Under state law, county office of educations' excess property tax revenue offsets state General Fund support for trial courts. In this post, we describe the offset and recommend the Legislature adjust the offset to better reflect growth in local property taxes.

February 16, 2017

The 2017-18 Budget

Trial Courts and the County Office of Education General Fund Offset

County Offices Of Education (COEs) Funded Through the Local Control Funding Formula (LCFF). Each of California’s 58 counties has a COE. COEs oversee the budgets and academic plans of school districts within their jurisdictions. Many COEs also operate certain alternative schools and provide various optional services to school districts. A primary source of funding for COEs is the LCFF. Each COE’s annual LCFF allotment is determined by formula. A COE’s annual LCFF allotment is supported first with local property tax revenue, with the remainder covered by state Proposition 98 General Fund.

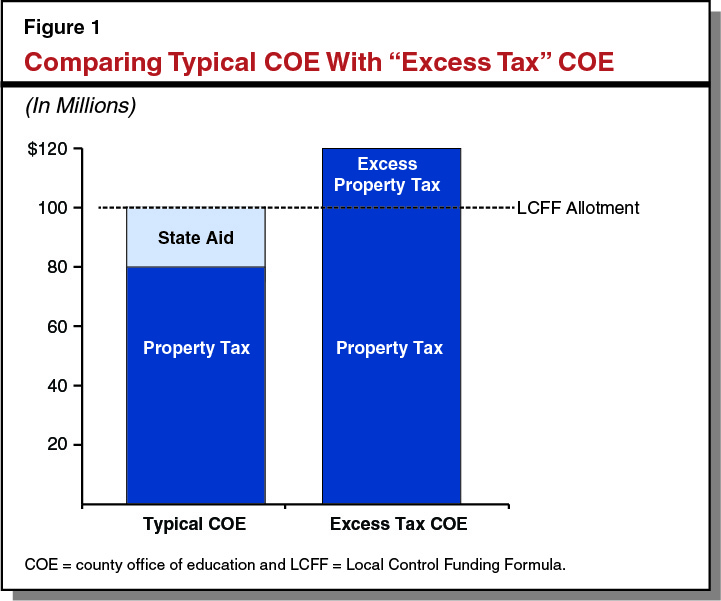

Some COEs Collect Property Tax Revenue in Excess of Their LCFF Allotment. Some COEs do not receive state LCFF funding because they collect enough property tax revenue in a given year to cover their entire LCFF allotment. In virtually all of these cases, the COEs collect more in property tax revenue than their LCFF allotment. We refer to this as a COE’s “excess property tax.” Figure 1 illustrates this concept for two COEs with the same annual LCFF allotment of $100 million. The first COE receives a combination of property tax revenue and state aid to meet its LCFF allotment. In contrast, the second COE receives $20 million in property tax revenue in excess of what it needs to meet its LCFF allotment. Because the amount of property tax revenue collected can change from year to year, a COE’s excess property tax status also can change from year to year.

Under State Law, COEs’ Excess Property Tax Revenue Offsets General Fund Support for Trial Courts. Since 2013-14, state law has required that any excess property tax revenue COEs collect beyond their LCFF allotments be transferred to trial courts. This excess property tax revenue offsets state support for trial courts. The transfer occurs at the direction of the Department of Finance and the State Controller’s Office the year after the taxes are collected. For example, excess property taxes collected in 2015-16 offset the state’s General Fund support to trial courts in 2016-17. In 2015-16, preliminary estimates show that five COEs had excess taxes totaling $37 million to offset General Fund support to trial courts in 2016-17. (These counties were Placer, San Luis Obispo, San Mateo, Santa Barbara, and Santa Clara.)

Governor’s Budget Underestimates Excess Property Tax Revenue. The Governor’s budget estimates that excess property tax revenue in 2017-18 will not increase over the 2016-17 level of $37 million. Our analysis of property tax growth, however, projects higher excess property tax levels and, in turn, higher General Fund offsets for trial courts. In 2016-17, we estimate that six counties will receive $45 million in excess property tax revenue, offsetting the same amount of state costs for trial courts. This is $8 million above the Governor’s estimates. (We estimate that Napa will become the sixth excess tax COE in 2016-17.) We estimate the annual excess tax revenue will continue to increase to $100 million by 2020-21.

Recommend Adjusting Trial Court Offset to Reflect Growth in Excess Property Tax Revenue. Adjusting the estimate of the trial court offset in 2017-18 upward by $8 million to account for property tax growth in 2016-17 would provide the Legislature with additional General Fund (non-Proposition 98) resources above the level assumed in the Governor’s budget.