Ballot Pages

Propositions on the June 5, 2018 Ballot

June 5, 2018Proposition 68

SB 5 (Chapter 852, Statutes of 2017), De León. California Drought, Water, Parks, Climate, Coastal Protection, and Outdoor Access for All Act of 2018.

Yes/No Statement

A YES vote on this measure means: The state could sell $4.1 billion in general obligation bonds to fund various natural resources-related programs such as for habitat conservation, parks, and water-related projects.

A NO vote on this measure means: The state could not sell $4.1 billion in general obligation bonds to fund various natural resources-related programs.

Summary of Legislative Analyst’s Estimate of Net State and Local Government Fiscal Impact

- Increased state bond repayment costs averaging about $200 million annually over the next 40 years.

- Savings to local governments, likely averaging several tens of millions of dollars annually over the next few decades.

Ballot Label

Fiscal Impact: Increased state bond repayment costs averaging $200 million annually over 40 years. Local government savings for natural resources-related projects, likely averaging several tens of millions of dollars annually over the next few decades.

Background

State Spending on Natural Resources Programs. The state operates various programs to protect the environment, conserve natural resources, provide flood protection, improve water quality, and offer recreational opportunities for the public. The state also provides grants and loans to local governments, nonprofits, and other organizations for similar purposes. In recent years, the state has spent about $5 billion annually to support these types of programs. The state primarily relies on a combination of general obligation (GO) bonds, fee revenue, and the state’s General Fund to support these programs. (The General Fund is the state’s main operating account, which pays for education, prisons, health care, and other services.)

State and local natural resources programs support a variety of purposes, including:

-

Natural Resource Conservation. The state provides funds to purchase, protect, and improve natural areas—including wilderness and open-space areas; forests; wildlife habitats; rivers, lakes, and streams; and coastal habitats. State conservation programs often are administered by state conservancies and other departments. These programs often provide grants to local governments or other organizations that carry out projects.

-

State and Local Parks. The state operates the state park system, which includes 280 parks. Additionally, the state provides funds to local governments to purchase and maintain local and regional parks, trails, and other recreation areas.

-

Flood Protection. The state funds the construction and repair of flood protection projects as part of the state’s Central Valley flood management system. This includes the repair and strengthening of levees and projects designed to divert water away from populated areas during large storms. The state also provides funds to local governments to complete similar types of projects throughout the state.

-

Safe Drinking Water. The state makes loans and grants for local projects designed to improve access to clean drinking water. This includes projects to install equipment that remove unhealthy pollutants from local water supplies.

-

Other Water-Related Projects. The state provides funds for various other projects throughout the state that improve water quality or the reliability of water supplies. For example, the state provides loans and grants to local agencies to construct water recycling and reuse projects, store more water underground (referred to as “groundwater recharge”), and clean up polluted groundwater.

Past Bond Funding for Natural Resources Programs. Since 2000, voters have authorized about $27 billion in GO bonds in statewide elections to fund various natural resources projects. Of this amount, approximately $9 billion remained available for new projects as of June 2017. (Most of the bond funds still available are for water-related purposes authorized by Proposition 1, which was approved in 2014.) The state repays GO bonds over time, with interest, using the state’s General Fund. (For more information on how bonds work and how this proposed bond would impact the state’s budget, see “Overview of State Bond Debt” later in this guide.)

Proposal

$4.1 Billion GO Bond for Natural Resources Programs. This proposition allows the state to sell a total of $4.1 billion in GO bonds for various natural resources-related programs. This total includes $4 billion in new bonds. It also includes a redirection of $100 million in unsold bonds that voters previously approved for specific natural resources uses.

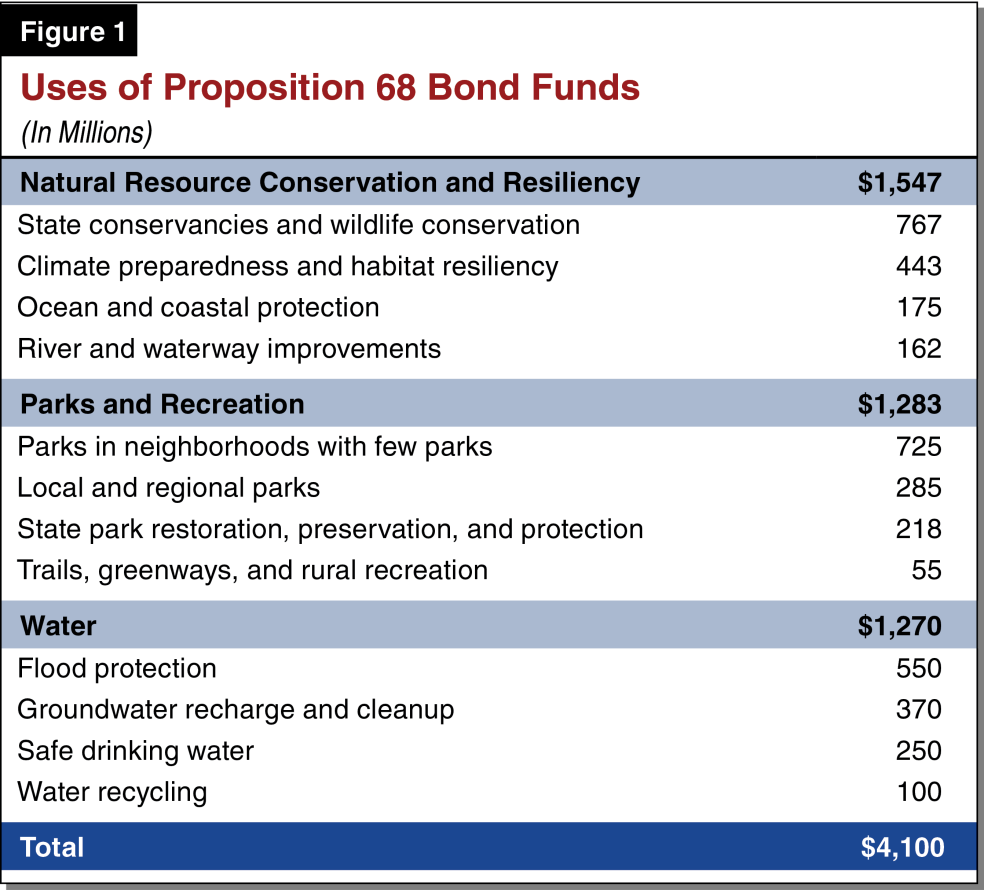

Bond Funds Specific Purposes. This proposition provides funding for various state departments and local governments to use for specific natural resources-related purposes, which are summarized in Figure 1. This includes $1.5 billion for a variety of programs generally intended to conserve natural habitats; improve coastal, river, and other ecosystems; and increase the resiliency of the environment to withstand the effects of climate change (such as sea level rise and more frequent droughts and forest fires). The bond also provides $1.3 billion for parks and recreation projects, most of which would be used to build or improve local parks. Lastly, the bond provides $1.3 billion for various water-related projects, including to increase flood protection, recharge and clean up groundwater, and provide safe drinking water.

Administrative Provisions. This proposition includes a number of provisions designed to control how the bond funds are administered and overseen by state agencies. The proposition requires regular public reporting of how the bond funds have been spent, as well as authorizes financial audits by state oversight agencies. In addition, for several of the programs funded by this bond, recipients—mostly local governments—would only be eligible to receive the funding if they provide some funding to support the projects. This local cost-share requirement, where it applies, is at least 20 percent of the bond funding awarded. As an example, a city receiving a $100,000 grant to build a new park trail would need to provide at least $20,000 towards the project.

The proposition also includes several provisions designed to assist “disadvantaged communities” and very disadvantaged communities (generally, communities with lower average incomes). For example, the local cost-share requirement would not apply to most of the grants provided to these communities. In addition, the proposition requires that for each use specified in the bond, at least 15 percent of the funds benefit very disadvantaged communities.

Fiscal Effects

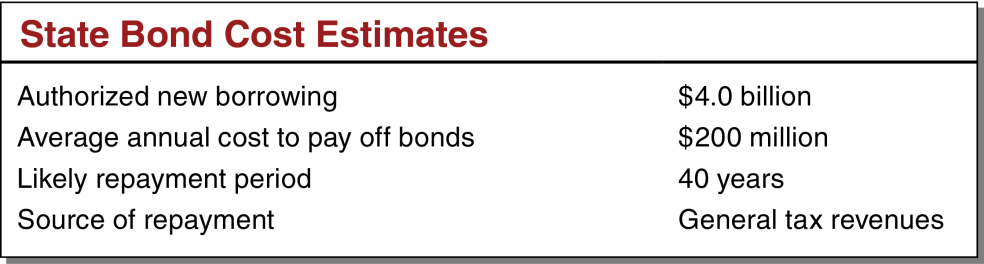

State Bond Costs. This proposition would allow the state to borrow $4 billion by selling additional GO bonds to investors, who would be repaid with interest using the state’s General Fund tax revenues. The cost to the state of repaying these new bonds would depend on various factors—such as the interest rates in effect at the time they are sold, the timing of bond sales, and the time period over which they are repaid. We estimate that the cost to taxpayers to repay this bond would total $7.8 billion to pay off both principal ($4.0 billion) and interest ($3.8 billion). This would result in average repayment costs of about $200 million annually over the next 40 years. This amount is about one-fifth of a percent of the state’s current General Fund budget.

Local Costs and Savings to Complete Projects. Much of the bond funding would be used for local government projects. Providing state bond funds for local projects would affect how much local funding is spent on these projects. In many cases, the availability of state bonds could reduce local spending. For example, this would occur in cases where the state bond funds replaced monies that local governments would have spent on projects anyway.

In some cases, however, state bond funds could increase total spending on projects by local governments. For example, the availability of bond funds might encourage some local governments to build additional or substantially larger projects than they would otherwise. For some of these projects—such as when the bond requires a local cost share—local governments would bear some of the additional costs.

On balance, we estimate that this proposition would result in savings to local governments to complete the projects funded by this bond. These savings could average several tens of millions of dollars annually over the next few decades. The exact amount would vary depending on the specific projects undertaken by local governments, how much local cost sharing is required by state agencies, and the amount of additional funding local governments provide to support the projects.

Other State and Local Fiscal Effects. There could be other state and local fiscal effects under this bond. For example, costs could increase to operate and maintain newly built parks. On the other hand, some projects could reduce future costs, such as by making levee repairs that reduce future flooding damage. The amount of these possible fiscal effects is unknown but could be significant.