We reviewed the proposed memorandum of understanding (MOU) for Bargaining Unit 8 (Firefighters). State Bargaining Unit 8's current members are represented by Cal Fire Local 2881. This review is pursuant to Section 19829.5 of the Government Code.

LAO Contact

January 23, 2017

MOU Fiscal Analysis:

Bargaining Unit 8 (Firefighters)

This analysis of the proposed labor agreement between the state and Bargaining Unit 8 (firefighters) fulfills our statutory requirement under Section 19829.5 of the Government Code. State Bargaining Unit 8’s current employees are represented by Cal Fire Local 2881. The California Department of Human Resources’ (CalHR) website includes the administration’s summary of the major provisions of the agreement and the fiscal effects of these provisions. (Our State Workforce webpages include background information on the collective bargaining process, a description of this and other bargaining units, and our analyses of agreements proposed in the past.) Including this agreement, the Legislature now has 14 agreements before it for consideration. (Our analyses of the other 13 agreements are posted on our website.)

If the 14 proposed agreements are ratified by the Legislature and affected employees, the state will have adopted a plan to address its large unfunded retiree health liabilities over the next few decades—through prefunding and reducing benefits for future employees—for most of the state workforce. These actions would lower state retiree health costs significantly over the long term. In order to reach these agreements, however, the Governor agreed to propose various pay and benefit increases for affected employees in the near term. These proposed pay and benefit increases—along with the state contributions to match employee payments to a retiree health funding account—would be a significant new budgetary commitment for the state with both near-and long-term effects on state obligations.

Major Provisions of Proposed Agreement

Long Duration. As we indicated in our recent analysis of proposed agreements between the state and 13 bargaining units, most of the proposed agreements we have reviewed over the past decade or so have had terms of about two years. (In general, these agreements were consistent with our 2007 recommendation to the Legislature not to approve any proposed labor agreements with a term of more than two years.) Units 5 (Highway Patrol) and 8 have been the main exception to this trend with agreements that typically have terms longer than three years. The proposed Unit 8 agreement would be in effect for four and one-half years—from January 1, 2017 through July 1, 2021.

Pay

Firefighters are compensated differently than most other state employees. Firefighters typically work—on average—four 72-hour workweeks in a 28-day cycle. For the work performed during each 72-hour workweek, these employees receive total pay that consists of pay for (1) a specified number of hours based on a classification’s “salary range” and (2) additional hours determined using a formula to pay for scheduled overtime—referred to as Extended Duty Week Compensation (EDWC). In the case of the classification Firefighter I, employees—who account for more than one-fourth of firefighters—are paid overtime for 19 hours of EDWC in a 72-hour week. Employees might work more than 72 hours per week during a 28-day cycle. For any time worked in excess of 72 hours in a workweek, employees receive additional pay for Unplanned Overtime (UPOT). The pay that employees receive in a typical pay period—salary plus EDWC—affects employee pension benefits and is subject to Medicare payroll taxes. (Employees in specialty classifications represented by Unit 8—including foresters, forestry aids, and fire prevention specialists—are compensated more similarly to other state employees based on a 40-hour workweek.)

Overtime Pay Formulas. As noted above, the state uses a formula to determine the hourly pay rate used to calculate employees’ overtime pay (both EDWC and UPOT) in a pay period. The agreement makes changes to the formula used to determine Firefighter I and battalion chief classifications’ hourly pay. The changes in the formulas increase employees’ total pay by increasing the hourly overtime pay rate over the course of the agreement. (We discuss the total pay increases received by Unit 8 members later in this analysis.)

Firefighter I Pay. Current state law increases the minimum wage from $10.50 per hour in 2017 to $15 per hour by 2022. In 2016-17, a Firefighter I employee earns $1,055 in a typical 72-hour workweek. Under current law without this agreement and because of the way that the overtime formula works, the administration estimates that the scheduled increases to minimum wage would increase this employee’s total pay in a typical week by 33 percent to $1,407 by 2020-21. The administration estimates that these current-law changes would increase annual state costs by nearly $63 million ($40 million General Fund) above 2016-17 levels by 2022-23 even if this agreement is not approved.

The administration further estimates that—if this agreement is approved—Firefighter I total weekly pay would increase from $1,055 in 2016-17 to $1,183 by 2020-21—a 12 percent increase. As Figure 1 illustrates, this is a significantly lower level of pay—by about 19 percent—than the administration assumes would be provided under current law. This is because, as noted above, the agreement changes the overtime formula and the details of how this formula is administered while—the administration reports—still complying with the minimum wage law. If the agreement is ratified, the administration assumes that annual state costs would increase by $37 million ($24 million General Fund) over 2016-17 levels by 2022-23—about $26 million ($16 million General Fund) less than what the administration estimates would be the case under current law without this agreement.

Figure 1

Proposed Firefighter I Weekly Pay Lower Than

Pay Under Current Law

|

2016-17 |

2017-18 |

2018-19 |

2019-20 |

2020-21 |

Pay Increase |

|

|

Under agreementa |

$1,055 |

$1,087 |

$1,115 |

$1,141 |

$1,183 |

12% |

|

Under current law |

1,055 |

1,105 |

1,206 |

1,307 |

1,407 |

33 |

|

aIncludes salary increase January 1, 2021 required under current law and not attributable to this agreement. |

||||||

Salary Increases Vary by Classification. In addition to the formula changes discussed above, the proposed agreement provides “special salary adjustments” (SSAs) to specified classifications over the course of the agreement. Most Unit 8 members would receive SSAs under the agreement. The timing and size of these SSAs vary by classification. After accounting for these SSAs and the formula changes discussed above, the average Unit 8 member would receive a compounded pay increase of about 18 percent over the course of the agreement. Figure 2 shows the differences in the proposed total pay increases across the various classifications in Unit 8. While the agreement would not provide Firefighter I a salary increase, the figure reflects salary increases the administration assumes would occur to comply with current minimum wage laws. These pay raises increase state costs for salary-driven benefits (pensions and Medicare) and overtime pay.

Figure 2

Compounded Pay Increases During Term of Agreement

|

Class Code |

Classification |

Increase in Pay by 2020-21 |

|

1755 |

Fire Fighter II (Paramedic) |

25% |

|

1077 |

Fire Apparatus Engineer |

22 |

|

1756 |

Fire Apparatus Engineer (Paramedic) |

22 |

|

1757 |

Fire Captain (Paramedic) |

20 |

|

1095 |

Fire Captain |

19 |

|

6387 |

Heavy Fire Equipment Operator |

19 |

|

1082 |

Fire Fighter II |

19 |

|

9723 |

Battalion Chiefa |

18 |

|

1046 |

Forestry Fire Pilot |

13 |

|

1083 |

Fire Fighter Ia,b |

12 |

|

Various |

Specialty Classifications |

10 |

|

Weighted Average |

18% |

|

|

Statewide Weighted Averagec |

12% |

|

|

aIncludes effect of proposed change to formula used to calculate hourly pay. bIncludes pay increases administration identifies as required under current law related to minimum wage. cReflects pay increases included in proposed or ratified agreements since 2015 between the state and 19 other bargaining units. Excludes Unit 8. |

||

Fire Mission Pay Differential. During the period each year officially referred to as “summer preparedness” (commonly known as fire season)—a period that varies year-to-year and region-by-region—about 130 employees in specialty classifications would receive a 5 percent pay increase. The administration estimates that the average summer preparedness period is five months long and that this pay raise will increase state costs by about $204,000 each year.

Health Benefits

Maintains State Portion of Premium Costs. The proposed agreement makes no change to health benefits Unit 8 members receive during their careers. The state’s contribution towards Unit 8 health benefits is established as a percentage of an average of health premiums for employees and their dependents. Specifically, the state pays up to 85 percent of the weighted average of the basic health benefit plan premium for the employee and 80 percent of the weighted average of the additional premiums required for dependents. This often is referred to as the “85/80 formula.”

Other Compensation

“Immediate Response Status” Compensation. About 200 employees in specialty classifications would be eligible to receive 1.5 times their regular pay rate when they are assigned to a fire incident. Employees would receive this higher level of pay from the time they are dispatched to the fire incident until the incident is declared controlled. This pay increase is subject to Medicare payroll taxes but does not affect employees’ pension benefits. The administration estimates that this provision will increase annual state costs by about $1.4 million ($912,000 General Fund).

Uniform and Boot Allowances. The proposed agreement would increase allowances received by Unit 8 members each year. Specifically, the uniform allowance would increase from $540 to $1,650 and the boot allowance would increase from $290 to $480. The administration informs us that these allowances are based on the average cost cited by vendors for uniforms and boots; however, the administration does not yet know the actual cost of these items as a vendor has not been selected. A significant change proposed for these allowances under the agreement is how they would be treated for purposes of determining employees’ pension benefits. Under the current agreement, the uniform and boot allowances received by rank-and-file Unit 8 members is considered pensionable compensation and affects employees’ pension benefits. (These allowances are not pensionable forms of compensation for Unit 8 managers and supervisors.) The proposed agreement would make it so that these allowances no longer are considered pensionable compensation for rank-and-file Unit 8 members. These allowances still would be subject to Medicare payroll taxes paid by the state and employees. In total, the administration estimates that this provision will increase annual state costs by $5.7 million.

Leave Cash Outs. Under the current Unit 8 memorandum of understanding (MOU), employees may not cash out any vacation or annual leave in a year unless they are separating from state service. To the extent authorized by department directors, the proposed agreement allows Unit 8 members to cash out up to 80 hours of vacation or annual leave each year. The administration assumes that departments will not receive additional budgetary resources to pay for these cash outs—estimated to be up to $20 million each year by 2020-21.

Travel and Business Reimbursements. State employees are reimbursed for specified costs incurred while traveling and doing business for the state. The proposed agreement adjusts the reimbursement rates provided to Unit 8 members. The proposed reimbursement rates seem consistent with statewide reimbursement policies established by the administration through policy memos (see PML 2016-010 and PML 2006-021); however, the agreement does not refer to these policy memos. The administration assumes that departments will use existing budgetary resources to pay for these increased costs—estimated to be about $16,000 each year.

Retiree Health Benefits and Prefunding

Current Benefits and Funding. Like most governments in the U.S., California has not funded health and dental benefits for its retirees during their working careers in state government. This has resulted in large unfunded state liabilities for the benefits. The state pays for retiree health and dental benefits on an expensive “pay-as-you-go” basis. This means that later generations pay for benefits for past public employees.

After most current employees retire, the maximum state contribution to their health benefits covers 100 percent of an average of CalPERS premium costs plus 90 percent of average CalPERS premium costs for enrolled family members. This maximum contribution is sometimes referred to as the “100/90 formula.” In 2017, the 100/90 formula entitles retirees to a maximum state contribution towards their healthcare of $707 per month for single coverage. Most state employees receive 50 percent of the maximum contribution from the state if they retire with 10 years of service, with this amount growing each year until it reaches 100 percent of the maximum contribution if they retire after 20 or more years. The state contribution for the typical retiree who is enrolled in Medicare is sufficient to pay the monthly CalPERS Medicare health plan premium and Medicare Part B premium costs—$134 per month for the typical Medicare enrollee.

Proposed Retiree Benefit Changes. The proposed agreement changes future retiree health benefits for employees first hired in 2017 and thereafter. Unlike the benefit received by current retirees, eligible retired future employees will receive a significantly smaller amount of money from the state to pay for healthcare. Specifically, (1) the maximum benefit available to retirees not eligible for Medicare will be based on the 80/80 benefit formula and (2) the maximum benefit available to employees eligible for Medicare will be up to 80 percent of the weighted average premium cost of CalPERS Medicare plans and retirees will be responsible for paying the full Medicare Part B premium. To be eligible to receive the maximum contribution, the agreement would require retired future employees to work with the state for 25 years—five years longer than current employees. Using 2017 premiums for comparison, whereas a typical current retiree enrolled in Medicare has no premium costs, a retired future employee enrolled in Medicare and receiving the maximum state benefit would be responsible for paying about $1,800 per year to pay Medicare Part B premiums and CalPERS Medicare plan premiums. In addition, retired future employees younger than 65 years would receive a smaller state contribution—by more than $400 per year for single coverage in the case of an employee who retired after working 25 years—towards their healthcare than they receive under the 85/80 formula during their careers.

Proposed Funding Changes. The proposed agreement institutes a new arrangement to begin to address unfunded retiree health benefits for employees. While the administration’s plan seems to be to keep making pay-as-you-go benefit payments for many years, the new arrangement would begin to fund “normal costs” each year for the future retiree health benefits earned by today’s workers. The agreement establishes a “goal” that employees and the state each regularly contribute one-half of the normal costs by July 1, 2019. Under the agreement, the state and Unit 8 members—including those hired after 2017 who are subject to lower benefit levels—each would contribute (1) 1.5 percent of pay beginning July 1, 2017, (2) 3 percent of pay beginning July 1, 2018, and (3) 4.4 percent of pay beginning July 1, 2019 and ongoing. The agreement deposits these payments in dedicated accounts in an invested trust fund managed by CalPERS. These accounts would generate earnings and gradually reduce unfunded liabilities over the next three decades or so. The 4.4 percent final contribution seems consistent with one-half of the actuarially determined Unit 8 normal costs—assuming a 7.3 percent discount rate—expressed as a percent of Unit 8 pay in 2015-16.

Fiscal Effects

Significant New Budgetary Commitment. The agreement would increase state costs in the current fiscal year (2016-17) by about $35 million ($17 million General Fund). As Figure 3 shows, the administration estimates that the proposed agreement would increase state costs each year through 2020-21. The administration estimates that state annual costs—relative to current law—would increase by about $148 million ($89 million General Fund) beginning in 2020-21. For reasons we describe below, the state’s annual costs to implement this agreement could be tens of millions of dollars above what the administration estimated by 2020-21.

Figure 3

Administration’s Fiscal Estimates of Proposed Labor Agreements

(In Millions)

|

2017-18 |

2018-19 |

2019-20 |

2020-21 |

||||||||

|

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

||||

|

Pay Increasesa |

$46.7 |

$71.9 |

$56.1 |

$86.3 |

$63.7 |

$97.9 |

$66.0 |

$101.3 |

|||

|

Retiree Health Prefunding |

4.2 |

6.5 |

8.6 |

13.3 |

13.0 |

20.0 |

13.3 |

20.5 |

|||

|

Leave Cash Outb |

5.9 |

18.7 |

6.1 |

19.2 |

6.2 |

19.7 |

6.4 |

20.2 |

|||

|

Allowances and Reimbursement Increasesa,c |

3.7 |

5.7 |

3.7 |

5.7 |

3.7 |

5.7 |

3.7 |

5.7 |

|||

|

Totals |

$60.5 |

$102.8 |

$74.5 |

$124.5 |

$86.6 |

$143.3 |

$89.3 |

$147.7 |

|||

|

aIncludes costs related to changes in calculating overtime, special salary adjustments, and pay differentials proposed under the agreement. We adjusted administration’s estimates submitted to Legislature to include administration’s estimated savings relative to current law minimum wage increases. bThe administration assumes that some or all of these costs paid using existing departmental resources. cIncludes costs related to travel and business reimbursements and uniform and boot allowances. Note: Numbers may not add due to rounding. |

|||||||||||

Likely Indirect Costs to Prevent Compaction. When rank-and-file pay increases faster than managerial pay, “salary compaction” can result. Salary compaction can be a problem when the differential between management and rank-and-file is too small to create an incentive for employees to accept the additional responsibilities of being a manager. Consequently, the administration often provides compensation increases to managerial employees that are similar to those received by rank-and-file employees. While the administration has significant authority to establish compensation levels for employees excluded from the collective bargaining process, these compensation levels are subject to legislative review. To prevent any compaction issues with Unit 8 managers, the administration likely will propose pay increases for excluded employees that are comparable to the pay increases received by rank-and-file employees over the course of the agreement. This could increase state annual costs by more than $9 million (more than $5 million General Fund) by 2020-21.

Agreement Could Be in Effect During Next Economic Downturn. The state has a revenue structure that depends on many volatile and unpredictable economic conditions, including fluctuations in the stock market. The U.S. economy currently is in one of the longest periods of economic expansion in the country’s history. It is difficult to predict with any level of certainty the timing, duration, or severity of the next economic downturn. However, it is certainly possible that a downturn could occur within the next few years. This agreement provides pay increases and other provisions that increase state costs through 2020-21. Employees will expect to receive the pay increases provided by the agreement, regardless of the condition of state revenues during the term of the agreement. While the Legislature has the authority to set employee compensation to any level in any budget year, this agreement would make any action in response to fiscal constraints to reduce Unit 8 compensation below what is provided by the agreement very difficult.

Salary-Driven Benefits

Pay Raises Increase Other State Costs. The state pays for Unit 8 employee pension and Medicare benefits as a percentage of pay. Accordingly, any pay increases also increase the state’s costs for these benefits. The costs resulting from the proposed pay increases that are displayed in Figure 3 reflect the costs of the salary and any increased pension or Medicare costs associated with the salary increases. The estimated pension costs are based on current assumptions. In 2016-17, the state pays 41.9 percent of pay towards firefighters’ pension benefits and 1.45 percent of pay towards Medicare benefits. This means that for every $1 of salary increase for firefighters, the state’s costs increase $1.43.

Agreements Fund Retiree Health Benefits as a Salary-Driven Benefit. Although the costs of an individual’s retiree health benefits are not related to his or her compensation, the agreement establishes the state’s cost to prefund retiree health benefits as a percentage of pay. This will increase state costs of future $1 salary increases for firefighters by more than $0.04.

New CalPERS Discount Rate Will Increase Pension Contributions… CalPERS pensions are funded from three sources: investment gains, employer contributions, and employee contributions. CalPERS reports that about two-thirds of benefit payment are paid from past investment gains. CalPERS expects investment returns over the next decade to be lower than past returns. At its December 2016 meeting, the CalPERS board voted to change a key assumption used in calculating how much money employers and employees must contribute to the pension system each year. Specifically, the board voted to lower the discount rate from 7.5 percent to 7.0 percent over the next three years. This lower discount rate means that CalPERS calculations of plan assets and liabilities will assume investments have lower returns. By assuming less money comes into the system through investment gains, the state will be required to contribute more money to pay for higher normal costs and a larger unfunded liability.

…Making Proposed Pay Increases More Costly… As part of the Governor’s 2017-18 budget proposal, the administration assumes that—due to the CalPERS discount rate assumption change and other factors—the state’s contributions towards firefighter pensions will increase by more than 15 percent of pay by 2020-21—to a total of about 57 percent of pay. Although the budget takes into account this rate increase, the administration’s estimate of the fiscal effects of this agreement reflected in Figure 3 do not take into account this rate increase. The additional annual cost to provide the proposed pay increases could be more than ten million dollars higher by 2020-21 than what is presented in the figure.

…And Potentially Creating Pressure for Even Higher Salaries in Future. The Pension Reform Act of 2013 (PEPRA) created a standard that all state employees pay one-half of normal costs for their pension benefits. Today, the contributions paid by Unit 8 members are slightly less than one-half of the total normal costs. Based on assumptions used in the Governor’s 2017-18 budget, the normal costs for firefighters’ pension benefits could increase by roughly 4 percent of pay by 2020-21 as a result of CalPERS’ lower discount rate assumption. If the proposed agreement is ratified, the increased normal costs likely will be an issue of collective bargaining after the agreement expires. Historically, when the state requires employees to contribute additional money to prefund retirement benefits—either pension or retiree health benefits—the state has agreed to provide pay or other compensation increases to offset the higher employee contributions. To the extent that the lower discount rate increases pension normal costs to the point that employees must contribute more money in order to stay close to the standard established by PEPRA, the state will face pressure to increase salaries above what might otherwise have been the case. Any salary increases also will increase salary-driven benefit costs, including the amount of money the state and employees contribute to prefund retiree health benefits under the proposal.

High Level of Pay Increases Could Increase State Pension Costs Even More. In addition to the discount rate, CalPERS includes many other actuarial assumptions in its calculations to determine the state’s costs, including assumptions about how quickly payroll grows. Payroll is affected by (1) the number of people employed by the state and (2) the amount of money these employees earn. CalPERS assumes that payroll will grow each year by 3 percent. When payroll grows faster than 3 percent, the state’s pension unfunded liabilities grow, resulting in higher annual costs for the state to pay off a larger unfunded liability. To the extent that the pay increases provided by this agreement result in firefighter payroll growing faster than 3 percent each year, the state likely will be required to contribute more money to CalPERS than assumed in Figure 3. For example, of the estimated $602 million increase CalPERS estimated for state contributions in 2016-17, $109 million was attributed to payroll growing faster than assumed in 2014-15. CalPERS found that payroll had increased by 6 percent due to an increase in the number of state employees participating in CalPERS and individual salary increases.

Insisting on Employee OPEB Contributions May Increase State Costs. In a 2015 report, we noted that the Governor’s approach of requiring employee—rather than just employer—contributions to fund retiree health benefits would create pressure for the state to provide offsetting increases in pay and other elements of compensation. It is now clear that this pressure affected the recent round of state employee negotiations. Employee pay increases now proposed—in this and the other 13 agreements pending legislative ratification—likely are larger than they would be if the administration had not insisted on employee contributions to retiree health benefits. We also noted in 2015 that higher pay increases of this type drive up state pension costs. As such, it will probably end up costing the state more—including pay and pension costs—to share retiree health costs with employees than it would have costed to pay for retiree health with just an employer contribution.

Pay

Some Proposed Classification-Specific Pay Increases Supported by CalHR Market Analysis. CalHR reviewed four classifications represented by Unit 8 in the 2014 California Firefighter Total Compensation Survey. In this report, CalHR surveyed 20 local fire departments—selected at random among 58 California fire departments that employ more than 75 firefighters—and compared total compensation provided to classifications the department identified as similar to the four state classifications. It is difficult to compare state and local firefighter jobs. Moreover, we have not reviewed specifically whether the state faces significant recruitment or retention issue among the four identified state classifications. That being said, after accounting for total compensation—including employer’s costs for salary, EDWC, health benefits, retirement, cash benefits, and paid leave—CalHR found that the state’s compensation lagged behind the local governments’ compensation by an average of 33 percent. Figure 4 shows the findings for each state classification and the pay increases proposed under the agreement. (In 2006, CalHR contracted with a consulting firm to conduct a similar compensation survey. That 2006 survey found that the state’s total compensation for firefighters lagged, on average, 21 percent.) As the figure indicates, the proposed pay increases are less than the identified lag. Without more information on the recruitment or retention challenges the state faces today in these specific classifications or the likelihood of other employers providing pay increases to employees in similar classifications over the next few years, it is difficult for us to assess to what extent the proposed pay increases are necessary to recruit and retain state firefighters.

Figure 4

Pay Increases Proposed for Firefighter Classifications Found to Lag Behind Surveyed Local Government Counterparts

|

Classification |

Percent Below |

Proposed Compounded |

|

Firefighter II |

-30% |

19% |

|

Fire Apparatus Engineer |

-30 |

22 |

|

Fire Captain |

-33 |

19 |

|

Battalion Chief |

-40 |

18 |

|

aDetermined by administration in 2014 California Firefighter Total Compensation Survey. |

||

Retiree Health Benefits

Timing Creates Legal Uncertainty. The current Unit 8 agreement has not expired. The current agreement provides eligible employees more generous retiree health benefits than are provided by the proposed agreement. The proposed agreement specifies that employees hired on or after January 1, 2017 are subject to the less generous retiree health benefits. An employee hired between January 1 and whenever both the Legislature and Unit 8 members have ratified the agreement would be hired with the current contract being the law of the land. One issue that we think should be considered is what—if any—legal rights an employee hired on January 3, 2017 has to the current retiree health benefit. The administration has provided no detailed analysis of any of the many complex legal issues that the proposed retiree health plan would bring. However, the administration indicates that it does not think there would be any legal issues and that the new employees would be subject to the new benefit.

Contribution Rates Likely Will Need to Be Changed in the Future. The agreement establishes the state (employer) and employee contributions to prefund retiree health benefits as a percent of pay. The normal costs to prefund retiree health benefits grow each year to account for growing health costs. Health costs historically have grown at a rate faster than the rate of inflation in the broader economy and faster than state employee salaries historically have grown. In addition, CalPERS’ expectation that investment returns over the next ten years will be less than in prior years suggests that the discount rate of 7.3 percent used to calculate normal costs under a “full funding” scenario might need to be lowered, thereby increasing normal costs. In order to maintain the state’s policy to set aside the full normal costs, the state and employees likely will need to revisit—on a regular basis—the percent of pay specified in the agreements. Increases in the employee contribution likely will create pressure for future salary increases, resulting in higher pension and other salary-driven costs.

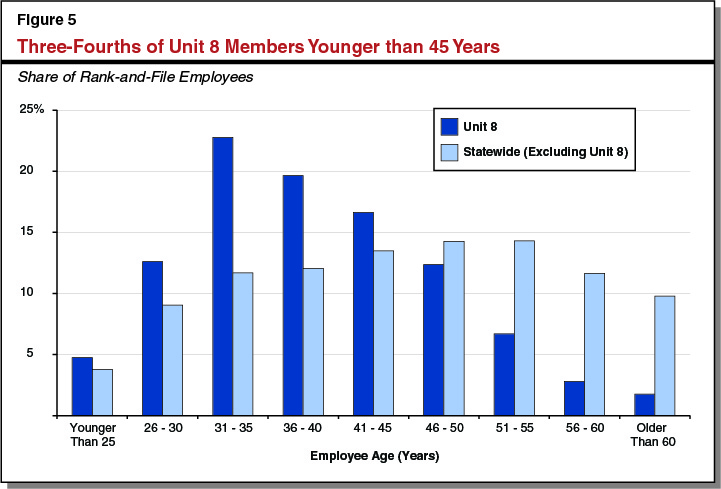

Reduced Benefit Likely Creates Incentive for Firefighters to Work Later In Life. The proposed retiree health benefit—based on the 80/80 formula—would provide a lower contribution from the state to eligible retired future employees’ healthcare than they would receive as active employees—based on the 85/80 formula. This means that retired future employees’ costs to pay for healthcare would be higher in retirement—after working more than 25 years with the state—than during their career. In addition, future employees will be subject to PEPRA, which requires employees to retire a few years later in life to receive a comparable pension received by a retiree today. These factors combined create an incentive for future firefighters to retire later in life. As Figure 5 shows, firefighters tend to be much younger than the rest of the state workforce. While more than 60 percent of the non-firefighter workforce is older than 40 years, slightly less than 60 percent of firefighters are younger than 40 years. The median firefighter is between the ages of 36 years and 40 years old. Future firefighters likely will work several years longer than current firefighters. Firefighting can be a physically demanding job. Among other possible effects of encouraging these employees to work later in life, there may be a greater likelihood of employees becoming disabled and retiring with disability retirements.