Ballot Pages

A.G. File No. 2019-003

August 22, 2019

Pursuant to Elections Code Section 9005, we have reviewed the proposed constitutional initiative (A.G. File No. 19-0003) related to property tax assessment.

Background

Local Governments Levy Taxes on Property Owners. California local governments—cities, counties, schools, and special districts—levy property taxes on property owners based on the value of their property. Property taxes are a major revenue source for local governments, raising over $60 billion per year.

Calculating a Property Owner’s Tax Bill. Each property owner’s annual property tax bill is equal to the taxable value of his or her property multiplied by the property tax rate. The typical property owner’s property tax rate is 1.1 percent. In the year a property is purchased, its taxable value is its purchase price. Each year after that the property’s taxable value is adjusted for inflation by up to 2 percent. This continues until the property is sold and again is taxed at its purchase price (this often is referred to as the property being “reassessed”).

Ownership Changes Increase Property Taxes. The market value of most homes (what they could be sold for) grows faster than 2 percent annually. This means the taxable values of most properties are less than their market values. Property transfers, therefore, typically trigger an increase in a property’s taxable value. This, in turn, leads to higher property tax collections. Because of this, movers often face increased property tax bills because the purchase price of the newly purchased home often exceeds the taxable value of the buyer’s prior home (even when the homes have similar market values).

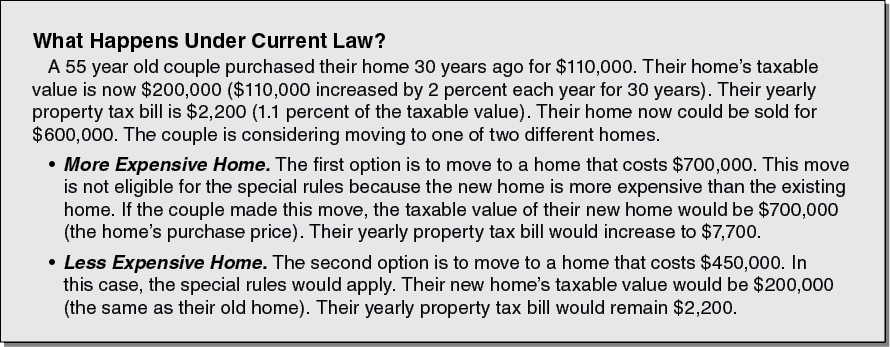

Special Rules for Some Homeowners. In some cases, special rules allow existing homeowners to move to a different home without paying higher property taxes. These special rules apply to homeowners who are over 55 or severely disabled or whose property has been impacted by a natural disaster or contamination. (We refer to these homeowners as “eligible homeowners.”) When moving within the same county, an eligible homeowner can transfer the taxable value of his or her existing home to a different home if the market value of the new home is the same or less than the existing home. Also, a county government may allow eligible homeowners to transfer their taxable values to homes in the county from homes in different counties. Ten counties allow these transfers. Except in limited cases, homeowners who are over 55 or severely disabled can only transfer their taxable value once in their lifetime. The nearby box (“What Happens Under Current Law?”) has an example of how these rules work.

Special Rules for Inherited Properties. Special rules also exclude from reassessment certain property transfers between parents and children. These rules also apply to grandparents and grandchildren if the grandchildren’s parents are deceased. (We refer to properties transferred between parents and children or grandparents and grandchildren as “inherited property.” This includes properties transferred before and after the death of the parent or grandparent.) The rules apply to all types of property including primary residences, vacation homes, and business properties. There is, however, a cap of $1 million in aggregate taxable value of all inherited properties that were not used as the parent’s primary residence.

Change in Ownership of a Business Property May Not Lead to Reassessment. Property can be owned by individuals or legal entities. Legal entities include sole proprietorships, partnerships, limited liability companies, and corporations. Properties owned by a legal entity are not necessarily reassessed when ownership of the legal entity changes. This is because while the owners of the legal entity change, the legal entity remains the owner of the property. Reassessment can occur, however, if any person or entity obtains more than 50 percent ownership of the legal entity, the legal entity’s properties are reassessed. Reassessment also can occur in other limited circumstances.

Other Taxes on Property Sales. Cities and counties collect taxes on the transfer of homes and other real estate. Statewide, transfer taxes raise around $1 billion for cities and counties each year.

Counties Administer the Property Tax. County assessors determine the taxable value of property. Statewide, county spending for assessors’ offices totals around $600 million each year.

California Taxes Personal Income. The state collects a personal income tax on income earned within the state. Taxable income can include profits from selling real estate. The personal income tax raises over $90 billion each year.

Proposal

The measure amends the State Constitution to make various changes to the special rules for eligible homeowners and inherited properties, as well as the rules for taxation of properties held by legal entities.

Expands Special Rules for Eligible Homeowners. The measure expands the special rules that give property tax savings to eligible homeowners when they buy a different home. Specifically, effective July 1, 2021, the measure:

- Allows Moves Anywhere in the State. Eligible homeowners could transfer the taxable value of their existing home to another home anywhere in the state.

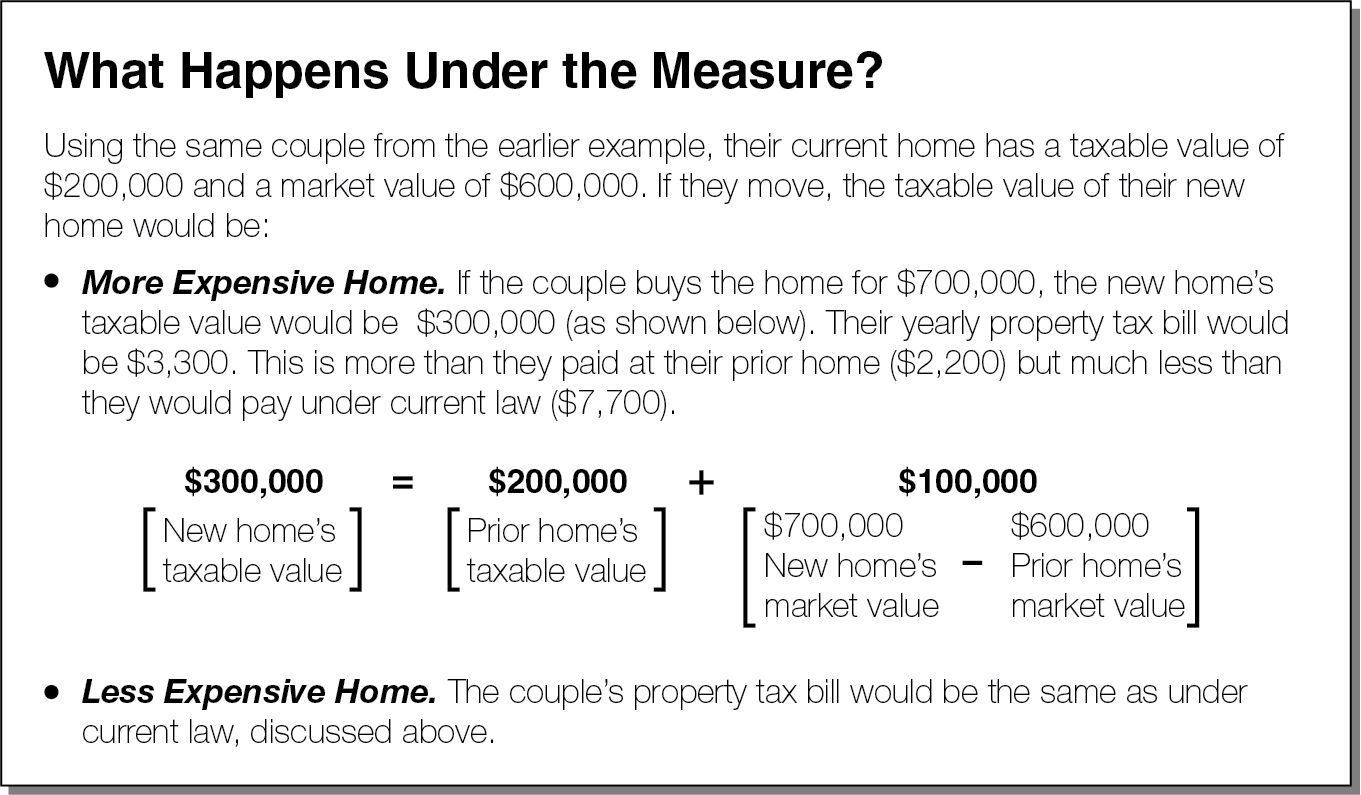

- Allows the Purchase of a More Expensive Home. Eligible homeowners could transfer the taxable value of their existing home (with some adjustment) to a more expensive home. The taxable value transferred from the existing home to the new home is adjusted upward. The new home’s taxable value is greater than the prior home’s taxable value but less than the new home’s market value. An example is shown in the nearby box (“What Happens Under the Measure?”).

- Increases the Number of Times a Homeowner Can Use the Special Rules. Eligible homeowners could transfer their taxable value up to three times in their lifetime.

To use the special rules, homeowners would need to file an application with their county assessor.

Narrows the Special Rules for Inherited Properties. The measure narrows the special rules for inherited properties. Specifically, effective January 1, 2021, the measure:

- Eliminates Exclusion for Properties Not Used as Primary Residence. The inheritance exclusion would apply only to properties used as the inheritor’s primary residence. Inherited property used for any other purpose than the inheritor’s primary residence—such as rental homes or business properties—would be reassessed to market value.

- Caps Amount of the Tax Benefit for Primary Residences. The assessor would exclude only the first $1 million of value that would be added upon reassessment. For example, consider a home with a taxable value of $500,000 that could be sold for $2 million. Were the home reassessed to market value, its taxable value would increase by $1.5 million. Instead, under the measure, $1 million of this increase would be excluded. Upon inheritance, the home’s taxable value would be $1 million—$500,000 (original taxable value) + $500,000 ($1.5 million [gap between original taxable value and market value] - $1 million [inheritance exclusion]).

- Increases the Annual Adjustment to an Inherited Property’s Taxable Value. The taxable value of an inherited property would increase each year at the same rate as the price of a typical California home.

Broadens Scope of Legal Entity Ownership Changes. In addition to the existing circumstances defined in current law, the measure broadens the types of legal entity ownership changes that trigger reassessment. Specifically, effective January 1, 2021, the measure requires properties owned by a legal entity to be reassessed if 90 percent or more of the ownership of the legal entity is transferred, even if no single person or entity gains more than 50 percent ownership. The transfer of 90 percent of the ownership could occur in a single transaction or over time as part of multiple transactions. The sale of stock in a publicly traded company through an established stock market would not count as a change of ownership.

Fiscal Effect

Increased Property Tax Revenue From Inherited Property Rules. As the measure would narrow the inheritance reassessment exclusion, it would result in more properties being reassessed at the time of inheritance. Under current law, between 60,000 and 80,000 inherited properties statewide are excluded from reassessment each year. Somewhere around two-thirds of these properties are not used as primary residences. Further, it appears that roughly one-fifth of the tax benefit on inherited primary residences went to those who received a benefit greater than $1 million. Both of these types of inherited properties would see an increase in their taxable value under the measure. This suggests the measure could lead to increases in property tax payments for 40,000 to 60,000 properties each year. This, in turn, would increase property tax revenues for local governments. In the first few years, schools and other local governments each probably would gain over $100 million per year. Over time, these gains would grow resulting in schools and other local governments each gaining about $1 billion per year (in today’s dollars).

Increased Property Tax Revenue From Legal Entity Ownership Change Rules. By expanding the scope of legal entities ownership changes that can result in reassessment, the measure would result in more legal entities’ properties being reassessed each year. This, in turn, would increase property tax payments by legal entities. Very little information is available about ownership changes of legal entities throughout the state. Because of this, the magnitude of the potential increase in property taxes paid by legal entities is unclear.

Reduced Property Tax Revenues From Expanded Rules for Eligible Homeowners. The changes to the special rules for eligible homeowners could have multiple effects on property tax revenue:

- Reduced Taxes From People Who Would Have Moved Anyway. Right now, around 80,000 homeowners who are over 55 move to different houses each year without receiving a property tax break. Most of these movers end up paying higher property taxes. Under the measure, these movers could apply for a lower property tax bill. This would reduce property tax revenue. The size of the revenue reduction would depend on what share of eligible movers apply to use the special rules.

- Potentially Higher Taxes From Higher Home Prices and More Home Building. The measure would cause more people to sell their homes and buy different homes because it gives them a tax break to do so. The number of movers could increase by a few tens of thousands. More people being interested in buying and selling homes would have some effect on home prices and home building. Increases in home prices and home building would lead to more property tax revenue.

The revenue losses from people who would have moved anyway would be bigger than the gains from higher home prices and home building. This means this part of the measure would reduce property taxes for local governments. In the first few years, schools and other local governments each probably would lose tens of millions of dollars per year. Over time, these losses would grow, resulting in schools and other local governments each losing hundreds of million dollars per year (in today’s dollars).

Net Change in Property Taxes for Local Governments. Some parts of the measure would decrease property tax revenues for local governments, while other parts would increase them. Overall, it is likely that revenue gains would exceed revenue losses. In the first few years, local governments collectively could gain tens of millions of dollars per year. These revenue gains would grow over time, eventually reaching a few hundred million dollars per year. Schools could receive similar property tax gains.

Change in State Funding for Schools. Should schools gain property tax revenues under the measure, state funding for schools may decrease by a similar amount in some years. In those years, most schools would receive the same amount of funding they would have received in the absence of the measure.

Increase in Property Transfer Tax Revenues. As the measure would increase home sales, it also would increase property transfer taxes collected by cities and counties. This revenue increase likely would be in the tens of millions of dollars per year.

Increase in Income Tax Revenues. Because the measure would increase the number of homes sold each year, it likely would increase the number of taxpayers required to pay income taxes on the profits from the sale of their homes. This probably would increase state income tax revenues by tens of millions of dollars per year.

Higher Administrative Costs for Counties. The measure would require county assessors to create and carry out a variety of new processes, which could necessitate increased staffing and information technology upgrades. This likely would increase annual costs for county assessors by tens of millions of dollars, with potentially higher one-time costs in the first few years.

Summary of Fiscal Effects. The measure would have the following major impacts on state and local governments:

- Local governments could gain tens of millions of dollars of property tax revenue per year, likely growing over time to a few hundred million dollars per year. Schools could receive similar property tax revenue gains.

- Other local and state revenues each could increase by tens of millions of dollars per year.

- County property tax administration costs likely would increase by tens of millions of dollars per year.