Ballot Pages

A.G. File No. 2017-038

November 30, 2017

Pursuant to Elections Code Section 9005, we have reviewed the proposed statutory initiative pertaining to estate taxes and financial aid for college (A.G. File No. 17-0038, Amendment No. 1).

Background

Estate Taxes

Federal Government Collects an Estate Tax. The federal estate tax applies to the transfer of assets at death. In 2016, Californians paid $3.9 billion in federal estate taxes. As of 2017, the tax applies to estates valued over $5.49 million. Estates include assets such as stocks, real estate, bonds, cash, and business holdings. The tax also applies to some gifts (money and property items) given to others from the estate. The federal estate tax does not apply to certain items, such as assets transferred to a surviving spouse.

California Currently Does Not Collect a State Estate Tax. California previously levied its own inheritance tax similar to an estate tax. Under a measure passed by the state’s voters in 1982, the inheritance tax was eliminated but the state was allowed under a provision in federal estate tax law to collect a portion of the revenues collected under the federal tax. The federal government changed that provision in 2001 and permanently eliminated it in 2012. For these reasons, California no longer levies any taxes upon the death of an individual.

Higher Education

California Has Three Public Higher Education Segments. The state’s three public higher education segments are (1) the University of California (UC), which serves as the state’s primary public research university and provides instruction and grants degrees through the doctorate; (2) the California State University (CSU), which provides instruction and grants degrees generally through the master’s degree; and (3) the California Community Colleges (CCC), which provides lower division undergraduate instruction and grants associate degrees and certificates. In addition to the public sector, California has a private sector consisting of nonprofit and for-profit colleges and universities.

Tuition Charges Vary by Segment. Systemwide tuition and fees for the academic year are generally highest at UC ($12,630 for a full-time undergraduate in the 2017-18 academic year) and lowest at CCC ($1,380 for a full-time credit student in 2017-18). In addition to these charges, students pay various other expenses, such as campus-specific charges for certain services (such as health services), textbook costs, and housing and food costs.

State Offers Financial Aid for College. To reduce the financial barriers of attending college, numerous state programs provide aid to undergraduate students. The Cal Grant program is the state’s largest program. The main types of Cal Grant awards guarantee grants to recent California high school graduates who meet certain financial need and academic criteria. The program offers Cal Grant A and B awards. The Cal Grant A award has a lower financial need requirement but a higher academic requirement than the B award. The Cal Grant A award covers systemwide tuition and fees for undergraduates at UC and CSU for four years of full-time enrollment or the equivalent. The Cal Grant B award also covers systemwide tuition and fees but not in a student’s first year of college. Though not providing tuition coverage the first year, the Cal Grant B provides some nontuition coverage for four years of full-time enrollment or the equivalent. Known as access awards, these awards help cover some living expenses, such as the cost of books, supplies, and transportation. In addition to the Cal Grant program, the state and segments offer other financial aid programs that cover tuition, fees, and/or some living expenses.

Proposal

Estate Taxes

New California Estate Tax. This measure creates a new California estate tax beginning in 2019. California estates would be subject to the tax if their value is above $3.5 million. The tax would be imposed on transfers of (1) estate assets owned by California residents and (2) estate assets located in California. Though based on current federal estate tax rules, California’s tax would continue even if the federal government chose to change or eliminate its estate tax in the future.

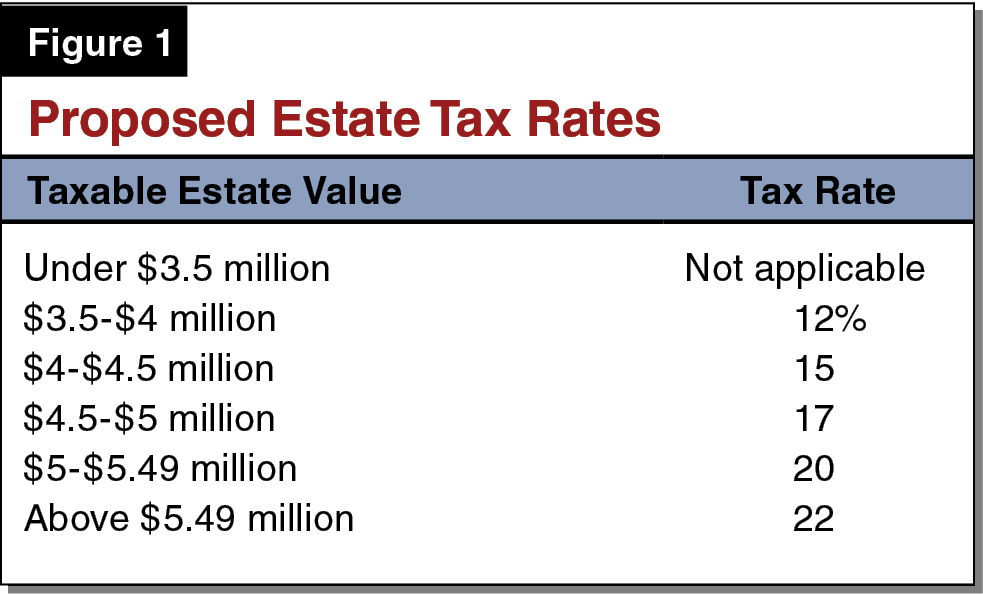

Amount of Tax Depends on the Taxable Estate Value. The taxable estate value is the estate value less deductions. Deductions include funeral expenses, administrative expenses, and indebtedness on the property (such as unpaid mortgages). The amount estates will be taxed depends on the taxable estate value and the tax rate associated with that value. Figure 1 (see next page) shows the tax rate increases as the taxable estate value increases.

Legislature’s Authority to Change Tax. The measure allows the Legislature—with a two-thirds vote—to change the tax brackets and rates shown in Figure 1 beginning in 2020. Also, while the measure generally applies federal estate tax rules and definitions to the new state tax, the Legislature—by a majority vote—could “close any loopholes” in the existing federal estate tax rules, including, but not limited to, changes to federal deductions and credits that would otherwise allow some Californians to pay a smaller amount of state estate taxes.

Higher Education

First Call on Funds Is Expanding Cal Grant Program. Under the measure, revenue from the new estate tax is used first to expand the Cal Grant program in specific ways. All of the proposed Cal Grant changes would apply only to students attending public higher education segments. Funds first would be used to provide tuition coverage in the first year of college for Cal Grant B recipients and eliminate two Cal Grant B entitlement criteria—the requirements that students be recent high school graduates and meet academic criteria. If funds are sufficient for these purposes, they then would be used to increase the Cal Grant access award for all Cal Grant B eligible students from $1,672 to $3,000, with a cost-of-living adjustment applied annually thereafter. If funds still remain, then the requirements that students be recent high school graduates and meet academic criteria would be eliminated for Cal Grant A recipients too.

Any Remaining Funds Used for a New Financial Aid Program. Any funds remaining after expanding the Cal Grant program would be designated for new “Universal Access Grants.” These grants would cover tuition and fees for all undergraduate, resident students attending the public segments who do not already have their tuition and fees covered by other sources of financial aid. Among these students, priority would be awarded in the following order: (1) students who were previously eligible for Cal Grant funding but became ineligible the following year, typically because they could no longer demonstrate financial need; (2) full-time students at CCC; (3) full-time students at CSU; (4) part-time students at CCC; (5) part-time students at CSU; (6) full-time students at UC; and (7) part-time students at UC. If funds are insufficient to fund maximum need for all students in a category, funds would be distributed to all students in that category on a pro-rata basis.

Other Major Education Provisions. In the event the amount of estate tax revenue collected exceeds financial aid costs for three consecutive years, the Legislature may use the surplus to improve access and quality of public education. To further the purposes of the measure and promote access to public higher education, the Legislature may adjust or change the spending priorities and the surplus provision by majority vote. The measure also specifies that revenue from the new tax may not be used to supplant other state or federal funds for public higher education and that the segments may not reduce current per-capita institutional financial aid spending.

Fiscal Effects

Increased State Tax Revenue. We estimate the measure’s estate tax would increase state tax revenue a few billion dollars per year, likely ramping up over the first few years of implementation. After accounting for the ramping-up effect, revenue collections could go up and down from one year to the next based upon the following main factors:

- Economy and Stock Market. Estate values are dependent on the economy and the stock market. Estate tax revenues would be volatile: higher in good economic years and lower in bad economic years.

- Future Legislative Actions. The Legislature would be able to change estate tax rates and other features of the tax in the future. The Legislature’s future actions, therefore, could increase or decrease the revenue generated from the tax.

- Taxpayer Decisions. Implementing the estate tax could cause taxpayers to make decisions that would decrease associated revenue. For example, a taxpayer might decide to move out of state during his or her lifetime to avoid all or part of the tax, actions which could significantly decrease revenue from the measure. In making estimates about the tax revenue generated by this measure, we currently are unable to predict the magnitude of these taxpayer decisions.

More Financial Aid Spending. We estimate that expanding the Cal Grant program in the ways specified under the measure and providing Universal Access Grants likely together would cost a few billion dollars annually, with each comprising roughly half of the estimated cost. For both the Cal Grant expansion and the Universal Access Grants, costs could vary from our estimate and vary year to year due to two main factors:

- Student Decisions. The measure might affect student behavior, resulting in more students overall attending college or more students attending the public higher education segments. The measure also might promote more students attending full time. These behavioral effects could have notable impact on the cost of the measure.

- Institutional Decisions. The measure might affect how colleges and universities structure their institutional aid programs. The measure might also affect tuition and fee levels at colleges and universities, which in turn, could affect student behavior and associated financial aid costs.

Summary of Fiscal Effects

This measure would have the following major fiscal effects:

- Increased state revenues of a few billion dollars annually, ramping up over the initial few years—with amounts depending upon economic trends, future legislative actions, and taxpayer decisions.

- The increased revenues would be dedicated first to subsidizing the costs of higher education for students, with any remaining monies dedicated to public education.