Ballot Pages

Propositions on the November 8, 2016 Ballot

November 8, 2016Proposition 52

State Fees on Hospitals. Federal Medi-Cal Matching Funds. Initiative Statutory and Constitutional Amendment.

Yes/No Statement

A YES vote on this measure means: An existing charge imposed on most private hospitals that is scheduled to end on January 1, 2018 under current law would be extended permanently. It would be harder for the Legislature to make changes to it. Revenue raised would be used to create state savings, increase payments for hospital services to low-income Californians, and provide grants to public hospitals.

A NO vote on this measure means: An existing charge imposed on most private hospitals would end on January 1, 2018 unless additional action by the Legislature extended it.

Summary of Legislative Analyst’s Estimate of Net State and Local Government Fiscal Impact

-

The fiscal effect of this measure is uncertain primarily because it is not known whether the Legislature would have extended the hospital fee absent the measure.

-

If the Legislature would have extended the hospital fee absent this measure, the measure would likely have relatively little fiscal effect on the state and local governments.

-

If the Legislature would not have extended the hospital fee absent the measure, the measure could result in state General Fund savings of around $1 billion annually and increased funding for public hospitals in the low hundreds of millions of dollars annually.

Ballot Label

Fiscal Impact: Uncertain fiscal effect, ranging from relatively little impact to annual state General Fund savings of around $1 billion and increased funding for public hospitals in the low hundreds of millions of dollars annually.

Background

Overview of Medi-Cal and Hospitals

Medi-Cal Provides Health Care Benefits to Low-Income Californians. The Medi-Cal program provides health care benefits to low-income Californians who meet certain eligibility requirements. These health care benefits include services such as primary care visits, emergency room visits, surgery, and prescription drugs. Currently, Medi-Cal provides health care benefits to over 13 million Californians. Total spending on Medi-Cal in 2015-16 was roughly $95 billion, of which about $23 billion was from the state’s General Fund (its main operating account).

Cost of Medi-Cal Is Shared Between the State and the Federal Government. For most costs of the Medi-Cal program, the state and the federal government each pay half of the costs. In some instances, the federal government pays a greater share of the costs than the state. In order to receive federal funding for Medi-Cal, the state must follow various federal laws and requirements.

Public and Private Hospitals Provide Care to People Enrolled in Medi-Cal. There are about 450 private and public general acute care hospitals (“hospitals”) licensed in California that provide services such as emergency services, surgery, and outpatient care to Californians, including those enrolled in Medi-Cal. About four-fifths of the hospitals are private and about one-fifth of the hospitals are public. Public hospitals are owned and operated by public entities such as counties or the University of California. Private hospitals are owned and operated by private entities, which can be nonprofit or for-profit.

Hospital Quality Assurance Fee

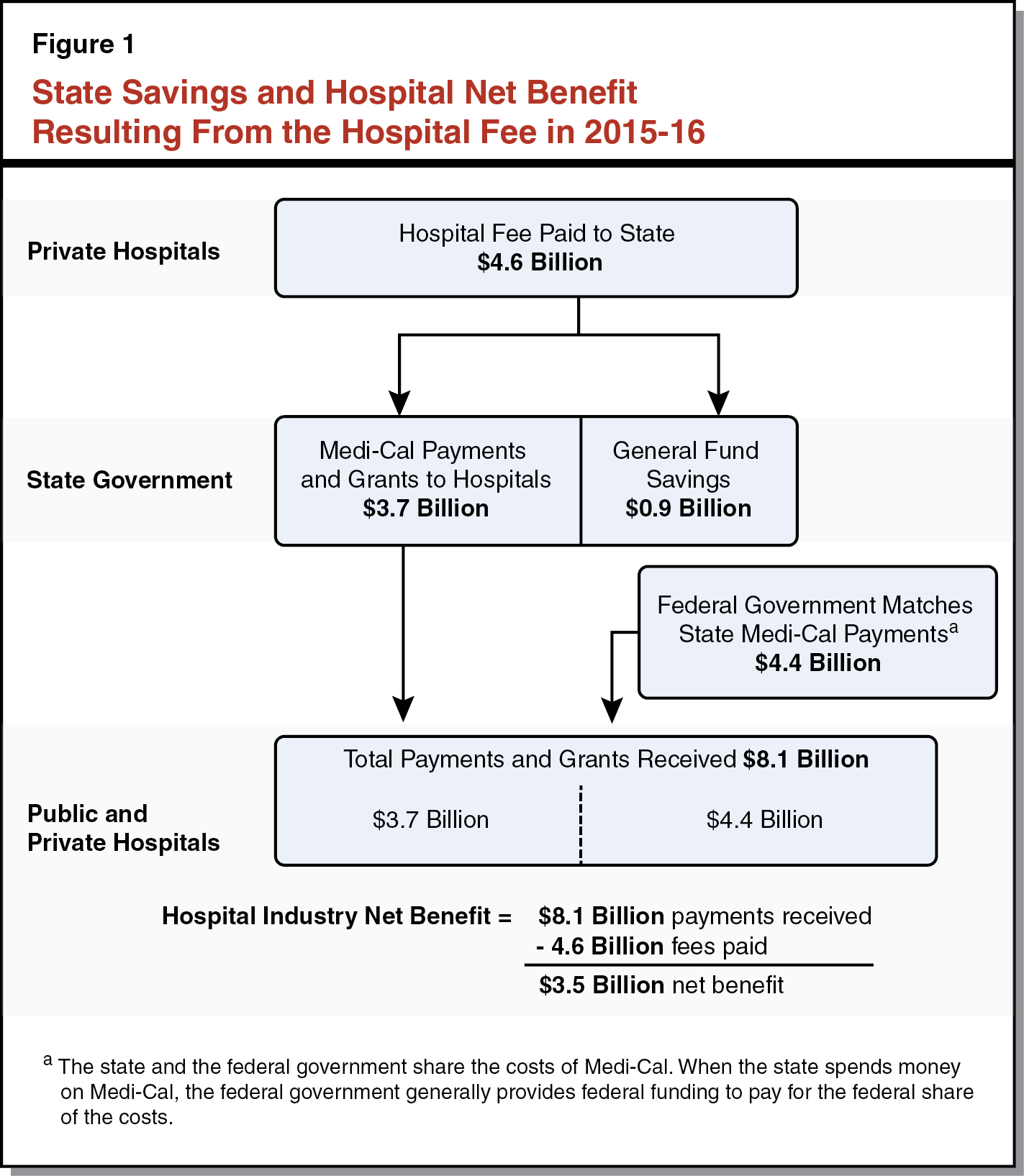

In recent years, the state has imposed a special charge on most private hospitals. This charge is called the Hospital Quality Assurance Fee (“hospital fee”). It has been collected since 2009. The charging of the hospital fee by the state is set to end on January 1, 2018. Figure 1 depicts the collection and use of hospital fee revenue in 2015-16. The fee revenue is used for two purposes: (1) to fund the state share of increased Medi-Cal payments for hospitals and grants for public hospitals ($3.7 billion in 2015-16) and (2) to generate state General Fund savings ($850 million in 2015-16). The hospital fee revenue used for increased Medi-Cal payments was matched with $4.4 billion in federal Medi-Cal funding, resulting in $8.1 billion in total Medi-Cal payments and grants to hospitals in 2015-16.

Hospital Fee Results in a Net Benefit to Hospital Industry. As shown in Figure 1, the hospital industry received in 2015-16 a net benefit of $3.5 billion as a result of the fee because the hospitals received $8.1 billion in payments and paid $4.6 billion in fees. Public hospitals in particular received a benefit of $235 million in 2015-16, comprised of grants and increased Medi-Cal payments. (While the hospital industry as a whole received a net benefit, a small number of private hospitals paid more in fee revenue than they received in Medi-Cal payments.)

Money From Hospital Fee Results in State Savings. As shown in Figure 1, fee revenue is used to generate state General Fund savings. These savings occur because hospital fee revenue is used to pay for children’s health care services in Medi-Cal that would otherwise be paid using state General Fund money. (The state General Fund is supported primarily through taxes such as income and sales taxes.) The amount of fee revenue used to generate state General Fund savings is based on a formula in state law. In 2015-16, the state General Fund savings was about $850 million.

Legislature Has Extended Hospital Fee Several Times in the Past. Since the fee began in 2009, the Legislature has extended it four times from the date that the fee was to end under law in place at the time. Consistent with this past practice, the Legislature could potentially enact a new law to extend the current hospital fee beyond January 1, 2018 (the date when the current fee ends).

Any Extension of Hospital Fee Must Be Approved by Federal Government. If the fee is extended beyond January 1, 2018 by the Legislature or by voters, the extension must also be approved by the federal government to receive federal funding. Federal government approval is required because the state uses hospital fee revenue to fund the state share of Medi-Cal payment increases to hospitals, and the federal government also pays for part of these payment increases.

Proposal

Makes Hospital Fee Permanent. While the hospital fee would otherwise end under current state law on January 1, 2018, Proposition 52 extends the current fee permanently. As with any extension of the hospital fee, the extension under this measure requires federal approval.

Makes It Harder for the State to End Hospital Fee. Under the measure, the state could end the hospital fee if two-thirds of each house of the Legislature votes to do so. Under current law, the fee can be ended with a majority vote in each house.

Makes It Harder to Change the Hospital Fee. Under the measure, changes to the hospital fee generally would require future voter approval in a statewide election. Under current law, changes to the fee can be made by the Legislature. For example, the Legislature can change the formula used to generate state General Fund savings. The measure does allow the Legislature—with a two-thirds vote of each house—to make certain specific changes, such as those necessary to obtain federal approval of the hospital fee.

Excludes Money From Hospital Fee in Annual Calculation of School Funding. The State Constitution requires certain formulas to be used to calculate an annual minimum funding level for K-12 education and California Community Colleges. These formulas take into account the amount of state General Fund revenue. As under current practice, the measure excludes money raised by the hospital fee in these calculations. The measure provides for this exclusion in an amendment to the State Constitution.

Fiscal Effects

The fiscal effect of this measure is uncertain primarily because it is not known whether the Legislature would have extended the hospital fee absent the measure. To date, the Legislature has extended the fee four times. Therefore, given past practice, it is possible the Legislature would have extended the hospital fee beyond January 1, 2018 in any case. There are also recent changes to federal law that may require changes to the structure of the hospital fee and these could affect the fiscal impact of the hospital fee. Below, we describe the fiscal effect of this measure under two main scenarios:

-

If Legislature Would Have Extended Hospital Fee Absent the Measure. In this case, the measure would likely have relatively little fiscal effect on the state and local governments (for the period over which the Legislature extended the fee). This is because the state would already be generating General Fund savings and providing funding to public hospitals. We note, however, that absent this measure the Legislature could change the structure of the hospital fee such that the General Fund savings and public hospital benefit could be different from what it has been.

-

If Legislature Would Not Have Extended Hospital Fee Absent the Measure. In this case, the measure would have a major fiscal effect on the state and local governments. The fiscal effects under this scenario would likely be similar to those experienced recently (as adjusted for growth over time): (1) annual General Fund savings of about $1 billion and (2) annual funding to the state and local public hospitals in the low hundreds of millions of dollars. The state and local governments also would realize some increased revenues as a result of the added federal funds brought into the state by the fee. These impacts, however, could be affected by new federal requirements that may require changes to the hospital fee. At this time, it is unclear what changes to the hospital fee would be necessary to comply with federal requirements. Any such changes could increase, decrease, or not change at all the impacts on the state and local governments.