Ballot Pages

A.G. File No. 2023-024

October 27, 2023

Pursuant to Elections Code Section 9005, we have reviewed the proposed statutory initiative related to the managed care organization (MCO) tax (A.G. File No. 23-0024, Amendment No. 1).

Background

MCOs and Medi-Cal

Many Health Insurance Companies in California Also Are Known as MCOs. An MCO is a type of organization that offers health insurance coverage to consumers. MCOs contract to provide or arrange for health care services in exchange for fixed monthly payments. Examples of MCOs in California include Kaiser Permanente, Anthem Blue Cross, Blue Shield of California, and L.A. Care Health Plan. Most Californians who are enrolled in a health insurance plan are enrolled in a plan offered by an MCO.

Medi-Cal Contracts With MCOs to Deliver Many Services. Medicaid—known as “Medi-Cal” in California—covers the cost of health care services for low-income residents. Administered by the California Department of Health Care Services (DHCS), Medi-Cal comprises a substantial portion of the state’s health care system and serves over one-third of people in California. The primary way Medi-Cal delivers services to people is by contracting with MCOs. These MCOs are responsible for arranging and paying for doctor’s visits, stays in the hospital, and many other health services used by beneficiaries. Medi-Cal provides MCOs monthly payments to help cover the costs of these services.

Many Fund Sources Support Medi-Cal. Under federal policy, the federal government pays for a share of the cost of services in Medi-Cal. Historically, more than half of Medi-Cal’s overall funding has come from the federal government. The state must pay for the remaining share of cost. California uses many fund sources to cover its share of Medi-Cal costs, including the General Fund (California’s primary budget account that can be used broadly and supports education, health, human services, criminal justice, and many other programs), state special funds (such as the MCO tax, described beginning in the next paragraph), and funds from local governments. In 2023-24, California is spending $152 billion on the Medi-Cal program, with 60 percent coming from the federal government, 25 percent coming from the state General Fund, and the remainder coming from other state and local government sources.

Overview of MCO Tax

California Taxes MCOs’ Enrollment to Help Cover its Share of Medi-Cal Costs. One of the fund sources California currently uses to support Medi-Cal is a tax on MCOs known as the “MCO tax.” California has had such a tax or fee for nearly 20 years. The Legislature has not established the tax permanently, but instead has approved and renewed it for fixed periods of time. The tax currently imposes charges on the number of people MCOs enroll each month in their Medi-Cal and commercial lines of business. The tax rate on Medi-Cal enrollment has been much higher than the tax rate on commercial enrollment, and consequently nearly all MCO tax proceeds have been from the tax on Medi-Cal enrollment. The tax does not apply to other kinds of people MCOs enroll, such as people in the Medicare program.

The MCO Tax Imposes Relatively Small Cost on MCOs… For the portion of the tax associated with Medi-Cal enrollment, Medi-Cal covers the cost of the tax. Medi-Cal uses federal funds to cover the federal government’s share of cost and a portion of MCO tax revenues to cover the state’s share of cost. The result of this arrangement is that (1) the tax enables California to draw down more federal funding for Medi-Cal and (2) MCOs only pay the cost of the much smaller portion of the tax on commercial enrollment.

…While Providing California a Sizable Financial Benefit. Even though Medi-Cal covers nearly all of the cost of the MCO tax for MCOs, the tax still provides California billions of dollars each year to spend in Medi-Cal. This large financial benefit exists primarily because the state uses federal funding to help cover the cost of the tax on Medi-Cal enrollment.

State Historically Has Used MCO Tax to Offset General Fund Costs in Medi-Cal. Prior to the most recently enacted version of the MCO tax (described later), the state primarily used the MCO tax to pay for the costs of the existing Medi-Cal program. When the MCO tax was in effect, the state could spend less General Fund to support Medi-Cal than it otherwise would have without the tax. By contrast, in years without the MCO tax, the state had to backfill the lost MCO tax revenue by spending more General Fund.

Federal Approval Is Required to Use the MCO Tax to Draw Down Federal Funds. To use the MCO tax to generate additional federal funds, the state must receive approval from the federal government. This approval is conditioned on meeting a number of rules established by the federal government to use taxes and fees imposed on health care providers to support Medicaid. In some years, California has had to restructure the MCO tax in response to changes in the federal rules. Also in certain years, the federal government rejected the state’s initially enacted version of the MCO tax, requiring the state to restructure the tax and resubmit it for approval.

Recently Enacted MCO Tax Package

State Recently Enacted New Version of the MCO Tax. In June 2023, the Legislature passed a law allowing for a new MCO tax. The new version of this tax would be imposed through the end of December 2026. Much like past versions, the new tax charges higher rates on an MCO’s Medi-Cal enrollment relative to commercial enrollment. For example, in 2024, the tax charges $182.50 for each monthly Medi-Cal enrollee and $1.75 for each monthly commercial enrollee, within certain enrollment levels.

MCO Tax Will Be Used to Offset General Fund Costs in Medi-Cal and Expand Support for Medi-Cal and Other Health Programs. The recently enacted MCO tax is expected to generate between $6 billion and $9 billion in revenue each year through 2026. This is several billion dollars higher than prior versions of the MCO tax. According to DHCS, the federal government has indicated it may not approve such a large MCO tax again. Over 99 percent of this revenue is from the tax on Medi-Cal enrollment. After helping cover the cost on Medi-Cal enrollment for MCOs, the state is planning to use the MCO tax for two key purposes. The first purpose will be to offset General Fund costs in the existing Medi-Cal program. The second purpose will be to expand funding and service levels in Medi-Cal and other health-related programs. While the Legislature has set aside MCO tax funds to increase service levels, it has not yet decided how to use these funds. California law requires DHCS to submit a plan to increase service levels in specified categories and states intent for the Legislature to make these decisions as part of the annual state budget approval process in 2024. At the time of this analysis, DHCS had publicly released an initial plan to allocate these funds through 2029, but this plan has not been approved by the Legislature.

Federal Approval of New MCO Tax Is Pending. The state submitted this new version of the MCO tax to the federal government for approval in June 2023, shortly after the Legislature enacted the tax in state law. The federal government has not yet indicated whether it will approve the tax. If the federal government does not approve the tax, the DHCS would need to restructure the tax and resubmit it to the federal government, likely affecting how much money the tax raises. Under California law, the new MCO tax would not go into effect without receiving federal approval to use the tax to generate additional federal funds.

Proposal

Permanently Establishes MCO Tax. The measure would add provisions to California law permanently establishing an MCO tax. The state could only charge this tax if it receives federal approval to use the tax to generate additional federal funds. Under the measure, DHCS would be required to use the structure of the most recent version of the MCO tax to the extent permitted by the federal government. The department could modify this structure in future years to ensure federal approval of the tax, within certain limits. For example, the measure prohibits the department from charging more than $2.50 for each monthly commercial enrollee and limits the total annual proceeds generated from commercial enrollment to $36 million (with these limits adjusted for inflation each year). The department could increase these limits by 10 percent if needed to secure federal approval.

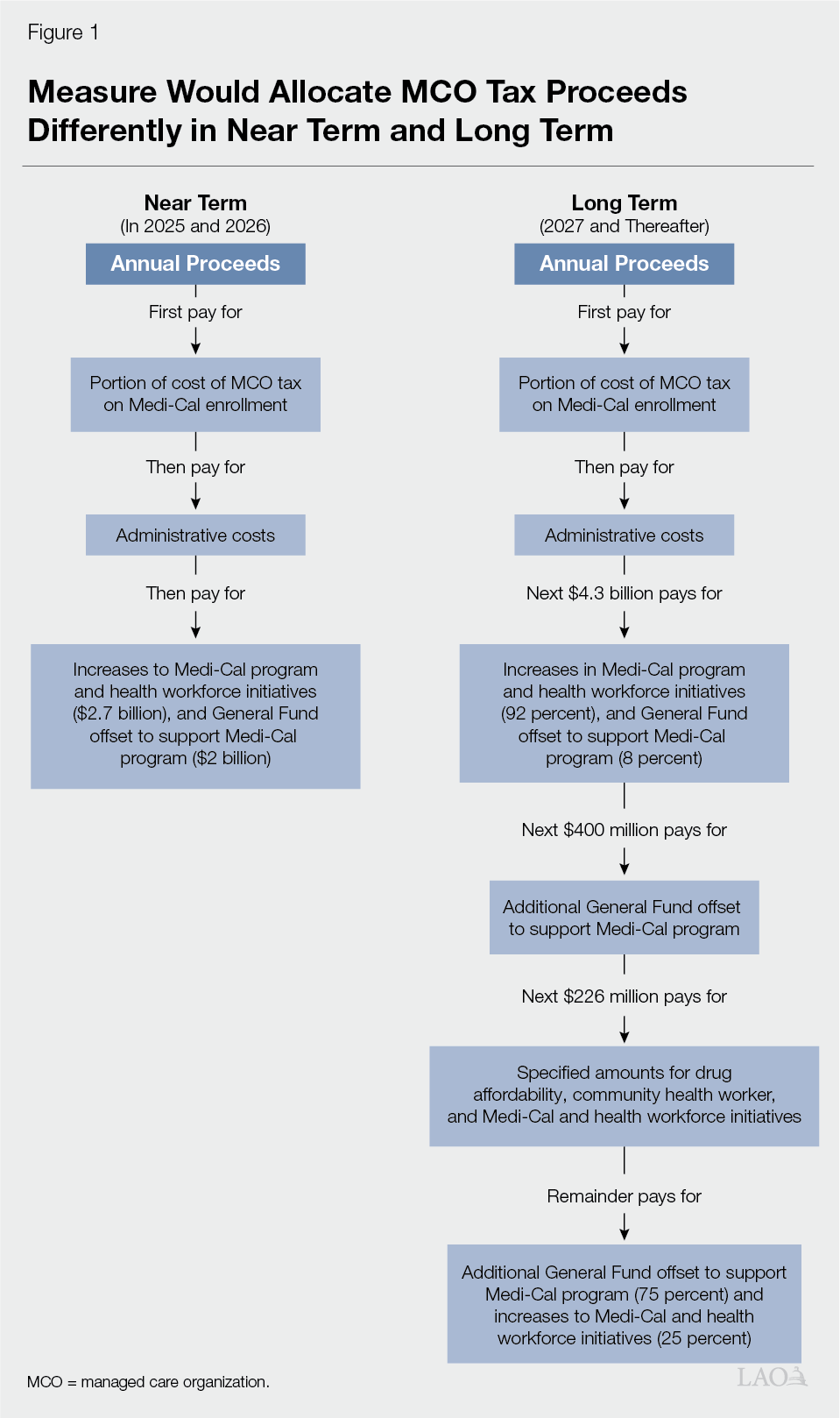

Establishes Specific Uses for the MCO Tax Proceeds... In addition to permanently establishing the tax, the measure would specify how the state could spend the resulting proceeds. As Figure 1 shows, the measure sets forth different ways to spend the funds in the near term (through 2026) and the long term (beginning in 2027). In some respects, the two approaches are similar. For example, in both the near term and long term, funds first would be used to cover a portion of MCOs’ cost of the tax associated with Medi-Cal enrollment, as well as certain administrative costs. Also in both approaches, remaining proceeds would be used to offset General Fund costs in Medi-Cal and expand support for Medi-Cal and other health programs. For example, the measure would provide funds to increase payments for certain groups of providers in Medi-Cal. However, how funds would be allocated for each purpose would differ in the near term compared to the long term, described further in the next paragraph.

…With Some Differences in the Near and Long Term. For the near term (2025 and 2026), funds generally would be allocated in the same way as proposed by DHCS for the recent version of the MCO tax. As a result, specified dollar amounts would be used to offset General Fund costs in Medi-Cal and expand support for Medi-Cal and health workforce initiatives. For the long term, the measure instead allocates funds for these purposes depending on how much in tax proceeds are generated. Also, more health programs would be eligible for increased support in the long term. For example, depending on the amount of proceeds generated, future versions of the tax could support initiatives to make prescription drugs more affordable and expand access to community health worker services.

Establishes Responsibilities for Certain Departments. Under the measure, DHCS would be responsible for administering the MCO tax and spending the associated proceeds. The measure allows the department to use a portion of the annual proceeds (generally up to $4 million) to cover the cost related to these administrative activities. In addition, the measure requires the California State Controller to complete periodic audits of the MCO tax and its fund accounts. The Controller could receive up to $750,000 of MCO tax proceeds to cover the cost of each audit.

Creates New Stakeholder Advisory Committee. To determine how to structure program increases supported by the MCO tax, DHCS would be required to consult with a new stakeholder committee. The committee would be comprised of people representing physicians, hospitals, and other health care entities. The Governor, Speaker of the Assembly, and Senate President pro Tempore would appoint members, as specified in the measure.

Limits Legislature’s Ability to Change Structure and Use of MCO Tax. To amend this measure, the Legislature would be required to receive approval from at least three-fourths of the members from each house (the Assembly and the Senate). Any changes approved by the Legislature would need to be consistent with, or further the purpose of, the measure.

Fiscal Effect

Uncertain How, if at All, Measure Would Impact the Overall Size of the MCO Tax Over Time. Because the measure does not change the structure of the most recently approved MCO tax, it likely would not affect the amount of tax proceeds generated through 2026 ($6 billion to $9 billion each year) for the recently enacted MCO tax. Whether the measure impacts the amount of MCO tax proceeds generated in 2027 and beyond depends on many uncertain factors. For example, since the Legislature has renewed the MCO tax several times since initially enacted, it is possible that the Legislature would continue to do so in the future absent the measure. To the extent the Legislature would not otherwise renew the tax, the measure could result in up to billions of dollars in additional annual tax proceeds. As another example, it is possible that the federal government could change the rules around approving the MCO tax in the future. Were the federal government to change the rules around approving the MCO tax in the future, the state likely would need to change the tax’s structure. Under the measure, the state would face certain limitations to meet these requirements, such as limits on how much it can tax commercial enrollment. These limitations potentially could require the state to enact an even smaller tax than it would absent the measure.

Also Uncertain Impacts on State Spending in Medi-Cal and Health Programs. It is likely the measure would allocate MCO tax funds differently than the Legislature would have without the measure. The extent of this difference, however, is uncertain, because the Legislature has not fully adopted its plan to spend funds for the recently enacted MCO tax. Moreover, legislative decisions around future versions of the MCO tax beginning in 2027 are unknown. Depending on these factors, the measure could have a variety of impacts. For example, the measure would limit how much of the tax is used to offset General Fund costs to support Medi-Cal. Also, the measure includes requirements intended to maintain existing spending levels in several areas of Medi-Cal and other health programs. As a result, the Legislature could have less flexibility to reduce spending levels in these areas in the future. These constraints could reduce options to balance General Fund revenue and spending.

Temporary Increase in Constitutional Limit on State Spending. The California Constitution limits how much tax revenues the state can spend each year, with exceptions like spending on infrastructure and emergencies. The Constitution also allows voters to increase the limit on a temporary basis—up to four years at a time. In some years, the limit is an important consideration in state budgeting decisions. The measure would increase the limit by the size of the MCO tax for four years starting in 2025-26 and could increase taxes subject to the limit beginning as early as 2026-27. After the temporary increase ends, the measure could somewhat increase the chances that the state would eventually collect revenues in excess of the limit. Revenues in excess of the limit, over a two-year period, trigger a requirement for the state to make taxpayer rebates and additional school payments.

Summary of Fiscal Effects. We estimate that the measure would result in the following major fiscal impacts:

- Uncertain overall impact on state revenues and spending, including reduced legislative flexibility over the use of MCO tax funds. The extent of this impact depends on whether the measure would result in different state decisions around imposing, structuring, and spending proceeds from the managed care organization tax than in the absence of the measure.