LAO Contact: Ashley Ames

May 16, 2016

Addressing California’s Convenience Zone Recycling Center Closures

Recycling Center Closures

Many Recycling Centers Have Closed in 2016. Since January 1, 2016, about 330 (or about 15 percent) “convenience zone” (CZ) recycling centers—those generally located within a half mile of supermarkets—have closed. As discussed in our report An Analysis of the Beverage Container Recycling Program, CZ recycling centers are an important part of the state’s Beverage Container Recycling Program (BCRP). They provide a convenient location for consumers to recycle beverage containers and have their deposit—the California Redemption Value, or “CRV”—repaid. The closure of so many CZ recycling centers is problematic because it reduces consumers’ ability to easily redeem their containers. It also places a burden on supermarkets within the zone that, under existing law, must either pay a fee or take back containers themselves, which is generally more expensive.

Closures Particularly Affected Small and Rural Recyclers. Based on our conversations with the California Department of Resources and Recovery (CalRecycle), many of the CZ recycling center closures have been at rural, low-volume sites. This is likely because many low-volume recyclers have higher per-container recycling costs, which makes them more financially vulnerable to market changes, such as those discussed below. As shown in Figure 1, based on surveys of recyclers conducted by CalRecycle, it costs small CZ recyclers over twice as much on average to recycle a container than large CZ recyclers. Payments from the state intended to cover recycling costs (discussed below) are based on a per-container statewide average rate, so they are usually less than a low-volume recycler’s actual costs.

Figure 1

Lower-Volume CZ Recycling Centers Face Higher Per-Container Costs of Recycling

2014

|

CZ Recycler Size (Number of Containers Recycled Annually) |

Average Recycling Cost Per Container (Cents) |

|

More than 6.6 million |

1.6 |

|

3.51 to 6.6 million |

2.2 |

|

Less than 3.51 million |

3.5 |

|

CZ = convenience zone. |

|

How Do CZ Recycling Centers Make Money?

As shown in Figure 2, CZ recyclers earn money from two main sources: the sale of collected scrap material and payments from the Beverage Container Recycling Fund (BCRF)—processing payments, handling fees, and administrative fees.

Figure 2

CZ Recycling Center Revenue

(Dollars in Millions)

|

Payment |

2015-16 Projected Amount |

Percentage |

|

Scrap salesa |

$51 |

37% |

|

Payments from BCRF: |

||

|

Processing paymentsb |

26 |

19 |

|

Handling feesb |

53 |

38 |

|

Administrative feesb |

7 |

5 |

|

aEstimate based on reported scrap values and projected container returns to CZ recyclers. bFrom CalRecycle’s fiscal year 2014-15 4th Quarter Report on the Status of the BCRF. CZ = convenience zone and BCRF = Beverage Container Recycling Fund. |

||

Revenue From the Sale of Scrap Material. Recyclers earn money when they sell the materials they collect to processors who sort, clean, and process the containers into formats ready for reuse—such as glass cullet or plastic flake—which they are able to sell to manufacturers for use in new beverage containers or other types of products. The amount recyclers make depends on the value of the recycled material, which is referred to as the “scrap value.” Scrap value is affected by many factors, including the relative cost of producing virgin material and the global markets that demand recycled scrap for manufacturing or other uses. It can also be affected by the difficulty of recycling certain materials and the quality of the recycled scrap. For example, material with a lot of contamination can be difficult to clean and process, and the resulting scrap will likely be of lower value.

Historically, the scrap value for aluminum has been the highest, and the vast majority of revenue to recyclers from the sale of scrap comes from aluminum sales. Glass scrap value has been the lowest, in part because glass can break into small pieces and become contaminated when mixed with other materials. Plastic scrap is influenced by oil prices, since virgin plastic is usually manufactured from oil derivatives.

Payments From BCRF. The costs of recycling glass and, depending on global markets, plastics are greater than the scrap value that those recycled containers are worth. This means that, absent some additional financial support, accepting these containers from consumers and recycling them would be unprofitable for recyclers and processors, and they would be unlikely to do so. In addition, recycling these containers has benefits that are not reflected in their scrap value—such as reduced litter, environmental benefits like reduced greenhouse gas emissions, and preservation of the resources used to make virgin materials. For these reasons, the state subsidizes recycling through two types of supplemental payments that provide CZ recyclers with a financial incentive to collect beverage containers with relatively low scrap values: processing payments and handling fees. (Recyclers also receive some fees to cover administrative and reporting costs.) These payments are mostly made from the BCRF.

- Processing Payments. Processing payments are intended to cover the difference between a container’s scrap value and the average cost of recycling it (including a reasonable rate of return). Aluminum’s scrap value is higher than its cost to recycle, so no processing payment is provided for aluminum containers. However, payments are provided for both glass and plastic. CalRecycle determines processing payment amounts by estimating recycling costs and calculating scrap values. As required under existing law, the department estimates recycling costs through surveys of recyclers every two years. The department determines scrap values based on monthly reports from processors. In accordance with state law, CalRecycle sets the per-container payment rates quarterly based on a 12-month rolling average of scrap values. Both the costs of recycling and the scrap value of beverage containers can fluctuate significantly based on changing market prices. As a result, processing payments vary over time. A small portion of processing payments are covered by beverage container manufacturers, but they are mostly paid by the BCRF. Both CZ recyclers and traditional recyclers (those not located in a CZ) are eligible to receive processing payments.

- Handling Fees. Additionally, CZ recyclers can qualify for a subsidy called a “handling fee” if they meet additional requirements, such as being located in the actual supermarket parking lot. Surveys have shown that CZ recyclers typically face higher costs of operation than traditional recyclers due to factors such as more expensive rent, costs to transport materials to processors, or less economies of scale due to lower volume of redeemed containers. The handling fee is intended to cover these higher costs. Currently, the fee is about one cent per redeemed container.

Causes for Closures

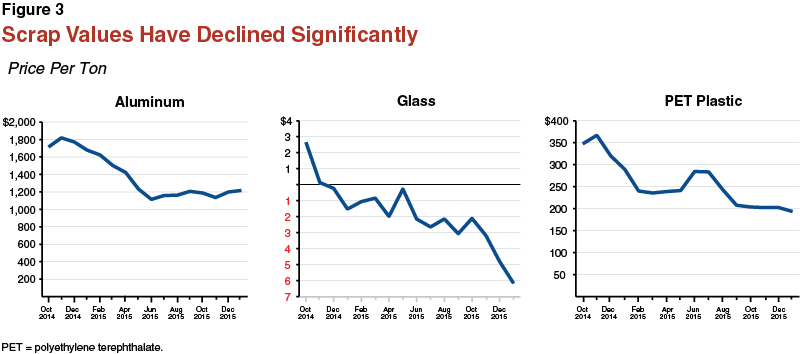

Declining Scrap Values Reduce Recycler Revenues. As Figure 3 shows, scrap values for all materials in the BCRP have declined significantly since 2014. In fact, glass scrap values declined so much that they are actually negative, meaning recyclers pay processors to take the glass (rather than processors purchasing the material from recyclers). Based on our conversations with CalRecycle and recent news reports, declining scrap values have occurred for a couple of reasons. First, California exports a significant amount of its recycled scrap material, primarily to China for manufacturing and other uses. Over the past few years, the Chinese economy has weakened, causing the demand for exported scrap to decline. Second, oil prices have declined significantly and have reached historically low levels in 2016. New plastic is manufactured from oil, so when the price of oil is very low, using recycled plastic can actually be more expensive because it has to be sorted and cleaned. This change has impacted the demand for recycled plastic, reducing its scrap value.

Recyclers Report Increased Operating Costs. Recyclers have reported some increased operating costs. For example, the largest CZ recycler in California—rePlanet—cited higher operating costs as a result of minimum wage increases and required health and workers’ compensation insurance when they announced the closure of 191 recycling centers in January 2016.

BCRF Payment Formulas Do Not Reflect Most Recent Market Changes. The payment calculation as currently set in statute has not kept pace with recent, rapid declines in scrap values because it (1) is only updated quarterly and (2) reflects a 12-month rolling average. These factors cause a lag between current market prices and the scrap values used for calculating processing payments. The result of the lag is that processing payments to recyclers are less than their net cost of recycling when market prices fall and processing payments are not updated for months. The Container Recycling Institute, a nonprofit organization focused on beverage container recycling programs, recently estimated that BCRF payments to recyclers were not enough to cover their costs, resulting in significant losses.

Additionally, the most recent survey of recyclers released by CalRecycle in 2015 actually showed a reduction in the statewide average per-container cost of recycling since the prior survey released in 2013. However, some recyclers have recently reported higher operating costs. One possible explanation for this difference is that the 2015 survey uses financial data from 2014, so any cost increase since then would not be reflected in survey results. It is also possible that higher-cost recyclers have closed, resulting in the survey showing a lower statewide average cost of recycling even though costs could have actually increased for individual recyclers. Regardless of the cause, the survey results were incorporated in processing payment rates in January 2016, which led to a reduction in processing payments to recyclers. The handling fee is based on similar cost surveys, and is set to be adjusted in July 2016. Many recyclers are concerned that it could also be reduced.

Options to Address Closures

There are many options available to address recycler closures, and we discuss a few of them related to processing payments and handling fees below. This list is not intended to be exhaustive, but rather to provide the Legislature with some choices that could mitigate CZ recycling center closures. We note that the BCRF faces an operating deficit estimated around $75 million annually, and the fund is expected to be depleted sometime after 2017-18. Therefore, when considering options to address CZ recycler closures, one factor the Legislature will want to weigh is how the options will impact the long-term health of the fund.

Processing Payments

Make Adjustments to BCRF Payment Formulas in Statute. Currently, statute requires that processing payments be adjusted no more than quarterly. Changing statute to allow for monthly adjustments would allow the payments to reflect more recent market changes. This change would probably increase workload for CalRecycle slightly, but would allow processing payments to more accurately reflect real time market prices.

Additionally, the Legislature could revise statute to base processing payments off a shorter rolling average period than the current 12 months. This would make payments more responsive to changes in scrap values. However, it would also make the payments more prone to fluctuations when scrap values change significantly. These fluctuations would make it more difficult for the department to predict payment amounts and therefore project the future condition of the BCRF. In times where scrap values are falling like in recent years, this change could put the BCRF at risk because payment amounts might increase quickly and unexpectedly. This risk could be mitigated by making changes to the formula that would require manufacturers to pay a greater share of the processing payment amount (they currently pay a small portion, and the BCRF covers the rest). These changes could reduce unexpected processing payment expenditures from the BCRF, but they would transfer the risk and associated costs to beverage manufacturers.

Requiring Manufacturers to Buy Materials Could Help in Long Run. In our report last year, we identified a market-based option that the Legislature could consider implementing for container collection and recycling. A market-based system would replace processing payments with a system that makes the manufacturer responsible for the recycling of its CRV materials. Under this structure, a manufacturer would be required to purchase a certain amount of containers from the California recycling market based on the total amount of CRV containers that it sold in California. Manufacturers could negotiate container purchases with recyclers, and the resulting price of sold containers should reflect market changes in the costs of recycling and scrap values. In this way, a market is better able to accommodate quickly changing prices, resulting in transactions that more accurately reflect real time value. This would eliminate overpayments and underpayments associated with relying on surveys and lagged formulas, ensuring that a fair price is paid and improving the efficiency of BCRP scrap markets.

Handling Fees

Remove Supermarket Site Requirement in Statute. Currently, CZ recyclers must be physically located within or adjacent to a supermarket parking lot in order to receive handling fees. This requirement is meant to make it more convenient for consumers to redeem their CRV deposits, but in some cases it can increase costs and reduce convenience when CZ’s go unserved. Alternatively, allowing CZ recyclers to be located anywhere within a CZ—rather than only on a supermarket site—would expand competition for locations and provide greater flexibility for the recyclers to find a low-cost location. While this option could slightly reduce convenience in some instances—for example, if a customer has to travel from the redemption center to a supermarket to collect the customer’s CRV deposit—it could result in more recyclers operating in California, which would improve overall convenience. The Legislature could also require that supermarket and other beverage dealers post where the nearest recycler is located if the recycler is not located on site.

Other Payment Options

Consider Tiered Payment Structure Based on Size of Recycler. The Legislature could consider other changes to how BCRF payments are structured that might benefit CZ recyclers, especially the more vulnerable low-volume recyclers. For example, changing the processing payment or handling fee from a statewide average per-container rate to a tiered rate based on recycler size could better reflect recyclers’ actual costs. As discussed above, smaller, lower-volume recycling center sites have higher per-container costs than higher-volume sites. The department already collects data on recyclers’ costs based on recycler size. So, adjusting payments by container volume tier would be fairly simple. The Legislature could also consider making handling fees a flat amount per site within a tier rather than on a per-container basis. The administration proposed a similar adjustment as part of its 2014–15 budget proposal, which was ultimately not adopted by the Legislature. Either of these changes would increase payments for smaller recyclers that have been more affected by recent market changes, but could reduce the BCRF payments for large recyclers. In considering different options, the Legislature could require CalRecycle to pilot test payment structures in order to identify their effects on consumers and CZ recyclers.