September 29, 2016

California's First Film Tax Credit Program

- Background

- The First Film Tax Credit Program

- Economic Effects

- State and Local Fiscal Effects

- LAO Comments

Executive Summary

California provides tax incentives for qualified film and television productions to be made in the state. The first film tax credit program was adopted in 2009 and provided $800 million ($100 million per year over eight years) in credits to selected feature films and television projects. In 2014, the Legislature created a new film tax credit program that increased the available amount of tax credits to $330 million per year—beginning in the 2015–16 fiscal year—and modified the program in various ways.

In this report, as required by law, we evaluate the economic effects and the administration of the first film tax credit program passed in 2009. We find that about one–third of the film and television projects receiving incentives under this program would probably have been made in California anyway. We suspect that this level of “windfall benefits” to some credit recipients may be low compared to other tax credits, which would suggest that the first film tax credit program targeted the types of production vulnerable to being filmed outside the state relatively well.

The $800 million in credits under the first film tax credit program will eventually go to more than 350 projects. These projects generated or will generate billions of dollars of economic activity over the life of the program. The net amount of new economic activity is uncertain, however, with benefits offset somewhat by economic opportunity costs and other changes in the state’s economy. The direct fiscal cost of this program to the state of more than $800 million, including administrative costs, is likely offset by several hundred million dollars of additional state tax revenues related to the increased economic activity. Local tax revenues—mostly those of Los Angeles County—could also increase somewhat.

As we have stated previously, the competition between states to provide public subsidies to specific individuals or companies is very problematic as a public policy. In general, we advise policy makers to reject such tax incentives. We have, however, acknowledged that California’s adoption of a film tax credit is understandable in light of the actions taken by other states to lure Hollywood productions away from California. If more jurisdictions back away from their film and television tax incentives, lawmakers should consider whether California’s incentive programs should be changed or eliminated as well.

Background

California and the Motion Picture Industry. The motion picture industry is one of California’s flagship industries. The U.S. motion picture industry is centered in Los Angeles County to such an extent that people all around the world refer to the entire industry as “Hollywood”—after a neighborhood in Los Angeles where many film studios were historically located. Firms within this industry make feature films, television programs, and other products (such as commercials and music videos) for distribution through various channels—including movie theatres, television broadcast, on–demand internet streaming services, and retailers. The economic output of this industry in California totals roughly $50 billion annually (about 2 percent of the state’s $2.5 trillion economy).

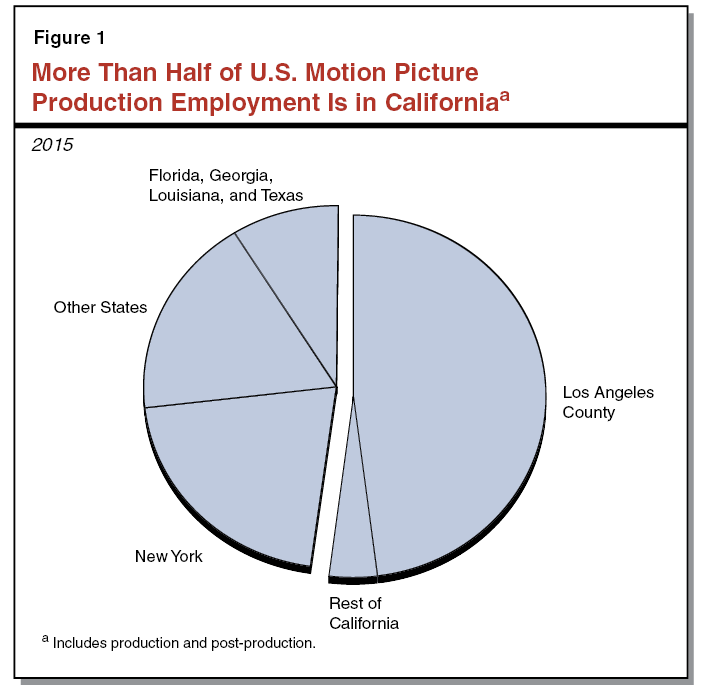

Most U.S. Film and Television Jobs Are Here. The motion picture industry employs about 145,000 people in California. About 115,000 of these employees work in film and television production and another 10,000 or so work in post–production. (The other 20,000 employees work in motion picture exhibition—that is, in movie theatres.) As shown in Figure 1, more than half of U.S. film and television production and post–production employment is located in California. The industry is heavily concentrated in Southern California—with about 90 percent of these California jobs in Los Angeles County. In addition, there is a significant post–production employment cluster in the San Francisco Bay Area. New York also has a large—and growing—film and television production industry, with nearly 50,000 production and post–production jobs. A considerably smaller number of people work in the industry in other states. The states with the next four largest motion picture industry employment clusters—Florida, Georgia, Louisiana, and Texas—each has roughly 5,000 film and television production and post–production jobs. (Our 2014 report, Overview of Motion Picture Industry and State Tax Credits, includes more detailed information about the film and television production industry.)

Motion Picture Production Is Mobile. A film or television episode can be made pretty much anywhere. Many U.S. states—and most developed countries, for that matter—now have modern film and television production studio facilities. Additionally, feature films are often made “on–location” in remote places. Cameras and other equipment can be easily moved. Key personnel and cast can fly from one location to another.

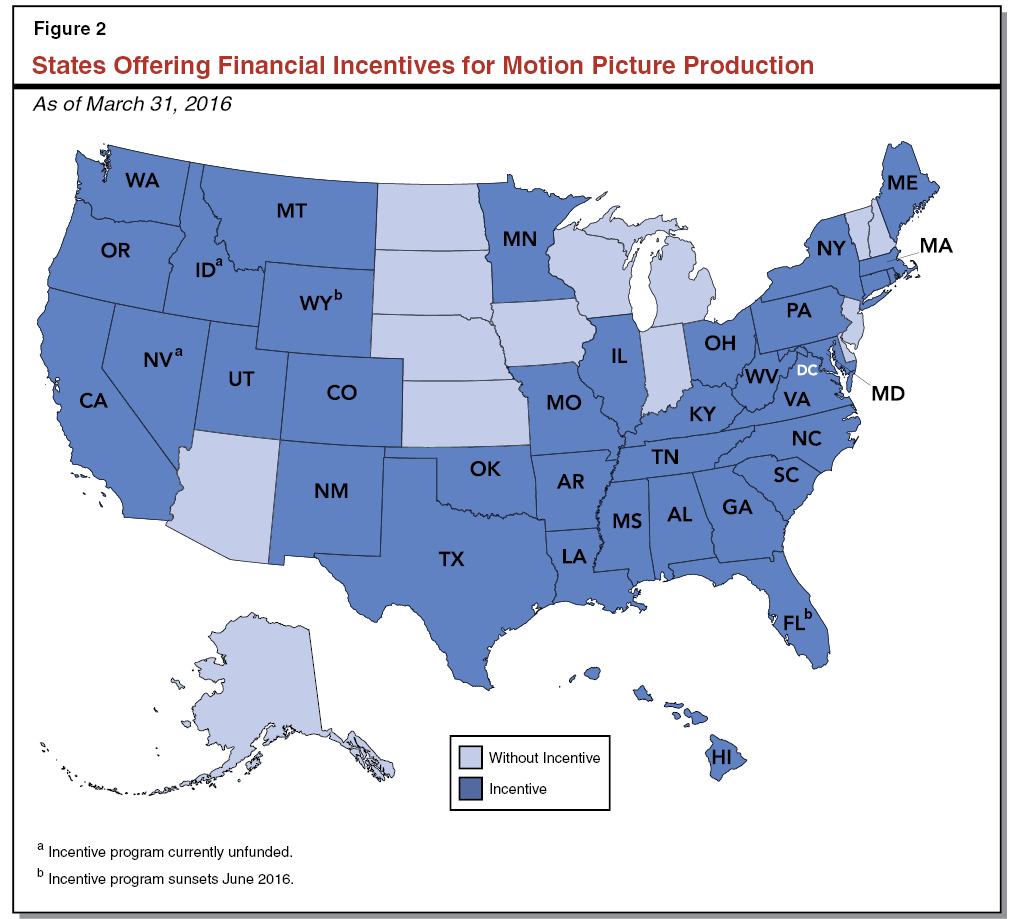

Many States Offer Public Subsidies to Attract Motion Picture Production. Many policy makers would like producers to make large–budget features and well–known television series in their communities. As we noted in our 2014 report, policy makers hope that attracting several high–profile motion picture productions will develop their region’s motion picture production industry and stimulate film–related tourism. Consequently, many states now offer financial incentives—typically transferable or refundable tax credits—to encourage film and television production. Over time, competition among states has escalated. Some states, such as New York, have recently expanded their incentive programs. On the other hand, states such as Michigan and New Jersey have discontinued their programs. As of March 2016, 35 states, Puerto Rico, and the District of Columbia offered some type of state financial incentive for film and television production (see Figure 2). However, as noted in the figure, some states’ programs are currently unfunded and others are expected to sunset this year, such as Florida’s tax credit.

Governments in other countries also offer similar subsidies. A notable example is Canada, where several provinces were among the first jurisdictions to offer financial incentives for motion picture production.

Financial Incentives Likely Influence Production Location Decisions. Motion picture production incentive programs typically provide corporate tax and sales tax benefits. Some states, such as Tennessee and Colorado, provide a cash grant or a cash rebate to qualified film and television productions instead of a tax credit. In most states, the tax credit is transferable or refundable because most production companies (or their parent corporations) would not have a sufficiently large tax liability in the state to use the full tax credit. The value of the state financial incentive is usually based on a percentage of production expenses. For example, the amount of the above–mentioned Colorado cash rebate is calculated as 20 percent of qualified spending. As we discussed in our 2014 report, this is typical. State incentive programs often qualify which production expenses, such as local crew wages, are used to calculate the amount of the incentive and those which are not, such as payments to out–of–state suppliers. These financial incentives are often significant. While there are many considerations in choosing a filming location, for many productions the availability of financial incentives appears to influence the decision.

California Adopted First Film Tax Credit in 2009. In response to the increase in financial incentives offered by other jurisdictions, the Legislature approved creation of the California Film and Television Production Tax Credit (film tax credit) program in 2009. This film tax credit program provided $100 million per year between fiscal years 2009–10 and 2016–17, for a total of up to $800 million in tax credits. In this report, we refer to the tax credit program established in 2009 as California’s “first” film tax credit program. As we discuss below, the first film tax credit program has allocated all available funds and is no longer accepting applications. Chapter 413 of 2014 (AB 1839, Gatto) replaced the first film tax credit with a newly expanded film tax credit program. The new program allocates up to $330 million annually through and including the 2019–20 fiscal year. A wider range of film and television projects are qualified to apply for tax credits under this new program.

LAO Required to Evaluate First Film Tax Credit. Chapter 841 of 2012 (AB 2026, Fuentes) requires the LAO to report on the economic effects and administration of the first film tax credit program. To produce this report, we reviewed the detailed project–level spending data that applicants report to the state—both the actual spending data provided by those that received a tax credit and spending estimates by those that did not. As required by statute, we use this data and other sources to estimate the economic effects of the first program. We also discuss the administration of the first film tax credit.

Future Report Planned. Under the 2014 film tax credit law, our office is required to produce another report on California’s film tax credit programs by July 1, 2019. We expect to continue monitoring some of the same issues we have discussed here, as well as evaluate available data for the expanded tax credit program passed in 2014. (Little data was available on this new film tax credit program at the time we completed this research.)

The First Film Tax Credit Program

Program Overview

Tax Credit Program Administered by State Film Commission. The California Film Commission (CFC) was established in 1985 to attract and retain motion picture production to the state. The CFC provides production assistance and information to filmmakers planning to shoot on–location in California. The CFC also coordinates film permitting for most state–owned property, such as for when a project wants to film at a state park or on a highway. In addition to these services, the CFC administers the state’s film tax credit programs.

Tax Credit Based on Qualified Production Costs. The first California film tax credit program provided tax incentives to selected motion picture companies making an eligible film or television project. The amount of the tax credit was equal to 20 percent of qualified expenditures for most projects. Television series relocating to California from other jurisdictions and projects that qualify as “independent” films were eligible for a tax credit of 25 percent of qualified expenditures. Only the production types described in Figure 3 could apply for and receive a film tax credit under the first film tax credit program. The program required that at least 75 percent of all production spending occur in California (expenses incurred outside the state were not qualified). Only certain production and post–production expenditures—such as crew wages and equipment—qualified for the tax credit. Non–qualified expenditures included, among other things, costs for securing the rights to the screenplay and cast compensation. Please see the nearby box for the distinction between qualified and non–qualified motion picture production spending.

Qualified Motion Picture Production Spending Under California’s First Film Tax Credit

We describe below which motion picture production expenses qualified for the first California film tax credit and which did not. The tax credit allowed selected taxpayers to reduce their tax liability by 20 percent (25 percent in some cases) of qualified production expenses only. Non–qualified production expenses were not considered in calculating the amount of the tax credit.

Wages for Most People Behind the Camera Are Qualified. Spending on goods and services in California used for film and television production and post–production were generally classified as qualified spending. These included the purchase and lease of equipment, spending on set construction, and many other expenses such as travel within the state. Wages and fringe benefits qualified for certain types of labor—primarily the crew working behind the camera. Qualified wages also included payments to some independent contractors and background actors that had no scripted lines.

Non–Qualified Expenditures. Individuals whose wages (and other compensation) were not considered to be qualified expenditures included:

- The writer or writers.

- The director.

- The producer, executive producer, line producer, visual effects producer, and associate producers.

- The music director, composer, and music supervisors.

- The cast and, with some exceptions, any other performer who appears on screen.

Other production expenditures that were clearly not qualified for the first film tax credit included the costs of acquiring the story, music rights and licenses, gifts and allowances to the cast and other non–qualified individuals, and certain payroll taxes.

Some Confusion on What Expenditures Qualified. The California Film Commission (CFC) provided detailed descriptions of qualified and non–qualified expenditures on its website and in training sessions. Nonetheless, some applicants were reportedly confused about what kinds of spending qualified or not. We understand these applicants incorrectly estimated their qualified spending and estimated tax credit in their applications. Such mistakes were reportedly common enough that, after several years, CFC staff modified their application review process prior to allocating a film tax credit to one in which staff manually reviewed the budget of every application (instead of plainly accepting the provided estimates). This somewhat increased state costs, delayed the tax credit allocation process for all applicants, and may have delayed the start of principal photography for some projects.

Tax Credits Provided Financial Incentives for Filming in California. Tax credits may be applied against state personal income, corporation, or sales and use taxes. Independent production companies were allowed to transfer—sell—their tax credit to another taxpayer. Non–independent projects could not sell their tax credits but they were allowed to assign them to other companies within the same corporate family.

Annual Demand for Film Tax Credits Exceeded $100 Million. The demand for film tax credits exceeded the $100 million available in every year of the program’s existence. The CFC accepted applications on a first–come, first–served basis. However, after the first year of the program—when production companies were still becoming familiar with it—most applications were submitted on the first day of each application period. The CFC used a random selection process—which we describe in the next section of the report—to determine the order in which applications received on the same date would be processed and allocated tax credits.

Tax Credit Allocation

Lottery Used to Randomly Allocate Film Tax Credits. Given the high level of demand relative to credits available under the first tax credit program, the CFC used a lottery process to randomly allocate film tax credits. The final lottery to allocate tax credits available under the first film tax credit program was held on April 1, 2015. The lotteries determined the order in which the CFC opened and processed applications received each fiscal year. Once the CFC had allocated all of the tax credits available for each year, the remaining projects were moved to a waitlist.

Television Series Received Priority in Subsequent Years. Any television series that had been allocated a California film tax credit was automatically given priority in subsequent allocation periods. We understand that the purpose of this regulation was to give television series, typically made over several years, a level of funding certainty needed for production budgeting and that, without it, some productions might have chosen to relocate to another state with greater certainty. Over time, recurring television series received an increasing share of the tax credit allocations each year—leaving less available for other projects. Less than $20 million of the $100 million was available for allocation in the final lottery because about $80 million had been reserved for television series already accepted into the program.

Application Materials Intended to Screen Applicants. Every production company submitting an application was required to provide certain details about the production to calculate the estimated tax credit and to demonstrate that the project was viable. This documentation included the script, production schedule, and proof that most of the project’s financing had been arranged. CFC staff validated the amount of the estimated tax credit based on estimated qualified production spending.

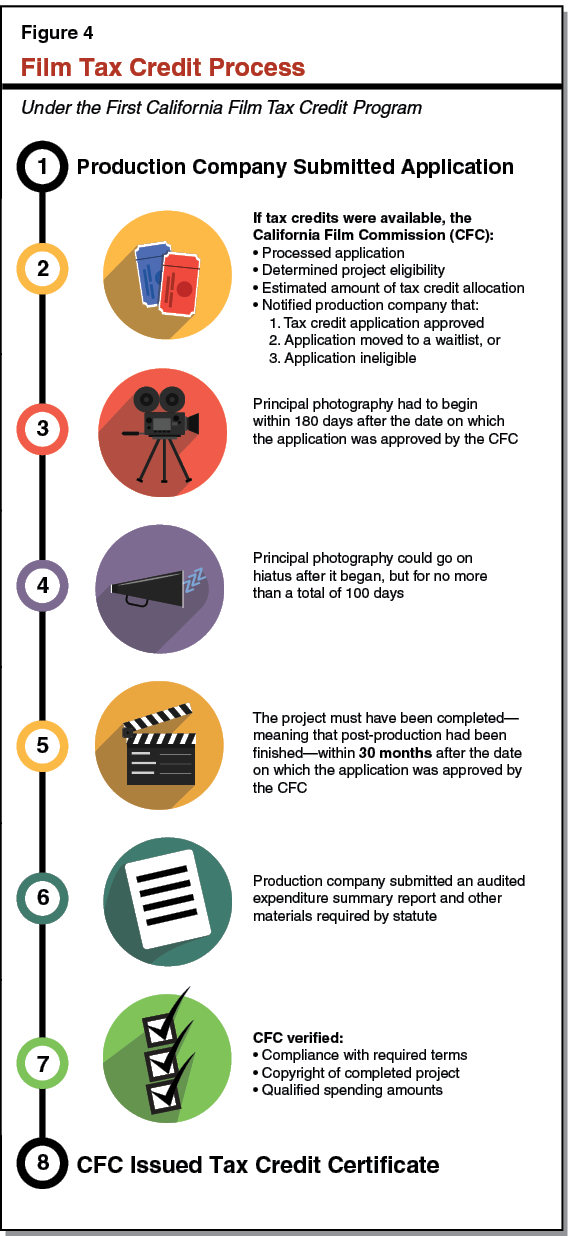

Some Productions Began Filming Prior to Approval for Tax Credit. Once an application had been processed, the CFC allocated film tax credits to the project provided that a sufficient amount of tax credits remained. At the conclusion of this review process, the CFC sent the production company a credit allocation letter (CAL) notifying them (1) that their application for a film tax credit had been approved and (2) of the amount of tax credits allocated to their project. The production company could begin principal photography after they had been notified their application was approved for a film tax credit. Under the first film tax credit program, as we show in Figure 4, the production had to begin filming within 180 days from the date the CFC allocated the tax credit. In several instances, projects began principal photography prior to being allocated a film tax credit. In these cases, the project still qualified for the film tax credit under program rules at that time, but any production expenses incurred prior to the allocation date could not qualify towards the tax credit.

Many Applicants Did Not Receive a Tax Credit Certificate. Four out of five applicants to the first program never received a tax credit. Many applicants, especially in the later years of the program, were never allocated a tax credit because there was not enough money available. However, we found that about 35 percent of projects withdrew from the program and, therefore, never received a tax credit certificate even though they had earlier been allocated a tax credit. Projects withdrew for various reasons. For example, some may have had problems with licensing a script, a key member of the cast may have been working on another project, or a television series may not have been “green–lit.” Other projects withdrew because they were otherwise unable to complete production within the time allotted (see Figure 4 for production milestone requirements). When production companies withdrew from the program without receiving a certificate, tax credits then became available for other projects on the waitlist later in the fiscal year. However, by the time these additional tax credits became available, many of the waitlisted projects had already begun production in California or somewhere else.

Tax Credit Certification

Time Between Credit Allocation and Certification Varied by Project. Projects must have completed production—including post–production—within 30 months after receiving the CAL. Once the project was completed, however, there was not a statutory deadline for requesting the CFC issue the tax credit certificate. We estimated that about 21 months passed, on average, between when a project was allocated a tax credit and when it was issued a tax credit certificate. Some projects were completed rapidly and then quickly submitted the necessary documentation. Other projects took much longer. We found that about 15 percent of projects waited for more than a year after completing production to request that the tax credit certificate be issued. We do not know why some projects chose to wait for so long to submit their documentation.

Tax Credit Certificate Issued After Qualified Production Expenses Audited. Production companies were required to submit the copyright registration number of the finished project to prove it was actually completed. The CFC also required production companies to provide documentation of all the qualified spending claimed for the tax credit. A certified public accountant—who had received specific training on the first film tax credit program—was also required to audit the spending records. If the actual amount of qualified spending exceeded the initial estimate, then the amount of the tax credit was capped at the amount initially allocated to the project. The CFC issued a tax credit certificate to the production company after staff had reviewed and verified this documentation.

$447 Million in Film Tax Credits Have Been Issued to 229 Projects. The CFC has issued $447 million in tax credits to 229 completed projects as of November 30, 2015. We summarize spending, including estimates of non–qualified spending, for these projects by project type in (see Figure 5). Feature films were the most common type of production to receive a film tax credit—more than half of the tax credits have gone to studio or independent features. (However, as we discussed above, the proportion changed over time because recurring television series received larger shares of the total available credits each year.) One–third of the 229 completed projects were independent feature films, eligible for the larger 25 percent tax credit. On average, studio films spent a total of about $35 million in qualified and non–qualified expenditures. In comparison, independent feature films only spent an average of $6 million per film. The average television series spent a total of about $30 million per season (the number of episodes per season varied among projects). The average movie of the week (MOW) or miniseries spent less on average—$3 million and $4 million respectively—than these other types.

Figure 5

Completed Productions Received $447 Million in Tax Credits

As of November 30, 2015 (Dollars in Millions)

|

Production Type |

Number of Productions |

Spending in California |

Tax Credits |

|||||

|

Number |

Percent |

Qualified |

Total |

Amount |

Percent |

|||

|

Feature |

||||||||

|

Studio feature |

51 |

22% |

$1,005 |

$1,785 |

$196 |

44% |

||

|

Independent feature |

75 |

33 |

237 |

441 |

57 |

13 |

||

|

Miniseriesa |

2 |

1 |

5 |

9 |

1 |

— |

||

|

Movie of the Week (MOW) |

||||||||

|

Studio MOW |

6 |

3 |

41 |

57 |

8 |

2 |

||

|

Independent MOW |

51 |

22 |

66 |

99 |

16 |

4 |

||

|

Television series |

||||||||

|

New basic cable series |

37 |

16 |

663 |

1,096 |

130 |

29 |

||

|

Relocating TV series |

7 |

3 |

153 |

215 |

38 |

8 |

||

|

Totals |

229 |

100% |

$2,171 |

$3,702 |

$447 |

100% |

||

|

aOne miniseries was an independent production. |

||||||||

Taxpayer Use of Film Tax Credits

Most Credits Used to Reduce Corporation Tax Liability. Of the $447 million in tax credits issued by the CFC under the first film tax credit program through November 30, 2015, taxpayers have claimed $232 million. Most of these claimed tax credits—about 80 percent—have been used to reduce corporation tax liabilities and 20 percent has been used to reduce sales and use taxes. Only a very small portion of the film tax credits—about $1 million—have been claimed against personal income tax liabilities. The Franchise Tax Board (FTB) administers state corporation and personal income taxes. The State Board of Equalization (BOE) administers sales and use taxes.

Tax Credits May Be Carried Forward for Up to Five Years. If taxpayers do not have sufficient tax liability against which to use their credits, they are allowed to carry the credits forward for up to five years. Consider a taxpayer that has a tax credit certified in 2015 but has no tax liability in the 2015 taxable year. That taxpayer may apply the credit against their state taxes in taxable years 2016 through 2020. Depending on when the CFC issues the final tax credit certificates under this program and other factors, FTB could still be processing tax returns claiming film tax credits authorized under the first film tax credit program through the 2024–25 fiscal year.

Tax Credits May Be Assigned to Affiliated Corporations. A majority of the credits (by dollar amount) have been allocated to companies that are owned by one of a handful of multinational media corporations. Each of these corporate families control dozens of affiliated companies. The individual production companies that receive the tax credits are unlikely to have a sufficient tax liability against which to apply them. State law allows the production companies to assign the credits to other affiliated companies within a combined corporate reporting group. FTB requires companies to report certain information when they elect to assign a tax credit. However, this is difficult to track in practice because, as we describe in the nearby box, we do not have very good visibility into taxpayer data on the use of film tax credits.

Independent Productions Allowed to Sell Tax Credits. Film tax credits allocated to independent productions may be transferred—sold—to another taxpayer. A film tax credit may only be sold once. (Many of the film tax credits offered by other states are also transferable under their own state tax laws.) We understand that businesses exist to broker these transactions between an independent production company and another taxpayer for a fee. State law requires taxpayers to notify FTB prior to selling a tax credit and for the seller to report the amount it received in the transaction.

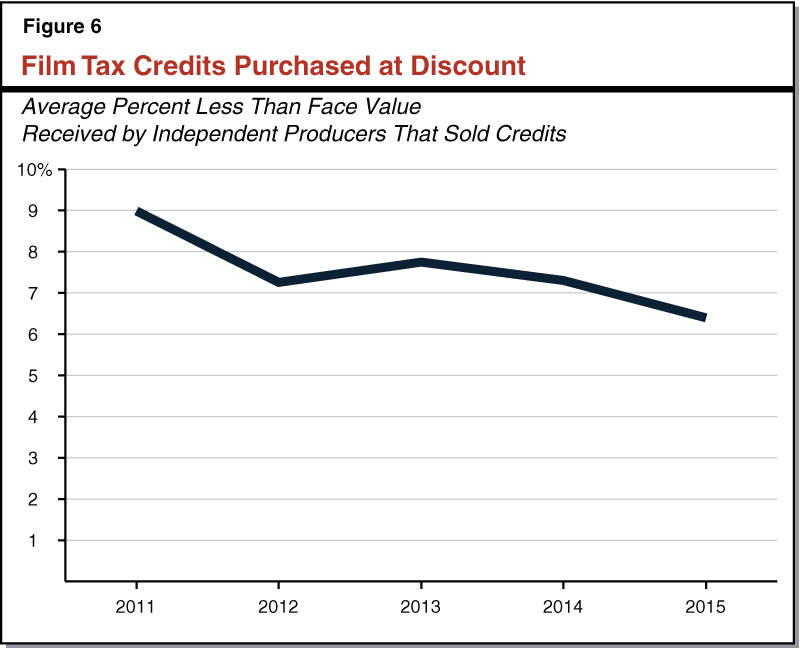

Film Tax Credits Sell for About 92 Cents on the Dollar. Rather than claim the film tax credit against tax liabilities, most owners of independent film production companies have sold their credits to another taxpayer. As of November 30, 2015, FTB records show that independent production companies sold at least 85 film tax credit certificates worth a total of $53.9 million. The data that FTB provided to us for most records included the amount each seller received in the transaction. As we show in Figure 6 the sellers of film tax credits received 9 percent less than their face value, on average, in 2011. The discount that buyers realized has fallen somewhat over time to an average of 6.4 percent in 2015. We do not know how much was paid to the companies that brokered these transactions because FTB does not request that information. Also, as we discuss in the nearby box, some taxpayers sold credits but do not appear to have reported the sale to FTB and so those transactions are not included here.

Available Data on Transfer, Assignment, and Use of Tax Credits Incomplete

Taxpayer Filings on Film Tax Credits Difficult to Fully Capture. The Franchise Tax Board (FTB), which administers corporation and personal income taxes, is unable to easily track the transfer, assignment, and use of most film tax credits because many taxpayers do not file electronically. While there is reasonably good data on the aggregate amount of film tax credits claimed by each corporate combined reporting group, FTB does not routinely capture more detailed information about film tax credits from paper tax forms. In addition, some taxpayers appear to be providing incomplete or inaccurate information on their tax filings with respect to the film tax credits they report. FTB has explained to us that taxpayers often submit the supporting documentation that would include key details such as the certificate numbers—which may or may not be accurate and complete—as attachments within very complex tax filings. FTB scans and electronically stores all paper returns, but these processes do not allow them to easily, and automatically analyze the information about specific film tax credit certificates. Therefore, for many of the tax credits that have been issued, we do not know from available data how much of any given tax credit certificate has been used and how much has been carried forward.

Comprehensive, Accurate Accounting of All Tax Credit Use Does Not Exist. FTB verifies taxpayer compliance in their auditing unit. However, there does not seem to be a way for FTB to easily share information on film tax credit use discovered during compliance activities with other entities, such as the State Board of Equalization (BOE) or the Legislature. Without comprehensive, accurate, and timely data, it is unclear to us how well the state can ascertain that credits are not being claimed more than once. There is no evidence that taxpayers have actually claimed a credit that had been previously used in a prior tax year or by another taxpayer. There seem to have been several isolated instances in which other taxpayers have mistakenly claimed film tax credits, but existing FTB and BOE tax compliance processes appear to have eventually identified these taxpayer errors.

Improving Data on Film Tax Credit Use Would Be Costly. Given limited resources, FTB prioritizes staff resources on compliance activities that return the most revenue to the state. To date, FTB has collected comprehensive aggregate information on film tax credit use. Improving the data quality for tracking film tax credit transfers and use may require additional staffing and budgetary resources at FTB, but the benefit of this additional spending may not be viewed as worth the cost.

Film Tax Credits That Reduce Sales Taxes. Taxpayers may also use film tax credits to claim a refund from BOE of sales and use taxes paid to the state. It has taken about a year, on average, for taxpayers to receive a refund after filing a claim. BOE must first check with FTB to make sure the taxpayer has not claimed the credit against income tax. Any sales tax refund over $100,000 takes more time to process than for smaller refunds because additional approvals are required. Only 14 credits, totaling $47.2 million, have been applied against the sales and use tax through November 30, 2015.

Economic Effects

Spending by motion picture projects generally benefits the economy through hiring of cast and crewmembers, leasing of studio space and filming equipment, and purchases of set materials and property. In evaluating the economic effects of a tax credit (or other government policies), it is necessary to distinguish between (1) “new spending” resulting from the policy and (2) spending that would have occurred in the economy regardless of whether or not the policy existed. This new spending in the economy also causes various indirect and induced economic effects. It is difficult to identify and quantify all of these effects, and many evaluations of tax credits (and other governmental policies) fail to do so. In this part of the report, we try as best we can to quantify some of these economic effects for California’s first film tax credit.

Estimated Production Spending by Credit Recipients

Total Production Spending Estimated for Completed Projects . . . All new spending in California affects the state’s economy regardless of whether or not it was qualified for the tax credit. For the 229 projects completed under the first film tax credit program as of November 30, 2015, we only have high–quality data on qualified spending. Non–qualified expenditures were not subject to the same rigorous reporting requirements as were qualified expenditures. (In some cases, the total amount of production spending reported to the CFC was clearly inaccurate—such as when total spending was less than qualified spending. For this reason, we estimated non–qualified spending for 12 projects that reported mathematically impossible or statistically unlikely amounts of non–qualified spending based on the other completed projects.) In Figure 7, we display our estimates of the total production spending of the projects that received film tax credits, including our estimates of the non–qualified spending of these productions. Overall, we estimate that the first $447 million of tax credits for completed projects was associated with total production spending of $3.7 billion in the state.

Figure 7

Estimated California Spending by Film Tax Credit Recipients

As of November 30, 2015 (In Millions)

|

Qualified Spending |

Non–Qualified Spending |

Total Production Spending |

Tax Credits Allocated |

|||

|

Wages |

Non–Wage |

Total |

||||

|

Completed productions |

$1,264 |

$907 |

$2,171 |

$1,531 |

$3,702 |

$447 |

|

Active productions |

661 |

402 |

1,064 |

594 |

1,657 |

223 |

|

Waitlisted Productions |

348 |

171 |

519 |

208 |

726 |

130 |

|

Totals |

$2,273 |

$1,480 |

$3,753 |

$2,333 |

$6,086 |

$800 |

|

Note: A significant amount of these production expenditures were not new to California. |

||||||

. . . And for Ongoing Projects That Had Not Reported Final Spending. The CFC allocated a total of $223 million in film tax credits to 80 projects in active production through November 30, 2015. In addition, as of that date, another $130 million in tax credits was available and had not yet been allocated to specific projects. We understand that CFC will allocate these credits to waitlisted projects and recurring television series. In Figure 7, we display our rough estimates of qualified and non–qualified production spending for the film and television projects that were still active and waitlisted at that time. (The production companies estimate qualified and non–qualified spending in their tax credit applications. We observed that among completed projects, actual spending was typically lower than these initial estimates. We adjust the information from the applications to account for this.) In total, the $800 million of tax credits under the first film tax credit program will be associated with productions that collectively have spent or will spend an estimated $6.1 billion in California over the entire life of the first film tax credit program.

Economic Effects of Tax Credit Must Account for Other Factors. Deriving this number is the starting point for estimating the net amount of new spending in California as a result of the first film tax credit. Our estimate of the net economic effects of the credits must also account for three additional factors:

- Adjustments to the $6.1 billion estimate of production spending.

- Indirect and induced economic effects.

- Opportunity costs.

We discuss these further below.

Adjustments to Total Production Spending Estimate

We make several adjustments to the $6.1 billion estimate of new film production spending to roughly estimate how much is new spending resulting from the tax credit and how much would have occurred here regardless of whether or not the tax credit existed.

California Writing and Editing (Reduction of $0.5 Billion). Much of the motion picture industry is concentrated in California. Film and television productions all over the world procure various specialized goods and services from California firms. Many film and television scriptwriters live in California, and they rarely need to travel to the same physical location as the production. In addition, when a feature is shot on–location in another state, some or all of the post–production work may be done here in California. Based on conversations with CFC staff, we understand that most scriptwriting and perhaps around half of editing and other post–production may have occurred in California regardless of the physical location of principal photography. (We are told there may have been some exceptions to this. Many New York productions, for example, have writing staff there.) In total, we make a rough estimate that about $0.5 billion in total production spending by projects that received a tax credit—about 8 percent of total production spending—might have occurred in California even had those projects filmed elsewhere. As such, we do not consider this to be new spending in the state’s economy resulting from the first film tax credit program.

Windfall Tax Benefits (Reduction of $1.5 Billion). Some projects that received a film tax credit would have been made in California anyway. The film tax credit is essentially a windfall benefit for these productions: that is, a benefit to the production company for doing something that they would have done even had they not received the tax credit. Windfall benefits occur with most—likely all—tax credits, but it is difficult to quantify this impact. In the nearby box, we explain how we were able to make our rough estimates for the windfall benefits arising from the first film tax credit program. Our model predicts that, overall, about a third of the projects receiving tax credits would have been made in California even had they not been allocated a tax credit. The probability that a project might have been made in California without the film tax credit varies depending on the type of project—from under 15 percent for an independent MOW to nearly 50 percent for an independent feature film. Using these probabilities, we estimate that about $1.5 billion of the total estimated production spending by these projects represented windfall benefits and not new spending on film production.

While we estimate that about 30 percent of these projects received windfall benefits, only 25 percent of total spending was a windfall. Projects such as studio features and television series—that on average have much larger budgets than independent features—appear more likely to select a location based on the availability of production incentives.

Projects Receiving Tax Credits More Likely to Be Made (Addition of $0.4 Billion). While some projects that received an initial tax credit allocation withdrew from the program, it appears that receiving a tax credit allocation could have had a small but measurable effect on whether or not a project was completed at all, as noted in the nearby box. We estimate that if the CFC allocated a credit to a project during the initial allocation period of the first film tax credit program, the project was about 5 percent more likely to be completed—at all, anywhere—than projects that were initially placed onto a waitlist. This increases the estimate of total spending in California resulting from the first film tax credit by an estimated $0.4 billion.

Estimating Windfall Benefits of California’s First Film Tax Credit

Some of the motion picture projects under the first film tax credit program probably would have filmed in California even if they had not received a tax credit. We explain below how we were able to estimate these windfall benefits arising from the first film tax credit.

Tax Credit Lottery Allows for Natural Experiment. It is impossible to identify with certainty which projects would have been made in California, which elsewhere, and which not at all, had they not received a film tax credit. Because of the way the first film tax credit was administered, however, we are able to roughly estimate the probability that any given film or television project might have been made in California without a tax credit. Beginning in 2011, the program was over–subscribed on the first day applications were accepted—with the demand for film tax credits far outstripping the available amount—and tax credits were mostly allocated to projects through a random process. This allowed for an imperfect natural experiment, as some projects were allocated a credit and other similarly situated projects were not. The California Film Commission (CFC) collected some information about projects that applied for and did not receive a tax credit from the program—whether they were made and, if so, where. (As noted elsewhere in this report, many projects were never allocated a tax credit because there was an insufficient amount of tax credits available. In other cases, some applicants received an allocation but withdrew from the program for various reasons—some of these were made eventually, but without a tax credit from California. When that happened, those tax credits became available for other projects that had been placed onto a waitlist. However, many of these began filming—in California or elsewhere—prior to being offered an allocation.) We supplemented this CFC data with publically available data sources, such as information from the Internet Movie Database and Variety.

Looking just at the film tax credit applicants in 2011, 2012, and 2013—the three years for which we have the best data—we see that 199 projects applied for and did not receive a film tax credit but were eventually made. Of these, as we show in the figure, one–third—66 projects—filmed in California without receiving a tax credit. Dozens of other project applicants that did not receive a film tax credit from California were filmed in British Columbia, Georgia, Louisiana, New York, and elsewhere.

One–Third of Projects That Applied for and Did Not Receive

a Film Tax Credit Made in California Anyway

|

Location |

Number of Projects |

Precent of Total |

|

California |

66 |

33% |

|

British Columbia |

20 |

10 |

|

Georgia |

18 |

9 |

|

Louisiana |

13 |

7 |

|

New York |

10 |

5 |

|

Other states |

33 |

17 |

|

Other Canadian provinces |

8 |

4 |

|

Other countries |

13 |

7 |

|

Unknown |

18 |

9 |

|

Totals |

199 |

100% |

Some Projects Would Have Been Made in California Anyways . . . We used the data on withdrawn projects to fit a logistic regression model to estimate the statistical likelihood of whether a production that received a film tax credit might have been made in California had it not received the incentive. Our model predicts that, on average, about a third of the projects receiving tax credits would have been made in California even had they not received a tax credit. The results depend significantly upon the type of production. For example, the model predicts that one out of every two independent feature films that applied for a film tax credit would have likely been made in California regardless of whether or not they received a credit. Meanwhile, our model predicts that only 13 percent of the independent movies of the week that applied for a film tax credit would have been made in California without one.

. . . Others Not at All. We also estimated how receiving a film tax credit allocation might have affected whether or not a project was made at all. If a project was allocated a film tax credit during the initial allocation period, it was roughly 5 percent more likely to be made—at all, anywhere—than the projects that did not win the lottery and were initially placed onto a waitlist. (We caution that this result is not statistically significant at a 95 percent confidence level. This means that we cannot rule out negative, zero, or somewhat larger positive effects.)

Production Budgets May Have Increased Somewhat. The tax credit could have somewhat increased the total amount of production spending, even for the projects that received windfall benefits, because it reduced the costs of qualified spending by 20 percent or 25 percent. We were unable to evaluate this potential effect given the available data.

Estimate: $4.5 Billion of New Production Spending. In conclusion, we make a rough estimate that about $4.5 billion of the $6.1 billion in total production spending by tax credit recipients was additional spending on film production in the state’s economy that resulted from the first film tax credit program. (This is the estimate of spending that occurs over the entire multiyear life of the program. The number is not adjusted for inflation over time.)

Estimated Indirect and Induced Economic Effects

In addition to new direct spending in the state’s economy, the first film tax credit program also resulted in indirect and induced economic effects, as discussed below.

What Are Indirect and Induced Economic Effects? New film and television production spending supported additional economic activity throughout the state. Film industry workers hired on these productions, for example, spent some of their income to buy more goods and services from California businesses. Businesses that supplied the new film and television productions may have then expanded their operations. The economic ripple effects from the initial increase in new production spending are called indirect economic effects. These indirect economic effects also subsequently induced additional effects in the state’s economy. For example, when a new employee is hired by a business that supports film productions, that individual will then spend some of his or her income to buy more household goods and services than they would have otherwise.

Estimating Indirect and Induced Economic Effects. The economy is complex, and it is always changing—growing in some areas, contracting in others. There is no way to directly observe how and how much the economy has changed due to the film tax credit. A regional input–output model is one commonly used method of estimating indirect and induced economic effects. This type of model uses statistics on the interconnections between different sectors of the economy to estimate how a change in circumstances (such as sustained new spending in the motion picture and video industries sector due to a tax credit) changes the level of economic activity in a particular geographic area.

The U.S. Bureau of Economic Analysis maintains such a model, the Regional Input–Output Modeling System (RIMS II). This model produces “multipliers” that are used to estimate how much a region’s economy might be expected to grow given an increase in spending by a specified industry. The RIMS II final output multiplier for motion picture and video industries in California is roughly 2. That means that for every $1 million in net new production spending, the RIMS II model estimates that total gross output of the California economy will grow by a total of $2 million: the initial $1 million in net new direct spending, plus an additional $1 million in indirect and induced economic output. This suggests that a net increase in new motion picture production spending might increase the state’s gross economic output by twice that amount—the net new direct spending plus a roughly equal amount of additional indirect and induced economic activity. However, as we discuss in the nearby box, regional input–output models (like any other economic model) simplify the economy for practical reasons and may significantly over– or underestimate the changes in a region’s economy.

Opportunity Costs

All actions have an opportunity cost. Opportunity cost is the economic value of the best alternative use of funds and other resources, such as workers and materials. In our evaluation of the economic effects of the first film tax credit, we must account for two kinds of opportunity costs:

- The $800 million in foregone state tax revenue the government would have used for other purposes.

- The billions of dollars in new motion picture production spending used some workers and materials that other industries would have used otherwise.

We discuss these below.

Reduced State Tax Revenue Has an Opportunity Cost. The film tax credit puts more money in the accounts of some businesses and individuals to spend and invest in the economy. In so doing, it prevents the state government from using those funds for other public purposes, ranging from spending on other programs to broad tax reductions. Those alternative actions by government would have benefited a different set of individuals and businesses—the economic benefit of the alternative action is the opportunity cost of the reduction in tax revenue from the use of the first film tax credits. These opportunity costs are unknown and reduce, perhaps significantly, the net economic effect of the first film tax credit program.

New Film Production “Crowds Out” Other Economic Activity. Under some conditions, new motion picture production spending uses resources that would have been put to some other use had there not been a tax credit program. For example, workers and resources (such as sound stage space and trailers) used to make a new film subsidized with a tax credit might have instead been used to make a different film that will now not be made. In another example, electricians and construction workers on a film crew might have instead worked in some other industry. In addition, as we discuss in the nearby box, the indirect and induced economic effects are based on a model that assumes unlimited inputs to production. In reality, there is always some slack in some parts of an economy and scarcity in many parts of an economy. The economic benefits of the new motion picture production spending are reduced to some extent by the opportunity cost of whatever economic activity was superseded.

Bottom Line: Billions in Net Added State Economic Output

Film Tax Credit Likely Increased Economic Output. As we discussed above, we believe that the first film tax credit program increased spending on motion picture production by roughly $4.5 billion. Indirect and induced economic effects further increased economic activity here by an additional amount, perhaps roughly equal to the new direct motion picture production spending. However, economic opportunity costs likely offset the increased economic activity significantly.

It is important that we emphasize that it is impossible to precisely measure the net change in an economy caused by a tax credit or any other policy change because many other economic changes are occurring simultaneously. It is not possible to know what the economy would have done had the policy not been adopted in the first place. We note that there is some uncertainty in the underlying data we use in this evaluation and, as we discussed in the nearby box, limitations to the methods that are used to estimate indirect and induced economic effects. Finally, any assessment of the full economic value of the opportunity costs is inherently subjective, as we cannot know how foregone revenue might have otherwise been used.

Limitations of Regional Input–Output Modeling

California’s first film tax credit increased motion picture production spending in the state. To estimate how much the state’s economy grew given that increased economic activity, we use economic multipliers calculated by a regional input–output model called the Regional Input–Output Modeling System (RIMS II). The RIMS II model—like similar models— has some well–documented limitations. (We have previously commented on these, http://www.lao.ca.gov/reports/2012/stadm/letters/evaluate–film–tax–credit–061312.pdf and http://www.lao.ca.gov/reports/2016/3489/cdfi–tax–credit–063016.pdf, and have controlled for some in our approach.) We discuss these limitations below.

Inputs Assumed to Be Unlimited, Prices Held Constant. Increased spending on motion picture production has increased demand in California for specialized labor and intermediate inputs, such as film cameras and specialized trailers used on film sets. This probably led to some supply shortages, with resulting increases in some prices and wages. However, the RIMS II model assumes the supply of these inputs is unlimited. As such, this model does not take into account any likely effects of price increases on motion picture production or on other industries that hire from the same workforce or use any of the same inputs. In addition, the model does not allow for input substitution, such as when a worker is replaced with a machine or when a physical set is replaced with a digital effect.

Location of Suppliers and Consumption May Affect Economic Benefits. The RIMS II model estimates how much of a sector’s inputs were sourced from within the region and how much from elsewhere. Generally, an economic multiplier is higher if more inputs were sourced locally. The motion picture industry and its suppliers are very highly concentrated in Southern California. We suspect the RIMS II model may underestimate the amount of inputs sourced locally. If this is true, the final output multiplier could be somewhat larger than we assume. On the other hand, if productions acquired more goods and services from out of state than the model has assumed, the economic benefit for California from new spending may be overestimated. The model may also overstate the economic benefit from new spending if higher household incomes were used to buy more goods and services from out of state than assumed by the model.

Overall, we think that the first film tax credit program probably increased the economic output of California by between $6 billion and $10 billion on net. This is a total amount over a period of more than a decade. The annual increase in likely economic activity—typically under $1 billion per year—boosts California’s economic output by no more than a few hundredths of a percentage point.

State and Local Fiscal Effects

The first film tax credit program affected state and local finances both directly and indirectly. For state finances, the direct effects were the reduction in tax revenue as taxpayers used the credits and the costs to administer the program. Indirectly, the credit affects state and local finances by causing new spending and employment in the economy. In this section, we discuss both of these direct and indirect fiscal effects for the state and local governments.

Tax Credits Reduced State Revenue. The first film tax credit will reduce total General Fund revenue by up to $800 million over the life of the program. (Only $232 million in tax credits had been claimed as of November 30, 2015.) The state’s corporation tax was most significantly affected—we estimate that nearly $700 million in tax credits, 87 percent of the total, will be applied against corporation tax liabilities. Just over $100 million in film tax credits will be used to request refunds of sales and use tax. Relatively minor amounts will be applied to reduce personal income tax liabilities. Under Proposition 98, decreases in revenues generally reduce overall school funding requirements. (In addition, other variables, such as school enrollment, and certain long–term economic trends also have an effect such that it would be impossible to provide a meaningful estimate of how the film tax credit affects school funding requirements in each fiscal year over the period.) The actual reduction in state revenues could be somewhat lower than $800 million in the event some tax credits are never claimed.

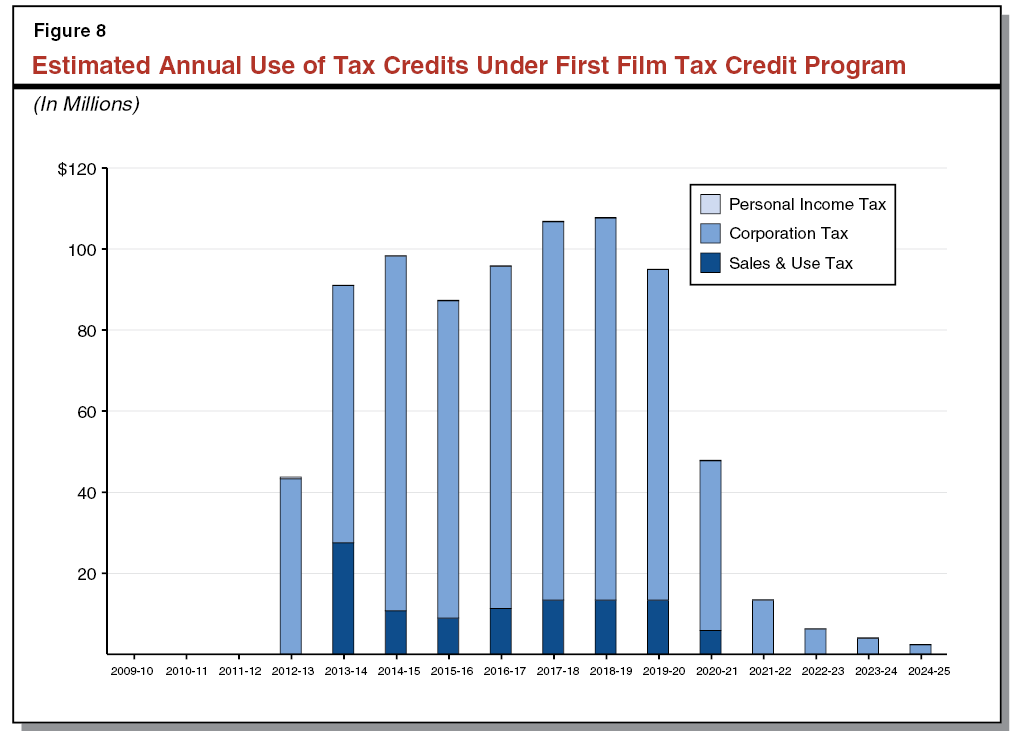

Tax Credit Usage Spread Over Many Years. In, we show when the credits under the first film tax credit program have been used and when we estimate such credits will be used in future years. Taxpayers claimed nearly $100 million in tax credits in 2014–15. We expect the General Fund revenue reductions will peak in 2018–19 at just under $110 million, as we show in Figure 8, before tapering off in later years. Tax credits could continue to be claimed until as late as fiscal year 2024–25, as taxpayers can carry credits forward for up to five years if they have insufficient tax liability to use them earlier.

Administration Costs. In addition to the tax credits reducing General Fund revenues, the program itself had one–time and ongoing administration costs. Annual salary for staff and other operating costs are about $230,000 per year. There were also some one–time program costs, totaling less than $100,000, in prior years. Over the life of the first film tax credit program, we estimate the state will spend a total of about $2 million in administration costs.

Increased Revenues Indirectly Caused by Tax Credit. The new spending in the economy resulting from the first film tax credit has also affected state tax revenues indirectly. For example, a worker who earned more income because of the film tax credit also paid more state income, and sales and use taxes. All state taxes have likely been affected to some degree by these economic changes. Over the life of the first film tax credit program, we estimate that new spending in the economy resulting from the credit has increased and will increase General Fund revenues by $300 million to $500 million (not adjusted for inflation). This estimate is based on our rough estimate of the increase in economic activity related to the film tax credit. The bulk of this increased revenue has likely come via the state’s personal income tax. Furthermore, these increases in state tax revenue boost overall school funding requirements under Proposition 98 in most years, offsetting the negative effects discussed earlier.

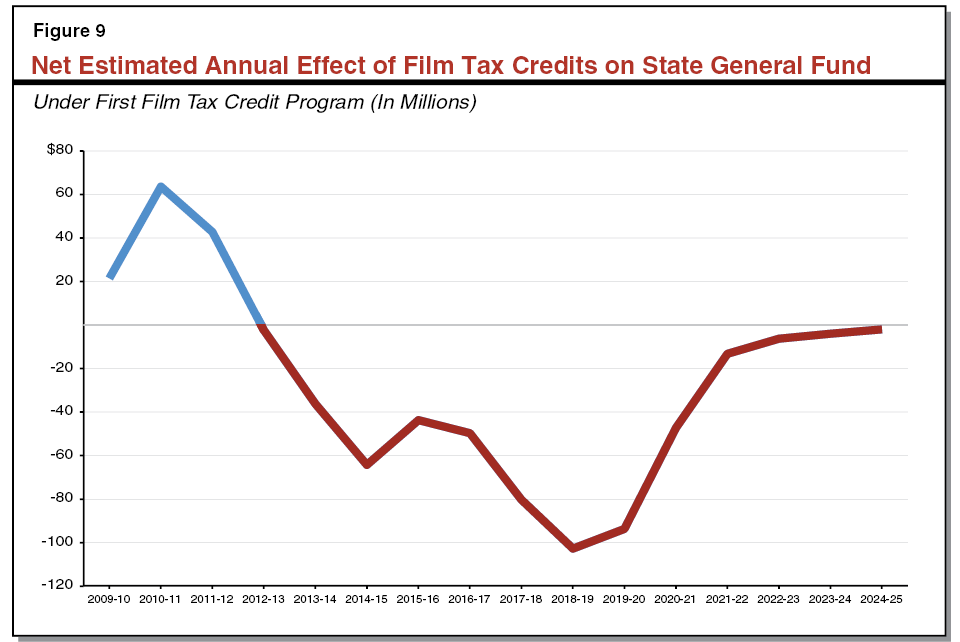

Net State Revenue and Administrative Cost Effects by Fiscal Year. The first film tax credit generated new spending in the economy several years before state tax revenues were reduced by the usage of the credit. Accordingly, as shown in Figure 9, the first film tax credit program can be viewed as having provided a net benefit to the state General Fund for the first few years of the program. Thereafter, as taxpayers claim more and more credits under the program, the first film tax credit program will likely reduce General Fund resources on net through 2024–25. Using some rough assumptions, Figure 9 shows that the effect on the General Fund could peak at around $100 million per year in reduced resources around fiscal year 2018–19.

Fiscal Effects on Local Governments. The first film tax credit program and the related increase in economic output will also increase local government tax revenue and demands for public services at the local level. We estimate that local tax revenues will increase by roughly $200 million over the entire, multiyear life of the first film tax credit program. The total increase could be somewhat higher because most new economic activity will occur in and around Los Angeles County, where local sales tax rates often are higher than the statewide average. Among the local government revenues affected will be property taxes. (A portion of local property taxes go to schools and community colleges, and in some years, this share will reduce somewhat the state’s share of required school funding costs under Proposition 98.)

LAO Comments

Below, we summarize our findings and observations concerning California’s first film tax credit program.

California Film Tax Credits

Program Appears Relatively Well Targeted. Most—likely all—tax credits provide windfall benefits to some taxpayers in exchange for doing something (like filming in California) that they were going to do anyway. We find that the first film tax credit program was a windfall benefit for about one–third of the projects that received a credit. We suspect that this level of windfall benefits may be low compared to some other tax credits. In fact, there is evidence in our analysis that much of the first film tax credit program was relatively well targeted. First, the tax credit was developed with the input of stakeholders to target those types of productions—such as independent MOWs and basic–cable television series—that were vulnerable to being lured to other locations for economic considerations. Our research shows that, indeed, those types of projects often film outside the state if they do not receive a film tax credit from California. In addition, while the credit may be a windfall for about one–third of the projects, those projects only account for about 25 percent of total estimated spending. The tax credit appears more likely to influence the location decisions of studio features and television series—that on average have the largest budgets—than, for example, lower–budget independent features.

New Program Addresses Perceived Issues of the First. We do not evaluate the new film tax credit adopted in 2014 in this report. However, we observe that the new program was designed in part to address several perceived issues concerning the first program. In particular, under the first film tax credit program (1) most tax credits were allocated randomly instead of based upon some objective criteria, and (2) credits reserved for recurring television series in later years of the program left little for other types of production. Instead of allocating projects on a first–come, first–served basis, the new program involves a “jobs ratio” score and allocates tax credits to the highest scoring applications. In addition, the new program reserves fixed portions of tax credits for each category of eligible production type. For example, 35 percent of the available credits are reserved for feature films. We expect to discuss the effectiveness of these changes in our 2019 report.

State Tax Competition

In General, Problematic Public Policy . . . As we noted in our April 2014 report on the film and television industry, states ideally would not use subsidies to compete for film and television productions—or for any other specific industry. We generally view company–specific or industry–specific tax expenditures—such as film tax credits—to be inappropriate public policy because they (1) give some businesses an unequal advantage at the expense of others and (2) promote unhealthy competition among states in a way that does not benefit the nation as a whole. We harbor deep concerns about the ability of officials in any state to make objective, well–informed decisions about allocating tax credits to specific individuals and companies in a way that better allocates resources across the entire economy. For these reasons, we generally advise policy makers to reject such tax expenditure programs.

. . . But Understandable to Defend a Flagship Industry Targeted by Other States. As we noted in our April 2014 report, it is nevertheless understandable that the Legislature has taken action in this area. Other states and countries have provided significant subsidies for film and television production. These subsidies have clearly resulted in some productions, which would have otherwise been filmed here, relocating away from California to those places. California’s first film tax credit program, and the expanded program passed in 2014, can be viewed as ways to “level the playing field” and counter financial incentives to locate productions outside of California unrelated to creative considerations. In evaluating this tax credit in the future, the state’s leaders may want to consider trends in other states. For instance, if other states keep scaling back their film tax incentive programs, it might allow California to scale back or eliminate its own.