Ballot Pages

A.G. File No. 2015-070

November 10, 2015

Pursuant to Elections Code Section 9005, we have reviewed a proposed constitutional initiative regarding personal income taxes (income taxes) and funding for education and health programs (A.G. File No. 15-0070, Amendment No. 1).

Background

California’s State Budget. California state taxes—primarily income taxes—are spent mainly from the state government’s General Fund. The General Fund is budgeted to spend about $115 billion during the current 2015-16 fiscal year.

State General Fund Spending. The largest category of state General Fund spending is for school districts and community colleges. Proposition 98, approved by voters in 1988 and modified in 1990, establishes a minimum funding level for schools and community colleges. This funding level tends to grow over time based on growth in the state’s economy, state tax revenue, and student attendance, among other factors. In the current fiscal year, the state budgeted $49 billion in Proposition 98 funding from the General Fund (over 40 percent of all General Fund revenues). (In addition to this state funding, schools and community colleges will receive an estimated $19 billion from local property taxes, with smaller amounts from federal sources and the California Lottery.) Other educational programs supported in part by the General Fund include the University of California (UC) and the California State University (CSU) (with a combined $6.5 billion of General Fund support in 2015-16) and subsidized child care and early education (with almost $1 billion of non-Proposition 98 General Fund support in 2015-16). The General Fund also pays for part of California’s health and human services programs, the largest of which is Medi-Cal (a health coverage program for low-income people). Medi-Cal is budgeted to receive $18 billion of General Fund support in 2015-16.

State Special Funds and Other Funding Sources. Many public programs receive funding from state sources other than the General Fund: various state special funds, federal funds, and other sources. For example, Medi-Cal is budgeted to spend $91 billion in total to provide coverage to over 12 million people in 2015-16, with funding from federal and special funds, as well as the General Fund. Likewise, part of the state’s child care and early childhood programs and a portion of UC and CSU spending are supported from other sources.

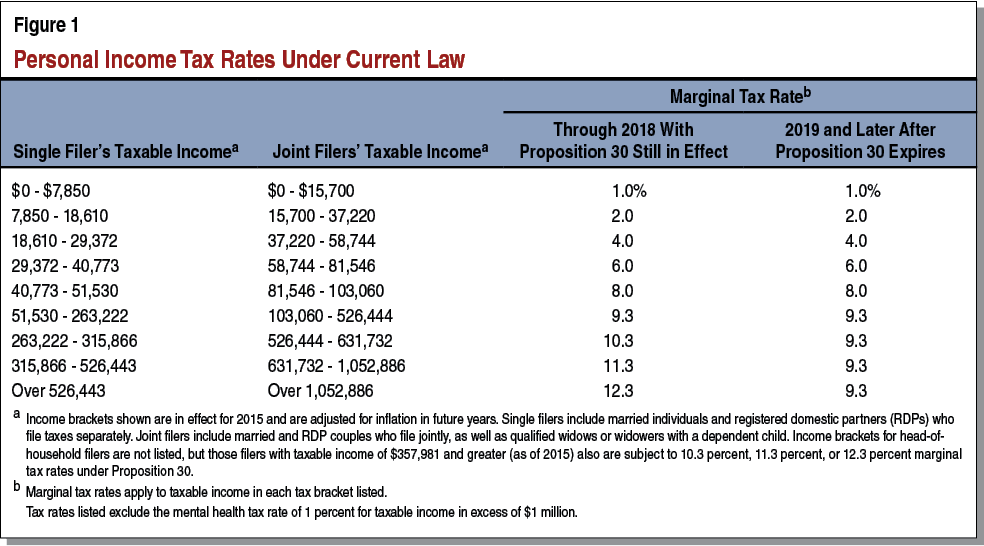

Proposition 30. Proposition 30, passed by voters in 2012, temporarily raised some state taxes. That measure increased the state sales tax rate by one-quarter cent from 2013 through 2016—an increase that is budgeted to generate $1.6 billion of revenue this year. From 2012 through 2018, Proposition 30 increased marginal income tax rates paid by roughly the 1 percent of tax filers in the state with the highest incomes—increases that are budgeted to generate $6.8 billion of revenue this year. (The actual total may be hundreds of millions of dollars or more above or below $6.8 billion.) Figure 1 summarizes income tax rates under current law, including Proposition 30’s temporary tax increases. After Proposition 30 expires, current law provides for a 9.3 percent top marginal income tax rate (not counting a 1 percent tax rate on taxable income in excess of $1 million for mental health programs).

Recent Budgets and Proposition 2. High-income people pay a large share of California’s state taxes, and they receive a large portion of their taxable income from sources tied to the ups and downs of the stock market. California’s state budget has been volatile due mainly to those large swings in income taxes paid by high-income people.

In response to budget deficits resulting from this volatility, the state took various actions, including budget cuts, tax increases, and other measures. As a result of these actions and the improving economy, the General Fund has not ended a fiscal year with a deficit since 2011-12. In November 2014, California voters approved Proposition 2. Proposition 2 creates a new set of rules to determine the amount of money the state has to deposit to a rainy day fund when the economy and stock market are doing well. This fund is intended to reduce the need for budget cuts, tax increases, and other measures in the future when the economy or stock market weakens. When the Governor declares a budget emergency under Proposition 2, required deposits to the rainy day fund may be suspended, and some money deposited to the fund previously may be used to help balance the state budget. Proposition 2 also requires speeding up payment of certain state debts. In addition to Propositions 2, 30, and 98, the State Constitution includes other rules affecting the state budget, such as the state spending limit that has been in place since passage of Proposition 4 in 1979.

Proposal

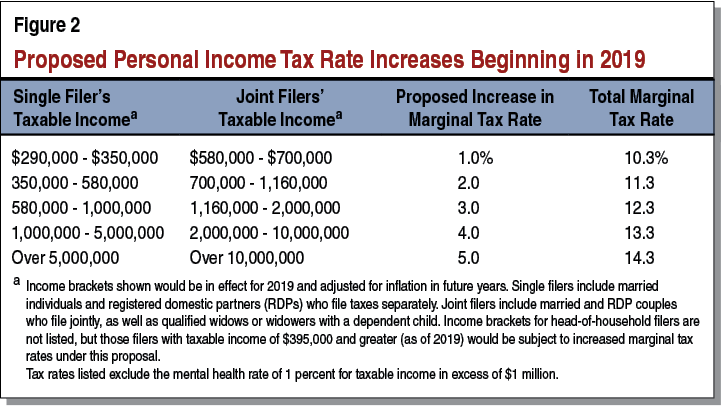

Permanent Tax Increases on Highest-Income Californians. Beginning in 2019 (following the scheduled expiration of the Proposition 30 income tax increases), this measure would permanently increase marginal income tax rates on roughly the 1 percent of tax filers in the state with the highest incomes. Figure 2 summarizes the proposed marginal income tax rate increases under this measure, as well as the total proposed marginal tax rate for each group (which includes the 9.3 percent top rate in current law).

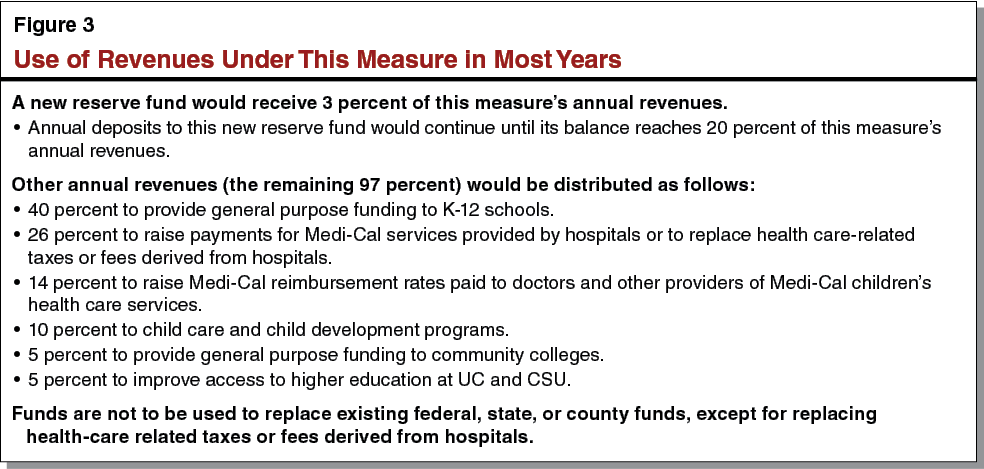

Use of Revenues in Most Years. The revenues generated by this measure’s income tax rate increase would be deposited to several new state special funds. In most years, these revenues would have to be used for specified purposes, as summarized in Figure 3.

Use of Revenues During State Budget Emergencies. The rules for using this measure’s revenues would change when the Governor declares a budget emergency under Proposition 2. When that occurs, the Legislature—with a 55 percent vote of each house—may vote to use up to half of this measure’s annual revenues (that is, those not deposited to the measure’s new reserve fund) to help balance the state budget. Such a vote may occur in no more than three consecutive state fiscal years. Moreover, in a budget emergency, the Legislature (again, with a 55 percent vote of each house) may vote to withdraw previous deposits to this measure’s reserve fund to help balance the state budget. No more than half of this reserve balance could be withdrawn during the first year a withdrawal is made for a budget emergency.

Other Provisions. This measure exempts its revenues and spending from the state’s constitutional spending limit. In addition, the taxes raised by this measure would not count toward calculating the state’s Proposition 98 funding requirements or Proposition 2 deposit requirements. The measure allows the Legislature to amend its provisions with a two-thirds vote in the future, but only to further the measure’s purposes.

Fiscal Effects

Increased State Tax Revenues. This measure would increase state income tax rates beginning in 2019. (This would result in increased tax revenues beginning in fiscal year 2018-19.) The precise amount of this revenue in any given year would depend heavily on trends in the stock market and the economy. For example, if the stock market and economy were weak in 2019 (the year this measure’s tax increases would take effect), this measure might generate around $7 billion of increased revenue. Conversely, if the stock market and economy were strong at that time, the measure might raise around $15 billion. Near the midpoint of that range—around $10.5 billion—is one reasonable expectation of the additional revenue that this measure would generate in 2019. Thereafter, that amount would rise or fall each year depending on trends in the stock market and the economy.

Increased Funding for Education and Health Programs. In most years, this measure’s revenues would be used to increase funding for various education and health programs, as listed in Figure 3.

Budget Emergencies. State budget emergencies will occur in the future when state tax revenues grow very slowly or decline. Weak state revenue growth generally will be caused by weakness in the economy or stock market, which will cause declines in tax payments by high-income households. In some budget emergencies, state tax payments by high-income people could decline by billions of dollars. Future Legislatures and Governors will have to consider various options to balance the state budget then, and reductions in overall state spending on education and health programs are likely to occur. Those reductions could be made to spending from the General Fund, from this measure’s special funds, or both. During budget emergencies, funds accumulated in the reserve established by this measure may help balance the budget, as could up to one-half of the annual revenues under this measure.

Summary of Fiscal Effects. This measure would have the following major fiscal effects:

- Increased state revenues annually beginning in 2019—likely in the $7 billion to $15 billion range initially—with amounts varying based on stock market and economic trends.

- These revenues generally would be spent on education and health programs, with a small portion deposited annually to a reserve fund.