Ballot Pages

A.G. File No. 2023-021

October 19, 2023

Pursuant to Elections Code Section 9005, we have reviewed the proposed measure (A.G. File No. 23-0021, Amendment #1) related to the Medi-Cal Rx program and revenues from federal drug price discounts.

Background

Medi-Cal Covers the Cost of Prescription Drugs for Low-Income Californians. Medicaid—known as “Medi-Cal” in California—generally covers the cost of prescription drugs (among many other health services) for low-income residents. In January 2019, Governor Gavin Newsom signed an executive order that, among other provisions, changed the way Medi-Cal pays for prescription drugs. Under this new approach, when a patient is prescribed a drug, Medi-Cal pays pharmacies directly for the cost to acquire and dispense the drug. This approach is called “Medi-Cal Rx.”

Manufacturers Provide Drugs at Discounted Prices to Health Care Providers Under Federal Program. Drug manufacturers provide certain health care providers drugs at discounted prices under a federal program known as the “340B drug price discount program.” Drug manufacturers are required to provide drugs at these discounted prices as a condition of participating in Medicaid. However, providers can prescribe these discounted-price drugs to patients regardless of whether the patient is enrolled in Medicaid, Medicare, or private insurance. Providers can dispense drugs either by operating their own pharmacies or by contracting with external pharmacies (such as CVS and Rite Aid).

Only Certain Health Care Providers Are Eligible for Federal Program. To be eligible to receive discounted drugs under the federal program, providers must meet certain federal conditions. For example, many eligible providers are hospitals or clinics that focus on delivering services to low-income people. Providers also generally must be public or private nonprofit institutions—meaning that they generally are exempt from paying taxes on their earnings.

Federal Drug Price Discounts Tend to Generate Revenues to Providers. Health care providers and pharmacies tend to earn revenues as a result of the 340B program. These revenues are generated by charging external payors, such as Medicare and private insurance, more than the discounted price of the drug. As an exception, providers and pharmacies tend not to earn revenues on drugs with 340B discounts when the drugs are provided to patients in Medi-Cal. This is because state law requires Medi-Cal Rx to pay for drugs with 340B discounts at their discounted price. Federal and state law does not place restrictions on how providers use their 340B revenues.

Several Departments License Health Care Entities in California. California law requires health insurance plans, health care providers, and health care facilities to be licensed to provide health care services. Several departments are responsible for licensing health care entities in California. Most health insurance plans in California are licensed by the Department of Managed Health Care. The Department of Consumer Affairs includes numerous licensing boards that license health care providers. For example, the Board of Pharmacy, one of the boards in the Department of Consumer Affairs, licenses both pharmacists and pharmacy facilities. The Department of Public Health also licenses many health care facilities, including clinics.

Proposal

Permanently Establishes Medi-Cal Rx in California Law. The measure would add a provision in California law to permanently allow the state to implement the Medi-Cal Rx program. This provision would not change the way Medi-Cal currently pays for prescription drugs, but rather codify this existing approach in state law.

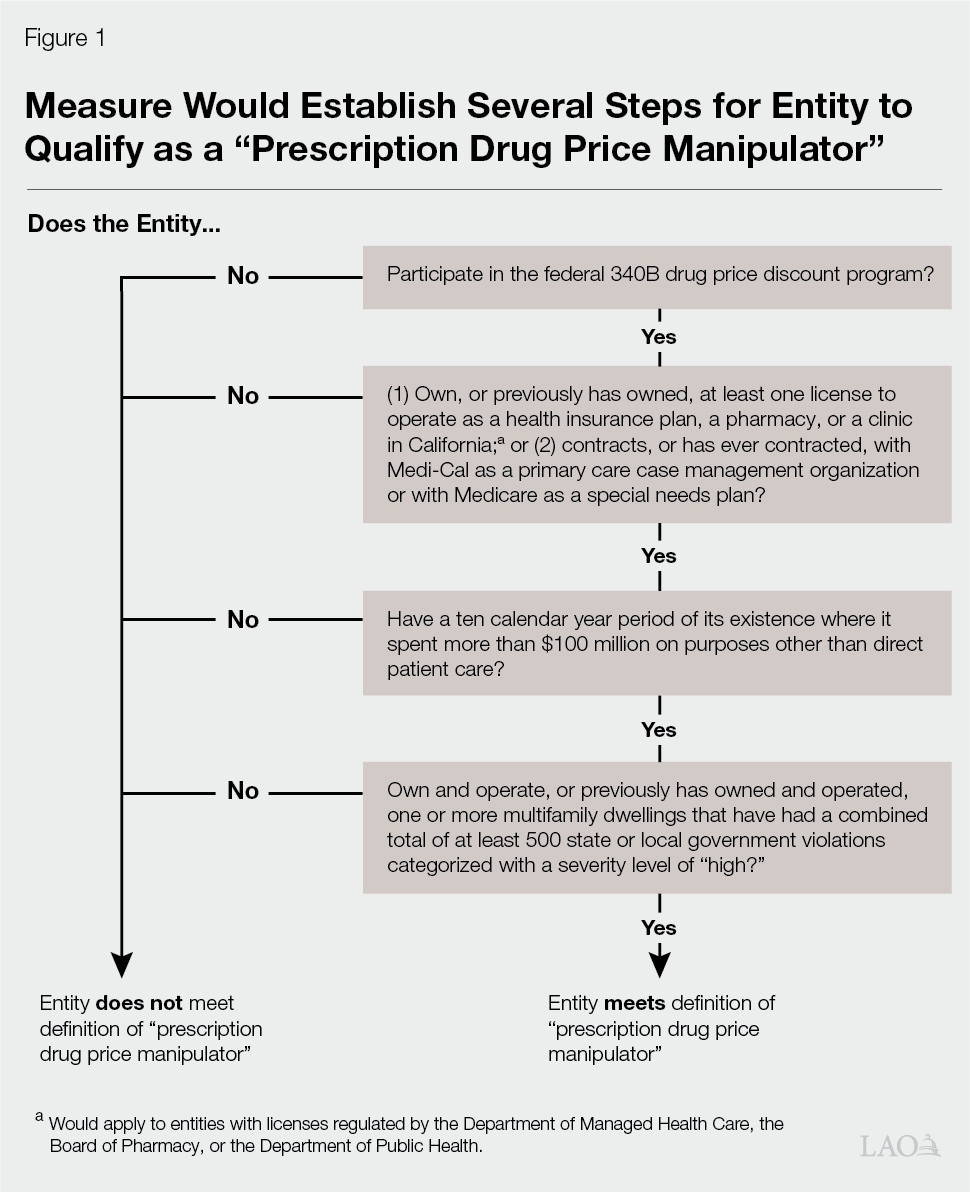

Defines Certain Entities as “Prescription Drug Price Manipulators.” The measure establishes a new category of entities called prescription drug price manipulators. As Figure 1 on the next page shows, the measure sets forth a number of tests to determine whether an entity would meet the definition of being a prescription drug price manipulator. Some of the major tests include: whether an entity has a license to be a health insurance plan, a pharmacy, or clinic; whether the entity has spent more than $100 million over a ten-year period on activities outside of direct patient care; and whether the entity owns multifamily dwellings that have received a specified number of violations. Entities qualifying as a prescription drug price manipulator would face new requirements under the measure, described further in the next paragraph.

Enacts Requirements on Prescription Drug Price Manipulators. Under the measure, prescription drug price manipulators would have to meet the following two requirements each year to maintain tax-exempt status and licensure as health insurance plans, pharmacies, and clinics: (1) spend at least 98 percent of the revenues earned in California on drugs with 340B discounts on direct patient care and (2) not engage in unprofessional conduct, dishonest dealing, or conduct inimical to the public health, welfare, or safety of the people of the state of California. A prescription drug price manipulator also would be prohibited from otherwise entering into a “pharmacy sales agreement” in California. The measure defines a pharmacy sales agreement as an arrangement where a pharmacy charges more than the discounted price for a prescription drug obtained by a prescription drug price manipulator through the 340B program. A prescription drug price manipulator could engage in such an arrangement only if it complies with the first requirement.

Establishes New Reporting Requirements. To ensure compliance with the measure’s requirements, tax-exempt entities that qualify as prescription drug price manipulators would be required annually to report financial information on the revenues they generate through the 340B program to the Attorney General, who oversees the Department of Justice. These entities also would be required to report this information to the Department of Managed Health Care, the Board of Pharmacy, and the Department of Public Health, to extent these entities have licenses with these departments to operate health insurance plans, pharmacies, and clinics. The measure authorizes these departments to cover the associated administrative costs from obtaining and reviewing this information by charging fees on prescription drug price manipulators. Under the measure, failure to submit timely, accurate information would be considered dishonest dealing, unprofessional conduct, or conduct inimical to public health, welfare, or safety of the people of the State of California.

Sets Forth Consequences for Not Complying With Measure. The measure sets forth a process and time line for the departments to determine compliance with the measure’s requirements to maintain tax-exempt status and licensure. If at the end of this process it is determined that an entity has violated these requirements, the entity would lose its state nonprofit tax status and any licenses to own and operate health insurance plans, pharmacies, and clinics. The entity would be prohibited from reapplying for tax-exempt status or the relevant licenses for ten years. Also during this ten-year period, the entity would be ineligible to receive any new or renewed state or local government grants or contracts. Moreover, during this period, individuals serving specified leadership roles in the entity would be prohibited from serving leadership roles in a California licensed health insurance plan, pharmacy, or clinic.

Sets Additional Condition for Receiving State and Local Government Grants and Contracts. The measure sets one additional condition for a prescription drug price manipulator to be eligible for California state and local government grants and contracts. Specifically, eligibility would be conditioned on the entity spending at least 98 percent or more of its revenue earned from its national participation in the 340B program (rather than revenue earned only in California) on direct patient care.

Fiscal Effects

Increased Administrative Costs to Review Compliance. The measure would result in new administrative costs to the Department of Justice, the Department of Managed Health Care, the Board of Pharmacy, and the Department of Public Health to annually review each prescription drug price manipulator’s compliance with the requirements. The exact magnitude of this cost is uncertain. Likely few entities would meet the measure’s tests to qualify as a prescription drug price manipulator, but the exact number is not known. Given the number of departments involved, total administrative costs associated with the measure could initially cost up to the low tens of millions of dollars to determine which entities qualify for the measure. Costs likely would decrease to the millions of dollars annually thereafter.

Potential, but Uncertain, Impacts to Health Programs From New Requirements on 340B Revenues. The measure could change how entities that qualify as prescription drug price manipulators spend their 340B revenue, to the extent those entities would otherwise spend less than 98 percent of their revenues on direct patient care. The shift in spending could impact state and local government health programs, such as Medi-Cal. The impact would depend on many unknown factors. For example, entities could expand spending on direct patient care for Medi-Cal patients, which could result in either costs or savings to the program depending on the specific health care services that are supported. On the other hand, if entities use their revenues to expand direct patient care for health care services to other patients (such as patients in Medicare), the fiscal impacts to state and local governments may be more limited. Moreover, some entities may choose to stop participating in the 340B program altogether as a result of the measure, also potentially resulting in either savings or costs to state and local governments.

Other Potential Impacts. The measure could have other fiscal impacts to state and local governments. For example, were an entity to be determined to be noncompliant with the measure, it would lose its tax-exempt status, its health care licenses, and its ability to receive new or renewed state and local government contracts. This result could have fiscal implications for state tax proceeds, Medi-Cal, or other state and local government programs. The impact would depend on many factors, including which entities lose their state tax-exempt status and licenses.

Summary of Major Fiscal Effects. The measure would have the following major fiscal effects:

- Increased costs to state government, potentially up to the millions of dollars annually, to review entities’ compliance with the measure and enforce the measure’s provisions. These costs would be paid for by fees created under the measure.

- Uncertain fiscal impacts to state and local government health programs, depending on how the affected entities respond to the measure’s requirements.