In this report, we assess many of the Governor’s budget proposals in the resources and environmental protection area and recommend various changes. We provide a complete listing of our recommendations at the end of the report.

Total Expenditures Down by 16 Percent—Due to Drop in Bond Spending. The Governor’s budget proposes a total of $8.3 billion in expenditures from the General Fund, special funds, bond funds, and federal funds for resources and environmental protection programs in 2014–15. The proposed budget includes $3.8 billion for the Department of Water Resources (DWR), $1.5 billion for the Department of Resources Recycling and Recovery (CalRecycle), and $1.4 billion for the Department of Forestry and Fire Protection (CalFire), as well as funding for many other departments. This proposed level of funding is a decrease of $1.6 billion, or 16 percent, below estimated expenditures for the current year, almost entirely from lower bond funds.

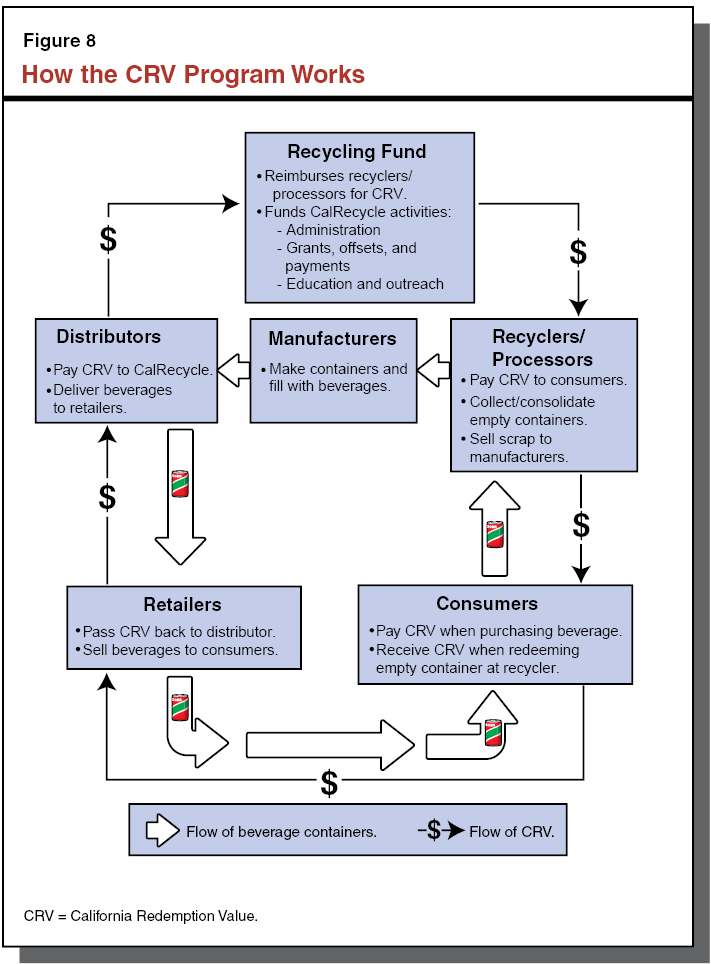

Budget Includes Several Major Policy Proposals. The budget includes a cap–and–trade expenditure plan from the administration—totaling $850 million in 2014–15. (We discuss this proposal in more detail in our report The 2014–15 Budget: Cap–and–Trade Auction Revenue Expenditure Plan.) The administration also proposes $621 million from various fund sources to implement the first phase of its recently released Water Action Plan (WAP). This plan identifies a series of actions the administration believes the state should take over the next five years to address a range of water–related challenges, such as reduced water supply and poor water quality. For example, one WAP activity proposed in the Governor’s budget is the transfer of the state’s drinking water oversight program from the Department of Public Health (DPH) to the State Water Resources Control Board (SWRCB). Another important issue addressed in the Governor’s budget is the roughly $100 million annual structural deficit in the Beverage Container Recycling Fund (BCRF). The administration proposes to reduce or eliminate several programs currently funded by the BCRF in order to bring the fund into balance. We find that these proposals are generally reasonable approaches to addressing significant policy challenges. We also identify trade–offs in the administration’s approach and offer recommendations to allow the Legislature to ensure that proposals are consistent with its priorities.

Opportunities for Legislative Oversight. The Governor’s proposed budget raises several issues that we believe merit greater legislative oversight. For example, the budget includes one–time funding of $43 million from the General Fund to address deferred maintenance at the Department of Parks and Recreation (DPR) and CalFire facilities. We find that while it makes fiscal sense to address deferred maintenance, there is uncertainty about what factors have contributed to the large amount of deferred maintenance in these departments, as well as how the state can best address maintenance needs on an ongoing basis. Similarly, the budget includes a total of $4.6 million for the Department of Toxic Substances Control (DTSC) to implement changes designed to address several operational problems, including backlogs in updating hazardous waste permits. We find that the funding requested will not be sufficient to fix all of the issues identified on an ongoing basis. This finding raises questions about how the department will manage these problems in out years.

Total Spending Down by 16 Percent. The Governor’s budget for 2014–15 proposes a total of $8.3 billion in expenditures from various fund sources—the General Fund, various special funds, bond funds, and federal funds—for programs administered by the Natural Resources and Environmental Protection Agencies. This level is a decrease of $1.6 billion, or 16 percent, below estimated expenditures for the current year. The proposed reduction in spending is related to bond funds. Specifically, the budget proposes bond expenditures totaling about $1.4 billion in 2014–15—a decrease of $1.9 billion, or about 58 percent, below estimated bond expenditures in the current year.

Multiple Funding Sources; Special Funds Predominate. The largest amount of state funding for resources and environmental protection programs in the budget year—about $4 billion (or 49 percent)—would come from various special funds. This reflects an increase of $142 million, or 4 percent, when compared to estimated special fund expenditures in the current year. The primary special funds that support resources and environmental protection programs include funds generated by beverage container recycling deposits and fees, an “insurance fund” for the cleanup of leaking underground storage tanks, the Fish and Game Preservation Fund, and cap–and–trade auction revenues.

General Fund Spending Grows Slowly. The Governor’s budget includes $2.2 billion in expenditures from the General Fund (27 percent of total expenditures) in 2014–15 for resources and environmental protection programs. This is a net increase of $54 million, or 2 percent, from 2013–14, reflecting both General Fund spending increases and decreases. The largest General Fund proposal in these programs is a proposed $14 million increase for CalFire to increase fire protection services in Lake Tahoe, San Bernardino, and Riverside.

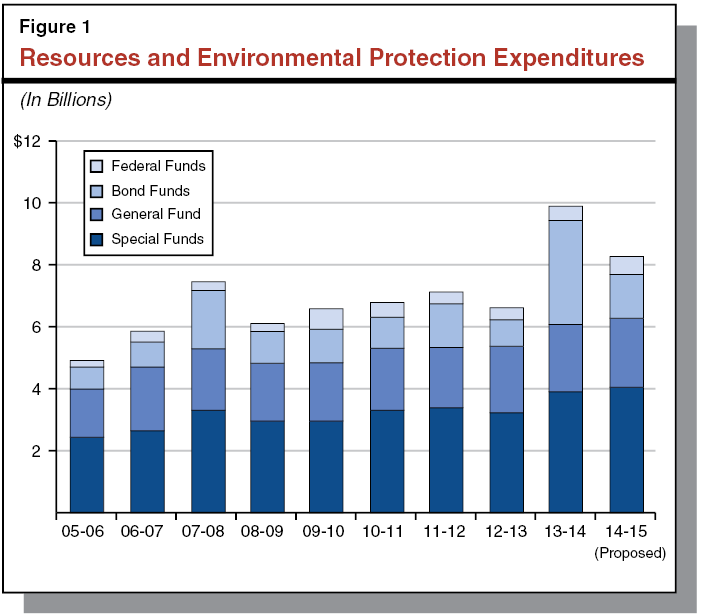

Overall Expenditure Trends. Figure 1 shows total expenditures for resources and environmental protection programs from all funding sources since 2005–06. As indicated in the figure, total spending generally has grown steadily between 2005–06 and 2013–14, averaging roughly a 9 percent annual increase. The increase is mainly due to the availability of a greater amount of special fund revenues. The availability of bond funds also resulted in spikes in spending in certain fiscal years, such as in 2007–08 and 2013–14. As indicated above, the proposed reduction in total expenditures in 2014–15 primarily reflects a lower–than–expected level of bond expenditures.

Figure 2 shows spending by selected fund sources for the state’s major resources programs and departments—that is, programs within the jurisdiction of the Natural Resources Agency. As the figure shows, total spending proposed for most resources programs is generally down in 2014–15, resulting from a reduction in bond fund expenditures. For example, the budget proposes a reduction of $1.3 billion, or 63 percent, in bond spending for DWR.

Figure 2

Major Resources Budget Summary—Selected Funding Sources

(Dollars in Millions)

|

Department

|

Actual

2012–13

|

Estimated

2013–14

|

Proposed

2014–15

|

Change From 2013–14

|

|

Amount

|

Percent

|

|

Water Resources

|

|

|

|

|

|

|

General Fund

|

$91.6

|

$100.2

|

$100.9

|

$0.7

|

0.7%

|

|

State Water Project funds

|

1,180.8

|

1,558.9

|

1,896.6

|

337.6

|

21.7

|

|

Bond funds

|

361.5

|

2,015.8

|

744.4

|

–1,271.4

|

–63.1

|

|

Electric Power Fund

|

937.8

|

988.6

|

956.4

|

–32.2

|

–3.3

|

|

Other funds

|

50.9

|

127.8

|

94.9

|

–32.9

|

–25.7

|

|

Totals

|

$2,622.5

|

$4,791.3

|

$3,793.2

|

–$998.1

|

–20.8%

|

|

Forestry and Fire Protection

|

|

|

|

|

|

|

General Fund

|

$859.2

|

$721.9

|

$777.6

|

$55.8

|

7.7%

|

|

Other funds

|

469.0

|

538.5

|

663.0

|

124.5

|

23.1

|

|

Totals

|

$1,328.2

|

$1,260.3

|

$1,440.6

|

$180.3

|

14.3%

|

|

Parks and Recreation

|

|

|

|

|

|

|

General Fund

|

$110.3

|

$117.6

|

$115.9

|

–$1.7

|

–1.4%

|

|

Parks and Recreation Fund

|

117.1

|

141.5

|

169.7

|

28.3

|

20.0

|

|

Bond funds

|

179.1

|

146.3

|

89.9

|

–56.4

|

–38.6

|

|

Other funds

|

157.7

|

312.6

|

279.2

|

–33.4

|

–10.7

|

|

Totals

|

$564.3

|

$718.1

|

$654.8

|

–$63.2

|

–8.8%

|

|

Fish and Wildlife

|

|

|

|

|

|

|

General Fund

|

$61.1

|

$63.5

|

$63.6

|

$0.1

|

0.1%

|

|

Fish and Game Fund

|

92.3

|

115.8

|

113.3

|

–2.6

|

–2.2

|

|

Bond funds

|

27.1

|

91.9

|

16.6

|

–75.3

|

–81.9

|

|

Other funds

|

154.5

|

184.6

|

210.5

|

25.8

|

14.0

|

|

Totals

|

$335.0

|

$455.9

|

$404.0

|

–$52.0

|

–11.4%

|

|

Conservation

|

|

|

|

|

|

|

General Fund

|

$3.6

|

$3.0

|

$3.0

|

—

|

0.1%

|

|

Bond funds

|

25.3

|

48.6

|

2.4

|

–$46.2

|

–95.0

|

|

Other funds

|

57.4

|

73.2

|

88.1

|

14.9

|

20.4

|

|

Totals

|

$86.3

|

$124.8

|

$93.5

|

–$31.3

|

–25.1%

|

Despite an overall decline in proposed bond spending for resources programs, the budget includes the appropriation of new bond funds in 2014–15 for both existing and new programs. For example, the budget proposes to spend $473 million in bond funds from Proposition 84 for grants to local agencies for multibenefit water projects through the Integrated Regional Water Management (IRWM) program. The budget also proposes $77 million in bond funds from Propositions 1E and 84 for flood control projects, planning, and emergency response activities. The only major resources department with an increase in total funding proposed in the Governor’s budget is CalFire, which is proposed to receive an increase of $180 million, 14 percent, over estimated current–year expenditures. This includes a $14 million General Fund increase to expand its fire protection service area as described above, as well as $50 million from cap–and–trade auction revenues to implement several programs designed to reduce greenhouse gas (GHG) emission levels.

Similar to Figure 2, Figure 3 shows spending and fund source information for the major environmental protection programs—those within the jurisdiction of the California Environmental Protection Agency (CalEPA). The proposed budget for CalRecycle includes a $31 million reduction in the BCRF from a proposal to implement various financial reforms designed to fix an ongoing structural deficit in the fund. The budget also proposes to transfer responsibility for administering the state’s drinking water regulation program from DPH to the SWRCB and shifts $202 million (primarily in federal and various special funds) to the board for these activities. The proposed 2014–15 budget for the Air Resources Board (ARB) includes (1) about $200 million from cap–and–trade revenues (GHG Reduction Fund) to expand incentive programs designed to promote clean transportation, and (2) a $240 million reappropriation of Proposition 1B funds to support local agencies’ efforts to reduce emissions from goods movement sources, such as diesel trucks, trains, and ships.

Figure 3

Major Environmental Protection Budget Summary—Selected Funding Sources

(Dollars in Millions)

|

Department

|

Actual

2012–13

|

Estimated

2013–14

|

Proposed

2014–15

|

Change From 2013–14

|

|

Amount

|

Percent

|

|

Resources Recycling and Recovery

|

|

|

|

|

|

|

Beverage container recycling funds

|

$1,216.3

|

$1,193.5

|

$1,143.2

|

–$50.2

|

–4.2%

|

|

Other funds

|

244.2

|

282.8

|

328.5

|

45.7

|

16.1

|

|

Totals

|

$1,460.5

|

$1,476.3

|

$1,471.8

|

–$4.6

|

–0.3%

|

|

State Water Resources Control Board

|

|

|

|

|

|

|

General Fund

|

$14.5

|

$15.0

|

$22.6

|

$7.6

|

50.9%

|

|

Underground Tank Cleanup

|

233.9

|

281.5

|

233.2

|

–48.3

|

–17.2

|

|

Waste Discharge Fund

|

100.5

|

109.9

|

116.0

|

6.1

|

5.6

|

|

Bond funds

|

33.1

|

144.6

|

187.1

|

42.5

|

29.4

|

|

Other funds

|

71.2

|

231.6

|

453.7

|

222.0

|

95.8

|

|

Totals

|

$453.2

|

$782.7

|

$1,012.7

|

$230.0

|

29.4%

|

|

Air Resources Board

|

|

|

|

|

|

|

Motor Vehicle Account

|

$113.7

|

$121.5

|

$128.1

|

$6.6

|

5.4%

|

|

Air Pollution Control Fund

|

140.0

|

125.7

|

114.4

|

–11.3

|

–9.0

|

|

Greenhouse Gas Reduction Fund

|

—

|

31.3

|

204.7

|

173.3

|

553.5

|

|

Bond funds

|

19.0

|

135.9

|

240.0

|

104.1

|

76.6

|

|

Other funds

|

69.9

|

137.8

|

114.1

|

–23.7

|

–17.2

|

|

Totals

|

$342.7

|

$552.2

|

$801.3

|

$249.1

|

45.1%

|

|

Toxic Substances Control

|

|

|

|

|

|

|

General Fund

|

$21.4

|

$21.8

|

$21.2

|

–$0.6

|

–2.6%

|

|

Hazardous Waste Control

|

44.7

|

52.1

|

55.7

|

3.6

|

7.0

|

|

Toxic Substances Control

|

43.6

|

43.7

|

44.1

|

0.3

|

0.8

|

|

Other funds

|

93.0

|

86.1

|

74.4

|

–11.7

|

–13.6

|

|

Totals

|

$202.7

|

$203.6

|

$195.3

|

–$8.3

|

–4.1%

|

|

Pesticide Regulation

|

|

|

|

|

|

|

Pesticide Regulation Fund

|

$71.8

|

$79.3

|

$80.2

|

$0.9

|

1.2%

|

|

Other funds

|

6.6

|

3.1

|

3.1

|

—

|

0.3

|

|

Totals

|

$78.4

|

$82.4

|

$83.3

|

$0.9

|

1.2%

|

Hydraulic fracturing and acid matrix stimulation are two types of well stimulation techniques used to increase the production of oil and gas. Typically, hydraulic fracturing relies on injecting a mixture of high–pressure water, sand, and chemicals deep into underground geologic formations. Acid matrix stimulation utilizes the injection of one or more acid mixtures into an underground geologic formation. Of the roughly 42,000 active wells in California, it is estimated that on average between 1,000 and 2,000 wells will likely undergo one or more of these types of well stimulation activities each year.

Chapter 313, Statutes of 2013 (SB 4, Pavley), commonly referred to as SB 4, requires the regulation of oil and gas well stimulation treatments such as hydraulic fracturing. The legislation requires, among other things, the development of regulations (which we discuss in more detail below), a permitting process, and public notification and disclosure of wells that will undergo hydraulic fracturing and acid matrix stimulation and the types of chemicals used for these processes. The legislation also states that workload associated with its implementation can be funded by the Oil, Gas, and Geothermal Administrative Fund (OGGAF). The OGGAF is funded through a fee administered by the Division of Oil, Gas, and Geothermal Resources (DOGGR) within the Department of Conservation. The fee is designed to recover the division’s costs to regulate oil and gas extraction in the state. The fee is currently assessed at $0.14 per barrel of oil produced or 10,000 cubic feet of natural gas produced in the state.

Among its regulatory requirements, SB 4 requires DOGGR to adopt rules and regulations by January 2015 regarding the construction of wells and well casings, as well as the disclosure of the composition and disposal of well stimulation fluids. As part of the regulations, DOGGR must require well operators to apply for a permit prior to performing well stimulation activities, which must be posted on a publicly accessible portion of DOGGR’s website. The regulations must also include provisions for random inspections by DOGGR during well stimulation activities. In addition, SB 4 requires DOGGR to provide a progress report to the Legislature by April 1, 2014.

Senate Bill 4 also requires that groundwater monitoring be performed in areas that have well stimulation activity, in order to detect if groundwater is contaminated. Specifically, the legislation requires SWRCB to (1) provide guidance to DOGGR on the development of regulations for wells where groundwater could be affected, (2) develop criteria specifying requirements for groundwater monitoring in areas with well stimulation activities and a plan for monitoring groundwater based on those criteria by July 1, 2015, and (3) begin monitoring groundwater by January 1, 2016. Senate Bill 4 also requires well owners and operators to develop groundwater monitoring plans if they are in an area which is not monitored by SWRCB. In addition, SB 4 requires DOGGR to enter into formal agreements with multiple departments (including the ARB and DTSC), in order to delineate roles and responsibilities related to its implementation.

The Governor’s budget includes proposals in three departments for workload related to the regulation of hydraulic and acid matrix fracturing. In total, the administration requests $20.5 million from the OGGAF and 85 positions in 2014–15. Of this total, $19.9 million and 80 positions are proposed to be ongoing. The Governor’s budget reflects an increase of $23 million in OGGAF revenue based on an assumed increase in the regulatory fee administered by DOGGR to pay for these additional costs. At the time of this analysis, it is uncertain how such a fee increase will be assessed. Specifically, the administration proposes adjustments for the following departments.

- DOGGR. The Governor’s budget requests 60 permanent positions, 5 limited–term positions, and $13 million in 2014–15 ($9.2 million ongoing) for DOGGR to regulate well stimulation techniques. The bulk of these positions would be used for engineering and geological workload, such as monitoring compliance with state regulations at extraction sites.

- SWRCB. The budget requests $6.2 million and 14 positions in 2014–15 for SWRCB to develop the groundwater monitoring criteria and plan, as well as to evaluate compliance by well owners and operators who develop their own groundwater monitoring plans. It also includes funding for contracts to perform groundwater monitoring. The request for SWRCB would increase to $9.4 million in 2015–16, which is primarily due to additional costs related to groundwater monitoring contracts.

- ARB. The Governor’s budget requests six positions and $1.3 million for ARB to develop regulations to control and mitigate GHG emissions, “criteria pollutants,” and toxic air contaminants resulting from well stimulation.

The Governor also proposes budget trailer legislation to address what the administration describes as an inconsistency in SB 4 related to groundwater monitoring. Specifically, sections of SB 4 varied in whether it required SWRCB to “review” or “approve” groundwater monitoring plans developed by well owners and operators. The proposed legislation would specifically require SWRCB to review—rather than approve—monitoring plans. According to the administration, this change is necessary in order to clarify DOGGR’s role as the lead state agency responsible for preparing environmental impact reports. Finally, the administration states that it may also propose budget trailer legislation to clarify how the fee increase will be assessed in order to generate the additional revenue reflected in the proposed budget to fund the requested proposals.

The Governor’s proposals raise several issues for legislative consideration. First, as indicated above, while SB 4 states that monies from the OGGAF can be used for costs associated with the implementation of the bill, the administration has not yet determined how the fee increase will be assessed. The administration is currently considering two options, either (1) increasing the per barrel fee on all production in the state, or (2) assessing a fee increase just on those wells that undergo well stimulation. This is a policy choice on which SB 4 was silent, and there are trade–offs with each option. On the one hand, assessing the fee on all in–state production would spread the costs over many more parties, thus reducing the fee burden associated with regulating any single well. However, this would mean charging some oil producers for the costs associated with the regulation of an activity in which they are not engaged. On the other hand, if the fee increase were levied solely on those entities that are using well stimulation, it would be more expensive for those producers. Based on the cost proposals from the administration, we estimate that if the fee were only charged to those entities performing well stimulation each year, the average cost would be around $10,000 to $20,000 per well, though the exact amount paid by any individual driller or operator might vary depending on the number of wells which undergo well stimulation.

Second, it appears that the SWRCB request for contract funding in 2014–15 is premature. As indicated above, SWRCB is not required to complete the development of its criteria and monitoring plan until July 1, 2015. In addition, SWRCB cannot begin monitoring groundwater until the criteria and plan are developed. Thus, funding for groundwater monitoring is not needed until 2015–16.

Third, SWRCB’s groundwater monitoring and other activities will vary based on a variety of factors, such as how many wells are stimulated, where the stimulated wells are located, and whether well operators/owners perform monitoring themselves. These factors will depend on the criteria and monitoring plan developed by SWRCB. Thus, while SWRCB will almost certainly have workload associated with monitoring and ensuring compliance by well owners and operators in 2015–16, the extent of that workload is unknown until the criteria and monitoring plan are developed. Thus, the number of positions needed to complete that workload in 2015–16 is currently unknown.

Fourth, while we agree with the administration’s contention that current law regarding SWRCB’s role in reviewing or approving monitoring plans is somewhat inconsistent, the proposed trailer bill language is a policy change that would affect which agency is responsible for approving groundwater plans, as well as who is the lead agency for preparing environmental impact reports. Therefore, the Legislature will want to make sure the proposal reflects its intentions for how groundwater monitoring is carried out.

Finally, the administration’s proposal to provide ARB with positions and contract funding to develop regulations to control and mitigate GHG emissions, criteria pollutants, and toxic air contaminants related to well stimulation raises questions regarding legislative intent and workload justification. Senate Bill 4 only requires monitoring of air quality in areas where well stimulation occurs. The legislation does not explicitly direct ARB or any other agency to develop regulations to control or mitigate emissions resulting from well stimulation. Thus, it is unclear if the proposed funding and positions for ARB are consistent with the intent of SB 4. We also note that, under state and federal authority, local air districts currently regulate emissions from wells. In fact, it appears that some air districts are already monitoring emissions that occur with well stimulation, potentially resulting in some duplication of effort between ARB and local boards. In addition, it is unclear why the Governor’s budget is proposing to provide ARB with ongoing resources for activities that primarily constitute one–time workload in developing regulations.

With regards to the administration’s hydraulic fracturing request, we recommend that the Legislature:

- Approve DOGGR Request. The Governor’s request for additional positions for DOGGR to implement SB 4 is justified on a workload basis. We therefore recommend that the Legislature approve 60 permanent positions, 5 limited–term positions, and $13 million in 2014–15 ($9.2 million ongoing) to regulate well stimulation techniques.

- Ensure Proposals Are Consistent With Legislative Intent. As described above, certain aspects of SB 4 are unclear. The Legislature will want to review these budget proposals to determine whether the administration’s interpretations of the requirements in SB 4 are consistent with legislative policy intent. Specifically, the Legislature will want to determine (1) how the proposed fee increase should be assessed—on all oil producers in the state or just those using hydraulic or acid matrix fracturing techniques, (2) if SWRCB should review or approve well owners’ groundwater monitoring plans, and (3) what activities it wants ARB and local air districts to perform in implementing SB 4. The Legislature may want to approve legislation to clarify its intent in some of these cases. In addition, if the Legislature decides that ARB’s role should be more limited than is proposed, we recommend ARB’s proposal be reduced or rejected to reflect that role.

- Reduce SWRCB Request. We recommend that the Legislature deny the request to fund groundwater monitoring contracts ($3.5 million in 2014–15 and $7 million in 2015–16) and direct SWRCB to request funding in the 2015–16 budget once its criteria and monitoring plan are complete. In addition, we recommend that the Legislature approve SWRCB’s request for 14 positions on a two–year limited–term basis. This would allow SWRCB and the Legislature to reevaluate the need for positions depending on actual workload data following the first year of implementation of the groundwater monitoring plans and other activities.

Many state departments own and operate their own facilities and other types of infrastructure. Within the resources and environmental protection program area, DPR and CalFire have large amounts of property and physical assets. As shown in Figure 4, this includes thousands of miles of trails and tens of thousands of campsites and other facilities spread over 1.6 million acres of park land, as well as nearly 300 fire stations, camps, and bases used to combat forest fires.

Figure 4

Department of Parks and Recreation and CalFire Key Assets Maintained

|

Holdings

|

Quantity

|

|

Department of Parks and Recreation

|

|

|

Museum objects, archaeological specimens, and archival documents

|

More than 6,000,000

|

|

Acres of land

|

1,600,000

|

|

Campsites

|

14,421

|

|

Archeological sites

|

10,271

|

|

Picnic sites

|

7,647

|

|

Miles of nonmotorized trails

|

4,456

|

|

Historic buildings

|

3,375

|

|

Overnight noncamping facilities

|

709

|

|

Park units

|

280

|

|

Department of Forestry and Fire Protection (CalFire)

|

|

|

Fire stations

|

228

|

|

Communications tower and vault sites

|

112

|

|

Lookouts

|

66

|

|

Conservation camps

|

39

|

|

Air and helitack bases

|

22

|

It is the responsibility of departments to maintain their infrastructure. Maintenance needs are driven by the number, age, types, and uses of a department’s infrastructure. The maintenance needs for DPR and CalFire are significant because they have a large quantity of diverse assets, and many of their facilities were built a long time ago. For example, roughly three–fourths of CalFire’s facilities were built prior to 1950. In addition, many facilities were not designed for the amount and type of use required of them today. For example, the older park units operated by DPR were designed for far fewer visitors when they were constructed. Additionally, today’s parks accommodate recreational vehicles and many more group campers than the number for which they were designed. This contributes to deterioration and damage of many park properties and facilities, thereby necessitating more frequent repairs and modifications.

Frequently, preventive and routine facility maintenance does not occur as scheduled. When this happens, it is referred to as “deferred maintenance.” This typically happens due to a lack of funding or resources, the diversion of maintenance funding to other priorities, and growth in maintenance costs. If maintenance is routinely delayed, a backlog of deferred maintenance forms and grows. Deferred maintenance is problematic because when repairs to key building and infrastructure components are delayed, facilities can eventually require more expensive investments, such as emergency repairs (when systems break down), capital improvements (such as major rehabilitation), or replacement. Some facilities that are particularly overdue for repairs can even create liabilities for the state. As a result, while deferring annual maintenance avoids expenses in the short run, it often results in substantial costs in the long run. For more information on deferred maintenance and infrastructure, please see our recent report The 2014–15 Budget: A Review of the 2014 California Five–Year Infrastructure Plan.

The Governor’s budget for 2014–15 proposes a total of $43 million (one–time) from the General Fund for deferred maintenance in the natural resources program area. Specifically, the budget includes $40 million for DPR and $3 million for CalFire. By comparison, DPR estimates a $1.2 billion backlog of deferred maintenance and CalFire estimates a backlog of $27 million. (We note that the DPR estimated backlog in this report differs from that in the Governor’s infrastructure plan and reflects an updated estimate from the department.) Neither department has identified the specific deferred maintenance projects they would complete with these additional funds. Instead, the Governor proposes budget control language requiring that the administration report to the Joint Legislative Budget Committee the list of deferred maintenance projects (DPR, CalFire, and other state departments) that will be funded 30 days prior to the allocation of funds. (We note that the Department of Fish and Wildlife [DFW] and the California Conservation Corps also expressed a deferred maintenance need of $15 million and $1 million, respectively. However, the Governor’s proposal does not include deferred maintenance funding for these departments.)

Proposal Addresses Clear Problem, but Is Only Partial Solution. The proposed funding for deferred maintenance is reasonable given that the size of the backlog identified by CalFire and DPR is much larger than the funding proposed. However, we find that the proposal for one–time funding is only a partial solution. The $43 million proposed in the Governor’s budget would address only a small fraction—3.5 percent—of the estimated deferred maintenance backlog for CalFire and DPR. More significantly, deferred maintenance, particularly in DPR, appears to be a growing problem. For example, past analyses found that DPR’s deferred maintenance backlogs were $900 million in 2007–08. Therefore, while the proposed funding will reduce deferred maintenance in the short term, the backlog is likely to grow in the future without additional actions.

Unclear How Projects Will Be Prioritized by Departments. As indicated above, it is unclear what specific projects will be undertaken with the proposed funding. At the time of this analysis, DPR and CalFire reported that they were in the preliminary stages of developing their plans for the use of their allocations and determining which projects they would complete. The departments have identified some general criteria that they would use to prioritize projects, such as safety and building integrity. This could include, for example, installation of smoke detectors, roof repairs, and fixing broken water treatment facilities. Based on our conversations with both DPR and CalFire, there appear to be many more projects that fit these criteria than can be completed with the proposed funding. It is, therefore, unclear how the departments would select among their higher priority projects when making funding decisions.

Proposal Does Not Address Underlying Problems. One–time money, such as the funding provided under the Governor’s proposal, can be directed towards the most critical maintenance projects, but it is only a temporary fix if facilities are not maintained in subsequent years. Yet, the state does not currently have a strategy for either (1) reducing the deferred maintenance backlog beyond the budget year, or (2) maintaining parks and CalFire facilities at a sufficient level on an ongoing basis to avoid deferred maintenance in the future. A plan that extends beyond the budget year could ensure that existing assets are maintained in order to continue serving the public in the future. It could also reduce long–term maintenance costs by avoiding the need for unnecessary and expensive facilities investments such as emergency repairs or replacement.

We acknowledge, however, that developing a long–term strategy for eliminating deferred maintenance is difficult for several reasons. For example, it is often difficult to understand the scope of the problem in each department because there are no standard ways to define, track, or prioritize deferred maintenance. This is especially true in the natural resources program area due to the diversity of programs and maintenance needs. In addition, the specific causes for the deferred maintenance backlog are not always clear. For example, facility and maintenance funding is not specifically identified in the Governor’s budget, making it difficult to identify how well aligned resources are with actual need. It is also unknown the degree to which deferred maintenance backlogs have occurred because of decisions made by the departments, such as whether they have historically used their maintenance funding for other purposes when unexpected operational costs occurred. In addition, it is unclear whether the departments’ funding for maintenance has increased to meet the additional demand of new or expanded facilities. For example, the number of state parks has grown from around 100 in 1950 to 280 today.

Direct Department to Report on Funding Priorities. We recommend that the Legislature adopt the Governor’s proposal, which provides some one–time funding for the most critical deferred maintenance projects. Additionally, we recommend that the Legislature require CalFire and DPR to report at budget subcommittee hearings this spring on the list of projects that they plan to fund and how they would prioritize competing maintenance needs. This would better enable the Legislature to ensure that the priorities identified by the departments align with legislative priorities. For example, the Legislature has sought opportunities for revenue enhancement at state parks in recent years and might prefer to prioritize DPR projects that could increase the amount of park fees collected.

Develop Longer–Term Approach to Fixing DPR’s Facility Maintenance Problems. The administration’s decision to address deferred maintenance is commendable. However, as discussed earlier, the state currently does not have a strategy for eliminating the remaining deferred maintenance backlog or a plan to resolve the underlying problem by ensuring that departments are completing necessary routine and preventive maintenance on an ongoing basis. Addressing these issues is challenging, but longer–term planning can reduce future facilities costs and protect valuable state resources. The DPR currently has one of the largest identified deferred maintenance backlogs in the state, and it has been building for many years. Due to these factors, this department might serve as a useful “test case” in how the state can develop a long–term maintenance plan for departments. We recommend that the Legislature request that the administration report at budget hearings on what approach the state might take to develop such a plan. Ultimately, given the scale of the problem and the potential budget implications, it might make sense for there to be a collaborative approach involving not only DPR, but also the Department of Finance (DOF), our office, and other legislative staff.

In order to assist the Legislature and administration in identifying longer–term solutions to DPR’s deferred maintenance problem, the state could analyze various factors including: DPR’s annual maintenance budget and expenditures, how it tracks maintenance and calculates maintenance need, actual maintenance performed, and the causes of the ongoing backlog. The analysis might also consider whether it makes sense to provide guidelines to the departments on how to classify and track maintenance. The approach could determine the appropriate level of ongoing maintenance funding to maintain facilities at a reasonable level, and tie the estimates to industry benchmarks to the extent possible. While it is difficult to estimate a standard maintenance cost for some park assets given the wide variety of holdings, there are industry standards availble for some park infrastructure, such as average maintenance cost per mile of trail or per campsite. Based on this information, it might be possible to develop a more specific plan to address the deferred maintenance backlog for legislative review.

In January 2014, the administration released the WAP, which identifies the state’s main water–related challenges. These include uncertain or scarce water supplies, declining groundwater supplies, poor water quality, declining native fish species, flood risk, and climate change. The WAP lays out more than 60 activities—categorized under ten broad goals—to begin addressing those challenges. Figure 5 lists some of those activities. Nearly all of the activities in the WAP have been recommended in numerous plans and reports issued in recent years by various state departments. These other plans and reports vary in terms of (1) their specific objectives, (2) which agency would be responsible for implementation, (3) the geographic area covered, and (4) the duration of the activities. When compiling the WAP, the administration asked departments to identify activities in those documents that they consider to be achievable in the next five years.

Figure 5

Water Action Plan Includes Activities Intended to Meet Numerous Goals

|

Goal

|

Example of Activity

|

|

Make conservation a California way of life

|

Provide funding for conservation and efficiency

|

|

Increase regional self–reliance and IWM across all levels of government

|

Increase use of recycled water

|

|

Achieve co–equal goals for the Delta

|

Restore Delta aquatic and intertidal habitat

|

|

Protect and restore important ecosystems

|

Bring salmon back to the San Joaquin River

|

|

Manage and prepare for dry periods

|

Revise reservoir operations to respond to extreme conditions

|

|

Expand water storage capacity and improve groundwater management

|

Increase statewide groundwater replenishment

|

|

Provide safe water for all communities

|

Consolidate drinking water and water quality agencies

|

|

Increase flood protection

|

Improve access to emergency funds

|

|

Increase operational and regulatory efficiency

|

Improve and clarify coordination of state Bay–Delta actions

|

|

Identify sustainable and integrated financing opportunities

|

Develop water financing strategy

|

As shown in Figure 6, the Governor’s budget for 2014–15 proposes $621 million (mostly bond funding) to begin implementing some aspects of the WAP. The administration indicates that for the first year of WAP implementation, it selected expenditures that it considered (1) actionable, (2) affordable, (3) supported by local agencies, (4) necessary to achieve implementation of the plan within five years, and (5) necessary for other activities in the plan to proceed. Below, we describe the most significant budget proposals.

Figure 6

Budget Proposal for Water Action Plan Addresses Multiple Water Issues

(In Millions)

|

Activity

|

Department

|

Amount

|

Fund Source

|

|

IRWM grants

|

DWR

|

$473

|

Proposition 84 bond

|

|

Flood protection

|

DWR

|

77

|

Proposition 1E bond

|

|

Wetlands and watersheds restoration

|

DFW

|

30

|

Cap–and–trade auction revenues

|

|

Water quality grants for disadvantaged communities

|

SWRCB

|

11

|

Various special funds

|

|

State Water Project energy efficiency

|

DWR

|

10

|

Cap–and–trade auction revenues

|

|

Water use efficiency project grants

|

DWR

|

10

|

Cap–and–trade auction revenues

|

|

Groundwater monitoring and management

|

SWRCB, DWR

|

8

|

General Fund, Waste Discharge Permit Fund

|

|

Drinking Water Program transfera

|

SWRCB

|

2

|

Propositions 50 and 84 bonds

|

|

Salton Sea restoration maintenance

|

DFW

|

—b

|

Salton Sea Restoration Fund

|

|

Total

|

|

$621

|

|

IRWM. The budget proposes $473 million in one–time bond funds for the IRWM program, which provides grants for water stakeholders within the same region to collaborate on projects that meet multiple water goals, such as improved quality, increased supply, and ecosystem restoration. (We discuss the IRWM proposal in more detail later in this report.)

Flood Protection. The budget proposes $77 million in one–time bond funds for flood control planning and projects. Of this amount, $26 million is for improvements to Folsom Dam and $12 million is for the construction of a facility that would enhance DWR’s ability to respond to flood emergencies in the Sacramento–San Joaquin Delta (the Delta).

GHG Emission Reductions. The budget proposes $50 million in cap–and–trade auction revenues for projects intended to reduce GHG emissions and provide water–related co–benefits, such as improved ecosystems. (Please see our report, The 2014–15 Budget: Cap–and–Trade Auction Revenue Expenditure Plan, for a more detailed discussion regarding these proposals.) The proposals include:

- Ecosystem Restoration. The budget includes $30 million and 17 positions for DFW to restore wetlands and other watersheds in order to improve the ability of those lands to capture and store carbon from the atmosphere.

- Water–Energy Efficiency. The budget includes $20 million for DWR for projects that would save energy and reduce water use, including $10 million for upgrades to State Water Project (SWP) generators to increase hydroelectric generation and $10 million for grants to local agencies to reduce energy consumption associated with water use.

Groundwater Monitoring and Management. The budget proposes a total of $7.8 million for groundwater monitoring and management activities. The specific activities include:

- Overdraft Management. The budget includes $1.9 million (General Fund) for ten positions at SWRCB to identify basins that are in danger of suffering permanent damage due to overdraft, which occurs when water withdrawals consistently exceed the water entering the basin. These positions would also develop management plans for those basins in which local agencies do not address the overdraft condition. The proposed funding would support management of one basin at the requested level of resources. The administration intends to propose budget trailer legislation to grant SWRCB the authority to develop these management plans.

- Groundwater Elevation Monitoring. The budget includes $2.9 million from the General Fund for DWR to (1) meet a statutory requirement that the department monitor groundwater elevation in basins where no local agency performs such monitoring, and (2) develop an information technology (IT) system so that individuals who drill wells can submit well records online.

- Groundwater Quality Monitoring. The budget includes $3 million from the Waste Discharge Permit Fund for SWRCB to monitor the water quality of groundwater used for public water supplies. This proposal would continue an existing monitoring program that was previously supported by bond funds.

Transfer of Drinking Water Regulation to SWRCB. The budget proposes to transfer drinking water regulation and financial assistance responsibilities from DPH to SWRCB. The budget includes a one–time increase of $1.8 million for moving and IT costs. This proposal is budget–neutral on an ongoing basis. (We discuss this proposal in more detail later in this report.)

We find that the WAP generally offers the Legislature a reasonable blueprint for addressing many of the state’s water challenges, as discussed below.

Generally Consistent With Legislative Priorities. Many of the activities in the WAP were derived from legislatively mandated plans or reports or were developed in response to legislative priorities. For example, the WAP includes several recommendations described in the legislatively required Delta Plan, such as prioritizing improvements to Delta levees and restoring habitat in specific areas of the Delta. The WAP also states the administration’s intent to establish a stable, long–term funding source to fund water systems in disadvantaged communities, including operations and maintenance. (Currently, the state operates some financial assistance programs supported by bond funds and federal funds, but these programs exclusively fund capital improvements.) The establishment of such a fund source is explicitly intended to meet the intent of Chapter 524, Statutes of 2012 (AB 685, Eng), which states that every human being has the right to safe, clean, affordable, and accessible water.

Reasonable Assumptions About Activities to Be Completed. In addition, it appears that progress could be made on all activities in the plan in the next five years. This is because the plan focuses primarily on efforts that could be undertaken administratively or with statutory changes, and does not assume that construction of significant new infrastructure will be completed during the plan’s implementation. For example, the WAP identifies completing the development of the Bay Delta Conservation Plan (BDCP) as an activity to be accomplished in the next five years, but does not assume that the major infrastructure associated with it—a pair of tunnels under the Delta and 150,000 acres of habitat—will be completed in that time.

Budget Proposals Provide Useful Starting Point. The specific activities proposed in the Governor’s budget for 2014–15 also appear to be generally reasonable first steps in implementing the WAP. The proposals have merit because they would take steps to address some of the state’s water challenges. We also note that proposed activities can be accomplished in the budget year and primarily use existing fund sources.

Several Budget Proposals Initiate Positive Policy Changes. The budget includes two noteworthy proposals that, in our view, represent significant positive policy changes. First, we find that transferring the Drinking Water Program (DWP) from DPH to SWRCB could improve the efficiency and effectiveness of state water policy by allowing a single department to address interrelated water issues more comprehensively. For example, there could be a more coordinated focus on the sources of pollution and their effects on drinking water. It could also improve the administration of drinking water–related financial assistance and enhance accountability and transparency on drinking water issues.

Second, the Governor’s groundwater proposals appear to be consistent with recommendations that we have made in the past on groundwater management. Unlike most other western states, California currently does not monitor or permit groundwater use at the state level. In past reports, we have recommended that the Legislature establish “active management areas”—defined geographic areas where specific rules are established to govern the withdrawal and use of groundwater—in circumstances where the highest potential for groundwater overdraft exists. The proposal for SWRCB to identify and potentially regulate overdrafted basins could align with this recommendation. We note that the effectiveness of this proposal would depend on (1) the specific authority granted to the board, and (2) the availability of adequate groundwater quality and supply data to identify overdrafted basins.

As discussed above, the WAP lists activities that the administration intends to complete in the next five years, and the administration has chosen to implement a subset of those activities in 2014–15. While we generally find that the administration has put forward reasonable proposals for legislative consideration, it is important to note instances where the administration’s proposals do not fully address legislative priorities or current issues facing the state. As such, we identify below some selected areas where the Legislature may want to take additional actions. Depending on the specific actions taken, proposed resources may need to be redirected, or additional resources may need to be provided, relative to the Governor’s budget proposals.

Response to Current Drought. California is currently experiencing severe drought, with significant economic, environmental, public health, and water management effects. For example, DPH has identified 17 communities that may face severe water supply shortages as a result of the current drought. In addition, groundwater throughout the Central Valley has been rapidly depleted over the past two years due to increased reliance on this water source for irrigation and drinking water. Though the WAP discusses the need for the state to improve its ability to respond to periodic droughts, the Governor’s budget includes little to address the effects of the current drought. (The administration has, however, issued a drought declaration that includes some administrative actions, such as directing state agencies to reduce water use and beginning a statewide public information campaign to encourage water conservation.) For example, while the proposed IRWM funding might reduce the consequences of future droughts, the program would not alleviate the effects of water shortages during the current drought because of the time required to award grants and construct the funded projects. Furthermore, the effects of the SWRCB groundwater management proposal is likely to be of limited help in addressing the current drought because the proposed funding would only support activities in one basin.

To the extent the Legislature wants to take additional actions to address the current drought, there are a variety of options it could consider. Two such options include:

- Enable Water Transfers for Communities Facing Shortages. The Legislature could direct DWR to—as it has in past droughts—purchase water to transfer to urban and agricultural areas facing extreme shortages. The state could also offer emergency loans to fund water purchases by those areas. Small or disadvantaged communities are at particular risk of water shortages because of the funding challenges they face in developing new supplies. For example, the 17 communities identified by DPH as facing the potential for severe shortage range in size from 39 to 11,000 people.

- Expand Groundwater Management and Monitoring. Groundwater use increases significantly in dry years, increasing the risk of overdraft. Additional groundwater monitoring or management could allow the state to identify and prevent damage to basins during the current drought and to better target assistance to communities that rely on those basins. For example, the Legislature could fund the SWRCB groundwater management proposal at a higher level, which would allow the board to regulate additional basins in overdraft. We have recommended in the past that the state require local water districts to submit standardized groundwater use data, which could improve the state’s ability to identify overdraft conditions.

Delta Activities. In 2009, the Legislature passed legislation that identified the Delta as a priority and required the development of a Delta Plan to address the decline of the Delta ecosystem and the decreasing reliability of water exports from the Delta. The legislation also required implementation of the Delta Plan to begin by January 1, 2012. Implementation has begun, but the level of funding proposed in the Governor’s budget for continued implementation of the Delta Plan in 2014–15 is limited. While the budget includes about $19 million across various state agencies for Delta–related activities—mainly for responding to floods and for scientific activities—it does not include new spending on a variety of Delta activities described in the Delta Plan and the WAP. These activities include (1) levee maintenance and improvements, (2) ecosystem restoration, or (3) “near–term actions” that can be accomplished as other longer–term actions are carried out (such as increased efforts to eradicate invasive species).

To the extent the Legislature wants to address the challenges in the Delta to a greater degree than is proposed in the Governor’s budget, it could consider a variety of options, including:

- Establishing a Delta Levee Assessment District. Historically, the state has paid most of the costs to upgrade and maintain levees in the Delta, in part because they protect state infrastructure (such as highways) that run through the Delta and allow SWP and Central Valley Project to move water through the Delta. This maintenance has been supported by bond funds and the General Fund in the past. The Legislature could prioritize establishing a Delta Levee Assessment District, as included in the WAP. The district would charge entities that benefit from Delta levees (such as landowners in the Delta and water agencies that transport water across the Delta) for the cost of maintaining those levees, potentially increasing funding available for levee maintenance.

- Integrating DFW Wetland Restoration Proposal With Existing Delta Efforts. Research indicates that the restoration of certain Delta wetlands can reduce GHG emissions and improve the Delta ecosystem. The Legislature could direct DFW to focus cap–and–trade auction revenues proposed for restoration activities on those wetlands in the Delta that (1) produce the greatest GHG benefits and (2) are consistent with habitat restoration described in the Delta Plan or BDCP. At the time of this analysis, DFW had not identified a specific amount of cap–and–trade revenues it would spend on Delta restoration.

- Funding Additional Delta Plan Implementation, Including Near–Term Actions. The major activities included in the Delta Plan and BDCP (such as constructing the tunnels or restoring significant amounts of habitat) will require several years or more to complete. During that time, species in the Delta are expected to decline and threats to water supply reliability will continue. Thus, the Legislature may want to consider funding actions that can be completed in the interim to begin addressing those challenges. For example, the Legislature could increase funding for efforts to reduce the amount of aquatic invasive plants in the Delta, which could improve conditions for native fish. The Legislature could also direct state agencies to develop guidelines for how the acquisition and restoration of individual parcels can be coordinated at larger scales. Research indicates that restoring connected parcels of land and considering how those pieces affect each other can ensure that ecosystem restoration benefits (such as improvements to fish populations) are achieved in the most cost–effective manner.

Conservation. While the WAP includes water conservation as one of its ten goals, the Governor’s budget includes few specific proposals to achieve that goal. Yet, there are a variety of steps that could be taken now to significantly increase water conservation in the future. First, research demonstrates that the price of water and how water rates are structured can significantly increase water conservation by consumers. However, the WAP does not propose changes to how water is priced in the state. Second, as described in our publication California’s Water: An LAO Primer (2008), the current water rights system can lead to inefficient uses of water. For example, Article X of the California Constitution requires that waste or unreasonable use of water be prevented. State regulatory agencies have interpreted this to require water users to consistently use their full allocation or forfeit the unused part, which can discourage conservation. (Water rights are granted in specific volumes for specific uses, such as irrigating crops.) The WAP does not propose any changes to the water rights system. Finally, the WAP identifies a goal of maintaining total urban water at 2000 levels through 2030, but the plan does not include goals or policies to significantly reduce agricultural water use, which accounts for roughly 80 percent of total water use in the state. While the Governor’s budget includes funding for water use efficiency ($10 million in DWR’s water–energy proposal), such funds would most likely support urban water use efficiency projects.

If the Legislature wishes to address conservation to a greater degree than identified in the WAP or the Governor’s budget, it could:

- Require Changes to Water Pricing. The Legislature could take steps to reduce demand for water by changing how water users are charged for water. For example, the Legislature could require that water agencies (1) charge higher rates for water in drought years, or (2) adopt “increasing block pricing,” which encourages conservation by charging water users lower per–gallon rates for essential water use (such as drinking, cooking, and bathing) but charges water users more per gallon above a certain threshold of water use deemed less necessary (such as for landscaping).

- Refine Definition of “Reasonable Use.” The Legislature could encourage conservation by making changes within the existing water rights system to account for the potential for water conservation in the definition of reasonable use. For example, where water is required for agricultural purposes, the water right could reflect the amount of water needed to grow a crop using available water efficiency technology.

- Encourage Agricultural Conservation. The Legislature could take steps to encourage agricultural water conservation, such as by setting goals for reductions in agricultural water use or funding agricultural water use efficiency measures.

Nitrate Contamination. Nitrates are the most common contaminant in groundwater that is not naturally occurring, and has been an area of recent legislative interest. Nitrate contamination of groundwater is common in many areas of the Central Valley and is generally caused by the application of fertilizers. In 2008, the Legislature required SWRCB to study the sources and extent of nitrate contamination and offer recommendations on how to address its impacts. The SWRCB released a report with such recommendations in 2013. Despite wide recognition of this problem, neither the WAP nor the Governor’s budget specifically address nitrate contamination. If the Legislature wants to address nitrate contamination, it could take various actions, such as those recommended in the SWRCB report. These include:

- Funding Nitrate Reduction Projects Through IRWM. Currently, DWR uses numerous factors to award funding for IRWM projects through a competitive process. The Legislature could direct DWR to prioritize IRWM projects that would evaluate or treat nitrate problems.

- Reevaluating Agricultural Waste Discharge Requirements. As noted above, nearly all nitrate contamination is the result of agricultural activity. In many cases, SWRCB waives certain water quality regulations for agricultural operations. The Legislature could direct SWRCB to reevaluate the conditions under which waste discharge requirements are waived in order to reduce nitrates entering groundwater.

- Funding Drinking Water System Operations and Maintenance. According to SWRCB’s report, one of the factors that limits nitrate treatment is the limited financial capacity of small disadvantaged communities to operate and maintain their drinking water systems. In order to ensure that small disadvantaged communities have the capacity to operate and maintain such systems, the Legislature could establish a new fund source for that purpose. Options recommended by SWRCB include a charge on fertilizer or a broader charge on all water use.

Plan for Completing Remaining Activities Needed. In the future, the Legislature is likely to be asked by the administration to appropriate funding or change statute to implement additional activities contained in the WAP. Without a description of the activities that the administration intends to accomplish and the years in which those activities will be undertaken, it is difficult for the Legislature to determine whether the administration’s direction on water aligns with its priorities. Based on our conversations with the administration, it is currently developing a strategy for implementing the remainder of the activities in the WAP over the following four years. Such a strategy might include specific activities to be performed, the scope of those activities, the schedule of when each activity would be undertaken, and the specific outcomes anticipated.

Water Financing Strategy Needed. The administration expects to develop a water financing strategy that will identify how WAP activities will be funded in the future. Many of the activities in the WAP would require funding to complete. General obligation bonds have been a major source of funding for water activities since 1996, but these one–time funds are rapidly being exhausted. Of the nearly $16 billion in bonds approved by voters for water programs since 2000, about 10 percent ($1.7 billion) remains unappropriated. The Governor’s budget proposes $550 million in new bond fund appropriations for WAP activities in 2014–15. We note that there currently is an $11.1 billion bond scheduled for the November 2014 ballot, but that the Legislature is considering changes to that bond. In the absence of a specific funding strategy that specifies how various funding sources (such as bonds, user fees, or charges on polluters) should be used and which activities will be supported by those funding sources, it will be difficult for the Legislature to ensure that any future water bond measure provides the funding consistent with WAP priorities.

While the administration has not yet proposed a specific funding strategy to implement the WAP, the plan does identify a couple of financing proposals that, if implemented, could provide additional funding for water–related activities. The intent of these proposals is to shift more funding responsibilities to beneficiaries, which is generally consistent with recommendations that we have made in the past. Specifically, the WAP proposes to analyze the potential for additional user and polluter fees. This could include charging polluter fees on fertilizer sales with revenues used to reduce nitrate pollution. The structure of user and polluter fees and whether they are fees or taxes would determine the activities that could be supported by the fees.

The plan also includes several proposals that would change how the costs of some water activities are allocated among parties so that beneficiaries pay a higher share of project costs. First, as discussed above, the WAP proposes creating a Delta Levee Assessment District, which would assess a charge on those that benefit from Delta levees in order to upgrade and maintain those levees. Second, the WAP proposes to clarify the types of water–related taxes and fees that are affected by Proposition 218 (1996). Proposition 218 enabled property owners to stop increases on their water bills through a formal protest process, as well as required voter approval for rate increases to support flood control and stormwater management activities. Although the WAP identifies the administration’s intent to address some of these issues, it does not propose specific changes. We note, however, that an initial public draft of the WAP discussed the option of exempting flood management agencies from some of the voting requirements of Proposition 218, as is the case with water service providers.

In view of the above, we offer some recommendations for the Legislature as it considers the WAP as a whole. These recommendations are intended to help ensure that the Legislature has sufficient information from the administration to assess long–term implementation of the plan. Later in this report, we make specific recommendations on certain budget proposals related to the plan.

Administration Should Provide Implementation Strategy With 2015–16 Budget. The administration indicates that it is developing a strategy for implementing the remainder of the WAP. We recommend the Legislature direct the administration to provide that implementation strategy no later than the release of the Governor’s proposed budget for 2015–16. This strategy should include a schedule of activities that the administration proposes for each of the next four budget years, the estimated costs of those activities, and the expected funding source. Having such a strategy would allow the Legislature to better understand how the goals of the WAP will be achieved and at what cost. The Legislature could then determine whether the strategy is consistent with its water priorities for the state.

Administration Should Report at Budget Hearings on Future Bond Funding for WAP Activities. In addition, as noted above, the Legislature is currently considering potential changes to the water bond scheduled for the November 2014 ballot. In order to ensure that the Legislature is able to make a fully informed decision as it considers those changes, the administration should report at budget subcommittee hearings this spring on the degree to which the bond currently scheduled for the ballot would fund specific aspects of the WAP. The administration could also identify any changes it would recommend to align the funding included in the water bond with the activities proposed in the WAP.

The DPH Administers State DWP. The DPH administers and oversees various programs that address health issues, such as chronic disease prevention, communicable disease control, environmental health, and inspection of health facilities. The department’s DWP regulates 7,900 public water systems, defined as privately or publicly owned water systems that serve more than 15 service connections or 25 people. The DPH directly regulates some public water systems in California, including all systems with more than 200 service connections. It does so utilizing two field operations branches and 23 district offices throughout the state. In 31 counties, the department enters into agreements with “local primacy agencies,” such as county health agencies, to regulate public water systems with fewer than 200 service connections.

The state spends about $300 million annually on DWP’s activities, which include the following:

- Regulating the quality of drinking water by (1) setting drinking water quality standards, (2) inspecting public water systems, (3) issuing permits, and (4) taking enforcement actions when necessary.

- Responding to emergencies by providing technical assistance to damaged water systems, assessing drinking water contamination, and ensuring access to safe drinking water.

- Providing financial assistance to fund safe drinking water improvements to public water systems.

- Providing oversight, technical assistance, and training for local primacy agency personnel.

SWRCB Oversees State’s Water Quality Program. The SWRCB and the nine regional boards perform a variety of activities related to the state’s water resources. These boards regulate the quality of the state’s surface waters and groundwater by permitting waste discharges into the water and enforcing water quality standards. The boards also provide financial assistance to fund wastewater system improvements, underground storage tank cleanups, and other improvements to water quality. In addition, the state board administers the state’s system of water rights.

The 2014–15 Governor’s Budget proposes transferring DWP from DPH to SWRCB. Under the proposal, DWP’s regulatory and technical assistance activities would be housed in a newly created Division of Drinking Water Quality (DDWQ) within SWRCB. The DDWQ would continue to utilize DWP’s field operations branches and district offices and would retain existing DWP staff to carry out drinking water activities. The DDWQ, however, would report directly to SWRCB’s state headquarters (to SWRCB’s executive director) under the proposed transfer. The SWRCB’s water quality regulatory function, by comparison, is generally carried out by the regional water boards (staff reports to regional board executive management), with the state board setting enforcement standards and priorities. Administration of financial assistance programs, including the Safe Drinking Water State Revolving Fund (SDWSRF), would be consolidated with SWRCB’s existing Division of Financial Assistance, which administers SWRCB’s similar state revolving fund program for wastewater treatment and other water quality improvements. The transfer would occur effective July 1, 2014.

Objectives of the Transfer. The administration intends for the transfer to achieve several objectives. First, it believes consolidating the state’s drinking water and water quality programs would result in more integrated water quality management. It considers that consolidating responsibilities for drinking water oversight and regulation with SWRCB’s water quality and water rights regulatory activities could allow a single department to address interrelated water issues more comprehensively. For example, there could be a more coordinated focus on the sources of water pollution and their effects on drinking water. In addition, there may be opportunities to coordinate permitting processes for entities that are currently regulated by both DWP and SWRCB.

The administration also believes this consolidation would improve the state’s ability to provide financial assistance to small disadvantaged communities. A SWRCB–administered drinking water program may be more likely to have the expertise and administrative resources required to adequately run the program and get financial assistance out the door in a timely manner. For example, the SWRCB has significant expertise in financial management, including recent experience leveraging their revolving fund to increase the amount of loans the fund is able to offer. This expertise could be extended to SDWSRF.

Finally, the administration believes the transfer would enhance accountability and transparency on drinking water issues because SWRCB’s board structure with regular hearings provides a process for the public and stakeholders to offer comments on proposed rules or other issues. This could improve the ability of the public to hold decision–makers accountable for drinking water outcomes.

Implementation Details. In designing the structure of the proposed program transfer, the Governor had several important implementation choices regarding the reorganization.

- Permitting and Enforcement. As noted above, drinking water permitting and enforcement responsibilities would remain with district offices reporting to SWRCB’s state headquarters. The agreements delegating authority to local primacy agencies in some counties would remain in place.

- Rulemaking Process. The DDWQ would develop drinking water quality standards using the same rulemaking process used by DWP, which requires formal review by DOF and the Office of Administrative Law, as well as a public comment period. The state board would ultimately adopt those limits through its hearing process.

- Public Health Expertise. The deputy director over DDWQ would be required to have specific public health expertise, including minimum amounts of experience in a public–health related field. In addition, all personnel currently employed by DWP would be transferred to DDWQ in order to maintain program expertise.

- Emergency Response. The DDWQ would retain a similar structure for responding to drinking water emergencies (such as a chemical spill affecting drinking water) as currently used by DWP. This involves having an on–call duty officer who triages emergency calls and communicates with the Office of Emergency Services as necessary. The director of DPH, as the State Public Health Officer, would retain authority to issue regionwide or statewide drinking water advisories, and to regulate the actions of and provide guidance to local health officers in the case of drinking water emergencies.

The administration has indicated that it plans to move DWP staff currently located in Sacramento into the CalEPA building in order to effectively consolidate the staff of SWRCB. The administration has indicated that moving DWP staff into the CalEPA building could displace some staff at other CalEPA departments. The administration plans to release a formal transition plan in February 2014, which should include further detail on the transfer of responsibilities and staff between the departments.

Budgetary Effects of Transfer. The proposed transfer would shift the total DWP budget of $308 million—including $43 million for state operations and $265 million for local assistance (mostly bond and federal funding for grants)—from DPH to SWRCB in 2014–15. In addition, the budget includes a one–time increase of $1.8 million in 2014–15 for moving expenses and IT consolidation. Accordingly, with the exception of modest one–time transition expenditures, the proposed transfer is essentially budget–neutral, meaning that it does not, on net, result in added costs or savings in the budget as a whole as proposed by the Governor.

As described below, we find that the proposed transfer is likely to improve the effectiveness and efficiency of state water policy. We also comment on specific aspects of the transfer that warrant legislative consideration, including (1) the continuation of some potential enforcement concerns, (2) coordination between SWRCB and DPH in responding to emergencies and protecting public health, and (3) statutory changes to the administration of SDWSRF.

Transfer Is Likely to Improve Effectiveness and Efficiency of State Water Policy. We agree that the transfer should meet the broad objectives laid out by the Governor. In particular, we find that the transfer could allow for some efficiencies and increased administrative capacity relating to drinking water financial assistance. Previous LAO analyses have identified many of the same advantages of combining the state’s drinking water and water quality programs within SWRCB. For example, some economies of scale may be realized by consolidating SWRCB’s and DWP’s financial assistance programs. Such a consolidation could allow staff to be shared across programs, allowing them to process additional grants and loans using the same resources. We also find that the transfer creates the potential for accelerated rulemakings related to drinking water. For example, SWRCB indicates that it intends to administratively update some eligibility requirements for SDWSRF grants and loans through its public hearing process. This process allows for public participation but typically is completed more quickly than the formal regulatory process that DPH has used in the past.