January 5, 2016

Improving California’s

Criminal Fine and Fee System

Executive Summary

California’s Criminal Fine and Fee System. Upon conviction of a criminal offense (including traffic violations), individuals are typically required by the court to pay various fines and fees as part of their punishment. Collection programs—operated by both courts and counties—collect payments from individuals and then distribute them to numerous funds to support various state and local government programs and services. Distribution occurs in accordance to a very complex process dictated by state law.

Key Problems With Existing Fine and Fee System. Based on our analysis of the state’s existing fine and fee system, we identified four major problems with the system.

- Difficult for Legislature to Control Use of Fine and Fee Revenues. The existing system distributes fine and fee revenue based on various statutory formulas, making it difficult for the Legislature to control how such revenue is used. This is because the current formula–based system limits the information available to guide legislative decisions, makes it difficult for the Legislature to reprioritize the use of revenue, and allows administering entities to maintain significant control over the use of funds.

- Revenue Distributions Generally Not Based on Need. The existing system distributes revenue in a manner that is generally not based on program need—thereby resulting in programs receiving more or less funding than needed.

- Difficult to Distribute Revenue Accurately. The complexity of the existing system makes it difficult for collection programs to accurately distribute fine and fee revenue.

- Lack of Complete and Accurate Data on Collections and Distributions. A lack of complete and accurate data on fine and fee collections and distributions makes it difficult for the Legislature to conduct fiscal oversight.

LAO Recommendations. To address the above problems, we make recommendations to improve the state’s fine and fee system. First, we recommend that the Legislature reevaluate the overall structure of the fine and fee system to ensure the system is consistent with its goals. As part of this process, the Legislature will want to determine the specific goals of the system, whether ability to pay should be incorporated into the system, what should be the consequences for failing to pay, and whether fines and fees should be regularly adjusted. Second, we recommend increasing legislative control over the use of criminal fine and fee revenue to ensure that its uses are in line with legislative priorities by (1) requiring that most criminal fine and fee revenue be deposited in the state General Fund, (2) consolidating most fines and fees into a single, statewide charge, (3) evaluating the existing programs supported by fine and fee revenues, and (4) mitigating the impacts of potential changes to the fine and fee system on local governments.

Introduction

Individuals convicted of criminal offenses, including traffic violations, are often required to pay a number of fines and fees as part of their punishment. The revenue from these payments are deposited in specific funds to support various state and local government programs and services. In recent years, a number of these funds have faced operational shortfalls due to a decline in fine and fee revenue. At the same time, the Legislature has expressed concern with the level of the state’s fines and fees and their impact on low–income individuals. In order to help address both of these issues, the Legislature recently took steps to (1) temporarily redirect monies to specific state funds experiencing shortfalls in fine and fee revenue and (2) provide onetime relief to individuals who were unable to pay the fines and fees for certain traffic violations. While these actions address some of the concerns and challenges with the state’s existing fine and fee system on a temporary basis, there are opportunities for the Legislature to make ongoing improvements.

In this report, we: (1) provide background information on California’s criminal fine and fee system, including how fines and fees are calculated and distributed; (2) identify problems with the existing system; and (3) make recommendations to improve the system. In preparing this report, we spoke with Judicial Council staff, trial court administrators and judges, and county staff throughout the state in order to gain an in–depth understanding of how fines and fees are calculated, distributed, and used. We also analyzed various reports and data compiled by the judicial branch and the State Controller’s Office. Finally, we talked to officials from other states regarding their fine and fee systems.

California’s Criminal Fine and Fee System

What Are Criminal Fines and Fees?

During court proceedings, trial courts typically levy fines and fees upon individuals convicted of criminal offenses (including traffic violations). As we discuss below, the total amount owed by an individual consists of a base fine, as well as various additional charges (such as other fines, fees, forfeitures, penalty surcharges, assessments, and restitution orders). Collectively, these various fines and fees are often referred to as court–ordered debt, which is the focus of this report. (Parking violations are not considered court–ordered debt as state trial courts do not administer such violations.)

How Are Criminal Fine and Fee Levels Set?

Trial Courts Determine Total Amount Owed. Trial courts are responsible for determining the total amount of fines and fees owed by individuals upon their conviction for a criminal offense. This calculation begins with a base fine that is set in state law for each criminal offense. For example, as shown in Figure 1, the base fine for the infraction of a stop sign violation is $35, while the base fine for the misdemeanor of driving under the influence (DUI) of alcohol or drugs is $390. State law then requires the court to add certain charges to the base fine, which can significantly increase the total amount owed. Some of these additional charges are calculated using the base fine. For example, the state penalty assessment consists of adding $10 for every $10 portion of the base fine. Others are flat charges, such as the court operations assessment of $40 per conviction. On a limited basis, state law also authorizes counties and courts to levy additional charges depending on the specific violation and other factors. Some of these additional charges require the county board of supervisors to approve a resolution before it may be imposed. Finally, statute gives judges some discretion to reduce the total amount owed by waiving or reducing certain charges. As shown in the figure, the total payment owed by an individual can be many times greater than the base fine.

Figure 1

Various Fines and Fees Substantially Add to Base Fines

As of September 1, 2015

|

How Charge Is Calculated |

Stop Sign Violation (Infraction) |

DUI of Alcohol/Drugs (Misdemeanor) |

|

|

Standard Fines and Fees |

|||

|

Base Fine |

Depends on violation |

$35 |

$390 |

|

State Penalty Assessment |

$10 for every $10 of a base finea |

40 |

390 |

|

County Penalty Assessment |

$7 for every $10 of a base finea |

28 |

273 |

|

Court Construction Penalty Assessment |

$5 for every $10 of a base finea |

20 |

195 |

|

Proposition 69 DNA Penalty Assessment |

$1 for every $10 of a base finea |

4 |

39 |

|

DNA Identification Fund Penalty Assessment |

$4 for every $10 of a base finea |

16 |

156 |

|

EMS Penalty Assessment |

$2 for every $10 of a base finea |

8 |

78 |

|

EMAT Penalty Assessment |

$4 per conviction |

4 |

4 |

|

State Surcharge |

20% of base fine |

7 |

78 |

|

Court Operations Assessment |

$40 per conviction |

40 |

40 |

|

Conviction Assessment Fee |

$35 per infraction and $30 per felony or misdemeanor conviction |

35 |

30 |

|

Night Court Fee |

$1 per fine and fee imposed |

1 |

1 |

|

Restitution Fine |

$150 minimum per misdemeanor conviction and $300 minimum per felony conviction |

— |

150 |

|

Subtotals |

($238) |

($1,824) |

|

|

Examples of Additional Fines and Fees That Could Apply |

|||

|

DUI Lab Test Penalty Assessment |

Actual costs up to $50 for specific violations |

— |

$50 |

|

Alcohol Education Penalty Assessment |

Up to $50 |

— |

50 |

|

County Alcohol and Drug Program Penalty Assessment |

Up to $100 |

— |

100 |

|

Subtotals |

(—) |

($200) |

|

|

Totals |

$238 |

$2,024 |

|

|

aThe base fine is rounded up to the nearest $10 to calculate these additional charges. For example, the $35 base fine for a stop sign violation is rounded up to $40. DUI = Driving Under Influence; EMS = Emergency Medical Services; and EMAT = Emergency Medical Air Transportation. |

|||

Fine and Fee Levels Set to Serve Multiple Purposes. The state has enacted various fines and fees for a variety of purposes. Some, such as the base fine and the restitution fine, are generally tied to the seriousness of the crime. Others were enacted to generate revenue to fund specific activities. For example, two DNA penalty assessments support the Department of Justice’s DNA Laboratory and other local DNA–related activities. Finally, some fines and fees were enacted to help offset state or local costs for providing particular services to individuals paying the specific charge. For example, the night court fee is used to offset facility costs for trial courts that choose to conduct night or weekend sessions for traffic offenses. The fee may not be charged if such sessions are not conducted. Over the past decade, the number and size of charges added to the base fine have increased significantly—resulting in increases in the total amount owed by individuals convicted of criminal offenses. For example, as shown in Figure 2, the total fine and fee level for a stop sign violation has increased significantly since 2005. (As discussed in the nearby box, fine and fee levels in California for criminal violations generally appear to be high relative to other states.)

Figure 2

Total Fine and Fee Level for Stop Sign Violation Has Increased Significantly Since 2005a

|

Stop Sign Violation (Infraction) |

|||

|

2005 |

2015 |

Change |

|

|

Base Fine |

$35 |

$35 |

|

|

State Penalty Assessment |

40 |

40 |

— |

|

County Penalty Assessment |

28 |

28 |

— |

|

Court Construction Penalty Assessment |

20 |

20 |

— |

|

Proposition 69 DNA Penalty Assessment |

4 |

4 |

— |

|

DNA Identification Fund Penalty Assessment |

— |

16 |

$16 |

|

EMS Penalty Assessment |

— |

8 |

8 |

|

EMAT Penalty Assessment |

— |

4 |

4 |

|

State Surcharge |

7 |

7 |

— |

|

Court Operations Fee |

20 |

40 |

20 |

|

Conviction Assessment Fee |

— |

35 |

35 |

|

Night Court Fee |

1 |

1 |

— |

|

Totals |

$155 |

$238 |

$83 |

|

aDepending on the specific violation and other factors, additional county or state assessments may apply. EMS = Emergency Medical Services and EMAT = Emergency Medical Air Transportation. |

|||

Certain Criminal Fines and Fees Appear Higher Than Certain Other States

Currently, comprehensive information is not available on the criminal fine and fee levels of other states. However, in order to compare California’s fine and fee levels to the rest of the nation, we surveyed other states. Specifically, we surveyed one large jurisdiction in each of 33 states (including many states similar to California) for the fines and fees associated with the two offenses: a stop sign violation and speeding at 20 miles per hour over the limit. We found that California’s fines and fees associated with these common traffic offenses are relatively high. For example, the total fines and fees for a stop sign violation in California is $238, which was higher than 28 of the surveyed states (about 85 percent). The total in other surveyed states ranged from $58 to $277, and averaged $157. The total fines and fees for speeding at 20 miles per hour over the limit in California was $367, which was higher than all of states we surveyed. The total in other surveyed states ranged from $73 to $350, and averaged $203.

How Are Criminal Fines and Fees Collected?

Counties and Courts Involved in Collection Process. While trial courts are responsible for determining the amount of fines and fees owed by individuals, counties are statutorily responsible for collecting fine and fee payments. However, some collection duties are often delegated back to the trial courts. As a result, collection programs may be operated by both courts and counties. Individuals who plead guilty or are convicted of a criminal offense must either provide full payment immediately or set up installment payment plans with the collection program. If an offender does not pay on time, the amount owed becomes delinquent.

State law authorizes the collection program to use a variety of tools or sanctions (such as wage garnishments or the suspension of a driver’s license) to motivate offenders to pay their debt. Additionally, in lieu of issuing an arrest warrant, state law authorizes collection programs to impose a civil assessment of up to $300 against any offender who fails to either make payment or appear in court without good cause. Finally, state law permits collection programs that meet specified criteria to recover most operating costs related to the collection of delinquent payments prior to distribution to various state and local funds. (Please see our November 2014 report, Restructuring the Court–Ordered Debt Collection Process, for more detailed information regarding the debt collection process.) Since 2009–10, programs reported collecting a total of roughly $1.8 billion in fine and fee revenue annually. However, this amount may be understated due to incomplete reporting by collection programs.

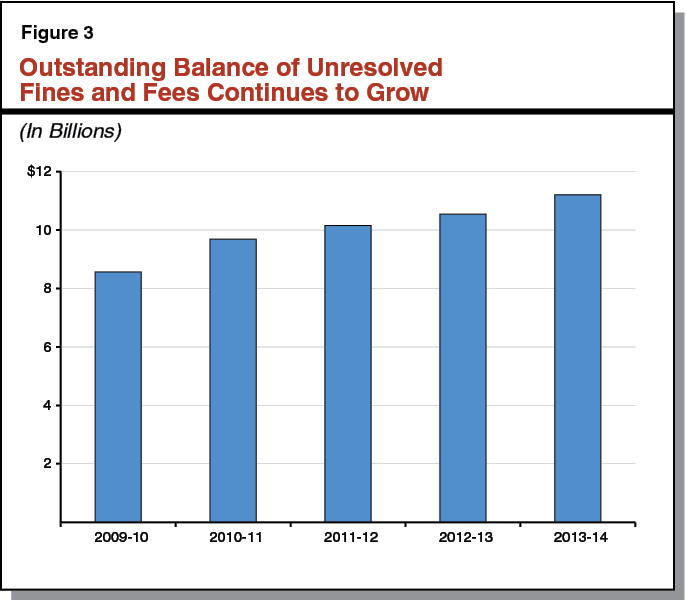

Amount of Outstanding Debt Increasing. Every year, the courts estimate the total outstanding balance of debt owed by individuals. This balance may decrease when individuals make payments or debt is resolved in an alternative manner, such as when a portion of a debt is dismissed because the individual performs community service in lieu of payment. However, this amount generally grows each year as some amount of newly imposed court–ordered debt goes unpaid and is added to the amount of unresolved debt accumulated from prior years. As shown in Figure 3, an estimated $11.2 billion in criminal fines and fees remained outstanding at the end of 2013–14. We would note, however, that a large portion of this balance may not be collectable as the costs of collection could outweigh the amount that would actually be collected.

How Are Criminal Fines and Fees Distributed?

As shown in Figure 4, over 50 state funds—in addition to many local funds throughout the state—are eligible to receive fine and fee revenue. However, some of these funds receive very little revenue, such as those that only receive revenue from fines and fees for specific offenses that occur infrequently. For example, the state Voter Intimidation Restitution Fund only receives revenue when an individual is convicted of voter intimidation. In order to comply with the numerous state laws dictating which funds receive fine and fee revenue, collection programs must carefully track, distribute, and record the revenue they collect. Programs submit this information, along with the revenue, to the county for (1) distribution to county funds and (2) transfer to the State Controller’s Office (SCO) for distribution to state funds.

Figure 4

Numerous State and Local Funds Receive Fine and Fee Revenue

|

State Administered Funds |

|

|

State General Fund |

Oil Pollution Response and Restoration Subaccount |

|

Abalone and Restoration and Preservation Account |

Osteopathic Medical Board of California Contingent Fund |

|

Abandoned Watercraft Abatement Fund |

Peace Officers’ Training Fund |

|

California Beverage Container Recycling Fund |

Pharmacy Board Contingent Fund |

|

California Fire and Arson Training Fund |

Private Security Services Fund |

|

California Motorcyclist Safety Fund |

Restitution Fund |

|

Cigarette and Tobacco Products Compliance Fund |

Safe Drinking Water and Toxic Enforcement Fund |

|

Cigarette Tax Fund |

Secret Witness Program |

|

Clandestine Drug Lab Clean–Up Account |

State Children’s Trust Fund |

|

Contingent Fund of the Medical Board of California |

State Court Facilities Construction Fund |

|

Corrections Training Fund |

State Dentistry Fund |

|

Court Facilities Trust Fund |

State Fire Marshal Fireworks Enforcement and Disposal Fund |

|

Department of Justice DNA Testing Fund |

State Highway Account |

|

Department of Justice Sexual Habitual Offender Fund |

State Optometry Fund |

|

Domestic Violence Restraining Order Reimbursement Fund |

State Penalty Fund |

|

Domestic Violence Training and Education Fund |

State Water Pollution Cleanup and Abatement Account |

|

Driver Training Penalty Assessment Fund |

Toxic Substances Control Account |

|

Emergency Medical Air Transportation Act Fund |

Traumatic Brain Injury Fund |

|

Environmental Enforcement and Training Account |

Trial Court Improvement and Modernization Fund |

|

Farmworker Remedial Account |

Trial Court Operations Fund |

|

Fish and Game Preservation Fund |

Trial Court Trust Fund |

|

Hazardous Materials Administration Subaccount |

Underground Storage Tank Cleanup Fund |

|

Home Care Penalties Subaccount |

Veterinary Medical Board Contingent Fund |

|

Illegal Drug Lab Cleanup Account |

Victim–Witness Assistance Fund |

|

Immediate and Critical Needs Account |

Voter Intimidation Restitution Fund |

|

Local Public Prosecutors and Public Defenders Fund |

Waste Discharge Permit Fund |

|

Missing Persons DNA Data Base Fund |

Winter Recreation Fund |

|

Motor Vehicle Account |

Worker’s Compensation Fraud Account |

|

Oil Pollution Administration Subaccount |

Various unspecified funds to support specific activities |

|

County Administered Funds (Per County) |

|

|

County General Fund |

Drug Program Fund |

|

Alcohol Abuse and Prevention Fund |

Fish and Game Propagation Fund |

|

Automated County Warrant Fund |

Forensic Laboratory Fund |

|

Automated Fingerprint Identification and Digital Image Photographic Suspect Booking Identification System Fund |

Inmate Welfare Fund |

|

Children’s Trust Fund |

Juvenile Justice Construction Fund (Kern and Ventura Counties) |

|

Courthouse Construction Fund |

Maddy Emergency Services Fund |

|

Criminal Justice Facilities Construction Fund |

Night Court Session Fund |

|

Criminal Justice Investigation Fund (Imperial County) |

Rabies Treatment and Eradication Fund |

|

Criminalistics Laboratory Fund |

Real Estate Fraud Prosecution Trust Fund |

|

County Jail Fund (Orange and Solano Counties) |

Special Purpose Funds |

|

DNA Identification Fund |

Transportation District, Commission, or Authority General Fund |

|

Domestic Violence Programs Special Fund |

Various unspecified funds to support specific activities |

|

City Administered Funds (Per City) |

|

|

City General Fund |

Various unspecified funds to support specific activities |

State law dictates a very complex process for the distribution of fine and fee revenue. As we discuss below, state law specifies how individual fine and fee payments are to be distributed to state and local funds, including additional requirements for when payments are not made in full (such as under an installment plan). Currently, state law contains at least 215 distinct code sections related to these processes.

Distribution Among State and Local Funds. State law (and county board of supervisor resolutions for certain local charges) specifies how payments made to resolve individual fines and fees are distributed among state and local funds. First, state law includes formulas for distributions of certain fines and fees. For example, state penalty assessments are deposited into the State Penalty Fund (SPF) for subsequent distribution to nine other state funds (such as the Victim–Witness Assistance Fund). Statute also requires that a portion of certain fines and fees be allocated to specific purposes (such as to support cost–recovery and the Trial Court Improvement and Modernization Fund) prior to distributing revenue to various state and local funds. Second, state law authorizes local governments to determine how certain fines or fees are to be distributed among various local funds. For example, individual counties choose how payments made to address the county penalty assessment are deposited among several local funds. Finally, state law includes some distributions that vary by criminal offense. Figure 5 provides an example of the distribution of fines and fees for a stop sign violation and DUI violation. As shown in the figure, payments to satisfy the base fine for a stop sign violation are deposited in the Trial Court Improvement and Modernization Fund, as well as in the county and/or city General Fund, depending on where the offense occurs and which law enforcement entity cited the offense. In contrast, payments to satisfy the base fine of a DUI violation are deposited into three additional funds and must be distributed in a particular order under state law. As shown in the figure, these various distribution requirements result in a complex series of deposits into numerous state and local funds.

Figure 5

Examples of Distributions to State and Local Funds

|

Fine and Fee/Recipient Fund |

Stop Sign Violation (Infraction) |

DUI Violation (Misdemeanor) |

|

Base Fine |

||

|

County and/or City General Fund |

$34.30 |

$264.60 |

|

Restitution Fund—DUI Additional Restitution Allocation |

— |

19.60 |

|

Local DUI Lab Test Special Account |

— |

49.00 |

|

Local DUI Alcohol Program Special Account |

— |

49.00 |

|

Trial Court Improvement and Modernization Fund |

0.70 |

7.80 |

|

State Penalty Assessment |

||

|

State Penalty Fund (subsequently distributed to 9 other state funds) |

$27.44 |

$267.54 |

|

County General Fund |

11.76 |

114.66 |

|

Trial Court Improvement and Modernization Fund |

0.80 |

7.80 |

|

County Penalty Assessment |

||

|

Courthouse Construction Funda |

$8.82 |

$86.00 |

|

Criminal Justice Facilities Construction Funda |

8.82 |

86.00 |

|

Maddy EMS Funda |

3.92 |

38.22 |

|

DNA Identification Funda |

1.96 |

19.11 |

|

Automated Fingerprint Identification Fund and Digital Image Photographic Suspect Identification Funda |

3.92 |

38.22 |

|

Trial Court Improvement and Modernization Fund |

0.56 |

5.46 |

|

Court Construction Penalty Assessment |

||

|

Immediate and Critical Needs Accounta |

$7.84 |

$76.44 |

|

State Court Facilities Construction Funda |

11.76 |

114.66 |

|

Trial Court Improvement and Modernization Fund |

0.40 |

3.90 |

|

Proposition 69 DNA Penalty Assessment |

||

|

County or State DNA Identification Fund |

$3.92 |

$38.22 |

|

Trial Court Improvement and Modernization Fund |

0.08 |

0.78 |

|

DNA Identification Fund Penalty Assessment |

||

|

DNA Identification Fund |

$15.68 |

$152.88 |

|

Trial Court Improvement and Modernization Fund |

0.32 |

3.12 |

|

EMS Penalty Assessment |

||

|

Maddy EMS Fund |

$7.84 |

$76.44 |

|

Trial Court Improvement and Modernization Fund |

0.16 |

1.56 |

|

EMAT Penalty Assessment |

||

|

EMAT Act Fund |

$3.92 |

$3.92 |

|

Trial Court Improvement and Modernization Fund |

0.08 |

0.08 |

|

State Surcharge |

||

|

State General Fund |

$7.00 |

$78.00 |

|

Court Operations Assessment |

||

|

Trial Court Trust Fund |

$40.00 |

$40.00 |

|

Conviction Assessment Fee |

||

|

Immediate and Critical Needs Account |

$35.00 |

$30.00 |

|

Night Court Fee |

||

|

Court Facilities Trust Fund (State) and Night Court Session Fund (County) |

$1.00 |

$1.00 |

|

Restitution Fine |

||

|

State Restitution Fund |

— |

$147.00 |

|

Trial Court Improvement and Modernization Fund |

— |

3.00 |

|

DUI Lab Test Penalty Assessment |

||

|

County Special Account |

— |

$49.00 |

|

Trial Court Improvement and Modernization Fund |

— |

1.00 |

|

Alcohol Education Penalty Assessment |

||

|

Alcohol Abuse and Prevention Fund |

— |

$49.00 |

|

Trial Court Improvement and Modernization Fund |

— |

1.00 |

|

County Alcohol and Drug Program Penalty Assessment |

||

|

County Special Account and General Fund |

— |

$100.00 |

|

Totals |

$238.00 |

$2,024.00 |

|

aAcutal deposits can vary by county. DUI = Driving Under Influence of alcohol/drugs; EMS = Emergency Medical Services; and EMAT = Emergency Medical Air Transportation. |

||

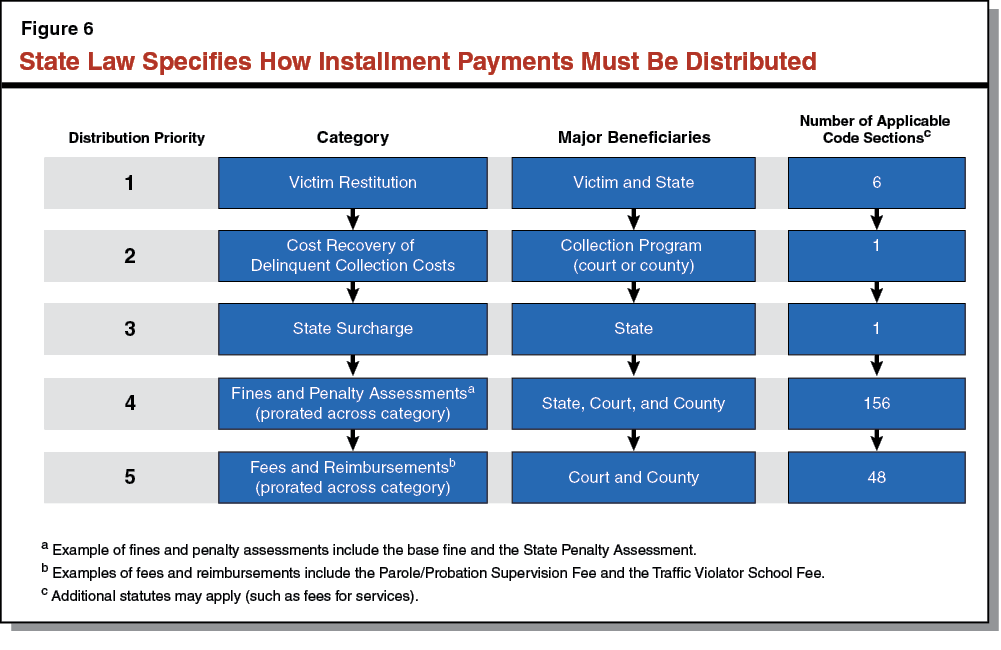

Distribution of Debt Not Paid in Full. Further complicating the distribution of fine and fee revenue, state law specifies the order in which payments that are less than the full amount owed are used to satisfy the fines and fees individuals are charged. For example, state law requires that installment payments be credited in a particular order. As shown in Figure 6, all fines and fees fall within one of five distribution categories. The fines and fees in each category must be fully satisfied before payments may be credited to the next category. This means that state and local funds in the lower distribution priorities fail to receive full allocations or receive delayed allocations if payments are not made in full or are delinquent. For partial payments that are not part of an installment payment plan, collection programs can either prorate the payments across (1) all charges equally or (2) any remaining charges after fulfilling those that are set amounts (such as the $40 per conviction court operations assessment).

Who Benefits From Criminal Fine and Fee Revenues?

Below, we discuss our best estimate of the total amount of revenue distributed to state and local governments and how it is divided between them. As we discuss later in this report, due to various data limitations, actual revenue amounts could be higher or lower than our estimates.

Total Revenue Distributed to State and Local Governments Declining. According to available data compiled by the SCO and the judicial branch, the total amount of fine and fee revenue distributed to state and local governments annually has declined since 2010–11. Specifically, the amount has declined by approximately $200 million—from nearly $2.2 billion in 2010–11 to nearly $2 billion in 2013–14. (As we discuss in more detail later in this report, this amount does not reconcile with the above $1.8 billion that collections programs report collecting in fine and fee revenue annually.) Most state and local funds receiving fine and fee revenue have also experienced a decline in the amount distributed to them. For example, the SPF received nearly $30 million less in 2013–14 than in 2010–11—about a 25 percent decline in revenue. The cause of such declines is unknown but could be due to a variety of factors—including the number of citations issued by law enforcement, individuals’ willingness to make payments, and the amount collected by collection programs. For example, the total number of criminal infraction and misdemeanor filings steadily declined by nearly 1.6 million total filings since 2010–11—a decline of about 22 percent. (A more detailed breakdown of deposits into specific state and local funds can be found in the Appendix)

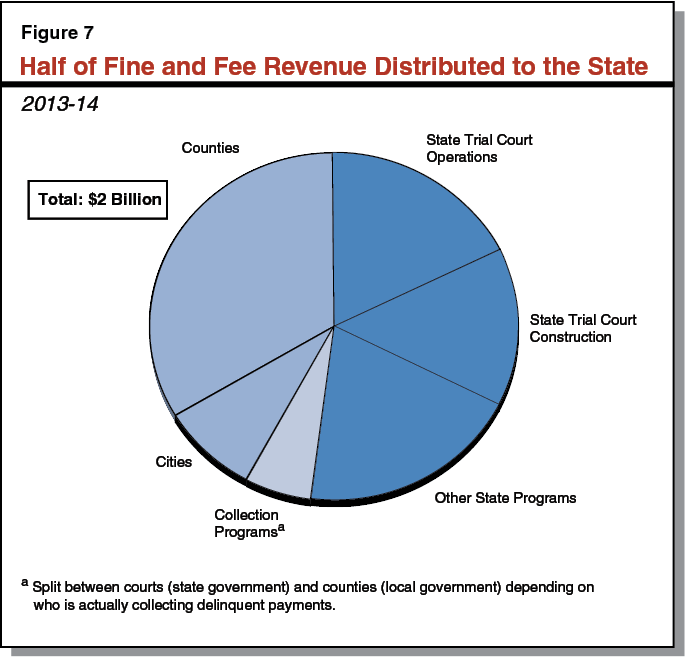

Half of Revenue Distributed to State. The state received a little over $1 billion of the total amount of fine and fee revenue distributed in 2013–14. As shown in Figure 7, this represents roughly half of all distributed revenue. Of this amount, a little less than two–thirds went to support trial court operations and construction. The remainder supported various other state programs such as victim–witness assistance, peace officer training, and the state’s DNA laboratory. Of the amount allocated to trial courts, roughly half funded statewide trial court construction, and the other half supported trial court operations.

Collection Programs Receive Share of Revenue. Collection programs received $114 million (or 6 percent) of fine and revenue distributed in 2013–14 for their operational costs related to the collection of delinquent payments. These funds are split between state trial courts and counties depending on which entity incurred the costs.

Remaining Revenue Distributed to Local Governments. We estimate that local governments received $820 million (or 42 percent) of the total amount of fine and fee revenue distributed in 2013–14. Of this amount, $657 million (or 80 percent) went to the counties. We would note, however, that counties often use their share of fine and fee revenue to meet their maintenance–of–effort (MOE) obligations to the state. These MOE obligations—or requirements for counties to continue to provide some financial support for trial courts—were established in 1997 when the Legislature shifted primary responsibility for trial court funding from the counties to the state. To date, annual county MOE obligations to the state for trial court operations total about $660 million.

Key Problems with Existing Fine and Fee System

Based on our analysis of California’s existing fine and fee system, we identified four major problems with the system. Specifically, we find that the existing system (1) makes it difficult for the Legislature to control how fine and fee revenue is used, (2) distributes revenue in a manner that is generally not based on program need, (3) makes it difficult for collection programs to accurately distribute such revenue, and (4) lacks complete and accurate data on fine and fee collections and distributions. Figure 8 provides a summary of our findings, which we discuss in more detail below.

Figure 8

Problems With California’s Fine and Fee System

|

|

|

|

Difficult for Legislature to Control Use of Fine and Fee Revenue

As discussed earlier, the state’s existing fine and fee system includes a complex distribution method that disburses monies to funds based on various statutory formulas. These formulas ensure certain programs receive funding annually, which often makes it difficult for the Legislature to control the use of fine and fee revenue. This is because the statutory distribution formulas often have the following effects:

- Limited Information to Guide Legislative Decisions. Because the current statutory formulas effectively guarantee certain programs funding, these programs are generally not required to regularly provide the Legislature with information on program expenditures and outcomes. This makes it difficult for the Legislature to regularly evaluate how effectively these programs are using the funds they are provided. Although some programmatic information is typically provided when programs require additional funding (such as due to insufficient revenue), the Legislature is often informed of these challenges late in the process when there are few viable options that would not cause major impacts to program operations.

- Difficult for Legislature to Reprioritize Use of Revenue. Because the existing distribution formulas effectively lock in the uses of fine and fee revenue on an ongoing basis, it is difficult for the Legislature to reprioritize the use of these funds based on changing needs and priorities (such as increasing the amount of revenue allocated to some programs or using these funds to support alternative programs that it deems to be of higher priority). This limits the Legislature’s ability to ensure that such funds are being used in a manner that is consistent with its priorities.

- Administering Entities Maintain Significant Control Over Use of Funds. The current formula–driven system also gives certain state and local entities significant discretion in how they use fine and fee revenue. For example, statute authorizes the judicial branch to determine the specific statewide projects funded by the Trial Court Improvement and Modernization Fund based on broad guidance outlined in statute. The Legislature only receives an annual report on expenditures once the fiscal year is complete. In other cases, entities have complete discretion over the use of certain funds. For example, cities have complete control on how they use the share of their fine and fee revenue that is deposited into their General Funds and are not required to report to the Legislature on how such monies are used. As a result, the Legislature maintains limited control over a significant portion of fine and fee revenues.

Revenue Distributions Generally Not Based on Need

By locking in funding formulas in statute, the existing system preserves the level of funding deemed appropriate when the formulas were established. On the one hand, this can result in some programs receiving more funding than necessary to fulfill their statutory requirements. For example, in some years, the Restitution Fund, the primary funding source for the Victim Compensation and Government Claims Board, received more fine and fee revenue than the board needed to make payments to eligible crime victims. This resulted in the Restitution Fund having an annual balance of over $100 million in unused funds from 2005–06 through 2007–08.

On the other hand, the distribution formulas can result in some programs receiving insufficient funding to fulfill their statutory requirements. For example, over the past decade, the existing formula allocating a specific percentage of SPF fine and fee revenue to the Peace Officers’ Training Fund—which supports the Commission on Peace Officer Standards and Training (POST)—has resulted in POST not having sufficient funding to maintain the level of training services previously provided, particularly when there has been a change in the amount of revenue collected. Given this shortfall, the Legislature chose to redirect $14 million annually during this time period from another SPF fund to support POST, as well as provide a one–time $3.2 million General Fund appropriation in 2014–15. The Legislature also approved an 18–month traffic amnesty program as part of the 2015–16 budget and directed that a portion of the additional revenues resulting from the program support POST in the short run. We would note that there are a number of other funds supported by fine and fee revenue that are also nearing or currently experiencing operational shortfalls.

Difficult to Distribute Revenue Accurately

The numerous statutory requirements governing the distribution of fine and fee revenue can also make it difficult for individual courts and counties to track, distribute, and report such revenue accurately and consistently. This is because every charge has its own distribution requirement which can vary based on other factors (such as where the offense occurred). This challenge is further complicated by additional statutory requirements related to how partial and installment payments are to be credited against various charges. This can result in payments for the same type of violation being distributed in different ways. Although some courts and counties have automated computer programs to assist them with this task, these automated programs can sometimes be difficult to correctly program. Other courts and counties do not have such programs and thus still make these calculations manually.

While courts and counties can be fined by the state for certain errors in their distribution of fine and fee revenue, unintentional errors still occur. Because of the numerous and overlapping distribution requirements specified in statute, a distribution error can sometimes impact over 20 state and local funds. This is particularly the case where certain funds receive funding after a portion of the revenue is allocated to a different fund. Since errors may not be corrected for several years, it can result in the misallocation of significant sums of money. Distribution errors are regularly found by the SCO, which is authorized to review whether criminal fines and fees have been deposited accurately and in a timely manner. In reviews conducted from 2006 through 2014, the SCO identified $63 million in errors made between 1998–99 and 2012–13. (We would note that the number of reviews conducted—and the fiscal years examined—in a given year varies by county and court.) Of this amount, about $48 million was related to instances where counties did not remit sufficient revenue to the state. We note that the total value of errors made between 1998–99 and 2012–13 is likely higher than $63 million because the SCO audits we examined did not evaluate all distributions occurring over this time period. While the SCO has found that counties and courts generally resolve the cause of most distribution errors identified in its reviews, it frequently finds new errors in subsequent reviews.

Lack of Complete and Accurate Data on Collections and Distributions

Although SCO and the judicial branch both collect information on the collection and distribution of fines and fees, each of the various records they maintain omit pieces of data. This is primarily because such data is often not required to be collected. For example, while counties transmit fine and fee revenue and information on how the revenue should be distributed among state funds to SCO, the SCO does not receive—and thus does not record—the amount kept by counties or cities. Additionally, the judicial branch is only required by state law to report on the amount of delinquent payments collected by collection programs and thus does not always record and report information on non–delinquent payments. Although the judicial branch informally tracks some distribution data, it is not required to do so under state law. In view of the above, the state currently lacks complete data on both the collection and distribution of fine and fee revenue.

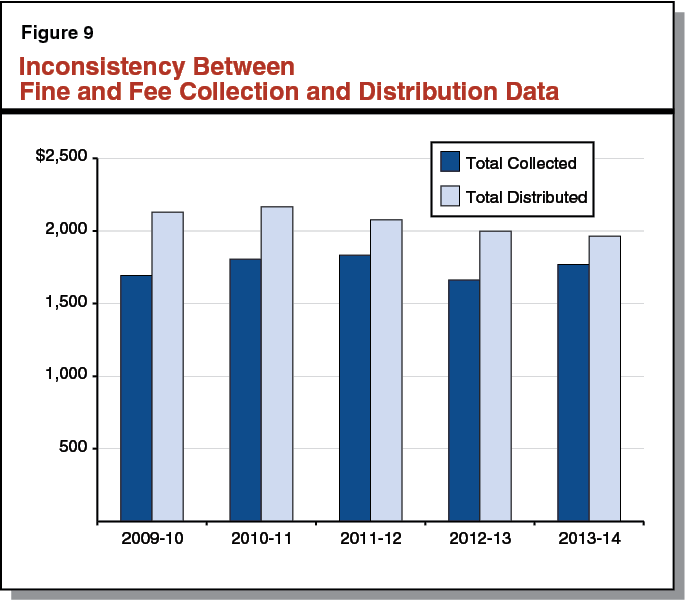

Compounding the problem regarding the lack of collections and distributions data, it appears that there are inconsistencies (1) between similar pieces of data collected by the SCO and the judicial branch and (2) in how collection programs report data. For example, as shown in Figure 9, SCO and judicial branch reports on collections and distributions are inconsistent, as they report a greater amount being distributed than collected. From our attempts to reconcile the data, it appears that programs may differ in what charges and distributions they classify as criminal fines and fees as well as how they report such information—impacting both the collections and distributions data. In addition, it appears that part of the difference is also attributable to data that is missing from collections reports. Without complete, consistent, and accurate data, it is difficult for the Legislature to conduct fiscal oversight to ensure that funds are being allocated accurately and used in accordance with its priorities and state law. It also makes it difficult for the Legislature to determine the impacts of enacted or proposed changes to fines and fees, which further limits the ability of the Legislature to effectively oversee the current system and programs supported by it.

LAO Recommendations

In this report, we reviewed California’s existing fine and fee system and identified several problems. To address these problems, we provide several recommendations to overhaul and improve the fine and fee system. First, we recommend reevaluating the overall structure of the fine and fee system to ensure the system meets legislative goals. Second, we recommend increasing legislative control over the use of criminal fine and fee revenue to ensure that its uses are in line with legislative priorities. Figure 10 provides a summary of our recommendations, which are discussed in greater detail below.

Figure 10

Summary of LAO Recommendations

|

|

|

|

|

|

Reevaluate Structure of Criminal Fine and Fee System

As discussed earlier, the state’s current fine and fee system has evolved from statutes passed over the course of numerous years. In order to ensure that the system effectively meets current legislative goals and priorities, we recommend that the Legislature reevaluate the overall structure of the system. As part of this evaluation, we recommend the Legislature consider the following key questions in its deliberations to guide any subsequent changes to the state’s fine and fee system.

What Should Be the Goals of the Criminal Fine and Fee System? A fine and fee system can serve various purposes:

- Deterrence. Fines and fees are used to deter criminal activity in several ways. First, they can be set to ensure that the fines and fees for committing an illegal act are greater than the benefit that individuals can obtain from the act—making it less likely that individuals commit the illegal activity. Deterrence can also be achieved by setting fines and fees high enough to result in a hardship that individuals will seek to avoid. Lastly, the effective enforcement of law and collection of fines and fees could deter criminal activity. This is because the more likely it is that offenders are caught and required to pay, the less likely it is that they would violate the law in the future.

- Proportional Punishment. Fines and fees can be used to provide a punishment that is proportional to the seriousness of a crime committed by an offender. This also conveys the seriousness of the offense. To achieve proportional punishment, fines and fees must be large enough to represent a reasonable hardship for offenders to ensure that they constitute a punishment. While the determination of whether the fines and fees for a particular offense are proportional and reasonable is subjective, it can be guided by information on how the requirement to pay affects offenders.

- Mitigating Effects of Crime. Another goal could be to generate sufficient revenue to help mitigate the negative effects of crime. For example, the state’s current system often requires offenders to compensate their victims for certain losses through restitution orders. The state’s system could be modified to offset other costs as well. For example, revenue could be used to offset costs imposed on the state and local governments by criminal activity, such as by providing funds for the enforcement of specific laws. To achieve this goal, it is necessary to collect information on the costs created by a criminal act and ensure that some portion of each offender’s payment is used to offset those costs.

In general, the above goals are not mutually exclusive—meaning a fine and fee system can seek to achieve more than one of the goals. For example, fines and fees could be set sufficiently high to deter criminal activity with the resulting revenue used to offset the negative effects of criminal activity. However, in certain circumstances, some of the goals cannot be fully accomplished together. For example, requiring a payment that is high enough to generate sufficient revenue to fully offset all negative effects of a crime may result in a punishment that the Legislature views as disproportionate. Accordingly, the Legislature may need to determine which of its goals it values most when assessing the state’s fine and fee system.

Should Ability to Pay Be Incorporated? The Legislature may also want to consider whether an individual’s ability to pay should be incorporated into its fine and fee system. California has historically incorporated ability to pay by authorizing judges to waive or reduce certain fines and fees under certain circumstances. To the extent the Legislature is interested in incorporating ability to pay, there are various ways it can do so. We would note, however, that some of these options would entail one–time or ongoing administrative costs.

- Calculate Fines Based on Ability to Pay. One option is to calculate fines and fees in ways that reflect an individual’s ability to pay. For example, the Legislature could consider a day fine system in which the total amount owed is calculated based on an offender’s daily income. Under such a system, a low–income earning offender and a high–income earning offender would pay the same percentage of their income as punishment for their offense. However, the total amount each pays would differ substantially. Alternatively, the total amount owed for each offense can have a statutory maximum and be adjusted downward based on an offender’s income, either automatically or through judicial discretion. This is similar to the state’s current system in which judges are given discretion to waive certain fines and fees.

- Implement Alternative Methods for Addressing Debt. Another option is offering alternative methods for individuals to address their debt. For example, the Legislature could require collection programs to adjust their installment payment plans to make payment easier for low–income individuals. Currently, programs vary in how they determine appropriate installment payment amounts. The Legislature could set guidelines for how programs should calculate installment payments, such as by specifying how to calculate discretionary income (such as which household expenses could be deducted) in establishing installment payments or by setting limits on how much of an individual’s income may be taken to address fine and fee obligations in a given month. The Legislature could also expand the use of alternative methods to satisfy fines and fees, such as by allowing offenders to completely address their debt through community service (which is currently not allowed).

What Should Be the Consequences for Failing to Pay? The Legislature will want to consider what consequences individuals should face when they fail to pay their fines and fees. Statute currently authorizes the use of certain consequences, including civil sanctions for failures to pay. The Legislature will want to consider whether to authorize additional sanctions and/or continue or modify existing sanctions (such as wage garnishments, tax liens, or holds on drivers’ licenses). For example, under current law, collection programs can only direct the Department of Motor Vehicles to suspend the driver’s license of an offender who fails to pay once. Programs tend to leave these suspensions in place until an individual completes payment, as the program is unable to resuspend the license if the individual stops making payments on the debt in the future. This can significantly increase the amount of time that individuals’ licenses are suspended. Alternatively, the Legislature could authorize programs to impose a suspension more than once, in order to allow programs to lift a suspension as soon as a new payment agreement is reached. (This is already permitted in cases where individuals have their licenses suspended for failing to appear in court.) The Legislature could also take action to help prevent offenders from becoming delinquent. For example, the Legislature could authorize programs to offer an incentive (such as a discount) if offenders pay their debt in full within a certain period of time.

Should Fines and Fees Be Adjusted? Once the Legislature sets the appropriate fine level for criminal offenses, the Legislature will want to decide whether and how such fines are adjusted in the future. Under current law, fines and fees are set in statute and are only changed through the enactment of new statute. Such changes have generally involved increasing existing charges or adding new ones. The Legislature could require that the state regularly adjust fine and fee levels in the future to ensure that they are set at an appropriate level to accomplish its goals for the system. For example, the Legislature could choose to reevaluate levels every five or ten years. Alternatively, the Legislature could require the automatic adjustment of fines and fees, such as based on a statewide economic indicator. This could raise or lower fine levels to conform to movements in the state’s economy—including lowering fines when the state enters a recession.

Increase Legislative Control of Criminal Fine and Fee Expenditures

Deposit Most Criminal Fine and Fee Revenue in the General Fund. We recommend that the Legislature require that nearly all fine and fee revenue (including such revenue currently distributed to local government) be deposited into the state General Fund for subsequent appropriation by the Legislature in the annual state budget. (We would note that this action would not impact the Proposition 98 guarantee because fines and fees are not tax revenues.) Depositing all fine and fee revenue in the General Fund would allow the Legislature to ensure that annual funding for state and local programs is based on workload and its priorities, rather than on the amount of revenue generated by the fine and fee system. Moreover, an annual review of programmatic funding levels would facilitate periodic reviews of programs to help ensure that they are operating effectively and efficiently. In addition, any fluctuations in the collection of fine and fee revenue would no longer disproportionately impact programs supported by fines and fees. Instead, fluctuations in revenue would be addressed at a statewide level across other state programs—ensuring that adjustments in funding levels were based on statewide legislative priorities.

Based on our assessment of existing criminal fines and fees, we recommend excluding two types of fines and fees from being deposited to the General Fund—fish and game assessments and victim restitution orders. This is primarily due to certain legal restrictions regarding these particular fines and fees. For example, the State Constitution requires that money collected under any state law related to the protection or propagation of fish and game be used for related activities. Victim restitution orders for damages should also continue to be paid directly to victims as these are charges set by the court to compensate individual victims for losses they incurred.

In addition, we note that the Legislature would need to account for certain legal requirements and ongoing commitments previously made from fine and fee revenue. First, Proposition 69 (2004) established a DNA assessment of $1 for every $10 portion of the base fine for criminal offenses. The Legislature would want to ensure that the programs supported by this assessment continue to receive at least the same level of funding they would have under the current system, in order to meet the requirements of Proposition 69. Second, the state and local governments have committed some of their fine and fee revenue to support long–term, contractual expenditures. For example, the State Trial Court Construction Fund and the local Criminal Justice Facilities Construction Funds commit monies for decades to make debt service payments to repay bonds sold to finance construction. The Legislature would need to ensure that revenue is available to meet such obligations in order to avoid litigation or punitive actions.

Depositing nearly all fine and fee revenue into the General Fund could also increase public confidence in the system. Currently, some members of the public distrust the existing system as they believe that various state and local entities, such as law enforcement and trial courts, directly benefit from each citation that is issued. Our recommendation could minimize this perception as the Legislature would be responsible for allocating all of the revenue based on its General Fund priorities.

Consolidate Most Fines and Fees. We also recommend the Legislature consolidate most fines and fees into a single, statewide charge and eliminate the ability of trial courts and local governments to charge additional fines and fees. (Based on our above recommendation, fish and game assessments, as well as victim restitution orders, would continue to be imposed separately.) Such consolidation would eliminate the need for the existing complex distribution model and make it easier for counties and courts to track such revenue—thereby improving the accuracy and completeness of collection data.

Simplifying the calculation of fines and fees could also generate greater public confidence in the system. Currently, individuals are often confused about how the total amount they must pay can increase so significantly from the initial base fine or why it can vary by county. This often results in individuals viewing the existing fine and fee system as unfair and overly punitive, which can sometimes result in a reluctance to pay. Simplifying the calculation of fines and fees can increase transparency by providing offenders with a clearer idea of their punishment.

Evaluate Existing Programs Supported by Criminal Fine and Fee Revenues. If the Legislature adopted our recommendation to deposit fine and fee revenue to the General Fund, it would need to determine the appropriate level of funding (if any) for the various programs currently supported by fine and fee revenue. In making these funding decisions, the Legislature might first want to consider whether an individual program should be a state responsibility, as well as how it compares to other statewide budgetary priorities.

To assist in its budget deliberations, the Legislature would need to acquire information on how fine and fee revenues are currently being used, such as by requiring state and local programs to submit reports on current expenditures or conducting hearings with various stakeholders. In addition, the Legislature would need to define its expectations on program service levels and determine the funding needed to meet those expectations. For example, the Legislature could direct programs to develop workload or staffing ratios to establish program funding needs. The Legislature could use this information to evaluate the need and cost–effectiveness of each program relative to all other programs currently supported by the General Fund. This would help ensure that programs that the Legislature prioritizes most receive an appropriate amount of funding, rather than whatever amount happens to be generated by fines and fees. However, we recognize that the above process would take time to complete, as most programs currently have limited data on program outcomes and expenditures. Accordingly, the Legislature could choose to gradually implement changes to the level of funding provided to various state and local programs as it receives such information.

Mitigate Impacts on Local Government. As discussed previously, local governments currently receive about 40 percent of criminal fine and fee revenue—about $820 million in 2013–14—for a variety of purposes. Under our recommended approach, such fine and fee revenue would instead be deposited in the state General Fund. As part of any restructuring of fine and fee revenues, we recommend that the Legislature mitigate the fiscal impact this would have on local governments. For example, one promising mechanism available to the Legislature for mitigating the impact on many counties is through reducing or eliminating the MOEs they are currently required to pay to the state related to trial court operations. As discussed previously, counties currently remit about $660 million annually to the state to meet these obligations. In 2013–14, counties received $657 million in fine and fee revenue—nearly the same amount owed to the state. We note that since the MOEs were first established in 1997–98, the state has taken actions to change MOE obligations for trial court operations—reducing the required payments from nearly $1.2 billion to about $660 million (a decrease of nearly 45 percent). This reduction included eliminating a portion of the MOE obligation entirely for 38 counties.

The Legislature could also consider taking other mitigating actions for counties and cities. For example, given that some fine and fee revenue distributed to local government has been used to meet ongoing obligations (such as facility debt service), the Legislature could gradually implement any changes in funding provided to local governments. This would give local governments time to fully address any ongoing obligations that are currently being paid for with fine and fee revenue. It would also provide local governments time to restructure or eliminate programs currently supported by fine and fee revenue.

Implementing Changes to the Fine and Fee System

As the Legislature considers making changes to the fine and fee system, it may also want to consider making comprehensive changes across the entire system—balancing changes to fine and fee levels, enforcement, collection, and distribution. Depending on the Legislature’s goal for the state’s fine and fee system, the Legislature may ultimately make changes—such as lowering fine and fee levels—that could result in a decline in revenue to state and local programs. To mitigate such revenue losses, the Legislature could make improvements to the collection process—such as those contained in our November 2014 report—in order to help increase the amount of fine and fee revenue ultimately collected. (Please see the nearby box for a summary of the findings and recommendations made in our November 2014 report on restructuring the court–ordered debt collection process.) This would increase the amount available for distribution, helping to mitigate any potential loss of fine and fee revenue. Additionally, after evaluating programs currently supported by fine and fee revenue, the Legislature could decide that certain programs currently receiving funding are not legislative priorities or make changes to programs so that they operate more cost–effectively. Redirecting the resulting funds freed up by such changes could also help mitigate the impact of a potential loss of fine and fee revenue on state and local programs.

Restructuring the Court–Ordered Debt Collection Process

Our November 2014 report, Restructuring the Court–Ordered Debt Collection Process, identified a number of weakness with the current court–ordered debt collection process. First, there is a lack of clear fiscal incentives for collection programs to collect debt in a cost–effective manner or to maximize the total amount of debt they collect. For example, there is almost no direct relationship between a program’s collection effort and the revenue that accrues to it. Second, we found that it is difficult to comprehensively evaluate and compare the performance of existing collection programs due to a lack of complete, consistent, and accurate reporting on how programs collect debt. Finally, we found that the current statutory division of responsibilities between counties and courts can undermine the oversight and modification of collection programs—thereby making it difficult to make improvements.

In view of these weaknesses, we recommended a series of improvements to the collection process. First, we recommend that the Legislature shift statutory responsibility for debt collection to the trial courts and pilot a new collections incentive model. This restructured process would: (1) consolidate responsibility with the entity best suited for managing collections, (2) provide courts with greater flexibility in how and when they collect debt, and (3) reward courts for collecting cost–effectively or increasing the total amount collected. Second, we recommend improving data collection and measurements of performance to enable a comprehensive evaluation of court–ordered debt collections. In combination, we believe these recommendations would improve the efficiency of debt collection and increase the total amount of debt revenue collected and distributed to state and local funds. We note that these recommendations related to the collection process complement the recommended changes in this report regarding the overall criminal fine and fee system.

Appendix

Summary of Fine and Fee Revenue Deposits in State and Local Fundsa

(In Millions)

|

2009–10 |

2010–11 |

2011–12 |

2012–13 |

2013–14 |

|

|

State Administered Funds (Non Judicial Branch) |

|||||

|

State Penalty Fundb |

$161.2 |

$153.4 |

$138.4 |

$130.5 |

$124.4 |

|

General Fund |

80.7 |

87.8 |

75.0 |

69.1 |

73.0 |

|

DNA Identification Fund |

27.6 |

40.7 |

53.9 |

62.8 |

67.9 |

|

Motor Vehicle Account |

36.1 |

41.3 |

42.3 |

48.3 |

53.5 |

|

Restitution Fund |

59.8 |

60.8 |

56.4 |

54.9 |

52.7 |

|

EMAT Act Fund |

— |

0.7 |

11.7 |

10.2 |

10.2 |

|

Fish and Game Preservation Fund |

0.5 |

0.6 |

0.3 |

0.5 |

0.5 |

|

Other Funds |

1.7 |

1.4 |

1.2 |

1.0 |

1.1 |

|

Totals |

$367.7 |

$386.6 |

$379.3 |

$377.4 |

$383.3 |

|

State Administered Funds (Judicial Branch) |

|||||

|

Trial Court Trust Fund |

$253.2 |

$269.3 |

$310.6 |

$302.2 |

$302.1 |

|

Immediate and Critical Needs Account |

247.3 |

263.5 |

241.5 |

224.4 |

217.5 |

|

State Court Facilities Construction Fund |

99.1 |

91.6 |

84.3 |

76.5 |

74.0 |

|

Trial Court Improvement and Modernization Fund |

75.5 |

67.1 |

61.8 |

58.3 |

48.2 |

|

Court Facilities Trust Fund |

2.1 |

1.9 |

1.7 |

5.7 |

2.3 |

|

Totals |

$677.2 |

$720.4 |

$700.1 |

$667.2 |

$644.1 |

|

Local Government Administered Funds (County) |

|||||

|

General Fund |

$466.9 |

$460.3 |

$431.7 |

$415.5 |

$415.9 |

|

Maddy EMS Fund |

93.3 |

92.2 |

85.0 |

81.0 |

86.1 |

|

Criminal Justice Facilities Fund |

84.4 |

79.2 |

71.7 |

65.3 |

52.1 |

|

Courthouse Construction Fund |

51.4 |

47.3 |

43.1 |

40.5 |

39.0 |

|

DNA Identification Fund |

25.3 |

29.4 |

28.9 |

28.0 |

27.5 |

|

Alcohol and Drug Related Special Funds (various) |

12.2 |

12.6 |

12.6 |

12.2 |

11.3 |

|

Automated Fingerprint Identification Fund and Digital Image Photographic Suspect Identification Fund |

9.7 |

9.2 |

9.3 |

8.3 |

8.1 |

|

Laboratory Special Funds (various) |

7.7 |

7.7 |

7.5 |

7.2 |

6.8 |

|

Other Funds |

13.4 |

9.6 |

10.2 |

10.0 |

10.0 |

|

Totals |

$764.4 |

$747.4 |

$700.0 |

$668.0 |

$656.8 |

|

Local Government Administered Funds (City) |

|||||

|

General Fund |

$214.3 |

$196.7 |

$178.1 |

$170.7 |

$165.4 |

|

Totals |

$214.3 |

$196.7 |

$178.1 |

$170.7 |

$165.4 |

|

Collection Programs |

|||||

|

Operating Costs |

$104.8 |

$114.9 |

$120.2 |

$114.5 |

$113.6 |

|

Totals |

$104.8 |

$114.9 |

$120.2 |

$114.5 |

$113.6 |

|

Total Amount Distributed |

$2,128.4 |

$2,166.0 |

$2,077.6 |

$1,997.8 |

$1,963.2 |

|

aDue to certain data limitations, these numbers reflect our best estimate of the amount of fine and fee revenue distributed to state and local funds. Actual amounts could be higher or lower. bState Penalty Fund revenues are allocated to nine other state funds (such as the Peace Officers’ Training Fund and the Restitution Fund) with each receiving a certain percentage specified in state law. EMS = Emergency Medical Services and EMAT = Emergency Medical Air Transportation. |

|||||