 million, beginning

in 2015‑16.

Effect on State and Local Sales and Use Tax Revenues.

Sales and use taxes are levied on a variety of products,

including the retail price of cigarettes and other tobacco products. The

retail price usually includes the cost of all excise taxes. The excise

tax increase under the measure would raise the retail price of taxable

cigarettes and tobacco products, and consumers would respond by buying

fewer of those goods. The net effect on sales and use tax revenue from

the sale of cigarettes and tobacco products could be positive or

negative, depending on the magnitude of the consumer response. The

excise tax increase could also lead to changes in spending on other

products subject to sales and use taxes. On net, we estimate sales and

use tax revenue effects ranging from a $30 million annual loss to a

$40 million annual gain. Again, this range reflects the uncertainty of

the magnitude of the consumer response to the proposed tax increase

under the measure. For example, sales and use tax revenue losses could

result if consumers respond to the proposed tax increase by buying far

fewer taxed cigarettes and other tobacco products.

Impact on State Administrative Costs

This measure would result in administrative costs for the State

Controller’s Office (SCO) and BOE. The costs to SCO would be minor and

absorbable. The BOE estimates costs resulting from this measure of

approximately $14 million to $17 million annually. This measure

authorizes but does not require the committee to reimburse BOE for its

costs associated with the measure. (We note that the administrative

costs of the committee created by this measure are supported by the

revenues generated by this measure.)

Impact on State and Local Government Health Care Costs

The state and local governments in California incur costs for

providing (1) health care for low-income and uninsured persons and (2)

health insurance coverage for state and local government employees and

retirees. Consequently, changes in state law such as those made by this

measure that affect the health of the general population—and low-income

and uninsured persons and public employees in particular—would affect

publicly funded health care costs.

For example, as discussed above, this measure would result in a

decrease in the consumption of tobacco products as a result of the

expected price increase of tobacco products. The use of tobacco products

has been linked to various adverse health effects by the federal health

authorities and numerous scientific studies. Thus, this measure would

reduce state and local government health care spending on

tobacco-related diseases over the long term. This measure would have

other fiscal effects that offset these cost savings. For example, social

services that otherwise would not have occurred as a result of

individuals who avoid tobacco-related diseases living longer. Thus, the

net long-term fiscal impact of this measure on state and local

government health care costs is unknown.

Summary of Fiscal Effects

This measure would have the following significant fiscal effects:

- Net increase in cigarette excise tax revenues in the range of

$500 million to $750 million annually by 2015‑16. Revenues would

decrease slightly each year thereafter. The funds would be used to

support research on brain and central nervous system diseases and

disorders.

- Increase in excise tax revenues on other tobacco products of

roughly $50 million annually going mainly to existing health

programs.

- Change in state and local sales tax revenues ranging from a

$30 million loss to a $40 million gain annually.

Return to Initiatives

Return to Legislative Analyst's Office Home Page