Ballot Pages

A.G. File No. 2017-018

October 9, 2017

As required by Section 9005 of the Elections Code, this letter analyzes the proposal (A.G. File No. 17-0018, Amendment No. 1) to split the existing State of California into three new U.S. states, subject to approval by the federal government. This initiative proposal amends state laws (statutes), but does not amend the State Constitution.

Background

California’s boundaries were established at its first constitutional convention in 1849. Currently, the State Constitution provides that “the boundaries of the State are those stated in the Constitution of 1849 as modified pursuant to statute.” Statutory modifications to California’s boundaries generally have been minor. While this constitutional provision allows statutes to change California’s borders, nothing in the State Constitution explicitly addresses how California might go about splitting itself into two or more new states. In this section, we describe other examples of proposed and actual state splits, as well as other provisions of the U.S. and State Constitutions that might affect such a proposal.

California Law and the Initiative Process

Broad Legislative Powers. The California Legislature possesses broad powers. As noted by the California Supreme Court, under the State Constitution, the Legislature “may exercise any and all legislative powers which are not expressly or by necessary implication denied to it by the Constitution.” Furthermore, through the initiative process, courts have found that the electorate’s legislative powers are “generally coextensive with the power of the Legislature to enact statutes.” If, therefore, the Legislature can pass a statute, it is generally true that the electorate may approve such a statute through the initiative process. Moreover, if there are reasonable doubts about the power of voters to approve an initiative, California courts have found it is their duty to “jealously guard” the initiative power and “resolve any reasonable doubts in favor of its exercise.”

Constitutional Amendments and Revisions. Just as statutes can be changed, so can the State Constitution. The California Constitution, however, distinguishes between constitutional revisions and amendments. The California Supreme Court has found that for a measure to be considered a constitutional revision, “it must necessarily or inevitably appear from the face of the challenged provision that the measure will substantially alter the basic governmental framework set forth in our Constitution.” Even a simple constitutional change “may enact such far reaching changes in the nature of our basic governmental plan as to amount to a revision.”

Initiative Constitutional Revisions Prohibited. Constitutional amendments may be proposed either by the Legislature or through the initiative process. Constitutional revisions, however, may be proposed only by the Legislature or a state constitutional convention. Such revisions may not be approved through the initiative process.

Process for Splitting States

Congressional Approval Required. Article IV of the U.S. Constitution discusses the process for admitting new states to the federal union. Section 3 of Article IV provides:

New States may be admitted by the Congress into this Union; but no new State shall be formed or erected within the Jurisdiction of any other State; nor any State be formed by the Junction of two or more States, or Parts of States, without the Consent of the Legislatures of the States concerned as well as of the Congress.

If the Congress approves a measure to create a new state, the measure would be presented to the President of the United States for approval or veto. In the event of a veto, the measure may be approved over the President’s objections with a two-thirds vote of the U.S. Senate and the U.S. House of Representatives. For example, President Andrew Johnson vetoed S. 456, the Nebraska state admission act, in January 1867, but the veto was overridden, resulting in Nebraska’s admission to the union.

Past Efforts to Split U.S. States. Four U.S. states were admitted to the union after being split from an existing state: Kentucky, Maine, Vermont, and West Virginia. The last such split—West Virginia’s split from Virginia—occurred in 1863 during the Civil War. Various efforts have been made to split up other states, including California. In 1859, the California Legislature—with the approval of voters in Southern California—consented to the separation of areas south of the Tehachapi Mountains (including Los Angeles and San Diego) into a separate territory or state. The Congress, however, never acted on this proposal, and it was never implemented.

“Consent of the Legislature” Required for State Splits. As noted above, Section 3 of Article IV of the U.S. Constitution requires the “Consent of the Legislatures of the States concerned as well as of the Congress” for specified acts to create new states. When West Virginia became a state in 1863, Section 3 generally was interpreted to require the consent of the state legislature and the Congress in order to split Virginia. (President Lincoln and some others recognized a unionist legislature—established in West Virginia after the rest of Virginia joined the Confederacy—as the body then empowered to give the required state legislative consent.) There have been other interpretations of Section 3 over time. Based on the most recent precedent from 1863, it appears most likely that the U.S. Constitution requires a state’s legislature—along with the Congress—to consent before that state is split into two or more new states.

Largely because the voter initiative process did not emerge until decades after 1863, there is no clear precedent for whether a voter initiative may provide the required state legislative consent to split a state. In other types of cases (not involving statehood), courts have sometimes allowed voter initiatives to substitute for required actions of state legislatures under the U.S. Constitution, while disallowing voter initiatives in some other contexts. The California Supreme Court, for example, has ruled that the voter initiative process may not provide the required state legislative approval to call for a U.S. constitutional convention.

Proposal

Statutory Measure to Split California. This measure states that it is an initiative measure through which “the people, acting as the legislative body of the State of California,” change state statutes to:

- Establish new boundaries for three new U.S. states within the boundaries of the existing State of California.

- Provide the state legislative consent for the formation of those three new states to Congress as required by the U.S. Constitution.

- Establish a process to transform the existing State of California into the three new states.

Proposed New States

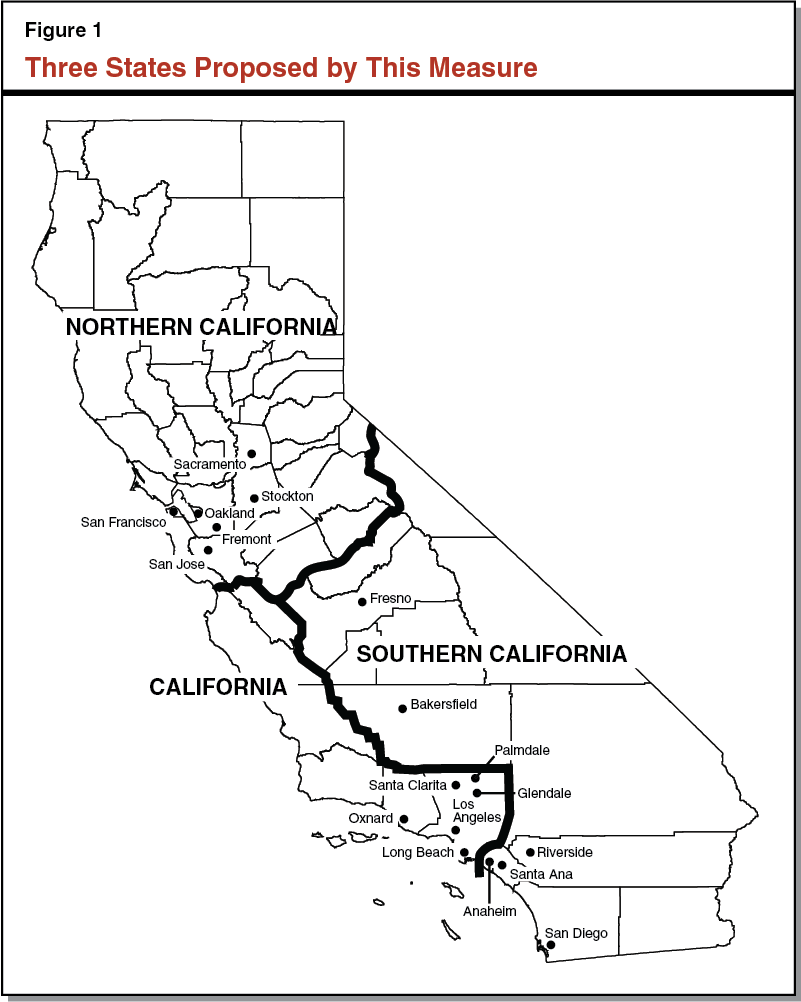

Proposed New States. The measure proposes to split the existing State of California into three new states—shown in Figure 1 (see next page)—to be named Northern California, California, and Southern California. The map in Figure 1 also shows the six most populous cities in each of the three new states.

Key Statutory Provisions

Request to Congress. The measure requires the Governor to transmit a formal notice of its approval to the Congress on January 1, 2019. The Governor must ask the Congress to act upon the proposed split of California within 12 months of that date.

Process to Divide California. The measure requires the California Legislature to respond to the initiative by dividing and transforming the existing State of California into the three new states. If the Legislature does not act on these matters within 12 months of congressional approval to divide the state, the debts of the existing State of California will be distributed among the three new states based on their populations, while existing state assets within the boundaries of each of the new states will become assets of that new state. The measure also references the need for each of the three new states to adopt a new constitution by convention or popular vote.

Fiscal Effects

This section of the analysis begins by describing some key characteristics and the prospective economic and tax bases of the three new states. Thereafter, we examine some of the public services funded by the existing state government in those three regions. Finally, we summarize key findings about how the measure could affect public finances, including a description of some major uncertainties about the measure’s effects.

Three New States

The existing State of California—with about 39.5 million people—is the most populous U.S. state. Following creation of the three new states, there would be 52 U.S. states (the three in this proposal plus the other 49 states). Key facts about the three states’ populations are described below.

- Southern California. Based on the most recent state population estimates, Southern California—with 13.9 million people—would be the fourth most populous state behind Texas, Florida, and New York. The population of the Inland Empire (Riverside and San Bernardino Counties) equals about one-third of the total. San Diego County and Orange County have similar populations—each with just over one fifth of the new state’s total. To the north, counties in the Southern San Joaquin Valley collectively include just under one-fifth of the new state’s population.

- Northern California. Northern California—with 13.3 million people—would rank approximately fifth among the states in population (just ahead of Illinois and Pennsylvania). About 60 percent of the population lives in the Bay Area (Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma Counties). About 17 percent lives in the Sacramento region, while 12 percent lives in the Northern San Joaquin Valley. Most of the rest of the population lives in relatively rural counties along the northern Sacramento River, the North Coast, and the Sierra Nevada, Cascade, Coast, and Klamath mountain ranges.

- California. The new state called California—with 12.3 million people—would rank approximately eighth among the states in population (behind Pennsylvania and ahead of Ohio). Los Angeles County has over 10 million residents: more than 80 percent of the new state’s population. The second-largest county in the new state—Ventura County, with 857,000 residents—has 7 percent of the population.

Different State Income Levels and Tax Bases

Income and Income Disparities. Personal income is an economic statistic that includes individuals’ wages, business income, and various other types of income. (Personal income generally excludes capital gains income—income received from sales of stock, homes, and other assets.) As of 2015, per capita (per person) personal income in California was about $54,000, ranking 9th among the 50 U.S. states. (For the U.S. as a whole, per capita personal income was about $48,000.) Within the existing California, wealth is disproportionately concentrated in the Bay Area, while the San Joaquin Valley is one of the poorest regions in the country. Income in the three new states also would vary:

- Northern California. The per capita personal income of the new state of Northern California was about $63,000 in 2015—ranking it approximately 2nd among all the states by this measure, or about $6,000 below top-ranked Connecticut. Northern California—with its technology industry centered in the Bay Area—would be a wealthy U.S. state, with per capita income levels well above those of the existing State of California. Within the new state, per capita income levels in the Bay Area are among the highest in the nation (more than $100,000 in Marin County and San Francisco), while incomes elsewhere are often considerably lower. Of Northern California’s 40 counties, 13 (Butte, Del Norte, Glenn, Lake, Lassen, Merced, San Joaquin, Sierra, Siskiyou, Stanislaus, Tehama, Trinity, and Yuba) had per capita personal income levels of under $40,000 in 2015.

- California. The new California’s income levels would be comparable to those of the existing State of California (about $53,000 per capita, as of 2015), ranking it about 12th among the states. Its economy is dominated by Los Angeles, but also includes relatively wealthy Ventura and Santa Barbara Counties. Within the new state, some of the largest disparities in income levels would be within Los Angeles itself, which includes some of the nation’s richest and poorest communities.

- Southern California. The new state of Southern California would rank about 30th among the states, with per capita personal income of about $45,000. This is about 20 percent below per capita income levels in today’s California and comparable to income levels in Florida and Oregon. In this new state, Orange County residents have relatively high incomes, and San Diego residents have incomes similar to those of the existing state. The income levels of the Inland Empire, the Southern San Joaquin Valley, and Imperial County, however, are far lower. Because of this, the new state of Southern California would have below average income levels compared to the rest of the country, at least initially.

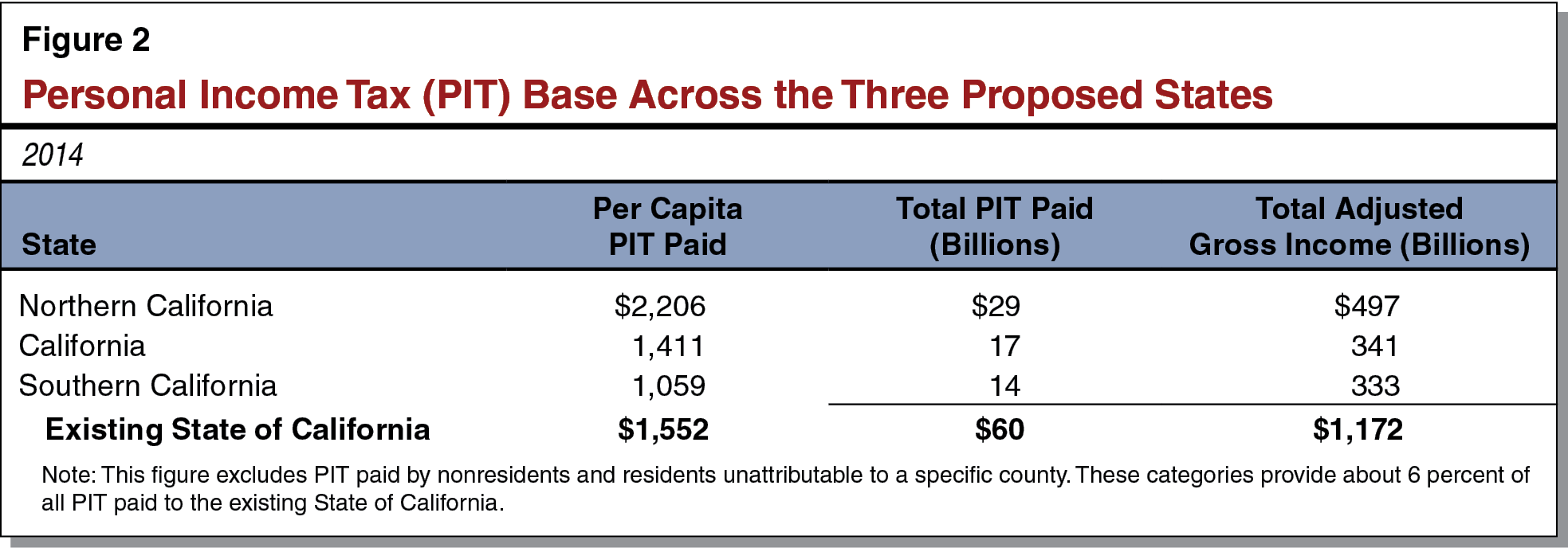

Income Tax Base Concentrated in Bay Area. The personal income tax (PIT) is the primary tax revenue source for today’s California state government, making up about 70 percent of the revenues of the state General Fund (the state account that provides most state support for public schools, universities, health and social services programs, and prisons). In 2014, as shown in Figure 2, the per capita PIT paid by filers in Northern California was much higher than that paid by filers in either of the other two proposed states. This is because Bay Area residents have the highest income levels in the state, and the existing California PIT relies on a progressive rate structure—one in which higher-income individuals pay a higher effective tax rate on their income, including capital gains income from stock and home sales when realized by taxpayers. Of the existing state’s $1.2 trillion in adjusted gross income (AGI) in 2014, $497 billion (42 percent) came from Northern California. The other two proposed states each generated less than 30 percent of California’s AGI.

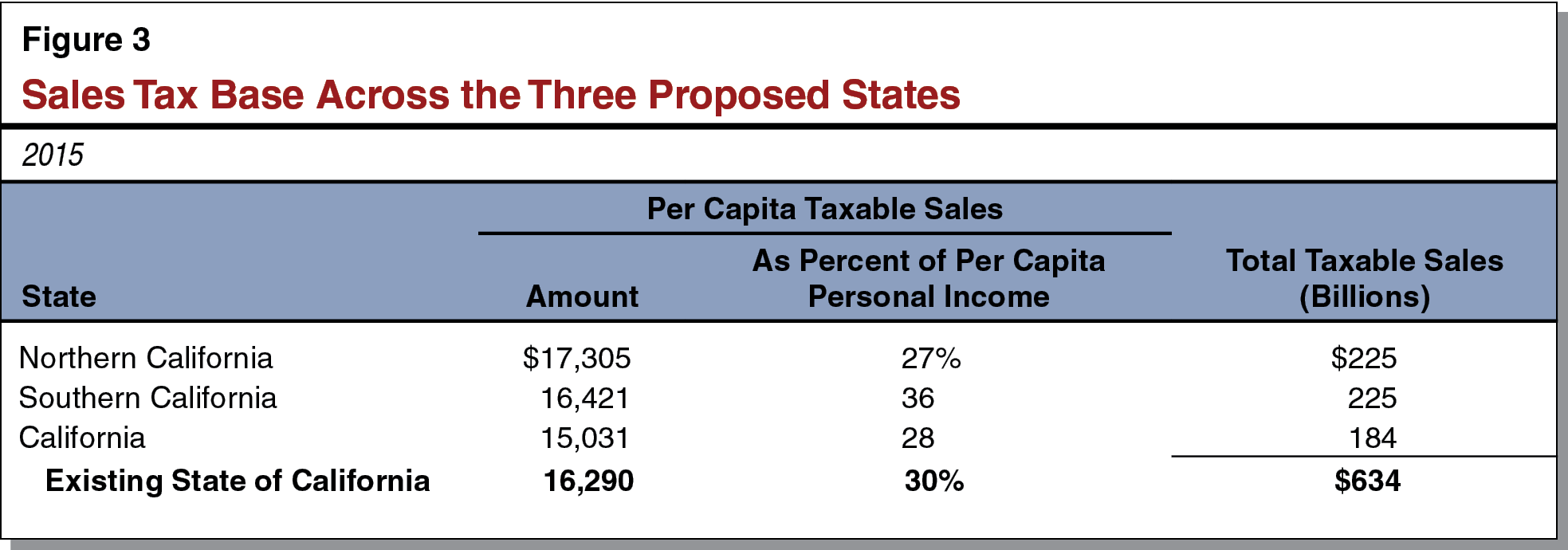

Northern California Leads State in Per Capita Taxable Sales. Currently, the sales tax—levied at a rate of at least 7.25 percent and higher in most communities—generates revenue that is divided among state and local government programs. As shown in Figure 3, Northern California leads the other two proposed states in per capita taxable sales—principally because a few Bay Area counties (Napa, San Francisco, Santa Clara, and San Mateo) have per capita taxable sales exceeding $20,000. The new California’s per capita taxable sales are below those of the existing state—principally because Los Angeles County’s per capita taxable sales are under $15,000. Nevertheless, the differences among the proposed states are not as great for this measure as they are for per capita PIT revenues. Part of the reason for this is that lower-income consumers spend a greater portion of their income on taxable goods. Accordingly, in Southern California—the proposed state with the lowest per capita income levels—per capita taxable sales total 36 percent of per capita income, the highest level among the three new states. The data in Figure 3 also is influenced by “interstate” consumer activity—for example, by a Los Angeles County (California) resident purchasing cars, clothes, or large appliances in Orange County (Southern California).

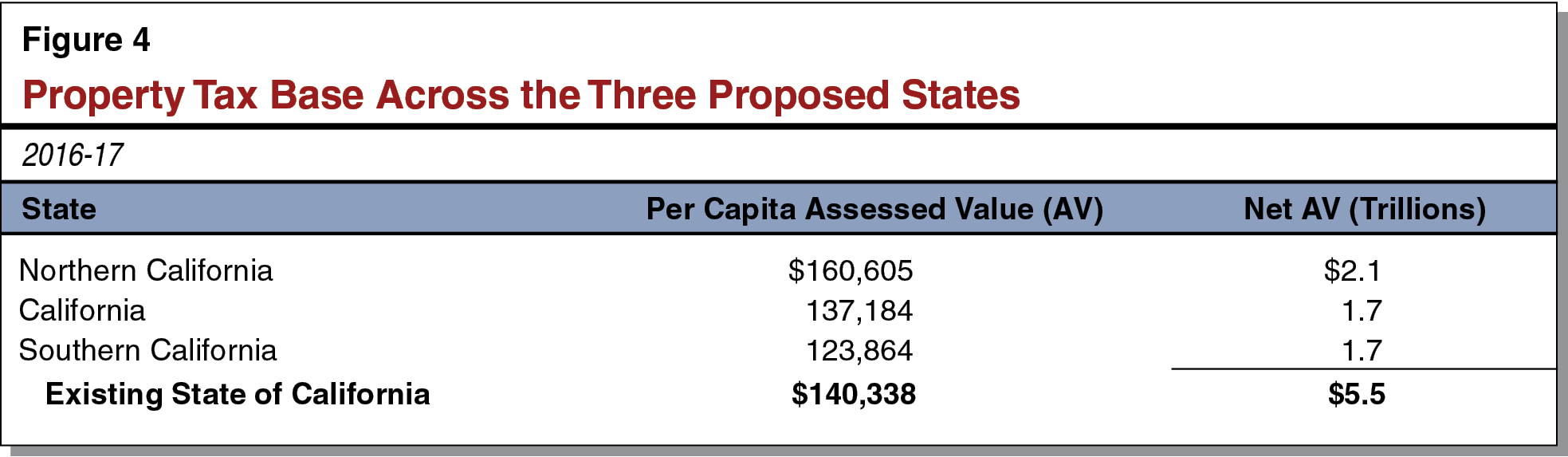

Per Capita Property Value Highest in Northern California. Property taxes are the main source of local government revenues and directly influence the existing state budget. (Higher distributions of property taxes to schools typically reduce the amount of money the state must provide to local school districts under Proposition 98, a state constitutional provision passed in 1988.) As shown in Figure 4 (see next page), the per capita assessed value (AV) of property in the Bay Area is higher than in any other region. Per capita AV in Southern California lags the other two states and the existing statewide average. This is because housing in parts of the proposed Southern California state—for example, in the Inland Empire and the Southern San Joaquin Valley—tends to be much less costly than in the Bay Area and Los Angeles.

Income and Wealth Differences Among the Three States. In summary, differences in incomes and wealth would translate into very different tax bases for the proposed states. Mainly because Bay Area residents in the new Northern California have higher incomes, they pay notably more per person in income, sales, and property taxes under the existing California tax system. Residents of the proposed California state—principally in Los Angeles—have income levels at about the existing state average, and on a per-person basis, they pay about the statewide average in income and property taxes, but less per person in sales taxes. Finally, income levels in the proposed Southern California are the weakest of the three new states. As a result, residents there currently pay much less per person in income and property taxes, while they spend a larger percentage of their incomes to buy physical goods subject to California’s sales tax. For these reasons, the new Southern California state, at least initially, probably would have a somewhat less robust tax base than that of the other two proposed states and the existing State of California.

Issues Concerning Public Schools and Higher Education

California governments spend around $100 billion per year on education—mostly for elementary and secondary (K-12) schools, but also for community colleges, the California State University (CSU) system, and the University of California (UC) system. Proposition 98, a provision of the existing California Constitution, establishes a minimum statewide funding level for K-12 schools and community colleges, funded from a combination of state General Fund revenues and local property taxes. The colleges and universities also receive tuition and fee revenue from students in addition to tax revenues. The different tax bases and characteristics of the three proposed states would force each to make major decisions about these areas of public spending.

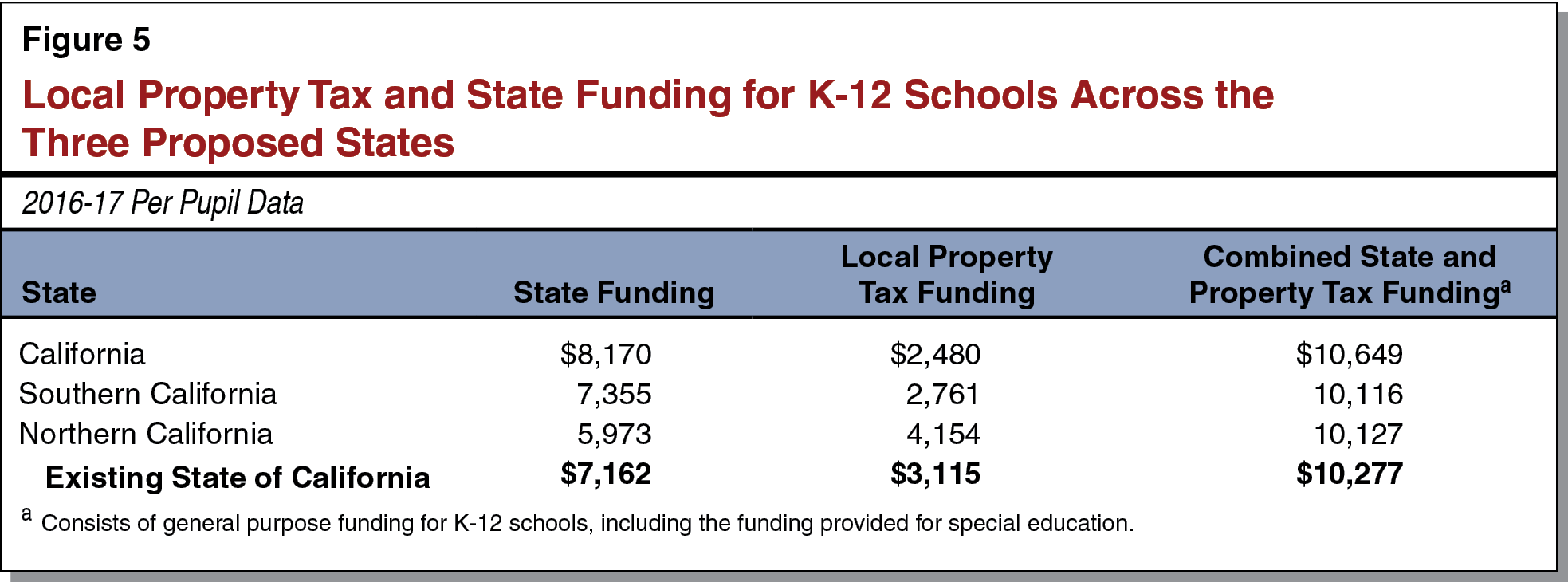

Different Regions Rely Differently on State School Aid. Figure 5 (see next page) shows the level of per-pupil funding from local property taxes and state sources for public schools as of 2016-17. (This excludes certain categories of federal and other funding.) By this measure, combined state and local property tax funding ranged from an average of $10,116 per pupil in the new Southern California state to $10,649 in the new California—a less than 6 percent spread, despite the income and wealth disparities among the new states. The reason for this relatively small disparity in per-pupil school funding is that the existing State of California provides state funding to supplement resources of districts that receive relatively less in property taxes. In other words, state funding—mainly from state income taxes—equalizes disparities in property tax wealth across school districts and regions. As a result of the existing state’s funding policies, the proposed states with the lowest levels of per-pupil local property taxes—California and Southern California—receive much more in state funding per pupil than Northern California. By contrast, Northern California—in which school districts receive far more local property taxes per pupil—now receives far less in state funding per student. The numbers in Figure 5 also are influenced by the fact that the proposed Southern California, due to its demographics, has far more K-12 students (2.3 million) than the other two states (1.7 million to 1.9 million each).

Public Higher Education Across the Three States. California's public higher education system consists of 72 community college districts (with 114 colleges), 23 CSU campuses, and 10 UC campuses. Currently, Northern California has the highest number of UC campuses and UC enrollment, as well as the highest number of CSU campuses and the second-highest CSU enrollment (behind the new California state).

Under the measure, each of the new states presumably would become responsible for a subset of these campuses. The leaders of the new states would face choices about how to manage and oversee the higher education institutions within their jurisdictions. Existing state practices are such that funding (and cost) per student is highest at UC and lowest at community colleges. For this reason, Northern California probably would incur relatively greater costs to maintain these institutions, compared to the other two states, at least initially. Federal research funding also is not evenly distributed among the three proposed states, with campuses (particularly UC campuses) in the proposed Northern California state now receiving more of this funding compared to campuses in the other two proposed states.

Issues Concerning Health and Social Services Programs

Key Health and Social Services Programs Across the Three States. Currently in California, state and local governments jointly fund various health and social services programs—in many cases, with additional support provided by the federal government. State and local governments in California now spend over $100 billion per year on public assistance programs, primarily to assist poor and disabled individuals in the state.

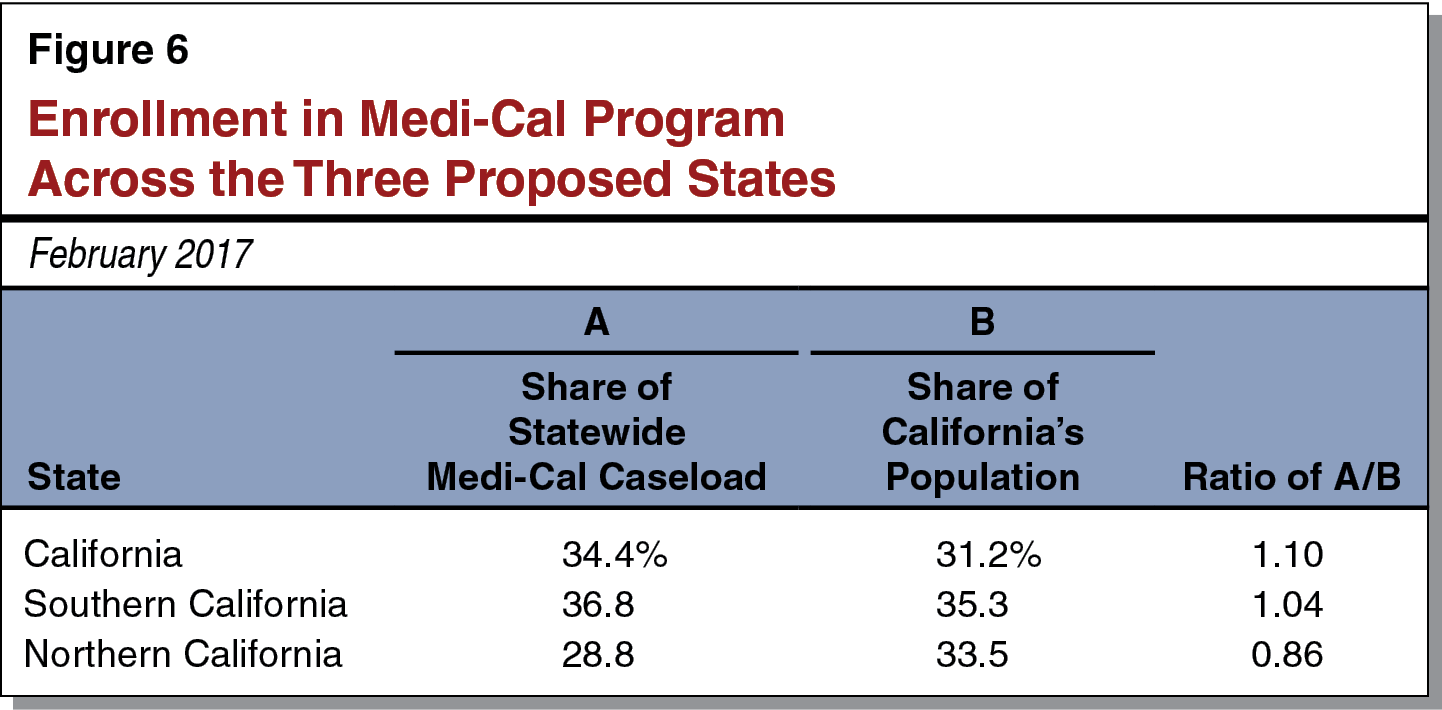

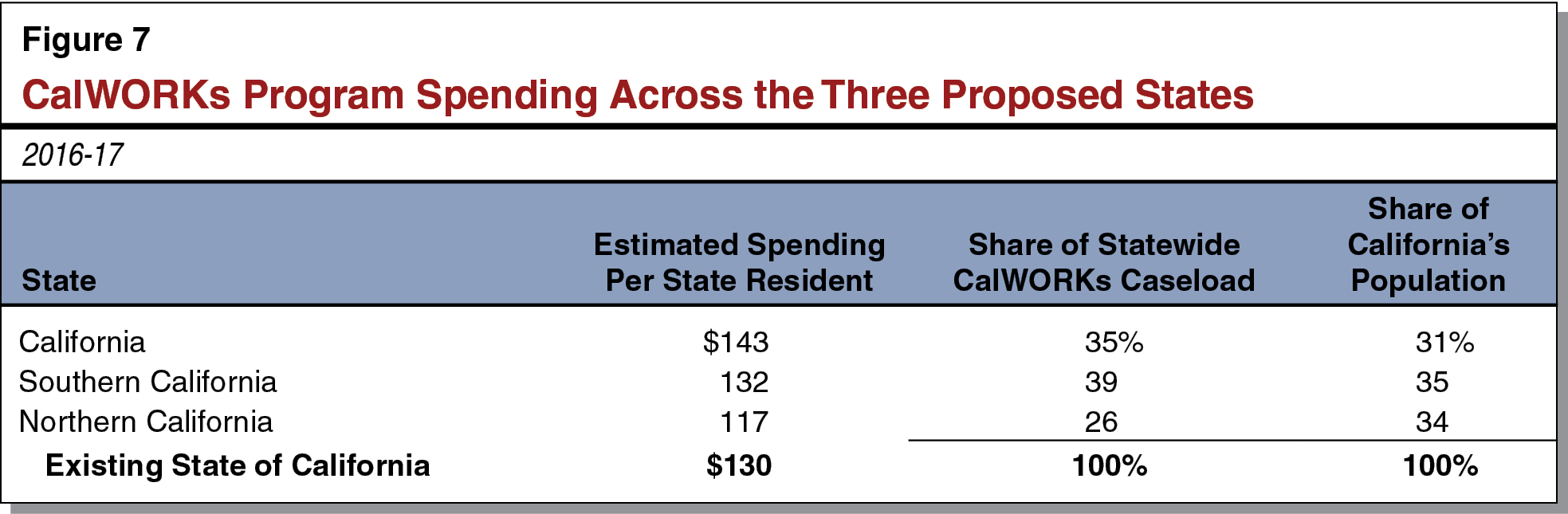

Figure 6 (see next page) shows that the caseload of the Medi-Cal program—the state’s primary health care program for low-income people—is not distributed evenly across the three proposed states. For example, the new California has 34 percent of the existing state’s Medi-Cal caseload, or about 1.1 times its 31 percent share of the statewide population. By contrast, Northern California’s share of the Medi-Cal caseload is below its share of the statewide population. Figure 7 (see next page) provides data on per-resident spending on the CalWORKs program—which provides cash assistance and welfare-to-work services to very low-income families. The figure shows that such spending is higher in the new California than the existing statewide average. By contrast, Northern California’s per-resident spending on CalWORKs is below the statewide average.

Changes in the socioeconomic status and the policies of the new states could increase the level of federal funding for the poorer new states or perhaps decrease it, at least for relatively wealthy Northern California. Changes in federal funding could offset some of the change in state and local funding for certain health and social services programs.

Issues Concerning Water Supply and Delivery

Complex Water System in Today’s California. California’s existing system of water supply and delivery is one of the most complex in the world. One reason for this complexity is that water does not naturally appear in California where demand is highest. Much of California’s rain and snow falls in water basins (watersheds) in the north, while much of the demand for water is in the south. Large federal, state, and local infrastructure projects have been built to move water from one part of the state to another.

Proposed California State Is Net Importer of Water. The proposed California state (including Los Angeles) is a net importer of water from the other two proposed states. The City of Los Angeles’ Department of Water and Power (LADWP), for example, imported two-thirds of its water in 2016 via external suppliers: the State Water Project (from the proposed state of Northern California) and the Metropolitan Water District’s Colorado River Aqueduct (from the proposed state of Southern California). In addition, LADWP imported about one-fifth of its water in 2016 via the city’s own aqueduct, which originates in the Mono Basin and the Owens Valley (in the proposed state of Southern California).

Decisions Concerning Water. The new states’ leaders would have to consider how to divide California’s water and related hydroelectric resources among the three proposed states. In addition, the Congress might have to consider water issues for the three proposed new states—as well as other states bordering the Colorado River—when considering the statehood proposal. Some issues likely would have to be addressed in the courts.

Issues Concerning Prisons

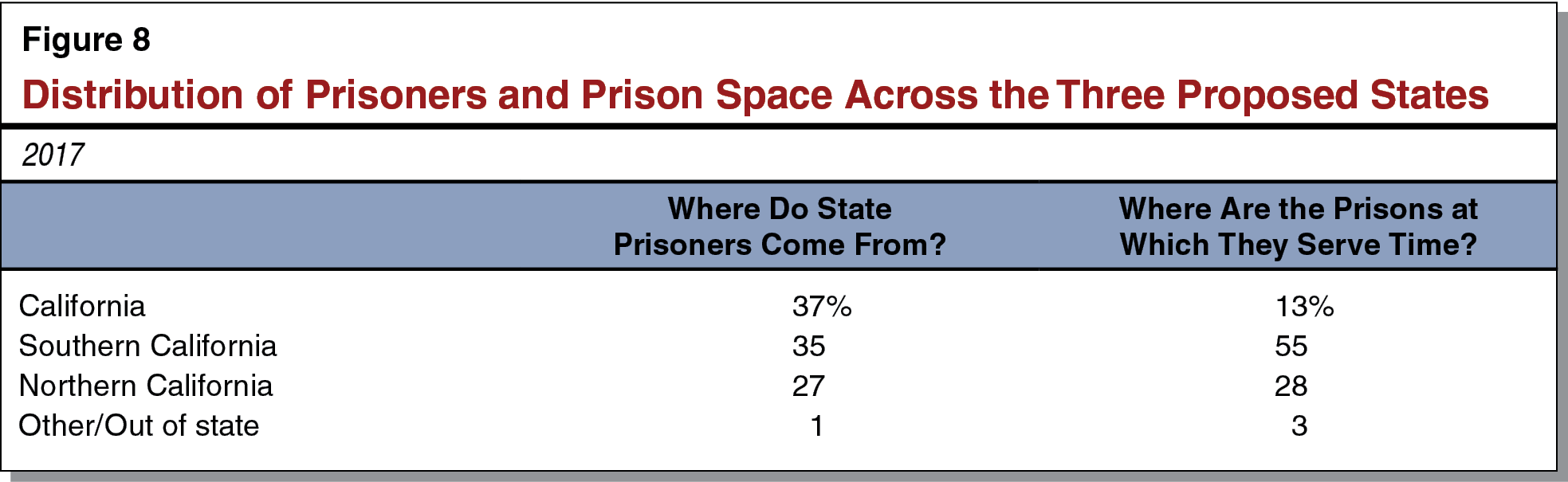

Distribution of Prison Beds Among the Three Proposed States. Currently, certain higher-level felons—generally, those with a current or prior conviction for a violent, serious, or sex offense—are housed in facilities, such as the 35 state prisons managed by the California Department of Corrections and Rehabilitation (CDCR). Figure 8 shows that over one-third of CDCR prisoners come from the proposed California state. Yet, that proposed state currently houses only 13 percent of the state’s prison inmates. The proposed Southern California state—especially the San Joaquin Valley—currently houses 55 percent of California prison inmates. The new states’ leaders would have to consider these issues when making decisions about prisons near the time of statehood. These issues could affect decisions by the new states’ leaders and the courts over the long term concerning prison operations, prison funding, and criminal justice policies generally.

Summary

Outcomes Would Depend on Future Decisions. For all of the issues described above, the effects that California’s split would have on the new state governments would depend on decisions by the existing state’s legislature in splitting up California’s assets and liabilities, as well as decisions by the new states’ leaders. Other fiscal and programmatic effects would be affected by decisions of the federal government and, to some extent, the courts. (Legal issues related to the proposal are summarized in the next section of this analysis.) In addition to the issues described above, the new states’ leaders would have to make decisions concerning many other issues, including other policies that would affect taxes and public spending, such as:

- The new states’ requirements for funding public schools, including whether to institute minimum levels of funding for K-12 schools and community colleges (as in the existing state’s constitutional provision known as Proposition 98).

- The new states’ tax structures, including whether to continue the provisions of California’s Proposition 13.

- The financing of transportation and other infrastructure and whether to complete California’s planned high-speed rail system as a multistate system.

- The possible organization of some services on a multistate basis, such as transportation, water, higher education, prison, and other public programs.

- The compensation of public employees—including their health and retirement benefits—and how to address unfunded liabilities of California’s existing public employee retirement plans.

Decisions Could Result in Demographic and Economic Changes. The decisions made by the new states could result in changes to the states’ demographics and economies, both initially and over time. For example, differing policies could result in migration or different settlement patterns initially. Over the longer term, the states’ economic development and other policies could alter their economies. The exact nature of these changes is unknown.

One-Time Costs to Transition From One State to Three States. The State of California and the three new state governments, collectively, would have to pay various one-time costs in the decade or so after approval of this measure. For example, one or more of the new states probably would spend money on new buildings, such as new state capitols, to house their state governments. Depending on decisions made during the transition period, some of these costs could perhaps be offset by selling existing State of California buildings.

Legal and Timing Uncertainties

Courts Challenges Virtually Certain. Because of the far-reaching consequences of this measure, it would almost certainly be challenged in the courts on multiple grounds before its statewide vote and/or after voter approval. Some of the issues likely to be adjudicated in the courts are:

- Can a statutory initiative measure like this one, which includes no state constitutional changes, set in motion fundamental revisions in California’s basic governmental framework?

- Assuming that the U.S. Constitution allows a state to be split, can a voter initiative measure like this one provide the required state legislative consent for the split?

- Does the state split unconstitutionally impair the contractual rights of state or local bondholders and/or current or retired public employees?

A court ruling against the measure on these or other issues could result in this proposal never taking effect.

Court and Other Issues Could Take Years to Resolve. While this measure anticipates action to divide California’s debts and secure congressional approval within two years after voter approval, it would be difficult for this timeline to be put into practice. When West Virginia separated from Virginia, court cases related to the states’ debts persisted for about 50 years. Some of the legal and practical issues of splitting up California suggest there is a high likelihood that the process would take many years to complete.

Summary of Fiscal Effects

This measure would have the following major fiscal effects:

- Assuming this measure is approved by voters and the federal government and allowed by the courts, all tax collections and spending by the existing State of California would end. California’s existing state assets and liabilities would be divided among three new states. These states would make their own decisions about state and local taxes and spending.