March 10, 2016

The 2016-17 Budget

Evaluating FI$Cal

Executive Summary

An Integrated Financial Management System. Over the last several years, the administration has been engaged in the design, development, and implementation of the Financial Information System for California (FI$Cal) Project. This information technology (IT) project will replace the state’s aging and decentralized IT financial systems with a new system integrating state government processes in the areas of budgeting, accounting, cash management, and procurement. Since the project began, it has changed in scope, schedule, and cost from what was initially anticipated. These changes have been documented in special project reports (SPRs). The FI$Cal Project is currently operating under its fifth SPR. While the project experienced early successes, subsequent challenges have caused the project to fall behind schedule. Ultimately, these challenges caused the project to deviate from the current SPR significantly enough to trigger the need for a new project plan—SPR 6—on which the Governor’s 2016–17 budget proposals are based.

Governor’s 2016–17 FI$Cal Budget Proposals. The Governor’s 2016–17 budget includes two FI$Cal–related proposals: the first allows the project to implement the changes proposed in SPR 6 and the second establishes a new state department to maintain and operate the FI$Cal System. The proposed changes to the project reflected in SPR 6 result in a 24–month schedule extension and an increase in the project cost (relative to SPR 5) by $237 million ($125 million General Fund). This brings the total cost of the project to $910 million ($494 million General Fund). The administration indicates that the budget proposals reduce the overall risk associated with the implementation of FI$Cal and sets the foundation for maintaining and operating the FI$Cal System once it is complete. The total cost for the project in 2016–17 is $135 million ($96.3 million General Fund).

Governor’s Proposed Project Changes Are Reasonable, but Project Risk Remains and Additional SPR Likely. We find that the Governor’s budget proposal to implement the changes proposed in SPR 6 reflects a reasonable plan to implement the remaining functions and departments in FI$Cal. We therefore recommend approval of this component of the Governor’s budget proposal. However, we note that the FI$Cal Project involves the development of an extremely ambitious and complex IT system and significant work remains before the system is fully implemented. Given the scope of the remaining work and signals from oversight entities that some project activities continue to track behind schedule, we think a future SPR is likely that would further extend the project schedule and increase costs. Should the project make significant changes going forward, a new budget proposal would be submitted for legislative review.

Regardless of Entity Selected for Maintenance and Operation (M&O), Accountability Should Be Strengthened. As for the administration’s proposal to establish a new state department for M&O of the FI$Cal System, we agree with the administration that an entity is necessary to maintain and operate FI$Cal. It is unclear to us, however, whether the establishment of a new department is the best way to fulfill this function. Various options of administrative structures for maintaining and operating the FI$Cal System are available for legislative consideration, each with its own potential benefits and costs. Regardless of the entity ultimately selected for M&O, we think that actions are needed to strengthen the Legislature’s ability to hold FI$Cal leadership accountable. We provide options to the Legislature for doing this.

Introduction

Since 2005, the administration has been engaged in the design, development, and implementation (DD&I) of the Financial Information System for California (FI$Cal) Project. The FI$Cal Project is extremely ambitious and complex, resulting in it being the most costly state information technology (IT) undertaking ever. The FI$Cal Project replaces the state’s aging and decentralized IT financial systems, with a new system that will integrate state government processes in the areas of budgeting, accounting, cash management, and procurement. Since 2005, the project has changed in scope, schedule, and cost from what was initially anticipated. These changes have been documented in special project reports (SPRs). The FI$Cal Project is currently operating under its fifth SPR, which was approved by the California Department of Technology (CDT) in January 2014. While the project experienced early successes, subsequent challenges have caused the project to fall behind schedule. Ultimately, these challenges caused the project to deviate from the current SPR significantly enough to trigger the need for a new project plan—SPR 6—on which the Governor’s 2016–17 budget proposals are based.

In this report, we describe the FI$Cal Project, provide an update on the project’s status, and describe the events that triggered the development of a new SPR. We also describe the Governor’s 2016–17 budget proposals to: (1) allow the project to implement the changes proposed in SPR 6 and (2) establish a new state department to maintain and operate the FI$Cal System. Finally, we make associated findings and recommendations.

Overview of The FI$Cal Project

An Integrated Financial Management System. Over the last several years, the administration has been engaged in the DD&I of the FI$Cal Project—an IT project that replaces the state’s aging and decentralized IT financial systems with a new system that will integrate state government processes in the areas of budgeting, accounting, cash management, and procurement. The system will eliminate the need for over 2,500 department–specific applications and enable the state financial systems and workforce to function in an integrated environment. The FI$Cal System will also automate processes that are currently highly manual, minimize manual reconciliations among control agencies and various separate financial systems, make information more readily available to the public and the state’s business partners, generally improve tracking of statewide expenditures, and standardize the state’s financial practices. The integrated system will be utilized in some way by every state department, the Legislature, and the public, allowing greater transparency of the state’s financial data and management. Such transparency currently does not exist given the state’s fractured financial management infrastructure.

Project Has Evolved. The planning for the FI$Cal Project began in 2005 when the Department of Finance (DOF) proposed an IT project that would implement an internal financial system for the department. The Budget Information System, as the system would have been called, was envisioned to better meet DOF’s budget development and administrative needs. In 2006, the administration proposed an updated project plan that significantly changed the scope and governance of the project. Rather than building a new system exclusively for DOF, the administration recommended that—because a majority of state departments were reliant on aged and inadequate technology—there was a need to modernize and replace the state’s entire financial management infrastructure. The updated project plan proposed increasing the scope of the project to include developing a single integrated financial management system for the state. The project was renamed FI$Cal and would be managed by a partnership of four control agencies that would comprise the project’s steering committee. After continued planning and a lengthy procurement that used an innovative procurement approach, a contracted vendor—Accenture PLC—was selected in June 2012 to customize existing off–the–shelf software to address the state’s financial management needs. Since 2012, the project has periodically updated the project scope, schedule, and/or cost from what was anticipated when the state initially contracted with the vendor. These updates have led to schedule extensions and cost increases, but also modifications that have mitigated project risk and made it more likely that the project will ultimately meet its objectives. See Figure 1 for a description of the evolution of the scope, schedule, and cost of the project since it was proposed in 2005. (Also, refer to our April 30, 2012 report, The 2012–13 Budget: Evaluating FI$Cal, for a more comprehensive description of the project’s history.)

Figure 1

Evolution of the FI$Cal Project Scope, Schedule, and Cost

(In Millions)

|

Project Plan |

Total Estimated Project Cost |

Final Implementation Date |

Summary of Project Plan |

|

Initial Project Plan (FSR) July 2005 |

$138 |

July 2011 |

The initial IT project was much more modest in scope than the current project. The Budget Information System, as the project was then known, was envisioned to better meet DOF’s budget development and administrative needs. |

|

SPR 1 December 2006 |

$1,334 |

June 2015 |

The administration realized there was a need to modernize and replace the state’s entire financial management infrastructure. SPR 1 proposed increasing the scope of the project to include developing a single integrated financial information system for the state. The project would integrate the budgeting, accounting, cash management, and procurement functions of the state. Four partner agencies were identified—DOF, SCO, STO, and DGS—and the project was renamed FI$Cal. The SPR extended the schedule by four years and increased the cost by nearly $1.2 billion. |

|

SPR 2 December 2007 |

$1,620 |

June 2017 |

SPR 2 analyzed advantages and disadvantages of various FI$Cal alternatives but proposed maintaining the project’s expanded scope to integrate the state’s financial management processes. The SPR extended the schedule by two years and increased the cost by nearly $300 million, relative to SPR 1. |

|

SPR 3 November 2009 |

Unspecified |

Unspecified |

SPR 3 established the use of a multistage procurement approach. The multistage procurement strategy would assist the project in eliciting more qualified vendors and more responsive proposals for building the FI$Cal System. The total cost and schedule for the project was left unspecified. At the conclusion of the procurement, when the software application and vendor would be selected, the project would submit SPR 4. |

|

SPR 4 March 2012 |

$617 |

July 2016 |

SPR 4 updated the project cost and schedule based on the contract with the selected vendor. The total project cost for the FI$Cal System was estimated at about $620 million, about $1 billion less than estimated in SPR 2. The cost reduction is attributed to (1) updated estimates and (2) the move to a more phased implementation approach that resulted in lower overall project costs through reduced risk to the vendor and lower state staffing costs. The system would be completely implemented in July 2016. |

|

SPR 5 January 2014 |

$673 |

July 2017 |

SPR 5 made various changes to the project’s implementation approach to reflect lessons learned over the two years since the vendor was selected and the development of the system began. The SPR resulted in a 12–month schedule extension and increased the total project cost by $56 million, relative to SPR 4. |

|

SPR 6 February 2016 |

$910 |

July 2019 |

SPR 6 made various changes to the project’s implementation approach to reflect lessons learned since SPR 5. SPR 6 resulted in a 24–month schedule extension and increased the total project cost by $237 million, relative to SPR 5. |

|

Fi$Cal = Financial Information System for California; FSR = Feasibility Study Report; IT = information technology; DOF = Department of Finance; SPR = Special Project Report; SCO = State Controller’s Office; STO = State Treasurer’s Office; and DGS = Department of General Services. |

|||

Four Control Agencies Manage Project. The project is managed by a partnership of four control agencies—DOF, State Controller’s Office (SCO), State Treasurer’s Office (STO), and the Department of General Services (DGS). These partner agencies have unique constitutional and/or statutory responsibilities over the state processes that will be integrated through FI$Cal—budgeting, accounting, cash management, and procurement. State law mandates these partner agencies to collaborate in the development of FI$Cal. The project developed a governance plan to guide the relationships among these partner agencies and other entities with a formal role in the FI$Cal Project—known collectively as “stakeholders” for purposes of this analysis.

Project Governance Structure. The objective of the FI$Cal Project’s governance plan is to delineate the responsibilities and decision–making authority for key project stakeholders. We discuss the roles and decision–making authority of key stakeholders below.

- Steering Committee. The Steering Committee is the main governing body for the FI$Cal Project. The Steering Committee has primary jurisdiction over decisions that affect the project’s scope, schedule, and/or cost. The committee is comprised of the project sponsor (who also serves as the Chair of the Steering Committee, currently filled by DOF’s Chief Operating Officer), representatives from each of the four partner agencies (DOF, SCO, STO, and DGS), and a state employee who represents the interest of all state departments. Additionally, the CDT is a nonvoting member of the Steering Committee. The committee operates under a consensus decision–making model. If the committee cannot reach consensus, the objector may choose to recuse himself or herself, in which case the committee can move forward. Alternatively, the governance structure provides for a process to escalate issues for which the Steering Committee is unable to reach consensus.

- Project Directorate. While the Steering Committee is the main governing body for the project, issues that cannot be resolved by the Steering Committee are elevated to the Project Directorate—the highest decision–making authority for the project. The Project Directorate includes the Director of Finance, the State Controller, the State Treasurer, and the Director of DGS. Like the Steering Committee, the directorate operates under a consensus decision–making model.

- Project Leadership Team. The Project Leadership Team is led by the Executive Partner (like an executive officer) and is comprised of state staff who (1) review the project’s performance, (2) make day–to–day decisions on issues affecting the project or escalate issues to higher levels of the governance structure if the issue exceeds the Project Leadership Team’s authority, and (3) oversee all FI$Cal Project staff. The Executive Partner is also the key advisor to the Steering Committee, oversees the development of the system, and advocates for statewide support of the project.

- Project Oversight Entities. The project is independently overseen by CDT and a third–party technical consultant. These entities present their findings and recommendations to the Steering Committee.

FI$Cal Service Center (FSC) Maintains and Operates System. There are a total of 195 FI$Cal Project staff who support various functions—one of which is the FSC. The center, operated by a combination of state staff and vendor staff, was established in July 2013—after the first system functions of the FI$Cal Project were implemented in a small number of departments—to (1) perform maintenance and operation (M&O) for the FI$Cal System, (2) provide support services to the users of the system, and (3) manage internal administrative functions. Under SPR 5, the FI$Cal Project and FSC operate simultaneously during the implementation of the system. The FSC will incrementally assume additional responsibility as functions and departments come on line. Once the system is fully implemented, the project will end and the FSC will assume complete responsibility on an ongoing basis for maintaining and operating the FI$Cal System. The FSC is also managed through a partnership among the four control agencies—DOF, SCO, STO, and DGS. The state’s financial management policies remain within the respective purview of the partner agencies, while the FSC operates the system in accordance with the policies set by the partners.

Back to the TopCurrent Project Status

Information technology projects often change in scope, schedule, and/or cost from what was initially anticipated because of the complexity of such projects. Significant changes to state IT projects are documented in SPRs. At a high level, SPRs document a project’s change in scope, schedule, and/or costs to reflect updated information. The SPRs are prepared by the project and submitted to CDT for review and approval. The FI$Cal Project is currently operating under SPR 5, which was approved by CDT in January 2014. The associated budget proposal was approved by the Legislature as part of the 2014–15 Budget Act. It calls for the implementation of the FI$Cal System in a series of “waves” that add departments and functionality—specific tasks related to budgeting, accounting, cash management, and procurement—to FI$Cal incrementally over time. (When a department joins FI$Cal, it will be able to access all functionality that has been implemented to date. As additional functionality is implemented, it will become available to all departments using FI$Cal.) Specifically, SPR 5 calls for the system to be rolled out through a “Pre–Wave” planning phase followed by four implementation waves over five years. While the project experienced early successes, subsequent challenges have caused the project to fall behind schedule. Ultimately, these challenges caused the project to deviate from the current SPR significantly enough to trigger the need for a new project plan—SPR 6—on which the Governor’s 2016–17 budget proposals are based. Before describing the Governor’s budget proposals, we provide an update on the project’s status and describe the events that triggered the development of a new SPR.

Pre–Wave Successful

The project deployed Pre–Wave—the first of the five implementation waves—in July 2013. Pre–Wave deployed a portion of the FI$Cal procurement functions to a small subset (five departments) of Wave 1 departments. The FSC—discussed earlier—was established with Pre–Wave deployment. All components of Pre–Wave were deployed on schedule and without incident.

Although the scope of Pre–Wave was narrow and only a few departments were impacted, the lessons learned during this planning phase were of great value to the project and informed future decisions. The activities necessary for deploying FI$Cal to departments are largely consistent across the various waves. These activities include engaging departments, converting data from current technology systems to FI$Cal, training end users, and testing the system. Pre–Wave was designed to serve as a pilot to test these procedures.

Wave 1 and Wave 2 Encountered Road Bumps

Despite the lessons learned from Pre–Wave, subsequent waves encountered road bumps that ultimately caused the project to deviate from the schedule proposed in the most recent project plan—SPR 5. Compared with Pre–Wave, Wave 1 and Wave 2 deployed significantly more complex functions to a larger number of departments.

Wave 1. The fifth SPR called for Wave 1 to implement in July 2014 a significant portion of FI$Cal’s budget functions and some of the accounting, cash management, and procurement functions to the four partner agencies and to a limited number of other state departments, including the State Board of Equalization (BOE) and the Department of Justice (DOJ). Instead, the FI$Cal Steering Committee made several significant last minute changes to the implementation approach just prior to Wave 1 going live that resulted in a substantially reduced number of departments—and therefore a reduced number of system users—and the deferral of certain functions and departments to later waves. Below, we describe the primary reasons for the delay in the implementation of Wave 1.

- Technical Difficulties Caused Deferral of Some Functions to Series of Subsequent Small Deployments—Wave 1.x. Because of technical difficulties with completing certain FI$Cal functions, the project moved the implementation of certain functions from Wave 1 to a series of subsequent small deployments, collectively known as Wave 1.x. Wave 1.x included functions necessary for the development of the state’s budget that were not immediately necessary in July 2014 when Wave 1 was scheduled for implementation. The Wave 1.x functions were deployed in 2014–15. The FI$Cal System was successfully used in the development of the 2015–16 budget, making FI$Cal the budget system of record for the state. Despite these successes, additional modifications and enhancements are planned to improve usability and end–user satisfaction.

- Departments Required More Support Than Anticipated. Even though the number of system users was reduced significantly—by deferring some departments to later waves—Wave 1 departments required more support than anticipated. Most significantly, Wave 1 departments needed support with month–end and year–end close–out activities associated with the new accounting functions. The project provided additional training sessions as well as individual support to the Wave 1 departments. As of February 2016, all Wave 1 departments have completed year–end close–out activities for 2014–15.

- Various Challenges Caused Project to Defer Several Departments and Certain Functions to Later Waves. The project went live in July 2014 with only a portion of the planned Wave 1 departments and functions. The deployment of FI$Cal’s accounting function at BOE and DOJ was deferred for three years. Both departments cited that the workarounds that the vendor proposed for known system defects were too time consuming. The intent of the deferral was to allow time for the defects to be resolved. Additionally, a decision was made to delay the implementation of the accounting functions for SCO and STO in order to perform additional testing. Although the project and the two departments had tentatively anticipated completion of the additional testing and deployment of FI$Cal’s accounting function to SCO and STO by September 2014, testing continued longer than anticipated. The SCO and STO began using FI$Cal accounting functions in December 2014 and August 2015, respectively. Finally, implementation of the system at the California Department of Aging was deferred by one year because the department had not completed tasks necessary to transition to FI$Cal.

Wave 2. The fifth SPR called for Wave 2 to implement a significant portion of FI$Cal’s procurement functions and some of the budgeting, accounting, and cash management functions in July 2015 to about 50, mostly small, departments. Although the development of these functions was falling behind schedule for many months leading up to July 2015, the project was optimistic that it would be able to catch up and meet the scheduled milestone. When the project was ultimately unable to catch up, the Steering Committee made a last minute decision to split Wave 2 into two different releases, scheduled for August 2015 and December 2015. The primary reasons for the delays in Wave 2 were:

- Concurrent and Competing Priorities Created Schedule Delays. The project planned to transition staff tasked with Wave 1 activities to Wave 2 activities following the deployment of Wave 1 in July 2014. The unanticipated workload resulting from the Wave 1 road bumps created concurrent and competing priorities. The ongoing Wave 1–related work eroded the availability of staff time originally set aside for Wave 2–related activities and caused the project to miss milestones leading up to the July 2015 Wave 2 deployment.

- Testing Delays and Requested Enhancements Caused Splitting of Wave 2 Into Multiple Parts. In June 2015, testing delays and requests for enhancements to procurement functions caused the Steering Committee to approve splitting the implementation of Wave 2 into two separate and delayed releases. The first release was scheduled for August 2015 and rolled out the budgeting, accounting, and cash management functions. The second release was scheduled for December 2015 and rolled out the procurement functions. As in Wave 1, some departments were deferred to later waves, resulting in Wave 2 bringing 45 of the roughly 50 originally planned departments onto the FI$Cal System.

Challenges in Prior Waves, Issues in Upcoming Waves Spur Development of SPR 6

Past Project Road Bumps Affect Schedule. The FI$Cal Project—as proposed in SPR 5—has two remaining waves to implement (Wave 3 and Wave 4). The project anticipated rolling out these waves in July 2016 and July 2017. However, the delays in prior waves have created significant schedule delays for future waves and have made the time line proposed in SPR 5 unrealistic.

- Wave 3 Delays. Under SPR 5, the third wave would implement the most significant portion of FI$Cal’s accounting and cash management functions to two large departments. Wave 3 has fallen significantly behind schedule because the project redirected resources needed for Wave 3 development to instead focus on delayed Wave 1 and Wave 2 activities. According to the project’s oversight entities, Wave 3 activities were tracking 14 months behind schedule as of November 2015.

- Wave 4 Delays. According to SPR 5, the fourth wave would make available the public transparency website and deploy all aspects of FI$Cal to the approximately 70 remaining departments in July 2017. According to the project’s oversight entities, Wave 4 activities were tracking three months behind the schedule provided in SPR 5 as of November 2015. Given the domino effect prior delays have had on the project’s schedule, further delays in Wave 4 seem likely.

Large Number of Departments in Final Wave Continued to Create Risk. The fifth SPR deferred the implementation of FI$Cal for the bulk of departments until the last wave—Wave 4. Given the large quantity of departments transitioning onto FI$Cal in the final wave, we questioned in our analysis of SPR 5 whether the project’s staffing would be at an adequate level to actively engage departments as needed for Wave 4 to succeed within the proposed time frame. (Please refer to our March 26, 2014 report, The 2014–15 Budget: Evaluating FI$Cal Project Plan, for additional detail regarding our Wave 4 concerns.) Additionally, since the approval of SPR 5, the Steering Committee has taken several actions to defer additional departments (such as BOE and DOJ) until the final wave of the project. While deferring deployment when a department is not ready is prudent, this action has grown the already large, final wave. Moreover, the project has witnessed firsthand that departments require intensive support following their transition onto the FI$Cal System. The time–intensive engagement is necessary to ensure departments are ready to use the system when it becomes available. Collectively, these issues make the risks associated with the large number of departments in Wave 4 more acute today than when we first noted it in our analysis of SPR 5.

Project Staffing Challenges an Ongoing Problem. During 2015, the project continued to experience difficulties in recruiting staff for vacant positions and retaining staff. Of particular concern, the project experienced turnover in six of eight executive positions in 2015. As of December 2015, the project reported its overall job vacancy rate was roughly 13 percent of total authorized positions, which amounts to 38 vacancies among the 288 authorized positions. This is a significant improvement from other periods, when the project’s vacancy rate exceeded 20 percent. While relatively low now, the project’s historically high and volatile vacancy rate can be attributed to (1) a relatively limited pool of applicants with necessary skill sets, (2) obstacles inherent in the existing civil service process to hiring qualified staff quickly after positions are authorized by the Legislature, and (3) high turnover rates among project staff (including at executive levels). Even if the project’s overall vacancy rate were to remain relatively low, sustained vacancies or high turnover of executive positions can significantly compromise the success of the project.

The schedule delays and these other issues facing the project ultimately spurred the development of a sixth SPR, which we describe in more detail in the following sections.

Back to the TopGovernor’s 2016–17 Budget Proposals for FI$Cal

The Governor’s budget includes two FI$Cal–related proposals: the first allows the project to implement the changes proposed in SPR 6 and the second establishes a new state department to maintain and operate the FI$Cal System. The administration indicates that these proposals would reduce the overall risk associated with the implementation of FI$Cal and set the foundation for maintaining and operating the FI$Cal System once it is complete. The total cost for implementing FI$Cal as proposed by the budget in 2016–17—including costs for a new proposed Department of FI$Cal discussed later—is $135 million ($96.3 million General Fund). The remainder of this report outlines the Governor’s budget proposals and presents our associated comments.

The FI$Cal Project Plan—SPR 6

In this section we describe the Governor’s budget proposal related to the changes proposed in SPR 6 and provide our assessment.

Governor’s Budget Proposal on Project Changes Included in SPR 6

In February 2016, CDT approved an SPR that updates the project plan for FI$Cal. This was the sixth update (SPR 6) to the project plan since FI$Cal began in 2005. The project indicates that SPR 6 reflects lessons learned since the previous project update was approved in January 2014. The last two years have been marked with significant activities, most notably the deployment and implementation of Wave 1 and Wave 2. Drawing on lessons learned over this period, the project reports it now has a better understanding of the magnitude and complexity of FI$Cal. Specifically, the administration determined the risk of moving forward with an unrealistic project schedule was too large and decided a different approach would be necessary in order to mitigate the risk of a significant disruption to the project in future years. The Governor’s budget includes funding to support the project, pursuant to the changes included in SPR 6 and as outlined below.

Does Not Propose to Change Project Objectives. The sixth SPR does not propose changes to the statutory objectives of the project. The intent of the SPR is to mitigate project risk—by changing the implementation approach, discussed below—so that the project objectives can be successfully fulfilled.

Extends Schedule and Increases Cost Relative to SPR 5. The proposed changes to the project reflected in SPR 6 result in a 24–month schedule extension and an increase in the project cost (relative to SPR 5) by $237 million ($125 million General Fund). This brings the total cost of the project to $910 million ($494 million General Fund). The increase in project cost is largely attributable to increased contract costs and costs to hire additional staff and retain staff over the additional 24 months that the SPR extends the project. The budget–year impact of these changes is $92.5 million ($71.9 million General Fund). See Figure 2 for project costs incurred to date and the future costs proposed in SPR 6.

Figure 2

Costs for FI$Cal Under Special Project Report 6

(In Millions)

|

Fiscal Year |

General Fund |

Total Funds |

|

2005–06 |

$0.5 |

$0.9 |

|

2006–07 |

2.2 |

5.0 |

|

2007–08 |

6.2 |

6.2 |

|

2008–09 |

2.1 |

5.6 |

|

2009–10 |

2.1 |

12.3 |

|

2010–11 |

1.8 |

25.8 |

|

2011–12 |

1.9 |

21.8 |

|

2012–13 |

— |

82.0 |

|

2013–14 |

3.4 |

75.3 |

|

2014–15 |

95.6 |

100.1 |

|

2015–16 |

103.7 |

153.9 |

|

2016–17 proposed |

96.3 |

135.1 |

|

2017–18 proposed |

87.7 |

129.7 |

|

2018–19 proposed |

50.4 |

85.8 |

|

2019–20 proposed |

40.1 |

70.4 |

|

Totals |

$494.0 |

$909.9 |

|

FI$Cal = Financial Information System for California. |

||

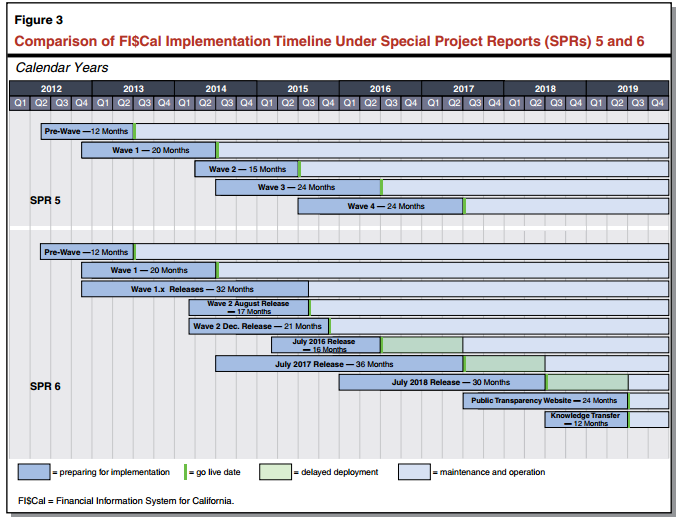

Transitions From “Wave” to “Release” Implementation Approach. Under the new plan, the project transitions from a wave implementation approach to a release implementation approach. Like waves, releases deploy functionality and departments to FI$Cal incrementally over time on scheduled implementation dates. These principal releases would take place in July 2016, 2017, and 2018. In contrast to waves, the release approach allows for functionality and departments that are not quite ready to implement at the scheduled date to roll out later. These intermediate releases would take place quarterly, as needed, if functionality is not ready at the time of the principal release. If a department is not ready to transition onto the system at the time of the principal release, the project could have until October of that year to transition. If the project requires additional time, the project would defer the department to a later release. Figure 3 provides a comparison of the FI$Cal implementation time lines under SPR 5 and SPR 6. As shown in the figure, SPR 6 allows for the deployment of departments and functionality after a scheduled principal implementation date—we refer to this as delayed deployment.

The release approach is more reflective of what the project has actually experienced in prior waves. In practice, the project has deployed functions after their scheduled implementation date, as is proposed in the new release implementation approach. However, rather than not meeting milestones set in a rigid schedule and having to make last minute changes to the implementation schedule, as was the case in SPR 5, the release approach anticipates that additional time beyond scheduled implementation dates will likely be needed for some activities. Staffing resources are allocated up front on the basis that some staff will be needed to stay on to complete work past a scheduled implementation date while other staff are working on the subsequent release. The project’s objective in transitioning from a wave to a release implementation approach is to maximize its flexibility, while reducing the potential for unplanned, negative schedule impacts for future releases. See Figure 4 for a listing of the functions the project will roll out and number of departments the project will implement over the remaining releases.

Figure 4

Departments and Functionality of FI$Cal Releases Under Special Project Report 6

|

Number of Departments |

Functionalitya |

Implementation Date |

|

|

Pre–Wave (actual) |

5 (a subset of Wave 1) |

Some procurement functions. |

July 2013 |

|

Wave 1 (actual) |

11 |

Significant budget functions. Some accounting, cash management, and procurement functions. |

Throughout 2014–15 |

|

Wave 2 (actual) |

45 mostly CFS departmentsb |

Additional budgeting, accounting, and cash management functions. |

August 2015 |

|

Remaining significant procurement functions. |

December 2015 |

||

|

July 2016 Releasec |

10 |

Financial management functions specific to the Department of General Services. Additional budget functions. Software upgrades. |

July 2016 |

|

July 2017 Releasec |

50 |

Remaining significant accounting functions. Remaining significant cash management functions. |

July 2017 |

|

July 2018 Releasec |

65 |

Public transparency website. |

July 2018 |

|

aFunctionality implemented in earlier waves is deployed to new departments as they join FI$Cal. Functionality implemented after a department originally joined FI$Cal will be deployed to that department as part of the subsequent wave deployments. bThe Department of General Services offers accounting, budgeting, and financial services to state entities on a fee–for–service basis. These departments, typically smaller entities, are known as contracted fiscal service departments. cPer the administration’s proposal, functionality and departments may be deployed in intermediate release over the 12 months following the principal implementation date. FI$Cal = Financial Information System for California and CFS = contracted fiscal services. |

|||

Establishes New Program to Ease Departments’ Transition. The project proposes to establish a new program to ease departments’ transition onto FI$Cal. The new program emphasizes communication and collaboration between the project and departments. As part of determining which departments will be included in each release, the project will spend time to better understand, analyze, and group state entities into deployment cohorts with similar financial management needs. The project will attempt to optimize support for departments by grouping them into implementation cohorts based on the size of the department, complexity of the department’s funding structure, and the similarity of departments’ financial processes. The project anticipates that adjustments to the departmental implementation cohorts may be necessary as the project learns more about department needs and challenges. A decision to move a department from one release to another will include an evaluation of (1) the department’s readiness and (2) the project’s ability to manage the release size and scope. The intent of this process is to help ensure that departments transition onto the FI$Cal System successfully in all three releases. This approach will be used to transition the remaining 125 departments onto FI$Cal.

Revises Implementation Schedule for Remaining Releases. In line with SPR 6, the project proposes to change the implementation schedule by shifting the bulk of the remaining work to later releases so that the project has more time before certain functions and departments are implemented. Specifically, the revised project splits the remaining two waves into three releases as follows:

- July 2016 Release. The updated project plan decreases the scope of what was previously known as Wave 3 by shifting the most significant portion of the accounting and cash management functions to the July 2017 release. Instead, for the July 2016 release the project plans to deploy additional budget functions, replace DGS’s current internal financial management system (previously planned for July 2015), and schedule software upgrades to the system. The fifth SPR anticipated some software upgrades in July 2016; however, additional upgrades not previously scoped within the project have been identified. This release also deploys the system to ten departments (one large, two medium, and seven small). (Unlike SPR 5, SPR 6 does not identify the specific departments that will transition onto FI$Cal over the various releases. Instead, SPR 6 lists the total number of departments and the relative size of those departments.) It is the intent of the project to test its new program to ease departments’ transition onto FI$Cal (described above) to a limited number of departments before deploying the system to a larger quantity of departments in later releases.

- July 2017 Release. The sixth SPR implements the most significant portion of the accounting and cash management functions one year later than what was anticipated in SPR 5. The project indicates that this change will allow more time to build and test these functions. In addition, this release deploys functions to 50 state departments (14 large, 14 medium, and 22 small).

- July 2018 Release. As previously planned, the final release includes the development of a public transparency website. However, the website will not become available to the public until July 2019, after the system has captured a full year of financial data. In addition, the final release deploys FI$Cal to the remaining 65 state departments (24 large, 11 medium, and 30 small).

Expands Knowledge Transfer Opportunities From Vendor to State. The sixth SPR provides one full year for knowledge transfer after all departments transition onto FI$Cal. The fifth SPR did not include any knowledge transfer after the system was fully deployed. The expanded knowledge transfer opportunity is intended to prepare the state to maintain the system with minimal support from the vendor on an ongoing basis. To date, the vendor has taken primary responsibility for DD&I and M&O. The project indicates that during the final year allotted for knowledge transfer, the vendor and project staff will switch roles, with the state taking primary responsibility of FI$Cal and the vendor supporting the project staff.

Does Not Reflect Final Agreement With Vendor. While the sixth SPR makes significant assumptions regarding the vendor’s role, it does not reflect a final agreement between the project and the vendor, and instead includes estimates of what the costs will ultimately be. The SPR assumes that the vendor commits to (1) remain engaged on the FI$Cal Project for an extended period of time and (2) take on additional responsibilities stipulated in SPR 6. The SPR also estimates the increased cost to the state for the vendor taking on these new commitments. We note that the project has not yet finalized the cost of these new commitments with the vendor.

LAO Assessment of FI$Cal Project Plan and Related Budget Proposal

Ultimately, we believe that the benefits of proceeding with FI$Cal development outweigh the risk and therefore recommend approval of the Governor’s budget proposal to implement project changes pursuant to SPR 6. (We discuss the administration’s proposal to establish the Department of FI$Cal in the next section of this report.) However, the FI$Cal Project involves the development of an extremely ambitious and complex IT system and significant work remains before the system is fully implemented. Given the scope of the remaining work, signals from oversight entities that some project activities continue to track behind schedule, and the inherent risk associated with an IT project of this complexity, we think a future SPR is likely that would further extend the project schedule and increase costs. Below, we describe our findings and recommendations related to the Governor’s proposal to implement the changes included in SPR 6.

LAO Findings on FI$Cal Project Status and Plan to Move Forward

Contract Negotiations May Change Cost and Schedule Projections. As noted earlier, the project and vendor have not yet reached final agreement regarding the cost of various new vendor commitments assumed in SPR 6. The negotiations with the vendor may result in significant changes to the scope of the vendor’s responsibilities relative to the scope included in SPR 6. Additionally, the project cost estimated in SPR 6 may not accurately reflect the vendor price for the specific activities once final negotiations are complete. Until the project and the vendor reach a final agreement, it is uncertain if the schedule and cost described in SPR 6 are accurate. If the final negotiations result in significant changes to the scope, schedule, and/or costs included in SPR 6, the project will require an additional SPR.

New Release Approach More Realistic Going Forward. Despite SPR 5 setting a strict schedule, in practice, the project has begun the implementation of new functions and departments between waves, as is proposed in the new release implementation approach. The release approach is a recognition by the project that some functions or departments may need additional time beyond the principal implementation date before they are ready to deploy. Rather than going live prematurely or setting unrealistic schedule expectations, the release approach provides the project some flexibility that prior experience has shown is needed. Additionally, prior decisions to stagger the deployment of functions after the scheduled implementation date have been the result of last minute changes to the implementation approach, rather than deliberate decisions made in advance. These last minute changes to the implementation approach have proven problematic for the FI$Cal Project and departments. The project was not prepared to keep staff engaged when workload persisted beyond the planned implementation date, as occurred in Wave 1 and Wave 2. These delays made it difficult to transition staff to other workload, as anticipated, and caused delays in other aspects of the project. Under the new release approach, the project plans to keep resources engaged to support a release after the principal release rather than assume the resources will be immediately freed up and available for subsequent releases. In this regard, SPR 6 reflects lessons learned from prior SPRs—namely that there may be some functionally or departments that need to be delayed—and plans accordingly. The project should therefore be better able to allocate resources more effectively to mitigate negative impacts on future releases.

Release Approach Provides Flexibility to FI$Cal Project . . . The proposed implementation approach provides the project the flexibility to delay roll–out of functions and shift the implementation of added departments based on their readiness. Specifically, the new SPR does not identify specific departments that will transition onto FI$Cal over the various releases, but instead lists the total number of departments and the relative size of those departments that are anticipated to be deployed on a scheduled implementation date. The sixth SPR also sets up a new program that supports departments leading up to implementation to help ensure that departments transition onto FI$Cal only when they are ready. These new features in SPR 6 help the project maximize its flexibility. Given the magnitude of the FI$Cal Project, project staff are likely to continue to experience challenges developing some functions or engaging some departments. The new implementation approach gives the project additional time to overcome these challenges without delaying the progress of the project due to staffing being held back to address issues from prior waves.

. . . While Maintaining Some Uncertainty for Departments. The administration’s proposed release approach and its new program to ease department transition allows for the shifting of functions and departments in the schedule, depending on their readiness. While this flexibility provides the project benefits described above, some uncertainty remains for departments. Because departments do not know when the project will exercise this flexibility, departments may be less able to adjust resources to reflect the change in schedule and may find the change disruptive to their workload.

Plan Mitigates Some Project Risk . . . The revised plan attempts to reduce risks associated with the project and improve the likelihood of FI$Cal’s success by allowing additional time to build and test certain functions. The proposed changes reportedly reflect lessons learned in the two years since the last SPR. Notably, the modifications to the project reveal the project’s improved understanding of the work required to implement complex functions specific to DOF, SCO, STO, and DGS while simultaneously addressing the needs of the diverse departments currently using or preparing to use the FI$Cal System.

While SPR 6 is associated with an extension of the project’s schedule and an increase in the project cost relative to SPR 5, these changes could potentially be less costly than moving forward with the prior plan. This is because the previous plan, which included a more aggressive schedule, could have resulted in rolling out system functions and adding new departments prematurely. Strictly following the aggressive schedule of SPR 5 would have resulted in costly rework and disruptions to the state’s financial systems. However, the project did not strictly follow the SPR 5 schedule. Instead, the unreasonable expectations created resulted in the project falling behind schedule. The oversight entities are already tracking the project’s progress based on the SPR 6 schedule. While SPR 6 makes it more likely that the project will be able to successfully implement these releases, the oversight entities have noted that some of these activities are already behind schedule. While a step in the right direction, perhaps SPR 6 may not go far enough in extending the project schedule.

. . . But Substantial Risk Remains. While we think the modifications to the FI$Cal schedule in SPR 6 reduce overall project risk and strengthen FI$Cal’s likelihood of success, substantial risk remains, especially in the final release planned for July 2018. This is because SPR 6 plans to transition a large number of departments onto FI$Cal in the final release. The fifth SPR also anticipated that the final wave—Wave 4 scheduled for implementation in July 2017—would be large. In our analysis of SPR 5, we raised a concern that the final wave was too expansive in size and may prove too difficult for the project’s resources to implement. Subsequent decisions by the Steering Committee deferred some departments to later waves, growing the size of Wave 4. While SPR 6 spreads the transition of departments onto FI$Cal over more years than SPR 5, the final release continues to include a much larger number of departments than have been rolled out at any other time in the project’s history. Moreover, the project has previously delayed departments with issues that make them challenging to transition onto FI$Cal (such as BOE and DOJ). These prior actions mean the final release will be comprised of the largest number of departments of any wave/release as well as the departments that are most likely to have challenges transitioning onto FI$Cal. We therefore remain concerned that the final release continues to be large, making it potentially difficult for the project to maintain its proposed schedule under SPR 6.

Reasonable to Hire Staff Now to Allow for Knowledge Transfer. The oversight entities have consistently raised concerns that the state may face significant difficulty maintaining FI$Cal after implementation without the vendor’s or some other M&O contractor’s assistance. Extending knowledge transfer opportunities enhances the likelihood that the state will be fully prepared to maintain FI$Cal after its implementation. That being said, the oversight entities report that only a small percentage of organizations successfully assume M&O responsibilities of an IT system of this type—that integrates various complex management functions—and a majority of organizations ultimately sign long–term M&O contracts with a vendor. While the additional year of knowledge transfer is a step in the right direction, some contractual relationship with the vendor or another contractor may be necessary on an ongoing basis to fill gaps in skill sets not available among state staff.

New Staffing Plan Seems to Address Recruitment and Retention Challenges Associated With Limited–Term Positions. The administration proposes transferring most FI$Cal Project staff to the Department of FI$Cal as DD&I workload comes to end. The administration has often asserted that it is difficult to recruit and retain employees for limited–term positions in part because workers prefer the security that is afforded employment in a permanent position. Especially in the case of IT projects, the use of limited–term positions is cited as a major hindrance to recruiting and retaining qualified candidates.

Under the prior project plan—SPR 5—many of the positions would be eliminated after the final wave. Under this prior approach, we would expect it to become increasingly difficult for the project to maintain a constant level of staff as the end of the project approaches because (1) employees would look for other employment opportunities in anticipation of their project job ending and (2) fewer qualified candidates would apply for vacant positions that would soon be eliminated. These staffing difficulties increase the risk that an IT project will not meet key milestones that affect the project’s schedule and budget and can ultimately lead to a project failing. For much of the project’s history, FI$Cal management has contended with recruitment and retention difficulties. Transitioning the vast majority of staff to the M&O of the system as they are no longer required for DD&I would likely help to mitigate future recruitment and retention challenges. However, if turnover in executive positions continues, it may pose challenges to maintaining the continuity and consistency of the vision and execution of the project.

Uncertain if Current Facility Can Accommodate Future Requirements of Project. The FI$Cal Project staff and many vendor staff are currently located in leased space in Sacramento, California. The FI$Cal Project is currently evaluating if the current facility can accommodate the requirements of the project in future years. Any facility would have to accommodate the nearly 100 new positions proposed in the Governor’s budget proposals for the project and department over the next several years. Additionally, the facility would have to accommodate training space to support current users of the system and the 125 remaining departments. According to the project, the limited space currently available for this purpose may jeopardize the project’s ability to support current and future FI$Cal departments. This problem would become more acute as additional departments are scheduled for deployment in future years. The DGS is currently conducting an ongoing facilities evaluation to identify whether changes are needed—either modifications to the current facility or a move to a different facility—in order to accommodate the requirements of the project.

LAO Bottom Line on Proposed FI$Cal Project Changes

Governor’s Proposed Project Changes Are Reasonable . . . The Governor’s budget proposal reflects a reasonable plan to implement the remaining functions and departments in FI$Cal. We believe that the time and effort that project staff has spent in updating the project plan has reduced overall risk and strengthened FI$Cal’s likelihood of success. The administration’s decision to delay the implementation of some functions and departments reflects the project’s commitment to a quality product rather than strictly adhering to predetermined milestones. While this strategy ultimately does extend the project’s schedule and increases its cost, we believe this approach is prudent given the negative impacts to the state should functions and departments be brought on line prematurely. On balance, we believe that the benefits of proceeding with FI$Cal development outweigh the risks, and therefore recommend approval of the Governor’s budget proposal in regards to project changes. Should the project make significant changes going forward, a new budget proposal would be submitted for legislative review.

. . . But Project Still Risky and Significant Work Remains. The FI$Cal Project involves the development of an extremely ambitious and complex IT system and significant work remains before the system is fully implemented. In its review of the Governor’s proposal and its ongoing oversight of the FI$Cal Project, the Legislature should be aware of and monitor factors that not only contribute to general risk inherent in all IT projects, but also the shifting of risks to the end of the project schedule due to the substantial number of departments rolled onto the system in the July 2018 release. The Legislature may want to ask the project at budget hearings to (1) indicate if the project is on schedule for the July 2016 release based on the scope proposed in SPR 6 and (2) identify the steps it is taking to address the risks inherent in the large July 2018 release.

Additional SPR Likely. We note that given the scope of the remaining work and signals from oversight entities that some project activities continue to track behind schedule, we think a future SPR is likely. Additionally, as SPR 6 does not reflect a final negotiation with the vendor, additional changes may be necessary once final negotiations are complete. Finally, we note that the Legislature may see a facilities–related request in future years based on the findings from the ongoing analysis of the current facilities’ capacity.

Back to the TopDepartment of FI$Cal

In this section we outline the Governor’s budget proposal to establish a new state department to maintain and operate the FI$Cal System and provide our comments on the proposal.

Governor’s Budget Proposal to Establish a New Department

In addition to the changes in the project described previously, the Governor’s budget proposes to establish the Department of FI$Cal to provide the ongoing M&O function for the FI$Cal System and support services for users of the system—roles currently provided by FSC. In the following section, we describe the mission, governance structure, funding mechanism, and staffing for the proposed department.

Mission. The Department of FI$Cal would be responsible for the implementation and ongoing M&O of the FI$Cal System. The Governor’s proposal indicates that in fulfilling this mission, the department would (1) expand support services to meet the needs of departments anticipated in the three remaining releases, (2) make system changes in response to department needs and/or changes in state and federal laws and regulations, (3) engage deferred departments (see the box below for a description of deferred and exempt departments), (4) add new functions to the system as deemed necessary in future years, and (5) provide a permanent administrative structure for FI$Cal.

Deferred and Exempt Departments

The current scope of the Financial Information System for California (FI$Cal) Project excludes deferred and exempt departments. Deferred departments are defined as departments that have implemented or are in the process of implementing their own financial management system. As these departments’ systems require upgrades or as departments desire expanded functionality, they will move onto FI$Cal. Under the Governor’s proposal, the Department of FI$Cal will be responsible for bringing deferred departments onto FI$Cal as needed. Deferred departments will not use FI$Cal in the interim, but will exchange necessary information with FI$Cal to support the constitutional and/or statutory responsibilities of the partner agencies. Exempt departments have statutory authority to use systems other than FI$Cal for their financial management. Exempt departments will not use FI$Cal directly, but will exchange necessary information with FI$Cal to support the constitutional and/or statutory responsibilities of the partner agencies. See the figure for a complete list of deferred and exempt departments.

Departments Deferred or Exempt From FI$Cal

Under Special Project Report 6

|

Deferred |

|

California State Lottery Commission |

|

Department of Corrections and Rehabilitation |

|

Department of Motor Vehicles |

|

Department of Transportation |

|

Department of Water Resources |

|

State Teachers’ Retirement System |

|

Department of Technology |

|

Exempt |

|

Legislature |

|

Legislative Counsel Bureau/Legislative Data Center |

|

Judicial Branch |

|

State Auditor’s Office |

|

University of California |

|

California State University |

|

Hastings College of the Law |

|

Public Employees’ Retirement System |

|

State Compensation Insurance Fund |

Governance Structure. The proposed department would be led by the Director of the Department of FI$Cal, to be appointed by the Governor and confirmed by the Senate. While the director would be responsible for overseeing the day–to–day operation of the FI$Cal System, the director would have limited authority over policy decisions affecting the system. This is because, as in the current structure of the FI$Cal Project, the Steering Committee would continue to set polices relative to their constitutional and/or statutory responsibilities over the state financial management processes integrated through FI$Cal—budgeting, accounting, cash management, and procurement. Instead, the director’s responsibilities would include (1) setting and monitoring administrative policies; (2) reporting department achievements and status to the partner agencies; and (3) acting as spokesperson for the department to the Legislature, external stakeholders, and the public—responsibilities that the Executive Partner has under the existing governance structure. As in the current governance structure, issues outside the director’s authority, such as policy decisions regarding the state’s financial processes, would be decided by the Steering Committee. Initially, the department would report directly to the Governor. The project envisions that the Department of FI$Cal eventually would be realigned under the California Government Operations Agency.

Department Funding and Staffing. The Governor’s budget proposes $42.6 million ($24.3 million General Fund) and 122 positions in 2016–17 to support the proposed M&O functions within the Department of FI$Cal. This position total includes 99 existing project positions that will shift from DD&I to M&O responsibilities plus 23 proposed new positions. When the department assumes complete responsibility for maintaining and operating the FI$Cal System in 2019–20, the department is expected to cost $70.4 million annually and include 274 permanent positions.

- Funding. The cost of operating the Department of FI$Cal would be funded 57 percent from the General Fund and 43 percent from the Central Service Cost Recovery Fund (CSCRF). The CSCRF portion would be paid for by allocating the operational cost to departments based on their share of use. The annual cost of operating the department will increase in future years as new functions and departments come onto the FI$Cal System. The cost of operating the department is expected to level off in 2019–20, at which point the annual ongoing cost is expected to be $70.4 million ($40 million General Fund).

- Staffing. As noted above, the proposed department would include 122 positions to support the FI$Cal M&O function. This position total for M&O will grow over time as the FI$Cal System becomes more mature and as other staff working on DD&I activities and finishing up the implementation work for the project—totaling 121 under the Governor’s proposal and nominally considered to be part of the department—shift to M&O activities. By 2019–20, it is estimated that the department will be comprised of 274 ongoing positions, primarily dedicated to M&O of the FI$Cal System. The departmental positions mentioned herein do not include positions in the partner agencies dedicated to FI$Cal—estimated to be around 60 positions in 2019–20.

Implementing Legislation Establishes Department of FI$Cal. The Governor proposes legislation to update the existing statute for the FI$Cal Project to reflect the department–related budget proposal. Among other things, the language (1) replaces the FSC and the FI$Cal Project office with the Department of FI$Cal and makes conforming changes and (2) eliminates the FI$Cal Executive Partner and establishes the Director of the Department of FI$Cal, who would be appointed and serve at the pleasure of the Governor.

Evaluating Options for an Administrative Structure for FI$Cal M&O

While we agree with the administration that an entity is necessary to maintain and operate FI$Cal, it is unclear to us whether the establishment of a new department is the best way to fulfill this function. We identify a range of options for maintaining and operating FI$Cal and propose questions that the Legislature may want to ask the administration in order to get a better understanding of the merits and challenges of establishing the Department of FI$Cal, as proposed by the Governor, versus other options.

Range of Administrative Structure Options for Maintaining and Operating FI$Cal

A range of options of administrative structures for maintaining and operating the FI$Cal System are available for legislative consideration. Below, we describe three options—the Governor’s proposal and two other basic options—and discuss the relative merits and drawbacks of each option.

- Create a New Department. As the administration proposes, responsibility for supporting the state’s integrated financial management system could be delegated to a newly created department. This approach could be more costly than other options given the administrative costs associated with establishing and operating a department, especially a department of a few hundred employees. The administration proposes that once the system is fully implemented, the Department of FI$Cal will need 37 administrative positions for 274 total authorized positions. This is a larger administrative infrastructure than that found in other similarly sized departments. For example, one department we queried has 22 administrative staff for 285 total authorized positions, while another department has 35 administrative positions for 340 total authorized positions. That said, some level of administrative support will be needed to maintain and operate the FI$Cal System, regardless of the entity selected for M&O. On the benefits side, creating a new department to maintain and operate the FI$Cal System would establish a dedicated entity in state government for maintaining and operating the system, increasing its visibility and perhaps signaling that maintenance of the system is a priority.

- Preserve FSC. The FSC has maintained and operated FI$Cal since July 2013, when the first system functions were implemented in a small number of departments. It is unclear why a new state department is necessary when an infrastructure already exists to maintain and operate the FI$Cal System. The responsibility for FI$Cal M&O could remain at the FSC. Although this is an option the Legislature could consider, we find it to be substantially similar to the Governor’s proposal to establish a new department. The main potential difference is that the FSC may be able to maintain the system with lower administrative costs. This is because the FSC would not necessarily have the added administrative infrastructure necessary to operate a new department because it could continue to obtain contracted administrative services from DGS, as is current practice. However, according to the project, the FSC does not provide the system with the visibility a department would provide the system.

- Delegate Responsibility to One of the Four Partner Agencies. Alternatively, the Legislature could delegate the M&O responsibilities to one of the four partner agencies. This approach utilizes the partners’ familiarity with the system, without building an extensive administrative infrastructure to support a new department. Although this option would be less costly than creating a new department because it would utilize an already existing administrative infrastructure, partner agencies have existing constitutional and/or statutory responsibilities that may result in their prioritizing existing responsibilities over FI$Cal M&O.

Questions for Legislative Consideration in Evaluating M&O Options

When balancing the benefits and trade–offs of these options, the Legislature should consider such criteria as (1) how the option affects accountability to the Legislature, (2) the cost and potential economies of scale of the option, and (3) the capacity of the entity under the option to maintain and operate the FI$Cal System. The Legislature may want to direct the following questions to the FI$Cal Project during budget hearings in order to get a better understanding of the merits and challenges of establishing the Department of FI$Cal versus other options.

- How does establishing a department improve the services already provided by the FSC?

- What authority would the Director of the Department of FI$Cal have independent of the partner agencies? How would the authority of the director differ from the authority of the current Executive Partner at the FSC? How would the Director of the Department of FI$Cal be held accountable?

- Are there any administrative costs associated with the creation of a new department that would not exist if the M&O for the project continued to be with the FSC or were placed within one of the partner agencies?

Regardless of the model used to maintain and operate the state’s integrated financial management system, the Legislature may wish to take steps to address the muddled accountability inherent in the current governance structure and likely to continue regardless of the entity selected for M&O unless addressed. In the next section we present options for strengthening accountability.

A Need to Strengthen Accountability

Muddled Accountability Under Current Governance Structure. The current governance model spreads accountability across the Executive Partner and the members of the Steering Committee, rather than empowering a single point of authority for decision making who can be clearly held accountable.

Accountability Continues to Be Problematic Under Governor’s Proposal. The Governor’s proposal does not address the existing muddled accountability and would continue to jeopardize the Legislature’s ability to hold FI$Cal leadership accountable. As proposed, the Department of FI$Cal would not have a single point of authority for decision making. Instead, authority would be diffused across the department’s director and the partner agencies. Typically in state government, a department director would have authority over the policy and administrative issues of his or her department. In the case of the Department of FI$Cal, however, the director would have no authority over the state’s financial management policies. These activities would remain within the respective purview of DOF, SCO, STO, and DGS. The director’s authority would largely be limited to administrative issues facing the department, even though changes in the state’s financial management policies could directly affect the FI$Cal System. Should issues regarding FI$Cal’s performance arise in the future, this governance structure would make it difficult for the Legislature to hold decision makers accountable for any actions that disrupted FI$Cal.

Options for Strengthening Accountability, Regardless of M&O Entity Chosen. Each option for an administrative structure to maintain and operate the FI$Cal System potentially presents problems with accountability. Therefore, regardless of the administrative structure chosen, we think that steps should be taken to enhance the Legislature’s ability to hold FI$Cal leadership accountable. The following options could strengthen accountability regardless of the entity chosen to maintain and operate the system, with the second option being a more incremental step to strengthen accountability for the short term.

- Discontinue Formal Role of Partner Agencies, Instead Establish Advisory Role. During the planning and DD&I phases of the FI$Cal Project, intensive engagement by the partner agencies was necessary. Critical decisions were being made regularly during these phases regarding the automation of processes over which the partners have constitutional and/or statutory responsibility. During the M&O phase, the Steering Committee will generally be making less frequent and less critical decisions about the automation of the state’s financial management processes. As a result, the existing role of the partner agencies—directing the course of the project through the Steering Committee—might no longer be necessary for the success of the system once it enters M&O. Instead, the leader of the entity selected to maintain and operate the system could solicit advice from partner agencies on an as–needed basis. Transitioning the partner agencies to an advisory role would establish the leader of the selected entity as the single point of authority for decision–making over issues affecting FI$Cal. The Legislature would therefore be able to hold the leader accountable for changes in policies that threaten the stability of the system.

- For the Short Term, Elevate Leader of Entity Selected for M&O to Voting Member of the Steering Committee. Because the FI$Cal System will not fully enter M&O until 2019–20, the Legislature may wish to take incremental steps to increase accountability in the short term. This would preserve the more formal role of the partner agencies until the system is fully implemented. The Legislature could increase the accountability of the leader selected to maintain and operate the system by establishing the leader as a voting member of the Steering Committee and Project Directorate. Because the Steering Committee operates under the consensus decision–making model—where all voting members must agree to a course of action—the leader of the selected entity could be held accountable for changes in policies that threaten the stability of the system. While this model would empower the leader to block policy changes that he or she believes would negatively impact the FI$Cal System, it would not necessarily allow the leader to independently pursue policy changes he or she believes would benefit the system. Instead, the leader would need to seek the support of the full Steering Committee.