- All Articles Proposition 30

2017 May Revision: Background on Revenue Issues May 24, 2017

We provide additional detail on several key revenue issues in the May Revision, including administration estimates of capital gains and Proposition 30 revenues.

Administration's January 2017 Proposition 30/55 Revenue Estimates February 7, 2017

We display the administration's estimates for this revenue source as of January 2017.

Sales Tax Rates: Prop. 30 and Comparisons to Other States December 15, 2016

California's sales tax rates are among the highest in the U.S., but different comparisons generate different rankings for California, ranging from second-highest to 11th-highest in the nation.

Fiscal Outlook: Proposition 30/55 Revenue Estimates November 16, 2016

We provide our updated Proposition 30/55 revenue estimates.

May Revision 2016: Proposition 30 Estimates May 23, 2016

We display the administration's Proposition 30 revenue estimates, as of the 2016 May Revision, as well as our office's estimates.

Administration's January 2016 Proposition 30 Estimates February 19, 2016

As part of the annual budget development process, the administration provides us with its current estimates of Proposition 30 revenues through 2018-19. 2018-19 is the last fiscal year affected by the Proposition 30 income tax increases for high-income Californians.

Fiscal Outlook: Proposition 30 Sales Taxes Expire At End of 2016 November 18, 2015

The expiration of the Proposition 30 sales tax increase affects the sales tax projections in our new Fiscal Outlook publication.

LAO Fiscal Outlook: Updated Proposition 30 Estimates November 18, 2015

In conjunction with the November 2015 edition of our Fiscal Outlook, we update our estimates for the revenue effects of Proposition 30 (2012).

May Revision: Proposition 30 Estimates, Accrual Uncertainties May 18, 2015

We discuss the May Revision estimates for Proposition 30 revenues.

California's Sales Tax Rate Has Grown Over Time May 5, 2015

As described in our report, Understanding California's Sales Tax, California's sales tax rate has more than doubled since 1962.

2013 FTB Data: Personal Income Tax Base Varies Regionally April 30, 2015

The Franchise Tax Board has released data on taxes paid and income reported on 2013 California personal income tax returns by county.

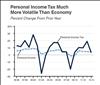

Personal Income Tax Much More Volatile Than Economy December 8, 2014

The state government's largest revenue source, the personal income tax, is much more volatile than "personal income," one key economic statistic that measures the overall size of the economy.

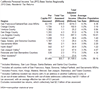

"Top 1 Percent" Pays Half of State Income Taxes December 4, 2014

In 2012, for perhaps the first time in state history, the top 1% of the state's tax filers paid slightly over half of the state's personal income taxes.