March 4, 2016

The 2016-17 Budget

Analysis of the Department of Developmental Services Budget

Executive Summary

Overview of Developmental Services Budget. The Governor’s budget proposes about $6.4 billion (all funds) for Department of Developmental Services (DDS) programs in 2016–17—a 6.7 percent net increase over estimated expenditures in 2015–16. General Fund expenditures for 2016–17 are proposed at $3.8 billion, a net increase of $265 million, or 7.5 percent, over estimated expenditures in 2015–16. The net increase in total expenditures reflects year–over–year increases in the budget for the Community Services Program (including several significant new policy proposals) and transition costs for Developmental Center (DC) closures, partially offset by decreasing costs in the DC Program budget due to declining caseload.

Governor’s Proposals Should Be Considered in Context of Recent Special Session Actions. On February 29, 2016, the Legislature enacted, and the Governor later signed, a package of ongoing spending proposals in AB2X 1 (Thurmond) that directly appropriates $287 million General Fund for various increases to Regional Centers (RCs) and community services providers in 2016–17 and leverages related federal funding. In light of these actions recently taken, the Legislature will need to consider the Governor’s proposed budget in this context. Ideally, spending increases should be targeted to areas with the greatest service challenges and the Legislature’s special session actions seek to do this in many ways.

Additional Community Services Funding Related to DC Closures Warranted. In May 2015, the Governor proposed to initiate the closure planning process for the remaining DCs, with the goals of closing Sonoma DC by the end of 2018, and Fairview DC and the general treatment area at Porterville DC by the end of 2021. The Governor’s January budget proposal includes additional funding to support accelerated community services development and placements in response to these planned closures. We find the Governor’s proposal would move the state forward on the path towards timely closures, ensuring successful transitions, and maintaining federal funding at the DCs as residents transition out. While we support additional targeted funding for this purpose, we make recommendations for legislative consideration to improve transparency and monitoring of the Community Placement Plan (CPP) program.

Targeted Funding for Certain Residential Facilities and RC Case Managers Makes Sense. The Governor’s 2016–17 budget proposal includes targeted funding to support the development and implementation of a new rate for certain residential facilities, as well as funding for RCs to provide for additional case managers to improve compliance with statutorily required service coordinator–to–consumer ratios. We find these proposals have significant merit, would support compliance with federal requirements, and would likely have positive impacts on residential capacity as well as the quality of case management services. We generally recommend approval of these proposals, pending additional information from the administration related to implementation and other issues.

Governor’s Budget Proposal Makes Important Steps Towards Compliance With New Federal Home– and Community–Based Services (HCBS) Regulations, but Uncertainty Remains. The Governor’s budget includes several proposals to support initial compliance efforts related to new federal HCBS regulations that became effective March 2014. In order to maintain significant federal funding, HCBS programs must be in compliance with the new rules by March 2019. While the Governor’s proposal is a critical next step towards compliance, we find that understanding of what compliance means for providers and the state—programmatically and fiscally—is still developing. We also find that implementation details for the Governor’s proposal are unclear and that the level of resources needed to meet full compliance with the new rules by March 2019 is uncertain and likely to change. Given these uncertainties, we recommend the Legislature use budget deliberations to gain additional clarity on HCBS compliance efforts and key aspects of the Governor’s proposal and suggest some key issues and questions for legislative consideration.

Substantial Continued Community Services Program Growth Makes Meaningful Financing Reform Critical. As the community services system continues to grow, meaningful restructuring of the community services financing methodologies is critical to ensure cost–efficient and effective program operations. We find that, overall, the community services financing structures have not fundamentally changed in several decades and therefore have not kept pace with the changing business environment in the delivery of services. Generally, spending changes over the past several decades have been made in response to some improvement or deterioration of the state’s financial condition, without systematic and strategic consideration of the state’s goals as a purchaser of these services or with regard to outcomes for consumers and performance of the system at large. The Governor’s January budget, along with recent special session actions, would make some headway towards community services financing restructuring. However, we find that more can be done to help ensure meaningful financing reform is ultimately achieved and therefore make recommendations for legislative consideration on related next steps. Specifically, we recommend the Legislature require the administration to: (1) report at budget hearings on next steps and vision for reforming provider rates and RC operations funding and (2) develop a strategic plan for financing reform.

Background

Overview of DDS. The Lanterman Developmental Disabilities Services Act of 1969 (known as the Lanterman Act) forms the basis of the state’s commitment to provide individuals with developmental disabilities a variety of services and supports, which are overseen by DDS. The Lanterman Act defines a developmental disability as a “substantial disability” that starts before age 18 and is expected to continue indefinitely. The developmental disabilities for which an individual may be eligible to receive services under the Lanterman Act include: cerebral palsy, epilepsy, autism, intellectual disabilities, and other conditions closely related to intellectual disabilities that require similar treatment (such as a traumatic brain injury). The department works to ensure that individuals with developmental disabilities over the age of three have access to services and supports that sufficiently meet their needs, preferences, and goals in the least restrictive setting. For children under the age of three with a developmental disability or delay(s), the department administers early intervention services through the Early Start program. Unlike most other public human services or health services programs, services for the developmentally disabled are generally provided without any requirements that recipients demonstrate that they or their families do not have the financial means to pay for the services themselves. The department administers two main programs, described in detail below.

Community Services Program. Community–based services are coordinated through 21 nonprofit organizations known as RCs, which assess eligibility and—through an interdisciplinary team—develop individual program plans (IPPs) for eligible consumers. The DDS provides RCs with an operations budget in order to conduct these activities. The department also provides RCs with a budget to purchase services from vendors for an estimated 290,496 consumers in 2015–16. These services and supports can include housing, activity and employment programs, in–home care, transportation, and other support services that assist individuals to live in the community. The RCs purchase more than 150 different services on behalf of consumers. As the payer of last resort, RCs generally only pay for services if an individual does not have private health insurance or if the RC cannot refer an individual to so–called “generic” services such as (1) other state–administered health and human services programs for low–income persons or (2) services that are generally provided at the local level by counties, cities, school districts, or other agencies. We note that the majority of consumers receiving services through the Community Services Program are enrolled in Medi–Cal, California’s federal–state Medicaid health program for low–income individuals. (For a description of the Medi–Cal program, please refer to our report, The 2016–17 Budget: Analysis of the Medi–Cal Budget.)

More than 99 percent of DDS consumers receive services under the Community Services Program. These consumers live in the community with their parents or other relatives, in their own houses or apartments, or in residential facilities or group homes designed to meet their needs. Less than 1 percent of DDS consumers live in state–operated institutions known as DCs, discussed below.

DCs Program. The DDS operates three 24–hour facilities known as DCs—Fairview DC in Orange County, Porterville DC in Tulare County, and Sonoma DC in Sonoma County—and one smaller leased community facility (Canyon Springs in Riverside County). Together, these facilities provide care and supervision to approximately 1,000 consumers in 2015–16. Each DC is licensed by the Department of Public Health (DPH), and certified by DPH on behalf of the federal Centers for Medicare and Medicaid Services (CMS), as skilled nursing facilities, intermediate care facilities for the developmentally disabled (ICF–DDs), and general acute care hospitals.

The DCs are licensed and certified to provide a broad array of services based on each resident’s IPP, such as nursing services, assistance with activities of daily living, specialized rehabilitative services, individualized dietary services, and vocational or other day programs outside of the residential unit. The DCs must be certified in order to receive federal Medicaid funding, and the vast majority of DC residents are enrolled in Medi–Cal. Generally, for these Medi–Cal enrollees, the state bears roughly half the costs of their care and the federal government bears the remainder. Over the past 15 years, oversight entities—such as DPH, CMS, and the United States Department of Justice—have repeatedly identified problems at the DCs, including inadequate care, insufficient staffing, and inadequate reporting and investigation of instances of abuse and neglect. (For more background on the history of problems identified at DCs, please refer to the “Department of Developmental Services” section in our report, The 2013–14 Budget: Analysis of the Health and Human Services Budget.)

Closure Plans for Remaining DCs. In May 2015, the administration announced plans to initiate and develop closure plans for the state’s remaining DCs, except for the secure treatment program at Porterville DC and the Canyon Springs facility. The Governor’s plan is to have the last closure completed by 2021. The 2015–16 spending plan reflects the Legislature’s approval of the Governor’s intent in concept. On October 1, 2015, DDS submitted to the Legislature a plan to close Sonoma DC by the end of 2018. Specific closure plans for Fairview DC and the general treatment area at Porterville DC are expected by April 2016.

Back to the TopThe Governor’s Budget Proposal

Overall Budget Proposal. The budget proposes about $6.4 billion (all funds) for DDS in 2016–17, which is a 6.7 percent net increase over estimated expenditures in 2015–16. General Fund expenditures for 2016–17 are proposed at $3.8 billion, a net increase of $265 million, or 7.5 percent, over estimated expenditures in 2015–16. This net increase in total expenditures reflects year–over–year increases in the budget for the Community Services Program, including several new policy proposals discussed below as well as transition costs for DC closures, partially offset by decreasing costs in the DCs Program budget due to declining caseload.

Community Services Program Budget Summary

The budget proposes $5.8 billion from all funds for support of the Community Services Program in 2016–17, which is a 8.2 percent net increase over estimated expenditures in 2015–16. Of the total, $663.5 million is proposed for RC operations expenditures and the remainder of $5.1 billion is for the purchase of services from RC vendors. General Fund expenditures are proposed at $3.4 billion, a net increase of $298 million, or 9.5 percent, above estimated expenditures in 2015–16. The net increase in total and General Fund spending is a result of caseload growth and utilization changes as well as several other policy–driven program changes discussed below. The community services budget plan includes the following major budget adjustments and policy proposals:

- Caseload Growth and Utilization Changes. Increase of $235 million ($149.2 million General Fund) due to caseload growth (about 4 percent) and utilization changes compared to the enacted 2015–16 budget. The growth in purchase of services is primarily within the day programs, in–home respite, health care, support services, and miscellaneous budget categories.

- Rate Increase for Certain Residential Facilities. Increase of $46 million ($26 million General Fund) to develop and implement a new rate for certain residential facilities serving four or fewer individuals based on a four–bed model.

- Additional Community Services Development Funds for Individuals Moving From DCs. Increase of $78.8 million ($73.9 million General Fund) in one–time resources for service development and placement, such as specialized residential facilities, targeted for individuals transitioning to the community from DCs proposed for closure.

- Funding to Begin Compliance Efforts With New Federal Regulations. Increase of $16.6 million ($11.9 million General Fund) to support compliance with new federal requirements related to Medicaid–funded community–based services, including funding for 21 Program Evaluator positions within the RCs and resources for providers to make program modifications.

- Funds to Support RC Caseload–Ratio Improvements. Increase of $17 million ($13 million General Fund) to support about 200 additional RC Service Coordinator positions to lower the caseload for case managers employed by the RCs.

- Continued Implementation of Prior–Year Policy Changes. Increase of $49.7 million ($27 million General Fund) to reflect the annualized cost of state hourly minimum wage increases and federal labor regulations, slightly offset by savings in the DDS budget due to implementation of Behavioral Health Treatment (BHT) by the Department of Health Care Services (DHCS) for new BHT–related caseload. (We note that at this time, the DDS budget does not yet reflect savings related to existing RC consumers receiving BHT services covered through RC–vendored providers. These individuals will begin a phased transition to DHCS–covered BHT services on February 1, 2016, and we expect the Governor’s May Revision to reflect the savings in the DDS budget and the new costs in the DHCS budget.)

DCs Program Budget Summary

The budget proposes $526 million from all fund sources for the support of DCs in 2016–17, which is an 8.4 percent net decrease below estimated expenditures in 2015–16. General Fund expenditures for 2016–17 are proposed at $308 million, a net decrease of $41.3 million, or 11.8 percent, below estimated expenditures in 2015–16. The DC budget plan includes the following major budget adjustments and proposals:

- Caseload Decline and Staffing Changes. The Governor’s budget plan proposes a net decrease of $8.8 million ($4.9 million General Fund decrease) compared to the enacted 2015–16 budget due to declining caseload and related staffing adjustments. These spending changes due to declining caseload are partially offset by required additional specialized support staffing related to maintaining federal certification requirements at Sonoma DC and DC closure activities.

- One–Time Funding for DC Audit Findings. The proposed budget includes $3.8 million General Fund in one–time funding related to audit findings of disallowed federal expenditures. (We note that the revised 2015–16 budget includes $42.5 million in one–time funds for this purpose.)

- Advanced Closure Costs for Sonoma DC. Increase of $1.3 million ($800,000 General Fund) for independent monitor contract resources as well as to begin preliminary closure activities at Sonoma DC, such as archiving historical and clinical records and relocating residents and their belongings to community settings.

- Workers’ Compensation Case Settlement Funding. Net decrease of $2.3 million ($1 million General Fund decrease) for settlement of remaining workers’ compensation claims. (The DDS requests total funding for this purpose of $15 million annually through 2021 when the last DC is planned for complete closure.)

- Porterville DC Fire Alarm and Personal Alarm Locating System. Increase of $8.3 million General Fund in one–time funding to replace the secure treatment area personal alarm locating system as well as for the construction phase to upgrade the fire alarm system at Porterville DC.

Headquarters Budget Proposal

The budget proposes $49.6 million ($32.6 million General Fund) for headquarters operations expenditures, which is a 7.8 percent increase above estimated expenditures in 2015–16. This increase is primarily to support 31 positions and contract resources for additional oversight of RCs, including for research and analytics, as well as for vendor audits, headquarters support to guide and oversee implementation of new federal HCBS regulations, and centralized support related to DC closures.

Back to the TopDC Closures and Related Funding

Introduction

In January 2014, the Task Force on the Future of the DCs convened by the administration released a plan for the long–term future of the DCs. The plan recognizes the need to reevaluate the role of DCs in light of the historical trend of individuals with developmental disabilities transitioning from institutional placements to community settings. The plan also recognizes the varying needs of existing DC residents and makes recommendations for improving community services and supports, while retaining state–operated facilities for individuals who are in acute crisis or involved in the criminal justice system. Consistent with the DC Task Force recommendations, the Governor proposed in May 2015 to initiate the closure planning process for the remaining DCs with the goals of closing Sonoma DC by the end of 2018, and Fairview DC and the general treatment area at Porterville DC by the end of 2021. The Governor requested, and the Legislature approved, initial resources to immediately begin the closure process at Sonoma DC with the statutorily required submission of a specific closure plan to the Legislature to come later. Budget–related legislation expanded the criteria for closure plans submitted to the Legislature for approval and required that closure plans for one or more of the DCs be submitted by October 1, 2015. The administration submitted its Sonoma DC closure plan on October 1, 2015.

In the analysis below, we describe the Governor’s major funding proposals related to the DC closures, including support for additional community services development specifically for individuals transitioning out of the DCs to the community (referred to as DC movers). We find that providing additional resources to accelerate the development of community services and placement for DC movers will move the state forward on the path towards timely closure, ensuring successful consumer transitions, and maintaining federal funding at the DCs as residents transition out. However, we make various suggestions to the Legislature to improve transparency and monitoring of these funds.

DC Population Continues to Decline

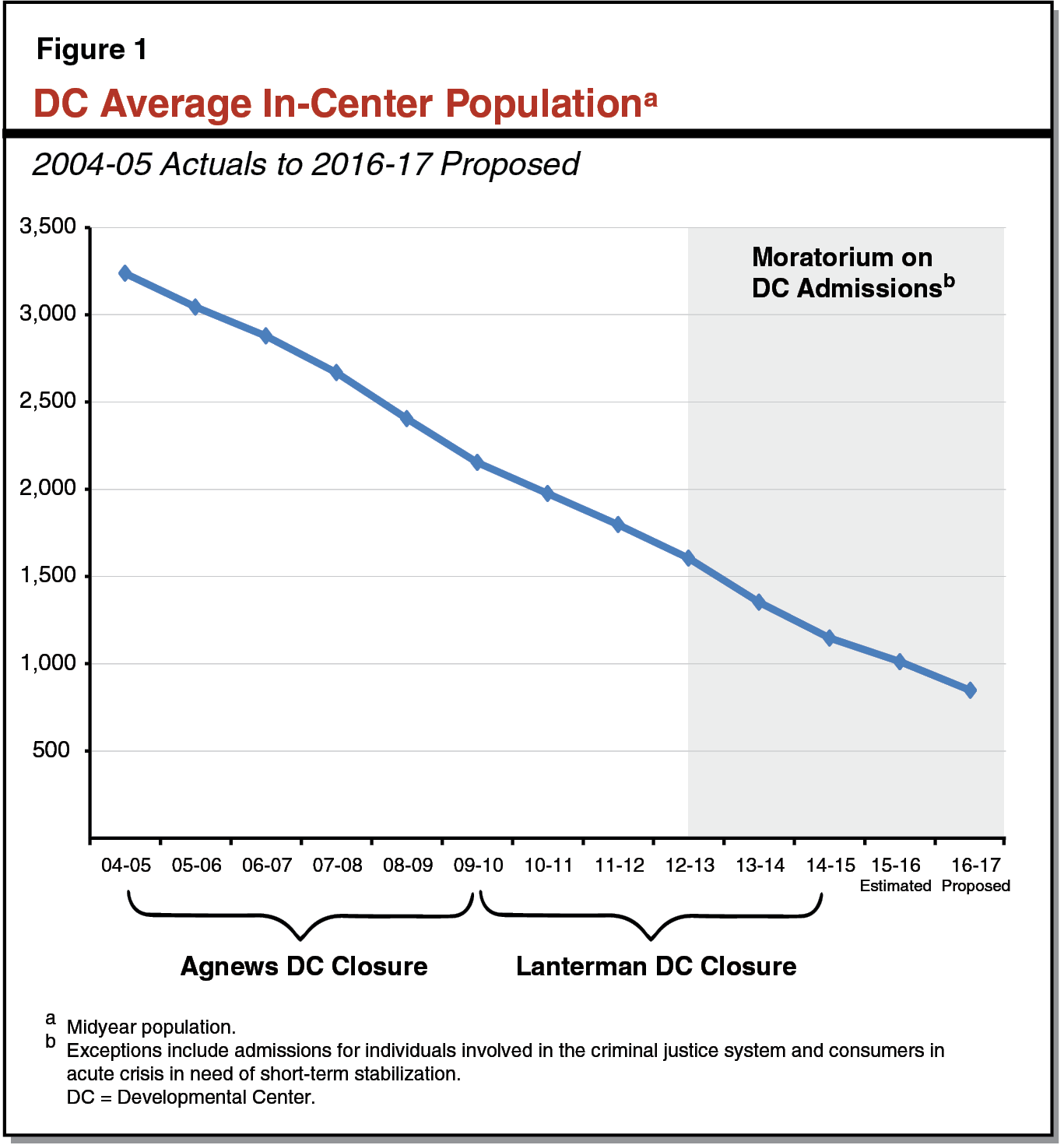

Between 2004–05 and 2015–16, the DC population has steadily declined from 2,668 to an estimated 1,011—an average annual reduction of about 10 percent—as shown in Figure 1. This decline is mostly attributable to the closure of Agnews and Lanterman DCs and the corresponding transition of DC consumers to community–based settings. In addition, a moratorium on most new admissions to DCs established in 2012–13 has contributed to this decline. (Exceptions to this moratorium are for individuals involved in the criminal justice system and consumers in acute crisis in need of short–term stabilization.) The Governor’s budget assumes that by the end of 2016–17, 747 individuals will be residing in the DCs. This assumes the placement of 240 individuals from the DCs into community–based settings in 2016–17.

State Takes Initial Steps Towards Closing Remaining DCs

Sonoma DC Closure Plan Submitted for Legislative Approval. On October 1, 2015, the administration submitted to the Legislature for approval a plan to begin the closure of Sonoma DC. The plan outlines various commitments regarding: (1) the provision of key specialized health services through the DC, such as dental and mental health, until such services are established in the community; development of community behavioral services; continued crisis services at Sonoma DC, as well as ongoing community oversight; (2) the expansion of the community state staff program (a program that allows DC staff to follow and support DC clients in their community placements) and commitment to explore incentives for employees to stay at Sonoma DC through the end of closure; and (3) working with the Sonoma community regarding disposition of the land as well as identifying potential options for the future use of the Sonoma campus.

Closure Plans for Other DCs Expected April 1, 2016. On November 30, 2015, DDS announced that closure plans for Fairview DC and the general treatment area at Portville DC would be submitted to the Legislature by April 1, 2016. As part of the initial stages of the closure process for these two DCs, DDS has begun soliciting stakeholder feedback and has held public hearings for both DCs as required prior to the submission of the closure plans.

Governor’s Budget Provides Additional Resources Related to DC Closures

Budget Assumes Continued Federal Funding Related to Federal Certification Requirements

Some Residential Units at DCs Found to Be Out of Compliance With Federal Certification Requirements. The DPH licenses health facilities and annually certifies them on behalf of CMS. Facilities must be certified in order to receive federal Medicaid funding. Since 2013, the three DCs—Fairview, Porterville, and Sonoma—have been found in surveys conducted by DPH to be out of compliance with federal certification requirements for ICF–DD residential units. The facilities were found to have some common deficiencies, including inconsistent treatment plans; residents who were not adequately protected from abuse or harm; and inconsistent implementation of policies generally related to residents’ health, safety, and rights.

Settlement Agreement Allows Federal Funding to Continue at Sonoma DC. Although decertification has the potential to result in lost federal funding, for most of the decertified units at the three DCs, the state has been able to maintain federal funding through various corrective actions. For Sonoma DC, effective June 30, 2015, the state successfully negotiated a settlement agreement with CMS to continue federal funding through June 2016 with the possibility of extension through June 2017, if certain requirements are met. Overall, the agreement reflects the state’s commitment to close Sonoma DC and move clients to appropriate community or other placements for current residents, with the highest priority being the health, safety, and successful transition of each client. The terms of the agreement require that Sonoma DC meet several requirements related to: client safety and health needs, active treatment, comprehensive assessments and needs identification, IPPs and transition plans, post–move monitoring, and quality assurance. For example, the settlement requires that DDS develop a plan to create additional community resources needed to meet clients’ needs as identified in their comprehensive assessments and transition plans. In addition, the agreement requires an independent monitor, which DDS has secured. The monitor conducts monthly reviews of conditions at Sonoma DC, with emphasis in specific areas such as treatment outcomes and client protections. The settlement also specifies that CMS may terminate the agreement at any time if, for example, CMS determines that Sonoma DC fails to substantially meet the terms and conditions of the settlement.

Federal Funding Could Be Lost Soon at Fairview and Porterville DCs. More recently, based on DPH surveys completed in July 2015, DPH notified DDS that all ICF–DD units at Fairview DC and all units at Porterville DC’s general treatment area were out of compliance and would lose federal funding effective December 2015. The DDS appealed this decision and federal funding has been extended through March 2016.

Governor’s Proposal. The Governor’s budget assumes federal funding related to Medi–Cal in 2016–17 for all three DCs (except for some residents generally related to the units not covered under the Sonoma settlement agreement). This means the administration assumes that Sonoma DC will meet the required milestones in the settlement agreement to allow for extension of the agreement, and therefore continued federal funding, for a second year through June 2017. For Fairview and Porterville DCs, the administration indicates it is in settlement negotiations with the federal government to reach an agreement similar to Sonoma DC and continue federal funding past March 2016. The Governor’s budget assumes the state will be successful in these settlement negotiations and therefore assumes $92.4 million in continued federal funding for all three DCs.

Additional Funding Targets DC Movers in Response to Planned Closures

Background. The DDS currently provides CPP funding to RCs to help build capacity of the community service delivery system specifically to move individuals out of or deflect individuals from being admitted to DCs, out–of–state placements, and certain mental health facilities ineligible for Medicaid federal funds because of their institutional setting. The RCs are in a key position to facilitate this process because of their community resource finding, service purchasing, and DC consumer case management responsibilities. In recent years, the DC budget has included a constant “base” amount of funding for this purpose of about $68 million total funds annually. Specific to the planned closure of Sonoma DC, the 2015–16 Budget Act provided $49.3 million ($46.9 million General Fund) in one–time additional funds to support the transition of individuals out of Sonoma DC. In total, this funding generally reflects the historical experience of community service placement costs derived from individualized assessments of DC movers, and includes the costs to perform these assessments, develop new or expand existing community services to facilitate the transitions to the community, and enhance case management of the DC movers.

Each year, DDS issues a request for proposals and related guidance to RCs regarding CPP funding requirements and generally begins reviewing RC proposals in the spring for funding that would be authorized the next fiscal year, subject to appropriation in the annual state budget act. For example, DDS will likely be reviewing RC CPP proposals for 2016–17 this spring and is currently finalizing related guidance. After DDS review, which includes consideration for RC circumstances and statewide priorities, the funding is allocated to RCs for approved projects. The DDS generally tracks use of placement funds and uses a database as part of the Statewide Specialized Resource Service (SSRS) to track capacity specific to CPP–developed resources. The RCs can contact DDS to help identify available CPP related community developments through the SSRS.

Governor’s Proposal. The Governor’s budget includes $78.8 million ($73.9 million General Fund) in additional one–time CPP resources to support accelerated transitions for individuals moving out of Sonoma, Fairview, and Porterville DCs related to planned closures. This is in addition to the historical $68 million in base CPP funding, for total CPP funding of $146.6 million ($122.9 million General Fund) in 2016–17. Of the additional amounts provided for the three DCs specific to closure, $58.2 million total funds is estimated for start–up purposes and about $15 million total funds would support the additional placement of 95 individuals moving out of these DCs in 2016–17 as shown in Figure 2.

Figure 2

Proposed 2016–17 CPP Funding and Placement Activity for DC Movers

Total Funds (In Millions)

|

CPP Activity |

CPP Expenditures |

Total Funds |

||

|

Sonoma DC |

Fairview DC |

Porterville DC |

||

|

RC operationsa |

$3.6 |

$1.2 |

$0.6 |

$5.4 |

|

Start–upb |

10.6 |

25.6 |

22.0 |

58.2 |

|

Placementc |

10.2 |

2.9 |

2.1 |

15.2 |

|

Total Additional CPP Tied to Closures |

$24.5 |

$29.7 |

$24.6 |

$78.8 |

|

Base CPP funding |

—d |

—d |

—d |

$67.9 |

|

Total CPP Funding |

—d |

—d |

—d |

$146.6 |

|

CPP Funding Type |

Community Placements |

Total Placements |

||

|

Sonoma DC |

Fairview DC |

Porterville DC |

||

|

Closure CPP |

54 |

24 |

17 |

95 |

|

Base CPP |

—d |

—d |

—d |

145 |

|

Total |

240 |

|||

|

aFunding supports RC staff to identify individuals for community placement, facilitate transitions, identify and develop new resources, provide enhanced case management through face–to–face visits, and other activities. bDevelopment of new facilities and programs or expansion of existing programs. cCost of consumers’ move into the community based on consumer specific information and needs from assessments. dInformation not included in budget estimate. CPP = Community Placement Plan; DC = Developmental Center; and RC = Regional Center. |

||||

LAO Assessment of Governor’s DC Closure–Related Proposals

While Governor’s Budget Assumes Retention of Federal Funding, Some Risk for General Fund Remains

We find that risk remains—at least to some degree—that federal funding may not continue at current levels for the three DCs in the near future. If the state is unsuccessful at extending the Sonoma settlement agreement for a second year and fails to reach a similar settlement agreement for Fairview and Porterville DCs, the state could be at risk of losing about $16.5 million in federal funds in 2015–16 and $92 million in 2016–17, as identified in Figure 3. Further, under the current terms of the Sonoma DC settlement agreement, federal funds would not continue beyond June 2017 and, therefore, the state would need to begin backfilling for the loss of federal funds with state General Fund to cover costs for the remaining residents from the end of the settlement term until the projected closure by the end of 2018. We note that the administration has reported that settlement discussions for Fairview and Porterville DCs are encouraging and an agreement is likely forthcoming.

Figure 3

Estimated Current Federal Funding at Risk Related to ICF–DD Deficiencies

(In Millions)

|

Developmental Center (DC) |

2015–16 |

2016–17 |

|

Fairview |

$8.1a |

$32.4b |

|

Porterville |

8.4a |

33.6b |

|

Sonoma |

—c |

26.4d |

|

Totals |

$16.5 |

$92.4 |

|

aAssumes three months of lost federal funding without a settlement agreement to allow federal funding to continue. bAssumes no settlement agreement that allows federal funding to continue. cCMS may terminate the Sonoma DC settlement agreement at any time. To the extent that this occurs in 2015–16, there is some risk for federal funds loss. dAssumes Sonoma DC settlement agreement is not extended for a second year. ICF–DD = intermediate care facility for the developmentally disabled and CMS = Centers for Medicare and Medicaid Services. |

||

Recent Event of Immediate Jeopardy at Sonoma DC Suggests Continued Challenges. While the state generally has had success in continuing federal funding in spite of federal certification deficiencies at the DCs, there is some uncertainty about the state’s ability to continue to meet federal requirements sufficient to maintain federal funding for Sonoma DC in particular. In an unannounced February survey at Sonoma DC, DPH declared a situation of “immediate jeopardy” (a situation of noncompliance that has, or is likely to cause serious injury, harm, impairment, or death to a resident) at the DC after discovering a client was not receiving oxygen as prescribed by a physician. The DDS reports that the survey is expected to be completed by February 22, 2016, with results and official findings forthcoming sometime thereafter.

CPP Funding Warranted, but Additional Program Oversight Needed

CPP Funding Supports Critical Residential and Other Resources for DC Movers. The use of CPP funding to support DC closures is an important strategy for successful consumer placements from a DC, as demonstrated by the Agnews and Lanterman DC closures. For these closures, CPP resources supported the development of key specialized homes tailored to meet the unique medical and other needs of consumers who were transitioning from Agnews and Lanterman DCs and provided enhanced case management to ensure successful transitions and ongoing community placement. We find that the Governor’s proposal to provide additional CPP funding related to the anticipated closures of Sonoma, Fairview, and Porterville DCs is critical for moving towards timely closures and ensuring the unique residential, health, and social support needs of transitioning consumers are met. Further, we note that, as part of the Sonoma settlement agreement to continue federal Medicaid funding, DDS has committed to the development of new community resources for current Sonoma DC residents. It is likely that a settlement agreement for Fairview and Sonoma DCs would include similar terms related to closures. The additional CPP resources proposed would help meet these requirements for Sonoma and the other DCs, if applicable.

Proposed Concurrent Closure Timelines Are Very Ambitious. The planned, concurrent closure timelines for all three DCs (although with varying end dates), are very ambitious compared to recent experience with prior DC closures. For Agnews DC and Lanterman DC, closures were completed over five– and six–year periods, respectively, and were completed one at a time.

Development of New Resources Takes Several Years. Historically, the development of new community resources, primarily housing, has taken about two to three years due to property acquisition, construction, building modifications, licensing, and other needed activities to ensure the service is ready for consumer placement. However, the administration believes that—given lessons learned from prior closures to advance the process—new developments instead will take only about one and one–half to two years. We also note that the department has had historical issues with the reversion of budgeted CPP funding for discontinued projects. Since 2005–06, a total of 1,056 CPP related residential start–up projects have been approved. Of these approved projects, 498 were completed, 273 are currently in progress, and 285 were discontinued as of late January 2016. (Many of the discontinued projects were for projects that never started for various reasons.) Because of the significant time it takes to develop resources and the various inherent challenges in doing so, identifying and implementing successful strategies and processes to expedite and ensure successful development—such as providing timely technical assistance, best practices, and clear guidelines to RCs and providers—will be important in ensuring successful DC closures and the most effective use of funds.

While Closure–Related CPP Funding Request Is One Time, Out–Year Requests Are Likely. As the closure process moves forward, evaluations of the needs of consumers and availability of resources will become more refined and also develop over time. As a result, it is likely that similar additional funding will be requested in the future to support the accelerated closure process for all three DCs.

Greater Budget Transparency and Monitoring of CPP Program Needed. The Governor’s budget proposal provides little overall context for the use of these requested resources, relative to the needs of consumers, projected transitions, as well as available and developing community capacity. For example, it is not clear what expected capacity this additional CPP funding could provide and how many consumers would potentially be impacted. Further, additional supporting detail, such as status of current CPP spending, is not included. While some of this information has been provided upon request and in legislative briefings, it is not included as part of the budget request. Further, we note that the department has struggled to appropriately respond to legislative requests to provide an inventory of where transitioning residents are anticipated to go in the community and related resource needs. We recognize that the transition of consumers out of the DCs and related resource development is tied to the unique needs of each transitioning individual and therefore is an inherently fluid process. However, as additional funding is appropriated to support resource development and placements through the CPP program, greater transparency and monitoring of the use of funds and related developments and progress is necessary to ensure appropriate legislative oversight and success of DC closures.

LAO Recommendations

Require DDS to Report at Budget Hearings Regarding Risk of Federal Funding Loss for DCs. Because of a continued risk of losing additional federal funding and the inherent uncertainty and challenges in addressing this risk, we withhold recommendation on the Governor’s federal funding assumptions pending additional information from the administration. Specifically, we recommend the Legislature request DDS to report at budget hearings on:

- The DDS’ progress in meeting the terms and conditions of the Sonoma settlement agreement, including specific milestones met; findings from recent DPH surveys and court monitor reviews and their potential impact on federal funding; and next steps towards extending federal funding through June 2017.

- The status of settlement negotiations with the federal government regarding Fairview and Porterville DCs as well as findings from any recent DPH surveys and reviews and their potential impact on federal funding.

Approve CPP Funding in Concept, but Consider Additional Budget Reporting to Improve Transparency and Monitoring of CPP Program. We support the administration’s proposal in concept to provide additional CPP funding tied specifically to the closure of the three DCs, but withhold recommendation on the specific amounts pending additional and updated information. We find that CPP funding has supported critical residential and other resource development for individuals transitioning from a DC and would help in working towards accelerated DC closure timelines and requirements related to ensuring continued federal funding at Sonoma DC and possibly the other DCs proposed for closure. We note that these estimated amounts could change at the May Revision due to changes to consumer placement assumptions and other adjustments. To help increase legislative oversight of the CPP program, we recommend the Legislature consider improving how CPP–related budget information is presented and provided to better meet the Legislature’s information needs. Specifically, we recommend providing more detailed information on CPP funding, by fund source and by specific DC and placements made, as well as the estimated additional capacity proposed CPP funding would create and potential number of consumers impacted. Further, to assist the Legislature in its evaluation of the Governor’s 2016–17 budget proposed for the CPP program, we recommend the Legislature require DDS to report at budget hearings on the following:

- The DDS’ process for soliciting CPP proposals, providing guidance to RCs and providers, prioritizing and approving CPP projects, allocating CPP funds to RCs, and monitoring of CPP funds and developments.

- The overall status of CPP projects in development and implementation challenges as well as placement status of DC residents compared to community placement goals.

- The estimated additional capacity the proposed additional and base CPP funding would provide and the potential number of consumers impacted with such funding, and the extent to which such funding addresses total estimated requirements to develop community resources for transitioning residents.

Growing Community Services Program Facing Financing and Federal Regulatory Challenges

Introduction

The DDS RC system—collectively referred to as the Community Services Program—has grown tremendously in complexity of programmatic operations and size—both in the number of consumers served and total expenditures—since the enactment of the Lanterman Act in 1969. This growth includes the impact of significant changes in both state and federal policy over the last several decades, such as the expansion of Medicaid–related financing options to include HCBS and policy direction to close state DCs in California and across the country. As the RC system continues to grow, we find that the many financing structures of the program fundamentally have not changed in several decades and therefore have not kept pace with changing business environments in the delivery of services. This increasingly presents challenges for the Legislature in making informed fiscal and policy decisions to ensure efficient and effective program operations that meet the goals of the Lanterman Act and requirements of the consumers the system serves.

In our analysis below, we describe some of the challenges related to RC system financing, including how new federal regulations will exert cost and programmatic pressures on the Community Services Program in order maintain federal funding, and evaluate how proposals included in the Governor’s budget may start addressing a number of the financing challenges. We also summarize legislation enacted as part of the recent special session that provides significant additional funding to the Community Services Program and consider the Governor’s January proposals in this context. Finally, we provide our recommendations related to the Governor’s specific proposals presented in January as well as for how the Legislature may wish to approach the financing implications of a growing RC system in the short and longer term.

Background

How Are RCs Funded?

Fund Sources. As shown in Figure 4, General Fund support accounts for about $3.4 billion, or nearly 60 percent, of the 2016–17 proposed $5.8 billion RC total budget. Federal reimbursements from the Medi–Cal program for certain clients and services provide $2.1 billion—most of the remaining support for the program. About $1.6 billion of these Medi–Cal reimbursements are for services provided under a federal HCBS waiver. Under federal HCBS waivers, federal Medicaid funds can be drawn down to pay for about one–half of the costs of certain community–based services for individuals at risk for institutionalization.

Figure 4

Proposed RC 2016–17 Funding

(Dollars in Millions)

|

2016–17 Proposed |

Percent of Total |

|

|

By Category of Expenditure |

||

|

RC operations |

$663.5 |

11.5% |

|

RC POS |

5,089.4 |

88.1 |

|

Othera |

21.1 |

0.4 |

|

Total |

$5,774.1 |

100.0% |

|

By Funding Source |

||

|

General Funda |

$3,426.9 |

59.3% |

|

Medi–Cal reimbursementsb |

2,079.0 |

36.0 |

|

Otherc |

268.2 |

4.6 |

|

Total |

$5,774.1 |

100.0% |

|

aEarly Start Program funds allocated to other agencies by the Department of Developmental Services, primarily to local education agencies. bThe majority of these reimbursements are for purchase of services (POS) under a federal Home– and Community–Based Services waiver. cIncludes, but is not limited to, reimbursements for Title XX Block Grant, Mental Health Services Act funds, Federal funds for the Early Start Program, and parental fees. RC = Regional Center. Amounts may not add due to rounding. |

||

Two Main Types of RC Expenditures. The RC budget is mainly comprised of two major types of expenditures—RC operations and purchase of services (POS):

- RC Operations. The RC operations budget funds administrative activities but also direct client services, including initial diagnosis of an individual’s developmental disability, assessment for eligibility and services, individual program planning and service coordination, clinical services such as medication reviews, as well as ongoing case management, monitoring, and follow–up assessments. Most of the RC operations budget supports these direct services. The RCs are also responsible for authorizing or “vendoring” with community providers for services—a process that requires the RC to ensure the provider meets all program requirements and obtains necessary licenses for operation to appropriately provide services to consumers and bill for those services. The RC operations are budgeted primarily through a funding formula known as the “core staffing formula.” This formula was first developed in 1978, and is generally based on salaries, wages, and business environment at that time.

- POS Through Vendored RC Providers. The budget for POS consists of ten main services categories as shown in Figure 5. Three categories—community care facilities (CCFs), day programs, and support services—account for almost three–fourths of all POS spending. In general, the budget provided to RCs are allocated as a percent of the total POS budget based on each RC’s POS expenditures in the prior fiscal year. According to DDS, in 2013–14, RCs vendored with over 45,000 providers for these various health and human services. Figure 5 also shows how rates are set for these services. We describe these various rate–setting methodologies for vendored providers in greater detail below.

Figure 5

Percent of Total RC POS Spending— By Budget Category and Rate Methodology

2012–13

|

POS Budget Category |

Rate–Setting Methodology |

Totals |

||

|

Set by DDS |

Negotiated Between RC and Provider |

Other |

||

|

Community care facilities |

17% |

7% |

— |

25% |

|

Medical facilities |

— |

1 |

— |

1 |

|

Day programs |

22 |

1 |

— |

23 |

|

Habilitation |

4 |

— |

— |

4 |

|

Transportation |

— |

6 |

1% |

6 |

|

Support services |

— |

22 |

— |

22 |

|

In–home respite |

5 |

— |

1 |

5 |

|

Out–of–home respite |

— |

— |

— |

— |

|

Health care |

— |

— |

2 |

2 |

|

Miscellaneous services |

— |

8 |

3 |

11 |

|

Total POS Budget |

49% |

44% |

7% |

100% |

|

Amounts may not add due to rounding. RC = Regional Center, POS = purchase of services, DDS = Department of Developmental Services. |

||||

How Are RC Providers Compensated?

Great Variation in Provider Rate–Setting. Provider rate–setting methodologies vary significantly depending on the type of service and provider. As Figure 5 shows, the vast majority of POS rates are set by DDS or negotiated between the provider and RC. Some rates, however, are established by DHCS through the Medi–Cal program, set at what is charged to the general public and referred to as “usual and customary” rates, or set using other methodologies. The DDS–set rates are established through historical cost statements, rate schedules, statute, or regulation. Even within a particular service type, such as for transportation, the rate–setting methodology can vary. The RC methodologies for negotiating rates with their vendored providers can also vary. Vendored providers generally have the ability to request exemptions or changes to rates, due to unanticipated program changes or to protect the health and safety of consumers in certain circumstances.

Existing Financing Structures Are Complex

The RC operations funding formula and various provider rate–setting methodologies described above have become more complex as they have evolved over time. For example, the variation in provider rate–setting—and resulting complexity—is, in part, the product of incremental changes made to the system over time, such as to account for new services as they have come on line. Layered on top of these underlying financing methodologies are various reductions and rate restrictions—enacted as budgetary solutions—that have been put into place over the course of several years, which we describe in greater detail below.

Proposed Budget Continues Most Prior–Year Budget Solutions

Many Budget Solutions Implemented Since 2003–04 Remain in Place. During periods of budget deficits since 2003–04, the Legislature enacted numerous DDS budget reductions and cost–savings measures in order to yield General Fund savings. These included service changes such as the elimination of certain services, reliance on increased federal funding, and the adoption of best practices and accountability measures, as well as rate restrictions for RC providers and reductions in RC operations formula funding. Most of these budget solutions remain in place today and are continued in the Governor’s proposed budget. We discuss RC operations reductions and provider rate controls since 2003–04 in more detail below.

Reductions to RC Operations. The RC operations budget experienced a number of reductions between 2003–04 and today. For example, in 2009–10, the RC operations budget was reduced by $10.5 million General Fund (ongoing) and then again in 2011–12 by an additional $14.1 million General Fund, through both targeted reductions (such as funding for office relocations) and unallocated reductions.

Many Restrictions on Vendor Rates. Since 2003–04, many provider rate restrictions were put into place as a means of budgetary control. These restrictions have affected providers differently, depending on the provider type. Even within the same provider type—with the same rate–setting methodology—providers could be affected differently depending on when a provider was first established relative to when various budget solutions were put into place.

- Rate Freezes Began in 2003–04. Some vendor services, including community–based day programs, in–home respite, supported living services, and transportation, became subject to rate freezes beginning in 2003–04. By 2008–09, all vendors with rates negotiated with RCs experienced rate freezes with some limited exceptions. Vendors of specific RC services received a 3 percent rate increase in 2006–07. We note that supported employment providers also received a rate increase of 24 percent in 2006–07, but then received a 10 percent decrease in 2008–09, for a net increase of 14 percent.

- Implementation of Median Rates Beginning 2008–09. Beginning in 2008–09, an upper limit was established for all new providers of services with negotiated rates. This limit was set as the median of all rates in place at the time for each service. When negotiating rates with new vendors, the RC is required to negotiate a rate that does not exceed the statewide median rate or the RC median rate for the service—whichever is lower. In 2011–12, a new survey was conducted that resulted in lower median rates, and therefore avoided costs that would have otherwise occurred if the median rate remained higher.

- Provider Payment Reductions Implemented in 2009–10, but With Full Funding Restored by 2013–14. Provider payment reductions enacted beginning in 2009–10 affected all vendors except supported employment providers and providers with usual and customary rates. Beginning in 2009–10, the percentage amount of the provider payment reduction was set year to year. A 3 percent provider payment reduction was implemented in 2009–10 and was increased to 4.25 percent in 2010–11. By 2013–14, however, funding lost from previous levels of payment reductions was fully restored.

Some Recent Rate Increases

Recent Rate Increases for State Minimum Wage and Federal Law Changes. Certain RC vendors received rate increases directly related to increases in the state’s minimum wage in 2006–07, 2007–08, 2014–15, and 2015–16. Further, a 5.82 percent rate increase was recently provided, effective December 1, 2015, for certain services to implement new federal regulations requiring overtime pay for home care workers. The Governor’s proposed budget continues these recent rate increases. (We note that significant rate increases are provided in recent legislation enacted in March 2016, which we describe in greater detail later.)

Spending and Caseload Growth

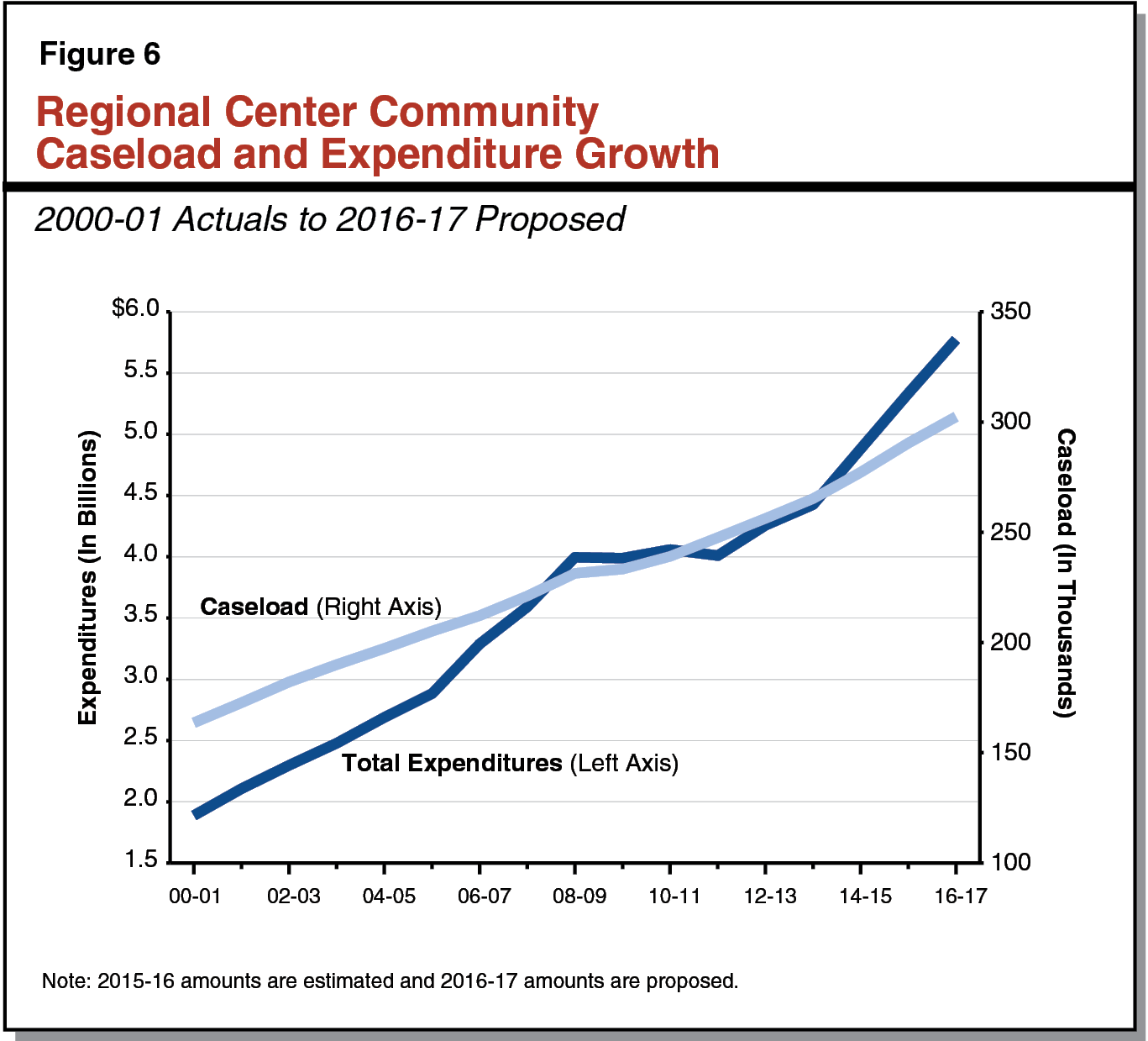

Caseload and Community Services Spending Continue on a Growth Path. As shown in Figure 6, spending on the RC system has grown significantly over the last 15 years. Expenditures went from $1.9 billion in 2001–02 to a proposed $5.6 billion in 2016–17, an annual growth rate of 7.2 percent. Three high–level factors drive spending for RC services: (1) caseload levels, (2) utilization of services, and (3) rates or prices for services. Between 2000–01 and 2007–08, DDS community services expenditures grew from $1.9 billion to about $3.6 billion, an average annual rate of 9.6 percent. During this same period caseload grew from 163,613 to 221,069 consumers, an average annual rate of 4.4 percent. However, during the most recent recessionary period, expenditure growth flattened, likely due to the many budgetary controls enacted that largely offset growth in expenditures due to increases in caseload and utilization of services. While caseload grew, it grew at a slower rate than in prior years, also likely due to budgetary controls implemented (including enactment of tighter eligibility requirements for the Early Start Program in 2009–10). Since 2011–12, however, both spending and caseload have been growing at rates more reflective of historical growth trends.

Governor’s Community Caseload Assumptions Appear Reasonable. The community caseload has steadily increased year over year, even though the most recent recessionary period (see Figure 7). The Governor’s budget projects that the average monthly RC consumer caseload will exceed 302,000 in 2016–17, a year–over–year growth of 4.1 percent. Caseload overall is growing somewhat faster in 2014–15 and 2015–16 relative to immediate prior years. This is in part due to the January 2015 restoration of eligibility in the Early Start Program to prior–year criteria—that is, criteria that existed before it was tightened as a budget solution in 2009–10. We note that the Governor’s budget assumption may very modestly overstate caseload in 2015–16 based on recent data. However, given recent fluctuations and uncertainty, we find that the Governor’s overall caseload assumptions appear reasonable. We withhold recommendation at this time pending the release of updated caseload estimates at the May Revision. We will continue to monitor caseload growth trends and recommend adjustments to the Governor’s caseload assumptions, if necessary, following our review of the May Revision.

Figure 7

Community Caseload Shows Continued Growth

|

Average Monthly Caseload |

Increase From Prior Year |

||

|

Number of Consumers |

Percent |

||

|

2007–08 |

221,069 |

— |

— |

|

2008–09 |

231,451 |

10,382 |

4.7% |

|

2009–10a |

233,294 |

1,843 |

0.8 |

|

2010–11 |

239,153 |

5,859 |

2.5 |

|

2011–12 |

247,674 |

8,521 |

3.6 |

|

2012–13 |

256,294 |

8,620 |

3.5 |

|

2013–14 |

265,216 |

8,922 |

3.5 |

|

2014–15a |

277,242 |

12,026 |

4.5 |

|

2015–16b |

290,496 |

13,254 |

4.8 |

|

2016–17b |

302,419 |

11,923 |

4.1 |

|

aEarly Start Program eligibility tightened in 2009–10 and restored January 1, 2015. bAdministration’s caseload estimate. |

|||

Why Are Caseload and Expenditures Growing? The underlying reasons for caseload and expenditure growth in the community services system are not well understood. Several high–level factors are contributing to this growth, such as an aging RC population as well as individuals moving out of the DCs who require more intensive services and supports relative to the average RC consumer. Another factor pushing caseload and costs upwards is an increase in the autism population served by DDS and the comparatively higher costs of treating autistic individuals. Also, as new medical treatments, equipment, and technology become available, the scope of services that DDS is able to provide to developmentally disabled individuals is broadening.

Longstanding Need for Community Services Financing Reform

Past Financing Reform Efforts for RC Operations and Provider Rates Generally Unsuccessful. Over the past couple decades, significant efforts were made to update or reform the community services financing structures for RC operations and provider rates due to enduring concerns about the rising costs of the RC system, adequacy of funding levels, and quality of outcomes for consumers. For example, the 2004–05 Budget Act provided positions and contract resources to enable a multiyear reform effort, starting with the review and development of standardized rates for certain services. The activities approved by the Legislature were intended to be part of a more comprehensive cost–containment program for the RC system. However, due to a number of issues, including ongoing budgetary challenges that were exacerbated due to information technology system development challenges and the recent recession, the RC operations and provider rates reform efforts did not move forward in a meaningful way. As a result, the principal funding structures for RC operations and provider rates remain largely unchanged.

RC Operations Funding and Provider Rate–Setting Methodologies Remain Outdated. The RC operations funding formula and many of the existing provider rate–setting mechanisms remain considerably outdated. Specifically, most of the funding methodologies in use do not adapt to changing economic conditions and do not reflect either the current way services are being provided or the actual costs of providing those services. For example, the RC operations formula has generally not been updated since 1990 (with some exceptions). The formula currently provides for one executive director at each RC at an annual budgeted salary of about $61,000 (although actual expenditures for such positions are much higher today). Additionally, provider rates that were historically set with annual cost statements have not been updated for over a decade and submission of cost statements for these rates have since been suspended in response to enacted rate freezes.

Complexity of the Financing Structures Creates Its Own Challenges. The complexity of the current financing mechanisms makes the exercise of updating and modernizing a difficult task. To the extent that the provider rate structure, for example, remains out of date, the more likely it is that what may have originally been a rational basis for that rate methodology no longer exists.

Renewed Momentum in Financing Reform Efforts as Task Force Workgroups Examine Operations Funding and Provider Rates. In July 2014, the Health and Human Services Agency repurposed the then–existing Developmental Centers Task Force as the Developmental Services (DS) Task Force, with the charge of examining community–based services. Recognizing the longstanding challenges of the current funding mechanisms in the community services system, the immediate work of the DS Task Force has focused on RC operations funding and provider rates by creating two specific workgroups to address issues in these areas. These workgroups have met several times since the initial larger task force meeting. In June 2015, the DS Task Force released two documents outlining various goals and consensus points for changes to the RC operations funding formulae and provider rates. These overall goals and points of consensus included concepts of sustainability, flexibility, transparency, and support for proper incentives for quality outcomes and performance in funding. Budget legislation passed in 2015 requires DDS to report at 2016–17 budget hearings on several community services financing issues related to RC operations and provider rates using the work from the DS Task Force.

Special Session Legislation Provides Significant Additional Community Services Funding Beginning in 2016–17. In June 2015, the Governor convened a special legislative session to address various health and human services issues, including the provision of sufficient funding for rate increases for community service providers serving individuals with developmental disabilities as well as the consideration of legislation to increase oversight and the effective management of services provided to consumers of the RC system. As part of the special session—on February 29, 2016—the Legislature adopted, and the Governor later signed, a package of ongoing spending proposals in AB2X 1 (Thurmond) that directly appropriates $287 million General Fund for various increases to RCs and community services providers for 2016–17. (This new General Fund spending would leverage an estimated $186 million in additional related federal funds.) Most of the additional General Fund spending, about 60 percent, is for salary and/or benefit increases for community service providers’ staff that devote most of their time to providing direct care to consumers. The legislation also makes changes for rates set by DHCS—for certain intermediate care facilities and skilled nursing facilities—for which a General Fund appropriation is not provided. (The administration indicates the budgetary impacts of these changes will be included in the DHCS budget at the May Revision.)

While the DDS–specific spending proposals are ongoing—subject to appropriation in the annual budget act in future years—most are capped at a fixed General Fund dollar amount and therefore would not vary year to year based on consumer utilization changes. Rate increases for services that are not capped—and therefore the total cost would change based on consumer utilization changes—include transportation, in– and out–of–home respite, supported living, and independent living services.

The legislation also requires documentation and extensive new reporting requirements by RCs and providers to (1) provide information to DDS to determine the allocation of many of these spending increases (including through a random sample survey of providers to be completed in April 2016) and (2) ensure program accountability regarding the use of these funds. This reported data would include, for example, the number of RC Service Coordinators receiving salary and/or benefit increases and information on staff turnover. Additionally, the legislation requires DDS to submit to the Legislature, by March 2019, a rate study addressing the sustainability, quality, and transparency of community–based services for individuals with developmental disabilities.

Figure 8 outlines the various spending proposals contained in AB2X 1 and their General Fund impacts, including whether or not the spending change is subject to a “fixed appropriation”—that is, a capped total General Fund amount year to year. Nearly all of the spending augmentations in AB2X 1 would become effective July 1, 2016, unless otherwise indicated.

Figure 8

Summary of Special Session Spending Augmentations in AB2X 1 (Thurmond)

(In Millions)

|

Enacted Spending Proposala |

General Fund Appropriation |

Fixed Appropriation (Y or N) b |

|

Community Services Staff Providing Direct Services to Consumers. Rate increases, as determined by DDS, for enhancing wages and benefits for community service provider staff who spend a minimum of 75 percent of their time providing direct services to consumers. Rate increases would only apply to services for which rates are set by DDS or through negotiations between RCs and service providers, as well as supported employment services and vouchered community services. (Employees of the Community State Staff Program are excluded.) |

$169.5 |

Y |

|

RC Staff Salaries and/or Benefits. Increases for RCs to provide RC staff salary and/or benefit increases as allocated by DDS. Would exclude RC unfunded retirement liabilities and RC executive staff. |

29.7 |

Y |

|

RC Administration. RC operations increase, as allocated by DDS, for administration, including for clients’ rights advocates contracts. |

1.4 |

Y |

|

Provider Administration Costs. Rate increases, as allocated by DDS, for rates set by DDS or through negotiations with the RC and provider, as well as supported employment services and vouchered community–based services. |

9.9 |

Y |

|

5 Percent Rate Increase for Supported Living and Independent Living Services. 5 percent increase to rate in effect on June 30, 2016. |

18.0 |

N |

|

5 Percent Rate Increase for In– and Out–of–Home Respite Services. 5 percent increase to the rate authorized and in operation on June 30, 2016 for family–member–provided respite services and in–home respite service agency rates. |

10.0 |

N |

|

5 Percent Rate Increase for Transportation. 5 percent rate increase to rates for transportation services in effect on June 30, 2016. |

9.0 |

N |

|

Competitive Integrated Employment Program. Requires DDS to establish guidelines and oversee a program to increase paid internship opportunities for individuals with developmental disabilities that produce outcomes consistent with a consumer’s Individual Program Plan, as specified, to include incentive payments for supported employment. |

20.0 |

Y |

|

11.1 Percent Rate Increase for Supported Employment. Provides an 11.1 percent rate increase for supported employment by restoring rates to levels in effect in 2006. |

8.5c |

N |

|

Resources to Support Bilingual RC Staff, Training, and Education Efforts. Provides a fixed amount to implement recommendations and plans to promote equity and reduce disparities in the purchase of services that may include pay differentials supporting bilingual RC staff, cultural competency training, parent education efforts, and other activities. |

11.0 |

Y |

|

Rate Increases for Certain Intermediate Care Facilities (ICFs). Provides a 3.7 percent rate increase to the reimbursement rates in effect in the 2008–09 rate year for dates of service on or after August 1, 2016 for ICFs for the developmentally disabled and continuous nursing care. Implementation subject to federal approvals for related federal funding. Effective for dates of service on or after August 1, 2016. |

—d |

—d |

|

Exemption From Retroactive Reductions for Distinct Part Skilled Nursing Facilities (DP/SNF). Prohibits the Department of Health Care Services from implementing or seeking retroactive reductions or reimbursement limitations for services provided by SNFs that are distinct parts of general acute care hospitals for dates of service on or after June 1, 2011 and on or before September 20, 2013. |

—d |

—d |

|

Total General Fund Appropriation |

$287.0 |

|

|

aSpending augmentations effective July 1, 2016, unless otherwise noted. bIf a fixed appropriation, total rate increases provided cannot exceed total appropriation amount. Therefore, year–to–year amounts would not vary based on utilization. Amounts for spending that are not fixed will likely vary year to year; amounts for 2016–17 are estimates. cSpending changes also affect the Department of Rehabilitation budget and are not included in appropriation but estimated to be about $3.5 million General Fund. dSpending changes affect the Department of Health Care Services budget and are not included in appropriation but estimated to be about $12 million General Fund for ICFs and about $123 million General Fund for DP/SNFs. DDS = Department of Developmental Services and RC = Regional Center. |

||

Governor’s Budget Provides Targeted Funding Increases for Community Resources

Below, we discuss most of the Governor’s major budget proposals related to the Community Services Program. Community Services Program spending proposals related to CPP are discussed earlier under the “DC Closures and Other Related Funding” section of this report. We note that overall spending totals displayed in this section below include the impacts of proposed CPP funding.

Budget Includes Targeted Funding Increases for Certain Residential Facilities

Background. About one–fourth of community RC clients do not live with their parent(s) or another family member, and of these individuals, the majority live in CCFs that generally provide nonmedical, residential care. For 2014–15, DDS reports about 27,000 consumers were utilizing CCFs. About $1.3 billion, or about 25 percent, of the proposed POS budget is for spending related to CCFs.

The CCFs are primarily funded through a rate methodology known as the Alternative Residential Model (ARM) rate—which has not been fully updated in many years. This rate methodology, which was initially established in 1987, was developed based on an analysis of then–operating residential facilities. Currently, per–resident rates are based on 14 different consumer service levels and related staffing requirements, assuming each home supports six residents. The RCs generally have historically had the authority to authorize changes in facility service levels. Under certain circumstances, an RC could, for example, authorize a facility service–level change from service level two to a service level three, to allow for additional staffing to meet the needs of consumers served in that facility, which would result in a higher rate paid per consumer. State regulations outline the service–level staffing standards and related rate methodology based on a six–bed model. However, it is common practice for many RCs to vendor with ARM–rate facilities with four or fewer beds, which is generally consistent with state and federal policy direction towards placements in smaller residential facilities. Therefore, the current individual rate paid to facilities assumes that overhead and staffing costs are spread across six placements, even though many RCs are using facilities with fewer placements.

Governor’s Proposal. The Governor’s budget proposes $46 million ($26 million General Fund) to allow for the development and implementation of a new rate for ARM–rate facilities serving four or fewer individuals in recognition of more current RC vendoring practices. Many details regarding the Governor’s ARM rate proposal are currently being worked out. The administration states the new rate methodology would be similar to the existing ARM rate methodology, but would assume placements for four residents. Additionally, the administration proposes both budget and trailer bill language to implement this new rate, as well as require RCs to report annually to the department on the number of facilities receiving these rates. Further, the trailer bill language also appears to prohibit RCs from authorizing any residential service–level changes for CCF providers, including for the new four–bed rate, if the change would increase state costs, with exceptions to protect the health and safety of consumers, upon approval by DDS.

Budget Proposes Funding to Improve RC Coordinator–to–Consumer Caseload Ratios

Background. Current state law, as well as the terms of the HCBS waiver, require RCs to have certain average service coordinator–to–consumer ratios depending on certain consumer characteristics. For example, RCs are required to maintain an average service coordinator–to–consumer ratio of 1:62 for consumers receiving services through the HCBS waiver, but maintain an average ratio of 1:45 for consumers who have moved from a DC within the last 12 months. The RCs have had longstanding challenges with maintaining these required caseload ratios, citing significant funding issues that relate to the overall funding methodology for RC operations. For the past two years, all 21 RCs reported not meeting caseload ratio requirements for one or more required consumer categories. Additionally, six RCs reported noncompliance with the HCBS ratio requirements in 2015.

Governor’s Proposal. The Governor’s budget includes $17 million ($13 million General Fund) to support an estimated 200 additional RC service coordinator positions with the goal of improving RC coordinator–to–consumer caseload ratios and thereby improving case management functions. Additionally, the administration proposes budget language to require reporting by RCs annually to DDS on the number of staff hired with these additional funds as well as report on RC’s effectiveness in reducing average caseload ratios. The administration states that the allocation of funding among RCs would be worked out through consultation with the association of RCs.

Proposed Fiscal and Program Research Unit

Background. The DDS reports significant issues in meeting increasing demands for general information, research, and analytics on a variety of topics impacting the developmental services system. Currently, these activities are generally performed by programmatic and other staff. Many other departments with oversight responsibilities of large caseload–driven programs have dedicated research and analytical staff to support a variety of operational and oversight functions. Further, these dedicated staff can proactively analyze programmatic information to support policy development and decision making.

Resources for New Fiscal and Research Unit. The Governor’s budget proposes $923,000 ($630,000 General Fund) for seven new permanent positions and the redirection of one vacant position to establish a Fiscal and Program Research Unit. This new unit would provide fiscal and programmatic analysis to assist with DDS responses to various research and analytical needs related to both the community services and DC programs. Given that the community services program is by far the larger of the department’s two major programs, a substantial portion of the new resources could presumably be focused on community services. The Governor’s proposal indicates an annual research plan will be produced within a half–year of filling positions.

Proposed Spending for New Federal HCBS Regulation Compliance

Background. In March 2014, new regulations issued by CMS became effective that significantly change what it means for services to be provided in a HCBS setting for Medicaid reimbursement. The new rules create a more outcome–oriented definition of home– and community–based settings—rather than one based solely on a setting’s location, geography, or physical characteristics—by focusing on the qualities and consumer experience related to services provided to ensure an integration with the broader community. The new rules provide for a five–year transition period for existing programs to come into compliance by March of 2019, after which noncompliant services will be ineligible for federal funding. These new regulations impact all Medi–Cal HCBS–related programs that are currently administered by several departments, including DDS, where DHCS serves as the lead Medicaid liaison to the federal government and state coordinating agency. In response to this new rule, DDS established a HCBS advisory group that began meeting in February 2015 to engage stakeholders and provide guidance on the transition process and ongoing compliance requirements. Nationally, states are in the process of evaluating and determining what the new rules mean for existing HCBS programs. Overall, some DDS programs and services may need to be redesigned and as a result will likely require various changes to statute, regulations, and program policies. However, the total impact to the program is unknown at this time.

The CMS has established an extensive process for states to evaluate the service settings in their current HCBS programs and requires that states submit to CMS for review and approval a statewide transition plan (STP). The STP is the process through which states determine their compliance with the new rules and provide assurances to CMS on how compliance will be achieved and maintained. In August 2015, California submitted its STP, covering all HCBS programs, including those operated by DDS, to CMS for review. In November 2015, CMS responded by expressing concerns with timelines presented and requested significant additional detail on how California will come into compliance. The DDS also intends to include a DDS–specific transition plan which is in development, to supplement the larger STP.

The majority of DDS’ Medi–Cal–related funding is used for community services operated as an HCBS waiver program, which is set to expire in March 2017. In order for the wavier to be renewed to ensure continued federal funding to the state after March 2017, the state will need to have a CMS approved transition plan in place to meet HCBS requirements by March 2019 and will need to have adequate assurance to CMS that thereafter, services provided under the waiver will be in compliance with the new rules.