- All Articles Capital Gains

How Uncertain Are Capital Gains Revenue Estimates? May 20, 2019

We examine historical patterns of financial markets to gauge the range of possible outcomes for capital gains revenue in 2018-19 and beyond.

Gauging Risk in Capital Gains Revenue Estimates February 12, 2019

We examine historical patterns of financial markets to gauge the range of possible outcomes for capital gains revenue in 2018-19 and 2019-20.

2017 May Revision: Background on Revenue Issues May 24, 2017

We provide additional detail on several key revenue issues in the May Revision, including administration estimates of capital gains and Proposition 30 revenues.

2017 May Revision: LAO Revenue Outlook May 12, 2017

We discuss our updated state revenue outlook, released as part of our response to the Governor's 2017 May Revision.

2017 May Revision: LAO Economic Outlook May 11, 2017

We discuss our new economic outlook, released as part of our response to the Governor's 2017 May Revision.

Administration's January 2017 Proposition 30/55 Revenue Estimates February 7, 2017

We display the administration's estimates for this revenue source as of January 2017.

May Revision: Capital Gains Estimates May 27, 2016

We discuss the administration's 2016 May Revision capital gains estimates, as well as our office's.

May Revision 2016: Proposition 30 Estimates May 23, 2016

We display the administration's Proposition 30 revenue estimates, as of the 2016 May Revision, as well as our office's estimates.

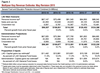

May Revision 2016: Administration & LAO Multiyear Revenue Figures May 17, 2016

This post compares the administration's multi-year forecast revenue estimates with those generated under the LAO May 2016 economic growth scenario through 2019-20. (This does not reflect required transfers to the Budget Stabilization Account under Proposition 2 under the LAO figures, as those estimates are still under development.)

The Stock Market Downturn and California's Finances August 28, 2015

We answer some questions we receive about California's budget and the stock market downturn of recent days.

May Revision: 2014 Personal Income Tax Numbers May 26, 2015

We discuss 2014 personal income tax data from both our May Revision revenue estimates and those of the administration.

May Revision: LAO Revenue Outlook May 16, 2015

Our office's May Revision revenue outlook anticipates billions of dollars of additional revenues in 2015-16, compared to the administration's updated projections.

FTB Spring 2015 Revenue Exhibit Data Posted May 14, 2015

The Franchise Tax Board has posted its spring "exhibit" data, which contains information used by our office and the administration to understand state income tax collections.

Personal Income Tax Is State's Dominant General Fund Revenue December 9, 2014

Over the past several decades, the personal income tax has replaced the sales tax as the main source of the state's General Fund revenue.

Proposition 2 Attempts to Manage State Revenue Volatility December 8, 2014

Proposition 2, passed by voters in November 2014, includes provisions intended to help manage state budget revenue volatility, principally by requiring certain state revenues to be deposited in budget reserves.