LAO Contact

January 13, 2017

The 2017-18 Budget

Overview of the Governor’s Proposition 98 Budget Package

The Governor presented his Proposition 98 budget package to the Legislature on January 10, 2017. In this post, we provide an overview and assessment of that package. Below, we first provide background on how the state calculates its school funding obligation under Proposition 98. We then describe the Governor’s proposed Proposition 98 funding and spending changes from 2015-16 through 2017-18. We conclude with a high-level assessment of the package. (We also have developed a series of EdBudget tables providing additional detail about the Proposition 98 budget.)

Background on Calculating Minimum Guarantee

Proposition 98 Sets Minimum Funding Level for Schools and Community Colleges. State budgeting for schools and community colleges is governed largely by Proposition 98, passed by voters in 1988. The measure, modified by Proposition 111 in 1990, establishes a minimum funding requirement for schools and community colleges, commonly referred to as the minimum guarantee. Both state General Fund and local property tax revenue apply toward meeting the minimum guarantee.

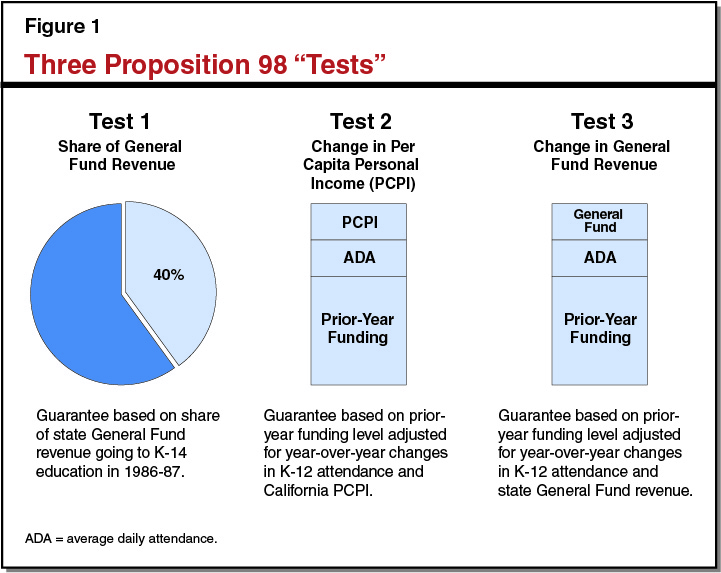

Various Inputs Determine Operative “Test.” As described in Figure 1, the minimum guarantee is determined by one of three tests set forth in the State Constitution. These tests depend upon several inputs, including changes in K-12 attendance, per capita personal income, and per capita General Fund revenue. The operative test that sets the minimum guarantee is triggered automatically depending on these inputs. In most years, Test 2 or Test 3 has been the operative test, with the minimum guarantee building upon the level of funding provided the prior year. Since the inputs are not finalized until a few years after the close of the fiscal year, the operative test can fluctuate and the minimum guarantee can change significantly from the level initially assumed in the budget.

Additional Statutory Formula Applies in Test 3 Years. In 1990, the state established an additional formula to ensure that school funding is treated no worse than the rest of the budget during tight economic times. Calculated when Test 3 is operative, the formula requires the state to provide a supplemental appropriation when Proposition 98 funding otherwise would grow less quickly than the rest of the budget. The state provides this supplemental appropriation on top of the minimum guarantee otherwise calculated for that year. Given its intent, the formula is commonly known as the “equal pain/equal gain” formula.

State Can Provide More Funding Than Required or Suspend Guarantee. During the economic boom that prevailed in the late 1990s, the state for several years provided more funding than was required by the minimum guarantee. Because the minimum guarantee generally builds upon the level provided in the previous year, such augmentations resulted in long-term increases in school funding. Alternatively, in 2004-05 and 2010-11, the state applied a provision of Proposition 98 allowing for the suspension of the minimum guarantee upon a two-thirds vote of each house of the Legislature. When the state suspends the minimum guarantee, it can provide a lower level of funding but it creates an out-year obligation to restore K-14 funding in later years (as described below).

State Creates “Maintenance Factor” Obligation in Certain Years. Proposition 111 established maintenance factor and set forth certain rules pertaining to it. The state creates a maintenance factor obligation when Test 3 is operative or the minimum guarantee is suspended. This obligation equals the difference between the actual level of funding provided and the Test 1 or Test 2 level (whichever is higher). Moving forward, the maintenance factor obligation is adjusted annually for changes in K-12 attendance and per capita personal income. In subsequent years, when General Fund revenue is growing more quickly, the Constitution requires the state to make maintenance factor payments until it has paid off this obligation. The magnitude and timing of these payments is determined by formula, with stronger and faster revenue growth generally requiring larger and more rapid payments. These maintenance factor payments increase the minimum guarantee on an ongoing basis.

Major Features of Governor’s Plan

As part of its budget package, the administration has updated its estimates of the minimum guarantee for 2015-16, 2016-17, and 2017-18. Below, we describe these changes as well as the proposed associated changes to Proposition 98 spending. (The administration also has updated its estimates of local property tax revenue across the period. The nearby box describes and assesses these changes.)

Minimum Guarantee for 2015-16 Revised Downward. Figure 2 compares the Governor’s estimates of the 2015-16 and 2016-17 minimum guarantees with the estimates made in June 2016. The revised estimate of the 2015-16 guarantee is $68.7 billion, a $379 million decrease compared with the previous estimate. This drop is due to a $1.5 billion decrease in General Fund tax revenue. As a result of this lower revenue, the state is no longer required to make the $379 million maintenance factor payment included in the June budget plan. Under the revised estimates, Test 3 rather than Test 2 is operative. The amount of the statutory “equal pain/equal gain” supplemental appropriation, however, is such that the state creates no new maintenance factor.

Figure 2

Tracking Changes in the Proposition 98 Minimum Guarantee

(In Millions)

|

2015-16 |

2016-17 |

||||||

|

June 2016 |

January 2017 |

Change |

June 2016 |

January 2017 |

Change |

||

|

Minimum Guarantee |

|||||||

|

General Fund |

$49,722 |

$48,989 |

-$733 |

$51,050 |

$50,330 |

-$720 |

|

|

Local property tax |

19,328 |

19,681 |

353 |

20,824 |

21,038 |

215 |

|

|

Totals |

$69,050 |

$68,671 |

-$379 |

$71,874 |

$71,368 |

-$506 |

|

Local Property Tax Update

Property Tax Estimates Revised Upwards in 2015-16 and 2016-17. As shown in the figure below, the Governor’s budget assumes property tax revenue will total $19.7 billion in 2015-16 and $21.0 billion in 2016-17. These estimates reflect an upward revision of $568 million across the two years compared with estimates made last June (bringing them closer to our November 2016 estimates). Higher estimates of revenue distributed to schools from Educational Revenue Augmentation Funds (ERAF) comprise the bulk of this increase. This upward revision is due primarily to an improvement in the administration’s estimation methodology. Another factor contributing to the upward revision to relates to supplemental tax revenue. Data reported by local educational agencies in 2015-16 show this revenue exceeding initial budget estimates, and the administration assumes this revenue will increase further in 2016-17. (Supplemental taxes consists of the property tax levied on properties sold midyear and are included in “other property tax revenue” in the figure.) These increases are partially offset by a higher estimate of excess tax revenue. (Excess tax revenue consists of the local revenue that some schools and community colleges receive beyond their general purpose funding level set by the state. This portion of local revenue is excluded from the Proposition 98 calculations.) We believe the administration’s revisions for 2015-16 and 2016-17 are reasonable.

Tracking Changes in Proposition 98 Property Tax Estimates

(In Millions)

|

2015-16 |

2016-17 |

||||||

|

June 2016 |

January 2017 |

Change |

June 2016 |

January 2017 |

Change |

||

|

Property Tax Components |

|||||||

|

Secured property tax revenue |

$16,664 |

$16,740 |

$76 |

$17,691 |

$17,731 |

$40 |

|

|

Other property tax revenue |

1,557 |

1,667 |

110 |

1,694 |

1,818 |

123 |

|

|

Redevelopment agency dissolution |

1,326 |

1,247 |

-79 |

1,287 |

1,298 |

11 |

|

|

ERAF |

521 |

837 |

316 |

881 |

1,042 |

161 |

|

|

Excess tax revenue |

-740 |

-810 |

-70 |

-729 |

-850 |

-121 |

|

|

Totals |

$19,328 |

$19,681 |

$353 |

$20,824 |

$21,038 |

$215 |

|

|

ERAF = Educational Revenue Augmentation Fund. |

|||||||

Property Tax Revenues Projected to Increase $1.1 Billion in 2017-18. The Governor’s budget assumes that property tax revenue will total $22.2 billion in 2017-18. As shown in the figure below, this is an increase of $1.1 billion (5.3 percent) from the revised 2016-17 level. This increase is driven largely by an assumed 5.3 percent increase in assessed property values, reflecting the continued strength of the state’s real estate markets. (In the figure, the growth in assessed values primarily affects the “secured property tax revenue.”) The administration also makes various smaller adjustments to other components of local property tax revenue. We think the administration’s assumptions for 2017-18 are reasonable (with our estimates being only slightly lower).

Proposition 98 Property Tax Revenue Estimates

(Dollars in Millions)

|

2015-16 |

2016-17 |

2017-18 |

Change From 2016-17 |

||

|

Amount |

Percent |

||||

|

Property Tax Components |

|||||

|

Secured property tax revenue |

$16,740 |

$17,731 |

$18,678 |

$947 |

5.3% |

|

Other property tax revenue |

1,667 |

1,818 |

1,966 |

148 |

8.1 |

|

Redevelopment agency dissolution |

1,247 |

1,298 |

1,447 |

149 |

11.4 |

|

ERAF |

837 |

1,042 |

1,017 |

-24 |

-2.4 |

|

Excess tax revenue |

-810 |

-850 |

-948 |

-97 |

11.5 |

|

Totals |

$19,681 |

$21,038 |

$22,160 |

$1,121 |

5.3% |

|

ERAF = Educational Revenue Augmentation Fund. |

|||||

Minimum Guarantee for 2016-17 Also Revised Downward. The revised estimate of the 2016-17 guarantee is $71.4 billion, a $506 million decrease compared with the estimates made last June. This drop is due primarily to the lower funding level in 2015-16 carrying forward. In addition, non-Proposition 98 spending is growing somewhat less quickly than assumed last June, such that the supplemental appropriation required by the equal pain/equal gain formula has shrunk. Though the administration has revised its estimate of 2016-17 General Fund revenue down by $1.6 billion, the almost equally sized revenue drop in 2015-16 results in the year-to-year growth rate remaining at 3.6 percent. Under the revised 2016-17 estimates, Test 3 remains operative, with the state creating a new maintenance factor obligation of $838 million (slightly more than the $746 million assumed in the June budget package).

2015-16 Spending Reduced Primarily by Scoring Some One-Time Payments to 2016-17. The administration proposes to reduce Proposition 98 spending to match the lower estimates of the 2015-16 and 2016-17 minimum guarantees. To reduce spending in 2015-16, the administration changes how it scores one-time payments for the K-12 mandates backlog and the California Collaborative for Educational Excellence (the Collaborative). Whereas the June budget plan had counted payments for these activities toward the 2015-16 guarantee, the Governor proposes to count $324 million for these programs toward the 2016-17 guarantee. As schools already were expecting to receive this funding in 2016-17, this proposal would not affect local programs. Spending is reduced an additional $55 million in 2015-16 primarily due to various automatic adjustments, such as savings resulting from a slight drop in student attendance.

2016-17 Spending Reduced Primarily Through School Payment Deferral. By scoring certain one-time payments in 2016-17 rather than 2015-16, the Governor’s budget plan increases 2016-17 Proposition 98 spending by $324 million. This increase, combined with the $506 million drop in the minimum guarantee and various minor adjustments, results in a spending level that would exceed the 2016-17 guarantee by $859 million. To avoid spending more than the minimum guarantee, the Governor proposes to defer an $859 million payment for the Local Control Funding Formula (LCFF). Specifically, the administration proposes to provide this funding in July 2017 rather than in June 2017, as originally scheduled. This delay would allow the state to count the payment toward the 2017-18 guarantee instead of the 2016-17 guarantee.

2017-18 Guarantee Increases $2.1 Billion Over Revised 2016-17 Level. The Governor’s budget includes $73.5 billion in total Proposition 98 funding in 2017-18. As shown in Figure 3, this reflects a 3 percent increase over the revised 2016-17 level. Test 3 is operative in 2017-18, with the higher guarantee driven primarily by the 2.6 percent increase in per capita General Fund revenue. (This 2.6 percent increase includes the 0.5 percent add-on required by the State Constitution.) In addition, the state makes a $266 million supplemental payment under the equal pain/equal gain formula. The administration also estimates that the state creates a new maintenance factor obligation of $219 million. This additional maintenance factor brings the state’s total outstanding obligation to $1.6 billion by the end of 2017-18.

Figure 3

Proposition 98 Funding by Segment and Source

(Dollars in Millions)

|

2015-16 |

2016-17 |

2017-18 |

Change From 2016-17 |

||

|

Amount |

Percent |

||||

|

Preschoola |

$885 |

$975 |

$995 |

$20 |

2.0% |

|

K-12 Education |

|||||

|

General Fund |

$42,719 |

$43,829 |

$44,811 |

$982 |

2.2% |

|

Local property tax |

17,052 |

18,236 |

19,200 |

965 |

5.3 |

|

Subtotals |

($59,770) |

($62,064) |

($64,012) |

($1,947) |

(3.1%) |

|

California Community Colleges |

|||||

|

General Fund |

$5,304 |

$5,443 |

$5,465 |

$22 |

0.4% |

|

Local property tax |

2,630 |

2,803 |

2,959 |

156 |

5.6 |

|

Subtotals |

($7,933) |

($8,246) |

($8,424) |

($179) |

(2.2%) |

|

Other Agenciesa |

$82 |

$83 |

$80 |

-$3 |

-3.3% |

|

Totals |

$68,671 |

$71,368 |

$73,511 |

$2,143 |

3.0% |

|

General Fund |

$48,989 |

$50,330 |

$51,351 |

$1,021 |

2.0% |

|

Local property tax |

19,681 |

21,038 |

22,160 |

1,121 |

5.3 |

|

aConsists entirely of General Fund. |

|||||

About Half of New K-12 Funding in 2017-18 Dedicated to LCFF. Figure 4 shows the Governor’s Proposition 98 spending proposals for 2017-18. The largest ongoing proposal is a $744 million augmentation to the LCFF. The proposed augmentation is approximately equal to the cost of applying the statutory 1.48 percent cost-of-living adjustment (COLA). The Governor’s budget also adjusts LCFF for changes in student attendance, though average daily attendance (ADA) is expected to remain virtually flat (at 5.9 million ADA). Given these proposed adjustments, the Governor estimates LCFF would be 96 percent funded in 2017-18, about the same percentage as in 2016-17. The administration continues to project LCFF will be fully funded by 2020-21. Though the bulk of new ongoing K-12 funding is for LCFF, the Governor’s budget also applies the statutory 1.48 COLA to a few other K-12 programs, including special education and child nutrition.

Figure 4

2017-18 Proposition 98 Changes

(In Millions)

|

2016-17 Revised Proposition 98 Spending |

$71,368 |

|

Technical Adjustments |

|

|

Make Local Control Funding Formula (LCFF) adjustments |

$65 |

|

Revise estimate of energy efficiency funds |

27 |

|

Annualize funding for previously approved preschool slot increases |

24 |

|

Make various other adjustmentsa |

-30 |

|

Subtotal |

($85) |

|

K-12 Education |

|

|

Retire June-to-July LCFF deferral (one time)b |

$859 |

|

Increase LCFF funding |

744 |

|

Provide 1.48 percent COLA for select categorical programsc |

58 |

|

Add mandated reporter training to Mandates Block Grant |

8 |

|

Subtotal |

($1,670) |

|

California Community Colleges |

|

|

Fund guided pathways initiative (one time) |

$150 |

|

Provide 1.48 percent COLA for apportionments |

94 |

|

Fund 1.34 percent enrollment growth |

79 |

|

Provide unallocated increase |

24 |

|

Fund Innovation Awards (one time) |

20 |

|

Augment Online Education Initiative |

10 |

|

Develop integrated library system (one time) |

6 |

|

Provide 1.48 percent COLA for select categorical programsd |

4 |

|

Subtotal |

($387) |

|

Total Changes |

$2,143 |

|

2017-18 Proposition 98 Spending |

$73,511 |

|

aIncludes the removal of prior-year one-time payments, a special education fund swap (using one-time instead of ongoing funds), a High Speed Network fund swap (using ongoing rather than one-time funds), and various minor adjustments. bUnder the Governor’s proposal, the state would make 11 LCFF payments in 2016-17 (producing savings relative to the 2016-17 Budget Act) and 13 LCFF payments in 2017-18 (12 normal monthly payments plus an additional payment for the prior year). cApplied to special education, child nutrition, services for foster youth, adults in correctional facilities, and American Indian education. dApplied to Extended Opportunity Programs and Services, Disabled Students Programs and Services, CalWORKs student services, and support for certain campus child care centers. COLA = cost-of-living adjustment. |

|

Remaining Funds Used to Eliminate the LCFF Payment Deferral. The Governor proposes to use virtually all of the remaining increase in 2017-18 K-12 funding to eliminate the payment deferral created in 2016-17. Under this proposal, schools would receive 13 months of payments in 2017-18—12 normal monthly LCFF payments plus a one-time payment of $859 million related to the prior-year deferral. Moving forward, the state would return to the regular statutory payment schedule.

About Half of New Community College Funding Is for Apportionments, Half for One-Time Initiatives. About half of new community college funding is for apportionments (consisting of $94 million for a 1.48 percent COLA, $79 million for 1.34 percent enrollment growth, and $24 million for an unallocated increase). The remainder is for categorical programs and is mainly one time. By far the largest of these initiatives is $150 million one time for community colleges to develop “guided pathways”—detailed, term-by-term roadmaps for students to complete academic programs, accompanied by early academic planning and ongoing student support services. The budget also includes $20 million one time for innovation awards to community colleges. Whereas the administration has been closely involved in implementing innovation awards in previous years, the proposal this year provides the Chancellor’s Office substantial latitude to set award criteria and select winners.

Budget Plan Includes $601 Million in Additional Proposition 98-Related Funding. In addition to the $2.1 billion increase in the 2017-18 minimum guarantee, the Governor’s budget includes $601 million in funding from one-time sources. Of this amount, $400 million is a proposed settle-up payment related to meeting the 2009-10 minimum guarantee. The Governor counts this amount as a Proposition 2 debt payment. After making this payment, the state would have a remaining settle-up obligation of $626 million ($532 million associated with 2009-10 and $94 million for more recent years). The other source of one-time funding consists of $201 million in unspent Proposition 98 funding from previous years. The Governor proposes to use the combined $601 million for four activities: (1) paying down the K-12 mandates backlog ($287 million), (2) funding the third and final year of the CTE Incentive Grant program ($200 million), (3) addressing deferred maintenance at the community colleges ($44 million), and (4) swapping out $70 million in ongoing funding (primarily for special education).

Budget Plan Includes Substantial Funding for School and Community College Facility Projects. Passed by the voters in November 2016, Proposition 51 authorizes the state to sell $9 billion in general obligation bonds—$7 billion for schools and $2 billion for community colleges. The Governor’s budget proposes to sell $601 million of these bonds in 2017-18, including $594 million for schools and $7.4 million for community colleges. The Governor’s proposal for schools would fund the state’s list of $370 million in already approved facility projects, as well as $230 million in additional projects. For school facilities only, the Governor proposes to make distribution of bond proceeds contingent on two conditions. Specifically, he proposes (1) requiring schools to enter into upfront grant agreements that include certain conditions and accountability measures and (2) making schools’ associated expenditures subject to local independent audits. For community colleges, the proposed $7.4 million would fund preliminary plans for five projects (two addressing seismic risks, two modernizing instructional space, and one replacing utility infrastructure).

Delays Implementation of Multiyear Child Care and Preschool Budget Agreement. As part of the 2016-17 budget package, the Legislature and the Governor agreed on a four-year plan to increase ongoing child care and preschool funding by roughly $500 million (roughly $200 million in Proposition 98 General Fund and $300 million in non-Proposition 98 General Fund). In 2016-17, the state provided $145 million for the first year of implementation ($137.5 million for rates and $7.8 million for 2,959 additional State Preschool slots). Though not formalized in statute, the agreement for 2017-18 assumed (1) annualization of the increases initiated the prior year, (2) 2,959 additional State Preschool slots, and (3) $86 million in non-Proposition 98 General Fund rate increases. The Governor’s budget proposes suspending much of this agreement for 2017-18 and extending implementation of the plan through 2020-21. (For 2017-18, the Governor’s budget only annualizes the additional slots and Regional Market Rate increases initiated last year. It does not annualize the increase in the Standard Reimbursement Rate. Under the Governor’s budget, the Standard Reimbursement Rate effectively would receive a 5 percent rather than a 10 percent increase, beginning in 2016-17. The remainder of the agreement would be postponed until 2018-19.)

LAO Comments

Assumptions About State General Fund Revenue Key Factor Affecting Estimates of the Guarantee. Though the Governor’s budget includes revised estimates of most of the inputs affecting the calculation of the minimum guarantee, the revisions to General Fund revenue estimates account for nearly all of the changes in school funding. Absent the drop in revenue across 2015-16 and 2016-17, estimates of the minimum guarantee in those two years would be similar to the estimates made last June. Regarding 2017-18, the administration’s estimate of the minimum guarantee is about $1 billion below our November estimate. The administration’s lower estimate of General Fund tax revenue explains the bulk of this difference. In May, both the administration and our office will release updated estimates of General Fund revenue. Below, we discuss how updated revenue estimates could affect the guarantee. We then comment on the overall mix of one-time and ongoing spending included in the Governor’s plan.

Minimum Guarantee Not Likely to Change Much in 2015-16. The guarantee in 2015-16 is not particularly sensitive to revenue changes. State revenue could increase by as much as $700 million with no increase in the minimum guarantee. This is because Test 2 would become operative but no maintenance factor payment would be required. Increases above this level would require the state to begin paying off maintenance factor, with the guarantee increasing about 50 cents for each dollar of additional revenue. Regarding downward revisions, revenue also could fall by as much as $1.8 billion in 2015-16 with no effect on school funding. This buffer is due to the equal pain/equal gain formula, which offsets the drop in the guarantee that would occur otherwise.

Minimum Guarantee in 2016-17 Is Somewhat More Sensitive to Revenue Changes. We estimate the 2016-17 minimum guarantee would rise or fall about 50 cents for each dollar of higher or lower revenue. Regarding upward revisions, the guarantee increases because the faster growth in per capita General Fund revenue increases the funding required under Test 3. Though additional revenue eventually would make Test 2 operative, the guarantee would increase further as maintenance factor payments become required. On the downside, a drop in revenue would lower the growth in per capita General Fund revenue and produce a correspondingly lower Test 3 requirement.

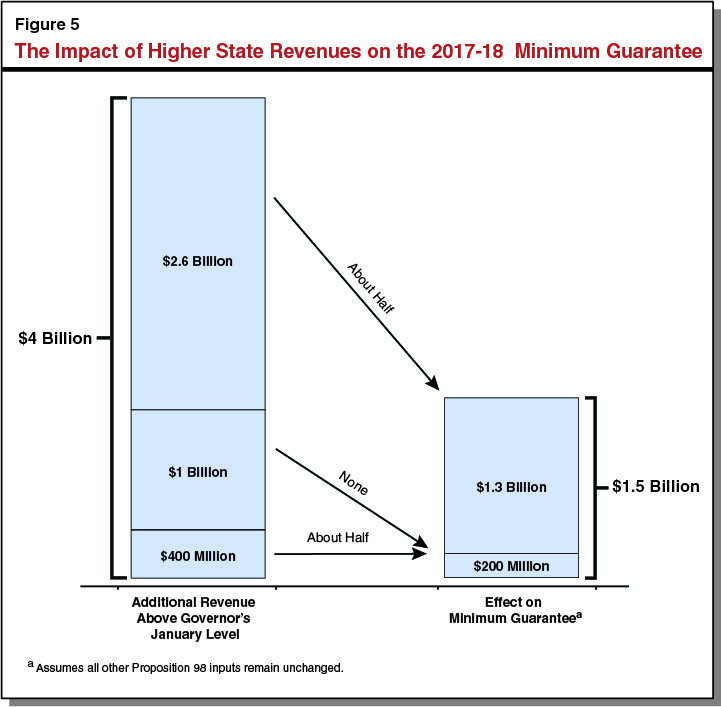

Higher General Fund Revenue, Higher Minimum Guarantee Likely for 2017-18. As discussed in our recent report, we believe the administration’s estimate of state revenue is low given its other economic assumptions. By May, General Fund revenue in 2017-18 could be significantly higher than assumed in January. Holding other factors constant, these higher revenue estimates would increase the 2017-18 guarantee. As Figure 5 shows, certain revenue cut points have specific associated impacts on the minimum guarantee. For the first roughly $400 million of additional revenue, the guarantee increases by about $200 million, bringing school funding to the level required to keep pace with growth in per capita personal income. For the next $1 billion of additional revenue, the guarantee does not change. Any further revenue increase, up to an additional $2.6 billion, would trigger a requirement to make maintenance factor payments and would increase the guarantee by about 50 cents for each additional dollar of revenue. In cumulative terms, revenue increases of $2 billion and $4 billion above the Governor’s January level would increase the 2017-18 guarantee by $500 million and $1.5 billion, respectively. Revenue increases beyond about $4 billion likely would have no effect on the minimum guarantee.

Recommend Relying on Mix of Ongoing and One-Time Spending. The Governor’s budget roughly balances new ongoing and one-time Proposition 98 spending. Regardless of the exact level of the 2017-18 minimum guarantee, we recommend the Legislature adopt a final budget plan that continues to rely upon on a mix of ongoing and one-time spending. The Legislature has taken such an approach the past few years. Under this approach, the Legislature could dedicate a portion of any additional increases in the minimum guarantee to LCFF and CCC apportionments while using the remainder for one-time payments to reduce or eliminate the K-12 mandates backlog. A stronger 2017-18 fiscal year does not necessarily imply a strong 2018-19 fiscal year. By setting aside some funding for one-time purposes, the state would be better positioned to accommodate a drop in the 2018-19 guarantee without needing to make cuts to LCFF or community college apportionments.