The budget proposes $24 billion (about $12 billion General Fund) to pay salary and benefit costs for state workers in 2014–15, up from an estimated $23.5 billion ($11.6 billion General Fund) in the current year. The increased costs reflect a general salary increase (GSI) of at least 2 percent for most state workers, rising health and pension benefit costs, and proposed increases in the number of state positions. Recent decisions made by the California Public Employees’ Retirement System (CalPERS) will further increase these costs in 2014–15 by about $430 million ($250 million General Fund).

In this report, we provide an overview of the state workforce, current collective bargaining agreements, and state employee compensation costs in 2014–15. We also discuss historical trends regarding state employee compensation costs and state worker take–home pay. We find that over the last two decades, after adjusting for inflation and state worker cost for health and retirement benefits, state worker take–home pay has remained largely flat while state costs per employee have grown significantly. In addition, assuming the number of state workers does not decline significantly, we expect the state’s employee compensation costs to increase for the foreseeable future.

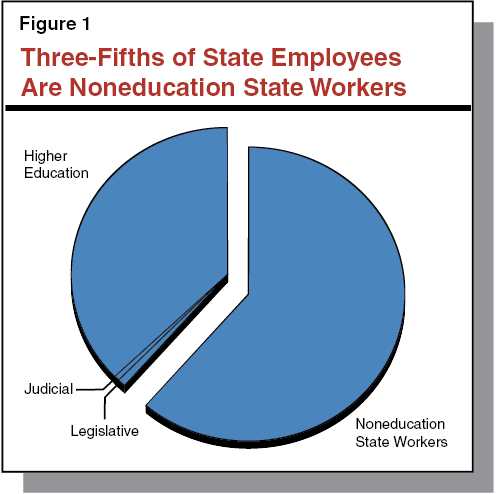

The state employs about 350,000 people. While the number of state employees has increased over the past 20 years, the ratio of state employees to California residents has remained relatively stable at about nine state employees per 1,000 residents. As Figure 1 shows, about one–third of the state’s employees work for one of the two state university systems. Most of the remaining state employees—about 215,000—work for one of the agencies or departments under the executive branch of state government that administers non–higher education state programs and policies. These noneducation executive branch state employees typically are referred to as “state workers.”

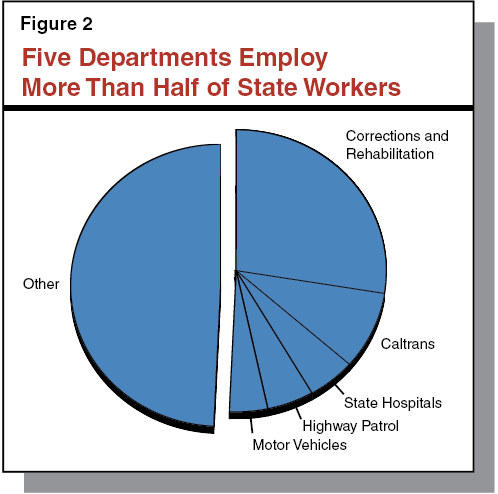

State workers perform many functions across state government. Classifications range from public safety officers to medical, legal, financial, and other professionals to service workers and tradespeople. The largest classification of state workers is correctional officer, supervising the conduct of inmates at one of the state’s correctional facilities. The number of state workers employed by each state entity varies widely: the smallest employ a single part–time state worker while the largest departments employ tens of thousands of state workers. Figure 2 illustrates that more than half of state workers work for one of the five largest departments—Department of Corrections and Rehabilitation, Department of Transportation (Caltrans), California Highway Patrol, Department of State Hospitals (DSH), and Department of Motor Vehicles (DMV).

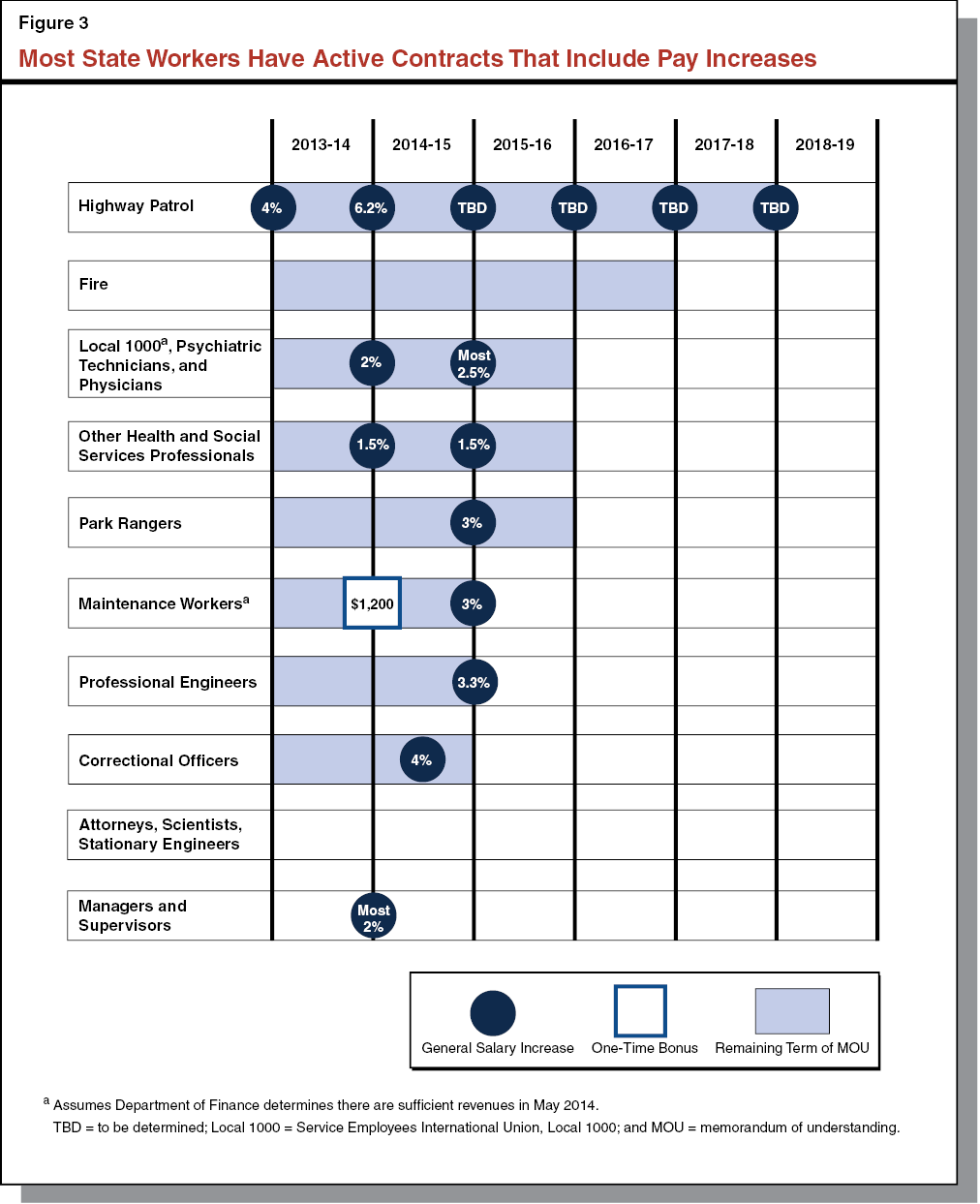

Compensation for Most State Workers Subject to Collective Bargaining. About 85 percent of state workers are rank–and–file employees whose compensation is established through collective bargaining between employees and the Governor. Rank–and–file employees are organized into 21 bargaining units. At the bargaining table, these units are represented by unions and the Governor is represented by the Department of Human Resources. The product of these negotiations is a contract known as a memorandum of understanding (MOU) and is subject to ratification by the Legislature. Most of the state’s bargaining units have active MOUs with the state but three bargaining units are working under an expired contract (scientists, attorneys, and stationary engineers). The remaining 15 percent of state workers, primarily managers and supervisors, are excluded from the collective bargaining process. The Governor has broad authority to establish compensation for excluded state workers—subject to legislative appropriation. As a result of the current MOUs and the administration’s decisions regarding excluded employees, most state workers are scheduled to receive a pay increase in the Governor’s proposed 2014–15 budget. Figure 3 shows which state workers are scheduled to receive pay increases under the proposal as well as the current status of MOUs with rank–and–file state workers. (For more details about specific provisions of current MOUs, visit our website.) We discuss the proposed 2014–15 salary increases in greater detail later in this report.

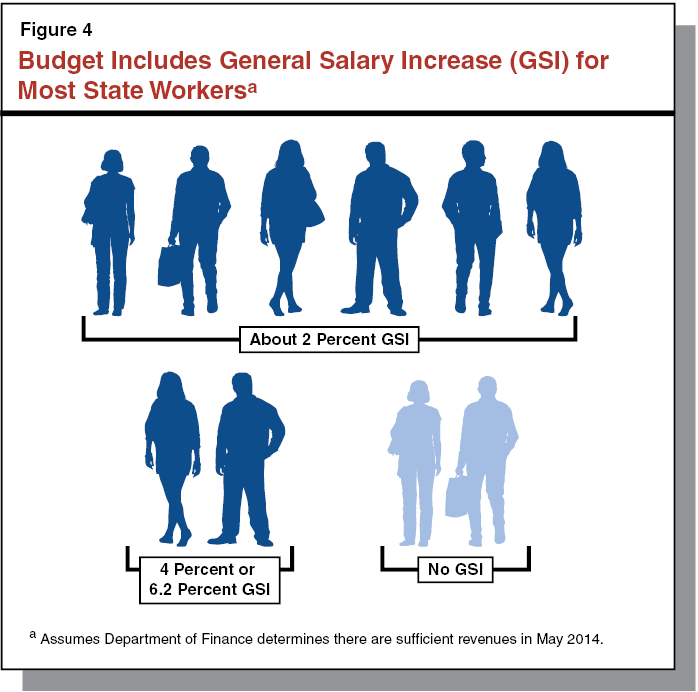

Budget Assumes Pay Increase for Most State Workers. The largest component of a typical state worker’s compensation is salary, accounting for about two–thirds of the state’s employee compensation costs. In 2014–15, the Governor proposes salaries will cost $16 billion (about $8 billion General Fund)—including costs associated with pay increases for most state workers. The 2014–15 pay increase is notable because it will be the first GSI for most classifications since 2007–08. (Over this time period, however, state workers did receive pay increases for being at the top step of their classification and for working specific jobs.) The size of the proposed 2014–15 GSI is consistent with current MOUs and varies by bargaining unit. For most state workers, the MOUs provide that their GSI could be delayed until 2015–16 if the Director of Finance determines in May 2014 that there are not sufficient revenues to pay for the pay increases while also fully funding “existing statutory and constitutional obligations.” Some supervisorial and managerial classifications are proposed to receive larger pay increases to address concerns of salary compaction (we discuss salary compaction in greater detail later in this report).

Some Bargaining Units Not Scheduled to Receive GSI. The Governor’s proposed budget does not provide a GSI for some bargaining units in 2014–15. These state workers are excluded from the GSI because either (1) their current MOU does not call for a pay increase in 2014–15, (2) their current MOU provides a one–time bonus in 2014–15 instead of a GSI, or (3) they are working under an expired MOU. Based on the Governor’s proposal, Figure 4 shows the share of state workers expected to receive a GSI in 2014–15.

In addition to salary, state workers typically receive non–salary benefits as part of their compensation. In 2014–15, proposed state costs for non–salary benefits equal about 48 percent of its salary costs. Two benefits—pension and health benefits—account for most of these costs. The remainder reflects payments for Social Security, Medicare, and other benefits. The money the state pays each year towards retired state worker health benefits (estimated to be about $1.6 billion General Fund in 2014–15) and to compensate injured workers is not included in this estimate. (As we discuss later in this report, the state’s 2014–15 pension benefit costs will increase significantly after CalPERS adopts its final rates later this spring.) This section of the report discusses pension and health benefit costs as proposed in the Governor’s budget.

CalPERS Role. Although decisions about (1) the scope of employee health and pension benefits and (2) how these costs are shared between the employer and employee are determined by the Legislature and through the collective bargaining process, CalPERS plays an important role in determining the state’s costs for these benefits.

Pension Benefits. Most state workers are enrolled in defined benefit pension plans administered by CalPERS. Pensions provide state workers with a specified benefit for life upon retirement. Retirees’ pensions are based on their final salary levels near the end of their careers, the number of years they served with the state, and the type of job they had while employed by the state. As fiduciary, the CalPERS board adopts policies to ensure there is sufficient money to pay for members’ future benefits, including determining the amount of money that must be contributed each year to prefund the plan and adopting investment strategies. Pension benefits are funded with contributions made by the worker during his or her career (paying a specified percentage of monthly pay established in MOUs and statute) and the state (paying the balance of necessary contributions). If the CalPERS board determines that there is an unfunded liability—insufficient funds to make future payments for earned benefits—the state must provide the funds necessary to ensure that future benefits are paid. As a result, the state’s contributions tend to fluctuate more each year (depending primarily on investment returns) than state worker contributions, which tend to change little year to year.

Health Benefits. The state offers state workers health benefits for the employee and his or her dependents and allows them to choose among a variety of health plans. For most state workers, the state pays a percentage of a weighted average of these plans’ monthly health premiums—the exact amount the state contributes varies by bargaining unit and is established in MOUs and statute. CalPERS manages the state’s health plans and negotiates insurance premiums with health care providers. The state’s costs change each year depending on these negotiations.

Costs for Both Benefits on the Rise

The state’s costs for state worker pension and health benefits have increased steadily for the past decade or so. The rising costs of these two benefits are largely attributed to (1) significant pension unfunded liabilities and (2) health insurance premiums outpacing inflation.

Increased Contributions to Pension Fund Necessary. The budget proposes $3.5 billion ($1.8 billion General Fund) for the state to make contributions to CalPERS in 2014–15 for state worker pension benefits. (In addition, the state will contribute about $480 million General Fund to CalPERS for California State University employees’ pension benefits.) At the time the Governor proposed his 2014–15 budget plan, the state projected that its contribution rates for most pension plans would increase from those paid in 2013–14. For example, as of that time the state was expected to pay about 21.4 percent of pay for employees in the State Miscellaneous Tier 1 plan (the state pension plan with the most members) in 2014–15—an increase from the 21.2 percent the state contributes in 2013–14 for these employees. These rate increases (and similar increases in recent years) reflect CalPERS’ determination that a larger amount of money must be contributed to the pension system to address its unfunded liabilities. Recently, through the collective bargaining process and legislation, the state mitigated some of these increased costs by requiring workers to pay a larger share of the contributions necessary to fund benefits earned in a given year—the “normal cost.” In addition, the state adopted less generous pension benefits for future employees that will reduce state costs in the future. Despite these changes, the state’s costs for workers’ pension benefits continue to increase due to unfunded liabilities related to:

- Investment Losses. Like many investors, CalPERS experienced significant investment losses during the economic downturns at the beginning and end of the last decade. The loss of funds created an unfunded liability to pay for past earned benefits.

- Actuarial Assumptions. The CalPERS board adopts assumptions and policies used to determine the amount of money necessary to be contributed each year. These assumptions and policies include how to calculate additional contributions necessary to make up for past investment losses or other unfunded liabilities (known as “smoothing” policies) and economic and demographic assumptions—including how much money CalPERS investments will gain in a given year and how long retirees are expected to live. Over the last few years, CalPERS has made changes to its smoothing and investment return assumptions that affected the calculation of the state’s unfunded liabilities and resulted in CalPERS approving higher contribution rates. (Later in this report, we discuss CalPERS’ recent changes to mortality actuarial assumptions.)

Health Premiums More Expensive. In the United States, it is common for employers in both the private and public sectors to pay a portion of health premium costs. Since the mid–to–late 1990s, health insurance premiums have increased each year at a pace exceeding inflation. To absorb these rising costs, many employers have chosen to shift premium costs onto employees, reduce the levels of benefits available to employees, and/or reduce other elements of compensation.

The health premiums negotiated by CalPERS also have increased at a rate exceeding inflation during this period. In some years, CalPERS has used one–time options to negotiate premium growth below 5 percent from the prior year; however, in other years, the average health premium has grown by as much as 10 percent from the prior year. The state has made efforts to reduce these costs by shifting a larger share of premium costs onto employees through the collective bargaining process and legislation. In addition, CalPERS has established a number of initiatives in an effort to contain the costs of providing medical services to members. In 2014–15, the Governor’s budget assumes that the state’s health benefit costs will increase by about $100 million and total more than $2 billion (about $1 billion General Fund).

Reduced Staffing Levels Created Savings in Past Budgets. In addition to increasing employees’ share of health and pension benefit costs, the state budget in recent years has contained employee compensation costs by directly or indirectly reducing the number of state workers. The state has achieved this by reducing the number of (1) hours worked by state workers through various furlough programs and (2) positions by holding open vacant positions, eliminating other positions, and initiating layoffs in certain departments. The furlough programs alone reduced state costs by approximately $5 billion between 2008–09 and 2012–13. (As we discuss in our March 2013 report, After Furloughs: State Workers’ Leave Balances, some of the short–term savings from furloughs resulted in long–term liabilities that must eventually be paid by the state in the form of higher leave balances carried by state workers.)

Higher 2014–15 Personnel Costs From Net Increase in Staffing. The budget proposes to increase positions for some state departments and decrease positions for others. On net, the administration proposes that the state increase its workforce by almost 1,600 positions across state government (less than 1 percent growth). Despite it being a relatively modest growth in positions, increasing the number of state workers directly increases the state’s employee compensation costs. We estimate that roughly $170 million of the proposed 2014–15 budget is attributable to the increase in the number of state workers. Most of the proposed personnel cost increase is proposed to be funded with non–General Fund resources.

2014–15 Position Growth Isolated to Specific Program Expansions. Figure 5 lists the state departments with a change of at least 50 positions requested in 2014–15. The position changes are requested either to administer a program already established by the Legislature or as part of a broader proposal to be deliberated during this budget cycle. As can be seen from the figure, the majority of the proposed new positions are for a few departments. The requested positions at DMV are limited term to support the implementation of Chapter 524, Statutes of 2013 (AB 60, Alejo), which requires the DMV to accept driver license applications from persons unable to provide proof of legal presence in the United States starting January 1, 2015. Most of the positions requested for DSH are associated with the administration’s proposal to activate new beds to accommodate additional patients in state hospitals. The requested positions at the Department of Veterans Affairs reflect the ramp–up of staffing levels at new veterans homes in Redding, Fresno, and the greater Los Angeles area. Some of these new positions reflect a proposal to convert contracted personnel at veterans homes to state workers. Some of the proposed position changes reflect transferring positions from one department to another. (The Employment Development Department has developed a plan to increase its position authority by a few hundred positions more than was presented in the Governor’s budget—and presented in Figure 5—to address concerns about customer service at the department. This proposal likely will be part of budget discussions in the spring.)

Figure 5

2014–15 Budget: Major Position Changes

|

|

Net Change in Positions

|

|

Departments Adding 50 or More Positions

|

|

|

Motor Vehicles

|

818

|

|

State Hospitals

|

362

|

|

Veterans Affairs

|

357

|

|

State Water Resources Control Board

|

354

|

|

Social Services

|

181

|

|

Health Care Services

|

143

|

|

Consumer Affairs

|

122

|

|

Forestry and Fire Protection

|

77

|

|

Fish and Wildlife

|

75

|

|

Conservation

|

65

|

|

Air Resources Board

|

65

|

|

Departments Eliminating 50 or More Positions

|

|

|

Developmental Services

|

–439

|

|

Employment Developmenta

|

–322

|

|

Public Health

|

–254

|

|

State Compensation Insurance Fund

|

–244

|

|

Corrections and Rehabilitation

|

–191

|

|

Managed Risk Medical Insurance Board

|

–57

|

As a standing policy, the CalPERS board reviews its economic and demographic actuarial assumptions every four years in an “experience study” prepared by CalPERS staff. The experience study compares the actuarial assumptions CalPERS uses to calculate contribution rates with what actually happened. Based on the study, the board decides whether it needs to adopt new actuarial assumptions that better reflect experience. The most recent study was released in January 2014 and analyzed the pension system’s experience between 1997–98 to 2011–12. Compared with existing CalPERS assumptions, the study found that (1) retirees live longer; (2) state workers—most notably, highway patrol officers and peace officers/firefighters—retire earlier; and (3) senior employees receive higher pay.

New Assumptions Increase Contribution Rates. At its February 18, 2014 meeting, the CalPERS board adopted new assumptions based on the experience study findings. The new assumptions, in turn, result in increased contribution rates, with the longer assumed life expectancy having the greatest effect on contribution rates. The board’s new assumptions affect CalPERS calculations of the normal cost and unfunded liabilities. The new assumptions will have the greatest effect on contributions to retirement plans for highway patrol officers (and to a lesser extent, peace officers/firefighters) because these employees are more likely to be male and have the opportunity to retire earlier in life. In a letter dated February 5, 2014—in anticipation of the February 18 meeting—the Governor requested that the board (1) implement the necessary increases to the state’s contribution to normal cost immediately and (2) phase in the unfunded liability rate increases within three years. CalPERS adopted the Governor’s proposal for state pension contributions, but a longer phase in for local CalPERS employees.

2014–15 State Contributions Likely Will be Higher Than Assumed in Budget Proposal. The new assumptions were not reflected in the CalPERS contribution rates used to develop the Governor’s January budget proposal. Figure 6 shows the rates used for budget planning and CalPERS’ estimated 2014–15 rates that incorporate the revised demographic assumptions. (CalPERS will formally adopt new rates incorporating these assumptions in late spring.) These estimated contribution rates suggest that the state will need to contribute approximately $430 million ($250 million General Fund) more in 2014–15 than the budget assumes. The administration is expected to update these costs in the May Revision. After the rate increases have been implemented fully in 2016–17, the state’s contribution rates are expected to range from 19.5 percent to 50.4 percent of pay, depending on the pension plan and assuming that payroll growth and other actuarial factors materialize consistent with current assumptions.

Figure 6

Estimated Changes in State CalPERS Contribution Rates

|

Pension Plan

|

2014–15

|

|

2016–17

|

|

Assumed in Budget

|

Estimated New Rate

|

Estimated New Rate

|

|

California Highway Patrol

|

36.4%

|

42.7%

|

|

50.4%

|

|

Peace Officer/Fire Fighter

|

31.3

|

35.6

|

|

40.5

|

|

State Miscellaneous Tier 1

|

21.4

|

23.4

|

|

28.2

|

|

State Safety

|

18.0

|

19.2

|

|

19.5

|

Cost Increases Interact With Recent Pension Law. Chapter 296, Statutes of 2012 (AB 340, Furutani), established a standard whereby public employees hired after January 1, 2013 pay 50 percent of the normal cost. Under the normal cost rates reflected in the budget, most state workers pay roughly 50 percent of these costs. In the event that total contributions towards the normal cost change by more than 1 percent of pay, Chapter 296 requires affected local government employees’ share of normal cost to be adjusted, but there is no comparable requirement regarding state employees. According to the CalPERS meeting materials, the total estimated normal cost will increase by more than 1 percent for two state pension plans: State California Highway Patrol and State Peace Officer/Fire Fighter. Any increase in state employee contributions to maintain the standard must be established either through collective bargaining or legislation.

State’s Costs Have Grown. In 1993–94, there were about 190,000 state workers. Due to the increase in number of state workers as well as the rising cost to provide benefits, the state’s personnel costs have grown a great deal over the past two decades. The bulk of state personnel costs go to pay for salary, retirement (including Social Security and Medicare), and health benefits. After adjusting for inflation, these costs increased by about 40 percent between 1993–94 to 2012–13.

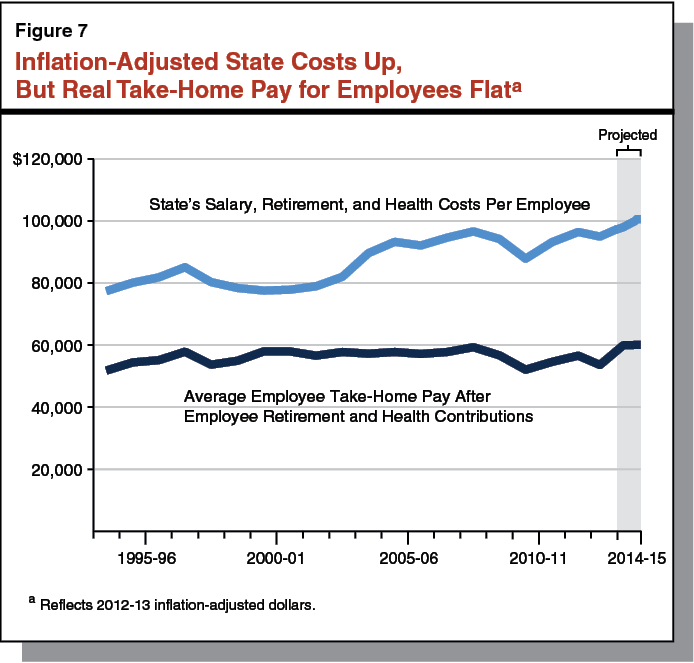

Despite the state’s policies to contain employee compensation costs for much of the past decade through furloughs, other staff reductions, and shifting benefit costs onto employees, the fiscal pressure from rising pension and health benefit costs have greatly increased the state’s compensation costs on a per–employee basis since the beginning of the last decade. Figure 7 shows how the state’s salary, retirement (including Social Security and Medicare), and health benefit costs on a per–employee basis have changed over the past two decades, after adjusting for inflation. Between 1993–94 and 2012–13, these costs increased by 24 percent (from about $77,000 per employee to about $96,000 per employee). After the scheduled pay increases and CalPERS rate increases in 2014–15 go into effect, we estimate that the state’s costs per employee will be more than 30 percent higher than they were in 1993–94 at more than $100,000 per employee.

State Workers’ Take–Home Pay Largely Flat. The average state worker’s inflation–adjusted take–home pay (defined here as the employee’s salary after paying contributions to retirement [including Social Security and Medicare] and health benefits) has been relatively flat over much of the past 20 years. The average state worker’s take–home pay even declined somewhat during the end of the last decade as state workers picked up larger shares of their benefit costs while being furloughed. Our review indicates that these findings apply to most state workers and are not the result of significant changes in the composition of the state workforce. As Figure 7 shows, on an inflation–adjusted basis, we expect the average state worker’s take–home pay to return to its pre–2007–08 levels in 2014–15.

For the reasons that we discuss below, state employee compensation costs likely will continue to increase beyond 2014–15.

Scheduled Rank–and–File Salary Increases. Pursuant to the current MOUs, most state employees will receive a pay increase in 2015–16. In addition, depending on the outcome of an annual salary survey, highway patrol officers could receive a salary increase every year through 2017–18.

Management Pay Increases. The administration has broad authority over supervisory and managerial salaries. Statewide, these salaries total about $4 billion ($2 billion General Fund). When rank–and–file employees negotiate pay increases, managerial employees do not automatically receive a comparable increase in pay. When rank–and–file pay increases faster than managerial pay—as has been the case for some classifications—“salary compaction” can result. Salary compaction can be a problem when the differential between management and rank–and–file is too small to create an incentive for employees to accept the additional responsibilities of being a manager.

To date, there has not been a consistent or coordinated process for the administration to analyze compaction issues and inform the Legislature where such problems exist. The proposed 2014–15 budget attempts to address compaction by (1) extending 2014–15 pay increases to managerial and supervisorial employees and (2) providing larger pay increases for a select group of classifications the administration has identified as being affected by compaction. Although these actions seem appropriate, compaction likely also exists in other classifications. To address compaction, the administration would need to review managerial and supervisorial classifications and propose pay increases for affected managerial state workers beyond what is proposed in the 2014–15 budget.

Pension and Health Benefit Costs Rising. The state should expect pension contributions to continue increasing for the next several years as CalPERS (1) continues to be affected by earlier market losses and (2) phases in higher rates based on the new actuarial assumptions. In addition, health premium costs likely will continue to outpace inflation for the foreseeable future.

Future Labor Agreements. Currently, the state is bargaining with the three bargaining units with expired contracts. If the state reaches an agreement with these bargaining units that includes terms similar to many of the other MOUs, the state will incur additional costs to provide these employees compensation increases in 2014–15. In addition, salary costs in 2014–15 could increase should the Legislature ratify addenda to existing MOUs providing pay increases to firefighters or other bargaining units not scheduled to receive pay increases in 2014–15. Beyond 2014–15, the MOUs for a large portion of the workforce will expire within the next year or two. The outcome of these collective bargaining negotiations will affect the state’s compensation costs in 2015–16 and beyond.